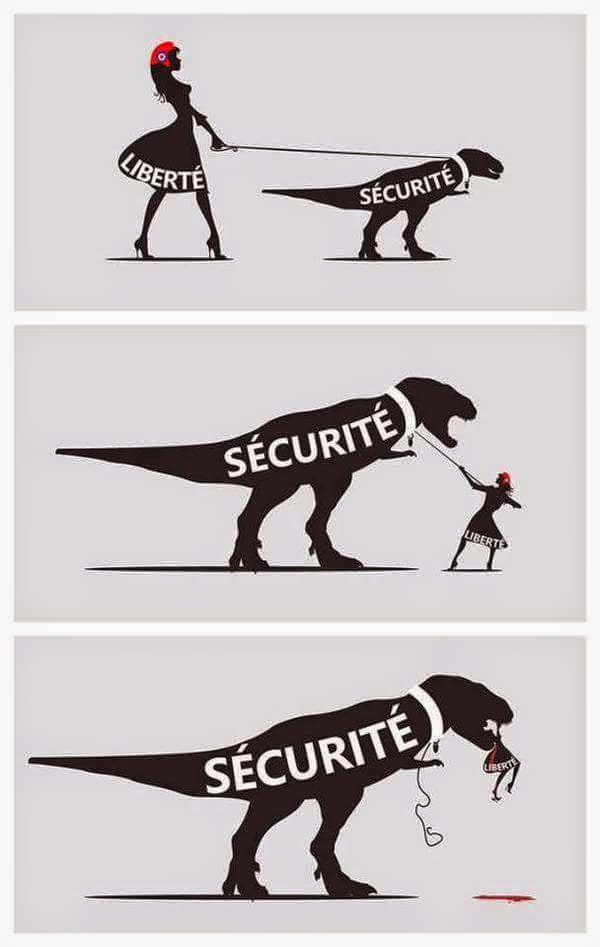

The event below, one of the very best known Jesus stories, appears in all three Synoptic Gospels. I would guess that 98% of Christianity interprets the story thusly; Christians, as well as all people, should pay their taxes to the government. I believe this is an incorrect application of the story. I believe the opposite is true; that Jesus in a round-about way instructed his followers to NOT pay taxes to Rome.

Let’s look at the full text from Matthew 22: 15-22 (New King James Version)

“Then the Pharisees went and plotted how they might entangle Him in His talk. And they sent to Him their disciples with the Herodians, saying, “Teacher [Rabbi], we know that You are true, and teach the way of God in truth; nor do You care about anyone, for You do not regard the person of men. Tell us, therefore, what do You think? Is it lawful to pay taxes to Caesar, or not?” But Jesus perceived their wickedness, and said, “Why do you test Me, you hypocrites? Show Me the tax money.” So they brought Him a denarius. And He said to them, “Whose image and inscription is this?” They said to Him, “Caesar’s.” And He said to them, “Render therefore to Caesar the things that are Caesar’s, and to God the things that are God’s.” When they had heard these words, they marveled, and left Him and went their way.”

THE PLAYERS

The Pharisees: The Pharisees wanted to do more than just “entangle” Jesus. They wanted to see him killed for his response. But, they were cowards and didn’t go. Perhaps they were afraid of yet again being called hypocritical vipers and filthy rotten corpses. So, they sent “their disciples” and the Herodians. The Pharisees despised Rome, but would cooperate with them whenever it suited their devious purposes.

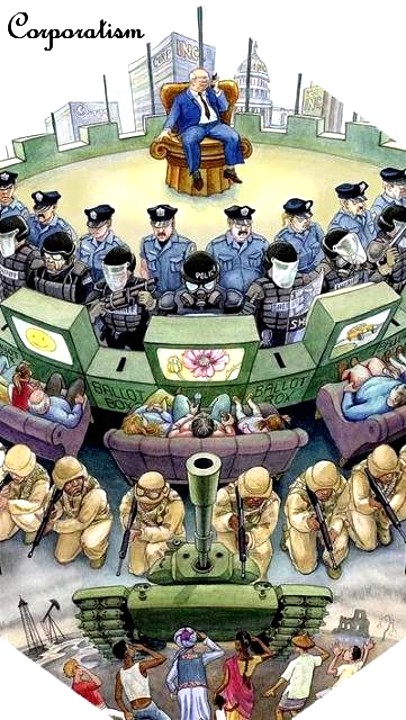

The Herodians: The Herodians held political power and they supported the Herods, and therefore, indirectly, Rome. To the Pharisees, this compromised the idea of Jewish independence. So, the two groups hated each other. The Gospels state that even Jesus avoided when possible the territory of Herod’s rule. But, the two groups were united in their hatred of Jesus. The Romans wouldn’t believe the Pharisee accusation of Jesus, because the Romans knew the Pharisees hated them. They needed pro-Roman witnesses to testify that Jesus was an insurrectionist. The Herodians were more than happy to go along.

Continue reading ““Render Unto Caesar that which Is Caesar’s” …. Means Caesar Will Soon Be Bankrupt!”