Guest Post by Jeff Thomas via International Man

(Gregory Mankiw, an economics professor at Harvard, interviews Janet Yellen.)

Most of us watch television. In part, we seek to be entertained, but, additionally, we often seek to be enlightened as to “what’s going on.” In a difficult era like the present one, in which some of the most prominent countries are experiencing the onset of an economic crisis, virtual cartoon characters are competing as choices in political contests, governments are becoming increasingly rapacious and a police state is developing rapidly, it’s not surprising if the average person questions, “What on earth are they thinking?”

Well, there’s no shortage of media exposure to answer that question. Today, there are a multitude of channels offering 24/7 “news,” from which we may hope to glean some insight as to what the leaders of the world are thinking. Yet, in spite of the endless folderol being offered, the leadership vision remains about as clear as mud.

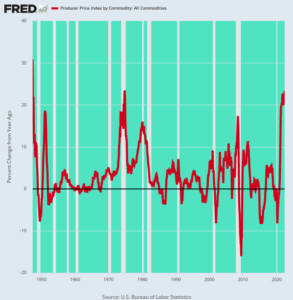

They don’t want war, but are invading more countries than ever before in history. Political hopefuls are vague at best regarding their proposed platforms for action, yet they attack each other as though they’re reporters for the tabloids. Governments continually speak of their wish to lighten the load on the common man, whilst heaping laws, regulations, fines and taxes on him like never before, and whilst heaping billions in tax dollars on their cronies in the financial industry. They claim to seek greater security for all, but instead, create an endless stream of agencies that have the authority to ignore basic rights and behave more like Mafia shakedown operators than law enforcers. Governments claim to be pursuing a sounder economy, but have created an unprecedented level of debt, that promises to crush the economies of several of the world’s most prominent countries in the very near future.

And so, many people look to the media, seeking answers. Typically a news programme will feature a “panel of experts,” who will debate the latest issues. They rarely reach a conclusion, but do succeed in creating a general impression that one political party is out to destroy the country and that the other (which they represent) is out to save it.

In addition to the panels, the media go straight to the source on frequent occasions, interviewing political and financial leaders. The list of questions is invariably prepared well in advance and the interviewee is never caught off guard. His handlers have prepared his answers for him and, on every occasion, a full plate of predictable reheated rhetoric is served up to the viewer for his consumption.

In these repartees, the interviewer is intended to appear congenial yet probing, yet the questions asked are invariably bland enough for the interviewee to either dismiss them or provide an easy retort. The interviewee is intended to appear as though he is informing the public of policies and procedures that, whilst too complicated for the viewer to fully grasp, are well in hand and will provide solutions in the not-too-distant future. Be patient.

The fact that these solutions never seem to arrive seems to be less relevant than the fact that a new solution is underway. In this manner, the viewer, no matter how badly his life is being affected, continues to sit tight and be hopeful, for, surely, better days are just around the corner.

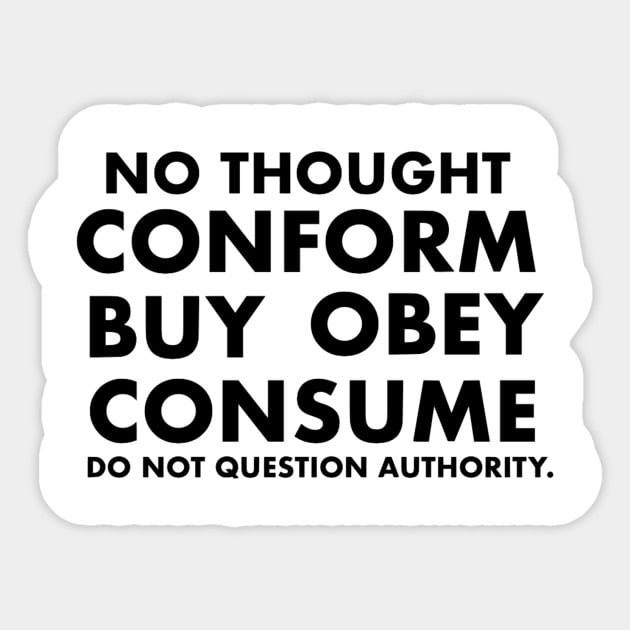

Incredibly, the average viewer seems to be able to consume endless quantities of this propaganda, year after year, and never say to himself, “Something’s radically wrong here.”

