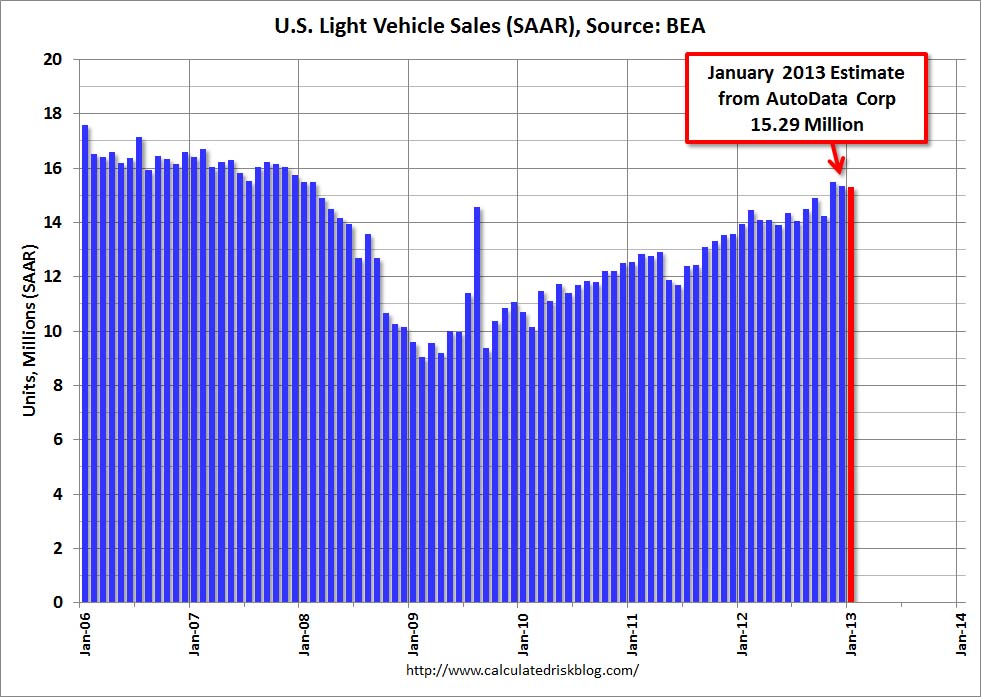

GM and Ford reported “strong” sales for March, up 6.4% and 5.7% respectively. The current annual rate of auto sales has “surged” to 15.2 million. Last year sales rose to 14.5 million from only 12.7 million in 2011. This sure sounds like a tremendous recovery led by great new models from our “saved” GM and wonderful iconic Ford Motors. The MSM was crowing about the results today, except the details tell a different story. GM’s car sales FELL 3% in March. The surge in sales was due to fleet sales going up 12%. It couldn’t possibly be the Federal government buying vehicles, could it? Cadillac sales surged as subprime loans in West Philly to the FSA reached record levels. There were 1,478 Volts sold in the whole country – so there will be 15.2 million vehicles sold in the country and the Obama Volt will account for less than 20,000 of these sales or .0013 of all car sales. Ford car sales FELL 0.2%. Their increase was also driven by fleet sales and truck sales. How dense is the average American? Gasoline prices are above $4.00 per gallon in many cities and they continue to buy low gas mileage trucks and SUVs.

The auto market is completely dependent upon 7 year 0% financing for good credits and subprime lending for 45% of sales and this is all they can achieve?

If sales have been so awesome for the last two years, why are their stocks and their profits in decline? Inquiring minds want to know.

If auto sales were 12.7 million in 2011 and they are pacing at 15.2 million in 2013, why has GM stock dropped from $38 to $28, a 26% decline? I thought Obama saved GM and they were doing awesome. Vehicle sales are up 20% since 2011 and GM still managed to earn $3 billion less in 2012 than they earned in 2011. This doesn’t even take into account the massive channel stuffing that has artificially boosted their sales figures.

It seems that selling vehicles to your dealers and to deadbeats through Ally Financial doesn’t generate profits. But who needs profits when a storyline will do.

If Ford Motor is doing so well why is their stock at $13 today when it was at $19 in 2011? For the math challenged, that is a 32% drop when auto sales are up 20% since 2011. Is the MSM reporting that Ford sales dropped by $2 billion in 2012 and their net income from operations dropped by $1 billion? Are we really having a strong auto recovery if the two biggest US automakers are making significantly less profit?

The MSM is not in the truth business. They are in the propaganda business. The storyline of auto recovery is false. The reported sales increases are due to channel stuffing and easy money from Bennie. The 45% of sales from subprime loans will bite the taxpayer in the ass when Ally Financial reports billions in losses over the next few years. You own Ally Financial. So it goes.

Hi Admin – OT – Slovenia 10 year bond yield

[img [/img]

[/img]

Domestic Car Sales Decline For Third Month As Hurricane Sandy Replacement Cycle Fades

Submitted by Tyler Durden on 04/02/2013 16:56 -0400

One of the hallmarks of the ongoing European economic depression has been the complete implosion in the continent’s automotive sales (here and here) and as Reuters summarized last week, there is little hope of a rebound for a long, long time. Curiously, where Europe has seen complete devastation, the US has been surprisingly resilient, and even when factoring in for such traditional gimmicks as channel stuffing, performed most notoriously by GM, which in March had the second highest amount of cars parked on dealer lots in its post-bankruptcy history, car sales have been rather brisk which in turn has allowed the US to report manufacturing numbers which, until the recent PMI and ISM data, were better than expected. One does, wonder, however, how much of a factor for this has been the forward demand-pull impact of Hurricane Sandy in late 2012, when as a result of tens of thousands of cars being totaled in tri-state area flooding, consumers scrambled to car lots to buy new autos. Well, we may have found the reason for the recent disappointing performance in both the Chicago PMI and the Manufacturing ISM – the positive effect from Sandy is finally fading, as today’s domestic car sales show, which posted a surprising decline in March, especially in non-Trucks which dipped to the lowest since October 2013, and the first miss in total light vehicle sales SAAR since October.

Sweet…a cheap repo Cadillac is in my future…hmmm…wonder if I can sell the 24″ rims to make one of the payments ? I think I’ll call it the Chemo Cadillac !

GM and Ford reported “strong” sales for March, up 6.4% and 5.7% respectively. The current annual rate of auto sales has “surged” to 15.2 million.

General Motors Co and its China joint ventures sold 215,070 vehicles in the country in February, down 10.6 percent from a year earlier, the U.S. automaker said on Tuesday. -Car and driver.

~~~

Seems to me they are buying back stock,