Hat tip Boston Bob

Deferred gratification is an unknown concept to most Americans. Wall Street and Madison Avenue have colluded to brainwash a dumbed down populace into going into perpetual debt in order to keep up with the Joneses and live for today. Saving for the future is for suckers. When 65% of Americans roll a credit card balance at 10% to 25% interest, you know our government run public educational system has succeeded in producing brain dead dumbasses. Charge!!!!

Credit cards are an addiction that most Americans never shake.

Through the booms, busts, and recessions of the last 15 years, U.S. credit habits have been remarkably consistent, according to a recent study from the Federal Reserve Bank of Boston. Most people carry over a balance from month to month, the study said, and they eagerly gobble up any additional credit their card-issuers offer.

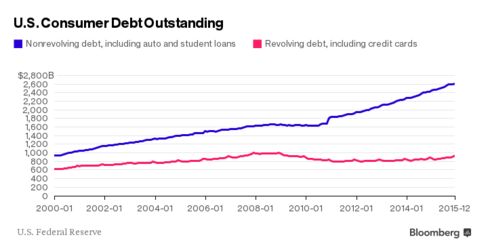

It adds up fast. Consumers owed a total of $936 billion in credit-card and other revolving debt in December, according to Federal Reserve data released on Feb. 5. They’ve added $103 billion since April 2011, but they still have less revolving debt than just before the financial crisis in 2008, when they owed $1.02 trillion.

To see how individual Americans’ relationships to credit cards has changed through time, researchers at the Boston Fed’s Consumer Payments Research Center analyzed a huge data set, a sample of 5 percent of U.S. credit report accounts from 2000 to 2014. Here are some findings:

About 35 percent of those aged 25 to 50 with credit cards are “convenience users,” who pay off their balances each month. The majority, whom researchers call “revolvers,” carry debt forward from month to month and usually pay high interest charges in the process.

Americans don’t really taper their credit-card borrowing until their fifties. Even at age 70, 45 percent of credit-card users aren’t paying off their credit cards each month. And the typical 80-year-old still has more than $600 on a credit card. “The median person is always borrowing, although at the end of life she is not borrowing much,” the study concludes.

Continue reading “Americans Can’t Help Themselves From Borrowing More on Credit Cards”

Just when you think Americans can’t act like bigger dumbasses, they top themselves. Not only do these non-thinking dregs believe that Iran is a threat to the United States, but they are willing to wait hours and in some cases days to be the first to get a new iPad. As if they won’t be available tomorrow or next week or for the rest of their freaking lives. How meaningless and pathetic must their lives be that they will worship at the altar of Apple for a lousy touch screen gadget. Such a vast swath of humanity has become so degraded, ignorant, and driven by nothing other than an insatiable appetite for material possessions, that only a collapse of the current economic system will bring people back to their senses. Or they will riot, loot, burn shit and kill each other. It will be a fitting conclusion when these zombies are killing each other with their igadgets.