Guest Post by Chris MacIntosh

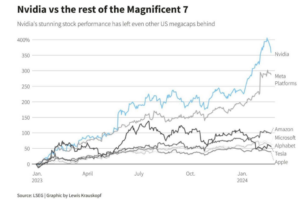

Remember all the media headlines about the Magnificent 7 carrying the stock market from earlier this year?

We’ve touched on the Magnificent 7 in previous issues pointing out that the majority of investors (both retail and professional) are increasingly putting their faith (and money) into just seven stocks. Increasing concentration of risk is what is required for blow off tops. Just saying….

It reminds us of the dot-com era when stocks like CISCO were all the rage.

Except this time around, this concentration blind chasing of just a handful of stocks is now even more severe than in the late 1990’s/early 2000’s.

Actually, it turns out the Magnificent 7 are yesterday’s news. Now, it’s all about “Magnificent 2” as just two stocks — Meta and NVIDIA — are driving most of the “growth” returns. According to Goldman Sachs, “Nvidia is the most important stock on planet earth from an index correlation, factor, and retail momentum perspective.”

The most important stock on the planet? It sounds an awful lot like the infamous Fortune article from the dot-com bubble that proclaimed that “no matter how you cut it, you’ve got to own Cisco.” Sure enough, in the following weeks, CISCO crashed more than 80%. But I digress…

It turns out today’s rally in Magnificent 2 (at the expense of the rest of the market) caught off guard even the biggest “exponential growth” shills evangelists:

Cathie Wood Can Only Watch as Nvidia Rides AI Wave She Foresaw

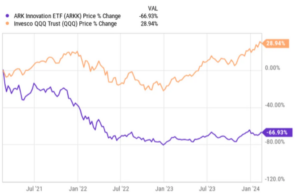

Despite Wood’s professed faith in the disruptive technologies of tomorrow, the main strategy at ARK Investment Management hasn’t held shares of its biggest winner, Nvidia, since early 2023, according to data compiled by Bloomberg. Meanwhile, its smaller ETFs have recently trimmed their already modest holdings in the Jensen Huang-led firm that’s just added $256 billion in market value in Thursday trading alone.

But it seems like missing out on NVIDIA is the least of Cathie’s worries. Over the past three years, Wood has underperformed her benchmark (the Nasdaq QQQ) by an eye-bleeding 95%.

A hundred bucks invested with crazy Cathie now gets you a cappuccino. Hahaha!

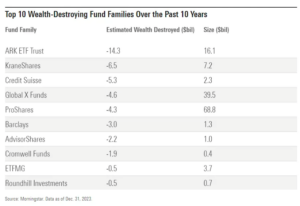

According to a new Morningstar ranking, her flagship fund, the ARK Innovation ETF, has been THE biggest wealth-destroying fund of the past decade, incinerating $14.3 billion in investor wealth. Yikes!

Here’s Morningstar with more details:

ARK, home of the flagship ARK Innovation ETF ARKK, tops the list for value destruction. After garnering huge asset flows in 2020 and 2021 (totaling an estimated $29.2 billion), its funds were decimated in the 2022 bear market, with losses ranging from 34.1% to 67.5% for the year. Many of its funds enjoyed a strong rebound in 2023, but that wasn’t enough to offset their previous losses. As a result, the ARK family wiped out an estimated $14.3 billion in shareholder value over the 10-year period—more than twice as much as the second-worst fund family on the list. ARK Innovation alone accounts for about $7.1 billion of value destruction over the trailing 10-year period.

It wasn’t that long ago when the popular press hailed Cathie Wood as a “superstar fund manager that you’ll beg her to take your money.” Yes, really. And by Bloomberg, no less.

But I suppose they didn’t tell you to what end.

By the way, for some historical context — as I was writing this, one of our clients sent me this. Appropriate!

Since human nature doesn’t change, market cycles repeat.

Flip Flop

It’s almost like there’s something wrong with the idea of EVs. I can’t put my finger on it. Maybe it’s the fact that when you trot down to your neighbourhood EV dealer, stopping for a soy latte and some tofu, you’re buying an expensive iPhone on wheels (and we all know what the resale value of a 5 or 10-year old iPhone is like). You tell yourself you’re excited to be saving the planet as you power the bad boy up with some vegan electricity subsidised by the pronoun compliant guvmint, but now those subsidies are now being pulled (governments are bankrupt — surprise), and your vegan electricity is being imported from Indonesian coal mines and it’s costing a lot more than your old planet killing V8 supercharged testosterone-boosting muscle car and you’re pissed. Or maybe it’s the cost? Or maybe most people just don’t appreciate being forced to switch their car because the alphabet people say so?

It could be any of these things, but you know what? If you ask me, it’s quite simple. It is this very simple metric by which so much of human behaviour can be deduced. When it comes to buying isht, what folks want is a high quality item at a reasonable price and one that is more competitive than alternatives. The fact is that when it comes to their wallet nobody gives a pig’s arse about saving the planet. And THAT, my friends, is where the EV fraud stumbles, trips, and then jarringly smashes its face into a brick wall of reality.

And this brings us to our beer-drinking, bratwurst-eating friends — some of the best designers and manufacturers of cars ever. The Germans, specifically, Audi, who are doing a massive U-turn on electric vehicles. DROPPING their earlier goal of producing only electric vehicles by 2026. And they’re not the only ones.

Audi puts big EV push on the back burner

CEO Gernot Döllner told Bloomberg. “In the end, we decided to spread it out to not overwhelm the team and the dealerships.

Hahaha! That’s what he actually said to Bloomberg, but you know what he’d say to his mates down at the local beer hall? He’d tell them what an insider in the European automotive industry told us over a year ago — that there is bugger all demand for these stupid things and that many of the European auto manufacturers were going to land up being stuck with unwanted inventory… and some would probably “not make it through.”

Speaking of “others.” Mercedes Benz are also doing the same. They are bailing on EVs and instead are ramping up production of ICEs.

Mercedes-Benz delays electrification goal, beefs up combustion engine line-up

The company now expects sales of electrified vehicles, including hybrids, to account for up to 50% of the total by 2030 – five years later than its forecast from 2021, when it aimed to hit the 50% milestone by 2025 with mostly all-electric cars.

And perhaps most curious of the bunch: Apple. After 16 years of teasing entry into the EV market, Apple just bailed on their long-awaited electric car.

After 16 Years, Apple Abandons Work On Electric Car

One other thing worth mentioning is that Apple sits on a gobsmacking $162 billion in cash. And even with all that cash, they decided to pass on the “EV revolution.”

What to make of all this? As we like to say around here, everyone is a greenie until it hits their pocket. It seems to me that maybe, just maybe, Audi, Mercedes, and Apple have figured out that EVs are not the silver bullet they were promised to be.

And speaking of Apple, guess what they’re focusing on instead…

Many employees from the Special Projects Group (SPG), responsible for the car, will transition to the artificial intelligence division led by executive John Giannandrea. Their focus will shift to generative AI projects, aligning with the company’s evolving priorities.

Why, AI, of course.

Editor’s Note: The Western system is undergoing substantial changes, and the signs of moral decay, corruption, and increasing debt are impossible to ignore. With the Great Reset in motion, the United Nations, World Economic Forum, IMF, WHO, World Bank, and Davos man are all promoting a unified agenda that will affect us all.

To get ahead of the chaos, download our free PDF report “Clash of the Systems: Thoughts on Investing at a Unique Point in Time” by clicking here.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

one of the biggest problems with coal gulping electrical vehicles is that the fucktarded owners don’t know that they are, they leave permanent geological scars, and are a totalitarian’s dream to go with 15 minute cities. can’t wait until someone seals schwab into one of them and ignites it.

In 30 years the Mag 7 will have been humbled like so many of yesterday’s super star stocks. Polaroid? Xerox? Name your favorite has been Magnificent-if you can even remember the name.

Likewise, one large regional war will affect the global markets

ISIS showed up Moscow, the middle east is a problem again.

The Middle East was already a problem. The real problem will be war in Asia. The west is to dependent on Asia for everything.

Take your stocks, fiat and crypto’s and just give it to “them” now…you know how this ends, if you don’t hold it you don’t own it.

You might not get to give it to them … they’re seemingly lined up to take it …

Two words…”SHIT PRODUCTS”.

That’s a wrap.