“Now remember, when things look bad and it looks like you’re not gonna make it, then you gotta get mean. I mean plumb, mad-dog mean. ‘Cause if you lose your head and you give up then you neither live nor win. That’s just the way it is.” – Josey Wales – Outlaw Josey Wales

To hell with them fellas. Buzzards gotta eat, same as worms. – Josey Wales – Outlaw Josey Wales

There is a war underway in this country. The working middle class that built this country from the ground up are being systematically eliminated by a small cabal of super rich powerful elite. The middle class was much like Josey Wales, a peaceful Missouri farmer just working his land trying to make an honest living. Then a band of lawless thugs come along and kill his wife and son and burn down his farmhouse. A man can only take so much before he gets mean and vengeful. The rich and powerful, the corrupt Wall Street bankers, the banker controlled Federal Reserve and the bought off politicians in Washington D.C. have been pillaging the middle class for decades.

They’ve killed the middle class and in 2008 they essentially burned down the worldwide financial system. Somehow, they convinced the American public the war was over. A small band of super wealthy individuals on the boulevard of greed, Wall Street, and in the putrid swamp of Washington D.C. blackmailed the American middle class taxpayers by threatening to bring down the financial system unless they were handed $700 billion, saved from bankruptcy by the Federal Reserve buying $1.2 trillion of toxic mortgage debt, and provided free money by their sugar daddy at the Federal Reserve. The politicians then absconded with another $800 billion of taxpayer funds and handed it out to their corporate political cronies in the name of shovel ready projects and adding 3 million new jobs.

At the end of the Civil War, the Confederate guerrillas that Josey Wales had joined agree to lay down their arms with a promise of freedom. Instead the Union thugs began to mow them down with a Gatling gun. This is perfect symbolism for what the ruling elite have perpetrated in the last three years. Within months of nearly destroying the worldwide financial system, the Wall Street desperados were paying themselves hundreds of billions in bonuses for a job well done plundering and sacking the American middle class taxpayer. They certainly earned the bonuses, considering they could borrow from the Fed at 0% and earn 2.5% on Treasuries or pile into stocks and commodities, knowing Uncle Ben would guarantee profits with QE2.

Jim Grant, in early 2009, described the excessive response by those in power to a crisis caused by them:

“To try to exorcise the Great Depression, President Herbert Hoover deployed fiscal and monetary stimulus equivalent to 8.3% of gross domestic product. To banish the demons of 2008-9, successive administrations have spent, or encouraged to printed, the equivalent to 28.9% of GDP. A macroeconomist from Mars, judging by these data alone, would never guess how much more severe was that depression than this recession. The decline in real GDP from August 1929 to March 1933 amounted to 27%; that from December 2007 to date, just 1.8%… so for a slump 1/15 as severe as the Depression, our 21st-century economy doctors administered a course of treatment more than three times as costly.”

Ultimately, GDP fell 3.1% between the 3rd quarter of 2008 and the 3rd quarter of 2009. The government response has amounted to throwing $7 trillion ($4.2 trillion increase in national debt, $700 billion of TARP bailouts, $200 billion of losses taken by Fannie Mae & Freddie Mac, $100 billion of losses taken by the FDIC, and the Federal Reserve increasing their balance sheet by $1.8 trillion) of your tax dollars at the problem. As a side benefit, they have thrown senior citizens under the bus by paying them 0% on their savings, not providing a cost of living increase to their social security for two years, and hitting them over the head with 10% levels of inflation on food and energy.

At this point it looks bad for the working middle class and it looks like they aren’t going to make it through the next banker made financial crisis. The middle class just wants the chance for a new beginning. They want jobs. They know the country has been hijacked by the banking corporatocracy, supported by the corrupt political class in D.C. It is time for the middle class to channel their inner Josey Wales and get plumb mad-dog mean. It is not time to lose your head and give up. The middle class are being pursued by Wall Street bounty hunters and government crooks trying to finish them off. It is time to make a stand and fight. It is essential that we know our enemies and how they achieved their power. It all began in 1913 with the creation of the Federal Reserve and the implementation of the personal income tax. I’ve previously detailed how the baby boom generation contributed to our fiscal plight in Part One – For a Few Dollars More, how the actions of the Federal Reserve’s over the last few decades have impoverished the middle class and placed the country at the brink of collapse in Part Two – Fistful of Dollars and addressed the nefarious creation of a central bank in Part Three – The Good, the Bad, and the Ugly.

How to Buy a Tax Break

“There’s another old saying, Senator: Don’t piss down my back and tell me it’s raining.” – Fletcher – Outlaw Josey Wales

When the Federal government spends more each year than it collects in tax revenues, it has three choices: It can raise taxes, print money, or borrow money. While these actions may benefit politicians, all three options are bad for average Americans. – Ron Paul

The Senator pissing down the backs of Americans while telling us it was raining was named Nelson Aldrich, from Rhode Island. He was a Republican lackey of J.P. Morgan who was the driving force behind the creation of the Federal Reserve and the passage of the Sixteenth Amendment, creating the personal income tax. His daughter married John D. Rockefeller, Jr. and his son became the Chairman of Chase National Bank. I wonder how beholden he was to the banker class. A decade before 1913 Aldrich had declared an income tax as communistic. He was right. Karl Marx published his Communist Manifesto in 1848. It included ten planks. Two of the ten planks were as follows:

- A heavy progressive or graduated income tax.

- Centralization of credit in the hands of the State by means of a national bank with State capital and an exclusive monopoly.

The United States had tinkered with an income tax during the Civil War and the 1890’s, but the Supreme Court declared it unconstitutional. Until 1913, the Federal government was restrained from overspending because it was completely reliant on tariffs and duties to generate revenue. Without the ability to print money and tax its citizens, politicians could not roll out new programs and fight foreign wars of choice.The Sixteenth Amendment changed the game forever.

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Politicians pulled the old bait and switch on the American people. The initial tax rates of 1% to 7% were low. That did not last long. By 1918, the top marginal rate was 77%, as Woodrow Wilson needed to fund his war of choice. The top tax rate reached 92% during the Eisenhower Administration and today rates are still 500% to 1,000% higher than they were in 1913. The government is addicted to tax revenue. In 2009, they absconded with $1.2 trillion in taxes from American individuals. Does anyone think the bloated government bureaucracy spends these funds more efficiently or for a more beneficial purpose than its citizens could have? The income tax distorts financial planning and business investment, and it encourages tax avoidance and evasion.

| Partial History of U.S. Federal Income Tax Rates Since 1913 |

||||

| Applicable Year |

Income brackets |

First bracket |

Top bracket |

Source |

| 1913-1915 | – | 1% | 7% | IRS |

| 2003-2009 | 6 brackets | 10% | 35% | Tax Foundation |

Source: Wikipedia

The average American thinks income taxes are essential because politicians tell them so. The only discussion is about what the rates should be. But, the country grew tremendously between 1789 and 1913 without a personal income tax. Income taxes do not benefit the average American, they drain wealth from the citizens and hand it to politicians who then use them to bribe constituents for votes with handouts and fund foreign wars of choice. The IRS tax code has progressively been utilized by the rich and influential class to skew it in favor of those with the most lobbyists. Politicians get elected by promising benefits to the masses while being funded by rich people and big corporations. A tax code of 60,000 pages, with over 600 IRS tax forms, and filled with tax breaks for influential constituents (farmers, oil companies, homeowners, foreign corporations, etc.) is not designed to benefit the average American. The tax code is used to pay off those who “contribute” to the politicians that control the tax code.

Congress frequently holds hearings on tax simplification so members can denounce the tax code’s complexity. Congressional experts and impartial think tanks provide useful simplification ideas. When the TV cameras are turned off, Congress swiftly ignores them and votes for more special interest breaks for their biggest contributors. The storyline that is pounded into the minds of all Americans is that 50% of the population pays no taxes and the rich pay an inordinate amount of taxes. The Republicans and Democrats fight a battle of false talking points to confuse and obscure the truth.

The Republican mantra since the Reagan era has been to cut taxes and allow the “free market” to work its magic. They have succeeded in convincing a vast swath of Americans that lowering the highest tax rates have benefitted the masses. This is completely untrue. An unfunded tax cut today is just a tax increase on future generations. Democrats went along with tax cuts as long as the Republicans went along with spending increases. The Democrats hit the jackpot, with a supposedly fiscal conservative president signing a Medicare D bill that added trillions of unfunded liabilities to our national balance sheet. The Republicans are on cloud 9, as a supposedly liberal anti-war president has increased war spending to $1 trillion per year while ramping up our foreign wars of choice. Everyone gets what they want in Washington D.C. This is called bi-partisanship.

The Big Lie

As the chart above shows, at least before Reagan the top marginal rates were kept high to pay for the social programs instituted by Congress and the wars of choice fought by our Presidents. After 1980, in some sort of warped Twilight Zone episode, politicians across the land convinced themselves and the masses they could have lower taxes, more entitlement goodies, never ending war, and an unlimited heaping of material goods, with no adverse consequences. Well, it was a lie.

- The GDP in 1981 was $3.1 trillion, today it is $14.7 trillion.

- The National Debt in 1981 was $907 billion, today it is $14.4 trillion.

- The amount of annual Federal income tax revenue in 1981 was $347 billion, today it is $1.1 trillion.

- The amount of annual Federal spending in 1981 was $678 billion; today it is $3.8 trillion.

- Total consumer debt in 1981 totaled $353 billion, today it is $2.4 trillion.

- Total mortgage debt outstanding grew from $1.5 trillion in 1981 to $14.6 trillion by 2008.

- Median household income was $17,710 in 1980 and is now $49,777.

These facts reveal an empire spiraling out of control, delusional and living on borrowed time with borrowed money. The output of the country has grown by 474% in the last 30 years, while the National Debt has grown by 1,588%. Those two facts alone paint a picture of eventual collapse. The lesson of allowing politicians and bankers unfettered access to unlimited amounts of fiat currency backed by nothing but a hollow promise to pay is clear, in the divergence of income tax revenue and spending. The dramatic slashing of top marginal rates from 70%, which had been in place for a fifty year period when the U.S. economy boomed, was supposed to invigorate the economy and unleash the free market spirit of our entrepreneurs. A funny thing happened on the way to prosperity for all. Federal income tax revenue has only grown by 317% in the thirty years since the Reagan Revolution. The CPI has grown by 289% over this same time frame. Therefore, tax revenue is essentially flat with 1980 on an inflation adjusted basis. This wouldn’t be a problem, except that the politicians we elected ramped up spending by 560% over these same thirty years. Federal spending has grown at almost twice the rate of income tax revenue. Bug meet windshield. I guess this is called supply side economics.

Politicians of both parties have promised the American public they could have low taxes, unlimited social welfare benefits, a house that always appreciated in price, electronic gadgets galore, and the true American dream of getting something for nothing. And it was all made possible by your friendly Wall Street banker and their friends at the Federal Reserve. The data above already paints a dire picture for the American Empire, but the next ten years will finish the job. GDP is stagnant as Federal government spending props up the teetering edifice of economic activity. The National Debt will reach $20 trillion by 2015 and is on course to reach at least $25 trillion by 2019. Both the Republican and Democratic “plans” to “reduce” the deficit are a joke. They don’t reduce anything. They add to the debt.

The citizens of this country should be outraged by such fiscal irresponsibility, and marching on Washington D.C. with pitchforks and torches. But, there is no outrage across the countryside. This is because the vast majority of Americans followed the example of their beloved government leaders and lived far beyond their means in a delusional attempt to borrow their way to material prosperity. The median household income has risen by 281% since 1981, less than inflation over the same time frame. The median household is taking home less than they did in 1981 on an inflation adjusted basis. The McMansions, BMWs, computers, 52 inch HDTVs, and 15 other essential electronic gadgets that represent the current American Dream were financed. Consumer debt, used to buy (rent) luxury automobiles and essentials like 4 TVs and 3 computers, grew by 680%, more than twice the rate of median household income. Mortgage debt grew by an astounding 973% in the last thirty years.

![[Mortgage+Debt+Outstanding+1952-2007.bmp]](https://2.bp.blogspot.com/__V1GJlBadyE/SZRz3kTxSfI/AAAAAAAAAag/Za3ExRYRDK8/s1600/Mortgage%2BDebt%2BOutstanding%2B1952-2007.bmp)

The last thirty years have been a faux American Dream. The madness of crowds has been replaced by the sober reality that the material goods purchased with debt steadily depreciate day by day, while the debt stays firmly in place. Who benefitted and who lost during these thirty years of delusion? There is only one beneficiary from the issuance of trillions in debt – Wall Street bankers. The ten biggest banks in the country hold more than 50% of the mortgage debt and 80% of the credit card debt in the U.S. The poor never had much, and they still don’t. Politicians have averted riots and social unrest by pouring trillions into welfare, social security disability, SNAP programs, earned income credits, and hundreds of other transfer payment bribes to the poor. The middle class has borne the brunt of the banker plundering and pillaging.

