The smart money (Wall Street Hedge Funds) is exiting as the dumb money (flippers & your cousin Eddie) arrives on the scene to take the losses. Some people never learn.

Guest Post by Doctor Housing Bubble

The Federal Reserve recently released household net worth figures and what was found in the report continues to follow the theme regarding a shrinking middle class. Wealth jumped nicely at the upper-end of the income spectrum but overall, the cubicle hamster isn’t doing all that well. The recent improvement in home values has helped but this largely has helped investors since in the last decade we have gained 10,000,000 renting households while losing 1,000,000 homeowners. The figures are interesting and are already creeping up in the pontificating that comes with any political season. At the core, a healthy housing market is one where owner-occupied buyers dominate the bulk of home sales. That is simply not the case. This is how you have well paid tech workers in San Francisco cramming into a 2-bedroom apartment like a clown car simply to get by. One thing that is certain from the overall trend is that larger investors are pulling back from the market dramatically.

Investors dominate the market

One interesting highlight that is occurring is that smaller time investors, those that purchase 10 or fewer properties per year are getting into the game while the bigger players back out. The television ads and radio shows are now screaming (for a few years now) how awesome it is to get into the flip/sell/buy real estate game.

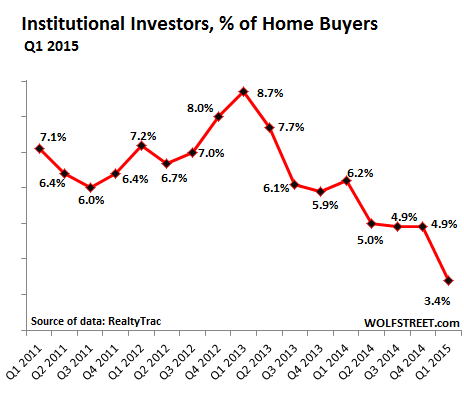

First, it might be useful to see how the big money is pulling back:

The big money is pulling back significantly. Yet investors are still a big part of the market: