Guest Post by David Haggith

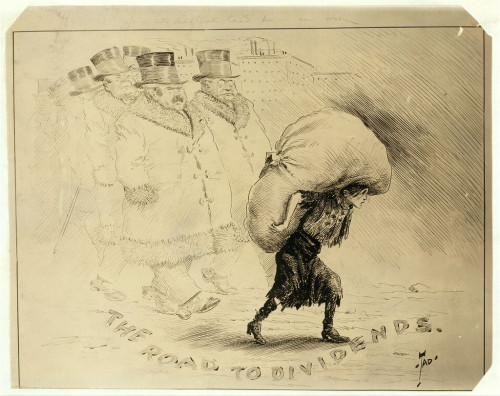

Year after year around tax time, a tired war horse of a story gets trotted out about how the heavily burdened rich already shoulder eighty percent of the tax load. Poor rich. They are oxen doing the heavy pulling to make things easier on the rest of us dumb cows. Thank God we have them!

Year after year around tax time, a tired war horse of a story gets trotted out about how the heavily burdened rich already shoulder eighty percent of the tax load. Poor rich. They are oxen doing the heavy pulling to make things easier on the rest of us dumb cows. Thank God we have them!

Don’t believe a word of it!

The tax burden of the beleaguered rich

Or, more importantly, look at the words that are not being spoken by the lap cats of the super wealthy who like to croon over this story around tax time. One recent rendition of it appears in The Washington Free Beacon:

While … top earners contributed almost four-fifths of the total amount of individual income taxes, they represented only 16 percent of the total number of individual income tax returns reported to the IRS.

In other words, a little shy of 20% of the populace pays 80% of the individual income taxes. That sounds grossly unfair. What an enormous burden the powerful are carrying for the rest of us. Let’s hope we always have them here to support us. According to the article above, only a liberal could love this unfair saddling of the rich with the load created by the rest of us:

“Liberals say that high earners pay a high share of taxes only because they have high incomes,” explains Chris Edwards, a tax policy expert at the Cato Institute. “But high earners also pay much higher tax rates than everyone else…. The [Organisation for Economic Co-Operation and Development] has found that the United States has the most ‘progressive’ or graduated income tax among all high-income nations,” Edwards said. “If Congress proceeds with major tax reform next year, it should focus on making the tax code more equal and proportional. The level of progressivity in the tax code has become extreme.”

Odd because the OECD has also found that the US has the greatest wealth disparity of any nation in the world. Apparently, then, the nation’s “progressive” tax structure is not crippling the opportunities of the rich to rise even higher after all. (That would seem to be the right way of putting those two statements by the OECD together harmoniously in order to look at the full truth in what they say, rather than just the convenient part as Edwards did.)

Edwards apparently lives among the top twenty percent or aspires to arrive there soon since he refuses to tell the full story … as does everyone who reiterates this tired tale. I’ve argued here before that the US tax code only looks overly progressive to those who are intentionally blind. They live in economic denial because they know that thinking through the truth wouldn’t take them to the tax reductions they lust after and the wealth fantasy they hold for their future. The fact is that the top 20% pay 80% of the income tax because they make 80% of the money, and that is what always gets left out of the story. (Moreover, the full story gets worse — far worse — so keep reading.)

It is hard for people to believe that the huge majority of all the money made in the US is going to such a small percentage of the population. As a result, when they hear that this group is paying 80% of the taxes (oh my!), they think that group is clearly pulling more than its fair share of the load. (Let’s hope they never get mad at us for it and decide to stop.) I mean, expecting 20% of people to carry 80% of the load is crazy!

Actually, the crazy truth is that so much money is made by so few that their taxes only appear to be an unfair burden. The wealthy’s portion of all income tax paid in the country looks outlandishly huge, yet it is lower than their portion of all money made in the country. (As has been often said, “I’d love to pay their taxes.”) In fact, the higher you look into the wealth strata, the crazier the truth becomes.

Edwards claimed the rich are taxed at a much higher rate. That is entirely a smoke screen, and congress knows it. Do you really believe that the rich make most of their wealth from PAY CHECKS? Heaven forbid! That’s dirty money. They make it from capital gains income, which has been taxed at a LOWER RATE than other kinds of income for a very long time. It began on the basis that the tax savings to the rich will trickle down from these behemoth job creators to the poorer class, but that clearly has not happened. George Bush Sr. rightly called it “voodoo economics” until he sold out to the scheme in order to get the vice presidency.

Let’s take a closer look at what taxes the rich really pay!

Those people who make $10,000,000 or more a year, make only about fifteen percent of their total income from wages/salaries. Capital gains accounts for about fifty percent of their income. The rich make their money from money — from capital gains, dividends, interest, etc. While these people are in an income-tax bracket of 39.6%, which applies to their salaries and interest, their maximum capital gains rate is only 23.8% … and for a long time was lower than that.

So, the higher tax rates for the wealthy are fiction because they don’t apply to the real world of the rich … especially the really rich. The 23.8% that the rich pay on half of their income is no more than what the middle class pay on theirs … and less than some of the middle class pay.

The richer you are, the lower your tax rate on most of your income because of how you make your money.

The higher income-tax bracket is how your government pretends to be taxing the rich more than anyone, while actually taxing the richest of the rich far less. Our bought-and-paid-for politicians put that tax rate in the code as window dressing so that the little and the medium people will all think the rich are paying the lion’s share. In fact, their lap cats pay more than they do.

The very area where the fabulously rich make all their money gets a tax discount. This tax break was designed specifically to create a huge bubble economy in the stock market — to pump up the casino. It has done that extremely well for three decades. Income disparity is growing between the rich and the middle class because most of the middle class (and all those under them) cannot afford to risk gambling in the Wall Street casino to any significant degree.

This cut rate tax for the supremely wealthy was created on the pretense (maybe at one time on the belief, but we are without excuse if we don’t know better by now) that rising stock values would cause job creation as wealthy people could afford to expand their factories. That didn’t happen. Instead, they had more money to spend on football teams, raising the cost of teams (while charging you more for the stadiums and the tickets to use your stadium), and more to spend on other stocks, and they moved their factories overseas to save themselves even more money. The more they were given, the more they craved … to the detriment of a once-great nation.

Those tax savings for the rich did not build roads. They did not build new factories or expand old ones. (Other than the many factories built overseas.) They created scarcely any jobs. The new money doesn’t trickle down. It exists all on paper and just creates huge inflation of stock values, none of which is getting plowed back into the corporations’ capital equipment or research and development. It just gets reinvested in other stocks in the world’s biggest casino where only the wealthy can afford to roll the dice.

Sure, we experienced some great expansions after those tax breaks were created for the rich, but that is only because government also hugely increased its spending and did so entirely on debt. It’s amazing how much you can party when the party is bought credit. It was all just one bubble after another built, not on the tax savings for the wealthy, but on the greatest expansion of debt in the history of the world (even adjusted for inflation).

Now, if you think, I’m just writing out of envy and saying to tax the rich more because they are so awful, I haven’t said we should tax the rich more than the middle class. I’m asking why are we taxing them less? What has giving the bulk of the tax breaks to the wealthy done for the rest of us? Most of us have enjoyed NO PORTION of any of that improvement of income over the course of thirty years of playing this game. It’s time to end welfare to the rich!

Since these investors do no work to make that income, produce nothing, and do not create new jobs by building up factories, or invent anything — and we know all of that now — their capital gains should be taxed at the same level as their other income, rather than at a lower rate. They accomplish none of those trickle-down goals because most of them are not really investing at all. They are just playing money form one stock to another.

They do not buy and hold as owners of a company to help it grow and prosper. They buy to take and leave quickly. While they are temporary owners, they order the corporation to use its financial strength to take out massive loans to in order to shower themselves in attractive dividends. They order the company to buy up its own stock, thus reducing how many ways they have to split dividends. This also pumps up the price of their own shares by creating fake demand for the company stocks.

As if all that loot is not enough, sometimes they even vote to have the company take out debt to buy them out — the golden escape hatch — so they don’t crash the value of their own stocks when they dump them all at once. They leave the companies with piles of debt, while they exit rich to buy other stocks elsewhere. Rinse and repeat.

All of this is mostly passive income for them, and yet they get a cut-rate tax deal decade after decade that encourages and empowers their buy-rape-and-sell speculation in the market. Their tax reductions cause everyone else to have to pay higher taxes (or cause the nation to go deeply in debt if we don’t all pay higher taxes).

