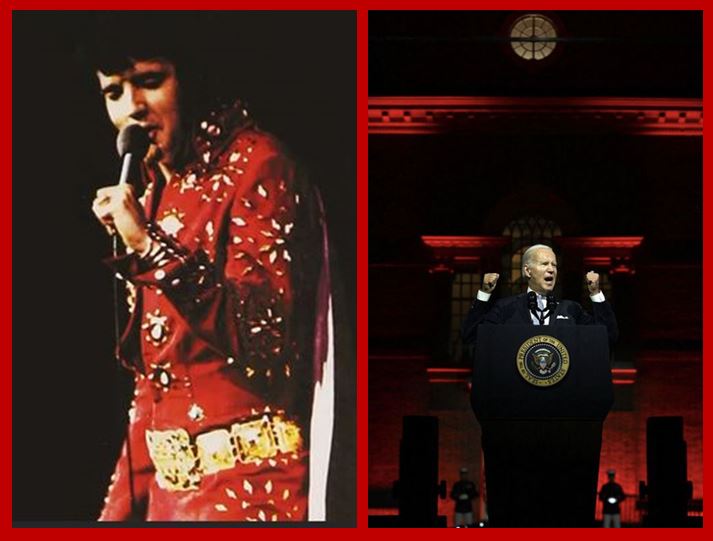

A few months ago, one of my offspring texted and asked if I had read or heard anything about the new Elvis movie that was playing in theaters at the time. When I said “no”, they responded back that they had seen the film, that it was very good, and these words: “I didn’t know Elvis was that big of deal back then”.

So allow me some latitude as I’m going somewhere with this…

In my mind, I thought: “Really? How could my kid not know? Elvis Presley was considered the “king of rock and roll”.

On the other hand, maybe it wasn’t so odd. After all, Elvis music was not played around my kids when they were growing up; and I, personally, have only considered the man, vaguely, as an American historical icon.

I considered my own cognitive associations involving Elvis:

– My dad had some Elvis gospel and Christmas albums.

– I have heard most of Elvis Presley’s songs at one time or another.

– I eventually learned that many Elvis songs were first performed by other musicians and blues singers.

Continue reading “Caught in a Trap: We Can’t Go On Together With Suspicious Minds”

/GettyImages-517388846-5c7ad22a46e0fb00018bd80a.jpg)