Tag: Congress

Warfare, Welfare, and Wonder Woman – How Congress Spends Your Money

Supporters of warfare, welfare, and Wonder Woman cheered last week as Congress passed a one trillion dollar “omnibus” appropriation bill. This legislation funds the operations of government for the remainder of the fiscal year. Wonder Woman fans can cheer that buried in the bill was a $10,000 grant for a theater program to explore the comic book heroine.

That is just one of the many outrageous projects buried in this 1,582 page bill. The legislation gives the Department of Education more money to continue nationalizing education via “common core.” Also, despite new evidence of Obamacare’s failure emerging on an almost daily basis, the Omnibus bill does nothing to roll back this disastrous law.

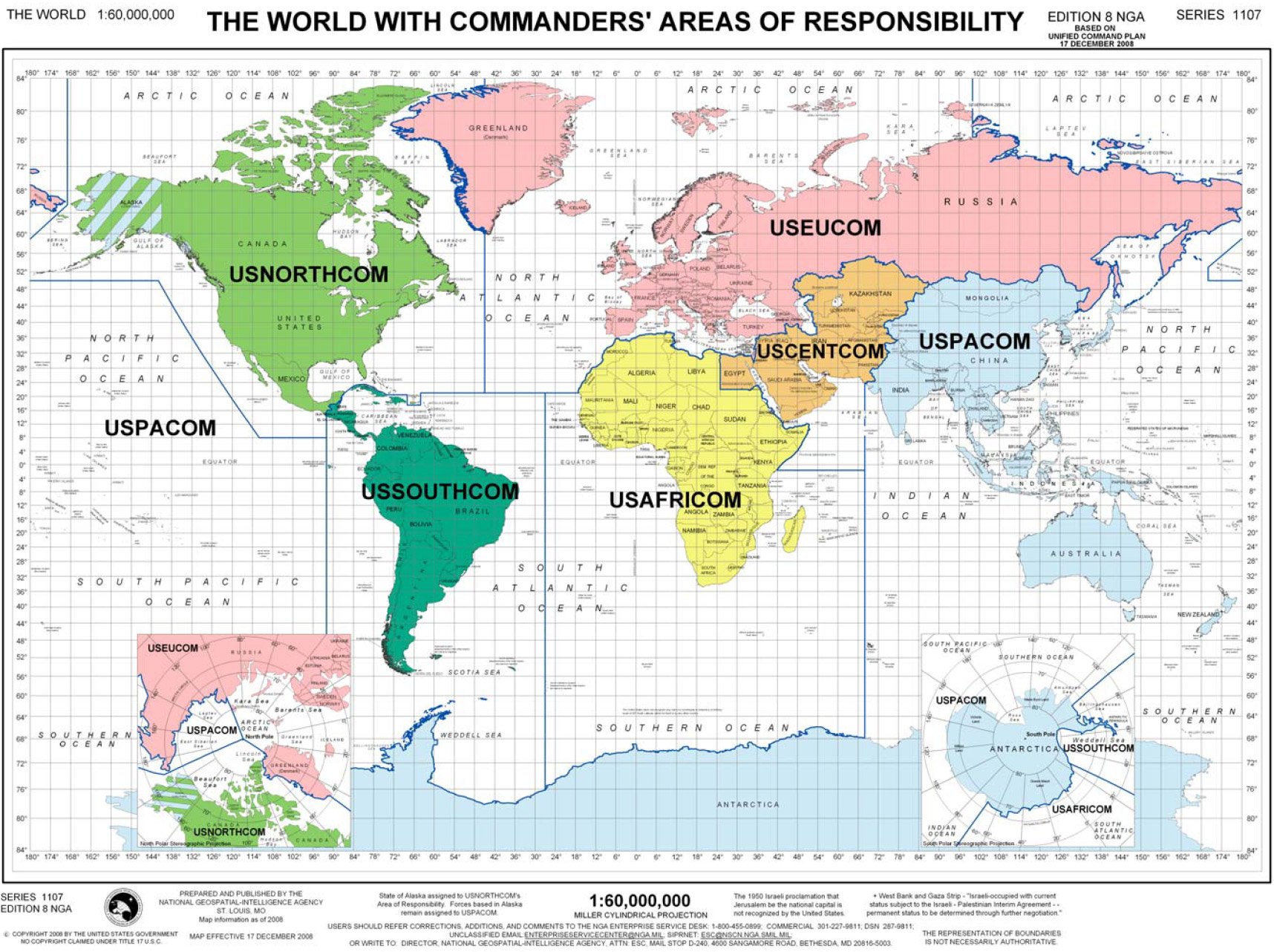

Even though the Omnibus bill dramatically increases government spending, it passed with the support of many self-described “fiscal conservatives.” Those wondering why anyone who opposes increasing spending on programs like common core and Obamacare would vote for the bill, may find an answer in the fact that the legislation increases funding for the “Overseas Continuing Operations” — which is the official name for the war budget — for the first time since 2010. This $85 billion war budget contains $6 billion earmarked for projects benefiting Boeing, Lockheed-Martin, and other big defense contractors.

Ever since “sequestration” went into effect at the beginning of last year, the military-industrial complex’s congressional cheering session has complained that sequestration imposed “draconian cuts” on the Pentagon that will “decimate” our military — even though most of the “cuts” were actually reductions in the “projected rate of growth.” In fact, under sequestration, defense spending was to increase by 18 percent over ten years, as opposed to growing by 20 percent without sequestration.

Many of the defenders of increased war spending are opponents of welfare, but they are willing to set aside their opposition to increased welfare spending in order to increase warfare spending. They are supported in this position by the lobbyists for the military-industrial complex and the neoconservatives, whose continued influence on foreign policy is mystifying. After all, the neocons were the major promoters of the disastrous military intervention in Iraq.

While many neocons give lip service to limiting domestic spending, their main priority remains protecting high levels of military spending to maintain an interventionist foreign policy. The influence of the neocons provides intellectual justification for politicians to vote for ever-larger military budgets — and break the campaign promises to vote against increases in spending and debt.

Fortunately, in recent years more Americans have recognized that a constant defense of liberty requires opposing both war and welfare. Many of these Americans, especially the younger ones, have joined the intellectual and political movement in favor of limiting government in all areas. This movement presents the most serious challenge the bipartisan welfare-warfare consensus has faced in generations. Hopefully, the influence of this movement will lead to bipartisan deals cutting both welfare and warfare spending.

The question facing Americans is not whether Congress will ever cut spending. The question is will the spending be reduced in an orderly manner that avoids inflecting massive harm on those depending on government programs, or will spending be slashed in response to an economic crisis caused by ever-increasing levels of deficit spending. Because politicians are followers rather than leaders, it is ultimately up to the people what course we will take. This is why it is vital that those of us who understand the dangerous path we are currently on do all we can to expand the movement for liberty, peace, and prosperity.

THE NEW NORMAL?

Our government and financial “leaders” tell us that things are back to normal and we are well on our way to economic recovery. They report rising GDP, declining unemployment, and record corporate profits. The legacy media propaganda machines, controlled by corporations dependent upon the government and Wall Street to funnel them advertising dollars in return for reporting falsehoods and mistruths, have been informing the masses that all is well. Just go back to staring at your iGadgets and tweeting your every thought to your followers, because the best and brightest in D.C. and Wall Street have it all figured out. The new normal is here to stay.

I guess my interpretation of normal deviates slightly from our glorious leaders’ definition. During the long-term bond bull market, from 1982 until 2007 the 10 Year Treasury steadily declined from 16% to 5%. This was normal because inflation declined at the same rate. Inflation declined from 13% to 3% over this same time frame according to the BLS. In reality, measuring inflation as it was measured in the 80’s and early 90’s would have yielded an inflation rate closer to 6% in 2007. During the decade prior to 2007, which consisted of supposedly strong economic growth, the 10 Year Treasury ranged between 4% and 7%. Even during the 2001 recession, it never dropped below 3.5%.

In a normal world an investor in a 10 Year Treasury bond would require a yield 2% to 3% above the rate of inflation. If the yield was below the rate of inflation they would be guaranteed to lose money. Only a fool, Federal Reserve chairman, or a CNBC bubble headed bimbo would buy a bond yielding less than the inflation rate. The BLS reported inflation rate has been between 2.1% and 3.2% over the last two years. Over this time frame, the 10 Year Treasury yielded 2% or below until the threat of tapering reared its ugly head this past summer. Would this happen in a normal free market? If things are back to normal, why aren’t supposedly free markets acting normal? The Chinese and Japanese reacted normally. They stopped buying Treasuries with a real negative yield.

The only fool willing to buy negative yielding Treasuries is none other than Ben Bernanke. He thinks they are the investment of a lifetime. He is so sure they are a can’t miss investment, he buys $2.5 billion of them per day, which just so happens to be the government deficit per day. Ben now has $3.8 trillion of bonds on his books, versus $900 billion in 2008. His balance sheet is leveraged 60 to 1, versus the 30 to 1 of Lehman and Bear Stearns prior to their implosions. When even the hint of reducing bond purchases from $85 billion per month to $75 billion per month caused 10 Year rates to jump from 1.5% to 3% in a matter of weeks, you realize how “normal” our economy and financial system is functioning.