Many of the beneficiaries of these opulent tax breaks do nothing with their tax savings but endlessly play in a casino where as club members they bid up the value of the assets of other members based on what they think the majority of members will do. To make sure the games kept going, the Fed became intentional frontrunner of the casino action by letting the casino club members know they would continue to create plenty of new chips to add to each gambler’s account. (Because that is all Federal Reserve money is anyway — a chip that has value because everyone else is willing to accept that it has value — a chip that can be traded for something else.) The Fed kept walking through the aisles and placing stacks of new chips in front of the members; but they didn’t give any to you (unless I have some readers here who belong to the One-Percenter Club and read this blog for masochistic reasons).

The speculative activity of the super wealthy is ENTIRELY WORTHLESS to the economy at large. In fact, it is parasitic because, after getting such large tax breaks, they actually damage the economy by using all the money to build a huge bubble that will pop and hurt everyone, even as they beg us to bail them out so they don’t fall on us!

On top of the huge cut they get on what they are taxed for those personal gains, the rich receive numerous tax credits and other kinds of deductions that are only available to those who live in the One-Percenters Club. You see, those who are in the top ten percent of the income stream pay an even lower percentage of their total income in taxes than the top twenty, and the top ten percent of the top ten percent (the infamous One Percenters), pay a lower percentage in taxes still.

In fact, the higher up the pyramid of greed people go, the less they pay of their fair share in taxes. The beauty of this conceit is that they appear to be extremely generous and to be paying more than their fair share because of that 39.6% income-tax rate and because of how they can shelter most of their income from even being reported.

They also get thousands of pets who wail on their behalf about how unfair it would be to tax their rich owners more. These are the underpaid who live in economic denial because they hope to join the dream someday. They are allowed to believe they can — that the largesse of the wealthy will fall beneath the table where they can feast on the scraps and become wealthy, too.

Don’t be duped by the tax-trotting rich or their lap cats.

Let’s see how much the rich pay in taxes laid out in real numbers!

The [Congressional Budget Office’s] most recent data, for 2011, show that the average household in the middle 20 percent paid $8,100 in federal taxes, less than 15 percent of its $55,400 market income…. The average household in the top 1 percent paid $422,700 in federal taxes, more than 29 percent of its $1,447,500 market income.

That’s the standard argument from the article quoted above. It says I’m wrong in all I just said. So, why don’t I go back up and correct myself? I don’t because I know in my gut the article is just plain wrong; so, instead, I dig deeper, and this is what I find:

First, the money stated as income for the top one percent is what they made as adjusted gross income, but the rich have many more “adjustments” than the rest of us. Therein lies the key to this deception.

The argument states the percentage they pay on what remains of their gross income after all their special tax deductions and investment credits, income deferrals, incorporation benefits, payment in stock options, off-shore tax shelters and other shelters, and it ignores other taxes where they benefit from caps, such as social security and medicare. (On Social Security, for example, a worker making $40,000 a year will shell out 6.2% of his income in Social Security withholding, while an exec making $400,000 a year will have to let go of only 1.8%. And, if you’re at the four-million-a-year level, it becomes miniscule.)

Second, the government’s summation that Edwards coughed up also ignored all trust funds. While trust funds are often to help the severely disabled, trust funds are also the favorite tax shelter for rich babies with golden spoons in their mouths. So, they are ignoring a large area of tax shelters.

Finally, consider that many of the most fabulously wealthy people in the US pay no income tax at all or very little in tax.

In the last year of the Bush tax cuts, there were well over a thousand people who reported more than $60 million in earnings [each] but paid federal income tax rates far below 20 percent. (Think Progress)

Comparing the income disparity of the super-rich to the merely rich and then to the rest of us

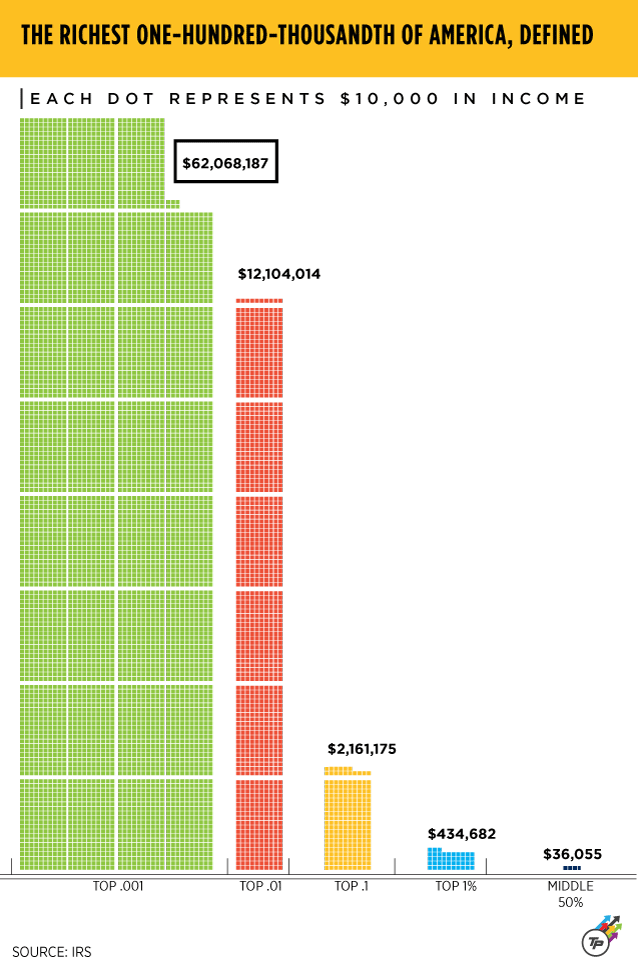

Consider how wealthy the top one percent are. Then consider how wealthy the top tenth of a percent of the one percent are, for those are the people who pay the lowest tax rates of all:

According to David Cay Johnston, an investigative reporter who won a Pulitzer Prize while at The New York Times, the percentage of income paid out in taxes becomes more skewed in favor of a lower rate for the rich, the higher you climb within the rarified stratosphere of the top one percent. This is an etherial world largely unseen because, until recently, the IRS did not break the superrich out from the merely rich.

The top tenth of a percent of the top one percent pay only 17.6% tax on their income … and that’s on the dollars of income they actually report. Those below them in the top one percent paid 23 cents on the dollar (that is, on the dollars that they actually report as income). How much more would the US tax system appear to be skewed in favor of the uber riche if we knew how much they really make before adjustments or how much they hide in tax havens that goes completely untaxed?

The higher you are within the crème de la crème, the faster your income is rising, too. (Go figure. You’re paying less in taxes on all you make; so, of course, your income is rising faster than anyone else as you compound this by putting your money out to make money.) Between 2003 and 2012, the bottom 99.9 percent of the top one percent (the poorest of the super rich) saw their income grow by $412,000 a year. That’s dreadful compared to the top tenth of a percent of the top one percent (1,361 American households). This cream off the top of the cream saw its income grow by $84.6 million annually per household!)

You should be able to see from this that money clearly bubbles up easier and faster than it trickles down. That’s because the rich have numerous filters to catch money on the way down and bring it back to the top and numerous releases to keep them out of the catches of the IRS. Oh, and the bottom 80% of the general population? Their incomes all fell during those same years.

Johnson writes,

On average everybody else in the top 1 percent worked all year to earn what those 1,361 households earned every three days, and yet those at the top were far less burdened by taxes…. The new report is the latest proof that our income tax system is no longer progressive. Instead of tax burdens rising with income, and thus with the ability to pay, burdens fall off as incomes rise into the stratosphere. That doesn’t make sense. (AlJazeera America)

I agree. That doesn’t make any sense at all.

And, yet, we allow it to be.

Wealth disparity in America is even worse than income disparity. The accumulated wealth (the sum of all your assets minus all your debts) of the top tenth of one percent is equal to the combined wealth of 90% of America. According to the Organisation for Economic Co-operation and Development the US has the highest income inequality in the world. (See AZ Central)

If the rich reached and sustained those rarified heights due to great creativity and productivity, that would be one thing; but they get there and remain there because we continue to provide them with legal shelters in which they can hoard their wealth.

Fifty-eight percent of all new income goes to the top one percent, who certainly don’t need new income and who are getting it just by playing with their after-tax money. To make sure they don’t run out of new income, the Fed has provided them with an ocean full of the new money to play with.

The Fed creates this new money as deposits directly into reserve banks, by adding it to the accounts of national banks that are mostly owned by the fabulously rich. So, we make sure that all the new money goes to those who need it and deserve it the most so they can let a little trickle down to the rest of the populace. A, yet, Janet Yellen has the audacity to express concern about the wealth disparity in America!

Oh, the concern of the benevolent rich. If we had more of their concern, we’d all be broke. Come to think of it, that’s not too unlikely in the not-too-distant future.

No surprise here. The rent seekers completely control all the levers of power. And with their hidey holes in Australia to jet off to when the plebes revolt, they will just slither back out from under their rocks afterwards to sink their bloodsuckers into us again. Maybe a few of the dumber ones will be eliminated when they move too slowly to escape the chaos they have created, but I am not too optimistic…

The story of our species; same as it ever was…

“their capital gains should be taxed at the same level as their other income, rather than at a lower rate.”

Here’s a novel idea: define income strictly as capital gains and leave wages, salaries, tips, etc. untaxable, since it ISN’T INCOME. that’s how the income tax was sold to begin with.

” the Fed became intentional frontrunner of the casino action ”

I’d say that the Fed was actually founded to fulfill that function, it didn’t just “become” the creator of the casino action.

“And, yet, we allow it to be.”

Yes, I suppose “we” do. Absent any input into the process of government, “we” have no choice but to just “allow it to be”, kind of like we allow the government to do anything.

Without an appeal to envy, income tax would never have been tolerated in the first place. I make $10 and I don’t give a fuck if you make $100, or $100 million. For that reason, I don’t want government to take any of your money or any of mine.

Good read, and I don’t disagree with the author, just adding my $.02.

The government is collecting absolute maximum record taxes ever on a regular basis (but still going farther in debt).

Who do you think is paying all those taxes?

Certainly not the poor downtrodden subsidized crowd, they’re the ones receiving it.

FWIW, for those wanting to tax capital gains at a higher rate -to punish the “rich” for being successful- think about what that will mean to your 401k and other finiancial investments.

The poor that can’t afford those aren’t going to be affected one way or the other since they live off of government subsidies paid by those they want destroyed, at least not unless they are actually successful at it.

The federal income tax is only a fraction of the taxes collected in the country. The 99% pay most of all other taxes.

What a load of Horseshit. The rich do pay the 80%, as this asshat acknowledges later. All his bullshit about deductions, etc., does not change that fact. Whatever else, the rich, as he calls them, pay all the fucking taxes.

He wants them to pay even more.

Here is a fucking novel idea – cut spending dramatically.

How about this one – spend less than you make, and go about making yourself rich, too. Or at least better off.

Nope – easier to blame those that are already paying all the tax.

Count on The Moon is a Moron to add a bit of gibberish. No surprise here. Envy is a terrible thing.

Ed – there are not enough capital gains to replace income tax, without drastically cutting spending. So they grab it from wherever they can.

My sole purpose in posting this article was to raise llpoh’s blood pressure.

Mission accomplished. 🙂

“58% of 1% of the top 2% of the bottom 17% of the median 17% of blah, blah, blah…”

So what does this maroon want to do – raise the capital gains tax? Couldn’t he have said that in a couple of sentences?

Income Tax is just the tip of the berg. Gander over to all the other stealth taxes being paid.

Sum up the annual revenue from the tax on gasoline attributed to the 1%, then compare the revenue from the 99%. Do that for all the stealth taxes.

It is obvious – the 1% pay very little in taxes but they hoard the wealth of the nation.

Kokoda – that is moronic. ALL fed excise taxes, which includes gas, amount to UNDER 5% of total fed taxes. You do the math.

Despite your ignorant bullshit, the fact remains that the “rich” pay the vast bulk of the federal taxes.

Here is a helpful bit of advice – look up the info before you shoot your mouth off and make an ass out of yourself.

Gas taxes, state and fed, amount to around $75 blllion a year. Compared to income tax of around $1.5 trillion a year, 80 per cent paid by “the rich” = $1.2 trillion.

1.2 trillion is more than 75 billion.

See, Kokoda, that is how math works.

Damn, but people buy in to anything that suits what they want to believe. Facts be damned.

The math of envy. Someone else should pay all the bills. Yes, the rich do pay essentially all of the income tax, and a higher percentage of the tax than they have as a percentage of all income. But it will never be enough for Bernie. Is there a moral limit as to how much someone should pay? Apparently not for the people not paying it.

As soon as they bring social security into it you know they are intellectually dishonest and just looking for a handout. Of course the person making $400k pays less percentage in SS, their benefits also don’t grow after the salary cap. In fact, the system is already set so that lower income people get a higher ratio of benefits to what they paid in so that it is already “progressive”.

The problem is that in order to get votes, politicians have kept SS taxes lower than they should be, just like they have kept taxes low and not funded the public pensions, again to stay in office. People who want to remove the cap without raising benefits essentially want someone else to pay for their benefits and should just admit that they want a form of welfare.

Gentlemen….as I said in my comment (which you ignored) was stealth taxes; I gave gasoline as an example. Do I need to inform you of ALL the ‘hidden’ taxes paid by the hundreds of millions (the 99%) for the purchase/use of anything.

Add these ALL up and add to the income tax inequality and it is grossly unfair.

Gas tax, presumably proportional to the amount of wear and tear you cause, yep, big problem. Better make it so someone else pays for you. Same as the many other taxes, tobacco etc.

See below for the CBO estimate for all federal taxes, including SS, which, while nominally a tax, are a forced savings and provide a higher return on contributions to lower income taxpayers than to upper income payers. State and local taxes total about half of federal and are 33% sales tax with property and income at 30% and 23%.

* CBO has approximated effective federal tax rates up through 2013. These estimates reflect tax law changes since 2011, but they “do not include any shifts in the income distribution that have occurred between 2011 and 2013” or “any behavioral effects in response to the tax law changes”:

Income Group 2013 Tax Rate

Lowest 20% 2.9%

Second 20% 8.0%

Middle 20% 12.3%

Fourth 20% 16.4%

Top 20% 25.5%

Top 1% 33.3%

as i read through this article i was thinking about llpoh going scorched earth on it.

praize jeebus he didnt’ disappoint.

seriously though it is bullshit, the narrative is framed in such a way that the correct question isn’t part of the discussion and rarely is (chomsky would be proud).

Instead of being envious of what others have, ask what right does the govt have to tax our income like they do anyway?

its like when you get into a discussion about firearms and its framed about how thorough the background checks should be, limiting magazine capacity and how far the regulations should go instead of saying “what part of shall not infringe is confusing?”

instead of asking how the govt should conduct an activity and whether they do it “effectively”, we need to ask whether they should be doing the activity in question at all in the first place (the predominant answer should be a resounding FUCK NO).

David….I wonder how CBO would revise the results given once they include Obamacare, since it is a tax.

As many on TBP understand, the takers now exceed the providers. For this reason, Obozo was elected and then re-elected. For this reason Hillary will be the next president. Haggith’s appeal to those that thrive on envy, jealousy, and confiscatory avarice will consume all the resources made available to them. When all these resources become depleted it will be too late to reverse our decline from a nation of leaders, providers, and individuals to a gaggle of followers, ward of the state conformist. Free shit is here to stay, tough love is nowhere to be found.

The fact is that the top 20% pay 80% of the income tax because they make 80% of the money, …

~

If you consume 80% of the food [wealth] then you will be accountable for 80% of the shit. [taxes]

My two cents …

This article is full of distortions, overall just pure bullshit. I don’t have the time to go point by point but there is a simply way to prove it’s false that the rich don’t pay most of the taxes.

Try to propose a flat tax and see what happens. What you will hear is that would be unfair because that would be a huge reduction in taxes for the rich and be too much of a burden on the poor. Do you need any more proof then that?

These arguments as to who isn’t paying enough taxes is just a smoke screen, it’s just so much sleight of hand. If everyone is busy pointing fingers as to who isn’t paying “their fair share” of taxes, they’re not focusing on the real problem and that is that the spending is out of control.

Its not hard to land in the top 20% guys, not at all.

Our country is addicted to debt, and spending. No amount of taxation could conceivably cover the enormous costs they are incurring.

PS: As I’ve said before, there is a world of difference between top 1% and top 0.1%.

The top 10% have more in common with your average 1% than your 1% has with 0.1%. As you scale upwards the wealth gets almost impossible to understand.

“Ed – there are not enough capital gains to replace income tax, without drastically cutting spending. So they grab it from wherever they can.”

Llpoh, here’s what I think. Wages, salaries, tips, etc. do not meet the definition of income. Capital gains are the stated target of the income tax. Now, why should you or I give a shit whether the government has enough money to waste?

How does their shortfall excuse the way they are robbing us? We ain’t democrats, you and I. We both know that the premise of democracy that says “we are the government” is a lie.

Nobody who works and produces what they have is in a position to have any influence on what government does. Office holders and their controllers are telling us two conflicting lies at the same time. They’re telling us that they are our leaders and that they are our servants. Which do we believe?

I don’t believe either one. I go with what John Trudell said for decades before he went on ahead of me back in this past winter: he said that believing ain’t knowing. Believing is deciding against our own reasoning that something we’re being told is true. We ought to admit to ourselves first that we only think this or that, we don’t believe.

Maybe you remember John, I don’t know. I don’t know whether you think he was full of shit or not. I think he saw things real clearly, myself.

A Boeing 757 at cruise burns 1722 gallons of jet fuel per hour and a medium sized 100 foot yacht burns about 250 gallons of diesel per hour. I would say if you could afford these fuel costs you would be in the .01% and are paying your fair share of gas tax.

Kokoda, do you mean obamacare with or without the subsidies the new taxes on my dividends and cap gains pay for? Probably hits the middle class, not the poor.

In any event it will collapse and we will have the single payer the left creams over, along with the waits for any non life threatening treatment anyone honest in England and other euros will tell you about. I used to work for several European banks and heard all the stories from lots of people, not just big government shills who will swear there are no waits etc.

Take away gun deaths, car accidents, obesity, and the dumbasses having kids at young ages while on drugs and too stupid to get any of the free care available, which have nothing to do with the delivery system, and our health stats look fine.

“they’re not focusing on the real problem and that is that the spending is out of control.”

I think that is an important problem, but not “the real problem”, or better put, the root problem. I think the root problem is the income tax itself. Having that particular spigot seems to let the big spenders believe that they have an endless supply of money to waste.

Letting that bunch of soft handed assholes spend anything other than their own money is where the whole fuckin thing went wrong to start with. Spending other people’s money is always gonna be uncontrollable, if the people authorized to do it are the type who can’t even provide for themselves without a government job.

Jesus fucking Christ Kokoda – you go all in on stupid, don’t you?

All the fucking excise taxes, of every fucking kind, only amount to 5% of the total fed tax take. Look it up yourself, and quit being such a dumbass.

The fed govt collects around $3 trillion in total axes, around 80% of that being paid by the rich.

Collectively, ALL of the states and local combined collect about $1.5 Trillion per year. Half of that is property, a quarter is income, and a quarter everything else.

The rich would pay a substantial portion of property tax, and 80 percent of the income tax, and let’s say 20% of sales tax.

So .8 times 3 trillion plus .5 times 800 billion plus .8 times 400 billion plus .2 times 400 billion equal total paid by the rich.

Which is $3.2 Trillion fucking dollars out of the entire tax take, including every fucking thing, of 4.6 trillion.

Or around 70% of all taxes paid in the US, States, and local communities are paid by the so called rich.

Kokoda, that is the fucking mah. Not some made up pie in the sky gullshit you keep pulling out your ass.

And surprisingly, there are folks here wh actuall believe the Kokoda type bullshit.

Tax the rich! Tax the rich!

The rich are already paying for damn near everything.

What say we slash spending instead?

“The fed govt collects around $3 trillion in total axes, …..” ———–Llpoh

I call BULLSHIT! …… I mean really, that’s a LOT of axes!

That’s about 100 axes PER PERSON!! Lemme aks yew … where are all the fucken trees, anyway, for that many axes?

Certainly not in your trousers. That is a tiny twig.

People like this Haggith have no idea what it takes to either do the work to get into and succeed in a technical field, or take the risk and long hours to run a business. They take the easy road and do things that are not that hard so dont pay that well, or if theyre in the govt get paid more just for hanging around, but still complain. Property you own should not even be taxed at all. Shrink the fucking government that takes all the taxes and wastes it on useless bullshit.

Herschel is correct. The govt should shrink to maybe 20% of its current size – infrastructure, defence, education, basic law enforcement, and little else.

Llpoh, why should education be any of the federal government’s business? Why should we trust them with any infrastructure? The only law enforcement they can even claim jurisdiction over is counterfeiting and treason. The federal government would have to shrink to 3% of its current size to stop spending most of what the people living here produce.

