You can’t watch the mainstream media propaganda channels for more than ten minutes without a talking head breathlessly announcing that gas prices have dropped for the 24th day in a row and are now back to $3.55 a gallon. Wall Street oil analysts, who are paid hundreds of thousands of dollars per year to tell us why prices rose or fell after the fact, are paraded on CNBC to proclaim the huge consumer windfall from the drop in price. This is just another episode of a never ending reality show, designed to keep the average American sedated so they’ll continue to spend money they don’t have buying crap they don’t need. The brainless twits that pass for journalists in the corporate mainstream media never give the viewer or reader any historical context to judge the true impact of the price increase or decrease. The government agencies promoting the storyline of those in power extrapolate the current trend and ignore the basic facts of supply, demand, price and peak oil. The EIA is now predicting further drops in prices. Two months ago they predicted steadily rising prices through the summer. What would we do without these government drones guiding us?

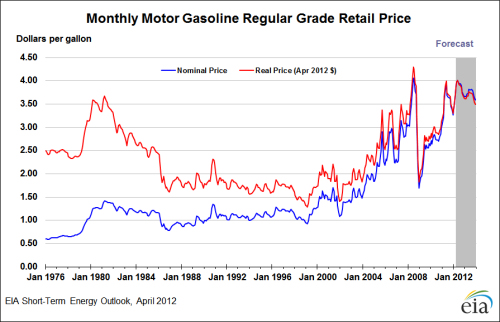

As you can see from the chart, gas prices tend to be volatile and unpredictable in the short term. You can also see that since 1998 the trend has been relentlessly higher. The average inflation adjusted price of gasoline in 1998 was $1.41 per gallon, versus $3.55 today, a 152% increase in fourteen years. Over this same time frame the BLS manipulated CPI was up only 44%. If we are swimming in oil, as the MSM pundits claim, why the tremendous surge in price? It must be those evil oil companies. It couldn’t possibly be the impact of peak oil. To acknowledge the fact that worldwide oil production has reached its peak would be to concede that our suburban sprawl, just in time world is drawing to an excruciating end. So the politicians spout their assigned storylines, supported by their paid off “experts” (aka Daniel Yergin), and unquestioningly reported as fact by their designated corporate media outlet. Those of a liberal bent assail oil companies and speculators; refuse to acknowledge the law of supply and demand, while touting green energy as the solution to all our energy needs. Those of a conservative bent believe in attacking foreign countries to secure “our” oil, refuse to acknowledge the law of supply and demand, and spout “drill, drill, drill” slogans because dealing with facts is inconvenient. The willfully ignorant public believes whichever storyline matches their preconceived beliefs. All is well – no one is required to think critically. Thinking is hard.

There are numerous factors that affect the price of oil on a daily basis, but at the end of the day supply and demand determine price. The chart below documents the key external events that have had a major impact on oil prices since 1970. The vital fact that you won’t hear on CNBC is that every recession since 1970 has been immediately preceded by an oil price spike. Anyone living in the real world (this excludes Cramer, Liesman, Bartiromo, & Kudlow) knows we have entered part two of the Greater Depression. The surge in oil prices in the last two years has precipitated this renewed downturn.

The MSM blathering baboons of bullshit dutifully report the price of gas on a given day. People who live in the real world fill up their gas tanks every week, so the average price over a period of time is what matters. The average price of a gallon of gasoline in 2008 was $3.39. The average price in 2011 was $3.48. The average price in 2012 has been $3.62 thus far. This data paints an entirely different picture than the one painted by the politicians, experts and the clueless captured media. Gas prices are higher than they were prior to the last economic implosion. Cause and effect is a concept beyond the intellectual capabilities of MSM journalists and the millions of government educated zombies they mesmerize with misinformation. The lack of intellectual curiosity and critical thinking skills plays directly into the hands of those with a storyline to sell or truth to obscure.

Swimming in Oil

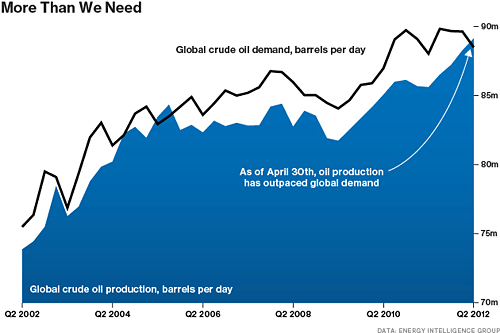

The recent storyline proliferated by the MSM at the behest of Washington DC politicians and the corporate interests that control them, is that the U.S. is on the verge of energy independence, with hundreds of years of plentiful oil right under our feet. The chart below made the rounds last week on Bloomberg, defender and mouthpiece of billionaires everywhere. This chart surely proves that peak oil is bullshit. Right?

Besides the false representation of oil production and the misleading conclusion that we have more oil than we need, the chart and Bloomberg screed does not provide the true context of why worldwide demand is tumbling. The chart is NOT showing global crude oil production. It is showing global oil and other liquids supply, which includes crude and condensate, natural gas plant liquids, other liquids (mostly ethanol), and processing gains (increase in volume from refining heavy oil). The MSM would rather mislead the public than provide the true picture of the supposed oil production boom. The question is whether the MSM is misleading the public due to their own journalistic incompetence or are they carrying out their assigned mission on behalf of the corporate oligarchs running the kingdom.

The chart below reveals a truer picture of the worldwide energy situation. Conventional oil production hit its peak/plateau around 74 million barrels per day at the end of 2004, and has barely budged from that level over the last eight years. Despite all the rhetoric about the North American oil boom, conventional oil production is at virtually the same level today as it was in 2004. The U.S.(shale oil) and Canadian (tar sands) gains in production have been matched by the collapse in Mexican production. The Middle East countries produced 23.3 million barrels in September 2004. The average price of a barrel of oil in 2004 was $38. They are now only producing 23.9 million barrels when prices are 120% higher.

Global oil demand in 2004 was around 84 million barrels per day. To increase liquid fuel supply to meet the 90 million barrels per day demand we had to turn to unconventional fuels like tar sands, tight oil, and biofuels, all of which have far higher production costs and far less energy content than sweet crude. As the easy to access, cheap to produce ($20 per barrel in Saudi Arabia), close to the surface sweet crude has been depleted, it has been replaced by heavy crude, tar sands, deep-water oil, and shale oil, with production costs in excess of $80 per barrel. Anyone anticipating a long-term decline in fuel prices must be smoking tar sands in their bong. The liquids that have “replaced” conventional crude have a few slight drawbacks. Natural gas liquids provide about 70% as much energy per barrel as crude oil, so a barrel of NGL is not equivalent to a barrel of crude. Have you filled up your SUV lately with some NGL? Ethanol provides only 60% as much energy per barrel as crude oil and its EROEI is pitifully low. The energy returned on energy invested for these non-conventional sources of energy approaches the minimum limits unless prices rise dramatically. The Obama green army does not want this chart making its way into the public discourse. Their fantasyland of renewable energy solutions is proven to be a fool’s errand.

Catch-22 Energy Edition

The price of a barrel of West Texas crude is currently $86 per barrel, down from $109 per barrel in February. Obama supporters will proclaim that his threat to crack down on speculators had the desired effect. He must have scared those nasty speculators with his gravitas. The price rise surely didn’t have anything to do with the U.S. led attack on Libya, the act of war economic sanctions on Iran, the beating of Israel/U.S. war drums, Japan demand due to the shutdown of their nuclear power industry, or the relentlessly higher demand from China and India. And now the MSM is trying to spin a yarn that prices have dropped by 21% because worldwide supply is surging. That is so much more palatable than telling the truth and admitting that we’ve entered the 2nd phase of the Greater Depression.

It took $140 a barrel in oil in 2008 to tip the world into recession. Worldwide economies were much stronger then. The U.S. National Debt has risen by $6.5 trillion, or 70% since 2008. Real GDP has risen by $200 billion since 2008, or a 1.5% increase. Debt to GDP has risen from 64% to 102%. Consumer debt at $2.55 trillion is exactly the same as the 2008 level even after Wall Street banks have written off over $1 trillion, subsidized by the American taxpayer. The consumer deleveraging storyline is completely false. In 2008 there were 234 million working age Americans and 145 million of them were employed. Today there are 243 million working age Americans and 142 million of them are employed. In 2008 there were 28 million Americans in the food stamp program. Today there are 46 million Americans collecting food stamps. The economic situation in Europe has deteriorated at a far greater rate. Therefore, it is not surprising that it only took $109 a barrel oil to push the world back into recession.

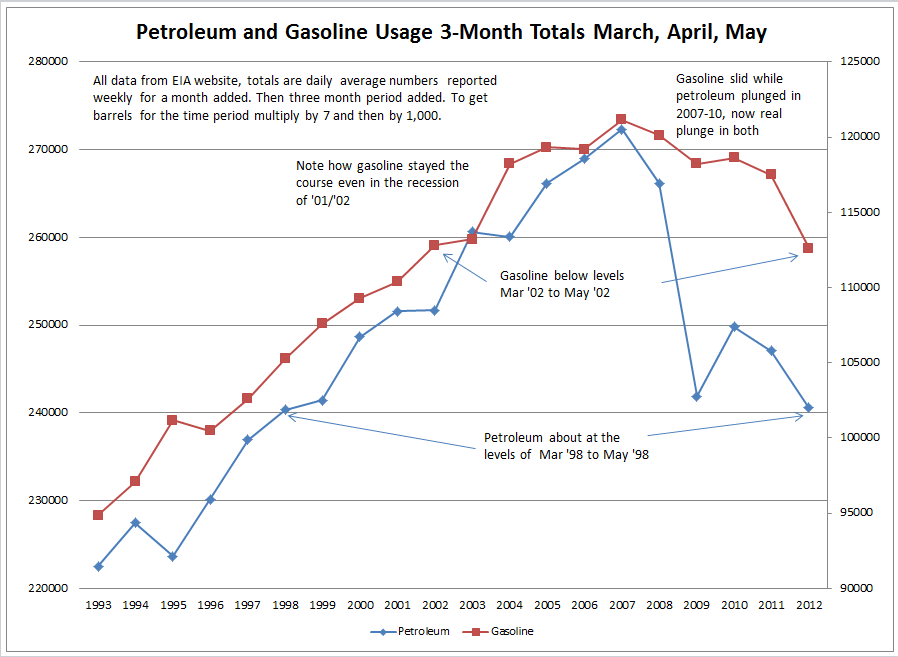

The main reason prices are dropping is the collapse in demand from Europe and the United States. The bumpy plateau of peak oil is in full force. Prices rise to the point where they push economies into recession, demand crashes due to the recession, and prices decline. The double whammy of oil prices reaching $111 a barrel in 2011 and $109 a barrel in 2012 have sapped the life out of the American consumer. This is reflected in the plunge in gasoline and petroleum usage since 2008, with a temporary leveling off in 2010, followed by a further nosedive since 2011. As this recession deepens over the next six months, prices will likely fall further. But this is where the Catch-22 kicks in.

Once prices drop below $80 a barrel it sets in motion a reduction in capital investment, as new production projects are not economically feasible below $80 per barrel. Oil analyst Chris Nedler explains the Catch-22 aspect of oil prices in a recent article:

Research by veteran petroleum economist Chris Skrebowski, along with analysts Steven Kopits and Robert Hirsch, details the new costs: $40 – $80 a barrel for a new barrel of production capacity in some OPEC countries; $70 – $90 a barrel for the Canadian tar sands and heavy oil from Venezuela’s Orinoco belt; and $70 – $80 a barrel for deep-water oil. Various sources suggest that a price of at least $80 is needed to sustain U.S. tight oil production.

Those are just the production costs, however. In order to pacify its population during the Arab Spring and pay for significant new infrastructure projects, Saudi Arabia has made enormous financial commitments in the past several years. The kingdom really needs $90 – $100 a barrel now to balance its budget. Other major exporters like Venezuela and Russia have similar budget-driven incentives to keep prices high.

Globally, Skrebowski estimates that it costs $80 – $110 to bring a new barrel of production capacity online. Research from IEA and others shows that the more marginal liquids like Arctic oil, gas-to-liquids, coal-to-liquids, and biofuels are toward the top end of that range.

My own research suggests that $85 is really the comfortable global minimum. That’s the price now needed to break even in the Canadian tar sands, and it also seems to be roughly the level at which banks and major exploration companies are willing to commit the billions of dollars it takes to develop new projects.

Oil prices may temporarily drop below $80, but prices below that level for a prolonged period will lead to supply being constricted, which will ultimately lead to higher prices. The storyline of hundreds of years of Bakken shale oil that will make the U.S. energy independent is the latest fiction to be peddled by the oligarchs as a way to sedate and confuse the masses.

What the Frack

U.S. oil production in 2007 averaged 8.5 million barrels per day. Today, the U.S. is producing 10.7 million barrels per day. We must have hit the jackpot. Not quite. Actual crude oil production has increased by 1 million barrels per day, a 20% increase. The other 1.2 million barrels have been from liquefied natural gas (up 34%) and government subsidized ethanol (up 100%).

The U.S. crude oil production is at the same level it was in 1998, but somehow we are on the verge of becoming energy independent. The recent increase is solely due to the horizontal drilling and hydraulic fracturing of shale deposits in Texas and North Dakota. You don’t hear much about Alaskan production declining for the ninth year in a row and California production declining to the lowest level in three decades. The paid shills predicting Bakken production of 3 million barrels per day are purposely lying or just plain delusional.

North Dakota oil production has reached 550,000 barrels per day versus 187,000 barrels per day in 2009. Simpletons in the MSM will just extrapolate this growth to 3 million barrels by 2020. No need to examine the facts. Oil market expert Tom Whipple reveals the dirty secrets behind the Bakken shale oil miracle:

It took the production from 6,617 wells to produce North Dakota’s 546,000 b/d in January. Divide the daily production by the number of wells and you get an astoundingly low 82 b/d from each well. I say “astounding” because a good new offshore well can do 50,000 b/d. BP’s Macondo well which exploded in the Gulf a couple of years ago was pumping out an estimated 53,000 b/d before it was capped.

Now a North Dakota shale oil well is not in the cost class of a deep-water offshore platform which can run into the billions, but they do cost about three times as much as a classic onshore oil well as they first must be drilled down 11,000 feet and then 10,000 horizontally through the oil bearing layer before the fracturing of the rock can take place. The “fracking” involves at least 15 massive pumps that inject water and other chemicals into the well. Take a Google Earth flight over northwestern North Dakota. The fracked wells are hard to miss as there are now about 9,000 of them and they are each the size of a football field.

There is still more — fracked wells don’t keep producing very long. Although a few newly fracked wells may start out producing in the vicinity of 1,000 barrels a day, this rate usually falls by 65 percent the first year; 35 percent the second; and another 15 percent the third. Within a few years most wells are producing in the vicinity of 100 b/d or less which is why the state average for January is only 82 b/d despite the addition of 1300 new wells in 2011.

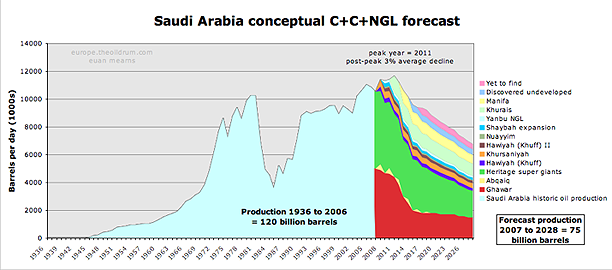

The rapid depletion of these wells, enormous expense to drill new wells, oil prices barely above cost of production, low EROEI, swiftly falling Alaskan and shallow water production, and the snail’s pace of deep water production are not a recipe for energy independence. Shale oil production will never exceed 1 million barrels per day. And if you believe Saudi Arabia’s promises to fulfill any shortfalls, I’ve got some delightful beachfront property in Afghanistan to sell you. Saudi conventional crude oil production is at the same level it was in 2005.

The seven year Saudi plateau is just a precursor to what is going to happen over the next decade. Saudi Arabia began pumping oil in 1945. It will all be gone by 2045. You can’t extract an infinite amount of oil from a finite world. Pretending this isn’t true won’t make it so. Oil has been the lifeblood of our nation since the late 1800s. The depletion of this essential ingredient of the modern world will not lead to a sudden death for our way of life but a slow downward spiral of waning supply, escalating prices, and economic decay.

The sustained high and rising oil prices will be economically destructive as our debt saturated, suburban sprawl, mall centric, SUV crazed, cheap oil dependent society methodically and agonizingly implodes. Chris Skrebowski describes our future succinctly:

“Unless and until adaptive responses are large and fast enough to constrain the upward trend of oil prices, the primary adaptive response will be periodic economic crashes of a magnitude that depresses oil consumption and oil prices.”

We’ve entered one of these periodic economic crashes. They are coming faster and faster. So enjoy that 40 cent drop in gas prices as you drive down to sign up for food stamps. The Saudis have a saying that acknowledges their luck in being born on top of billions of barrels of oil and the inevitability of its depletion:

“My father rode a camel, I drive a car, my son flies a jet plane, his son will ride a camel.”

Delusional Americans believe they have a right to cheap plentiful oil forever. They refuse to acknowledge that luck has played the major part in their rise to economic power. The American saying will be:

My great grandfather rode a horse, my grandfather drove a Model T, my father drove a Buick, I leased a Cadillac Escalade, my son died in the Middle East fighting for my oil, his son will never be born.

Demand Destruction Baby.

Opening now in Eurotrashland, Coming Soon to a Gas Pump Near You.

RE

Oil is the mother of all bubbles. Everything is derived from oil. Oil provides the energy means to transform other resources into something we consume. The most important being the acquisition of the natural resources (mining). Almost all jobs are the result of something to do with the resource transformation. It will take a while, but in the future if you don’t have something to do with food production, and I mean physical work, not driving a tractor, your going to die. The mainstream population will never get it. Oil has given us the power to create a civilization where the people don’t have to know what powers it. The abstraction of the life we live is suicidal. Where’s the reboot button?

http://www.carpoolworld.com/

RE is that really you?

@aca

Of course it’s me. Does anybody else use Bullwinkle’s Mr. Know-it-All as an Avatar?

RE

Damn you admin. You suck.

That’s not RE. He never posts less than 1000 words.

What is reported is really taking on an almost hilarious tone. It doesn’t seem as if anything is surreptitious anymore, only bold-faced misinformation.

One could look at it as “there is more alternative information to gauge against” but that has been the case for years… That explanation is beginning to look like naive hope.

Was it really that long ago when the price-spike in gasoline truly motherfucked the economy? Have people forgotten how foolish the urban/ suburban monster truck commute model they were sold proved disastrous?

Yet a vast number of people listen with earnest to the news report, as it tells them what they want to hear as opposed to what they need to hear. It makes people feel better. It soothes the sense of error… that sense that allows a person to learn from their mistakes. Appealing to the innate desire for one to feel absolved of error, the “Fourth Estate” has proven itself but a massive failure, serving only as a mass-psycho therapeutic instrument aimed at numbing the average viewer to the continued fleecing.

Because we are NOT just lucky… oh no. Luck would imply that we are not intelligent, hard-working, responsive and responsible people…. just as our failures are, of course, the product of BAD LUCK.

People are being bombarded with advice which curbs their instinct to do something about the approaching energy shocks. It is getting to be beyond ridiculous.

So much for the “Rational Consumer”.

“The superior gratification derived from the use and contemplation of costly and supposedly beautiful products is, commonly, in great measure a gratification of our sense of costliness masquerading under the name of beauty.”

– Thorstein Veblen, “The Theory of the Leisure Class” (1899)

Oh joy. My local price for regular has dropped to the bargain price of $4.20 something. Down from$4.45. Happy days are here again. Good thing it’s summer-motorcycle time.

President Obama went through a lot of work to bring the economy down to the point where so many people dont drive to work anymore .So supply is up.And you complain. 3.52 in flagstaff.

admin- Those of a liberal bent assail oil companies and speculators; refuse to acknowledge the law of supply and demand, while touting green energy as the solution to all our energy needs. Those of a conservative bent believe in attacking foreign countries to secure “our” oil, refuse to acknowledge the law of supply and demand, and spout “drill, drill, drill” slogans because dealing with facts is inconvenient. The willfully ignorant public believes whichever storyline matches their preconceived beliefs. All is well –

Yes, my Republican loyalist friends firmly believe that the game plan is to use up all “their” oil while wisely conserving our vast supplies for the future.

I lean more toward Michael Bunker version of the future . Party politics over the span of 230 years has gotten US nowhere .

http://www.lastpilgrims.com/

Gas should get a lot cheaper when there’s no longer a transportation to work need.

http://www.politifact.com/ohio/statements/2011/nov/07/betty-sutton/betty-sutton-says-average-15-us-factories-close-ea/

The data shows there were 398,887 private manufacturing establishments of all sizes in the United States during the first quarter of 2001. By the end of 2010, the number declined to 342,647, a loss of 56,190 facilities. Over 10 years, that works out to an average yearly loss of 5,619 factories. Dividing that by the 365 days in a year produces a 15.39 average daily number of factories lost.

…the bureau’s statistics show the nation lost 8,660 factories in 2010, which works out to more than 23 each day that year. The rate was similar in 2009. In 2007 and 2008, roughly 1,500 factories shut down annually, which works out to just four daily closures.

Question for anyone who knows…

In the article, it states deep water production is coming along at a snail’s pace…

So… Could that maybe greatly increase our oil production if that was looked in to more?

Plutori

Deep water drilling is profitable at oil prices above $80 as long as you don’t blow up your rig and spew millions of gallons into the ocean.

Plutori, the reason deep water drilling is not looked into more is because it is most likely negative EROEI. That is, it is the equivalent of putting a barrel in to get rather less out, which is suicidal.

As it is, tar sands and shale plays have an EREOI of 1:4 to 1, and slipping. They yield about a barrel and a quarter for every barrel invested in extraction. And this is before calculating the costs of refining and getting to market. As it happens, the oil being extracted by deep sea drills is, like the tar sands products, heavy, sour crude that is much costlier to refine than the sweet, light crude we have ripped through so recklessly.

By contrast, in the glory days of Spindletop, the EROEI was 100:1.

People like to believe that the reason more deep water drilling is not being done is because of political and bureaucratic obstruction, when the truth is that there are hundreds of permits that have been issued but are not being used because the risks and costs don’t justify the rewards for many potential drills.

We are flying into a deflationary depression and accelerating as we go. All commodities will be heading down into the end of this decade.

What good is any oil supply if no one has the money to buy it?

Down, down we go………

EF

May I take your focus to the EROI chart? What provides the maximum return? HYDRO at almost 100%. Whats it cost to capture the energy of free water falling over a dam? next to nothing. Heres the plan. Build a bunch of dams in all the valleys, even where there might be a trickle stream today. Then finish the final testing on the HAARP antennas up in alaska. HAARP is the frequency generator focused on the ionosphere which is intended to change and create weather. And be the ulitmate weapon of mass destruction but thats just a side benefit. Then we crank up HAARP and flood the place. Free energy for the taking. Since its impact is global, we can create drought everywhere else, and start exporting the only source of fresh water on the planet. Talk about price gouging- $500 bucks a barrel baby.

YES PURCHASING POWER DOES ACTUALLY BE;LONG TO THE PEOPLE!

Admin says: “This is just another episode of a never ending reality show, designed to keep the average American sedated so they’ll continue to spend money they don’t have buying crap they don’t need.”

I somewhat disagree. This is the opening salvo by the MSM designed to get the oblivious average American to re-elect the Halfrican. Created and saved jobs will be part of the the drug fed to the masses too, along with instant death from the sky of followers of Islam by some all-seeing missiles.

Bottom Line, our fine folks in the US will understand all of this when the crisis becomes big enough. Not enough pain has been felt yet. We don’t have enough unemployment, enough poverty or enough hardship on the masses yet to really get their attention. There are still too many SUVs being sold, too many air conditioners running and too many big screen Tee Vees blaring 24/7. Nothing changes until the painful crisis occurs. We can all blogg the truth till our fingertips develope gang-green but it will all fall on mostly deaf ears for the time being until the real pain of a real recession sets in.

Most of America has lived in fanatasy land for the last 40 years. It’s hard to leave a delusional utopia when you grew up in it and have known nothing else. I mean, what else have we all known unless you dig deaper like Mr. Quinn does here. Jim Kunstler, the brilliant writer who pens the Clusterfuck Nation blogg outdid himself today with his analogy. America feels like shit these days because that’s the only place our perceived lifeblood comes from in the form printed money and media-speak. The money and news-propaganda is simply excreted from the rancid bowels of the government and MSM. It has the same backing and worth as shit. Americans are notorious for stuffing their face with high-fat shit food anyway so the MSM just feeds the need. Nothing will change until the collapse occurs, the real collapse.

China imported a net 25.3 million metric tons of crude in May, or 5.98 million barrels a day, up 10 percent from April, customs data showed yesterday. The previous record was 5.87 million barrels a day in February. Purchases cost an average of $120 a barrel, compared with about $123 in April, the data showed.

[img [/img]

[/img]

Perhaps it is not worth pointing out that one thing China is seemingly not hoarding is the USD.

Theres seven gas stations in my town and they all have gasoline.Dont woooorrry.The coming economic armagedon well soon take your mind off oil.

How long will the U.S. allow China to suck up all the remaining oil? Not very long.

The inflation-adjusted oil price chart indicates that the next wave in oil prices will probably be down beyond the 2008 price low (which was in the $40s). Another piece of the puzzle…

Bob

Not very likely. And if it happened, it would only last for a few months. Charts without facts are useless.

Your premise is flawed.

Put a graph up which shows Helicopter Ben’s QE games imposed over the cost of a barrel of oil. More monetary heroin = more speculation = higher commodity prices. Revision to mean is going to be a bitch. Once the credit creation machine malfunctions you’ll see a lot of the 1% become the 99% and some 99% starve off and die. It’s going to be horrific and there’s not a damn thing we can do to stop it. Hold on tight because it’s going to be a very bumpy ride.

I’ve had a strategy of rolling sold put options on UGA (gas ETF) to hedge our family’s gas prices each quarter (pretty speculative, but if gas spikes, it doesn’t hurt as much and if it’s flat I make money). Of course, this quarter it hasn’t worked out too well. Unless gas goes up a few cents a gallon by July I’ll be out a few hundred bucks. But then again… we’re paying much less in gas consumption right now than we were in prior quarters…

Admin, many price charts tell stories. The inflation-adjusted oil price chart above tells a story of a commodity that took a long term trend into a blowoff top, and then reversed trend sharply into a blowout bottom. Unusual and significant price action! Subsequent price action has been a partial recovery that has not approached the previous high — therefore, revealing itself as a correction to the main trend, which is still down.

If the corrective move has ended, or continues to move sideways without exceeding the old high, a new, even more vigorous wave down would take prices below the $40 mark. The next wave of the sequence after that would be another counter-trend rally, followed by a final new low. This is all in accordance with Wave Theory, which is strong on the big picture questions but many times fuzzy with the specifics.

All this would unfold over a timeframe that would be a fraction of the time it took to complete the corrective wave (say 1+ years). After that, oil prices could be expected to languish and then begin to climb as they did in the 1998-2006 period. An new top would be possible a couple or few years after the bottom.

That’s the story (more or less) I read from that chart.

Charts are charts. They don’t predict anything. Facts and reality will determine oil prices. Supply, demand and war will determine prices, not charts. Technical analysis is bullshit. Everyone knows the 200 DMA and 50 DMA and RSI and MACD. It is all programmed into computers so it is no longer predictive.

Bring manufacturing back from China. Exports give them the discretionary income to drive oil demand. Economic war is the most important thing we need to focus on… No more ‘free trade’ and incentives for importing from China. Our policies dig our own grave. The solution is not as much in getting us on bikes as it is in keeping the Billion Chinese on them. Less Empire Building wars, and more hardball

Economic war to crush foreign economies for our own survival.

SAH spouts off on something she knows nothing about. Now there is a surprise.

Manufacturing isn’t coming back. The trade war has been won, and the Chinese won it. Low cost high value workers by the millions are available in China. The can fit out a factory with literally THOUSANDS of engineers in days – not weeks, months or years, but DAYS. The US doesn’t produce enough engineers/scientists/manufacturing professionals to compete, and hasn’t in a very long time. There are things which could have been done around the periphery, but they should have happened years ago. A trade war will only drive US cost of living up higher than it is. And of course, China now makes things the US no longer does. That gives them, what do you call it, oh yeah, “leverage” in a trade war. Plus they have this other little bit of leverage – they buy US fucking debt by the billions and billions. What is that again? Oh, right – it is leverage. And just what would happen if all of a sudden China not only stopped buying US debt, but dumped the debt it has already? Gee, now that would be a problem.

Seriously, SAH, don’t be so stupid.

SAH, now you’ve done it

Where to start? Maybe with you and the other Cyclops and the China derangement syndrome. As far as oil, China is but one player in the world oil market. Consider Japan and then all the rest.

“Economic war to crush foreign economies for our own survival.” Yeah, as if that hasn’t been tried before with dire unintended consequences. But why do you think this ~free trade~ (note sneer quotes) even exists? Mini-history: you probably think the Marhshall Plan was humanitarian largesse. The reality is, the post-war plan was simply to restore some semblance of recovery for Europe and U.K. and Japan, even a little aid to Russia. Heh.

Recovering countries pretty well trashed with WW2 would soon be buyers of American exports. And when they got to export capability, what they sold to the U.S. earned them stealth-inftated dollars. The intended policy kept the game going for many years thanks to Bretton Woods. The extraordinary privilege of the reserve currency worked well. Now, not so much.

As for the Chinese dragon, note that Japan owns almost as many US treasuries as China. The latter with around 29% of foreign holdings. Third on the list is Canada, Korea down a ways, Germany also to be considered and France, etc.

And the elephant no one notices is: 2/3 of the whole is held domestically, both guvmint and private.

Of course, in the middle of a trade war, China and Japan could dump over $2 trillion of treasuries without blinking and eye — and the Bernank could swallow them up as easily. But then, who do we turn to for the ‘kindness of strangers’? “Who will buy this wonderful morning?”

Now think of rare earths and graphite …

Novista – yep. Well said.

Great article. People so rarely point out the Final Solution to our global energy problems—it’s free, it’s infinite and we all enjoy at least 150 W/m² of it. Fossil fuels are no longer requisite for ground transportation and power grids, and our remaining supplies should be reserved for applications for which no suitable replacement is readily available (primarily air travel).

Colonel, I don’t think you get it yet. Air travel for the military maybe. But not for too long. If your talking 150 w/m2 to grow your food, your on the right path, if your saying solar energy, again, you don’t get it. Solar energy panels are a transformation of raw resources into final product, with almost every step of the way requiring fossil fuels.

Solar panel manufacturing currently relies on fossil fuels, yes. That’s a symptom of the infrastructure and not at all inherent to the technology. Within a pure solar energy economy, producing solar panels will involve little to no petrochemicals. Yes there will be a protracted transition period, but make no mistake; solar energy is the only energy there is, and direct solar collection is the only energy source we will utilize by the end of this century.

I don’t see a pure solar energy economy, at least one with solar panels. The solar economy will be one based on the process of converting light energy to chemical energy and storing it in the bonds of sugar. We can then eat it.

How will I get to work in my solar powered car on cloudy days?

World wide hyperinflation. Crash and burn, render the debt meaningless. End the FED. Great reset, back to basics and more protectionist/isolationist economic theories. No more ‘let’s raise the world’s living standards’, no more. American interests only.

@Llpoh – Mexico has more and more manufacturing jobs. Unions and their Boomer entitlements (that younger Union Members have been voted out of getting) makes it impossible to manufacture competitively in the USA. But Mexico can do it – is that because they crank out so many more Engineers than the USA? Or is it the Boomer Union Unfunded Entitlement workers in the USA who fucked things, every bit as much as the pro-Corporation job exporting policies of Boomer politicians.

SAH – Mexico = cheap wages. A lot of Mexican facilities are direct copies or direct transplants of US plants, so they need fewer engineers than countries building mfging from scratch. They are not developing their own mfg nearly to the extent that China is. Mexico is also not the offshore location of choice anymore. For a lot of reasons.

Only very large corps are unionized by and large in the US – ie such as GM. Mfg is leaving due to cost, quality, and inability to source high skill employees quickly. I have mentioned that China can source thousands of engineers for a new plant in a week. That would take years in the US, if it is even possible. To compete against Mexicio, China and their ilk the US needs to be so efficient that it is able to offset its labor and compliance costs. To do that requires skilled professionals – many more than are being produced.

A Chinese worker costs about 5 per cent of what it costs me to employ a worker. So if transport issues are less than 95 per cent of my labour costs I am screwed.

SAH – that is just the tip of the iceberg. There are too many hurdles to overcome to return the US to serious mfg. Your isolationist theories will not work. But hey, it is easier to put your head in the sand than for the US to actually do those things necessary to compete. But easy doesn’t work.

Admin says “Technical analysis is bullshit.”

Another point of view, more closely aligned with the Turnings/Cycles/Waves mindset: Fundamentals don’t matter. Prices matter.

Efficient Market Theory is wrong about the market factoring in everything people know; it is exactly right about factoring in everything people feel — it just bungles the rationality argument.

We all have seen situations in which the underlying ‘fundamentals’ haven’t changed a bit, yet market prices are gyrating wildly. We’re witnessing quite a bit of that right now.

Price levels in markets are driven by social mood and its trends and fluctuations. Fundamental issues don’t seem to matter until they do matter, and only when public consciousness focuses on them.

Most important, different perceptions/interpretations/conclusions are applied to the same fundamentals at different times, with huge disparities in subsequent market prices.

The only form of market analysis that captures the impact of social mood on markets is technical analysis. Just as social mood changes via turnings, cycles and waves, market price changes develop trends and patterns that are related and can be interpreted and analyzed. The biggest limitation to tecnical analysis is that patterns are never complete until the price changes associated with them are already over, and can unfold in many different ways. But in spite of the high level of uncertainty that results, it is very possible to extrapolate potential unfolding trends in a particular market using various technical analysis approaches, and predict with accuracy how far a particular price trend will go.

As Admin points out, sometimes popular techniclal indicators lose some or all of their predictive value as too many people follow and apply them. But what usually happens is that such behavior does not affect the direction of the change, but its current shape and timing.

Finally, there is only one way to participate actively in any market. That is to trade. If one has fundamental opinions, they must be expressed in techincal trading terms, becoming part of the market itself. This is why the manipulative efforts of the Federal Reserve, Wall Street Banks, High Frequency Traders, etc. will ultimately come to naught — they have all become part of the markets they trade in, and the fabric of technical trading that results, which unfolds in pretty patterns right before our eyes. Their actions lie in plain sight, giving us hints about what is likely to happen next.

Fundamental analysis is usually the most popular approach to markets during Bull phases. Technical analysis tends to become more popular in Bear markets. Only one is actually mostly bullshit. Perhaps, because we all respect Admin so much, we might allow that some parts of Technical analysis could be labeled bearshit.

Hey Archie Bunker told us this years ago

I want to discuss the idea of isolationism for a moment, and what the impact of putting up tariffs to slow the importation of foreign goods into the US would mean. In general, the US imports approx. $800 billion more in manufactured goods each year than it exports. If The labour content of this is considered to be around 25% overall, and the cost of each employee is considered to be arounf $75,000 per employee – US cost – then you can calculate that by replacing foreign goods with US produced goods, the US could add around 2.7 million manufacturing employees. This represents around 2% of the total current US workforce – and theoretically would drop the unemployment rate by 2%. That would bring the percentage of US manufacturering employees back up to around 15% of total employment – a far cry from the days of 30, 40 and even 50% level that they used to be.

But what would the cost be? First, the cost of goods purchased by consumers would rise substantially – pick a number. Let’s say by 20% of the $800 billion differential. That would be $160 billion, which would translate roughly into an added cost to evry man/woma/child of approx. $500 per year. Fairly significant in the scheme of things.

Second, if 2.6 million persons were to re-enter manufacturing, there would be needed something like 500,000 manufacturing professionals in addition to the laborers. These professionals do not exist, and it would take years to deveolp them – perhaps decades. What would be the case until then? It would mean low quality high cost goods, in the best of scenarios.

Third, there woud be enormous unintended consequence. There is a huge number of products and materials that the US can no longer produce. There would be trade wars, and the US would be starved of goods and services that they cannot do without readily.

There would be retaliatory action re the selling of US debt – which would have a negative impact on the economy.

Those folks talking about isolationist systems are overlooking the main fact. Yes, the US is importing a lot of goods. But the reality is that when the US had heavy manufacturing, they were heavy EXPORTERS of goods. And isolationism will NOT make the US competitive and allow for the return of exports. It will make the US increasingly uncompetitive. Manufacturing has crumbled NOT because of imports, but because its costs are too high and its quality too low to allow it to EXPORT goods as succesfully as it used to do. Tariffs will only serve to further make the US uncompetitive.

And of course, the real downside is that trade wars more often than not lead to actual wars.

The answer is this – the US must rebuild and become internationally competitive. It starts with education and a workforce driven to work hard, innovate and push for excellence. It requires government policy that does not hinder but rather helps – EPA, OSHA, local laws, etc etc etc need to be adapted so as to promote manufacturing instead of killing it off. There are a great many things that can be done to start the process, including:

– stop funding non-science/math/engineering tertiary education so as to dramatically encourage more graduates in these fields

– grant immediate depreciation write-offs for all US produced capital goods

– eliminate all payroll taxes

– streamline accounting practices and reporting, especially for smaller business

This list can go on and on. It is not hard to come up with things that would encourage rather than discourage manufacturing.

But the fact is, the damage is done. It took decades to destroy the US manufacturing sstem, and it will take decades to rebuild it. But unless there is a monumental shift in the attitudes of politicians and the general public (who more and more see manufacturers as evil exploiters of workers and resources) it will not happen. I do not think it will happen. There is no collective will.

–

Are you really that stupid?

You don’t look at the price you have now and go backward to what a price 14 years ago would be with the 14 years of inflation, you calculate what the price would be now WITHOUT the 14 years of inflation.

The chart referred to isn’t here but it’s on Puplavas Financial Sense site.

(Did someone point out how stupid it was and you deleted it?)

llpoh

Your comment should be an article.

If people that come here don’t get it, maybe there’s no hope. Bring the Doomocalypse!

