The real world revolves around cash flow. Families across the land understand this basic concept. Cash flows in from wages, investments and these days from the government. Cash flows out for food, gasoline, utilities, cable, cell phones, real estate taxes, income taxes, payroll taxes, clothing, mortgage payments, car payments, insurance payments, medical bills, auto repairs, home repairs, appliances, electronic gadgets, education, alcohol (necessary in this economy) and a countless other everyday expenses. If the outflow exceeds the inflow a family may be able to fund the deficit with credit cards for awhile, but ultimately running a cash flow deficit will result in debt default and loss of your home and assets. Ask the millions of Americans that have experienced this exact outcome since 2008 if you believe this is only a theoretical exercise. The Federal government, Federal Reserve, Wall Street banks, regulatory agencies and commercial real estate debtors have colluded since 2008 to pretend cash flow doesn’t matter. Their plan has been to “extend and pretend”, praying for an economic recovery that would save them from their greedy and foolish risk taking during the 2003 – 2007 Caligula-like debauchery.

I wrote an article called Extend and Pretend is Wall Street’s Friend about one year ago where I detailed what I saw as the moneyed interest’s master plan to pretend that hundreds of billions in debt would be repaid, despite the fact that declining developer cash flow and plunging real estate prices would make that impossible. Here are a couple pertinent snippets from that article:

“A systematic plan to create the illusion of stability and provide no-risk profits to the mega-Wall Street banks was implemented in early 2009 and continues today. The plan was developed by Ben Bernanke, Hank Paulson, Tim Geithner and the CEOs of the criminal Wall Street banking syndicate. The plan has been enabled by the FASB, SEC, IRS, FDIC and corrupt politicians in Washington D.C. This master plan has funneled hundreds of billions from taxpayers to the banks that created the greatest financial collapse in world history.

Part two of the master cover-up plan has been the extending of commercial real estate loans and pretending that they will eventually be repaid. In late 2009 it was clear to the Federal Reserve and the Treasury that the $1.2 trillion in commercial loans maturing between 2010 and 2013 would cause thousands of bank failures if the existing regulations were enforced. The Treasury stepped to the plate first. New rules at the IRS weren’t directly related to banking, but allowed commercial loans that were part of investment pools known as Real Estate Mortgage Investment Conduits, or REMICs, to be refinanced without triggering tax penalties for investors.

The Federal Reserve, which is tasked with making sure banks loans are properly valued, instructed banks throughout the country to “extend and pretend” or “amend and pretend,” in which the bank gives a borrower more time to repay a loan. Banks were “encouraged” to modify loans to help cash strapped borrowers. The hope was that by amending the terms to enable the borrower to avoid a refinancing that would have been impossible, the lender would ultimately be able to collect the balance due on the loan. Ben and his boys also pushed banks to do “troubled debt restructurings.” Such restructurings involved modifying an existing loan by changing the terms or breaking the loan into pieces. Bank, thrift and credit-union regulators very quietly gave lenders flexibility in how they classified distressed commercial mortgages. Banks were able to slice distressed loans into performing and non-performing loans, and institutions were able to magically reduce the total reserves set aside for non-performing loans.

If a mall developer has 40% of their mall vacant and the cash flow from the mall is insufficient to service the loan, the bank would normally need to set aside reserves for the entire loan. Under the new guidelines they could carve the loan into two pieces, with 60% that is covered by cash flow as a good loan and the 40% without sufficient cash flow would be classified as non-performing. The truth is that billions in commercial loans are in distress right now because tenants are dropping like flies. Rather than writing down the loans, banks are extending the terms of the debt with more interest reserves included so they can continue to classify the loans as “performing.” The reality is that the values of the property behind these loans have fallen 43%. Banks are extending loans that they would never make now, because borrowers are already grossly upside-down.”

Master Plan Malfunction

You have to admire the resourcefulness of the vested interests in disguising disaster and pretending that time will alleviate the consequences of their insatiable greed, blatant criminality and foolish risk taking. Extending bad loans and pretending they will be repaid does not create the cash flow necessary to actually pay the interest and principal on the debt. The chart below reveals the truth of what happened between 2005 and 2008 in the commercial real estate market. There was an epic feeding frenzy of overbuilding shopping centers, malls, office space, industrial space and apartments. During the sane 1980’s and 1990’s, commercial real estate loan issuance stayed consistently in the $500 billion to $700 billion range. The internet boom led to a surge to $1.1 trillion in 2000, with the resultant pullback to $900 billion by 2004. But thanks to easy Al and helicopter Ben, the bubble was re-inflated with easy money and zero regulatory oversight. Commercial real estate loan issuance skyrocketed to $1.6 trillion per year by 2008. Bankers sure have a knack for doing the exact opposite of what they should be doing at the exact wrong time. They doled out a couple trillion of loans to delusional developers at peak prices just prior to a historic financial cataclysm.