Oh no – someone gave grandpa chocolate again…

There should be an audit (but who would do it – the lilly white judiciary?-of the Federal Government from the Executive offices on down to those who sweep the floors in the bottom caves of the IRS. Including DOD even though the Federal Government has National Defence as a valid task. But are they doing it right?

Every item exclusively reserved for the Federal Government should be listed. All items exclusively listed for the States should be listed. If the Department of Energy is not mentioned in the Constitution, then it should be rapidly and in an orderly fashion – VANISH. Same with HUD and all the other alphabet agencies, committees and organizations (some 10,000 of them) should be swept clean of Washington D.C. and let’s see how life would be as the designers of the Constitution designed it.

It’s really simple to review the very small 58 page book published by CATO Institute with includes the Declaration of Independence,the Constitution of the United States, and assorted 25 Amendments to the same. Makes you wonder how a 58 page Declaration of of Indpendence can support some 4000 pages of Obamacare, doesn’t it. as far as I’m concerned, no law passed by Congress should exceed the Constitution in length. Further it would be the Congressmen who pass the law that would define ti, not lobbiests, staff and others who benefit from fiddling with a broadly written “law”, contorting it into a nightmare of earmarks, special exceptions other goodies the original drafters of the law probably never anticipated being stuffed into the final version. (Gag time!(

Now 58 pages is a pretty pissant little book, easily understood and that which is not reserved to the Federal Government and the States are pretty simple to figure out by process of elimination. Is the Department of Energy mentioned in it? No? Then the Federal Government has no business sticking its; big fat nose into anything that has ti energy exceept the interstate sales thereof. Is HUD in there? Nope and it too should go as as fast as it can out the door and on it’s arse.

I could go on for a five hundred page book listing things that the Federal Government does that is totally unconstitutional and should be wiped off the books .

I’d be glad to volunteer for a committee to compile such a document detailing Federal and State actions far over-reach the very limited powers given to the Federal Goverment by the Constitution and its’ Admendments.

I’m too damn old to see it come to fruition but I’ve love to see started on my watch..

MA

DAvid,

Bottom line is the more citizens are subsidized the more become subsidized. A flat tax that affects all purchases would be the most fair. But a flat tax across the board (corporations included) will never happen because there will be those that cry unfair no matter what share of taxes the wealthy pay. If we equally tax everyone (poor, middle, and wealthy alike) then people become more engaged in where their money confiscated and how tax is revenues are spent. A 10% consumption tax will tx the wealthy more than the average citizen. Purchasing an Audi S8 ($130,000) at 10% generates more revenue than purchasing a Kia at 10% ($20,000). The wealthy pay more, the less wealthy pay less, but everyone pays!

By dismissing groups from taxes we have a condition analogous to the professional military. When there was a draft more of the population was concerned about military interventions because more of us had a chance of engagement. Now, a professional military leave the vast majority asleep at the wheel because it does not affect them. Your shallow, short term thinking, and simplistic comparisons entirely miss the big picture as you focus on minutia and unfairness and ignore solutions that will improve fairness and our culture of free shit vs. unfair vs. the rich.

Tom I agree with the flat tax, but only if it’s 0%. Your idea that a flat tax would make people more engaged is still just an excuse for taxing what people earn. No government anywhere has the rightful authority to demand a share of what people earn by their own efforts.

When I start a business, there’s nobody from the government buying in by contributing money for the startup, yet they want a cut every year, just as though the government is a partner in my business. I didn’t ask for partners. They didn’t offer, either, but I’m still expected to cut them in.

Ed,

You missed the point entirely. The practical example provided was the difference in revenue generated between an Audi A8 and a Kia purchase. The specific example presented was a 10% VAT which applies to purchases, not income. In this scenario, your start up cots are not a factor and your income is not taxed. Your sales of goods or services have an added cost that is standard for any transaction. If you fail or succeed the govt receives zero from income. The govt only receives an add on tax for any receipt that you generate.

“The govt only receives an add on tax for any receipt that you generate.”

I’m describing the tax slavery we currently suffer under and you’re proposing an alternative, which is still a tax. I say, let’s don’t agree to allow them to tax anything, for any reason they present.

I’m talking about current tax laws. You’re talking about your idea for an additional tax, additional because the current government we have will seize upon the idea of a flat tax and enact it alongside the current taxes they already demand.

I’m not addressing your point because it’s theoretical, but I’m not actually missing the point.