Guest Post by Bruce Wilds

The trade deficit with China continues to weaken America and strengthen our rival. For all the ruckus it created, the trade war failed to bring down the trade deficit. Even while unusual circumstances continue to cloud the picture it appears that America’s trade picture is in worse shape today than when it started. This is evidenced by the number of container ships from Asia lined up at American ports. The trade talks started in early 2017 and have dragged on with promises of a deal always around the corner. Looking back, we were told, they were always moving forward or nearing completion but such announcements generally proved premature.

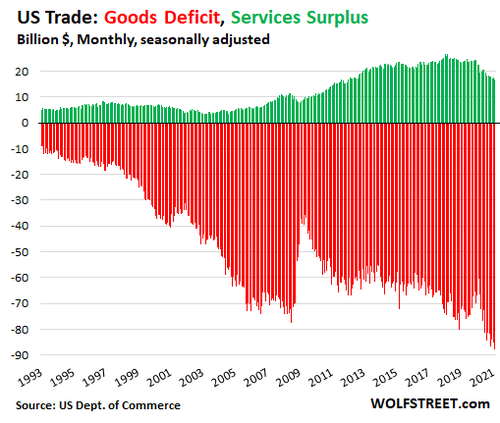

Today, the trade deficit is growing and is bigger than ever. Those familiar with China and how it negotiates knew the Chinese would never agree to, or more importantly, honor any deal not strongly tilted in their favor. The events that unfolded and overshadowed the trade talks not only surrounded Covid-19 but more importantly how governments and central banks reacted to the pandemic. Here in America, a tsunami of freshly printed money was unleashed upon the masses creating the oddest recession in history. To be blunt, Americans saw their incomes soar while locked away in their homes and unable to attend work.

This of course resulted in consumers buying goods, many of them imported from China, rather than doing the right thing and paying obligations such as rent or mortgage payments. In fact, our government with little thought to the long-term ramifications, added fuel to this buying binge when it rapidly imposed a moratorium on evictions and foreclosures. This means we should expect the controversy over just how much trade contributes to America’s economic growth to again rise as growth slows. Trade between countries is given far too much credit for being a big driver of our economy than it deserves and can actually become a drag.

The fact is if John needs to buy a wheelbarrow for work it does not matter where it is built. John needs and will buy a wheelbarrow. Where trade does fit into this has to do with what country employs workers to make that wheelbarrow and how much it will cost. While John may save money if the wheelbarrow was produced in a low-wage country trade has more to do with who benefits from commerce and should not be seen as a force driving us forward.

In many ways, trade should be seen as a way to increase access to a greater variety of goods at a better price but this only works over a long time if it is balanced. A county that constantly enjoys a trade surplus at the expense of its trade partners often reaches a position to exploit the weaker countries and generally does so. Throughout history, trade policies have had massive long-term ramifications on the strength of a nation’s economy.

With this in mind, Americans should be concerned the U.S. trade deficit jumped 18.9% in July of 2020 due to a leap in imports. The trade gap increased to $63.6 billion from $53.5 billion in the prior month. Imports shot up 10.9% while exports advanced 8.1%. Because people tend to forget or brush aside the fact that for years America has imported far more than it exports, this is not good news.

With this in mind, Americans should be concerned the U.S. trade deficit jumped 18.9% in July of 2020 due to a leap in imports. The trade gap increased to $63.6 billion from $53.5 billion in the prior month. Imports shot up 10.9% while exports advanced 8.1%. Because people tend to forget or brush aside the fact that for years America has imported far more than it exports, this is not good news.

The increase in both imports and exports was at the time promoted as a good sign saying it pointed to stronger consumer spending at home and increased demand for American-made goods abroad. In the shall we say, excitement, what few people wanted to talk about was that according to Commerce Department this number was notably worse than the expected deficit of $58 billion and is the widest trade deficit since 2008 when Americas pulled back on spending and fell into a funk.

Critics of America’s existing trade policy say trade deals over the years have failed to deliver on what they promised. Instead, they have added to environmental problems across the world and exacerbated economic inequality within many economies as manufacturing jobs have been outsourced to low-wage countries. Some activists also claim these deals can curb freedom of speech on the internet and other detractors say it incentivizes currency manipulation.

When viewing the global economy we should consider that much of the “free trade” movement has been fueled by the mega-companies desire for larger markets and greed. The desire of big businesses to both develop and control future rules has caused them to lobby governments into giving up control and becoming subservient to corporate “efficiency.”

The promise that increased trade will create new jobs has turned out to be largely a myth. History has shown that trade agreements with low-wage nations are not the great job creators we have been told. The idea trade is a huge benefit to the masses flows from large multinational companies that have the most to gain. It is difficult to deny that in our modern world these large companies already have more power than most nations and their power continues to grow at an alarming rate.

It would be fair to say that not everyone was a fan of Trump’s trade war strategy or that it was well executed. This included many of America’s mega-companies that moved production overseas years ago to exploit cheap labor. Several of these mega-companies opposed any policy that would harm their profits. Putting their interest before America, such companies and their lobbyists mounted a well-funded propaganda campaign against the trade talks based on the idea consumers will be forced to pay higher prices which would hurt the poor.

|

| This Brings Us To The Magnificent Chart Above Which Shows The Growing Deficit |

Trade is not a big driver of the economy as often claimed, instead, it can greatly weaken a country sapping its strength. Trade benefits multinational companies. The money they wield has hijacked the conversation about how much benefit trade creates. I contend that trade shifts growth and jobs from one country to another rather than simply adding to growth in a substantial way. In many ways, the global economy has become an ill-regulated business model tilted to favor big businesses and giant conglomerates. This translates into the companies and their owners or shareholders benefiting far more than the economy in general. It is not difficult to make the argument this has been harmful to the smaller domestic companies that generate many jobs here in America, Apple is a prime example of this.

Circling back to the example of John and his wheelbarrow used at the beginning of this article, it is wise to remember that the economic cycle is rooted in reality.

John only needs so many wheelbarrows, when he has enough, he stops buying them until they are worn out and he needs more. Low-interest rates, super sales, and easy credit can only stimulate growth in these sales so much, and often it is at the cost of future sales.

As the economy slows and trade tensions rise expect more fingers to point at sagging trade as the culprit. The fact is, no matter what we have been told by those with an agenda, trade between countries is only a win-win if it is balanced. Also, it is not a big factor in producing quality and sustainable economic growth. Still, we hear the narrative spun by politicians playing the “fear card” with statements such as “We can’t let countries like China write the rules of the global economy.” This implies we will lose the power to control our own fate if we stand firm and refuse to embrace the wishes of large companies.

I am not alone in recognizing China’s reliance on an age-old and tested Asian negotiation technique, call it a tactic or style if you like, but it is deeply rooted in wearing down your opponent over time. China intends to exploit the advantages a state-driven economy has over free enterprise while expanding its military armed with a slew of modern cutting-edge weapons. China is a state-run economy based on a business model that is geared to expand by crushing the competition. Subsidizing those companies working within its system in a multitude of ways helps it achieve this goal. China’s practice of exporting goods at slightly below cost in exchange for manufacturing jobs is not stupid, it’s predatory and we are its prey.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I wonder how much of that deficit is going into the pockets of “European” banksters.

John Q. Public gets a $1,200 stimmy check. He goes to Walmart and spends, over time, $1,000 of it. Who gets the money? China! EVERY trillion dollar defect-inducing Covid bill is a gift of $$$ to the Chinks.

Very true. Just after WW2 countries in the dragon triangle were third world at best, Japan, Singapore, Taiwan. American business flooded into these countries because they were poor and offered cheap labour. Everything was produced there from the junky plastic toys to high end electronics.

The standard of living rose in these countries and as it did wages and wage increases were demanded and paid to the workers. Cost of production went up as well to the point where locals would no longer do menial work for low wages. So these companies shifted to other low wage countries like India and china.

Everything in bold in the last paragraph is on the money. Because china is run by communists they are completely full court press on taking over control of other countries and being the global manufacturing base is just one aspect of that goal. The chinese KNOW how the west thinks… and the west is so corrupted that they simply don’t care that they sell out, or allow to be stolen. their nations interests to china. Its a war and china is winning it…

They want this country for it’s land mass and natural resources and will kill Americans if they won’t stand up and defend their families and friends. They do not want to co exist w/ other races.

Coexisting is what you do when the alternative is too terrible to contemplate. Attitudes toward that are one of the primary differences between the races.

If Europeans have a unique weakness, it is probably the ability to be exploited by Empire. The horrible thing about Empire is that all of the common people of the world are its potential victims. Especially the citizens in it.

All of the worthless cocksuckers “earning” their living with mouse clicks brought us to this point in history. Congratulations, you parasite pieces of shit, your “money” is worthless, just like you.

I went to Homedepot yesterday to buy a wheelbarrow. I was looking at a Jackson brand model and they showed 1 in stock online. I get to the store and notice two tubs on the 2nd shelf so I have one of the cashiers call over someone to help out. He looks around on the shelf and tells me they don’t have the sub-components to finish the wheelbarrow. No tires, axles, handles etc etc. He points at alternatives which are Chinese made garbage. I asked him how to get one on order and he tells me they have 60 already on order for the store, but until its confirmed they are on indefinite backorder. He told me that they have had major shortages on metal products in general. I walked out of the store with my money intact.

Might be prudent to download some pictures of medieval wheelbarrows, so you have an idea to work with when we’re reduced to making everything ourselves.

That’s a shame, because a lot of that stuff is the only place where you CAN find Made in U.S.A.

Wow. Looks like having that “post-industrial” economy was just as stupid of an idea as open borders and amnesty turned out to be.

Why does it seem like it has been a decade since I even heard anyone discuss gross profit margins relative to history and what that means in a social context. Last I heard, they are still historically high, if not in record territory. And yet wage disparity and economic disparity continue to show that the values of this society are not what is claimed. Licentious greed is what is rewarded in this system. Not merit or value.

Ken – do you know what gross profit margin is? It seems not. It is a measurement that has almost nothing to do with the viability of a business, but rather is used to measure sales less cost of goods sold. In manufacturing it measures how the manufacturing end is performing, but what it does not measure is business profitability, because it does not include expenses.

Manufacturing has gross margin percentages of around 25 percent. But their net profits are minuscule – many are losing money. Many have net protis of 1%. Manufacturing is a very low profit industry overall.

Talking about gross profit is disingenuous. It is pushing a narrative. Hey! Manufacturing has 25% gross margins, so they are doing great, and are evil bastards for not sharing all that wealth! Horseshit. They are barely hanging on with those gross margins.

Here is a list of net margins by industry, which tells the true profitability of business:

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/margin.html

Hey, Chief … ya CUNT, how ya doin??

An American ex-pat woman (see link below) says Aussies use the C-word in their everyday conversations; — ‘yeah sick cunt’, ‘oi cunt’, ‘hey cunt’ or ‘what’s up cunt?’

I’m just just practicing my Australian.

.

https://www.dailymail.co.uk/femail/article-9536309/American-Kaymie-Wuerfel-reveals-culture-shocks-shes-experienced-moving-Australia.html

Stuck, you ignorant cunt, yes that is entirely true. The entire article seems factually correct. Except bags are usually ten cents. Most folks carry reusable bags. I hate it, but it has eliminated a lot of plastic trash.

I know exactly how it is defined, and I am intending to use it that way. If only the expenses associated with the good are weighed and not using financial chicanery as part of that calculation, I do believe profit margins are historically high for an historically long time, yet there is no pretense to share those profits with anyone but the rich via the rigged market that has lower participation from what remains of the “middle class” that it has ever had before. And the looting of the US economy continues and accelerates.

You clearly do not understand. Gross profit margins are not profit margins. Only net margins are shareable. How can you decide that gross margins are too high and should be shared without knowing if companies are actually turning a real profit? You cannot. It is that simple.

I posted the net margin figures. You see any huge margins in there for manufacturing, which is what this article is largely talking about vis a vis import/export disparity? Hell no you do not.

I get sick of the narrative. I post facts and actual figures, and the shit narrative arguments come back that the figures are fake. There is no arguing with that shit – anything that contradicts a narrative is claimed to be fake! Unreal.

You believe? Who gives a shit what you believe. What an you prove factually? I made my case with facts, and you come back with “you believe” based on not an iota of fact. Show me some fucking facts or data that supports your assertion, and quit yapping about gross profit margins which is a management tool and not a measure of company profit. I have forgotten more about reading financial statements than you will ever know.

The rich are not getting rich due to profits. That is moronic. Are you a moron? They are getting rich via capital valuations and the easy access to money at low interest rates that they turn into capital assets that then explode in (fake) value. And of course there is the ever skyrocketing Stockmarket.

The rich used to make profits to get rich. That is no longer the way of it, for the most part.

Nice try!

It is IMPOSSIBLE to reason with 95% of folks once they believe their own narrative / story / bullshit.

A VISUAL EXPLANATION OF PROFIT MARGIN VS.GROSS MARGIN!!

.

Or, you could just look it up in a thousand places on the net … like, investopedia.

Jeebus H Krist!! This isn’t rocket science !!!

https://www.investopedia.com/ask/answers/122314/what-difference-between-gross-margin-and-net-margin.asp

Thanks Stuck. It is amazing that people post shit that they know nothing about. Gross margin is a tool for measuring operational performance – ie how much does it cost you to make a product before expenses. In other words, gross margin reflects how well you run your business, whether the cost of raw materials is climbing, whether labor costs are climbing or falling versus sales price, etc. But it is not actual net profit – which is the critical thing for all businesses: after cost of goods sold and after expenses, are you making any profit?

And manufacturing companies make very little profit. As a general rule.

We can go on to talk about cash flow, which for some industries – ie airlines – can be positive even though large losses may be being posted due to depreciation expense of large capital items, etc.