Guest Post by Jeremy Grantham

(Approaching the End of) The First U.S. Bubble Extravaganza: Housing, Equities, Bonds, and Commodities

Executive Summary

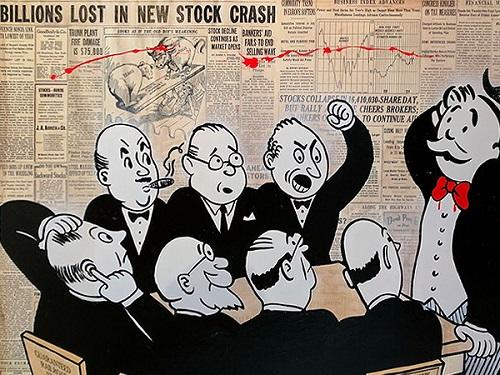

All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the U.S. in 1929 and 2000 and in Japan in 1989. There were also superbubbles in housing in the U.S. in 2006 and Japan in 1989. All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average.

Today in the U.S. we are in the fourth superbubble of the last hundred years.

Previous equity superbubbles had a series of distinct features that individually are rare and collectively are unique to these events. In each case, these shared characteristics have already occurred in this cycle. The checklist for a superbubble running through its phases is now complete and the wild rumpus can begin at any time.

/https://public-media.smithsonianmag.com/filer/4f/9b/4f9bad96-304a-4451-85a7-c9fa56f4cc53/screen_shot_2017-10-04_at_54310_pm.png)