Trump is right. The Fed is to blame for the coming crash. But, the crash is not because of their tightening. The crash is coming because of their 8 years of 0% interest rates. Real interest rates are still negative. Only an idiot would say the Fed is too tight. Trump reveals himself again.

Guest Post by John Hussman

Yesterday, the U.S. market lost over $1 trillion in market cap. Who got it? Where did it go? Nobody, nowhere. Market cap = price x shares outstanding. Every share has to be held by someone every moment until it’s retired. There is no “getting in” or “getting out” in aggregate.

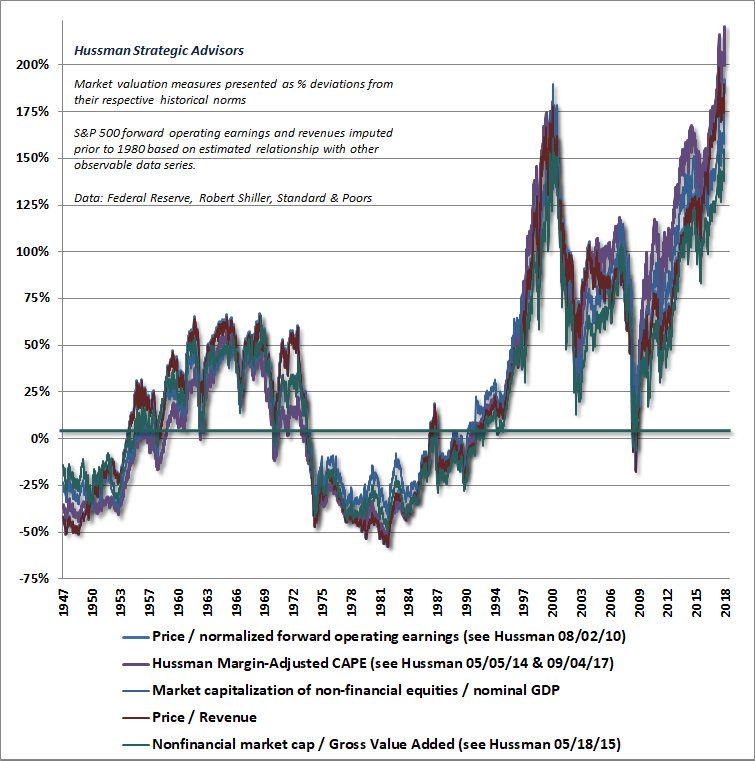

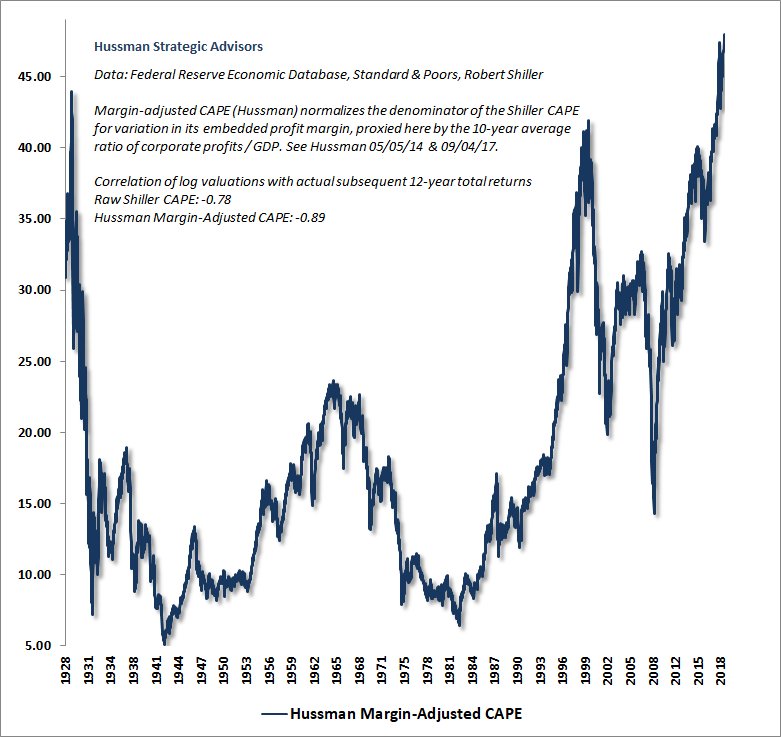

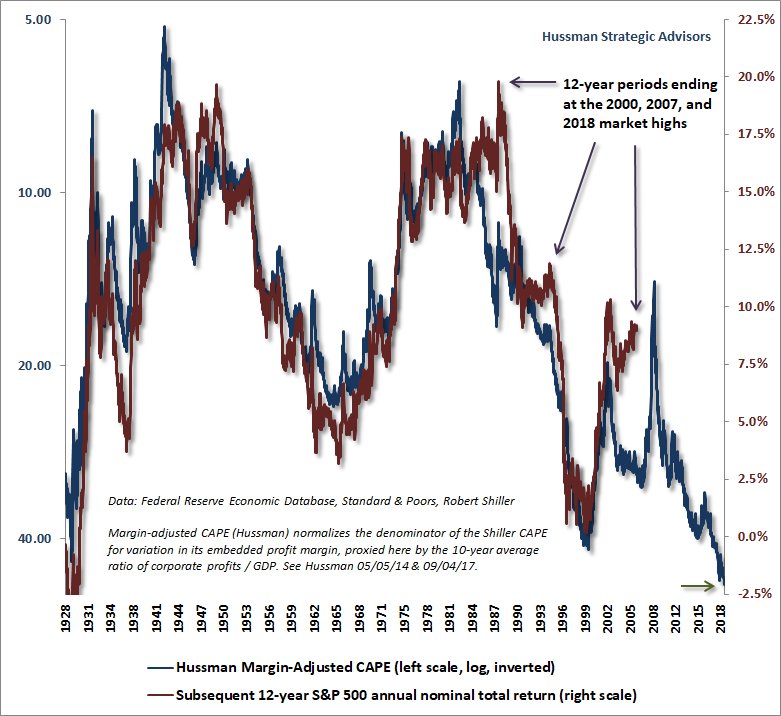