If he were to actually turn off the television for a week or so, stand back, and assess the propaganda as a whole, he might conclude that, in fact, the media acts at the behest of the economic and political leaders, to propagate their message. The “debates” and “pressing questions” are limp at best and never lead to any significant change or improvement. Nor are they intended to. They are pacifiers only.

Worse, the leaders themselves continue to not only fail the public, but to steadily morph the governmental, economic and social systems in a direction that will lead inevitably to a bad end.

It is true, of course, that the citizens of these leading nations are becoming increasingly cynical about their leaders and their own futures, but their reaction to the pablum, after having a good grumble, tends to be to “hope the next administration will be better.” This is very foolhardy indeed. (Once the apple is thoroughly rotten, expect to see only worms inhabiting it.)

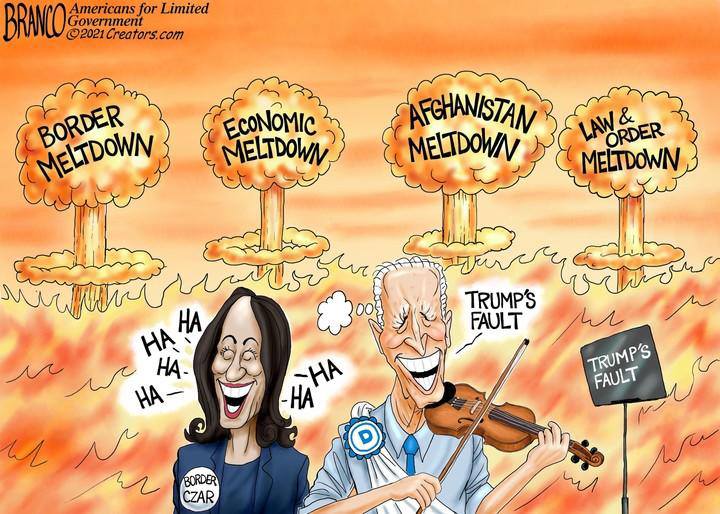

But those who sense that they’re being shafted need to vent somehow. And, for this we have political parties. Whether our country has Democrats and Republicans, Tories and Labour, or any other such groupings, those who are elected are under no illusion that they exist to serve those who elected them; they exist to serve the major donors who pay for the elections. And the major donors contribute to both parties, in order to ensure that their objectives are carried out by the candidates who are successful, regardless of their party. The overall plan will continue, full steam, regardless of who’s in office.

But the parties do provide the electorate with targets at which to aim their rubber-tipped arrows. Regardless of which party is in power, liberal voters will complain that not enough is being done for their causes and conservative voters will do the same.

Will one win out over the other eventually? Unquestionably not. The system is designed to remain as is – with endless bickering encouraged, but no actual progress planned.

The most prominent countries in the world are on the cusp of a major economic crisis. With it will come political and social crises and, most certainly, war. The television viewer, if he accepts this at all, will say, “Well, that will teach them. Then they’ll have to admit that our side was right.”

Unfortunately, no. After the inevitable economic crashes, after years of pointless warfare, after increased totalitarianism at home, there will be an eventual end to the strife. When the dust begins to settle, the average person will turn on his television, hoping to see that some answers have been reached.

Instead, what he’ll witness, if he turns on a liberal station, will be pundits stating that, if only there had been more QE and more entitlements, it might have all worked out, but that, instead, there was disaster, as a result of the conservatives.

Likewise, the pundits on the conservative station will expound that all the suffering could have been avoided if the entitlements had been kept in check and the bombs could have been dropped on the enemy earlier. Both liberals and conservatives will return to their corners to dress their wounds and prepare for the next round of polarization against each other.

So, who is it that we blame for mankind’s debacles? Surely, we were tricked by the leaders – the politicians, central bankers, leaders of major industries, etc. Or was it the media that did such a sterling job of packaging up the propaganda that we were unable to see the forest for the trees?

It will matter little, because nothing will be learned and we shall begin the game anew. But if it’s a genuine solution we’re after, yes, that is possible. But that solution depends upon whether we’re prepared to cease to allow the media to provide our reasoning for us. We must be prepared to study our leaders’ actions, to be prepared to be contrarian and, most importantly, to question everything. If not, we ourselves are amongst the blind and the clueless and we can expect an endless cycle of the same dog and pony show.

Editor’s Note: All you can hope to do is to save yourself from the consequences of all this stupidity.

The coming financial collapse is going to be much worse, much longer, and very different than what we saw in 2008 and 2009.

That’s exactly why New York Times best-selling author Doug Casey and his team just released an urgent video. Click here to watch it now.

Click to visit the TBP Store for Great TBP Merchandise