A little over a month ago, when mortgage rates were still “only” 5% we shared several devastating anecdotes from real estate agents and industry execs who validated our worst fears: US housing was imploding… fast, with subsequent observations only confirming this dire conclusion about the state of the most popular asset class among the US middle class.

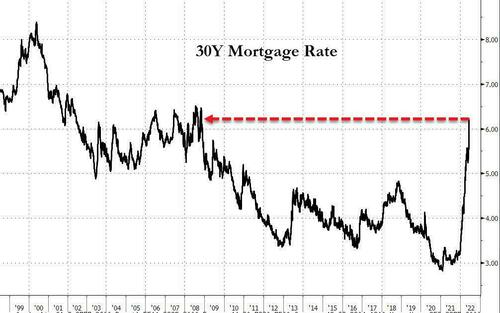

Fast forward to this week when things have gone from worse to catastrophic, because with 30Y mortgage rates soaring at the fastest pace on record to above 6%, or levels last seen just before the housing bubble burst…

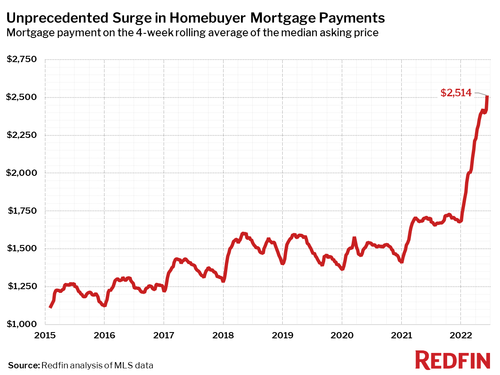

…. sending the average mortgage payment on a median mortgage up by almost $800 in just the past 6 months…

making housing the most unaffordable in history…

… sending new home sales plunging at the fastest pace since the peak of the covid crisis after the longest negative streak since 2010…

… and homebuyer sentiment imploding to the lowest level in generations…

Which brings us to the latest housing market summaries from real-estate brokerage RedFin, which are not pretty.

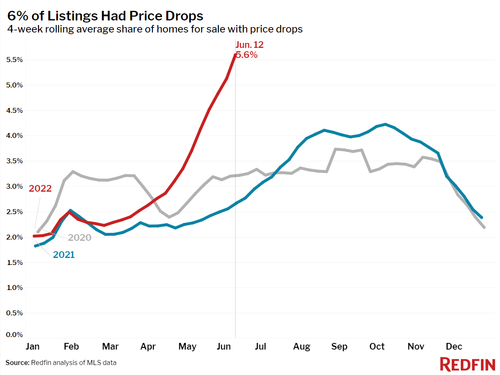

The first shows that after the period of unprecedented gains for home prices and a uniformlly sellers market, has flipped, and according to Redfin, the highest share of sellers on record dropped their list price during the four weeks ending June 12 as mortgage rates shot up to levels not seen since 2008, collapsing the pool of potential home shoppers.

In the Austin, Texas, and Nashville, Tennessee, metro areas, the share of new-construction offerings with price cuts has quadrupled from a year earlier, according to Redfin. They tripled in Phoenix and doubled in the Tampa, Florida, region.

“We are in a different place — the builder can no longer name a price and say, ‘pay it or move along,” said Nicole Freer, a Houston agent who has slashed prices by $2,000 to $20,000 on homes she lists for builders. “They’re telling us: ‘Our managers have allowed us to negotiate again.’”

Still, despite the clear cracks in housing, homebuying has never been more expensive. Due to delays in pricing, the typical buyer with a 30-year fixed-rate mortgage is looking at a monthly payment of $2,514, up from $1,692 a year ago!

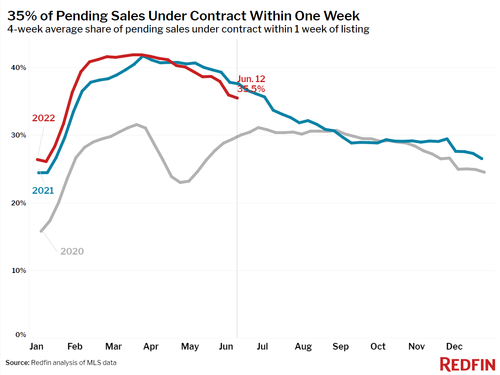

But those who remain in the market may notice they face less competition from other buyers.

Homes are more likely to sit on the market for a few weeks, compared to last year when they would go under contract within a week…

… and home prices are being bid up less often than they were earlier in the spring.

“The housing market isn’t crashing, but it is experiencing a hangover as it comes down from an unsustainable high,” said Redfin deputy chief economist Taylor Marr. “Housing demand has already cooled significantly to the point that the industry has begun facing layoffs. This week’s rate hikes will further stretch homebuyers’ budgets to the point that many more may be priced out. While a lot of home sellers are already dropping their prices, more homeowners will likely decide to stay put now that the mortgage rate on a new home is significantly higher than their current one.“

“If it weren’t for the surge in mortgage rates, the housing market would still be in a boom right now,” said Redfin Bay Area real estate agent James Cappello. “Demand from homebuyers was still extremely high as recently as February, but rates are making it really tough. Going from 3% to nearly 6% almost instantly has scared a lot of people out of the market.”

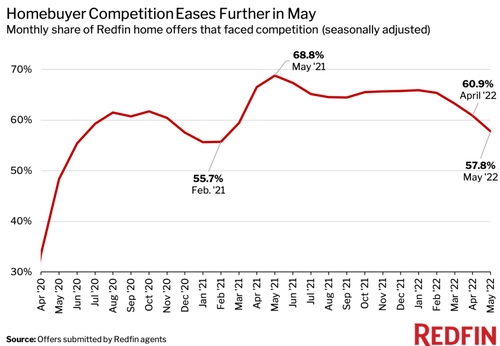

There’s more. In a subsequent report, Redfin reports that competition for existing inventory is collapsing with 57.8% of home offers written by Redfin agents facing competition on a seasonally adjusted basis in May, the lowest level since February 2021. That’s down sharply from a revised rate of 60.9% one month earlier and a pandemic peak of 68.8% one year earlier, and marks the fourth-consecutive monthly decline. On an unadjusted basis, May’s bidding-war rate was 60.8%, down from 67.8% in April and 71.8% in May 2021.

As a result of declining competition, the typical home in a bidding-war received 5.3 offers in May, down from 6.8 in April and 7.4 in May 2021.

“Homes are now getting one to three offers, compared with five to 10 two months ago and as many as 25 to 30 six months ago,” said Jennifer Bowers, a Redfin real estate agent in Nashville.

“Offers also aren’t coming in as high above the list price as before. I recently listed a three-bedroom, three-bathroom home in a super cute neighborhood for $399,900. It ended up going under contract for $12,000 above the list price with an inspection, whereas three months ago, the buyer probably would have paid $60,000 over asking and waived the inspection.”

In light of the above, it’s not surprising that today Bloomberg reports that “the fastest-rising mortgage rates in decades have cooled demand so abruptly in many hotspots that it took the industry by surprise. Builders that were artificially limiting sales and auctioning houses to the highest bidder now have inventory to move.”

It’s part of a rapid shift in the US housing market as the Federal Reserve sharply raises interest rates to tame inflation, sending home-loan costs to the highest level since 2008 and straining buyers whose affordability limits were already being tested. Just this week, brokerages Compass and Redfin said they would slash jobs, as economic data showed housing starts dropped to the lowest level in more than a year and homebuilder sentiment is at a two-year low while homebuyer sentiment is the lowest on record.

The market has certainly noticed the collapse in housing, and share prices for builders have collapse, with the Supercomposite Homebuilding Index tumbling 42% this year through yesterday, almost double the 23% drop in the S&P 500.

Builders, who last year had so much power that people would wait in line overnight for homes they would meter out, are now contending with both falling demand and high material and labor costs. And with the Fed signaling more big rate hikes in coming months, they’re eager to get contracts signed before house hunters pull back even more.

In Sarasota, Florida, would-be buyers are hesitating because homes are taking so long to build, and it’s impossible to know where borrowing costs will land by the time they’re completed, said Donnette Herring, a Realtor with Keller Williams.

“Inflation makes them nervous,” Herring said.

The signs of a shift are still early. Conditions vary from region to region and even between subdivisions, including many where demand still far outpaces supply. And rather than cutting prices, many builders are offering incentives such as free upgrades, money toward closing costs and subsidized mortgage rates. But the market is changing fast, said Ali Wolf, chief economist at Zonda. Her company, which tracks new construction, began hearing of price cuts toward the end of May and into June.

“The builders that are cutting prices are also those that raised prices the most over the past six to 12 months,” she said.

Many of those are in areas that were favored destinations for pandemic migrants who have been moving from pricey regions in search of cheaper homes and more space. In the Phoenix metropolitan area, 22% of new-home listings had price cuts from May 9 through June 5, up from 7% a year earlier, according to data from Redfin. In Tampa, the share jumped to 21% from 9% a year earlier, and in Austin, it climbed to 13% from just 3%.

The cuts have come from both small private builders and big public ones, including D.R. Horton, Meritage Homes and Lennar according to listings in Florida, Texas and Arizona publicly available on sites such as Redfin and Realtor.com. A PulteGroup website shows 146 finished homes in Arizona, mostly with price reductions. Jim Zeumer, vice president of investor relations, said those appeared to be typical incentives used to sell spec houses – those built without a buyer in place – that are complete or will be finished soon.

“We will typically have one or two finished specs in a community but use incentives to manage inventory levels over the life of a community,” Zeumer said.

During the recent boom, many builders were waiting until homes were nearing completion before allowing buyers to purchase them because of uncertainty around materials and labor costs. As a result, they have a flood of new homes that need to be matched up with buyers.

In the Houston region, it’s the fast-growing areas further from the city, such as Conroe to the north and Alvin to the south, that are cooling the most, said Freer, the local agent. Builders who were only selling homes that were almost done now are telling her that they’ll take orders for “dirt.”

Of her roughly 120 listings for builders, about 70% now have cuts, she said. Soon it will be 100%.

A key metric to watch is the contract cancellation rate, said Rick Palacios, research director at John Burns Real Estate Consulting in Irvine, California. It topped 9% nationally in May, according to his company’s survey of builders, up from 6.6% in April. That’s still short of the 16% pace after the pandemic lockdowns first took hold two years ago.

“The writing is on the wall that more supply is coming, no matter how you slice and dice the data,” Palacios said. “Builders are trying to get in front of that wave. We could have the double-whammy of the economy cooling and a lot of supply coming on. That’s not the best recipe to sell homes.”

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Oh good I can finally afford a house

So the price of houses is expected to come down. Great! Now all I need to do is find one made of gingerbread because it doesn’t appear that food is getting any cheaper or more available going forward.

Stop eating and buying gas and you’ll be fine.

Until we run out of water!!!

It’ll hit in Charleston (SC) soon, but in May SFRs/condos sold at 98-102% of listing price an average of <30 days on the market. East Islands (Sullivan's Island, Isle of Palms & Wild Dunes) listings sold at an average of $1,204/sq ft in 11 days.

Yankee Invasion. GBTO.

Here in Texas, it’s California people who see bargains compared to what they sold in CA.

Credit Bubble Bulletin : Weekly Commentary: Bursting Bubbles and Failed Experiments

“For the Week:

The S&P500 sank 5.8% (down 22.9% y-t-d), and the Dow fell 4.8% (down 17.7%). The Utilities were clobbered 9.0% (down 10.8%). The Banks fell 4.6% (down 24.0%), and the Broker/Dealers lost 3.6% (down 23.8%). The Transports declined 3.7% (down 21.9%). The S&P 400 Midcaps sank 7.6% (down 21.9%), and the small cap Russell 2000 slumped 7.5% (down 25.8%). The Nasdaq100 dropped 4.8% (down 31.0%). The Semiconductors sank 8.9% (down 34.7%). The Biotechs were little changed (down 21.0%). With bullion down $32, the HUI gold index sank 7.7% (down 6.7%).”

http://creditbubblebulletin.blogspot.com/2022/06/weekly-commentary-bursting-bubbles-and.html

Thank you. I was wishing I could relive last week. 🙁

Values have dropped and will drop more. I see people online make inane comments about homes selling for “over value”. No – they sell AT value and values are just more volatile than many people understand. If a home were priced at, say, $400,000 last fall and would have had 8 bids and sold for $465,000, its value then was $465k. If that same home were listed for $400,000 two months ago, garnered 3 bids and sold for $422,000, its value was $422,000. If it’s listed for $399,900 now, gets a price reduction to $389,000 and sells for $380,000, its value will prove to be $380,000. That would be an 18% drop from the peak of last year.

If Costco could print toilet paper, like the centbank does, there’d be no hoarders seemingly offsetting the reverse hoarders. “Take my TP, please!, in return for your shitbox!”

The hoarders, especially the Southern Hoarder, needs a wall…

…and a matching firing squad (every roll hasta have a tube…that spits fiery projectiles)

…that can dip into homeland security’s ammo hoard….

People are trapped where they live. If they sell they can’t take their mortgage with them.

I can’t see how this leads to a glut of housing?

Bottom line is you should have moved yesterday.

New homes won’t be built. The market value is 1/2 as interest rates have doubled.

If no new homes are built…look out below. The economy relies heavily on real estate.

Look out for rising rents. Even rent swaps.

You will own nothing & be happy !

Brought to you by the WEF / NWO & the parasitic leftist Washington DC elites owned by the ChiComs

Great, maybe now I can get a carpenter/plumber/or roofer to work on my house. They are all working on the new constructions and have no time to do jobs for joe homeowner.

This. ^^^^^^

We are going to have a recession, a normal economic period that happens from time to time. We are not going to have a “housing crash”, that’s hysteria. Housing crashes are brought about by housing oversupply and we have a housing shortage. I have survived 6 “Crash of Everything, We’re all Gonna Die” periods since 1968, and #7 is coming up. I’ll survive it and so will you. Fortunes are made during crashes and lost during booms. Be prepared and stay alert for the tremendous opportunities that happen as every “crash” subsides.

It depends where you are talking about. Canada is almost certain to have real estate price crash, outside the major cities. I am starting to see it near me. Buyer/seller standoff. Places staying on the market for longer than a month. That is almost unheard of around here for the last decade.

Vancouver and Victoria will stay high no matter what. There simply is almost no more land to build on and they are the only places that don’t go deep freeze for 4 months a year. There may be some softening in the major cities east of the Rockies, but demand is high enough to support silly prices still. Turdo is importing enough of the third world to keep inventory low.

I also see the market slowing down,looking for a home with minimum 20 acres but refuse to engage in the “bidding wars” !

The world holds together long enough figure in 6 months or so will see more realistic pricing,perhaps then will buy.

I have cash so the mortgage thing not a issue with me personally,tis just a attitude of I am not going to pay more then what a property is worth to me.

Want mine? I have 20+ acres. 15 minutes to town, 1 hour to big box stores.

$900k Canadian. Tractor, several trucks, barn, outbuildings.

I want out of this country.

Eh,am not leaf material!

I have seen in N.H. places that need some work but perfectly livable with 20+ acres in the high 200-300 range,just did not like the locations,I am a bit picky but figure this will be me last homestead that will die on so might as well really like it!

What country you going to head to?

Seen similar. What I am selling for (hopefully) $900k Canadian in BC is available in Oregon/California for ~$250k US.

I hate California and Oregon politics and degenerate culture, but if I can bank 400-500k and have a place similar to what I have now, in a warmer climate with a long growing season, I can live with it.

I’ll be off grid and deep in the sticks, so hopefully I will be dead before civilization encroaches. Everything through a trust, so I will appear dead broke and squatting in the trusts property. Might even be able to take advantage of the freebies the idiots are handing out to the poor.

Anon,normally I will let folks know “We Are Full”,that said,you may” Possibly “work out so will say you just might fit in Northern New England,of course,we will need a interview/a few drinks together ect. just to be sure.

Good luck with home country sale and perhaps we will meet down the road.I will say you would be better I feel in northern New England than the upper west coast but as always,tis your choice.

I’d be curious to see that $250k house and 20 acres in California. I see people coming here to Texas and driving up prices as they open their big bags of money from selling in CA, and offer $50-100k over asking.

Will you accept Bitcoin?

You do not seem to understand what is happening here. The cycle is way too far overextended.

It was overextended in 2001, but the government stepped in and lowered the interest rates, and allowed RE corporations to basically purchase for both recession prices, and no interests.

They did the same in 2007.

This time is different. The government did not have double digit inflation to deal with in 2001 or 2007.

Double digit inflation is threatening the dollar as the worlds reserve currency. If the dollar loses its status as the reserve currency due to its devaluation because of inflation, the government loses its ability to spend money by way of massive deficits. For government, spending money is what gives them power.

So no, the government will not bail out the markets this time, they need both high interest rates, and deflation to rescue the dollar, and its status. There are short term cycles and long term. You need to know which one you are dealing with.

To everything there is a season. A time for mass inflation, and a time to crash the markets and have mass deflation.

First you let the peasants buy assets with everything they have ever earned, plus more debt than they can ever repay.

Then you crash the market and take all their assets when they can no longer make the debt payments. After you financially and emotionally crush them, you start letting them dream they can own things again. They will probably not believe it, but their children and grandchildren will. Then the cycle begins again.

Is this the shortest boom on record? Just last year I was hearing buyers offering $50k over asking price–and losing to someone who offered $100k over. The bad news is what they did to “comparable sales” which is the appraisal district’s primary valuation tool for existing homes. Big $$ sales last year, and the price you pay for a house is automatically considered its “value” by the appraisal district–and so are the other houses in the area. Now they’re worth a lot less, but it’s too late for this year’s appraisals (done eff. Jan 1.).

In our area total property tax rates (city, county, school district, port, community college, utility district, etc.) can range from 2.75% to 4% or so. So if you overpaid by $100k for a house, that’s an extra $4,000 a year in taxes.

Those overpays affect the “market” value of all the neighborhood. For existing homes, the taxable value cannot increase more than 10%, but if your market got bumped by 30%, they’re going to get you net year for another 10% tax basis. That’s where foreclosures and walk aways can help bring down “comparables.” But in the end, only government wins.