![]()

On a long enough timeline, consumption equals production.

Guest post by Robert Gore at Straight Line Logic

If one had to choose a single symbol to represent the apex of human thought and achievement, a strong candidate would be the equal sign: =. That sign says that the symbols and mathematical operations to the left of it are equal to the symbols and mathematical operations to the right. Furthermore, to retain equality, anything done to the left side of the equation must be done to the right side. The equation is the heart of elementary arithmetic, the most complex principals of mathematics and science and their real world applications, and everything in between. Only logical challenge can disprove an asserted equality, and no amount of wishing will turn an inequality into an equality. The equal sign represents humanity’s capacity for ruthlessly pristine logic.

Many people shun mathematics, science, and logic, seeking refuge in their antitheses. A good part of human intellectual history has been attempts to either ignore equalities or turn inequalities into equalities. Forgiving, sloppy, delusional illogic is usually collective. Every age has its particular refuges. Our age has rejected the mathematics of debt. What can logically not occur, a perpetual inequality—consumption greater than production— has become the foundation of the global economy. As the tagline for Zero Hedge notes: “On a long enough timeline the survival rate for everyone drops to zero.” In the same vein, on a long enough timeline, consumption equals production. Understand that equality, and the future comes into stark relief.

Housing was the focal point of the last debt crisis. Old age funding—pensions and medical care programs—may well play that role during the next one. The math is straightforward: over time contributions and investment returns (if any) must equal promised benefits. The current reality is also straightforward: aggregate contributions, even if augmented by sterling investment returns, will be nowhere near enough to fund promised benefits. Current government and central bank policies exacerbate the predicament, making the achievement of even minimal investment returns problematic. The pay-as-you-go structure of many old age funds, such as Social Security and Medicare, does not allow for any investment returns at all.

It is easy for politicians to promise benefits and assume high investment returns. It is much harder to make the required contributions, whose benefits are long term and promise no immediate political payoff, and to actually realize the assumed investment returns. Underfunding of an old age fund can persist for years, especially if the fund borrows money. At any positive interest rate, borrowing further unbalances the equation; debt service will always outweigh the funds received. Debt only delays the day when promises are broken and the benefits paid out are realigned with what the fund actually has. Greece, Detroit, and Puerto Rico are the first chapters of what promises to be a very thick book.

Many of the governments facing actuarial imbalance do their best to make it worse. Contributions to old age funds come from the real economy, which is also where investment returns are generated. If there is a government on the planet that has improved the functioning of its economy over the last few decades, SLL is unaware of it. Dwindling growth (charitably defined as that benchmarked by official government figures) in the US, Europe, Japan, and China confirms that assertion. The ever-expanding Federal Register is emblematic of regulators gone wild, not just in the US, but around the world, and debt is a “gift” that keeps on taking. Most of the world’s $225 trillion pile of debt has paid for consumption or zero sum speculation. By definition these activities do not generate a return in excess of debt service, consequently their associated debt acts as an economic drag.

Central banks pushing down interest rates, in many cases to negative territory, kills old age funds dependent on investment returns. Most such funds are still assuming they can generate an annual 6 or 7 percent return, but if interest rates on safe debt are in the 2, 1, or -1 percent range, they have to take more risk to hit their targets. Taking more risk means investing more in equities and long-dated bonds. By most measures stocks are at the high end of their valuation ranges, and investing in them is especially dicey with governments and mounting debt gumming up economies. Long-dated bonds are most subject to interest rate risk should central banks find themselves unable to continue suppressing rates.

Such suppression encourages debt and discourages saving. Debt only makes sense when it is used to generate a return greater than the costs of debt service. Saving that funds productive investment is the true foundation of long term progress and economic growth. Dwindling savings further erodes the ability of the real economy to fund the contributions necessary to maintain old age funds’ solvency. If having children is thought of as “saving” for old age security, and in less developed countries that is often the literal case, then contributions are also facing a demographic “savings” deficit. In virtually every developed country, including China, over the next few decades the percentage of elderly will dramatically increase relative to the younger population that will supposedly support them (see links here and here).

Promised old age benefits are for income and medical care, and the funding gap for the latter is even greater than the former. In the US, decades of government intervention in medicine have produced almost complete separation of those receiving care from those paying for it, competition-destroying, cost-increasing concentration in the medical, drug, and insurance industries, and now Obamacare, which has exacerbated existing problems and created new ones. It relies on the healthy subsidizing the unhealthy and the more affluent subsidizing the less. Not surprisingly, the healthy and affluent are either shunning or subverting the system and insurance companies are fleeing unprofitable markets. Those who remain are seeking hefty premium increases. So add costly, convoluted, and inefficient medical and health insurance systems to the factors contributing to the unsustainable old age funding inequality.

