The smart money (Wall Street Hedge Funds) is exiting as the dumb money (flippers & your cousin Eddie) arrives on the scene to take the losses. Some people never learn.

Guest Post by Doctor Housing Bubble

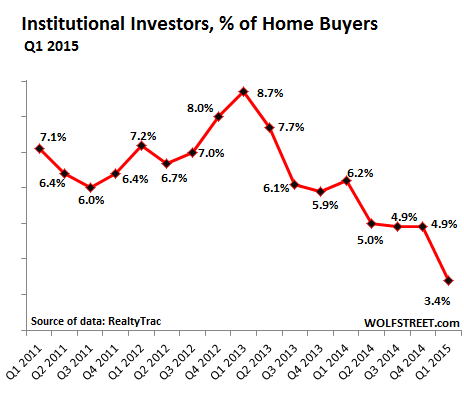

The Federal Reserve recently released household net worth figures and what was found in the report continues to follow the theme regarding a shrinking middle class. Wealth jumped nicely at the upper-end of the income spectrum but overall, the cubicle hamster isn’t doing all that well. The recent improvement in home values has helped but this largely has helped investors since in the last decade we have gained 10,000,000 renting households while losing 1,000,000 homeowners. The figures are interesting and are already creeping up in the pontificating that comes with any political season. At the core, a healthy housing market is one where owner-occupied buyers dominate the bulk of home sales. That is simply not the case. This is how you have well paid tech workers in San Francisco cramming into a 2-bedroom apartment like a clown car simply to get by. One thing that is certain from the overall trend is that larger investors are pulling back from the market dramatically.

Investors dominate the market

One interesting highlight that is occurring is that smaller time investors, those that purchase 10 or fewer properties per year are getting into the game while the bigger players back out. The television ads and radio shows are now screaming (for a few years now) how awesome it is to get into the flip/sell/buy real estate game.

First, it might be useful to see how the big money is pulling back:

The big money is pulling back significantly. Yet investors are still a big part of the market:

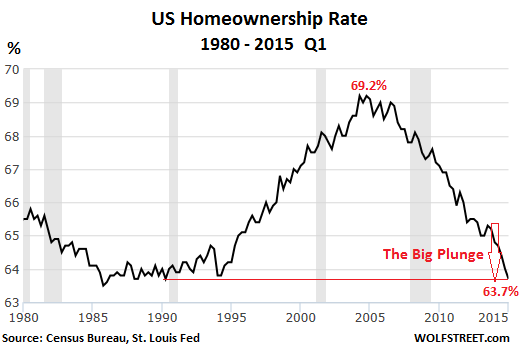

“(Wolf Street) The homeownership rate in 2014, not seasonally adjusted, plunged by 1.2 percentage points to 64%, the largest annual drop in the history of the data series going back to 1965. And in the first quarter of 2015, it dropped to 63.7%, according to the Commerce Department, the lowest since Q2 of 1990, unwinding 25 years of the American Dream.

The highest ownership rates were in the Midwest at 68.6%. The lowest were in the West at 58.5%, which includes California where homes have become immensely expensive, and the American Dream a phrase tarnished with cynicism.”

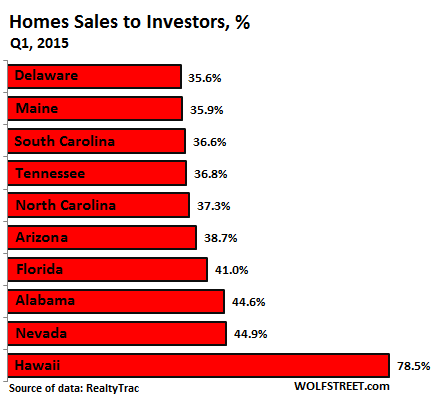

So for now, if you want to play in the California real estate game, you have to pay. But overall, prices on real estate are up pretty much across the country. It is shocking to see how big of an impact investors are having across various states:

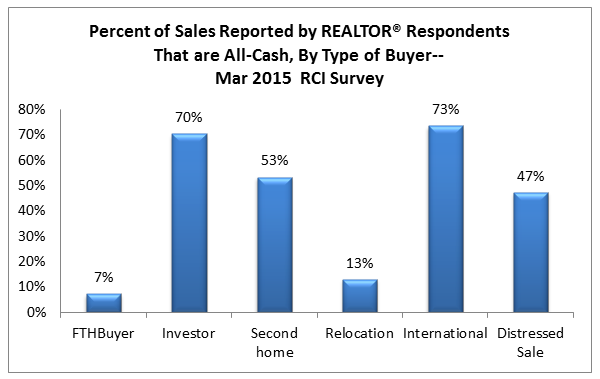

Hawaii of course is usually a second home trophy location. You don’t get more landlocked than an island. And for cash buyers, the foreign money is a big player:

A big portion as reported by the NAR is investor buying from an international background. Many are using the property as a second home. I’ve received a large number of e-mails talking about people seeing “ghost” properties where someone bought the place, but no one is living in the house. At times, some people will go a year without seeing someone set foot in the property.

Of course the Fed report points out that real estate was the largest net worth driver over the last few years (too bad we are reaching generational lows in homeownership):

The homeownership rate is back to where it was 25 years ago. And as we have mentioned, you would think builders would be adding more new homes but for what? They realize that many Millennials are not in the market for more expensive properties and many are living at home with their parents. What builders are building is multi-unit properties to meet the changing demographics out there. Rental Armageddon continues and in places like California, the homeownership rate continues to become a tougher proposition.

While driving around Saturday I saw two banks with posters on their front lawns advertising low interest lines of credit on your home….the folly of the past is being repeated .

Multi-family units are the rage here in the Denver Metro area, not so much for single family homes. I hear we have one of the hottest markets around. I also hear days on market are starting to creep up, some flippers are already getting burned, and that is here in our “hot” market. I believe the authors point, the Big’s that bought low in 09,10 & 11 have been and are now dumping to get out, even here in this market.

Enjoy your writing:

Dr. Housing Bubble

cubicle hamster

Wolf Street

I wonder how much of these investors are foreign investors?