Guest Post by Nick Giambruno

When I first heard the term “financial repression,” I thought it had to be a joke.

Why would governments and central banks use a term with such a negative connotation?

Even people who are financially illiterate will still understand that financial repression is a bad thing.

Nonetheless, financial repression is real and will destroy the bond market.

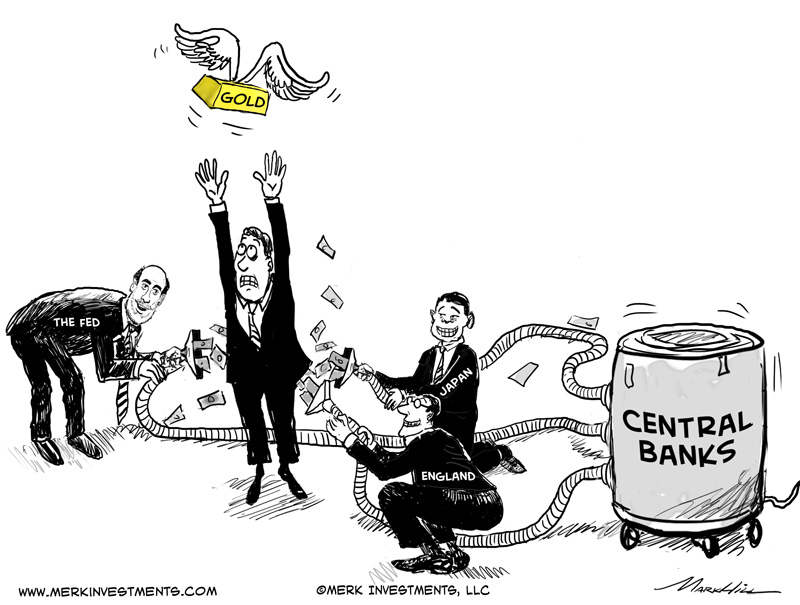

Simply put, financial repression is strategy governments use to reduce their debt burden by manipulating interest rates below inflation. It allows them to borrow in dollars and repay in dimes.

Here’s how the IMF describes it: