Ticking away the moments that make up a dull day

You fritter and waste the hours in an offhand way.

Kicking around on a piece of ground in your home town

Waiting for someone or something to show you the way.

Tired of lying in the sunshine staying home to watch the rain.

You are young and life is long and there is time to kill today.

And then one day you find ten years have got behind you.

No one told you when to run, you missed the starting gun.

Pink Floyd – Time

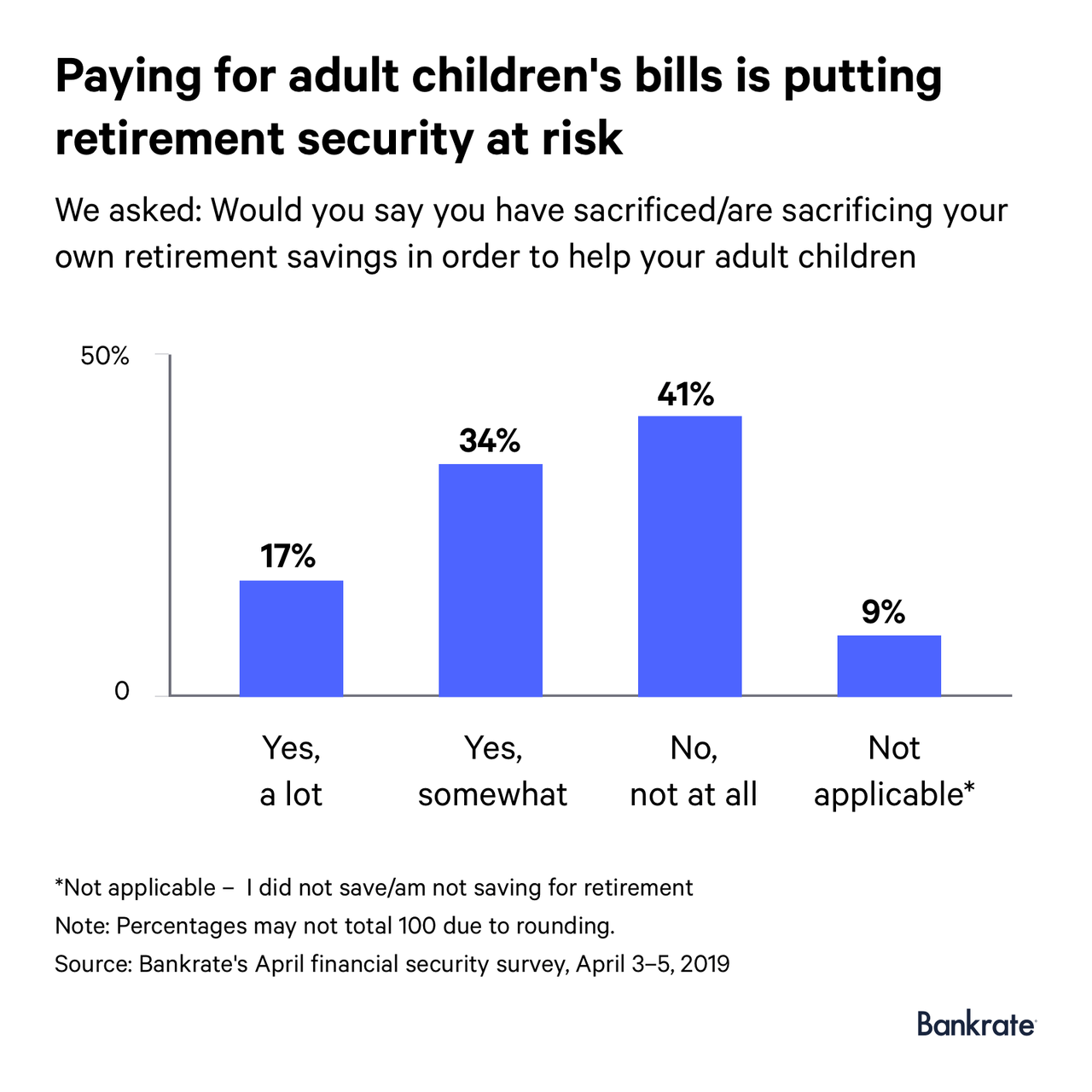

I stumbled across two mind blowing charts yesterday that had me pondering how generations of Americans had frittered their lives away, spending money they didn’t have on things they didn’t need, utilizing easy to acquire debt, and saving virtually nothing for their futures or a rainy day. We are a nation of Peter Pans who never grew up. While I was driving home from work, one of my favorite Pink Floyd tunes came on the radio and the lyrics to Time seemed to fit perfectly with the charts I had just discovered.

We were all young once. Old age and retirement don’t even enter your thought process when you are young. Most people aren’t sure what they want to do for the rest of their lives when they are in their early twenties. Slaving away at your entry level low paying job, chasing the opposite sex, getting drunk, and having fun on the weekends is the standard for most young people. But you eventually have to grow up. Because one day you find ten years have got behind you. No one tells you when to grow up. And based on the charts below, tens of millions missed the starting gun.

I graduated college in 1986 and started my entry level CPA firm job, making $18,000 per year. I did live at home for a year and a half before getting an apartment with a friend. I was able to buy a car, pay off my modest student loan debt, go out on the weekends, and still save some money. I was in my early 20’s and had opened a mutual fund account at Vanguard. Anyone who entered the job market from the mid 1970s through the mid 1980’s, which would be the late Baby Boomers and early Generation Xers, had job opportunities and the benefit of low stock market valuations.

P/E ratios of the market were single digits in the late 70s and early 80s, versus 20 today. Dividend yields on stocks averaged 5% for the S&P 500, versus 1.9% today. The Dow bottomed out at 759 in 1980, while the S&P 500 bottomed at 98. A 20 year secular bull market was about to get under way. Baby Boomers and Generation Xers had the opportunity of a lifetime. Even after six years of the bull, when I graduated from college the Dow stood at 1,786 and the S&P 500 stood at 521. I had just begun to invest when the 1987 crash wiped out 20% in one day. It meant nothing to me. I didn’t have much to lose, so I just kept investing.

The 20 year bull market took the Dow from 759 to 11,722 by January 2000. The S&P 500 rose from 98 to 1,552 by March 2000. You also averaged about a 3% dividend yield per year over the entire 20 years. Your average annual return, including reinvested dividends, exceeded 17%. Anyone who even saved a minimal amount of money on a monthly basis, would have built a substantial nest egg for retirement. If you had invested in 10 Year Treasuries, your annual return would have exceeded 11% over the 20 years. Even an ultra-conservative investor who only put their money into 5 year CDs would have averaged better than 7% per year over the 20 years.

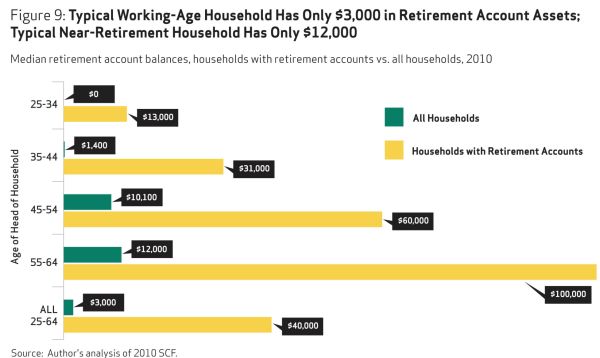

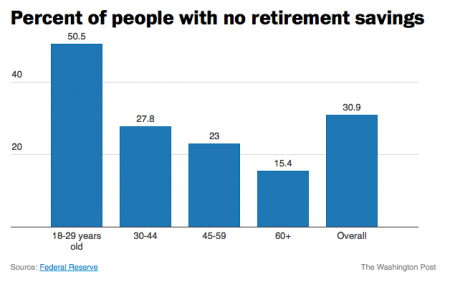

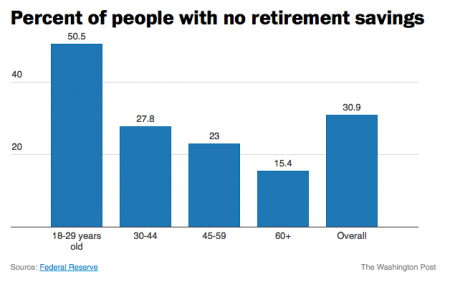

Even with the two stock market collapses since 2000, your average annual return in the stock market since 1980 still exceeds 11%. That’s 34 years with an average annual total return of better than 11%. Every person who had a job over this time frame should have accumulated a decent level of retirement savings. That is why the chart below is so shocking. Over 15% of all people 60 and older and 23% of people 45 to 59 years old have NO retirement savings. None. Nada. Zilch. This means 25 million Boomers and Xers are stuck living off a Social Security pittance and choosing between keeping the heat on or eating a feast of Ramen noodles and Friskies. It seems they let 30 years get behind them. They missed the starting gun.

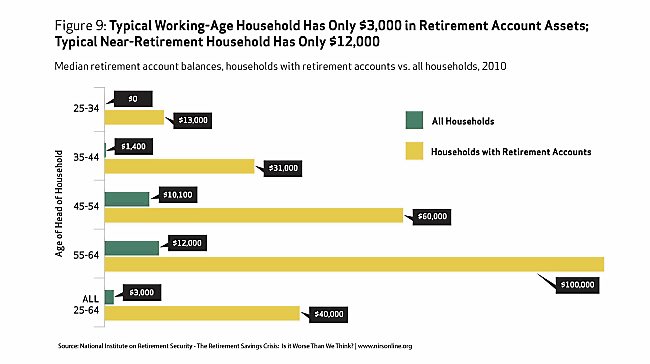

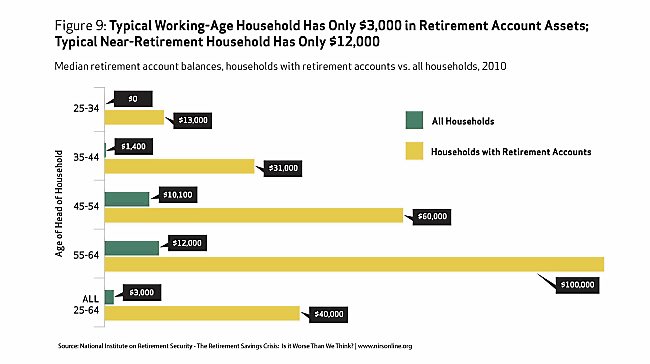

I’m not shocked that over 50% of 18 to 29 year olds have no retirement savings. With the terrible job market, declining real wages, massive levels of student loan debt, two stock market crashes in the space of eight years, and 4% annual returns since 2000, young people today have neither the means nor trust in the system to save for retirement. Their elders had no such excuse. Just a minimal amount per paycheck saved over the last 30 years would have compounded to well over $100,000, even at modest salary levels. It is disgraceful that 25 million people over the age of 45 have saved nothing for their retirement. Far more disgraceful is the median household retirement balance of $3,000 for all working age households. There are 122 million households in this country and 61 million of them have $3,000 or less in retirement savings.

The far worse data points are the $12,000 median retirement balance of aged 55 to 64 households and the $10,100 median retirement balance of aged 45 to 54 households. These people are on the edge of retirement and have less than one year’s expenses saved. There is no legitimate excuse for this pitiful display of planning. These people had decades to save, strong financial market returns, and if they worked for a decent size organization – matching contributions to their retirement accounts. They didn’t need a huge salary. They didn’t need to save 20% of their salary. They didn’t have to be an investing genius. A savings allocation of just 3% to 5% would have grown into a decent sized nest egg after a few decades of compounding.

We know from the data in the chart, it didn’t happen. The concept of delayed gratification is unknown to the millions of nearly broke Boomers and Xers, shuffling towards an old age of poverty, misery and regret. A 64 year old has a life expectancy of about 20 years. They’ll have to budget “very” frugally to make that $12,000 last. The question is how did it happen. I don’t buy the load of crap that you can’t judge people as groups. I judge people by their actions, not their words. I know you can’t lump every Boomer and Xer into one box. Individuals in every generation have bucked the trend, lived within their means, saved for the future, and accumulated significant nest eggs for their retirement. But the aggregate numbers don’t lie. The majority of those over the age of 45 have squandered their chance at a relatively comfortable retirement. These are the people who most vociferously insist the government do something about their self created plight. It’s their right to free healthcare, free food, subsidized housing, free utilities, higher minimum wages, and a comfortable government subsidized retirement. They are wrong. They had a right to life, liberty and the pursuit of happiness. It was up to them to educate themselves, get a job, work hard, and accumulate savings.

The generations of live for today, don’t worry about tomorrow Americans over the age of 45 have no one to blame but themselves. They bought those 4,500 sq foot McMansions with negative amortization 0% down mortgages. They had to keep up with the Jones-es by putting in granite counter-tops, stainless steel appliances, home theaters, Olympic sized swimming pools, and enormous decks. They have HDTVs in every room in their house and must have every premium cable channel, along with the NFL package. They upgrade their phones every time Apple rolls out a new and improved version. They pay landscapers to manicure their properties. They lease new BMWs every three years. They have taken exotic vacations on an annual basis. They haven’t packed a lunch for themselves since they were 16 years old. Eating out for lunch and dinner has been a staple of their existence for decades. That morning Starbucks coffee is a given. A new wardrobe of name brand stylish clothes for every season is a requirement because your neighbors and co-workers are constantly judging you. Nothing proves you’re a success like a Rolex watch, Canali suit, Versace boots, or Gucci handbag. The have it now generations got it then and have virtually nothing now because they acquired all of these things with debt.

Real cumulative household income is up 10% since 1980. Consumer debt outstanding has risen from $350 billion in 1980 to $3.267 trillion today. That is a 933% increase. We’ve had decades of faux prosperity aided and abetted by Wall Street shysters, corrupt politicians, mega-corporation mass merchandisers, and Madison Avenue maggots trained in the methods of Edward Bernays to convince willfully ignorant consumers to consume. And consume we did. Saving, not so much. You can blame the oligarchs, bankers, retailers, and politicians for the fact you didn’t save, but it rings hollow. No matter how much propaganda is spewed by the ruling class, we are still individuals with free will. The older generations had choices. Saving money requires only one thing – spending less than you make. Most Boomers and Xers chose to spend more than they made and financed the difference. When the average credit card balance is five times greater than the median retirement account balance, you’ve got a problem. The facts about our consumer empire of debt are unequivocal as can be seen in these statistics:

- Average credit card debt: $15,593

- Average mortgage debt: $153,184

- Average student loan debt: $32,511

- $11.62 trillion in total debt

- $880.3 billion in credit card debt

- $8.05 trillion in mortgages

- $1.12 trillion in student loans

I don’t blame those in their 20’s and 30’s for not having retirement savings. Anyone who entered the workforce around the year 2000 has good reason to not trust the system or their elders. There have been two stock market collapses and every asset class is now extremely overvalued due to the criminal machinations of the Federal Reserve. There are far less good paying jobs. Real wages keep declining. They were convinced by their elders to load up on student loan debt, leaving them as debt serfs. The Wall Street/Federal Reserve scheme to boost home prices and repair their insolvent balance sheets has successfully kept young people from ever being able to afford a home. So you have young people unable to save, invest or spend. You have middle aged and older Americans with little or no savings, mountains of debt, low paying service jobs, and an inability to spend. The only people left with resources are the .1% who have captured the system, peddle the debt, and reap the rewards of consumption versus saving. They may be able to engineer a stock market rally to further enrich themselves, but they can not propel the real economy of 318 million people. Our consumer society is dying – asphyxiated by debt – shorter of breath and one day closer to death.

I’d love to offer some sage advice on how to fix this problem, but it’s too late. Too many people missed the starting gun. More than ten years got behind them. No one is going to come to the rescue of people who never saved for their future. The Federal government has already made $200 trillion of entitlement promises it can’t keep. State governments have made tens of trillions in pension promises they can’t keep. They can’t tax young people who don’t have jobs. Older generations who think the government is going to rescue them from their foolish shortsighted choices are badly mistaken. Their benefits are likely to be reduced because the unsustainable will not be sustained. The 45 to 64 year old cohort who chose not to save can run and run to try and catch up with the sun, but it’s too late. It’s sinking. Their plans have come to naught. They are destined for lives of quiet desperation. There is nothing more to say.

So you run and you run to catch up with the sun but it’s sinking

Racing around to come up behind you again.

The sun is the same in a relative way but you’re older,

Shorter of breath and one day closer to death.

Every year is getting shorter; never seem to find the time.

Plans that either come to naught or half a page of scribbled lines

Hanging on in quiet desperation is the English way

The time is gone, the song is over,

Thought I’d something more to say.

Pink Floyd – Time