The Super Rich Storyline

There are three storylines that are pounded home repeatedly by the mainstream media and the Republican Party ideologues.

- More than 50% of Americans don’t pay any taxes.

- The top 1% pays 38% of all the Federal income taxes.

- Increasing the highest tax rate above 35% would destroy jobs and kill small business owners.

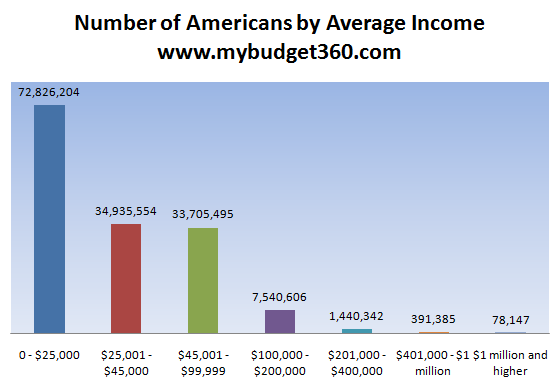

The misinformation spewed forth by the super rich, who control the media, politicians, and media message, to disguise their continued looting of the American middle class, is unrelenting. There are 117 million households in the United States with a median household income of $48,000. Data from the Tax Foundation shows that in 2008, the average income for the bottom half of taxpayers was $15,300. The first $9,350 of income is exempt from taxes for singles and $18,700 for married couples. Politicians of both parties also provided credits for children, earned income credits, mortgage tax deductions, property tax deductions, and a myriad of other tax goodie payoffs for votes. When half the households in the country make less than $48,000 per year in income, of course they won’t be paying any Federal income taxes. There are approximately 151 million Americans earning income. Almost 73 million, or 48%, make less than $25,000. As Wall Street enriched billionaires are interviewed by millionaire journalists on CNBC, scorning those who don’t pay their fair share of taxes, they outsource the blue collar jobs of those on the lower income scale to China and India. Without good paying jobs, the middle class uses debt to maintain their American dream, further enriching the billionaire class in a circle of death.

This chart reveals the true nature of who controls our country. It is a battle between a few thousand of the richest people in America versus the other 150 million. The facts are the middle class and poor pay a much higher percentage of their income in taxes than the rich. The Social Security tax cuts off at $106,800. Therefore, the median household pays 6.2% of their income, while the rich household making $5 million per year pays .13% of their income. This applies to sales taxes, property taxes, state taxes, local taxes and the thousand other taxes and fees charged on utility bills, etc. William Domhoff notes that the top 1% who make $1.3 million per year only pay 30.9% of their income in taxes, while those making $141,000 per year pay 31.5% of their income in taxes. I guess their tax lawyers aren’t as well paid. Even those making $34,000 pay 27% of their income in taxes.

Source: Citizens for Tax Justice

The top 1% does pay 38% of the Federal income tax because they have a 23.5% share of the national income. The last time the top 1% reached this level of income was in 1928, just before the Great Stock Market Crash and the Great Depression. During the glory years of the American Empire, between 1946 and 1971, the top 1% of households’ share of the national income ranged between 8% and 13%. With the era of unbridled greed and debt that began in the 1980s, the inequitable distribution of wealth has risen to new heights. This level of pillaging by those in control of the finance sector of the economy, supported by their mouthpieces in Congress, and championed by their controlled media pundits, has reached a level that will eventually lead to revolution.

The biggest lie pushed forth by the powerful super rich in this country is related to the top marginal tax rate, which is currently 35%. The Republican agenda includes a further cut in the top rate to 25%. It is sold to the American public as a good thing for them. It has nothing to do with them. The 35% rate applies to only taxable income over $379,000. Of the 151 million Americans earning a living, this rate would apply to about 200,000 people. The top marginal tax rates during the glory years of the American Empire (1946 – 1971) were between 70% and 90%. These rates only applied to taxable income above $400,000, when the average income was less than $10,000 per year. These were the best years for the American middle class.

The IRS issues an annual report on the 400 highest income tax payers. In 1961, there were 398 taxpayers who made $1 million or more. Today there are over 78,000 taxpayers who make more than $1 million. The loopholes written into the tax code over decades by lobbyists paid for by the super rich, plus much lower tax rates on the largest sources of income of the wealthy (capital gains taxed at 15%), explain why the average federal income tax rate on the 400 richest people in America was 18.11% in 2008, according to the IRS, down from 26.38% when this data were first calculated in 1992. Among the top 400, 7.5% had an average tax rate of less than 10%, 25% paid between 10% and 15%, and 28% paid between 15% and 20%. The average American’s share of their income going to federal taxes increased from 13.1% in 1961 to 22.5% in 2008. William Domhoff explains how the super rich have paid off Congress to rig the system in their favor:

“According to another analysis by Johnston (2010a), the average income of the top 400 tripled during the Clinton Administration and doubled during the first seven years of the Bush Administration. So by 2007, the top 400 averaged $344.8 million per person, up 31% from an average of $263.3 million just one year earlier. How are these huge gains possible for the top 400? It’s due to cuts in the tax rates on capital gains and dividends, which were down to a mere 15% in 2007 thanks to the tax cuts proposed by the Bush Administration and passed by Congress in 2003. Since almost 75% of the income for the top 400 comes from capital gains and dividends, it’s not hard to see why tax cuts on income sources available to only a tiny percent of Americans mattered greatly for the high-earning few. Overall, the effective tax rate on high incomes fell by 7% during the Clinton presidency and 6% in the Bush era, so the top 400 had a tax rate of 20% or less in 2007, far lower than the marginal tax rate of 35% that the highest income earners (over $372,650) supposedly pay.” – Wealth, Income, and Power – William Domhoff

As an added bonus, hedge fund managers like John Paulson, who made $9 billion over two years, paid no income taxes on his windfall. In 2007, Republicans and a key Democrat, Sen. Charles Schumer of New York, fought to keep the tax rate on hedge fund managers at 15%, arguing that the profits from hedge funds should be considered capital gains. Schumer, the ultra-liberal champion of the poor, knows who butters his bread – Wall Street. But it gets better. As long as they leave their money, known as “carried interest,” in the hedge fund, their taxes are deferred. They pay taxes only when they cash out, which could be decades from now. These upstanding citizens access their jackpot winnings by borrowing against the carried interest, often at rates as low as 2%. I’m sure every youngster in America dreams of becoming a hedge fund manager so they can use system risking leverage to make bets on derivatives, reap billions in profits, pay no taxes, and produce no value for the country. The new American Dream.

