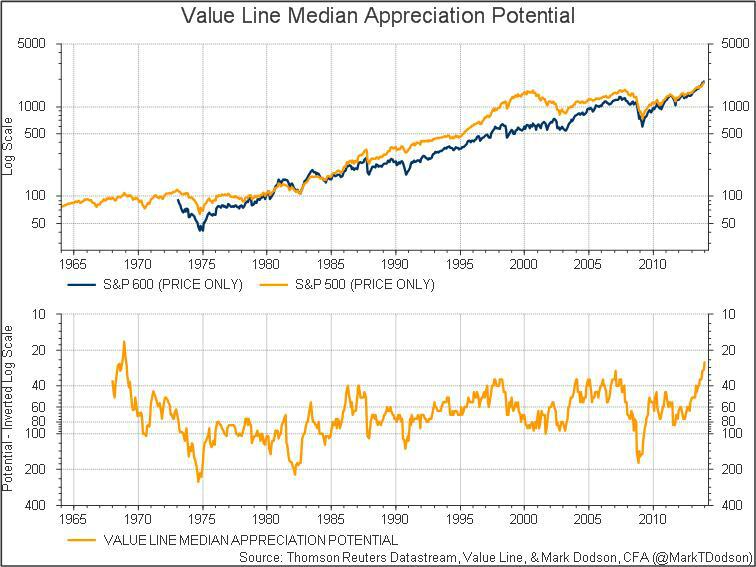

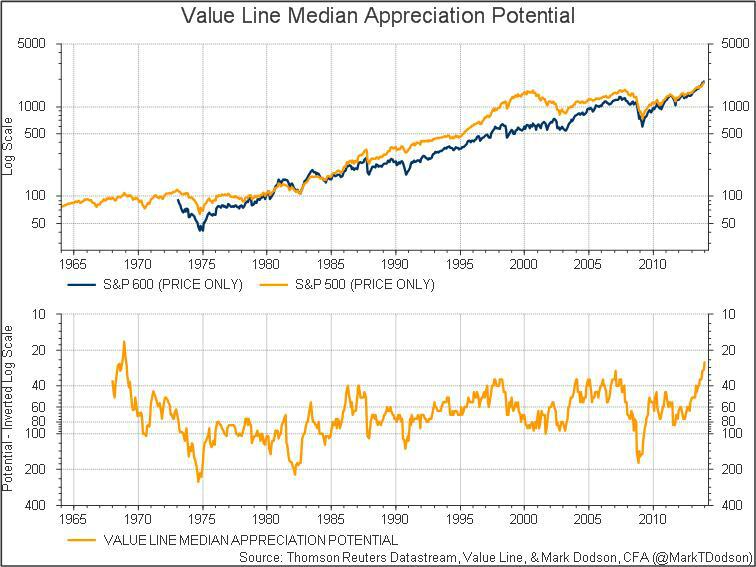

Back in the mid-1990’s I subscribed to the Value Line Investment Survey. I was a stock investor back then. The markets were actually fairly efficient and not rigged. Value Line assess 1,700 stocks in 90 industries every week, providing a timeliness rating and giving their assessment of stock appreciation potential for each stock. It’s based strictly on math. It’s about as impartial as you can get. Well, their latest report shows that the median appreciation potential of all 1,700 stocks is now at the lowest level since 1969. This confirms about ten other fact based assessments that show stocks to be in bubble territory. The shills and shysters will continue to try and lure you into their web of lies. They will brush off factual information and lie through their bleached white teeth.

You may be asking whether the Value Line prediction in 1969 proved to be correct. The S&P 500 stood at 105 in the middle of 1969. It stood at 98 in the early part of 1980. So the stock market was 7% lower ELEVEN years later. Do you believe facts or some Wall Street whore?

Source: John Hussman