That inequality propels mounting global debt, which has papered over shortfalls. That works until it doesn’t. Crashing commodity prices, sputtering economies, the frantic, counterproductive exertions of governments and central banks, and rising dependency ratios (the ratio of the dependent to those who support them) mean the reckoning is at hand. Whether or not anybody wants it or plans for it, benefits are going to align with the actual resources available to pay them, just as house prices aligned with economic reality during the last crisis. Unfortunately, this alignment will be far more severe than that one.

That equal sign can be a real bitch.

Robert Core , I have read your post and dropped by your site since you showed up. Strange thing is I agree with 95% of what you write and think.Kinda like Admin and Stucky. As I lay here in the hospital there is something really liberating about knowing that if I died today the only people that would really care is my mom and my cat.( little bb)

Well here they come for me .Time for another body scan. I will be back.HOPEFULLY.

“Having children is like saving for retirement.”

If lil joe (6’8″) makes the bigs I get to retire. Otherwise, not so much.

C’mon diamondbacks, you know you want him. You flew him out there three times already. I cant really afford one more year of college. Red shirted him and all. He has the best college knuckle curve in this hemisphere. 91mph fastball. A sweet slider. Cmon maaaannnn…….

Robert,

Great piece – one of my favorites from you yet. I’ve been preaching the power of math to others for years. It falls on deaf ears so I am no longer preaching. Pay off your debts. Get a little land and learn to take care of yourselves. Not much else you can do – math will reassert itself eventually with or without our say so.

Great piece Robert. I am impressed at the speed you pick up information and plug it in, and like Jim, you have a gift for laying it out.

They have the equal sign ok. One plus one plus all your money equals what they want.

Thanks everybody, and bb I hope you get to feeling better.

Hope you get well bb , being sick or hurt or injured sucks .

bookmarked your site Mr. gore , for when I have more time to peruse it please .

WTF,

Great, hope you enjoy it.

I’ve been saying it for years – and no one listens.

Pensions are not performing as the actuaries have modeled them. Robert Gore is correct.

How can a lifetime of contributions ($100.000) plus my employers contributions (1:3) pay out over my lifetime at age 55? Simple calculations says at 0% return, my pension will exhaust after 8 years of payouts, where the actuaries say they need a minimum of 6% ROI?.

I’m almost there…….

My returns on personal retirement savings is in the negative territory as the savings rate is around 1% but the real inflation rate of 10% (the goobermint says it’s only 2%) is eating away at it.

It can’t continue for very much longer………..

Fiatman

You’re retiring at 55 huh? Must be nice. You don’t expect any sympathy here do you?

Nice way to say you can’t escape the math. This realization brings on a feeling of dread.

Retired at 55? Drug dealer or government drone. No sympathy. See you at wal mart in ten years greeter.

Francis Marion says:

Robert,

Great piece – one of my favorites from you yet. I’ve been preaching the power of math to others for years. It falls on deaf ears so I am no longer preaching. Pay off your debts. Get a little land and learn to take care of yourselves. Not much else you can do – math will reassert itself eventually with or without our say so.

Thanks FM, for a wonderful summary of what one can do. Am watching math reassert.

WIP… none whatsoever…….. I’m saying the math does not add up in 95% of all pension plans.

Letting employees go at 55 is a huge mistake financially for most plans, as we are tending to live longer than the previous generation. Actuaries thought that the rise of the stock market gains was the holy grail of returns, that is NOT happening today as we all can see. A stock market crash would be disaster for all pension plans that are on the government mandated formulas.

Robert great summary of current malaise.

I have never really understood how the debt based world we live in is sustainable. If one thinks of economy mathematically and applies laws of exponents to the equation the world economy to me at least seems like an elastic band. When things are working normally, normal as anything controlled by the government, it will stretch but the prudent will make sure that it isn’t too far it so as to be not beyond it’s elastic limit. Yet here we are 2016. Everyone pulling ever more furiously.

2007 was in my opinion a snap back of elastic because the Brothers Lehman let go. What should have happen then was a liquidation of the TPTF in a grand reset. But the West doubled down on stupid and started pulling on it again. This time they are going for broke.

This morning I was sitting table at Son-in Law’s house. We are dog-sitting for them. They are away doing a family thing. Eating my toast and sipping my tea I looked above the sink to a sign over the window. Everyone has seen those signs with quaint slogans. Made in some sweat shop in China.

Anyways it said.

“Nothing is impossible”

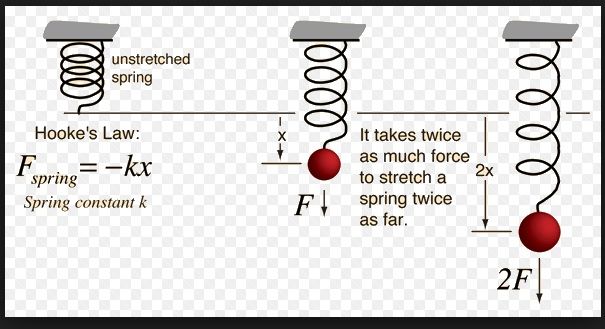

I laughed to myself because depending on how you define the word nothing it does embody the current economic mess of the world. Hooke’s Law certainly applies.

