Guest Post by David Galland and Stephen McBride, Garret/Galland Research

George Soros is trading again.

The 85-year-old political activist and philanthropist hit the headlines post-Brexit saying the event had “unleashed” a financial-market crisis.

Well, the crisis hasn’t hit Soros just yet.

He was once again on the right side of the trade, taking a short position in troubled Deutsche Bank and betting against the S&P via a 2.1-million-share put option on the SPDR S&P 500 ETF.

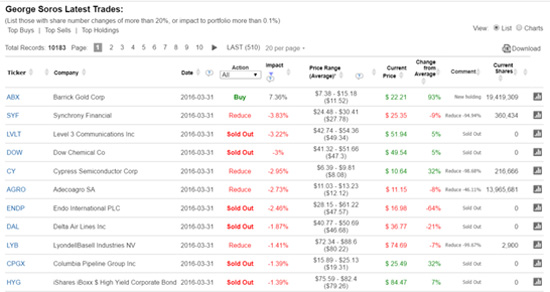

More interestingly, Soros recently took out a $264 million position in Barrick Gold, whose share price has jumped over 14% since Brexit. Along with this trade, Soros has sold his positions in many of his traditional holdings.

Soros had recently announced he was coming out of retirement, again.

First retiring in 2000, the only other time Soros has publicly re-entered the markets was in 2007, when he placed a number of bearish bets on US housing and ultimately made a profit of over $1 billion from the trades.

Since the 1980s, Soros has actively been pursuing a globalist agenda; he advances this agenda through his Open Society Foundations (OSF).

What is this globalist agenda, and where does it come from?

Continue reading “How George Soros Singlehandedly Created the European Refugee Crisis—and Why”