Update (1345ET): The shortage of physical silver is exposing a tear in the precious metals market unlike any we have seen before.

As we detailed below, various executives from bullion dealers have explained that huge demand has left them with no supply (and no source) for physical silver.

And while silver futures prices (paper silver) have ‘stabilized’ modestly during the day…

Physical silver prices remain at extremes…

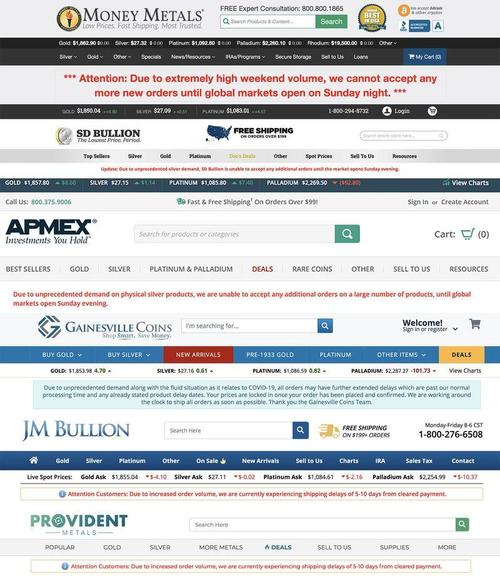

Source: APMEX

Source: JMBullion

Source: SDBullion

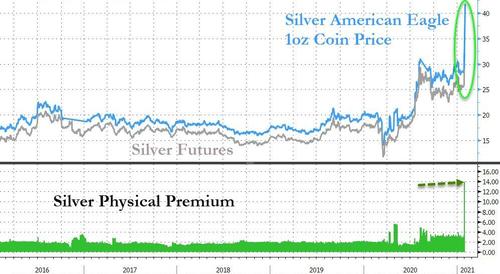

And, as the chart below indicates, that massive premium is unprecedented…

Simply put, the establishment can print all the paper silver it wants, but there is no physical supply… and that likely ends badly for those attempting to suppress reality for too long.

* * *

As we noted over the weekend, online bullion dealers saw such huge demand for silver ahead of today’s moves as ‘Reddit-Raiders’ prepared to take aim at the precious metals markets.

Sites from Money Metals and SD Bullion to JM Bullion and APMEX, all halted sales amid the unprecedented demand.

Over the weekend, Tyler Wall, the CEO of SD Bullion wrote the following (emphasis ours):

In the 24 hours proceeding Friday market close, SD Bullion sold nearly 10x the number of silver ounces that we normally would sell in an entire weekend leading to Sunday market open.

In a normal market, we normally can find at least one supplier/source willing to sell some ounces over the weekend if we exceed our long position (the number of ounces we predict we will sell over the weekend).

However, everyone we talk to is afraid of a gap up at Sunday night market open.

This is about ready to get really interesting as there was very little inventory left from suppliers/mints going into Friday close.

Our direct AP supplier informed us after close on Friday that the “US Mint will be on allocation for the remainder of Type 1” (Current Silver Eagle Design).

Our sales for the month of January exceeded any one month last year during the heart of the pandemic. It was an all-time record month in our company history.

And, perhaps most importantly, as QTR tweets so succinctly, “no matter what happens with #SilverSqueeze, a lot of younger people are for the first time informing themselves that metals are the only true real money. That realization sticks for life, even when squeezes end… this is a red pill moment for many, and it’s beautiful.“

However, the comments from APMEX’s CEO Ken Lewis were just as shocking… (emphasis ours)

To our valued customers,

APMEX Statement On Current Market Conditions:

In the last week, we have seen a dramatic shift in Silver demand from our customers. For example, the ratio of ounces sold per day was running about two times earlier in the week and closer to four times the average demand by the end of the week. Once markets closed on Friday, we saw demand hit as much as six times a typical business day and more than 12 times a normal weekend day. Combined with the extremely high demand levels, we are also seeing a surge in new customers. On Saturday alone, we added as many new customers as we usually add in a week.

Any Precious Metal dealer will take a long position in the futures market to protect against spot price exposure when the markets open. We do this because it is our goal not to take a speculative position on metal. The weekends are unique as we are not able to real-time hedge our position. We took an aggressive position this weekend, but clearly could not have predicted the volumes that were seen. We have partnerships around to world that allowed us to cover these long positions, but only to a point. Once we exceeded our comfort levels, we had little choice but to stop the sale of Silver on our website. This was a difficult decision to make and unprecedented in our history.

As we evaluate the markets, it is difficult to know where Silver’s price and demand will go in the coming day and weeks. APMEX is highly capitalized and has more than $150 million in inventory to support demand. We have made strategic decisions to procure additional metal, locking up any metal we can find in the market place. We suspect premiums will rise and rise quickly, as we are seeing significant increases in our costs, when we can even locate the metal. It is also highly likely that we will need an additional day or two to fill orders based on current order counts. The one guarantee we can make to our customers is that you will only be sold metal that is on-site, or we have procured the metal with a firm commitment date from our partners. In markets like this, we feel this is the best approach a retailer can take, as no one can predict product availability.

We want to thank our customers for their patience and understanding during these turbulent times. APMEX prides itself on best in class service and delivering on promises to our customers.

GoldSilver.com’s President, Alex Daley, also noted this rush on physical silver came at a time when the industry was already experiencing tight supply…

…a year of significantly higher than previous volumes which stretched many mints to their limits, the US Mint providing very limited allocations of its most popular product pending a redesign, and stocks of generally stretched thin as holders are simply not selling.

In fact, over the weekend we saw over 50 times the number of buys as sells. This is exacerbated because bid/ask spreads widen quickly in physical metals markets when supply thins out. Ask premiums rise rapidly with demand. Yet future mint allocations, which are often at pre-contracted premiums, slow the speed at which bid premiums rise and eventually pull asks back down toward them. We saw this last Spring and are seeing it again now.

This spike in demand quickly drove up spot prices, as well, jumping nearly 20% in the past week, much of that since Friday. There are many good fundamental reasons for silver prices to be higher than they have been, as Jeff Clark has often outlined.

However, moves this fast in premiums and spot prices can often reverse as quickly, so we encourage all of our customers to exercise good judgment and disciplined trading in volatile markets.

We wonder if Nelson, Lamar, and William Hunt would approve of Reddit’s approach?

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Just like We work was a fraudulent way to prop up commercial real estate, it’s starting to look like Robin Hood was a slush fund to keep the hedge funds liquid. I guess they thought they would pay it back with the IPO money. How could a broker that supposedly handles other people’s transactions need almost 5000 million dollars in a week just to survive? Buckle up, this won’t be pretty.

Robin Hood was simply a company set up so the Big Boys could get data for popular stocks in order to front-run muppets. The supposedly egalitarian mission statement was BS and shot down especially after it was found RH was forwarding market data and getting money from the hedge fund vultures who got punked.

Don’t drink the Kool-Aid. So then why do they need the money?

RH CEO said they have to lodge funds with BTCC, their clearing house. It’s usually done on a fractional basis but someone in BTCC or above decided to demand 100% to cover GME and other stocks.

This article is interesting. The owner of BTCC is a tiny private company called Cede & Co and it says that they own ALL the shares in the US. You never own shares yourself, only get the dividends or profit or loss when trading them.

https://www.zerohedge.com/markets/these-are-shadowy-new-york-financial-institutions-forced-robinhood-restrict-trading-certain

The Hunt brothers tried to take the silver market to its knees in the 70″s. I remember it well. It got to $50/oz. That’s now $250 in today’s buying power. Do you think silver has some more to rise?

Indentured Servant (IS) brought to our attention some years ago the discrepancy in price between rounds and bars. It was substantial, I converted my junk silver, got 20-something percent more silver, with greater purity. I’m itching to unload those bars near the top of this. Thanks IS, wherever you are.

Star-If only. 🙂

Cool.

Now we only need

1.) a working theory how to get back to that without violence

2.) and even more important, how to then sustainably keep it like that.

I’d settle for no income tax for anyone and a consumption tax on durable goods for everyone. Make it a level playing field.

Right on cue, the bullion banks slammed the PM prices as we began to see a strong move upwards. This fraudulent naked shorting is becoming so tiring – It’s been going on for decades ,yet these criminals who simply don’t have any of the physical to back their shorting, continue to get away with this corrupt practice. It’s high time to ignore their spot prices and trade the metals based on their demand/supply dynamics. Here’s a good article I read today on this very subject – https://www.bullionstar.com/blogs/bullionstar/silversqueeze-physical-silver-shortage-vs-paper-silver/

If I sell a piece of property I do not own, its fraud. If I sell a piece of property I own TWICE, its at least one case of fraud. If I sell it 100 times, its at least 99 cases of fraud. Why does this basic concept of property ownership and sale not apply here? And yes, I realize that this same bullshit is the basis of checking accounts versus savings accounts. The fraud simply must end….regardless of the outcome.

Great article, Nbtt. Very informative. Moar ingredients for shenanigans leading to spicy times.

And yet dealers quote spot price minus their premium when the purchase.

Exact same thing happened back in ’08-’09 when JPM deliberately crushed the price. They even got caught but nothing really happened. This is their system, they’ll do whatever they like until they are made to stop, not before.

At least now it is all out in the open.

Your 100% on that timing Farmer, and if I remember correctly (without getting into my ledger) it went down to $8 an ounce, and for a physical no counter party risk macro long legacy guy it was a killing.

For someone trying to make an investment out of a macro long legacy bet…they got killed.

How many people do you really think had their eyes open to this?

JPM is also on both sides of the trade. They short paper silver and have also hoarded physical. There are silver ETFs, SLV and PSLV. The last one is backed by physical and could be the break point. If holders of PSLV demand delivery and there isn’t enough physical to meet the demand, it may break the link and set the price of physical silver free to increase to a more realistic level.

SITUATION UPDATE, FEB. 1- POPULIST FINANCIAL UPRISING MAY TEAR DOWN THE ENTIRE ‘RIGGED’ SYSTEM

Monday, February 01, 2021 by: Mike Adams

(Natural News) The silver lining for the events of the last year is that huge numbers of people are awakening to fact that everything is rigged:

• The elections are rigged.

• Wall Street is totally rigged. There is no “free market.”

• The courts are rigged and no longer provide anything resembling “equal justice.”

• The money supply is rigged with fiat currency and endless money printing.

• The news is rigged with fake news from the globalist-controlled media.

• Speech is rigged by the tech giants that censor truth and promote lies.

Yet now, thanks to public access to the stock market, people are discovering they can stick it to the system by participating in “short squeeze” actions by purchasing certain assets. This is the entire story behind the WallStreetBets / Robinhood / GameStop phenomenon that we’ve all witnessed over the past week.

More importantly, we believe that certain strategic groups are using the same strategy to expose the vulnerabilities of the entire fraudulent system as a prelude to bringing that system down. In other words, certain white hat groups are, we believe, actually working to accelerate the demise of the fraudulent financial system in order to replace it with a more honest money system after the crash.

The entire house of cards of our current system is built entirely out of fakery and fraud. And I don’t mean just the stock market, but also the entire U.S. government which depends on endless debt creation for its very existence. The debt printing machine is the Fed, and the Fed is intertwined with the monopolistic banks (like JP Morgan) that stay afloat by manipulating both stocks and precious metals (such as silver).

The silver market has long been suppressed by these banksters and their government financial thugs as a way to hide the true extent of their debt spending and currency fraud. If gold and silver were to be allowed to find their true price, they would skyrocket compared to dollars, exposing the weakness and fraud of the entire dollar-based debt system that has stolen 98% of its value from the American people since 1971. (That’s how much the dollar has lost in real purchasing power.)

Now, retail investors are countering the silver market manipulations by purchasing physical silver. Right now, there’s hardly an ounce of physical silver to be found anywhere, as most of the supplies were sold out over the weekend. In London, the bullion banks are reportedly short 100 million ounces of silver, and the shortage is spreading like wildfire.

The banks are fighting back hard today, and after silver spot hit $30, the banks organized a counter attack that drove the price back down, but they’re being forced to deploy very costly financial weapons to achieve price suppression, and sooner or later, they will run out of ammunition.

Why does all this matter? Because the banksters suppress the market by trading paper contracts that claim to represent silver, but in reality there’s no physical silver behind those paper contracts. The entire system is a complete fraud, yet it is used by the globalist banks to suppress the price of real silver through paper contract manipulation. This allows them to continue pushing the propaganda delusion that claims fiat currencies hold value, when in reality they hold nothing.

When retail investors buy physical silver, it puts enormous pressure on the entire silver ecosystem and “squeezes” those who hold the fake paper contracts, in some cases forcing them to come up with the actual physical silver they owe or end up defaulting on the silver delivery implied by their paper contracts.

Many people who are currently buying silver contracts are demanding delivery of that silver, and they’re doing this on purpose, as a strategy to force the fraud of the silver paper market out into the open. Other retail investors are merely buying silver as a smart hedge against the coming collapse of the dollar and other fiat currencies, since owning physical metal is one of the key strategies for surviving a global debt collapse.