[img]undefined[/img][img [/img]

[/img]

Thank you for a concise explanation of an important axiom in economics.

Hooke’s Law only applies for so long. There are two types of deformation in materials. I think same can be applied to economics. They are elastic and ironically plastic deformation. In a normal world, one that takes into account the equal sign of supply and demand, the economy will stretch and recede as market requires. However we are living in a world of plastic, a matrix. A buy now and pay later place. It looks to me like yield point for normal return has been exceeded and we are about to find out what the UTS (breaking point) of economy. I suppose as long as bow doesn’t break the and the majority swallow the blue pill, living in the world of illusion, it will continue to be as it always was.

Yet one doesn’t to look far to see storm clouds lurking on the horizon.

Stupid is as stupid does.

The Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP) in partnership, funded the James Bay Hydro power project in the 1970’s to bring online a series of dams with attendant infrastructure. Power generation, transmission grid, maintenance and upgrading.

Before construction commenced, a market for the power generated had to found and secured. The Canadian market was too small, so therefore an agreement was signed with the USA and the big energy corporations of the US north east, namely Con Ed.

This agreement was and is a detriment for Canada, since the power sold is pegged at a ridiculous low rate of return. Not even enough to cover the cost of ongoing maintenance and upgrading of the system.

This entire fiasco was sold to the Canadian public by their governments, as a secure way to “invest” their pension funds and to provide long term employment that paid its own way. A similar situation occurred in the west of the country, with the Columbia River Project.

Both mega projects were locked into long term (60 year) agreements, at return rates much lower than the annual cost of project maintenance. You may as well describe the USA as consisting of 50 states, 5 territories and the province of Canada! Pensions? What pension?

Great read!

“It is easy for politicians to promise benefits and assume high investment returns. It is much harder to make the required contributions, whose benefits are long term and promise no immediate political payoff, and to actually realize the assumed investment returns”

They never intended to pay it all back except for the first people in. When the ponzi starts to break they just make new rules and create new savings plans.

The 401K is the perfect example as it was created to remove the older pension systems and to get the money under the banksters control. It will be stolen(actually it has already been stolen) just like the pensions and a new plan will be rolled out.

good day Mr. Gore,

you have written another winner! Thank you.

I have come to the conclusion that smart/educated people,

ones that do understand math, are spending energy on denial.

Many declare they are too busy, stressed at work, have “enough

problems right now” and so on, to pay attention and “get myself

even more stressed out.” So I have been told by a few trusted

friends/actual quotes. That amounts to magical thinking. I have

thought perhaps they are mulling the issues over and will come

to right thinking soon. Then a few weeks later, there are brags about

how well their “funds” are doing and announcements of vacation

home purchases, extended trips to Europe, and taking on some debt.

So I have to give up hope the mulling bore any fruit.

The “market” will reset, maybe soon, to true market value. It may be a

big negative number…and what you “have” will be all there is. The

retiring boomers better have something tangible set aside to pay property

taxes. Tremendous debt and no real savings = collapse of that particular

system. Then what? We are almost fully retired and have diminished

strength. We can’t become farmers anymore/only small efforts.

We bought a 116 yr. old farmhouse with a couple of acres and access to a

stream. Wood heat and propane and a sand point well with a pump in the

basement. Standard of living? One would say bare bones, no particular

luxury items or status symbols/show off stuff…but no debt. However, running

water, electricity, shelter, internet (such as it is), and some items put back in

case their are shortages. Old phone books = back up TP. Nonetheless, I have

never been “happier,” content, and more anxiety free. Of course, we/me were not

born and raised here, (many are) but we have gotten a good welcome. (4 yrs. this March)

I respect my neighbors…one farm family in particular. They have become true friends.

Thank you for your work Robert. Your effort is worthy and valuable.

Suzanna

there…yikes.there are shortages.

Thank you, Susanna.

Greg in NC, great point. Crrated to get the money under bankster control. Bingo

Another TBP commenter hits the big times:

http://www.zerohedge.com/news/2016-06-04/equal-sign-can-be-real-bitch

Well done Robert!

I want to thank you all for making this possible, and my agent, and my publicist, and my stylist, and my lawyers, and my accountants, and my business manager, and my investment advisor, and the studio, and the members of the Academy, and my well wishers (both of them). Thank you, thank you, thank you.

Excellent essay; it’s a shame that the people who most need to read this (and benefit from it) are almost to a man (or woman) immune to logic.