According to the government run FDIC, there are less than 100 “Problem” banks in the entire U.S. That is awesome news. I guess $700 billion of TARP, the Fed buying up $4 trillion of toxic “assets” and free money from the Fed for 8 years really did the trick. What a great country.

Isn’t it interesting how there were also less than 100 “Problem” banks right up until the 3rd quarter of 2008 when the Wall Street/Fed created financial catastrophe struck. The FDIC thought all was well with America’s banking system in August 2008. They were really on top of things. That should really give you confidence in their current assessment of U.S. banks. That six fold increase in problem assets last quarter is just a hiccup. All is well.

The big problem is not TPTB printing money and papering over their bad debts (for a price); the Banksters doth loudly protest: “Oh please don’t throw me into that briar patch”. The Big Problem is the World (ie: BRICS, OPEC, etc) demanding more and more dollars for their goods (re Venezuela etc), and ultimately demanding payment in Yuan, Rubles, and gold. No more hamburgers (today or any day) for some more freshly printed fiat green paper dollars next week or ever. When that looms, you can be sure some (False Flag) aggression will require US to go to war again; and require their new e-money with their The Mark Of The Beast.

The next QTR results – will the number of problem banks rise and the assets rise?

How the fuck do I know? What is the purpose of that question? Are you as big a dumbass as you appear?

Point being: Look back to 2008 and see how those two items fared, by QTR. Just had a significant rise in assets last QTR.

When both rise, SHTF.

But, then again, I’m not as big a dumbass as you.

Hey dumbass. A sixfold increase in problem assets in one quarter must be good news. You don’t even comprehend the point of the post because you are so focused on being the devil’s advocate. The fucking bad debt is already on the balance sheets of the banks well before the FDIC has a fucking clue that it is a problem. Capeche?

I’m still waiting for all that factual backup about all your unemployed friends who are now living high on the hog. I need to know your secret of working half as much and making so much more. Based on your financial comprehension, I know it’s not in the field of high finance.

Any workable suggestions about what to do about it to be discussed

“Any workable suggestions about what to do about it to be discussed”

You’re the know it all. I await your worldly wisdom. You are the most predictable douchebag on this site. You contribute nothing but wise ass comments. Go fuck off and troll another site.

I’ve made the same one numerous times and asked for other realistic proposals to consider as well if anyone has other thinking about them (ones that could actually work).

Other than (usually) ad hominem attacks and other disapproval, no one ever wants to provide one. To me that means that no one actually has one or has any idea at all what to do except complain and hope someone else has a solution.

So, now that you’ve already offered you standard ad hominem, do you have any suggestions to put forth that might actually be discussed while seeking some solution? If you do, I would like to know what they are and maybe have some productive ideas advanced.

BTW, asking a valid question is not a “wise ass comment”. It’s asking a valid question.

Open your fucking eyes dude. I posted four charts that show debt issuance since 2009 is off the charts and at all time highs in every area of the economy.

My solution is for people and corporations to live within their means and not borrow to live a lifestyle higher than their means allow. My solution is for the Federal Reserve to not rescue banks and blow fucking bubbles by keeping rates at emergency level rates for 8 years.

The point of the post, which clearly goes over your pinhead, is that the Fed and Wall Street have already set in motion the next debt induced financial collapse. The solution for the average person is to de-leverage and stay away from the stock market before it blows again.

Now provide your solution to the trillions in debt overhanging our wonderful economic system. I’m sure you will provide your usual drivel about everything being rosy and awesome because Trump will save us all.

There exists a solution, it’s called a Jubilee.

You tell everyone holding that phony paper to pound sand. Last I checked the Federal Reserve/World Bank/UN/Banking cartels didn’t have an Army/Air Force/Navy or Marines to handle collections.

Will there be a fallout?

*shrug*

Who would initiate a Jubilee? Certainly not the bankers. It would take a revolution by the debt slaves to institute a debt jubilee. The banking system would collapse into insolvency.

A form of debt jubilee occurred in 2008/2009. Banks wrote off hundreds of billions in credit card and mortgage debt, but they just had us pay them back through TARP, ZIRP and QE.

“Last I checked the Federal Reserve/World Bank/UN/Banking cartels didn’t have an Army/Air Force/Navy or Marines to handle collections.”

Have to disagree on that HSF. They do, the bankers own them, and THAT is what is preventing a jubilee. In fact, I would venture to go as far as say that is now the ONLY purpose of the US military (other than a make work program for those lower down the rungs) – a big, armed collections enforcer with nuclear weapons. The other enforcers for internal enforcement, (revenue collectors) are the IRS, and then trickling down to your local police and courts.

Regarding anonymous, Admin is spot on. The FDIC is as reliable as the BLS and other government agencies tasked with delivering statistics. They all must carry the party line. FDIC is as artificial of a protection to banking crises, as the TSA is a defense against terrorism. It make people feel comfortable, but that is as far as it goes. Illusion and theater, nothing more.

If there is a debt jubilee, it will be of the FED, for the FED and by the FED. John Q. Public will get foreclosed when he can’t make his payments and his collateral repossessed.

Remember all the “positive” financial government announcements since 2008 was to make Obama look like a smart president rather than the court jester of the 1% investor class of America . Jesters all in the Washington swamp owned and operated by the circle jerk of Wall Street to K-Street to Capitol Street !

No it is not better , fixed or even close to it !

Prepare to duck & cover , shit will fly !

I gotta give these evil bastards credit. I thought it was over in 2000 but somehow these sonsabitches keep this economic corpse propped up.

No bad debts hidden on bank balance sheets. Right?

[img [/img]

[/img]

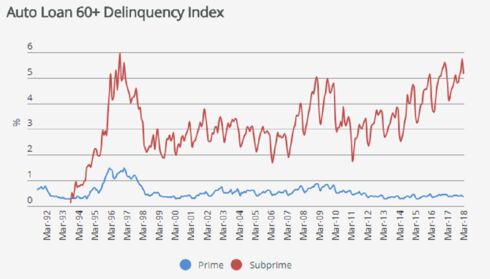

I’m sure this won’t impact banks.

[img [/img]

[/img]

All leveraged banks are a problem. The banking system is designed to handle normal, one-off, banking failures. 2008, when they were pretty well all flushed, demonstrated that unprecedented re-leveraging of the system ( a quadrupling of central bank assets via counterfeit money) was required to refloat the banking sector – a shitload more debt on top of the same asset base, which needed inflating to create the illusion of sufficient collateral for the new debt load plus old. Sort of an upwardly, reinforcing feedback loop – more credit or money printing, inflates asset prices, creating more collateral for even more debt.

This is the greatest ponzi scheme ever devised, and hence, the greatest everything bubble in the history of the world. A minor detail (which is conveniently ignored or disguised) is you need income to keep up with the exponential growth in debt, but I guess a combination of ZIRP and NIRP helps keep it going far longer than could be imagined.

When it goes down again, they think they can reinflate it a third time. I don’t. At some point, the counterfeiting will destroy the currency.

I wonder whether banks are on the hook for any of this debt?

[img [/img]

[/img]

Holy Shite…

Nick gets upset with me if I don’t pay off the SAMs club card at the office on the way out of the store.

I wonder whether banks are on the hook for any of this debt?

[img [/img]

[/img]

I’m pretty sure we’ve already established precedent on that issue.

Margin debt in the stock market is also at an all time high. Yeah, that’s going to end well.

Bernanke and the Fed all knew it was going to blow up in ’08. They pleaded stupidity for 2 reasons:

1. there was zero consequence of telling everyone that everything was OK when it wasn’t. If these fuckers faced the firing squad, it’d be a different story

2. the bigger the crisis, the bigger the bailout. If they had nipped the problem in the bud, they wouldn’t have gotten dumptruck loads of cash in addition to the regular carloads of cash they steal on a normal day.

So to use Taleb’s anecdote of skin in the game – not only do these banksters NOT have skin in the game, but they are positively incentivized to blow up shit.

Here is the cover of the NY Post …. TODAY.

[img ?quality=90&strip=all[/img]

?quality=90&strip=all[/img]

I’m telling ya Herr Quinn, we are awash in money! Repeat as often as you need so you can belieeeeve — “EVERYTHING IS FUCKEN GRRRRREAT!!!”

There. Dontchya feel better?

A couple of years ago the FDIC had like 1.13% of the funds necessary to cover their “commitment”. I’m sure that’s below 1% by now.

It seems quite evident we’re in the everything bubble. To keep the sheep sleeping the TPTB have hammered precious metals. To me that’s the answer. Dump all paper and go balls to wall into the incredibly undervalued, no counterparty risk asset-precious metals. Taking into consideration all the other factors like decreasing ore concentrations, EROI (BTW, shale/tar sands is another Ponzi to the tune of $250 Billion in unrealized losses), etc. I see a $Quadrillion pieces of green paper looking for a new home in precious metal and the silver to gold ratio going from 80:1 to 16:1.

The “elite” are quietly selling off and moving into PMs.

See below for the amount of paper standing on the shoulders of PMs

demonocracy.com

There are less than 100 problem banks because there are many fewer banks period. The absolute number is down by something like 50%.

Oligopolic consolidation.