It is plain to see by anyone without an ideological agenda that a few thousand corrupt individuals have managed to gain control of the American economic system. The introduction of the personal income tax and creation of the Federal Reserve in 1913 have provided the means for the few to dominate the many. Over the last century, a rich super class has created their wealth through issuing debt to the masses, writing the tax code in their favor through their captive politician protectors, using their own private bank to issue trillions in fiat currency and create inflation, and used their control of the mass media to convince the average American that this was beneficial. Chris Whalen in his brilliant economic history of the United States – Inflated – How Money & Debt Built the American Dream sums up what has happened:

“Once the two functions, controlling the amount of currency in circulation, and second the government’s fiscal operations, are housed under the same roof, inflation and a decrease in the value of money are the inevitable result. It is always easier to borrow than to raise taxes. Politicians who have access to the printing press will invariably use it.”

The small cabal of banking elite committed the crime of the century between 2001 and 2008. They used their power over the Federal Reserve and political class to reap hundreds of billions in ill-begotten profits and crashed the worldwide economic system in 2008. They then held the country hostage as they extorted trillions more in bailouts from the taxpayers. As a reward for their chutzpah, they have paid themselves billions in bonuses. While 44 million people try to make ends meet with food stamps, these criminals continue to pillage the countryside attempting to steal the remainder of middle class wealth. As the middle class sinks further into despair, anger is building. The political class has tried to pay off the poor with entitlement payments, but it is the middle class that will revolt when their hope for a better life is destroyed by the moneyed class. With debt in the system expanding at hyper-speed, the American Empire will not decline with a whimper but with a bang. All previous Fourth Turning’s in U.S. history have resulted in tremendous bloodshed. The next ten years will follow this pattern. I’ll address the coming revolution against the criminal banking element in the last part of this five part series – Unforgiven.

Get Ready Little Lady…

[img [/img]

[/img]

RE

Super read.

Ten Bears: These things you say we will have, we already have.

Josey Wales: Thats true. I aint promising you nothing extra. Im

just giving you life and youre giving me life. And Im saying that

men can live together without butchering one another.

Ten Bears: Its sad that governments are chiefed by the double

tongues. There is iron in your words of death for all Comanche to

see, and so there is iron in your words of life. No signed paper

can hold the iron. It must come from men. The words of Ten Bears

carries the same iron of life and death. It is good that warriors

such as we meet in the struggle of life… or death. It shall be

life.

Instead of fiddling with the income tax code to remove a loophole here or a rate there, why don’t we repeal the 16th Amendment? Somehow our country survived and thrived for over a century without an income tax.

The alternative is to admit that the government has the authority to set rates however they want, then treat us like children getting an allowance, and we’re supposed to thank them providing all those wonderful services, most of which get funneled to the FSA in exchange for votes. Fuck that.

People need to accept that the free lunch is over. You work for what you want. You have no right to health care, an education, or a BMW. You only have a right to pursue those things. No hand-outs, no welfare. If you screw up, you’d better rely on family and charity.

“Instead of fiddling with the income tax code to remove a loophole here or a rate there, why don’t we repeal the 16th Amendment”- SH

And while were at it, let’s decertify Da Fed, let all the TBTF Banks fail, cancel Social Security, Medicaire and SNAP Cards, Impeach Obama-sama and all 535 CONgress Critters, deport all Illegal Aliens and eliminate the entire Military except the Coast Guard. Have I left anything out here?

Stop sweating the small stuff guys, when the Fiat collapses, you won’t be paying any Income Tax at all for a while, because you will have no money to pay it with. You’ll get your chance to set up a whole new system just like you think would be perfect, right after the Revolution is finished assuming you are still standing and have the best group of Enforcers.

[img [/img]

[/img]

RE

Thank you for poking holes in the Super Rich Story Line.

Ever notice how the Hero generation in The Outlaw Josey Wales (Wales’ young son and the young fighter Jamie) ended up dead?

“This boy was brought up in a time of blood and dying and never questioned a bit of it. He never turned his back on his folks or his kind. I rode with him… and I got no complaints.”

Will we be saying this about our own children?

“It is a battle between a few thousand of the richest people in America versus the other 150 million.”

This is the quote that spells out nicely exactly which side should be scared shitless right about now…

The only mathematical solution is nukes or virus to wipe out our side, otherwise they’re Royally Fucked.

WE WILL WIN.

” In 1961, there were 398 taxpayers who made $1 million or more. Today there are over 78,000 taxpayers who make more than $1 million. ”

Interesting statistic, but it doesn’t take into account Inflation. The chart I am looking at now has 2010 CPI at 652 and 1961 CPI at 90. That is about 7X inflation during the period. So really you have to look at the the number of people making $7M or more today compared to the number making $1M in 1961. So there are for sure many fewer than 78,000 people in the same adusted income bracket. I’ll bet its less than 10,000. Still more than in 1961 of course, but ahigher population also.

