We have extensively covered the economic devastation that currently plagues the largest and most important age cohort in the US: adults under 35, also known as Millennials. For a refresher see Millennials Devastated As American Dream Becomes Nightmare For Most, On Crushing Student Loans, Worthless College Degrees And The Millennials, Dear Recently Graduated Millennials: Prepare To Work Until You Are 73, and of course, Meet The Millennials: All You Ever Wanted To Know About America’s Youth, In Charts. Today, we present the latest nail in the coffin of the generation which none other than Obama said he is betting on to “Help Shape the New American Economy.”

The bottom line, or rather, negative line, is the Millennials’ savings, because “after a flirtation with thrift after the recession, young Americans have stopped saving. Adults under age 35—the so-called millennial generation—currently have a savings rate of negative 2%, meaning they are burning through their assets or going into debt, according to Moody’s Analytics. That compares with a positive savings rate of about 3% for those age 35 to 44, 6% for those 45 to 54, and 13% for those 55 and older.”

From the WSJ:

The turnabout in savings tendencies shows how the personal finances of millennials have become increasingly precarious despite five years of economic growth and sustained job creation. A lack of savings increases the vulnerability of young workers in the postrecession economy, leaving many without a financial cushion for unexpected expenses, raising the difficulty of job transitions and leaving them further away from goals like eventual homeownership—let alone retirement.

“In the very near term it’s a plus for spending and economic growth, but in the long run these households are not saving, and that will impair their ability to spend in the future,” said Mark Zandi, the chief economist of Moody’s Analytics who calculated the numbers with Moody’s economist Mustafa Akcay.

the new Moody’s data—using a technique developed at the Federal Reserve to combine its Survey of Consumer Finances and Financial Accounts of the United States reports—show how savings rates diverge across demographic groups.

Here is the problem: recall that Janet Yellen’s “suggestion” to defeat record wealth inequality is for “poorer” Americans to build assets. Well, there is a problem when you can’t even save enough to have $1 left in your pocket at the end of the month after all expenses:

“I’ve been saving almost exclusively in my mind,” said 26-year-old Emily Turner, a 2010 graduate of Villanova University who lives in southern Maryland. Most of her paycheck from the digital consulting and web-design firm she works for “doesn’t even make it to a conventional bank account. I’ve certainly not had the opportunity to invest in stocks or anything.”

The rest is well-known to regular ZH readers:

The problems from a lack of savings promise to reverberate for years. Those who don’t save are unlikely to be wealthy in the future, meaning American angst over wealth inequality seems poised to persist if most millennials are unable to save or choose not to.

Young households’ wealth has declined even more than their incomes. In the previous generation, Americans who were under 35 in 1995—often labeled Generation X—earned wages that were 9% higher than today after adjusting for inflation. Now, the median millennial has a net worth of $10,400, down 42% from $18,200 for Generation X, according to Fed data.

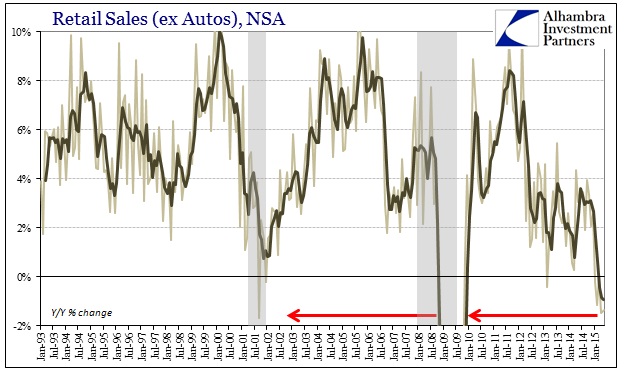

Why the disastrous economic data for America’s most important generation? The answer is simple: the economy is, despite all the pomp and propaganda, still a disaster. That, and of course, the $1.2 trillion student loan bubble.

For some young households, the inability to save reflects the weak job market, said Shai Akabas, an economist at the Bipartisan Policy Center. While unemployment nationally has fallen below 6%, workers age 25 to 34 have a 6.2% unemployment rate and those 20 to 24 face 10.5% unemployment.

“There’s people who really can’t save because they don’t have the means to save and that’s not a small group of people,” Mr. Akabas said. “If you’re in a $25,000-a-year job and starting a family, it’s going to be very hard to accumulate savings regardless of your consumption decisions.”

Another big difference from earlier generations is the rise of student loans. In 1995, borrowers under 35 had median student debt of $6,100, according to Fed data. That has risen to $17,200.

For Ms. Turner, debts include $5,000 in student loans, $3,000 on credit cards and $6,000 borrowed from family. “There’s no formal note for that, but it resides in my psyche that I will pay it back at some point,” she said.

“I know I shouldn’t have accepted credit so freely,” she said. “But part of youth, the wiring of a young person, is the focus on really short-term gratification.”

And then there is also the fact that Millennials just prefer to live well:

The money mostly went to her social life and travel, [Emily Turner] says: a trip to Central America, a wedding in Southern California, a bachelorette party in Austin, Texas, trips to Atlanta and Charlotte, N.C., to see friends, another bachelorette party in Austin.

There was a sign it wouldn’t be this way. After the recession, the savings rates of those under age 35 climbed to 5.2% in 2009 and even briefly surpassed the savings of those age 35 to 44, according to Moody’s.

Don’t worry Emily, soon enough you won’t have the ability to fund such distractions at which point you can once again focus wholeheartedly on boosting your savings. Best of luck.

And in other comedic news, here is Obama’s recent Op-Ed targeting the Millennials:

Why I’m Betting on You to Help Shape the New American Economy

History has dubbed you the “Millennials.”

You’re part of the first generation to grow up in the digital age. Some of you grew up with cell phones tucked into your book bags, while others can remember the early days of landline, dial-up internet. You’ve gone from renting movies on VHS tapes to purchasing and downloading them in a matter of minutes.

Today, more of you are earning college degrees than ever before — and more young people from low-income families are getting a shot at higher education than previous generations. Along with having higher education levels, you’ve got a lower gender pay gap than other generations?—?and we’re working to close it even further. Take all those things together, and it’s no surprise that entrepreneurship is in your DNA. One survey found that more than half of Millennials expressed interest in starting (or have already started) their own business.

So here’s something we know for certain: Your rising generation of Americans isn’t just adapting to a 21st-century economy. You’re actively changing it.

And we know that when we invest in your potential, rather than stack the deck in favor of the folks who are already at the top, our entire economy does better. It’s the reason we’ve expanded grants, tax credits, and loans to help more families afford college. It’s why we’re giving nearly 5 million Americans the chance to cap student loan payments at 10 percent of their income. And thanks to the Affordable Care Act, the number of uninsured young adults has fallen by nearly 40 percent over the past four years.

You may have graduated into the worst recession since the Great Depression, but today — for all the challenges you’ve already faced, and after all the grueling work it’s taken to bounce back — you’re in the best position to break into the newest sectors of the new American economy.

…

Throughout my time in office, my Administration has bet on American innovation. We’ve bet on America’s young people. And today, I’m betting that you’ll continue unleashing new ideas and new enterprises for decades to come.

And that’s why dear Americans young people, you are fucked.

For further proof, see here:

Etc.