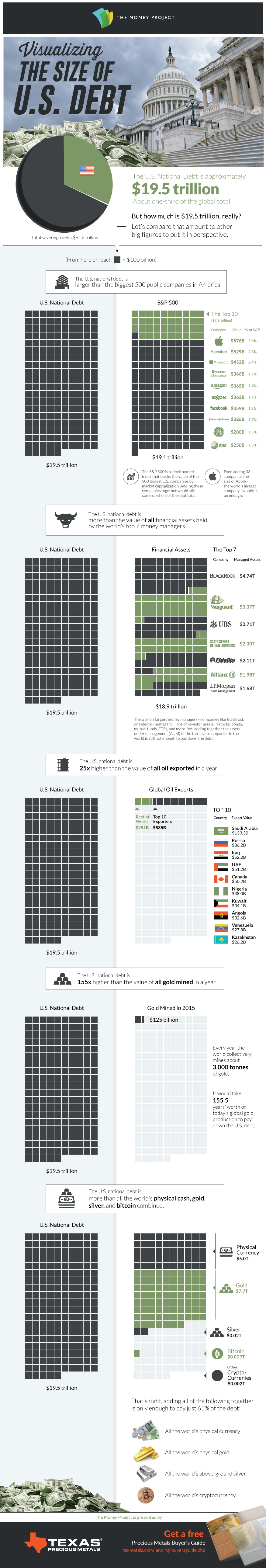

Today’s data visualization plots the U.S. National Debt against everything from the assets managed by the world’s largest money managers, to the annual value of gold production.

1. The U.S. national debt is larger than the 500 largest public companies in America.

The S&P 500 is a stock market index that tracks the value of the 500 largest U.S. companies by market capitalization. It includes giant companies like Apple, Exxon Mobil, Microsoft, Alphabet, Facebook, Johnson & Johnson, and many others. In summer of 2016, the value of all of these 500 companies together added to $19.1 trillion – just short of the debt total.

2. The U.S. national debt is larger than all assets managed by the world’s top seven money managers.

The world’s largest money managers – companies like Blackrock, Vanguard, or Fidelity – manage trillions of investor assets in stocks, bonds, mutual funds, ETFs, and more. However, if we take the top seven of these companies and add all of their assets under management (AUM) together, it adds up to only $18.9 trillion.

3. The U.S. national debt is 25x larger than all global oil exports in 2015.

Yes, countries such as Saudi Arabia, Kuwait, and Russia make a killing off of selling their oil around the world. However, the numbers behind these exports are paltry in comparison to the debt. For example, you’d need the Saudis to donate the next 146 years of revenue from their oil exports to fully pay down the debt.

4. The U.S. national debt is 155x larger than all gold mined globally in a year.

Gold has symbolized money and wealth for a long time – but even the world’s annual production of roughly 3,000 tonnes (96 million oz) of the yellow metal barely puts a dent in the debt total. At market prices today, you’d need to somehow mine 155 years worth of gold at today’s rate to equal the debt.

5. In fact, the national debt is larger than all of the world’s physical currency, gold, silver, and bitcoin combined.

That’s right, if you rounded up every single dollar, euro, yen, pound, yuan, and any other global physical currency note or coin in existence, it only amounts to a measly $5 trillion. Adding the world’s physical gold ($7.7 trillion), silver ($20 billion), and cryptocurrencies ($11 billion) on top of that, you get to a total of $12.73 trillion. That’s equal to about 65% of the U.S. national debt.

The debt isn’t payable in dollars that are anywhere near equivalent in value to those that were borrowed.

It will either not be paid or paid for the way the Wiemar Republic paid its WWI debt.

Get used to it and make your financial plans accordingly, your personal situation’s plans as well if it turns out to be the latter rather than the former.

What are “they” going to pay off the debt with? More debt?

Someone, PLEASE, explain to me in simple terms how that is supposed to work. Better yet, explain to me how that’s different than the last 35 years, and how, WHEN THE TREND CHANGES, what worked before will CONTINUE TO WORK, even FASTER!

The “Debt” is like an underfunded public pension, or a bank that is insolvent. When the time comes to pay off, and simply borrowing MORE cannot be done, then our Great Oz will step back and admit, “The cupboard is bare.” Pensions will go unpaid. Bank deposit accounts will be “bailed-in.”

In a nutshell, accountants will wade in and simply cross liabilities off the ledger. People, REAL PEOPLE, who planned and depended upon being paid under the terms of those liabilities will simply GET STIFFED.

Until that happens, until the trend change, it’s business as usual. When interest rates do rise, though, this time it will be because the HERD has lost the Pathological TRUST necessary to sustain a belief in the unbelievable. Rates will rise because people will FINALLY FEAR DEFAULT, they’ll FINALLY FEAR they’re going to get STIFFED.

What do we think will happen to the value of all those IOU’s when the herd wakes up and realizes all that “green grass” promised them for the future is actually painted asphalt? How do you spell STAMPEDE? The Bond Ocean will drain out, along with most of the “wealth” people thought existed in it. And Uncle Sam’s managers will see their little game of borrow and spend crash and burn.

Desperate times indeed, but it’s not going to be Wiemar Republic. It’s going to be 1930-32 in the USA, only times a thousand.

This is the on-budget debt. We all know it’s the tip of the iceberg.

Total credit market debt is more than 10 times this, and if you add all the things FASB accounting rules would add to a firm’s balance sheet, total debt exceeds ONE QUADRILLION DOLLARS.

Never in the history of Mankind has such an overhang of doom been allowed to arise. No matter how I try, I cannot see any way this is reconciled in an orderly way.

Starting 50 years ago we (and our parents) consented to:

1. Removing silver from coinage, which was the last time money you could hold was connected to a single real yardstick.

2. The Civil Rights Act which eventually spawned Welfare Addiction, race-blindness and a whole host of insanely unreal beliefs (and the Scarlet Letter R being assigned to all heretics.)

3. The Immigration Act which has flooded North America with ever-lower quality people (no matter how “nice” some of them are.)

4. Related to #1, full scale Monetary Madness.

5. The Apogee of Society being Organized by Coercion. The Feral Government’s apparatchiks now regulate people down to the level of their sex lives and their genitalia. There is no longer any aspect of human existence not regulated (coerced) by people who work for the political system.

If humanity survives the next 100 years (far from a given, with the existence of nuclear and biological weapons), historians a few centuries from now will marvel in astonishment at the collective insanity of the times in which we all now live. They will wonder if any of us realized just how profoundly irrational, insane, and outright batshit-crazy was our entire socio-political system.

Who gives a flying fuck any more. This Shit simply doesn’t matter. We’ve entered a new dimension of fiat currency science.

I was unable to look at the details.

People have said “China owns us”…and rumors of what

will happen when we/US confront our trade deficit abound.

I am guessing the peoples’ mindset may need to change to

a “just enough to get by” paradigm.

And, BTW, what the hell are they spraying on us?

That which cannot be fixed will not be fixed. Sadly, collapse and reset is the only option remaining.

“Collapse and rest.”

That’s the problem, isn’t it? In the grand scheme this is inevitable. BUT THE DEVIL IS IN THE DETAILS.

We’re entering a period when being at the wrong place at the wrong time gets you killed faster than being a scantily clad, pretty white girl wandering through Chicago’s Englewood neighborhood.

The problem is, we don’t know in advance where NOT TO BE, or WHEN NOT TO BE THERE.

Hey zigzag!

A friend of mine has a tag line on his emails: “If you can’t live with it, and you are not allowed to fix it, it just might be time to break it.”

Right on DC Sunsets!! We the deplorable’s cannot pay this debt off. It’s simply too much “debt/working person” ratio. Wages would have to rise to the stratosphere to make the deplorable’s pay it off.

Since we are not a manufacturing giant any more, and we couldn’t sell our goods at those prices anyways…. were hooped!!

No the goobermint has lead us up to this point with their fiat experiment, which is the grand daddy of them all, and they ultimately will throw us under the bus when the time comes.

Get your PM’s ready…………

The debt will never be repaid. The money has been printed and spent for non-tangibles.

The key is: “wealth is productivity.” The more productive we are, the more wealth is created (goods) with the same amount of work, thus we lower our costs, which gives us more disposable income to buy more goods, and the economy (GDP) grows.

If we went into debt to build new roads / bridges / power plants / sewer systems / or a host of other things that would improve productivity – then we could grow our way out.

Take for instance you borrow $5,000 and buy a car that gets you to a better job, and your raise in pay allows you to repay the loan – that’s great – a win-win. Suppose you borrow $5,000 and take a vacation. What do you have to show for it? That’s right – nothing – you don’t have the car (asset) or the job (income earning). This is what the US is currently doing.

We are going $Trillions$ in new debt every year, as direct welfare payments. This debt has no asset value behind it – it’s just money to feed the breathers / eaters / breeders. So the debt will never improve our productivity, it is not going into infrastructure, thus the economy will not grow because of it.

And if that’s not enough, let’s import a couple 100,000 sand niggers / SPICS / spear chuckers every year because we’re so compassionate.

For those of you with imagination…….Assuming you could pay off the debt and assuming a payment rate of one million dollars per day with no days off it would take 53,410 YEARS to pay back $19.5 Trillion.

IS – That is an eye opening calculation

Yep. Pretty soon our debt will add up to real money!……..any day now!

I/S-Yes but if you get to Zimbabwe level, the entire dept disappears with the first 20 ONE TRILLION dollar notes the FED prints with a 500 billion dollar surplus to boot. That would only take about 30 seconds for the first printing.

No. No. No.

Monetizing the debt as you suggest might eliminate the risk of a deflationary catastrophe on the monetary side, but it would maintain the impossibility of actually making good on all those promises while it would completely destroy the ability of anyone, including government officials, to borrow….for generations.

If you want to know what it looks like when the government tries to close the loop, where government borrows its money and then buys (and monetizes) its own debt, look to Japan. Bondholders in Japan have lost 15% of their wealth in the last two months.

Closed loops don’t work. All roads lead to a collapse in the perception of dollar-denominated wealth, and this is because for 35 years we’ve had a vast INFLATION in the perception of dollar-denominated wealth. What goes up must come down.

Another comparison …… our nearly 20 trillion dollar debt, in $1000.00 bills, would create a stack 1200 miles high. Add in unfunded liabilities according to http://www.usdebtclock.org/ and the stack of thousand dollar bills grows to 7,7oo miles.

A few years ago I published a column that did the math on using $100 bills.

At that point, to print a sum of banknotes equal to total FED calculated credit market debt would have equaled the displacement of 5 (five) average cruise ships.

We will not be at risk of a currency (banknote) hyperinflation until banknotes above the denomination of $100 appear, even if only for inter-bank purposes. What that happens, have your trade goods in hand (including gold, silver, ammo, toilet paper, tampons, whiskey, vodka, etc.)