Silver, like gold, is an atomic element. This means it cannot be destroyed except through nuclear fusion or fission. Once you own physical silver in your possession, you can’t lose it by forgetting a password, or having a bank failure or even through a house fire. Silver doesn’t burn away, it just melts… but it’s still silver.

In my podcast today, I repeat something I’ve said for years: The best safe havens from the coming financial collapse are land, gold and silver. Other physical stores of wealth include firearms, ammunition, tractors (farm equipment), diesel fuel and storable food.

Why do you think Bill Gates and Jeff Bezos are buying up hundreds of thousands of acres of land across America? It’s because land is the last-ditch store of wealth when the entire broken financial system comes crashing down.

And that’s where all this is headed: The collapse of the debt system followed by the bankruptcy of the US government under Biden. Old Joe will be relegated to signing blank executive orders as he remains “president” of a bankrupt shell of a former government that will fall as quickly as the old Soviet Union. States like Texas will quickly declare their own sovereignty and begin rolling out their own state-based money systems and military defense operations.

When this happens, you don’t want to be anywhere near a Democrat-controlled city or state, as those will collapse into lawlessness and total chaos. Only red counties have a chance at maintaining the rule of law, thanks to ethical, law-abiding citizens who won’t put up with the chaos and violence of the Left.

Plus, many productive citizens and small business owners have already moved out of blue cities and states. The vast majority of the populations left behind in those hellhole cities like Seattle, Portland, Chicago, Detroit and Los Angeles are government handout recipients who contribute nothing to society. That’s why those cities will collapse very quickly: There’s almost no one left who knows how to do anything!

Not wasting my time reading Mike Adam’s bullshit.

He was SOOOOOOO wrong about the Trump saga …. don’t worry, he said, Trump will remain in office!! How this dude has any credibility left, and why people think he’s all that, is beyond me.

I don’t think he or anyone is all that…just a man with an opinion…sometimes he is right and sometimes he is wrong…but I like his HEART… and his ATTITUDE…and his FEARLESSNESS, and I’ll go along with these fleshed out bullet point truths.

The clanging you hear is from his self made brass balls.

Where’s the bullshit?

• The elections are rigged.

• Wall Street is totally rigged. There is no “free market.”

• The courts are rigged and no longer provide anything resembling “equal justice.”

• The money supply is rigged with fiat currency and endless money printing.

• The news is rigged with fake news from the globalist-controlled media.

• Speech is rigged by the tech giants that censor truth and promote lies.

Mark,

I find all of this fascinating because I can’t seem to wrap my head around the whole scam. Tell me if I am close….

There are 2 silver prices 1) physical and 2) paper. Paper is a claim on a # of ounces. Paper is traded all the live long day with a teeny tiny, if not ZERO, delivery of physical. This allows more ounces to be traded than actually exists.

5 questions.

1) What is to stop the controllers of physical to simply make it extremely difficult (I understand it already is but they could increase the difficulty) and EXPENSIVE for someone to take delivery? This could be a way for them to stay solvent…by simply passing their losses to those who want delivery by increasing the costs of delivery.

2) How does the Monkey Hammering happen? What, exactly, are the controllers doing to push the price down?

3) When they push the price down, they are only pushing down the price of paper silver, correct?

4) What other avenue (I assume PM dealers) does the retail investor have to buy AND sell silver at the true price?

5) Do the controllers even recognize as fact the real price of PMs? I assume no.

Ed,

I am getting ready to ZZZZZZZZZZZ.

I don’t know if I’m the best one to answer your technical questions…there are some sharper knifes then me here who post on the technical angles. If one of them reads this…please have at it.

I have been mostly accumulating/stacking silver since the early 80’s (during obvious macro dips) went in big in both metals in 99, 08, 15, and last March (always after much prayer & research) and just recently this year did some serious selling, but that was to build our dream home.

I still have the vast majority of what I have accumulated…and see PMs at my age (71) and the condition of the ‘slouch’ (that is explained in the link) wealth insurance for my wife, and I and a legacy for our daughter and her family.

If you’re interested this is part of my PM story, on TBP from three years ago.

Maggie was the editor and suggested I write it after we were going back and forth on another thread.

Now, I am defiantly a Contrarian (in many ways) so keep that in mind, but this may cover some ground you are interested in.

Having a generator installed tomorrow for the dark winter the Luciferian’s are always threatening us with, so I won’t be on line until later in the day.

You come across extremely earnest and forthright, hope you find some nuggets here.

TBP holds a great wealth of wisdom from the hive…this is my little buzz.

Ed,

This is worth the time and will answer your questions better than I could.