If our financial system was functioning normally and free market capitalism was allowed to operate according to true supply and demand, the 10 Year Treasury would be yielding 4% to 5% and 30 year mortgage rates would be 6% to 7%. Think about that for a minute. This scenario was normal from 2002 through 2007. That is what normal looks like. Now open your eyes and observe what your owners are telling you is normal. The slight increase in mortgage rates from 3.5% to 4.5% has brought the Wall Street buy and rent housing recovery scheme to it knees. Imagine if mortgage rates were allowed to rise to their true market rate. Housing would collapse in a heap.

Allowing Treasury rates to adjust to a true market rate, based on true inflation, would double or triple the annual interest expense on the $17 trillion national debt and blow a gigantic hole in Obama’s already disastrous $1 trillion annual deficits. Does this sound like “normal” to a rational thinking human being with the ability to understand simple math? Luckily, there are very few rational thinking Americans left and even fewer with the ability to understand simple math. We have been programmed to believe rather than think. As long as the stock market continue to rise, then everything is normal.

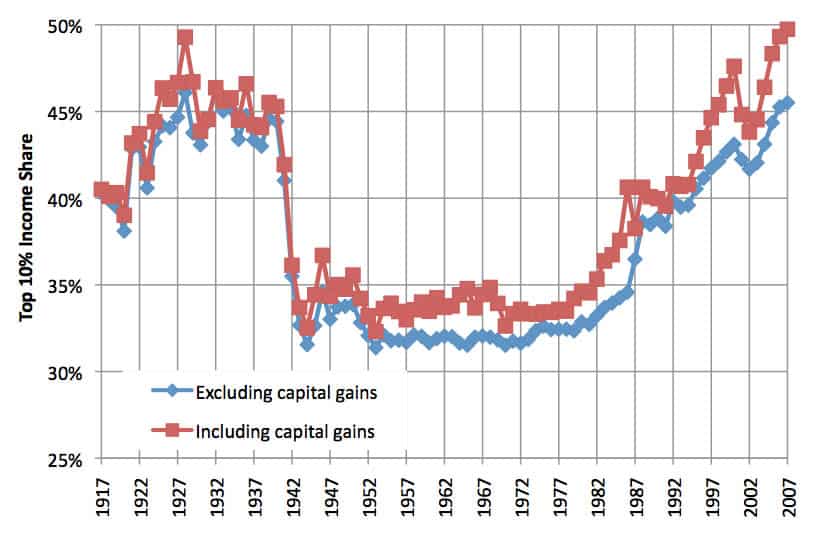

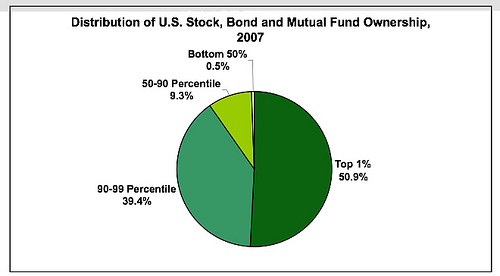

Do you think Ben Bernanke and his cohorts at the Federal Reserve worry about the average person who doesn’t own stocks, has to fill up their gas tank, feed their kids, make the mortgage, auto, and credit card payments, and figure out Obamacare, while working two part time jobs? Quantitative Easing (MONEY PRINTING) has one purpose and one purpose only – to further enrich the owners of the Federal Reserve – Wall Street banks. The .1% own most of the stocks in this country and their greed and avarice can never be satisfied.

This artificial prosperity plan for Wall Street has the added benefit of allowing the captured politicians in Washington D.C. to continue their $1 trillion per year deficit spending with no consequences for their squandering of future generations’ wealth. Bernanke and Yellen will never taper, because they can’t. The Fed balance sheet will continue to grow by at least $1 trillion per year until they crash the financial system again. Except this time, there will be no money printing solution. We are all trapped like rats in this monetary experiment being conducted by evil mad scientists. No one will get out alive. Welcome to the new normal. Now eat your cheese.

YEAH – THEY’RE WORKING FOR YOU

I’m sure the hundreds of multi-millionaires slithering through the halls of Congress are looking out for the best interests of the common man. They are the status quo working on behalf of the status quo. Click the link below if you want the details about Issa, Feinstein, Pelosi, Rockefeller, and the rest of the snakes in Congress.

Issa tops The Hill’s 50 Wealthiest

The chief inquisitor of President Obama’s White House is now Congress’s richest man.

House Oversight Committee Chairman Darrell Issa (R-Calif.) saw his fortune rise to at least $355 million in 2012, enough to take the crown on The Hill’s 50 Wealthiest list.

Issa, who made his riches with the Viper car security system, snatched the No. 1 spot away from Rep. Michael McCaul (R-Texas), who came in second with a net worth of at least $101 million.

Thirty-seven of the lawmakers on the list are from the House, with the remaining 13 coming from the Senate.

While several high-profile lawmakers are among the wealthiest — including Rep. Nancy Pelosi (D-Calif.) and Sen. Mitch McConnell (R-Ky.) — most of the leading contenders for the White House in 2016 missed the top 50.

Rep. Paul Ryan (R-Wis.), the GOP’s vice presidential candidate in 2012, reported a minimum net worth of $2.3 million, while conservative star Sen. Ted Cruz (R-Texas) posted wealth of $1.5 million.

Two other rising GOP stars, Sens. Rand Paul (Ky.) and Marco Rubio (Fla.), reported more modest financial means. While Paul’s wealth stood at about $455,000, Rubio was in the red with a negative net worth of roughly $190,000.

On the Democratic side, Sen. Mark Warner (Va.) stood out among possible 2016 hopefuls with a minimum net worth of $88.5 million, good enough for third place on The Hill’s list.

Two other Democrats in the 2016 discussion, Sens. Elizabeth Warren (Mass.) and Kirsten Gillibrand (N.Y.), fell on opposite ends of the financial spectrum. While Warren reported a portfolio worth at least $3.9 million, Gillibrand was barely in the black with a net worth of $166,000.

The Hill’s Wealthiest list bid farewell to some familiar faces this year.

John Kerry — a perennial contender for richest lawmaker thanks to his wife’s ties to the Heinz ketchup fortune — left the Senate this year to serve as President Obama’s secretary of State.

Ex-Sen. Herb Kohl (D-Wis.), owner of the NBA’s Milwaukee Bucks and another regular on the list, decided to retire after last year’s election.

And the late Sen. Frank Lautenberg (D-N.J.), who was the first full-time salesman for the payroll processing company Automatic Data Processing, died in 2013.

Taking their place are several lawmakers who are serving their first terms on Capitol Hill.

Among the new additions is Rep. Joseph Kennedy (D-Mass.), whose $15.2 million showing continues the tradition of having a wealthy member of the Kennedy clan in Congress.

Other first-timers include Rep. Suzan DelBene (D-Wash.), a former Microsoft executive with wealth of at least $23.9 million; Rep. Chris Collins (R-N.Y.), a former businessman with $22.3 million; and Rep. Steve Daines (R-Mont.), a former tech entrepreneur with at least $9.2 million.

Other lawmakers earned a spot on the list after their assets climbed skyward.

Rep. Jim Cooper (D-Tenn.) saw his share in Kentucky and Tennessee farmland and real estate spike, helping to give him a net worth of $8.2 million. Rep. John Fleming’s (R-La.) wealth was $10.7 million in 2012 after his holdings in franchise development and properties soared in value.

But it’s Issa who stands as king of Capitol Hill, thanks in no small part to the removal of $100 million in liabilities from his balance sheet on his 2012 form.

Issa listed several investment funds among his assets, including some that are worth more than $50 million each. He also has properties valued in the millions of dollars.

Before coming to Congress, Issa was a successful chief executive who founded Directed Electronics and served as chairman of the Consumer Electronics Association.

The runner-up on the list, McCaul, owes much of his wealth to family trusts. His wife, Linda, is the daughter of Clear Channel Communications founder Lowry Mays.

To come up with its rankings, The Hill used financial disclosure forms covering the 2012 calendar year. The reports are not perfect, because they provide value ranges instead of exact figures.

The Hill adds up the low figures in each value range for every asset and liability. Then, the sum of a lawmaker’s liabilities is deducted from the sum of his or her assets to calculate a minimum net worth.

Some lawmakers provide lengthy bank statements or investment reports with their annual financial statements. The Hill uses exact figures when possible.

The methodology is designed to provide a conservative estimate of a lawmaker’s worth, and it’s likely that many lawmakers, such as Issa and McCaul, are wealthier than their reports indicate.

Read more: http://thehill.com/business-a-lobbying/317429-the-hills-50-wealthiest-lawmakers-#ixzz2cWbdZAwZ Follow us: @thehill on Twitter | TheHill on Facebook

THE GREAT POSTAL FRAUD

“One of the things the government can’t do is run anything. The only things our government runs are the post office and the railroads, and both of them are bankrupt.” – Lee Iaccoca

You may have heard that the U.S. Post Office lost $16 BILLION last year. You may also have heard that Congress snuck a requirement into a bill that had nothing to do with the Post Office, mandating that they must deliver on Saturdays, even though eliminating Saturday delivery would save the Post Office $2 BILLION per year. Congress evidently can’t read a financial statement or interpret a chart. I’m sure the trends detailed on this chart will reverse themselves shortly.

While reading an editorial today supporting the Post Office in its efforts to save money by eliminating Saturday delivery I saw another MASSIVE LIE perpetuated by the MSM and the government.

Here is the Orwellian statement:

“The U.S. Postal Service is an independent governmental agency that doesn’t take taxpayer funds.”

This is complete and utter bullshit. This statement also described Fannie Mae and Freddie Mac until 2008. They were just little old independent government agencies helping out the housing market – until the shit hit the fan!!! Then they became albatrosses around the necks of the American taxpayer. You own them now. They have lost $200 billion of your tax dollars, and will lose billions more before all is said and done.

You can access the U.S. Post Office financial statements online. Here is their December 2012 report:

http://about.usps.com/who-we-are/financials/financial-conditions-results-reports/fy2013-q1.pdf

The honesty of the people writing this report is refreshing. They essentially admit they are BANKRUPT and unable to meet their financial obligations. In other words, a truly INDEPENDENT entity admitting they can no longer operate. How is this for honesty:

“The Postal Service continues to suffer from a severe lack of liquidity. The Postal Service held total cash of $2.9 billion and $2.3 billion as of December 31, and September 30, 2012, respectively, and had no remaining borrowing capacity on its $15 billion debt facility (See Note 3, Debt, for additional information). The increase in cash balances for the quarter is largely attributable to the seasonal impact of holiday mailings, along with additional revenue resulting from this year’s political campaign and elections. Cash balances generally decline during the remainder of the fiscal year, as revenue is not as strong in the remaining quarters. By the end of this fiscal year, the Postal Service projects it will have a liquidity balance that will be less than its average weekly expenses of $1.3 billion. This low level of available cash means that the Postal Service will be unable to make the $5.6 billion legally-mandated prefunding of retiree health benefits due by September 30, 2013. Further, this level of cash could be insufficient to support operations in the event of another significant downturn in the U.S. economy.

Through the three months ended December 31, 2012, the Postal Service has suffered 5 quarters of consecutive net losses and net losses in 14 of the last 16 quarters. The net loss of $1.3 billion for the first quarter of the year included $1.4 billion of expense accrued for the legally-mandated prefunding payment for retiree health benefits. The requirement of the Postal Accountability and Enhancement Act, Public Law 109-435 (P.L. 109-435) to prefund its retiree health benefit obligations, a requirement not shared by other federal agencies or private sector businesses, plus the precipitous drop in mail volume caused by changes in consumers’ uses of mail, have been the two major factors contributing to Postal Service losses since the recession ended in 2009. Without structural change to the Postal Service’s business model, it will continue to be negatively impacted by these factors and, absent legislative change, it anticipates continuing quarterly losses for the remainder of 2013.”

The politicians that are mismanaging this country use governmental accounting fraud to cover-up the fact that the obligations of this bloated pig of an operation are going to be paid by YOU, the taxpayers of the United States. Today, none of the past, current, or future liabilities of this INDEPENDENT GOVERNMENT AGENCY are reflected in the Federal budget projections or the National Debt calculation.

Do YOU want to know how much YOU really owe? Brace yourself.

- In the past six years they have lost $41 BILLION and they have a cumulative deficit of $36 billion. How many INDEPENDENT organizations can run up deficits of $36 billion without going out of business? YOU are on the hook for these accumulated deficits, just like you were on the hook for all of the Fannie and Freddie backed toxic mortgages.

- The Post Office will lose another $10 to $15 billion this fiscal year. You will be on the hook for that too.

- They have $15 billion of debt on their balance sheet, with $9.5 billion payable in the next 9 months. How will this INDEPENDENT government agency that is losing $16 billion per year pay off $9.5 billion? They won’t. The government drones will pass a bill in the middle of the night extending the terms with no cash flow requirements or expectation of repayment. I wonder if I can get a loan like that?

- The really interesting stuff is buried on page 42 of their report. I wonder why it is all the way back there? In addition to their $15 billion of debt, they have another $70.5 BILLION of unfunded future obligations. The two biggest are:

- $33.9 Billion of payments for pension and health benefits for retirees, all due within the next 5 years. It’s not cheap providing gold plated benefits to government workers.

- $25 billion for workers compensation and sick leave payments. Yikes!!! It must be all that stress, because the mail never stops. It keeps coming and coming. It’s almost enough to make someone go postal, or at least file a stress related workers comp claim.

This really sounds like a promising story. Mail volumes continue to plummet. Someone should tell Congress the internet age has arrived. The Post Office has thousands of money losing, unneeded outlets. It has 637,000 employees when it only needs 300,000. Over 70% of Americans favor ending Saturday delivery, so Congress passes a law making that impossible to implement, ensuring $2 billion more losses per year. That’s par for the course. Over 70% of Americans were against passing TARP too. And according to your leaders in Washington, and parroted by the MSM, you are not on the hook for their losses.

It’s beyond laughable, but so is most of what is going on in this tragedy of a country, disguised as a comedy. The truth is that you are on the hook for the $36 billion of accumulated deficits, the $85 billion of debt and contractual obligations, and the annual $16 billion losses they continue to pile up. But what’s $120 to $150 billion among friends? Bennie can print that out of thin air in a few days. Why run an operation efficiently at a surplus, when you can keep hundreds of thousands of union government drones employed (until they go on workers comp) by sticking it to the working American taxpayer. I sure hope I don’t get a visit from the Postmaster General because of this article.

http://youtu.be/6nKlzQo3Wqo

A FISTFUL OF DOLLARS – PART TWO

It is not easy to destroy the greatest empire in the history of mankind. The 20th Century was the American Century, but as with all empires, the combination of hubris, monetary debasement, imperial overreach and delusional overconfidence have set in motion the inevitable downfall of the American Empire. The policies, decisions, beliefs, and institutions implemented over decades have led the country to the threshold of financial disaster. Based on my observations, a catastrophic combination of demographics, fiat currency debasement, titanic levels of debt, smothering taxation, power in the hands of the few and Wall Street greed have led us to peak Empire. It will be downhill from here as we experience collapse, revolution and ultimately, retribution for the guilty and presumed guilty. I have already addressed the Baby Boomer generation’s contribution to our current plight, to the delight and accolades of Boomers across the land in For a Few Dollars More – Part One. The Boomers were a victim of their size and the timing of their arrival on the scene of empire collapse. Their delusions of debt based wealth and me first attitude could not have been satiated without the creation of the Federal Reserve and the institution of the personal income tax in 1913.

“When a man’s got money in his pocket he begins to appreciate peace.” – Joe – Fistful of Dollars

“Every town has a boss.” – Joe – Fistful of Dollars

In the Old West of the 1800’s, before the creation of the Federal Reserve, money in your pocket meant gold or silver. If Joe were to repeat that line today, he would change it slightly:

“When a man thinks he’s got money in his pocket he begins to appreciate the good things in life like McMansions, BMWs, government provided retirement, government provided healthcare, and delusions of ever increasing wealth.”

Man made inflation is a glorious invention for the men who invented it. For the people who deal with it every day, not so much. Joe knew that every town had a boss. If you didn’t know who the boss was in the United States of America before 2008, you know now. Ben Bernanke and the Federal Reserve Bank of the United States is the boss of this town.

Crony Capitalism Pays for the Cronies

Without Federal Reserve intervention in the financial markets since September 2008, the biggest banks in the world would have entered bankruptcy liquidation. The U.S. economy would have experienced a 10% to 20% fall in GDP. The unemployment rate would have soared above 15%. The stock market would have fallen 70%. Wealthy bondholders and stockholders would have seen their wealth cut in half. Incumbent politicians would have all been thrown out of office. The richest Americans, constituting the ruling class, would have borne the brunt of the pain.

In a true capitalist system, organizations and people who assumed too much risk and made poor decisions would have failed. But the United States does not have a capitalist system. We have a corporate fascist economic system where a small cartel of bankers, military weapons suppliers, and mega-corporations set the agenda for the country through their complete capture of politicians and the mainstream corporate media. At the height of the crisis in 2008, President George Bush revealed whose side he chose:

“I’ve abandoned free-market principles to save the free-market system, to make sure the economy doesn’t collapse. I feel a sense of obligation to my successor to make sure there is not a, you know, a huge economic crisis. Look, we’re in a crisis now. I mean, this is — we’re in a huge recession, but I don’t want to make it even worse.”

George Bush was born with a silver spoon in his mouth. He was not trying to save the free-market system, because we didn’t have a free market system. He was saving his fellow billionaires under the cover of saving the average American. Bush knew as much about saving our economic system as he knew about when to declare mission accomplished in Iraq. He turned the task of saving the free market system over to his multi-billionaire Goldman Sachs Secretary of Treasury Hank Paulson and the real boss of Washington DC, Ben Bernanke. These noble American patriots proceeded to save the top 1% richest Americans on the backs of the American middle class. They did it under the guise of keeping the country out of a Depression. Those who committed the crimes and destroyed the worldwide financial system not only didn’t get punished, they were enriched by the actions of Paulson and Bernanke. This entire sordid chapter in the history of the American empire from 2008 until the imminent collapse, sometime before 2015, will leave future historians dumbfounded at the utter insanity and foolishness of the decisions that were made during the death throes of the empire. Not only did George Bush not save the free-market system, but he drove a stake thru its heart.

To boil the entire 2008 financial collapse down to one word, it would be: DEBT.

Three decades of ever increasing levels of consumer, corporate, and government debt eventually led to an unprecedented implosion. It was as predictable in 2008, to those who understand the fiat monetary system, as it was to Ludwig von Mises decades ago:

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Federal Reserve – Destroyer of Worlds

The 2008 crash and the 1929 crash were manmade disasters. Alan Greenspan and Ben Bernanke created the atmosphere and conditions that led to the risk taking by bankers, home buyers and consumers. Monetary expansion, excessively low interest rates, the Greenspan/Bernanke Put, disinterest in regulation, and pandering to politicians allowed the party to get out of control. Taking away the punch bowl never crossed their mind. The Federal Reserve is controlled by the major Wall Street banks. These banks were partnerships until the 1980s, with partners personally liable for the actions of their banks. Excessive risk taking meant possible personal bankruptcy. Once they became corporations, excessive risk meant excessive compensation for the executives, with the downside being borne by the shareholders.

But that wasn’t enough. The executives were large shareholders, so they convinced the Federal Reserve to bail their corporations out whenever they made bad bets. It was a sweet deal if you were a banker. Knowing their lackeys at the Fed had their back, the goliath Wall Street banks used their power and wealth to convince the SEC to waive the 12 to 1 leverage rules so they could leverage their balance sheets 40 to 1. This meant that a 5% loss in their capital and they would be insolvent. The Harvard MBA CEO titans of the financial world created the housing bubble through their creation of fraud inducing mortgage products, a bewildering array of derivative products that even their MBA geniuses didn’t understand, and betting against the derivatives they were selling to their clients. When this toxic brew of fraud and debt exploded in their faces, the value of the assets on their books plunged by 30% to 40% in 2008 and 2009. The 10 biggest financial institutions in the country were effectively bankrupt. An orderly bankruptcy liquidation that wiped out the bondholders, stockholders and top executives was the solution to excessive risk taking and failure.

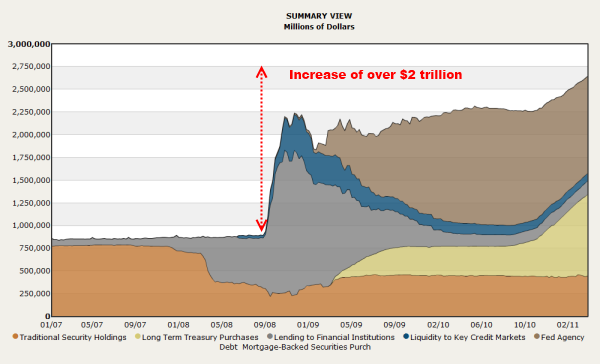

This was an unacceptable solution to the billionaire class that owns half the financial wealth in the country. The President was a multi-millionaire. The Treasury Secretary was a billionaire. There were 250 millionaires in Congress. The top executives of the banks that own and control the Federal Reserve are multi-millionaires. The owners and talking head pundits of the mainstream media are all in the billionaire/millionaire class. The cover story used to bilk $700 billion from middle class taxpayers into the coffers of Wall Street mega-banks was that if we didn’t hand over the loot, the financial system would collapse and a Great Depression would ensue. Every program, policy, and rule change that has been rolled out since September 2008 by the Federal Reserve, Treasury, and Congress has benefitted billionaires, bankers, and politically connected corporations. The Federal Reserve has printed over $2 trillion out of thin air to save the billionaires that have been pillaging the middle class for decades.

The Federal Reserve bought $1.25 trillion of toxic mortgages from Wall Street, allowed these banks to borrow at 0%, threatened the FASB into suspending mark to market accounting so banks could fake the value of their loans, instructed banks to rollover commercial real estate loans as if they weren’t really worth 40% less than the value on their books, and rolled out $600 billion of QE2 in order to create a stock market rally, benefitting their billionaire constituents. The $800 billion stimulus program was shoveled to the corporate friends (contributors) of Congressmen across the land. Cash for Clunkers benefitted government owned car companies. The home buyer tax credit and changing loss carry back rules benefitted mega home builders. Every one of these deeds enriched bankers and billionaires while further impoverishing the working middle class. Real middle class wages continue to fall, unemployment remains near record levels, real inflation in food and energy is running above 10%, senior citizens haven’t gotten a Social Security increase in two years, savers are getting .25% on their savings, home prices continue to fall, and future generations will be stuck with the bill for the billionaire bailout.

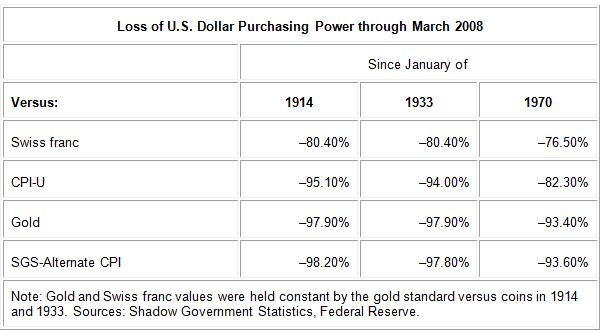

The standard of living for the average American continues to fall. Real household income is lower than it was in 1999. The only reason it increased in the 1980s and 1990s was the huge influx of women into the workforce. Two earners were needed to try and maintain a constant standard of living. Real average weekly earnings are lower today than they were in 1970, even using the government bastardized CPI calculation that has been so massaged since 1982 that it has only resulted in a happy ending for government bureaucrats at the BLS. Calculating the CPI exactly as it was calculated in 1980 reveals the truth of what the Federal Reserve has wrought on working class America, a drastic decrease in their standard of living. The insidiousness of Federal Reserve created inflation has sucked the life out of the middle class and enriched the cocktail party class.

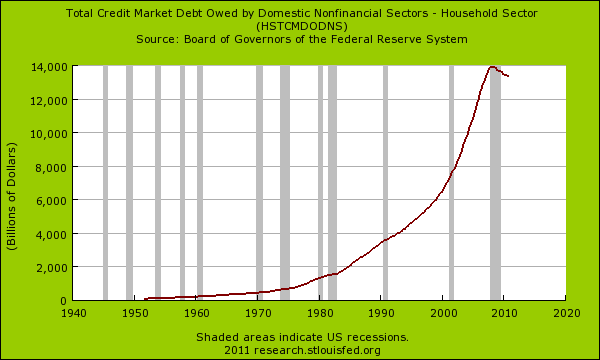

The stealth transfer of wealth from the working middle class to the richest in our society was done through convincing the middle class that buying things with debt made you richer. This delusion was sold by the billionaire owned corporate mainstream media and peddled by billionaire bankers to the masses through credit cards, “creative” mortgage products, easy access to home “equity”, auto leases, and easy financing products. Only in a society where a fiat currency could be printed by a central bank with no requirement that it be pegged to an anchor such as gold, could such a staggering amount of debt be accumulated.

Delusions of Debt

The bill that has been rung up is in the form of a national debt that has increased by $4.6 trillion since September 2008, a 48% increase in two and a half years. Over this same time frame real GDP has increased by $200 billion, a 1.6% increase in two and a half years. Over this same period, the Federal Reserve has tripled their balance sheet by adding $2 trillion of debt. Think about this for one second. The leaders of the great American empire have burdened future generations with $6.6 trillion of new debt and increased the Gross Domestic Product by $200 billion. Is this a good return on investment? Did the 30 million unemployed and underemployed Americans benefit? Did the 45 million people on food stamps benefit? Did the 11 million households who are underwater in their mortgage benefit? Did the 3 million people who lost their homes in foreclosure since 2008 benefit? Are Americans paying twice as much for groceries and gasoline benefitting? Did the Tunisians, Egyptians, and other poor people around the world benefit?

The answer to all these questions is NO. The only beneficiaries have been bankers, billionaires, mega-corporations and the politicians who were bought off by these greedy traitors to the Republic. Anyone with an ounce of sense knows the country got into this mess due to the issuance of mountains of debt that was un-payable based upon any reasonable assessment of future cash flows to service the debt. Consumers could never have increased their wages enough to pay off the credit card, mortgage, home equity, student loan, and auto debt they accumulated since 1980. The government could never collect the amount of taxes needed to pay for the $100 trillion of entitlement promises they have made over the last four decades. By 2008 we had reached peak debt delusion.

The only questions that remained were how would the debt be defaulted on and who would bear the brunt of the default. The Federal Reserve Chairman and the U.S. Treasury Secretary rolled out a master plan that revolved around convincing the masses they were being saved, while actually enriching their masters on Wall Street. Their PR machine and captured mouthpieces throughout the mainstream media and in Congress spun the fear mongering message of Depression if the mega-banks were not handed trillions of taxpayer funds.

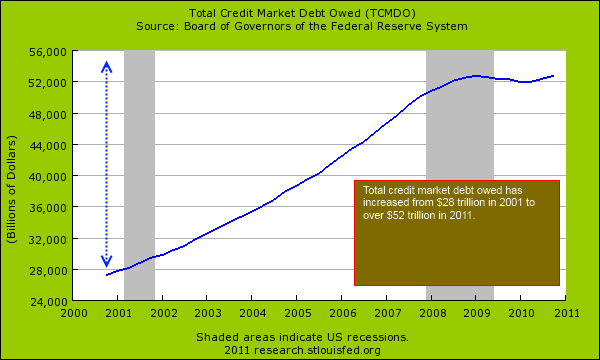

The proof of what did not happen is borne out in the chart below, showing the total credit market debt in the U.S.at $52.6 trillion, $200 billion higher than it was in 2008. If those who had collected billions in fraudulent profits while using unprecedented levels of debt were rightfully required to take responsibility for the catastrophe they caused, the debt levels would have dropped dramatically. The losses would have been borne by those responsible. The economy would have taken a body blow, all Americans would have been hurt, and many billionaires would have become millionaires or even paupers. The debt would have been written off and lessons would have been learned. The remaining banks (there are 8,000 others besides the 10 who control 50% of the deposits) would have followed traditional risk mitigation methods and the economy would have recovered.

But, as you can see, debt was not written off. No bankers were harmed during the making of this fake recovery. No criminal bankers were prosecuted. No government drones took responsibility for their failure. While the masses were distracted by stimulus packages, mortgage moratoriums, Obamacare and reality TV, the debt was shifted from the criminally negligent banks to you. The proof is right on the Federal Reserve website for all to see:

- Financial institutions reduced their debt from $17.1 trillion in 2008 to $14.2 trillion today.

- The Federal & state governments increased their debt from $8.7 trillion in 2008 to $11.9 trillion today.

- The GSEs (Fannie, Freddie, Sallie) increased their debt from $3.2 trillion in 2008 to $6.4 trillion today.

- Corporations increased their debt from $7.0 trillion in 2008 to $7.4 trillion today.

- Household debt declined from $13.8 trillion in 2008 to $13.4 trillion as the Federal Reserve backstopped the write-off of $600 billion of bad debt by the banks.

Over $6 trillion of toxic debt was shifted from the insolvent financial industries to the middle class taxpayers under the guise of “Saving the System”. Bad debt does not become good by shifting it to taxpayers. The story line about Americans embracing austerity is false. Household debt rose from $8 trillion in 2000 to $13.8 trillion in 2008, a 72% increase, and has declined by 3% due to write-offs, not austerity.

Champion of the Middle Class

By extending the debt, shifting it to the taxpayer and pretending it is payable, the Federal Reserve and your government have chosen, to use its weapon of choice since inception in 1913 – INFLATION, to default on the debt. It is not a new tactic, it is their only tactic.

The Federal Reserve has slowly and methodically destroyed the American middle class through relentlessly printing more money and purposefully creating inflation, since its reprehensible creation in 1913. For the last three decades only one voice in the wilderness of Washington DC has fought this banking cabal.

“Since the creation of the Federal Reserve, middle and working-class Americans have been victimized by a boom-and-bust monetary policy. In addition, most Americans have suffered a steadily eroding purchasing power because of the Federal Reserve’s inflationary policies. This represents a real, if hidden, tax imposed on the American people.

From the Great Depression, to the stagflation of the seventies, to the burst of the dotcom bubble last year, every economic downturn suffered by the country over the last 80 years can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial “boom” followed by a recession or depression when the Fed-created bubble bursts. In conclusion, Mr. Speaker, I urge my colleagues to stand up for working Americans by putting an end to the manipulation of the money supply which erodes Americans’ standard of living, enlarges big government, and enriches well-connected elites, by cosponsoring my legislation to abolish the Federal Reserve.” – Ron Paul – Sept 10, 2002

His colleagues in Congress did not stand up to the Federal Reserve in 2002. Instead, they cheered them on as Greenspan’s ultra loose monetary policy led to the greatest housing bubble in history and a financial collapse unparalleled in human history. As the collapse was hurdling down the track in 2006, Representative Paul once again rose in protest against an organization that is rapidly destroying the American dream.

“The coming dollar crisis is not likely to be “fixed” by politicians who are unwilling to make hard choices, admit mistakes, and spend less money. Demographic trends will place even greater demands on Congress to maintain benefits for millions of older Americans who are dependent on the federal government.

Faced with uncomfortable financial realities, Congress will seek to avoid the day of reckoning by the most expedient means available – and the Federal Reserve undoubtedly will accommodate Washington by printing more dollars to pay the bills. The Fed is the enabler for the spending addicts in Congress, who would rather spend new fiat money than face the political consequences of raising taxes or borrowing more abroad.

The irony is that many of the Fed’s biggest cheerleaders are the same supposed capitalists who denounced centralized economic planning when practiced by the former Soviet Union. Large banks and Wall Street firms love the Fed’s easy money policy, because they profit at the front end from the resulting loan boom and artificially high equity prices. It’s the little guy who loses when the inflated dollars finally trickle down to him and erode his buying power. Someday Americans will understand that Federal Reserve bankers have no magic ability – and certainly no legal or moral right – to decide how much money should exist and what the cost of borrowing money should be.” – Ron Paul – July 11, 2006

The dollar crisis is upon us. Congress and President Obama are avoiding the day of reckoning. The Federal Reserve is enabling profligate spending by politicians, while at the same time enriching their masters on Wall Street. Everything being done in Washington DC seems to be the exact opposite of what should be done. I think the fable of the scorpion and the frog describes our situation best. The scorpion asks a frog to carry him across a river. The frog is afraid of being stung, but the scorpion argues that if it stung, the frog would sink and the scorpion would drown. The frog agrees and the scorpion stings the frog during the crossing, dooming them both. When asked why, the scorpion points out that this is its nature. The Federal Reserve is printing money, creating inflation, enriching billionaire bankers, and dooming the country to certain collapse because that is its nature.

My intentions have been foiled again. I realize that my attempt to put our current economic predicament into perspective will now need to be a five part series. . For a Few Dollars More addressed the Baby Boomer impact on America’s decline. A Fistful of Dollars examined how the Federal Reserve’s actions over the last few decades have impoverished the middle class and has placed the country at the brink of collapse, The Good, the Bad, and the Ugly will address the nefarious creation of a central bank and the implementation of a personal income tax in the dreadful year 1913. Outlaw Josey Wales will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

I can’t wait to see how it ends.

THE FRAUD & THEFT WILL CONTINUE UNTIL MORALE IMPROVES

The BEA reported the latest figures for personal income, personal consumption expenditures and the savings rate last week. The government mouthpieces in the mainstream media obediently reported that personal income and expenditures reached an all-time high in March. The chart below shows the ever increasing level of expenditures by consumers since this supposed economic recovery began in the 4th quarter of 2009. All good Keynesian economists know that consumer spending is always good for America, no matter how it is achieved. We must be in a recovery if income and spending are reaching new highs, right? That is the fraudulent storyline being propagandized to the non-questioning lapdog public. A false storyline and data that has been massaged harder than a Secret Service agent by a Columbian hooker will not lead to a happy ending. Some critical thinking, a calculator, and some common sense reveal the depth of the fraud and expose the theft being committed by the avaricious governing elite at the expense of the prudent working middle class.

Digging into the data on the BEA website to arrive at my own conclusions, not those spoon fed to a willfully ignorant public by CNBC and the rest of the fawning Wall Street worshipping corporate media, is quite revealing. It divulges the extent to which Ben Bernanke and the politicians in Washington DC have gone to paint the U.S. economy with the appearance of recovery while wrecking the lives of senior citizens and judicious savers. Only a banker would bask in the glory of absconding with hundreds of billions from senior citizen savers and handing it over to criminal bankers. Only a government bureaucrat would classify trillions in entitlement transfers siphoned from the paychecks of the 58.4% of working age Americans with a job or borrowed from foreigner countries as personal income to the non-producing recipients. How can taking money from one person or borrowing it from future generations and dispensing it to another person be considered personal income? Only in the Delusional States of America.