Anyhow, the people running the show are not most of the 78,000 people making $1M or more these days, but rather SOME of the top 400 or so worth $1B or more. I’ll just list the first 35 off the Forbes list:

Browse The ListNet Worth Calculated September 2010 Rank Name Net Worth Age Residence Source

1

Bill Gates $54 B 55 Medina, WA Microsoft

2

Warren Buffett $45 B 80 Omaha, NE Berkshire Hathaway

3

Larry Ellison $27 B 66 Woodside, CA Oracle

4

Christy Walton & family $24 B 56 Jackson, WY Walmart

5

Charles Koch $21.5 B 75 Wichita, KS Diversified

5

David Koch $21.5 B 70 New York, NY Diversified

7

Jim Walton $20.1 B 63 Bentonville, AR Walmart

8

Alice Walton $20 B 61 Fort Worth, TX Walmart

9

S. Robson Walton $19.7 B 67 Bentonville, AR Walmart

10

Michael Bloomberg $18 B 69 New York, NY Bloomberg

11

Larry Page $15 B 38 Palo Alto, CA Google

11

Sergey Brin $15 B 37 San Francisco, CA Google

13

Sheldon Adelson $14.7 B 77 Las Vegas, NV casinos

14

George Soros $14.2 B 80 Westchester, NY hedge funds

15

Michael Dell $14 B 46 Austin, TX Dell

16

Steve Ballmer $13.1 B 55 Seattle, WA Microsoft

17

Paul Allen $12.7 B 58 Mercer Island, WA Microsoft, investments

18

Jeff Bezos $12.6 B 47 Seattle, WA Amazon

19

Anne Cox Chambers $12.5 B 91 Atlanta, GA Cox Enterprises

20

John Paulson $12.4 B 55 New York, NY hedge funds

21

Donald Bren $12 B 78 Newport Beach, CA real estate

22

Abigail Johnson $11.3 B 49 Boston, MA Fidelity

23

Phil Knight $11.1 B 73 Beaverton, OR Nike

24

Carl Icahn $11 B 75 New York, NY leveraged buyouts

24

Ronald Perelman $11 B 68 New York, NY leveraged buyouts

26

John Mars $10 B 74 Jackson, WY candy, pet food

26

Jacqueline Mars $10 B 71 The Plains, VA candy, pet food

26

Forrest Mars $10 B 79 Big Horn, WY candy, pet food

29

George Kaiser $9.4 B 68 Tulsa, OK oil & gas, banking

30

James Simons $8.7 B 72 East Setauket, NY hedge funds

31

Len Blavatnik $7.5 B 53 London Access Industries

32

Steve Cohen $7.3 B 55 Greenwich, CT hedge funds

33

Edward Johnson $7.1 B 80 Boston, MA Fidelity

34

Philip Anschutz $7 B 71 Denver, CO Investments

35

James Goodnight $6.9 B 68 Cary, NC SAS Institute

35

Mark Zuckerberg $6.9 B 26 Palo Alto, CA Facebook

Note however that in this list you do not see any names like Dupont, Astor, Vanderbilt, Roosevelt etc in the list. Hell the only Rockefeller that turns up is David pretty far down the list. George Bush doesn’t even turn up on the list at all! Now let me ask you, do you think these family fortunes simply disappeared here? Of course not, just all the Old Money has long since sequestered itself into stocks and bonds, and individual members of those families don’t show $1B net worth, but in aggregate they hold as much or more wealth than all the Billionaires actually listed. These folks sit on the boards of major corporations taking home those $1M paychecks, but they don’t show the individual net worth of some of the recent tycoons. They still are out there running the show though.

All this money is wrapped up under layers and layers of holding companies, quite a bit of it held offshore of course. There simply is no way to account for it all, and the IRS couldn’t touch most of it even if they wanted to try, which they really do not. The IRS is a tool to sieve money from the working slaves, not the Masters of the Universe.

Capitalism and its monetary system is one big joke, and the JOKE is on you. For a solid 100 years in this country at least, and really quite a bit before that, the working man has been systematically ROBBED by the Pigmen who control the banking system and own the maor corporations. You are a slave, that is all you ever have been, and this country has been Fascist since long before you were ever born. Live with it.

RE

“This is the quote that spells out nicely exactly which side should be scared shitless right about now…”-Ecliptix

Of course they are scared. That is WHY they are doing whatever they can to try to prop up the system and keep it from collapsing. Behind the scenes, they are preparing to try to hold on to power by transfering wealth into a new currency system, but so far have not been successful in doing so, and if what I believe is true about growth and monetary systems, they cannot succeed.

This system will collapse, and there will be HELL Coming to Breakfast. To be sure, the Guillotine will make its return.

[img]http://www.dimbulb.net/.a/6a00d83454a03269e2013487f6f572970c-500wi[/img]

RE

Did you know that over 7million Americans starved almost to death and were then guillotined during the Great Depression?

I always liked the whole putting money offshore thing,nice how the uber rich can finagal things.And whoever convinced us all into thinking free trade would work out,yep im sure we can compete with that cheap labor overseas,if we just get used to livin in cardboard mansions.Printing money and borrowing it is the only thing keeping this circus going.

Josey Wales: … you gotta get mean. I mean plumb, mad-dog mean.

The Four Horsemen: Mean? Mean to us? Your 6-shooter against our $6 trillion of WMD? You dirty no-good sorry SOB make me laugh!

Josey Wales: Yeah, you own official corruption – the tax code and the Fed. But we got 25 million un/under-employed who can make guillotines faster than ’em Chinese. We just gotta learn how to use ’em the French way.

The Four Horsemen of U.S. Banking

http://www.globalresearch.ca/index.php?context=va&aid=24967

RE – Completely agreed. They’ve gone on to massive outright lies now so I reckon the slow-motion collapse is picking up steam. It is going to be a rough ride for those of us who make it to the other side of this. Most won’t make it, I think.

RE – for fuck sake give it a rest. The guillotine crap is really old and if you are going to start with the pictures put them in after the debate/comments have run their course a while. The Admin works hard on this stuff. Please keep it in mind.

The income tax on certain activities and privledges was struck down in 1895 as unconstitutional. The 16th amendment was “ratified” and and this closed the loop on those certain activities and privledges bringing them within the taxing authority. Read the Pollock decisions for more background on that.

Prior to 1913 we had many different types of money in circulation. Gold, Silver, Greenbacks (united states notes), silver certificates, gold certificates, and national bank currency.

After 1913 we added Federal reserve banks notes and federal reserve notes.

Notice how the currency notes used to say “Redeemable In Lawful Money At The United States Treasury Or At Any Federal Reserve Bank” Slowly this language disappeared and was replaced with. “This Note Is Legal Tender For All Debts Public And Private”. They also used to state “Payable to the bearer on demand” That is no longer stated either.

So the federal reserve did what central banks do. Eliminate competition. All we have left now is Federal reserve notes. The Fed is a “GSE” quasi government but mostly private. The US CONgress gave them an enormous “PRIVLEDGE” in that they can create elastic currency for our supposed benefit. This is PRIVATE credit via a government conveyed privledge. Do you see what I’m getting at yet?

The 16th amendment allows the government to tax income that is generated via a government sponsered privledge or activity without apportionment. AKA an excise tax on something that is avoidable. Don’t buy the smokes or beer…don’t pay the tax. When you cash your paycheck what do you get? What is the nature of that “money”? Is it private credit created by the Fed via the securitization of that debt instrument (your paycheck, you endorsed it!) or is it “Lawful money”?

Lawful money is still obtainable. The statutes are still in place for it even though the Treasury quit printing them in 1971. However the Treasury says on there website that FRN’s can act as United States notes as well.

See: http://www.treasury.gov/resource-center/faqs/Currency/Pages/legal-tender.aspx

And: http://www.law.cornell.edu/uscode/html/uscode31/usc_sec_31_00005115—-000-.html

Investopedia also has an interesting definition on lawful money.

See: http://www.investopedia.com/terms/l/lawfulmoney.asp

Title 12 section 411 is really the lynchpin of all of this.

See: http://www.law.cornell.edu/uscode/uscode12/usc_sec_12_00000411—-000-.html

This IS the root…strike it!

Well BooHoo for fucking Admin.

Lots of other people put time and effort into putting over their viewpoint on this blog, but that doesn’t stop Jim from shitting all over their articles and comments from a great height.

People in glasshouses…………

PS. I’m a mad cow infected douchebag.

Admin– Superb article, well researched and thanks for illuminating where the blame should be placed. Where are the pitchforks?

LLoph, grab a handful of meds, willya? This is TBP, the home of shit-throwing monkeys. Having heard it all, seen it all, and having shat on a number of posts his own self, I trust the Admin can defend his own virtue. as threadbare a garment as that may be.

One minute Jim Quinn is ranting about how the ultra-rich forced the income tax on us, then the next minute he is ranting about how they used to have much higher rates than the 35% now. Which one is it Jim, is the income tax bad or is it just bad when someone besides the “rich” have to pay it?

One minute Jim Quinn is ranting about the how the ultra-rich forced the income tax on us, the next he is ranting about how the evil Republicans want to cut it.

One minute Jim Quinn is ranting about how retired people are getting screwed, the next he is ranting about the “working middle class”. Retired people aren’t working, and if they are collecting many multiples more of SS and Medicare than they ever paid in then they aren’t getting screwed.

Inconsistent arguments have ruined this article.

Four Great post. Looking forward to part five.Hoping for 5-5

When the pitchforks come out, who do we all think is going to be in line for stabby stabby? I doubt the right people… More than likely, it will us vs us, with “them” safely sequestered away in underground superbunkers with nuclear power, AC, warehouses full of frozen caviar, and whatever bikini models happen to have lined up at the humphole’s entrance. Perhaps Blankfiend will have set up streaming hidden webcams in major city centers to watch the fun as it happens. Or just go video game style with predator drones. I know that’s what I would do if I were a billionaire…

Waiting for Part 5, Mr Quinn. I am going to guess you are going to list the names of the blatant criminals, of which there are many, and then tacitly suggest that America goes on a murder rampage on their faces. Be careful who you call out – wouldn’t want you to get suicided or Guantanamoed.

“The lamps are going out all over Europe: we shall not see them lit again in our lifetime.” (Sir Edward Grey on the eve of WWI).

Make that the world, but the USA in particular. I wish it weren’t so, but I strongly doubt there’ll be pitchforks or anything approaching that level of civil disobedience, never mind outright rebellion; not in the US, not in Europe at least. While the slack-jawed sat before their screens (starting in the 50s in most of the USA), the finishing touches to the project begun in 1913 (if not earlier) were about to begin being applied. They have now been put in place. Sorry, gang, the great herd of middle-class cattle have been corralled in the finance feedlot while those who put the brand of complacency on them are laughing all the way to the bank. Outsmarted, outfoxed, outmaneuvered at every turn, the dumbed-down middle class (working class included) will have neither the strength or energy to rise up from their overstuffed chairs.

Lights out, game over, “those with the most toys win,” and as for the rest of us, it’ll be every man for himself.

There is no need for the ignorant masses to revolt.

It is the non-ignorant thinking class that will revolt, backed by the young people whose future has been sold off by the criminals running this country.

It does not take a majority to prevail… but rather an irate, tireless minority, keen on setting brushfires of freedom in the minds of men.

Samuel Adams

“Educate and inform the whole mass of the people… They are the only sure reliance for the preservation of our liberty.”

—Thomas Jefferson

ConfederateH needs to re-read for comprehension.

” …the ultra-rich forced the income tax on us … ” Sheesh. Do you understand the amendment process? Never mind. In actuality, it was the Populist movement c. 1890 that tried to resuscitate Lincoln’s tax. Their motive was to ‘punish the robber barons’. It would have been more apt to say those rich were guilty of receiving stolen goods, eagerly handed to them by their friends in Washington.

No, the rich never wanted an income tax — but when the first progressive tax scheme was launched, following the 16th amendment, it was natural for the system to be gamed.

As for the rest … inconsistent analysis has ruined your comment. Don’t let the door hit you on the way out. Have a nice day.

Getting rid of the income tax won’t necessarily solve anything.

NEVER under-estimate the ability of the gub’mint to extract dollars from your wallet.

For example … this story today from Charlotte; A church was fined $100 per branch cut for EXCESSIVE PRUNING, bringing the violation to $4,000.

Actual picture of the evil SOB excessively pruning a tree. Welcome to the Fascist States of America, pastor. [/img]

[/img]

[img

.

.

http://www.charlotteobserver.com/2011/05/28/2333197/church-fined-for-improper-tree.html#ixzz1O1vaHeax

Up until now I have completely agreed with the logic of this series. But this class warfare approach causes me some indigestion. Forget the percentages of income paid but look at the absolute dollars. If top 1% pay 38% , then for the sake of simple numbers if 1 trillion in taxes is collected then this 1 % paid $380 billion. Now for those who earned this income honestly that is enough. We have to be careful that we don’t punish the honest workers in this category because of the few crooks. No we must just go after the crooks some other way because if we to just tax them more, the few will just find ways to avoid it anyway and we will just be punishing the hard workers in this category who are providing jobs and are paying enough already in absolute dollars.

The working man is carrying the load of this nation that the corporations should be carrying. If you live and work in a State that has a personal income tax and sales tax you are paying 40% plus of your wages in taxes. The federal and state governments are set up to support the activities of the corporations. The corporations operate under the uniform commercial code, UCC. Government; all three branches of the federal and state government agencies all operate under the UCC. Small business all over the country is forced to operate under this code. The structure of government is supported by personal income taxes and state sales taxes. Where do you see the large corporations paying these taxes? The exception is small business is paying dearly with government agencies on the back of local business like stink on shit. This is the trap we are forced to live under. We supoort the system these large global corporations operate and benefit in, while the corporations pocket in profits the money they should by paying to run the system. Now that over the years these corporations have sourced their labor needs from cheap foreign sources; eliminating our jobs here, they have caused a problem where we can no longer support their government run system with our declining local tax base . So their system of controlling us is collapsing.

Our forefathers were against large corporations. Dealing with the likes of the East India Corporation they knew full well what corporations were about. Corporations grow to be monopolies that control their environment. They use our military for their own benefit. Is that not what we have now?

The playing field for business has been compromised by these large global corporations. They need to be broken down to small regional operations. And GE should not own media outlets. This has led to deceptions and conflict of interest.

The best thing that can happen to create employment and new small business would be the collapse of the large corporations that control most all commerce in this country.

“Mischief springs from the power which the moneyed interest derives from a paper currency which they are able to control, from the multitude of corporations with exclusive privileges…which are employed altogether for their benefit.”

Andrew Jackson

Great read Jim, although I’m going to hate to see you off GITMO for sedition.

Who will run the site?

flash

President Paul will commute my sentence.

Love the charts and info.

Wish there was an easier way to deprogram the manipulated – but I haven’t found it yet.

I cringe inside when I hear MSMs/PTBs messages repeated everywhere – especially when I know them to be red herrings.

Lookee’ here folks, nothing to see over there.

Thanks (again) for shedding light into the darkness. Can’t wait for the next installment!

Administrator says:

flash

President Paul will commute my sentence.

LOL… more likely he will be you cellmate.

I’ll support Ron Paul till the bitter end , but the reply I most often get from toadsucking milksops when I mention RP’s candidacy is a fucking snarky “he can’t win”.

That shit makes me want to fucking scream,

Of course he can’t win if you don’t support him , you fucking moron.

flash

My 17 year old son and his friends can see what is happening. He asks me if there will be jobs when he graduates college in 4 years. If this economy goes off the rails in the next two years, Ron Paul will have a chance.

Administrator says:

If this economy goes off the rails in the next two years, Ron Paul will have a chance.

Off the rails? LOL… the economy has left the rails, hit another train and is now upside down in the ditch on fire with very few expected to survive.

“The decline in real GDP from August 1929 to March 1933 amounted to 27%; that from December 2007 to date, just 1.8%… so for a slump 1/15 as severe as the Depression, our 21st-century economy doctors administered a course of treatment more than three times as costly.”——This is deceiving. Keep in mind the feds are cooking the numbers on the GDP just as they are on the 14 trillion debt(minimally at 60 trillion), as well as unemployment showing less than 10%(real number closer to 22%). As for GDP, keep in mind that over 40% of our GDP is from finance(shuffling money in a blrnder). In the Great Depression, we had a manufacturing base still intact. Today, it is gone. And today, the purchasing power of the dollar has been reduced bt 96%. We are now a nation of consumers that produce nothing but debt and war. “Service Economy” thingy didn’t work out so well did it”

The revolution will start when the 45 million people on Welfare/Disability get cut off from their “benefits.” Since they don’t work, their work will be to continue to get everything for nothing, hence stealing/looting/rioting/murdering. Even the old geezers/boooooomers will be rioting when their pittance is cut off. When the U.S. can’t borrow any more money from any more foreign/domestic suckers, the first to go will be entitlements (after Geitner has raided all retirement funds and bank accounts). The last to go will be the military, which will be recalled to Washington to protect the pols as they make their way into their bunkers.

The working middle class will go to work, like they always do, regardless. Their benefit is from instinct, from thousands of years of working, reproducing, and furthering their species. Of the value of a days work, the value of working for a living. Passing these value onto their offspring. Their reward is in a days work done, having contributed something, produced or fixed something. The devils in Washington and Wall Street are going to end up the same place all the other robber barons, criminals, exploiters, manipulators, lawyers, and war criminals end up: Dante’s inferno; just a matter of which level.

“The working middle class will go to work, like they always do, regardless”-A-hole

No, they won’t. In case you missed it, the “working middle class” is rapidly disappearing.

RE

Oh geez…please give me a break. There is no significant population that would revolt even if you held a blowtorch to their balls. As long as the power that be can keep the internet up, the playstations running, liquor in the stores, and some cheap fast food these people will not so much as lift a finger. The angry masses you guys are waiting for are too busy surfing cheesy internet porn while shoving chicken nuggets into the gaping hole under their noses to worry about much of anything. Riddle me this my fair people…if there was no revolt when Roosevelt confiscated privately held gold what in the name of heaven do you think is going to budge these lumps now??? As Dr Gonzo pointed out in the book “Fear and Loathing in Las Vegas” we will all be riding this strange torpedo out to the end.

Actually, there were numerous Revolts and Riots sprinkled around the country all through the years of the Great Depression. The Bonus Army March wasn’t an isolated incident. However, TPTB at the time had sufficient Pinkertons and regular Army to put down the revolts. Much smaller population to deal with at the time, and mostly rural.

Different story today. Larger population, more urban. Once things get rolling here, it won’t be any different than what is currently going on in Greece and Spain. After that, it shoudl get really lively.

RE

RE:

Maybe disappearing, but still the largest bloc of working people (people that actually work, instead of steal, tax, or loot others).

From National Journal article today “…..Still, amid all of this change, whites without a four-year college degree remain the largest demographic bloc in the workforce. College-educated whites make up about one-fifth of the adult population, while minorities account for a little under one-third. The picture is changing, but whites who have not completed college remain the backbone of many, if not most, communities and workplaces across the country. They are also, polls consistently tell us, the most pessimistic and alienated group in American society.”

My point is, there is reward and dignity, in and of itself, non-monetary, in doing an honest days work. The true crime, and why this country is going into the toilet, is that these people, the backbone of our country, have been allowed to become pessimistic and alienated. When your spine starts to deteriorate, you, as a functioning organism, are done.

Do nothing but gold google ads appear on everyone else’s page?

I was hoping for some dude ranch ads or an employment ad for the Federal Reserve to pop up.

Admin:

Admin: Yea, always gold and Everbank.

