“People should not be afraid of their governments. Governments should be afraid of their people.” – Alan Moore – V for Vendetta

“Authority, when first detecting chaos at its heels, will entertain the vilest schemes to save its orderly facade.” – Alan Moore – V for Vendetta

I wrote an article called V for Vendetta – 2011 just over nine years ago on the day after the Tucson shooting where congresswoman Gabrielle Giffords and eighteen others were shot by a psychologically disturbed lunatic, with six dying. At the time, I thought of the scene from the V for Vendetta movie where someone did something stupid and all hell broke loose. I expected a similar result from this act, but those in control of our society were successfully able to put a cork in the bottle, preserving their façade of order.

We learned shortly thereafter, through the patriotic efforts of Edward Snowden and Julian Assange, how the government was using the vilest of schemes to surveil every American through their abuse of the Patriot Act. The government has become an enemy of the people.

It is interesting to go back and view my conclusion from nine years ago and assess its accuracy as of today:

“This country has not reached the level of control and fear seen in Orwell’s 1984 and V for Vendetta, yet. We are moving relentlessly in that direction. Surveillance, monitoring, spying, censorship, secret prisons, predator drones, and conforming to state rules and regulations put citizens further under the thumb of an all-powerful state. The freedom to dissent, the freedom to be left alone, the freedom to speak out against injustice, the freedom to disagree with your government, and the freedom to present your ideas without fear of retribution or penalty are essential in a democratic society.

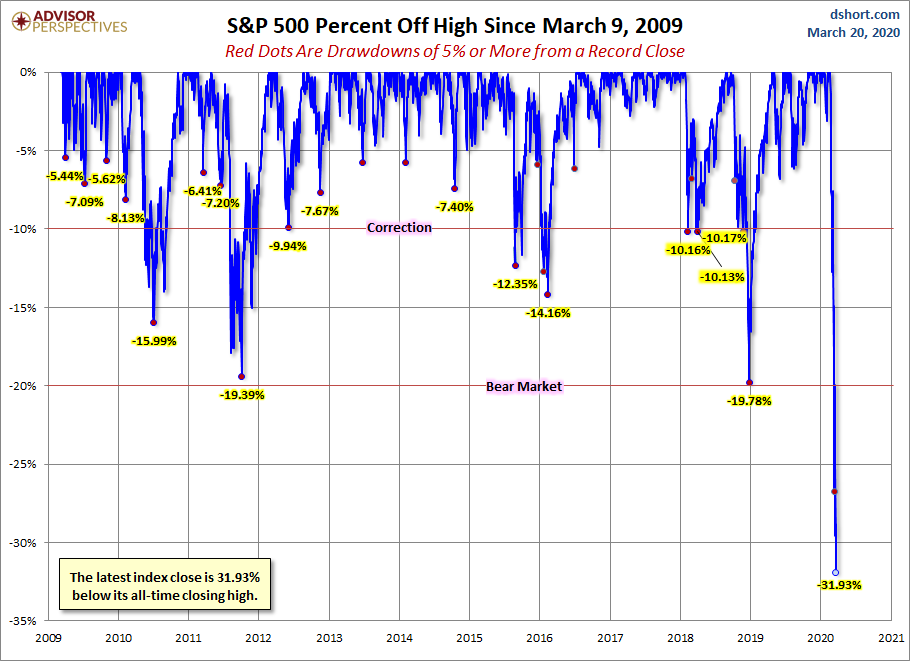

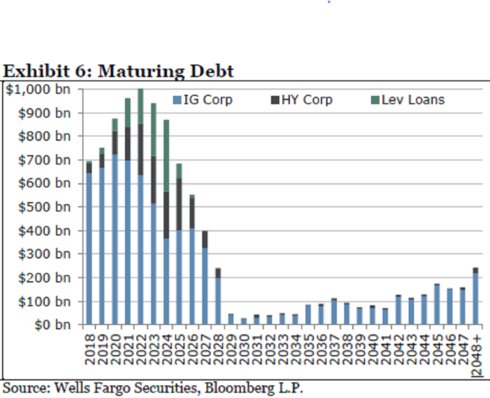

The next phase of this Fourth Turning will surely include another downward spiral in financial markets as un-payable debts accumulate to a tipping point level. When ATM machines stop spitting out twenties, food shelves are bare and gas stations are shuttered, social chaos will ensue. The government will react with further command and control measures. In V For Vendetta, the government creates a terrorist incident in order to gain unquestioned control over the population. Americans will need to be more vigilant than they have been over the last ten years in keeping an eye on their government.”