If you really want to understand what has happened in this country over the last forty years, you need to analyze the data across the decades. This uncovers the trends over time that has led us to this sorry state of affairs. The chart below details the major components of personal income over time as a percentage of total personal income. It tells the story of a nation in decline and on an unsustainable path that will ultimately result in a monetary collapse.

|

1970 |

1980 |

1990 |

2000 |

Apr-08 |

2010 |

Mar-12 |

|

| Total Personal Income |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

| Wages & Salaries |

66.1% |

60.2% |

56.7% |

56.2% |

52.7% |

51.9% |

51.8% |

| Interest Income |

8.3% |

12.1% |

15.5% |

11.6% |

11.2% |

8.2% |

7.4% |

| Dividend Income |

2.9% |

2.9% |

3.5% |

4.5% |

6.5% |

5.8% |

6.2% |

| Government transfers |

8.5% |

11.3% |

11.7% |

12.2% |

14.3% |

17.9% |

17.3% |

It is always fascinating to compare data from 1970, prior to Nixon closing the gold window and allowing bankers and politicians to print and spend to their hearts delight, to present day. The chart above paints a picture of a nation of workers and savers descending into a nation of parasites and spenders. Any rational person knows that income comes from one of two methods: working or investing. A country can only grow by working, saving, investing and living within its means. Money taken from workers and investors and transferred to the non-working and spenders is NOT INCOME. It is just redistribution from producers to non-producers. The key takeaways from the chart are:

- Working at a job generated two-thirds of personal income in 1970 and barely half today. This explains why only half of Americans pay Federal taxes.

- One might wonder how we could be in the third year of a supposed economic recovery and wages and salaries as a percentage of total personal income is lower than pre-crisis and still falling.

- Government transfers have doubled as a proportion of “income” in the last forty years. The increase since 2000 has been accelerating, up 122% in 12 years versus the 55% increase in GDP. The slight drop since 2010 is the result of millions falling off the 99 week unemployment rolls.

- Luckily it is increasingly easy to leave unemployment and go on the dole for life. The number of people being added to the SSDI program has surged by 2.2 million since mid-2010, an 8.5% increase to 28.2 million people. Applications are swelling with disabilities like muscle pain, obesity, migraine headaches, mental illness (43% of all claims) and depression. Our leaders have set such a good example of how to commit fraud on such a grand scale that everyone wants to get a piece of the action. It’s like hitting the jackpot, as 99% of those accepted into the SSDI program (costing $132 billion per year) never go back to work. I’ve got a nasty hangnail. I wonder if I qualify. I’d love to get one of those convenient handicapped parking spaces. Once I get into the SSDI program I would automatically qualify for food stamps, a “free” government iPhone, “free” government cable and a 7 year 0% Ally Financial (85% owned by Timmy Geithner) auto loan for a new Cadillac Escalade. The SSDI program is now projected to go broke in 2016. I wonder why?

- A nation that rewarded and encouraged savings in 1970 degenerated into a country that penalizes savers and encourages consumption. The government, mainstream media, and NYT liberal award winning Ivy League economists encourage borrowing and spending as the way to build a strong nation. Americans have been convinced that borrowing to appear successful is the same as saving and investing to actually achieve economic success.

- Americans saved 7% to 12% of their income from 1960 through 1980. As Wall Street convinced delusional Boomers that stock and house appreciation would fund their luxurious retirements, savings plunged to below 0% in 2005. Why save when your house doubled in price every three years? Americans rationally began to save again in 2009 but Bernanke’s zero interest rate policy put an end to that silliness. Why save when you are being paid .15%? Buying Apple stock at $560 (can’t miss) and getting in on the Facebook IPO (PE ratio of 99) is a much better bet. The national savings rate of 3.8% is back to early 2008 levels. I wonder what happens next?

- The proportional distribution between interest and dividends which had been in the 3 to 4 range for decades is now virtually 1 to 1, as Ben Bernanke has devastated the lives of millions of poor senior citizen savers while continuing to subsidize his wealthy stock investors buddies on Wall Street.

Now for the bad news. The Baby Boom generation has just begun to retire en masse. Government transfers will automatically accelerate over the next decade as Social Security and Medicare transfer payments balloon. Government transfer payments have already increased by 3,250% since 1970, while wages and salaries have increased by 1,250%. The non-existent inflation touted by Ben Bernanke accounts for 590% of this increase. We have passed a point of no return. As the number of Americans receiving a government EBT into their bank account grows by the day and the number of working Americans remains stagnant, the chances of a politician showing the courage to address our un-payable entitlement liabilities is near zero. Americans choose to deal with problems in a reactive manner rather than a proactive manner. Until the next inescapable crisis, the fraud and looting will continue until morale improves.

| Billions of $ |

1970 |

1980 |

1990 |

2000 |

Apr-08 |

2010 |

Mar-12 |

| Total Personal Income |

$835 |

$2,257 |

$4,852 |

$8,548 |

$12,457 |

$12,361 |

$13,328 |

| Wages & Salaries |

$552 |

$1,358 |

$2,750 |

$4,800 |

$6,565 |

$6,413 |

$6,905 |

| Interest Income |

$69 |

$272 |

$753 |

$989 |

$1,397 |

$1,012 |

$984 |

| Dividend Income |

$24 |

$65 |

$169 |

$381 |

$810 |

$723 |

$821 |

| Government transfers |

$71 |

$256 |

$570 |

$1,041 |

$1,786 |

$2,217 |

$2,312 |

A Few Evil Men

“Every effort has been made by the Federal Reserve Board to conceal its powers, but the truth is the FED has usurped the government. It controls everything here (in Congress) and controls all our foreign relations. It makes and breaks governments at will… When the FED was passed, the people of the United States did not perceive that a world system was being set up here… A super-state controlled by international bankers, and international industrialists acting together to enslave the world for their own pleasure!” – Rep. Louis T. McFadden

The largest fraud and theft being committed in this country is being perpetrated by the Central Bank of the United States; its Wall Street owners; and the politicians beholden to these evil men. The fraud and theft is being committed through the insidious use of inflation and manipulation of interest rates. The biggest shame of our government run public education system is their inability or unwillingness to teach even the most basic of financial concepts to our children. It’s almost as if they don’t want the average person to understand the truth about inflation and how it has slowly and silently destroyed their livelihood while enriching the few who create it. Converting the chart above into inflation adjusted figures reveals a different picture than the one sold to the general public on a daily basis. Even using the government manipulated CPI figures from the BLS, the ravages of inflation are easy to recognize.

| Billions of Real $ |

1970 |

1980 |

1990 |

2000 |

Apr-08 |

2010 |

Mar-12 |

| Total Personal Income |

$4,937 |

$6,261 |

$8,569 |

$11,374 |

$13,304 |

$13,007 |

$13,328 |

| Wages & Salaries |

$3,264 |

$3,767 |

$4,856 |

$6,387 |

$7,011 |

$6,748 |

$6,905 |

| Interest Income |

$408 |

$754 |

$1,330 |

$1,316 |

$1,492 |

$1,065 |

$984 |

| Dividend Income |

$142 |

$180 |

$298 |

$507 |

$865 |

$761 |

$821 |

| Government transfers |

$420 |

$710 |

$1,007 |

$1,385 |

$1,907 |

$2,333 |

$2,312 |

| CPI |

38.8 |

82.7 |

129.9 |

172.4 |

214.8 |

218 |

229.4 |

Total wages and salaries have risen by only 112% on an inflation adjusted basis over the last 42 years. This is with U.S. population growth from 203 million in 1970 to 313 million people today, a 54% increase. On a real per capita basis, wages and salaries rose from $16,079 in 1970 to $22,060 today, a mere 37% increase in 42 years. That is horrific and some perspective will reveal how bad it really is:

- The average new home price in 1970 was $26,600. The average new home price today is $291,200. On an inflation adjusted basis, home prices have risen 85%.

- The average cost of a new car in 1970 was $3,900. The average price of a new car today is $30,748. On an inflation adjusted basis, car prices have risen 33%.

- A gallon of gasoline cost 36 cents in 1970. A gallon of gas today costs $3.85. On an inflation adjusted basis, gas prices have risen 81%.

- The average price of a loaf of bread in 1970 was 25 cents. The average price of a loaf of bread today is $2.60. On an inflation adjusted basis, a loaf of bread has risen 76%.

In most cases, the cost of things we need to live have risen at twice the rate of our income. This data is bad enough on its own, but it is actually far worse. The governing elite, led by Alan Greenspan, realized that accurately reporting inflation would reveal their scheme, so they have been committing fraud since the early 1980s by systematically under-reporting CPI as revealed by John Williams at www.shadowstats.com:

The truth is that real inflation has been running 5% higher than government reported propaganda over the last twenty years. This explains why families were forced to have both parents enter the workforce just to make ends meet, with the expected negative societal consequences clear to anyone with two eyes. The Federal Reserve created inflation also explains why Americans have increased their debt from $124 billion in 1970 to $2.522 trillion today, a 2000% increase. Wages and salaries only rose 1,250% over this same time frame. Living above your means for decades has implications.