Gold & Silver Price Manipulation – The Greatest Trick ever Pulled

https://www.bullionstar.com/blogs/ronan-manly/gold-silver-price-manipulation-the-greatest-trick-ever-pulled/

Ed, This is a free education, from a man who can break it all down into understandable facts and history. We are in No. 7 right now.

THE HIDDEN SECRETS OF MONEY

Hidden Secrets Of Money is a groundbreaking new docu-series hosted by Mike Maloney, monetary historian and author of the world’s best selling book ‘Guide To Investing In Gold & Silver’. Mike’s goal is to remove the fog of modern economics for ordinary people and show them that although the world economy is on shaky ground, in every crisis there lies opportunity. The mission for the series: To enlighten the world that maximum prosperity can only be achieved through individual freedom, free markets, and sound money. The latest episodes will be streamed Netflix-style direct to YouTube, they show the amazing parallels between Ancient Rome and the Unites States Of America today. This playlist is the complete series so far.

Mark 🙂

Hazlitt’s book “Economics In One Lesson ” removes the fog from the system as well .

The only thing the present system will be replaced with in the event of a crash is a digital currency with a social credit system attached to it . In your future…”Sorry,you can’t purchase food today; you’re social credit rating is 4. Try again next week” .

SLV had an 800% increase in daily volume. Nothing really resembling a launch yet.

Don’t play their game. Buy only physical. Slow and steady.

This might be helpful to some people:

https://goldsilver.com/blog/will-silver-be-squeezed-upor-slammed-down/?utm_campaign=20210201_Mike_Video_Newsletter_Silver_Slam&utm_content=touchpoint_1_newsletter&utm_medium=email&utm_source=zaius

WARNING STUCKY – DO NOT READ THIS – IT’S THE DREADED MIKE ADAMS (again)!

For over 20 years I suffered from constant upper respiratory chest infections, with terrible chronic coughing, and the older I got the longer and more often I became sick, then I discovered Colloidal Silver. A complete and total prevention cure, not once since I started taking it (in late 2014) have I gotten sick. Not one head cold either.

Same effect on my wife as far as colds…she keep her own botttle on the nightstand – I better not touch it…and keep it re-supplied.

I have shingles…Colloidal Silver cuts the outbreak time by about 60% and the severity (pain) even greater.

Had a tick bite in a location I don’t want to even mention…it got infected…used Colloidal Silver Gel and it cleared up.

Got a fungus infection in my ear…yep you guessed it Colloidal Silver to the rescue.

I have not made my own yet, but have everything to do that, and I will…but I keep at least 5 bottles on hand.

This book is the best explanation out there on what its works on and wht.

Big Pharma and the FDA despise and fear Colloidal Silver…like the Banksters fear and despise Silver…for the same reasons both will destroy their CON GAME.

SITUATION UPDATE, Feb. 2 – The silver MIRACLE explained: Its money, medicine and freedom all in one

Tuesday, February 02, 2021 by: Mike Adams

Tags: antibacterial, assets, Colloidal Silver, first aid, Gear, gold, goodhealth, ionic silver, natural remedies, Precious Metals, preparedness, prepping, silver, silver coins, survival

Even though “awakened” people are super excited right now about acquiring physical silver as a means to fight against currency debasement and inflation, most people don’t yet realize the full potential of silver as a source of concentrated medicine that can be used in almost any survival situation.

On the financial side, physical silver (in your possession, not silver contracts or silver “paper”) represents:

• Real money and a means of exchange.

• A hedge against inflation.

• A safe harbor for assets / asset protection.

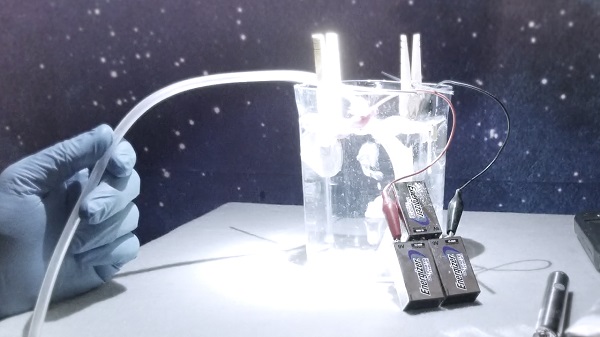

In addition, silver coins can be used to inexpensively manufacture colloidal silver using very simple objects such as batteries, clothespins and a mason jar (full details below). This, in turn, allows silver coins to be transformed into: