Off the microphones, cameras and keyboards of Gail Tverberg, Ugo Bardi, Steve Ludlum, RE & Monsta

Off the microphones, cameras and keyboards of Gail Tverberg, Ugo Bardi, Steve Ludlum, RE & Monsta

Follow us on Twitter @doomstead666

Friend us on Facebook

Aired on the Doomstead Diner on November 11, 2014

Discuss this Media Presentation at the Podcast Table inside the Diner

Yen, Euro & Oil Frostbite Falls Daily Rant

Yen, Euro and Oil Collapse Cafe Chat with Guests Gail Tverberg, Ugo Bardi and Steve Ludlum

Read more from Gail, Ugo & Steve on their Blogs

Gail Tverberg: Our Finite World

Ugo Bardi: Resource Crisis

Steve Ludlum: Economic Undertow

Snippets from the Analysts: (follow the Links to read full versions)

The collapse of oil prices and energy security in Europe

Ladies and gentlemen, first of all, let me say that it is a pleasure and an honor to be addressing this distinguished audience today. I am here as a faculty member of the University of Florence and as a member of the Club of Rome, but let me state right away that what I will tell you are my own opinions, not necessarily those of the Club of Rome or of my university.

This said, let me note that we have been discussing so far with the gas crisis and the Ukrainian situation, but I have to alert you that there is another ongoing crisis – perhaps much more worrisome – that has to do with crude oil. This crisis is being generated by the rapid fall in oil prices during the past few weeks. I have to tell you that low oil prices are NOT a good thing for the reasons that I will try to explain. In particular, low oil prices make it impossible for many oil producers to produce at a profit and that could generate big problems for the world’s economy, just as it already happened in 2008.

Oil Price Slide – No Good Way Out

The world is in a dangerous place now. A large share of oil sellers need the revenue from oil sales. They have to continue producing, regardless of how low oil prices go unless they are stopped by bankruptcy, revolution, or something else that gives them a very clear signal to stop. Producers of oil from US shale are in this category, as are most oil exporters, including many of the OPEC countries and Russia.

Some large oil companies, such as Shell and ExxonMobil, decided even before the recent drop in prices that they couldn’t make money by developing available producible resources at then-available prices, likely around $100 barrel. See my post, Beginning of the End? Oil Companies Cut Back on Spending. These large companies are in the process of trying to sell off acreage, if they can find someone to buy it. Their actions will eventually lead to a drop in oil production, but not very quickly–maybe in a couple of years.

So there is a definite time lag in slowing production–even with very low prices. In fact, if US shale production keeps rising, and Libya and Iraq keep work at getting oil production on line, we may even see an increase in world oil production, at a time when world oil production needs to decline.

Last Line of Defense …

Figure 1: Continuous WTI futures (TFC Charts, click on for big). Price convergence results in a breakdown as customers are unwilling- or unable to bid prices higher. Absent the high prices there is insufficient cash flow to enable drillers to continue operations. Today’s marginal barrels are extracted from high cost deepwater offshore plays, from tight-oil shale formations and from ‘tar’ sands: without customer credit, drillers are more dependent upon junk bond leverage than ever.

Of course, once on the borrowing treadmill, it is impossible to step off. Borrowers must run faster to stay in place, ever-increasing amounts are needed to keep pace with operating- and service costs as well as to rollover maturing legacy debt. Consumer access to credit must be considered a ‘hard limit’ to petroleum extraction along with geology. Even as drillers are able to borrow they find there are fewer ‘end users’ with available credit … onto whom the drillers can lay off their ballooning exposure.

Conventional analysis insists that fuel constraints result in higher prices due to simply supply and demand. The assumption is that consumers will always find more funds. Instead, fuel constraints reduce customer purchasing power: customers stumble first, the drillers fail afterwards. As customers’ borrowing capacity shrinks the petroleum industry has little choice but to adjust prices to meet the market which forces drillers to reduce output. At some point they fail outright. Fuel supply cuts => diminished consumer borrowing capacity => more fuel supply cuts in a vicious, self-reinforcing cycle.

The Double Whammy

Reverse Engineer

Over the course of the last week, we have had two MAJOR Black Swans come in for a landing.

The first one actually has been ongoing for a couple of weeks now, the collapsing price in the Oil Market, plunging from its recent “set point’ at around $90/barrel to $77 for WTI as I write this article:

The second Swan came in the form of an announcement by BoJ Chief Psycho Kuroda that the BoJ would ENGAGE Warp Drive on the Printing Press and buy up every last JGB the Nip Goobermint sells in order to meet their ever increasing need for cash. The Yen was already sliding, this announcement however sent it on a Downhill Run worthy of an Olympic ski course.

Flip this upside down to get JPYUSD. Nobody publishes it that way, I wonder why?

Are these two events unrelated coincidence? Of course not.

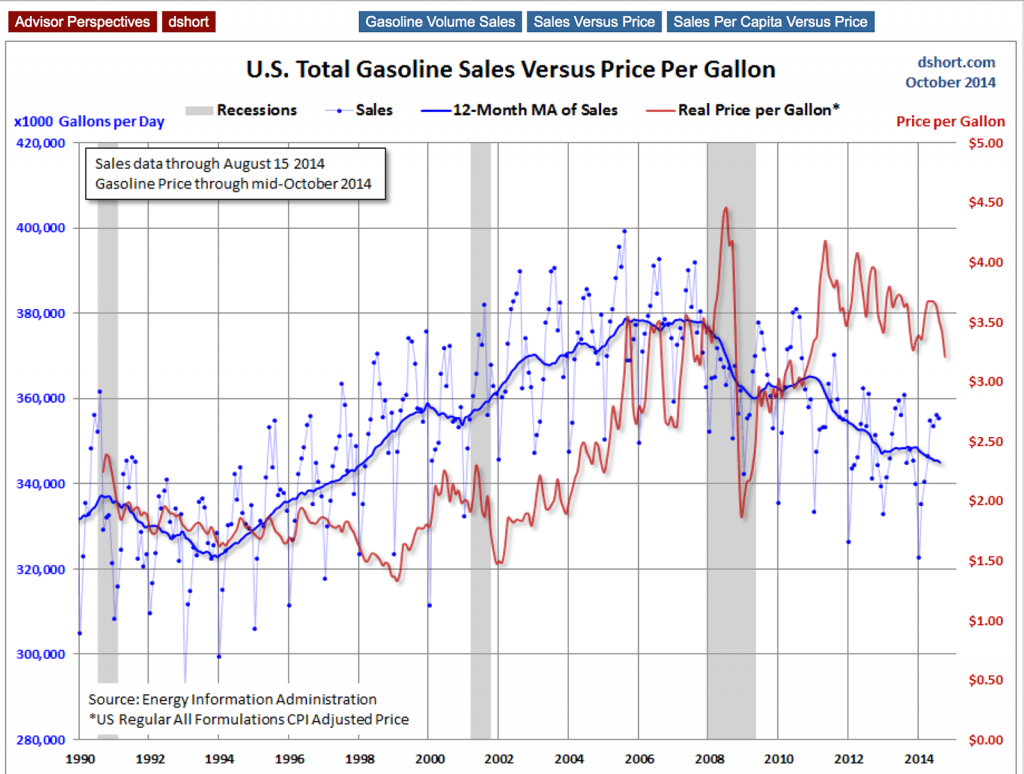

Demand Destruction has taken hold all across the globe now, and Oil consumption is dropping everywhere. Here in the FSoA, we’ve seen a 10% drop in gasoline consumption since 2008, and the end to this is nowhere in sight either.

For the rest, listen to the Rant while you tend your Garden, watch the Video while you Cook Dinner, or if you don’t like Media, just read the damn articles!

Don’t miss our Upcoming Podcast with David Hughes, Author of the recent Drilling Deeper Report, analyzing the Fracking and Tight Oil plays in the Oil Patch.

…and that’s All the Doom, This Time until Next Time, here on the Doomstead Diner ![]()

RE