At the recent market peak, the most reliable measures of U.S. equity market valuation (those best correlated w/actual subsequent long-term returns) were ~200% above (3 times) historical norms. No market cycle, not even 2002, 2009, has ended at valuations even half that level..

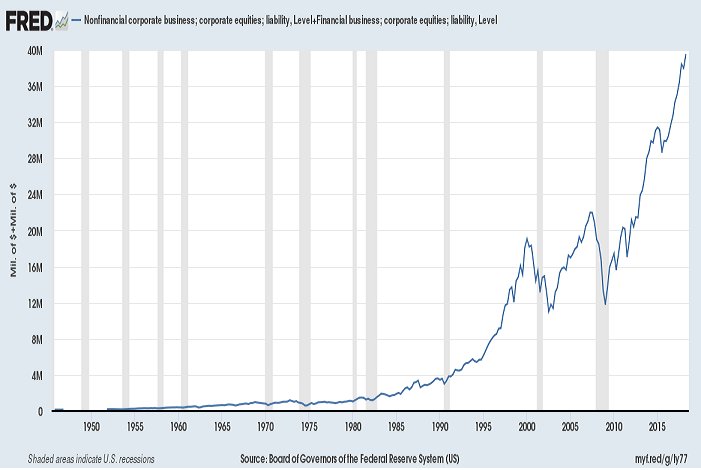

What is half of $40 trillion in U.S. market cap? $20 trillion. The reason I use words like “offensive” and “obscene” to describe valuations in this Fed-induced yield-seeking bubble is that many innocent investors will lose massive amounts of what they came to view as “wealth”.

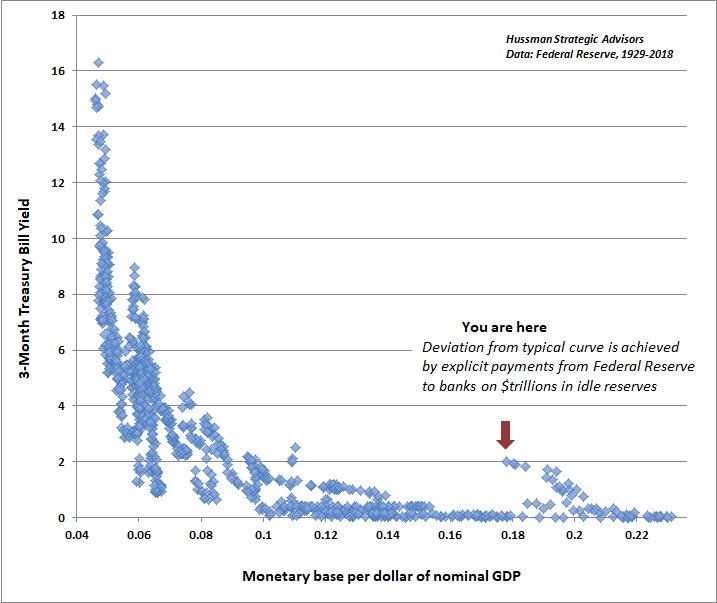

Now, when base money earns zero, the first refuge is safe alternatives like T-bills. So more base money/GDP first depresses T-bill yields. *When* investors are inclined to speculate, they chase riskier securities too. Fed can “tighten” by cutting balance sheet or paying IOER.

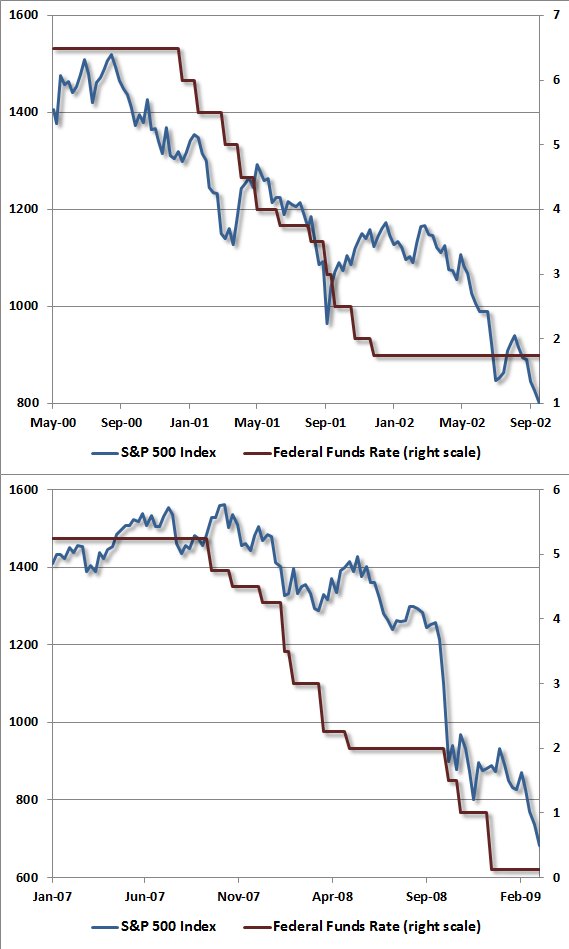

When investors are inclined toward risk-aversion, safe liquidity becomes a desirable asset (even at low yields) rather than an “inferior” one. That’s why Fed easing had no effect in supporting the market throughout the 2000-2002 and 2007-2009 collapses.

There’s also this;

“The World Is Quietly Decoupling From the US… And No One Is Paying Attention”

The article was posted today on Russia-Insider …. it is written by Brandon Smith.

https://russia-insider.com/en/world-quietly-decoupling-us-and-no-one-paying-attention/ri25028

The massive malallocation of wealth and resources is just a side effect of the Fed choosing to save the financial sector – the very people responsible for the situation they found themselves in – at the expense of the rest of society.

Ultimately, the root cause of the problem is allowing hostile parasitic foreigners to exist in decision making positions within our society.

The Federal Reserve Board consists of foreigners? What planet are you on?

The list of governors reads like a Synagogue membership list. What planet are you on?

Withdrawal symptoms from ZIRP.

**** And In Other News Today, The Look Out B-E-L-O-W market continues to slide:

Dow Down -459.84

The symbols of wealth in our strange Matrix world continue to not bother me much. So much of it is utter bullshit, just like the 90’s when new tech companies that never made a penny sold for 100$/share. The real wealth of land, water, food, energy resources and the infrastructure to sustain them are what matters to me. Stocks just seem like such bullshit, its not like the old days where you actually own anything with them, so few stocks even give dividends anymore. It’s just a big part of the skimming operation. Trump is just the new Capt. of the Titanic and he wants the band to play on during his tenure as President, he wants the funny money game to go on as long as possible. Who knows maybe he believes his own bullshit and we can “grow” our way out of the massive debt. Clearly, not growing our way out will be amazingly nasty, most likely a real correction would be as destabilizing as a world war, and the two things may very well be linked.

We continue to be in a predicament. Can’t grow our way out of the debt-spending game. Can’t go darwinian and destroy the so called safety nets to actually balance the budget. So everyone clings to the growth game and kicking the can down the road on the debt. The US would be in big trouble sooner, except all the big economies are doing the same shit, China, Japan etc. Most of us are young enough still that its highly likely that this highly coupled system falls apart in our lifetime. Maybe J. Tainter style. I don’t think the enviro crazies are going to be too happy when the pseudo-capatilism game ends, fighting over beans isn’t going to improve the environment, and neither will war.

Every year we don’t hit the icy waters at this point is just one more year to smell the roses, I’ve given up on the idea of lifeboats actually being available.

Hussman is to finance what Krugman is to economics.

No greater predictor in history . Just pick the opposite side and you’ll come out a winner every time.

Hussman has been right more than anyone I’ve followed in the last twelve years. You, on the other hand are just another anonymous voice with zero cred. You and Starfucker should get together and diss Bonner’s writings or tell us how about how great Musk is for putting a Tesla car in space. Sometimes the dumb comments make my eyes water.

Who got it? Nobody? Dont say nobody. If you follow my gab you know my indicator has been on a “screaming sell” for 5 weeks now.