And I thank Jimbo for providing us, on a daily basis, the reasons why the backbone of our country is pessimistic and alienated. Excellent work.

Might I suggest a button for TBP:

https://merchant.paypal.com/cgi-bin/marketingweb?cmd=_render-content&content_ID=merchant/donations

People can make donations, like give you money, if they feel so compelled.

DJ:

You obviously don’t know any people on Welfare/Disability.

They would eat their own young,

[img]http://t3.gstatic.com/images?q=tbn:ANd9GcQFDZVB9jcgS4xOymakoecaZBkcClgFRVZKtvNeKBqOX99FEfhA[/img]

There is a group of very financially savvy individuals in this country who are masters at exploiting distant peasant labor and the absence of environmental regulations for massive profits. This same group are also very clever in their ability to craft financial intruments (derivatives, CDOs, MBS) which extract wealth from the nation.

This very small group of financial wizards have used their wealth and influence to continually diminish their tax burden.

This process effectively sets up a wealth vacuum, where the national wealth of the United States is sucked up and deposited into the accounts of this handful of people.

These people are not interested in creating jobs. They are only interested in seeing their wealth grow. The only jobs they will create are the least amount of jobs for the lowest possible wage.

If people enrich themselves by extracting the wealth of a nation, either through offshoring labor or through complicated financial instruments, their tax burben should be extremely high. It should be the highest tax rate paid by any citizen.

If the super rich continue to pay diminishing tax rates, our national wealath will continue to be siphoned off to distant lands and offshore bank accounts.

This much is obvious.

Smokey just showed up on Zero Hedge in the comment section.

I urge you to go over to ZH and give him shit and tell him to come back over here.

http://www.zerohedge.com/article/guest-post-outlaw-josey-wales-part-four#comment-1329397

MSM gets a clue.

‘WE ARE ON THE VERGE OF A GREAT, GREAT DEPRESSION’

[img [/img]

[/img]

Maybe this link will work.

http://www.cnbc.com/id/43236764

ragman

I agree. Cain is neo-con, Fed loving, corporate shill.

He is DOA in my book.

by Smokey1

on Wed, 06/01/2011 – 12:38

#1329231

Great series. Looking forward to the finale–UNFORGIVEN.

I just hope nobody forwards that final installment to DHS.

reply flag as junk (1)

by Jim Quinn

on Wed, 06/01/2011 – 13:16

#1329397

Come back you SOB.

You’re a legend and the site isn’t the same without you.

reply flag as junk (1)

by Smokey1

on Wed, 06/01/2011 – 13:34

#1329476

I’ll return when China crashes.

reply flag as junk (0)

by Jim Quinn

on Wed, 06/01/2011 – 13:38

#1329495

I’ll meet you on the 50 yard line at the Super Bowl. You’ll know what to do.

edit reply flag as junk (0)

by Jim Quinn

on Wed, 06/01/2011 – 13:40

#1329506

It’s about time for DP to leave the barn and claim we are the same person for the 750th time.

@Flash, thanks for the link

That cracks me up, the “experts” and “traders” are “baffled.”

Yes, it is amazing unexpected that when you remove family-supporting jobs for all – including your best customers – then back the government in jacking up all fees and costs to (barely) stay alive, that *SHOCKINGLY* consumers quit consuming.

My oh my. Next these geniuses will figure out that SNAP cards can’t be used to go to the movies, put gas in your car or to pay off auto loans and Visa debts.

Of course, playing their book, their advice is to BTFD! Cause we all know that when there is no cash, profits are squeezed and the “great profits” all produced in the blood of your former workers – and former customers – then returns through Wall Street will be astronomical!

Get rich here folks! We’ll give you a 5% “gain” and as long as you pretend the 10% drop in the value of your money didn’t happen, you will be laughing all the way to being rich!

Morons and liars. I dream of day when Wall Street and Park Avenue are ghost towns and all these “rich, smart” experts are trying to figure out how to make plants grow with Gatorade – “it’s what plants want!”

Jim says….” The rich and powerful, the corrupt Wall Street bankers, the banker controlled Federal Reserve and the bought off politicians in Washington D.C. have been pillaging the middle class for decades.”

Can you put real names and faces with these “rich and powerful” or do we just shoot everybody and let God sort them out?

Good to know that Smokey lives– and lurks.

And Teresa pulls out a reference to Idiocracy – A story that should be studied alongside, perhaps instead of, Shakespeare in school… It’s more relevant.

It’s got electrolytes!!

God I miss his sense of humor. He is referring to David Pierre.

by Smokey1

on Wed, 06/01/2011 – 14:29

#1329669

Yes, the traitor should soon arrive.

I don’t think he has ever missed an article of yours on ZH.

He’s either with the sheep, or, as you so aptly put it many months ago, he may be preoccupied whacking off while watching endless video reruns of the planes hitting the towers.

What the rich bitches don’t have a clue about is that the middle class is armed to the teeth and we will be coming for them when the rain sets in. There will be no place for them to hide. They have no survival skills. Money won’t bail them out this time….when the rain sets in. People just like me who read alternative news sources to learn the truth are gathering information as to the whereabouts of these hideous losers so we can make THEM work for US….when the rain sets in.

My article only made the market drop 279 points today.

To RE’s chagrin, gold continues upward.

Admin:

Great biscuits, champ. You have managed to articulate what I’ve suspected for years… that the poor and rich both benefit froim the sweat of the middle. No question. When I lived in SF proper, I noted this quite well.

A bum yells or shits on the sidewalk in Diamond Heights (swank area) and the cops are there fucking pronto, peeling the shit off the sidewalk as well as cleaning the poop.

If a bum smashes parked cars with a tire iron in the Haight, no cops for an hour… unless a poor fool tries to stop the bum, then pronto, cops come for the defender.

It’s becoming the same in a social sense… it’s what’s on the media line.

Again, great work.

Smokey is a deserter. Her left us here with a gaggle of anarchists and packed up, leaving holes in my daily dose of laughter. What an asshole.

I wish I had never commented the day he left. In a small way, I feel guilty. Then again, I know the assfucker will return under his true handle (not the weaker versions he’s tried, though “The Savior” made me think he read my eulogy).

Smokey lurks… and one day, out of the blue, he will peel back the disguise which will make us vomit and laugh at time, right through our noses:

[img [/img]

[/img]

(Picture courtesy of Admin at