Ben

What the fuck are you blathering about? The fucking chart shows nominal and real prices. Even a fuckwad like yourself should be able to read a fucking chart and realize that gas prices have accelerated at 3 times the rate of general inflation.

Are you really as stupid as you appear?

I really should require an IQ test before allowing dumbasses to comment.

I believe Brainless Ben doesn’t understand what the term REAL refers to. It means inflation adjusted you dumbass fuckwad. Our public school system again proves that it does nothing but spew out ignorant douchebags.

I am quite suspicious of this article. Who wrote it?

I am not buying the idea that higher production costs of tar sands oil

or biofuels account for the huge increase in oil prices since 2004

when oil production levels were the same. I do believe oil production

figures are the same as 2004, but that the price increase is due to

a non-competitve marketplace and manipulated oil prices. The

increased price is due to oil company market manipulation and all

the extra margin goes to their profits.

Wow, this article sounds suspiciously like some propoganda

the API or govenment would be trying to sell. First this article

bashes the government and corporate media (which actually

is not trustworthy) to gain your trust and some credibility.

Then the article introduces a bogus proposition in the effort

to try to explain away the idea the oil companies have taken

advantage of us with increased oil prices at the same levels

of production as 2004. There has been very little increase

in the cost of producing crude oil in the past decade. All the

price increase goes to oil company margin.

randy

fuck your suspicions. I wrote the fucking article.

Make your fucking case versus my facts or go fuck yourself.

randy

I love when ideologues like yourself enter the fray with your storyline of evil oil companies and NO facts to back up your bullshit.

Make your fact based case douchebag.

A good article filled with facts,

but there’s also a thread in there that really make sense.

If the following statements are true, and I’m sure they are:

> To acknowledge the fact that worldwide oil production has reached its peak would be to concede that our suburban sprawl, just in time world is drawing to an excruciating end.

> a never ending reality show, designed to keep the average American sedated so they’ll continue to spend money they don’t have buying crap they don’t need.

> The government agencies promoting the storyline of …

> Anyone living in the real world … knows we have entered part two of the Greater Depression.

> … Bloomberg, defender and mouthpiece of billionaires everywhere.

then why the torrent of abuse aimed at the MSM :

> The brainless twits that pass for journalists …

> The MSM blathering baboons of bullshit …

> … the clueless captured media.

> Simpletons in the MSM …

The point hinges on this dillema:

> The question is whether the MSM is misleading the public due to their own journalistic incompetence or are they carrying out their assigned mission on behalf of the corporate oligarchs running the kingdom.

The facts show quite clearly that there is no question about it –

the MSM, which is owned by billionaires and who employ those journalists,

are DEFINITELY “carrying out their assigned mission”.

Why the equivocation ?

I think the answer to that is because the author thinks it is still too ghastly

for most people to be told that the MSM is involved in a conspiracy with governments

to hide the fact that the era of capitalist economic growth is coming to an end.

Is Obama a fool, or a very clever political operator

doing the best he can under difficult circumstances ?

No doubt about it – he is not a fool.

He has got the vast majority of the world’s population fooled.

So what is his game plan for the future ?

After all, his strategy till now has been to simply cover all this up,

but ultimately that doesn’t get capitalism of the hook.

There’s no shortage of potential wars,

which would allow him to put the economy on a war footing,

with levels of austerity (think gasoline rationing, food rationing, etc)

that would otherwise be impossible in the Land of the Free.

It is all too easy to visualise a war in Syria provoking a war in Iran,

and a disintegrating Iraq needing to be re-invaded.

This would undoubtedly lead to more civil war in Lebanon

and more war with Israel – already a neo-fascist state and the US’s closest ally.

Baluchistan Province in western Pakistan has never really been under the control of Islamabad,

and would be happy for military support to break away,

giving the invaders better access to eastern Iran and the on-going war in Afghanistan.

The tribal areas in northern Pakistan are a hot-bed of anti-US sentiment,

and need to be cleaned out once and for all, even if it means killing the lot.

Could the Pakistani Government survive such a dismemberment ?

Should a weakened Government be allowed to continue to hold nuclear weapons

while not being a member of the NNPT

and having a history of selling nuclear technology to all-comers ?

India would be happy to sit back and watch while Pakistan is wiped out,

on condition they were allowed to re-exert control over all of Kashmir.

Assuming war only spreads as far as this,

there is the potential for the US to be engaged in “the struggle for freedom” for decades yet,

and all the while the US economy would be held on a war footing.

The lack of gasoline would be directly attributed to the evil intent of the enemy,

and the promise of an eventual return to the good old days of oil addiction

relies on keeping the truth concealed –

and surprise, surprise, this is exactly what the US Government is doing.

Would the US population put up with that ?

Well, what would be their choices ?

Do they protest Government policy and risk being labelled “unpatriotic” or worse ?

If they do, they will find Obama has already thought of that possibility –

covert surveillance of the telephone system and internet

would evolve seemlessly into outright censorship of any dissent.

And the claimed right to have “terrorist lists”, “no-fly lists” and “kill lists”

that ostensibly only apply to Al Qaeda now,

would certainly be grounds for the rounding up and detention without trial,

or even torture and summary execution,

of unpatriotic subversives and dissidents in a time of war.

And what to do with all the unemployed young men in the US and Europe ?

What could we think of for them to do in a time of war ?

I’m sure Obama has a plan for that too.

Since so many things fall into place when you see things this way,

to still hold doubts about the sanity of politicians, journalists and economists

is entirely misplaced.

Should read:

A good article filled with facts,

but there’s also a thread in there that really makes no sense.

While i agree that china is kicking our ass.I would be curious what you think the future of the usa looks like.Besides A road warrior movie.

Not periodic crashes but chronic and permanent.