The country, its leaders, its banks and the American people should have come to their senses after the 2008-2009 melt-down. Politicians should have used the crisis to address our oncoming long-term fiscal train wreck, the recklessly guilty Wall Street banks should have been liquidated and their shareholders and bondholders wiped out, the bad debt rampant throughout the financial system should have been purged, and American consumers should have reduced their debt induced consumption while saving for an uncertain cloudy future. These actions would have been painful and would have induced a violent agonizing recession. It would be over now. We would be in the midst of a solid economic recovery built upon reality. Iceland told bankers to screw themselves in 2008. They accepted the consequences of their actions and experienced a brutal two year recession.

The debt was purged, banks forced to accept their losses, and the citizens learned a hard lesson. Amazingly, their economy is now growing strongly. This is the lesson. Wall Street is not Main Street. Saving Wall Street banks and wealthy investors did not save the economy. Stealing savings from little old ladies and funneling it to psychopathic bankers is not the way to save our economic system. It’s the way to save bankers who made world destroying bets while committing fraud on an epic scale, and lost.

Despite the assertion by the good doctor Krugman that there are very few Americans living on a fixed income being impacted by Bernanke’s zero interest rate policy, there are actually 40 million people over the age of 65 in this country that might disagree. There are another 60 million people between the ages of 50 and 64 years old rapidly approaching retirement age. We know 36 million people are receiving SS retirement benefits today. We know that 49 million people are already living below the poverty line, with 16% of those over 65 years old living in poverty. Do 0% interest rates benefit these people? Those over 50 years old are most risk averse, and they should be. Despite the propaganda touted by Wall Street shills and their CNBC mouthpieces, the fact is that the S&P 500 on an inflation adjusted basis is at the same level it was in 1996. Stock investors have gotten a 0% return for the last 16 years. The market is currently priced to deliver inflation adjusted returns of 2% over the next ten years, with the high likelihood of a large drop within the next year.

Ben Bernanke’s plan, fully supported by Tim Geithner, Barack Obama and virtually all corrupt politicians in Washington DC, is to force senior citizens and prudent savers into the stock market by manipulating interest rates and offering them no return on their savings. A fixed income senior citizen living off their meager $15,000 per year of Social Security and the $100,000 they’ve saved over their lifetimes was able to earn a risk free 5% in a money market fund in 2007, generating $5,000 or 25% of their annual living income. Today Ben is allowing them to earn $150 per year. From the BEA info in the chart above you can see that Ben’s ZIRP has stolen $400 billion of interest income from senior citizens and prudent savers and dropped it from helicopters on Wall Street. This might explain why old geezers are pouring back into the workforce at a record pace. Maybe Dr. Krugman has an alternative theory.

Another doctor, with a penchant for telling the truth, described in no uncertain terms the depth of the fraud and theft being perpetrated on the American people (aka Muppets) by Ben Bernanke, the Federal Reserve, their masters on Wall Street, and the puppets in Washington DC:

“We are not doing very well. The economy is just coming along at a snail’s pace. The first quarter numbers that we just got last week were not very good at all. The GDP number was 2.2%. That was a disappointment, but you know, it was all automobiles. 1.6 out of the 2.2 was motor vehicle production. So, people were catching up after not being able to buy them the year before. So, this is a very weak economy… I think the real danger is that this is a bubble in the stock market created by low long-term interest rates that the Fed has engineered. The danger is, like all bubbles, it bursts at some point. Remember, Ben Bernanke told us in the summer of 2010 that he was going to do QE2 and then ultimately they did Operation Twist. The purpose of that was to make long-term bonds less attractive so that investors would buy into the stock market. That would raise wealth and higher wealth would lead to more consumption. It helped in the fourth quarter of 2010 and maybe that is what is helping to drive consumption during the first quarter of this year. But the danger is you get a market that is not with the reality of what is happening in the economy, which is, as I said a moment ago, is really not very good at all.” – Martin Feldstein

The entire bogus recovery is again being driven by subprime auto loans being doled out by Ally Financial (85% owned by the U.S. government) and the other criminal Wall Street banks. The Federal Reserve and our government leaders will continue to steer the country on the same course of encouraging rampant speculation, deterring savings and investment, rewarding outrageous criminal behavior, purposefully generating inflation, and lying to the average American. It will work until we reach a tipping point. Dr. Krugman thinks another $4 trillion of debt and a debt to GDP ratio of 130% should get our economy back on track. When this charade is revealed to be the greatest fraud and theft in the history of mankind, Ben and Paul better have a backup plan, because there are going to be a few angry men looking for them.

Henry Ford knew what would happen if the people ever became educated about the true nature of the Federal Reserve:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

ASLEEP AT THE WHEEL

Americans have an illogical love affair with their vehicles. There are 209 million licensed drivers in the U.S. and 260 million vehicles. The U.S. has a higher number of motor vehicles per capita than every country in the world at 845 per 1,000 people. Germany has 540; Japan has 593; Britain has 525; and China has 37. The population of the United States has risen from 203 million in 1970 to 311 million today, an increase of 108 million in 42 years. Over this same time frame, the number of motor vehicles on our crumbling highways has grown by 150 million. This might explain why a country that has 4.5% of the world’s population consumes 22% of the world’s daily oil supply. This might also further explain the Iraq War, the Afghanistan occupation, the Libyan “intervention”, and the coming war with Iran.

Automobiles have been a vital component in the financial Ponzi scheme that has passed for our economic system over the last thirty years. For most of the past thirty years annual vehicle sales have ranged between 15 million and 20 million, with only occasional drops below that level during recessions. They actually surged during the 2001-2002 recession as Americans dutifully obeyed their moron President and bought millions of monster SUVs, Hummers, and Silverado pickups with 0% financing from GM to defeat terrorism. Alan Greenspan provided the fuel, with ridiculously low interest rates. The Madison Avenue media maggots provided the transmission fluid by convincing millions of willfully ignorant Americans to buy or lease vehicles they couldn’t afford. And the financially clueless dupes pushed the pedal to the metal, until everyone went off the cliff in 2008.

America is proving itself to be insane as described by Albert Einstein:

“Insanity: doing the same thing over and over again and expecting different results.”

The 2008 cataclysm was created by the voracious greed and avarice of Wall Street, sustained by corrupt politicians in Washington, non-existent regulation by banking regulators, Federal Reserve easy money policies, unspoken guarantees of Fed bailouts if Wall Street excess risk taking blew up, and millions of delusional Americans with an unlimited credit line. Excessive debt created the problem. Adding debt is the present solution to the problem. And the accumulation of debt will lead to a tipping point that destroys the U.S. dollar and topples the Great American Empire.

This spiral of government sponsored debt financed debacles has shockingly accelerated as we have supposedly been experiencing an economic recovery for the last two years. The 2008 financial meltdown was the result of too much debt peddled to too many people who never had the means or intentions to repay the debt. The Wall Street peddlers of debt didn’t care if it got repaid because they had already packaged it, bribed Moodys and S&P to rate the toxic garbage as AAA, and sold it to their “clients”. Then they made derivatives bets that it wouldn’t be repaid and raked in billions more as their Ponzi scheme unwound. There was just one problem with their master plan. The Wall Street titans made their derivate weapons of mass destruction so complicated and confusing that their own evil organizations of Harvard MBAs didn’t understand them. Enough hubristic CEOs existed at enough financial firms (AIG, Lehman, Bear Stearns, Citicorp) to bring the entire system crashing down as the toxic derivatives intertwined every major institution in the worldwide banking cabal.

What has happened since those dark days of 2008 is mind blowing in its epic proportions and epic stupidity. To quote Doug Casey, “Not only haven’t we done the right thing, we’ve done the exact opposite of the right thing.” It is absurd and ultimately suicidal to cure a debt disease by administering massive doses of more debt. But that is exactly what those in power have done. The National Debt has risen from a $9.7 trillion to $15.6 trillion, a 61% increase in three and a half years, while our real GDP has grown by $244 billion, a 1.9% increase. Not exactly a fabulous return on investment. But at least there are 7 million less people employed today than there were at the peak in 2008. Plus, senior citizens and middle class savers have seen $450 billion of annual interest income they were earning in 2008 pilfered from their savings accounts and handed to the Wall Street banking elite through Ben Bernanke’s ZIRP.

The Federal Reserve has tripled their balance sheet (actually your liability) from $950 billion to $2.9 trillion. Various other Federal government controlled bureaucracies (Fannie Mae, Freddie Mac, FHA) have stealthily subsidized hundreds of billions in losses on behalf of the criminal Wall Street banks. Other Federal government run agencies (BLS, BEA, CBO) exist solely to massage, manipulate, misuse, and malign economic data and financial projections in order to muddle, misinform and mislead the American people about the true nature of our ongoing economic calamity. Propaganda and obfuscation are the scheme of choice by the powers that be. They are counting on decades of government run public education to insure that millions of non-critical thinking dullards will be unqualified or uninterested in the truth about our grim economic prospects. The oligarchy’s master plan has centered on houses, automobiles, and the illusion of a jobs recovery.

Whenever I’m trying to understand the motivations of the sociopathic Washington politicians, Wall Street bankers and mega-corporation CEOs, I always come back to the words of master manipulator Edward Bernays:

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. …We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. In almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons…who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind.” – Edward Bernays, Propaganda, 1928

The relatively small number of wealthy men thinks they are smarter than the masses and can manipulate them through their control of the government, the financial system and the media. The players in this game remain the same, but they have switched positions. The debt accumulation which led to the 2008 collapse was heavily concentrated on the books of the ruthless Wall Street psychopathic banks and on the backs of a readily pliable public. Today, the Federal government and the Federal Reserve have switched positions with their banker puppet masters, essentially shifting all past and future debt onto the backs of the American middle class. The Federal Reserve Flow of Funds Report, issued two weeks ago, reveals the extent of this blatant scheme to screw the American people in order to save and further enrich the Wall Street psychopaths who won’t be satisfied until their looting and pillaging leads to complete collapse and the world erupting into a world war. The despicable facts are as follows:

- Total U.S. credit market debt has RISEN from $50.9 trillion in 2007 to $54.1 trillion as of 12/31/11, a $3.2 trillion increase.

- Household debt has declined from $13.8 trillion in 2007 to $13.2 trillion as of 12/31/11. The mainstream media would point to this $600 billion decline as proof that Americans have embraced austerity and have learned their lesson. Of course that would be a lie. The Wall Street banks have written off $200 billion of credit card debt and the 5 million completed foreclosures extinguished another $800 billion of mortgage debt. The truth is that consumers have continued to pile up debt.

- Much has been made of corporate America being flush with cash. If they are so flush, why have they added $900 billion of debt since 2007, an increase of 13% to an all-time high of $7.8 trillion?

- The revealing data shows up in the financial company data. These Wall Street national treasures have reduced their debt from $17.1 trillion in 2008 to $13.6 trillion as of 12/31/11. How were they able to do this, while writing off $1 trillion of consumer debt?

- You guessed it. They dumped it on the American taxpayer. The Federal government increased their debt from $5.1 trillion to $10.5 trillion. And our old friends called government sponsored enterprises (Fannie, Freddie, Student loans) increased their debt from $2.9 trillion to $6.2 trillion. Wall Street banks and millions of deadbeats who chose to game the system and live the good life have effectively foisted their $4.5 trillion of debt upon the backs of middle class taxpayers who lived within their means. Another $4.2 trillion has been pissed down the toilet by Obama with his $800 billion Keynesian porkulus program, home buyer tax credits, cash for clunkers, green energy boondoggles, 47 million people on food stamps success story, 99 weeks of unemployment, doubling of SSDI membership, and his multiple wars of choice in the Middle East.

The average hard working, taxpaying American has been enslaved in debt of such proportions that they will never be able pay it off. Your share of the $15.6 trillion National Debt is now $50,000, and growing by $4,500 per year. Your share of the future unfunded liabilities, created by the people you elected, is approximately $350,000. This crushing burden is in addition to the $13.8 trillion of mortgage, credit card, student loan, and auto loan debt Americans have accumulated in the last three decades of delusion. Forty percent of all credit card users do not pay-off their credit card every month and carry an average balance of $16,000 at an average interest rate of 15%. Good to see the Wall Street banks passing along some of their 0% borrowing windfall to their “customers”.

Source: TF Metals Report

Pedal to the Metal

You may have noticed the corporate mainstream media, crooked politicians and lying Wall Street shills attempting to pound the economic recovery storyline into the consciousness of a terminally distracted populace. This is part of the Bernays inspired master plan of a small cabal of powerful men to control the public mind and keep our mass consumer society functioning smoothly so these corporate fascists can continue to gorge upon the carcass of a once vital republic. Decades of mass media consumer indoctrination, dumbing down of children through public school education and the conscious manipulation of attitudes and opinions of the malleable masses has succeeded. The invisible government of the rich and powerful has effectively converted responsible citizens into mindless consumers of products, bought with debt, peddled by associates of the invisible government. The crowded shopping malls, automobile showrooms, and restaurants are a testament to the power of propaganda and the intellectual bankruptcy of a vast swath of the American population.

Only psychopaths would encourage and condone behavior that would financially enrich themselves while destroying the lives and personal wealth of millions. The invisible government (Wall Street bankers, D.C. political hacks, mega-corporate executives, mass media titans) exhibits all the traits of a psychopath as described in a recent Harvard Business Review article:

- Glibness and superficial charm

- Lack of empathy

- Consistent decisions in their self-interest, even where it is ethically questionable

- Chronic, sometimes transparent lies, even with regard to minor things

- Lack of remorse

- Failure to take responsibility for their actions, and instead blaming others

- Shallow emotions

- Ignoring responsibilities

- Persistent focus on gratifying their own needs at the expense of others

- Conning and manipulative behavior

Do you recognize any of these traits in our president (Obama), congressmen (Weiner, McCain) Wall Street bankers (Dimon, Blankfein), corporate CEOs (Immelt), and mass media titans (Murdoch)? These people and many more like them will stop at nothing to further their self-serving agenda. They are intelligent and highly skilled at lying and manipulation. They lack empathy and don’t care what others think as they relentlessly pursue riches and power no matter the damage they inflict upon the people they so casually abuse, scorn and look down on. These are the people attempting to convince you that the path to economic recovery is through increased spending by consumers, utilizing debt supplied by them.

The entire recovery theme is a sham, financed by the Federal government with your tax dollars and the tax dollars of future unborn generations. I’ve arrived at this conclusion after pondering what I’ve been seeing with my own two eyes and through the insightful analysis found in the non-mainstream media (Zero Hedge, Jesse, Mish and many others). The mantra being pounded relentlessly by the mainstream media is that retail sales are booming and the unemployment rate has declined significantly, therefore an economic recovery is at hand. The chart below reveals the dramatic surge in vehicle “sales”. The annual pace is all the way back to 15 million, from the low below 10 million in 2009. The brief surge in mid-2009 was due to Obama’s highly successful Cash for Clunkers program that cost taxpayers $2.8 billion or $24,000 per car sold. It was highly successful for Government Motors (GM) and their union workers (Obama voters).

This rapid surge in auto sales has also resulted in a boost to overall retail sales, which have reached an all-time high. Automobile “sales” make up 18% of the retail sales number, by far the largest segment. The “record” retail sales are the result of surging gasoline sales, swelling food inflation, and a somewhat confusing cascade of car sales. It’s somewhat confusing until you realize how and why the 50% rise in vehicle sales has been accomplished by our Bernaysian masters. Retail sales in the first two months of 2012 are up 8.2%, led by a 9.2% wave of motor vehicle sales. Auto sales are at levels last seen in early 2008. This seems peculiar, since there are still 7 million less employed people in the country than in early 2008 and the real median household income is 9% lower than it was in early 2008. Real average hourly earnings have fallen for the last three months and are 1.2% lower than they were in October, 2010. A critical thinking person might ask himself, how could American households with less jobs and lower wages increase their purchases of automobiles by 50% in the last two years?

The answer is just what you expected. A phenomenal amount of debt peddled to people without the means or intent to ever repay the debt by the usual suspects: Ally Financial, Capital One, Wells Fargo, JP Morgan and Bank of America. These fine upstanding institutions control 25% of the auto loan market. They doled out $24 billion of new car loans in the 4th quarter of 2011, with an outpouring of loans to those downtrodden subprime borrowers and an extension in the average loan length beyond 6 years. Subprime borrowers now account for 45% of all auto loans. As a refresher, subprime borrowers generally have little or no assets, have a history of late payments or defaulting on obligations, and have low incomes. No worries there. When has making hundreds of billions in subprime loans ever caused a problem before. Ally Financial CEO Michael Carpenter had this to say about the market:

“We have seen crazy, irrational competition in the subprime end of the marketplace, which is one reason why more banks are targeting the lower end of the market.”

Bank of America and Capital One increased their market shares of the auto loan market by 40% in the 4th quarter as they attempt to keep up with Ally Financial in reckless lending to deadbeats. If you aren’t familiar with Ally Financial, then you should be. You own 74% of this POS. Here is a brief summary:

- GMAC, after contributing mightily to the financial crash of 2008 through their reckless subprime mortgage (Ditech) and auto lending and requiring a $16 billion bailout from American taxpayers, changed its name to Ally Financial in 2009. It’s sort of like John Dillinger using acid to try and change his fingerprints.

- Ally Financial provides financing for all GM and Chrysler customers and dealers and is the market share leader in auto lending.

- Ally Financial still owes the American taxpayers $12 billion.