Consumer spending accounts for 70% of GDP. The government apparatchiks, corporate media propagandists, and the Wall Street shysters assured the masses that the negative GDP in the 1st quarter and dreadful retail sales were solely the result of harsh winter weather, as if the weather in the winter is ever good. They were absolutely unequivocally sure that retail sales would soar once Spring arrived.

The thing about retail sales is they aren’t lost. If you are snowed in for a few days and can’t buy that new pair of shoes, they’ll be there next week. The reality is if poor retail sales are really the result of weather, there is pent up demand that will be satisfied when the weather improves. In addition, harsh winter weather should increase the sales of items used to deal with harsh winter weather, shovels, salt, winter coats, long johns, etc.

So here we are in July. Retail sales have been essential flat for the last three months. There has been no rebound. There has been no surge. When inflation is taken into consideration, real retail sales are falling. But still the stock market rises. It rises because it has nothing to do with reality. The average American is far poorer today than they were at the depths of the recession in 2009. Real wages continue to fall, despite the bullshit about a jobs recovery.

The shit dumped by the media and the government is so deep, you need hip boots to wade through it. The reality is the .1% have been enriched by the Federal Reserve at the expense of the 99.9%. Retail sales will continue to stagnate, as the prices for energy, food, healthcare, tuition, clothing, and services rise relentlessly, along with taxes from local, state, and federal governments.

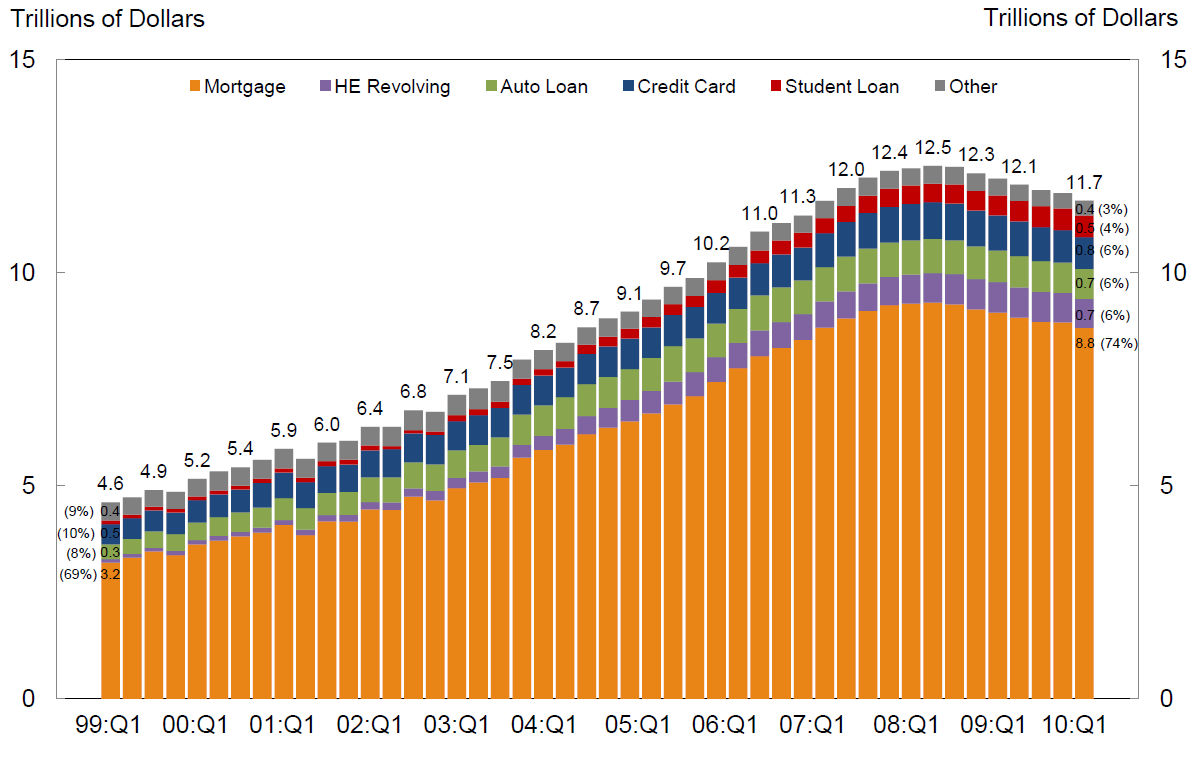

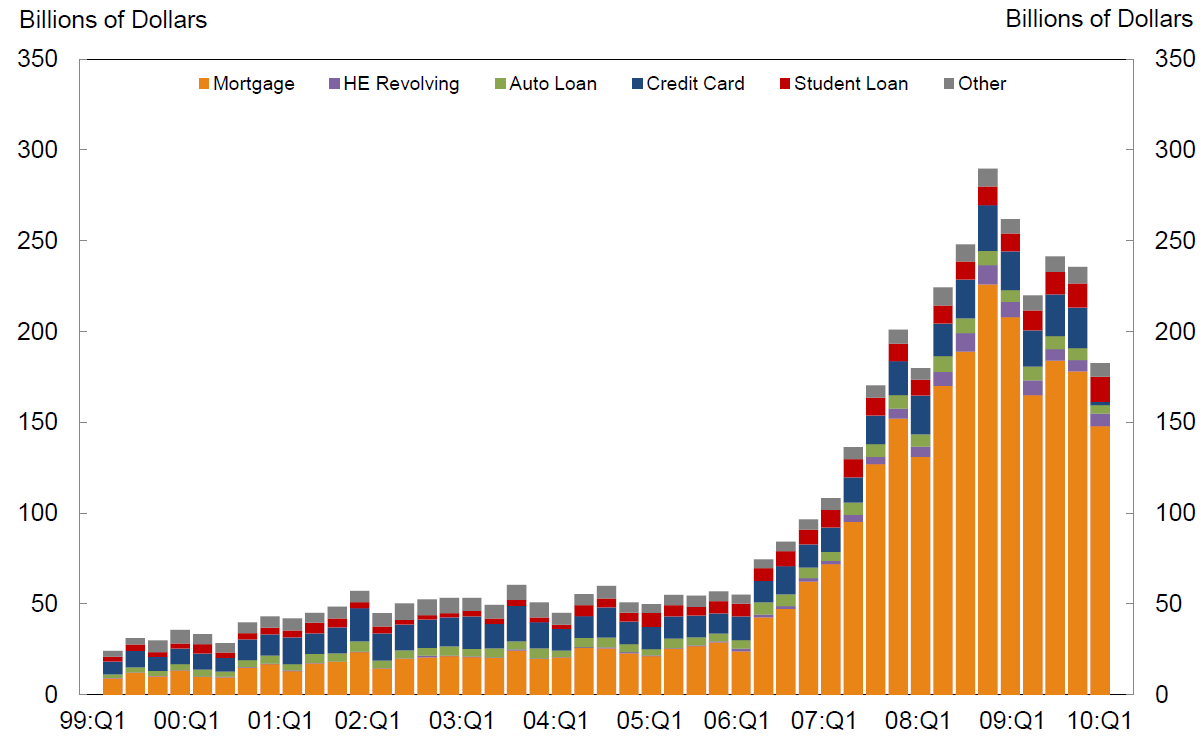

The oligarchs are using the exact same game plan that blew up in 2008 – dole out gobs of consumer debt (auto, student) and try to convince the ignorant masses they are wealthier because they are driving a new GMC Yukon with a 0% down, o% interest, 7 year loan. The megacorps use the free money from the Fed to buy back their stock, pumping their EPS and the stock bonuses of the executives, while laying off thousands, and distributing 2% raises to the plebs. The Too Big To Trust Wall Street titans take the free candy from the Fed, use their HFT supercomputers, and rig the markets with trillions in derivatives of mass destruction. The raping and pillaging of the middle class will continue until there is nothing left but bleached bones.

This Wall Street fantasy world is interrupted every day with anecdotes from the real world, but the willfully ignorant public enjoys believing the lies as their normalcy bias overcomes their own eyes.

Macy’s is supposed to be one of the successful retailers in the country and their earnings report was nothing but PR maggot spin and misinformation. The huge headline was their earnings per share rose by 11%. That sounds really impressive. You have to go deep into their propaganda press release to find out their profit actually went up a pitiful 3.9%. They spent millions buying back their stock. Brilliant move considering the stock cratered by $4 per share today. They announced same store sales growth of 3.4%, but in a little footnote say this includes on-line sales. Their on-line sales are growing strongly and their bricks and mortar is dying. They are closing stores and firing people.

Retail stocks are down 4% this year, while the S&P 500 is up 5%.As you can see in the chart Department stores (Macys, Sears, Kohls, JC Penney) and general merchandise stores (Wal-Mart, Target) are sucking wind with sales collapsing in July. So much for that back to school surge.

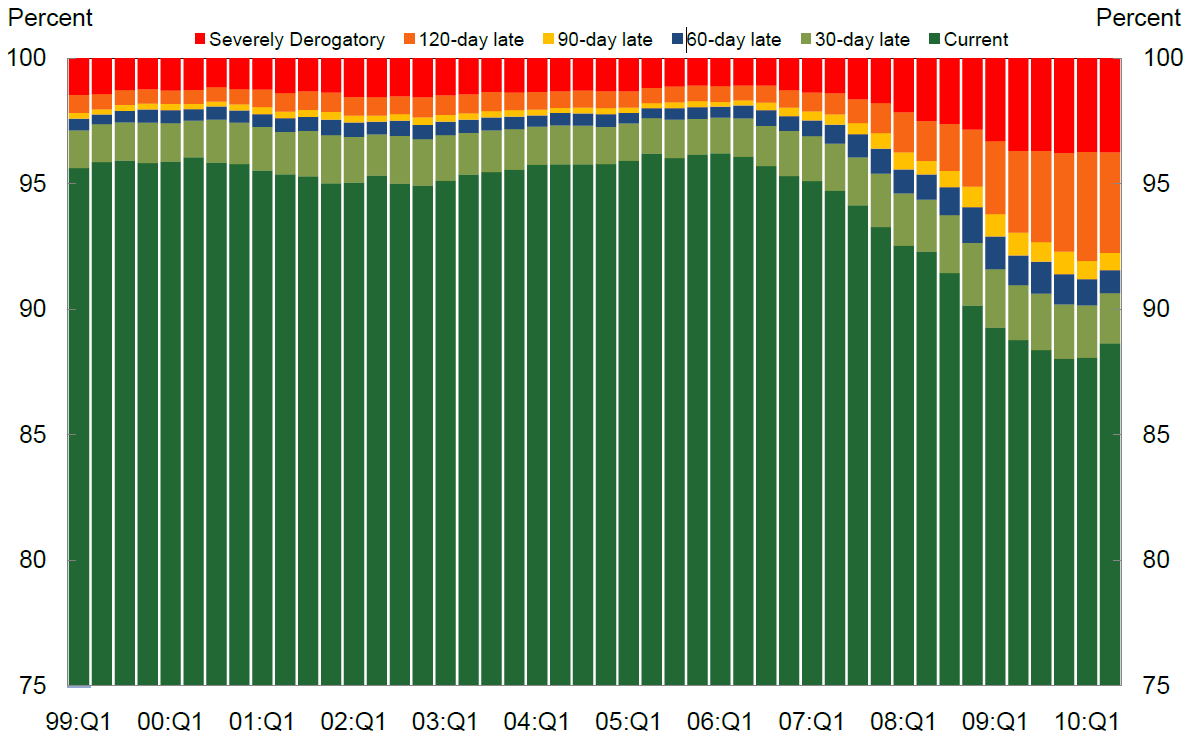

JC Penney will report another huge loss later this week. Wal-Mart will report shitty results as their customers are the ignorant masses. Retail is dying a long arduous slow death. It will not reverse itself. Americans are using their credit cards to pay for utilities, gas, taxes, and everyday bills. This Federal Reserve created Bubble 2.0 is going to cause havoc when it bursts because it has engulfed stocks, bonds, and housing simultaneously.

Does anyone with two brain cells actually believe we are having a housing recovery with mortgage applications at 14 year lows? Mortgage rates have fallen for the last year, as mortgage applications have plummeted. That is a sure sign of a strong health housing recovery and really bodes well for home furnishing, building materials, appliance, and electronics retailers.

Retail sales have missed expectations to the downside in 8 of the last 12 months. But, Jim Cramer assures us this is about to change. All is well. The future is bright. Jobs are plentiful. Consumers are confident. The stock market is at all-time highs. There is cash on the sidelines. Subprime loans are going to invigorate consumer spending. The deadbeats won’t default this time. They promise.

So the recession ended in 2009 according to TPTB. Shouldn’t year over year changes in retail sales be accelerating rather than declining since 2010? The unemployment rate, according to the geniuses at the BLS, has fallen from 9.6% in 2010 to 6.2% today. This should have spurred a huge spending spree by all the joyous employed people. What happened? The 9 million people who “willingly” left the workforce surely have plenty of leisure time to shop. The same government drones at the BLS also tell us that prices have only risen by 8.5% over the last four years, so paying more for food, energy and healthcare surely hasn’t deterred discretionary spending. Right?

Again, anyone critically assessing the bullshit heaped upon the public by the government, Fed, media, corporatacracy, and banking cabal realizes everything is a Big Lie. Just examining the highly manipulated and seasonally adjusted data reveals a number of truths:

- Total retail sales have grown by 3.7% in the last year. People with their eyes open know that inflation is above 5%, so real retail sales are falling.

- The total is skewed higher by the 8.1% increase in auto “sales”. Again, those awake to the truth know that leasing a car counts as a sale, financing a car for 7 years counts as a sale, and subprime loans to deadbeats who will default counts as a sale. Orwell would be proud.

- Excluding the renting of cars to millions of Americans, retail sales have grown by a pitiful 2.7% in the last year, well below the true rate of inflation.

- Furniture, appliance and electronics stores have negative sales over the last three months and essentially flat on a year over year basis. This proves the housing recovery meme is a complete fraud and the home price increases have been driven solely by Wall Street hedge funds using free money from the Fed to pump prices and bailout the Wall Street banks with billions of toxic mortgages on their books.

- If so many jobs are being created why would clothing sales only be up 1.4% in the last year? Don’t newly employed people need clothes? Maybe they don’t, since most of the jobs are fry cook jobs at McDonalds and Burger King.

- Sporting goods stores and department stores are filled with discretionary products and both classes of retail are in absolute freefall. Negative 3% to 4% annual sales are disastrous, considering inflation at 5% or higher. This trend assures thousands more retail locations will be shuttered over the next year. Look for more SPACE AVAILABLE signs in a mall near you.

- Even restaurant sales have peetered out as the obese masses can’t afford the latest Applebees special. The 4.6% annual increase is almost entirely due to rampant food inflation that has caused restaurants to increase prices and reduce portions.

- Lastly, even the glorious on-line future of retailing has hit a snag. Maybe Amazon stock at $327 isn’t a bargain after all. Online sales FELL month over month and have only risen by 6.7% in the last 12 months. The rate of growth in this category was 15% to 20% for years. The bricks and mortar retailers funded campaigns in all states to impose sales taxes on internet retailers. They’ve succeeded in reducing internet sales while continuing to see negatives sales in their bricks and mortar stores, with the added benefit of depleting consumers of more disposable income and handing billions more to government drones to waste.

So the pundits and propagandists for the ruling class continue to perpetuate the Big Lie of economic recovery, while the evidence in the real world proves it is a lie. Luckily for the oligarchs, if you trot out an “expert” with a degree from Harvard or an important title and instruct him to tell the people all is well and they are getting wealthier by the day, a large portion of the willfully ignorant will believe him. Another portion are so deficient in math skills and the ability to understand any financial concept, they wouldn’t understand anything they are told. The rest of the population is twittering, facebooking, instagramming, texting, or watching the Kardashians.

You will be fascinated to know that Kim (blowjob) Kardashian has 20 million twitter followers and is publishing an entire book of her selfies. She is our modern day John Steinbeck or Ernest Hemingway. So it goes.