The difference between bad retail mortgage loans and bad commercial loans is about 25 years. Commercial real estate loans usually have five to seven year maturities. This meant that an avalanche of loans began maturing in 2010 and will not peak until 2013. With $1.2 trillion of loans coming due between 2010 and 2013, disaster for the Wall Street Too Big To Fail banks awaited if the properties were valued honestly. A perfect storm of declining property values and plunging cash flows for developers should have resulted in enormous losses for Wall Street banks and their shareholders, resulting in executives losing not only their obscene bonuses but even their jobs. Imagine the horror for the .01%.

The fact is that commercial property prices are currently 42% below the 2007 – 2008 peak. The slight increase in the national index is solely due to strong demand for apartments, as millions of Americans have been kicked out of their homes by Wall Street bankers using fraudulent loan documentation to foreclose on them. The national index has recently resumed its fall. Industrial and retail properties are leading the descent in prices according to Moodys. The master plan of extend and pretend was implemented in 2009 and three years later commercial real estate prices are 10% lower, after the official end of the recession.

Part one of the “extend and pretend” plan has failed. Part two anticipated escalating developer cash flows as the economy recuperated, Americans resumed spending like drunken sailors and retailers began to rake in profits at record levels again. Reality has interfered with their desperate last ditch gamble. Office vacancies remain at 17.3%, close to 20 year highs, as 12.3 million square feet of new space came to market in 2011. Vacancies are higher today than they were at the end of the recession in December 2009. The recovery in cash flow has failed to materialize for commercial developers. Strip mall vacancies at 11% remain stuck at 20 year highs. Regional mall vacancies at 9.2% linger near all-time highs. Vacancies remain elevated, with no sign of decreasing. Despite these figures, an additional 4.9 million square feet of new retail space was opened in 2011. The folly of this continued expansion will be revealed as bricks and mortar retailers are forced to close thousands of stores in the next five years.

It is clear the plan put into place three years ago has failed. Extending and pretending doesn’t service the debt. Only cash flow can service debt.

Now What?

Extending and pretending that hundreds of millions in commercial loans were payable for the last three years is now colliding with a myriad of other factors to create a perfect storm in 2012 and 2013. The extension of maturities has now set up a far more catastrophic scenario as described by Chris Macke, senior real estate strategist at CoStar Group:

“As banks and property owners continue to partake in loan extensions amid a softening economy, commercial banks continue to “delay and pray” that property values will rise. Many loans are piled up and concentrated in this year, and at the same time, the economy is slowing. This dilemma has resulted in the widening of what is commonly termed the “loan maturity cliff,” which is attributed to the so called extend-and-pretend loans. During the market downturn, lenders extended the maturity dates of loans with properties that had current values below their balances. Instead, however the practice has resulted in a race for property values to try to catch up with the loan maturity dates.”

The Federal Reserve, Wall Street banks, Mortgage Bankers Association and the rest of the confederates of collusion will continue the Big Lie for as long as possible. They point to declining commercial default rates as proof of improvement. The chart below details the 4th quarter default rates for real estate loans over the last six years. Default rates in the 4th quarter of 2009 peaked for all real estate loan types. Still, today’s default rate is 450% higher than the rate in 2006. A critical thinker might ask how commercial default rates could fall from 8.75% to 6.12% when commercial vacancies have increased and commercial property values have fallen. It’s amazing how low default rates can fall when a bank doesn’t require payments or collateral to back up the loan and can utilize accounting gimmicks to avoid write-offs.

|

|

Real estate loans |

|||

|

All |

Booked in domestic offices |

|||

|

Residential |

Commercial |

Farmland |

||

|

2011:4 |

8.22 |

9.86 |

6.12 |

3.26 |

|

2010:4 |

9.07 |

10.11 |

7.98 |

3.61 |

|

2009:4 |

9.55 |

10.45 |

8.75 |

3.43 |

|

2008:4 |

6.03 |

6.64 |

5.49 |

2.28 |

|

2007:4 |

2.90 |

3.07 |

2.75 |

1.51 |

|

2006:4 |

1.70 |

1.95 |

1.32 |

1.41 |

The reality as detailed by honest analysts is much different than the numbers presented by Ben Bernanke and his banker cronies. A recent article from the Urban Land Institute provides some insight into the current state of the market:

Ann Hambly, who previously ran the commercial servicing departments at Prudential, Bank of New York, Nomura, and Bank of America said a wave of defaults is coming in commercial mortgage–backed securities (CMBS). And Carl Steck, a principal in MountainSeed Appraisal Management, an Atlanta-based firm that deals in the commercial real estate space, said property values are still falling.

Noting that CMBS investors booked $6 billion in real losses in 2011 and have already taken on $2 billion more in losses so far this year, Hambly told reporters in a private briefing that “it’s going to take a miracle” for many borrowers to refinance their deals when they come due between now and 2017.

Carl Steck said that lenders who are taking over the portfolios of failed institutions are finding that the values of the loans “are coming in a lot lower than they ever thought they would.” And as a result, he thinks a “fire sale” of commercial loans is just over the horizon.

Analysts expect 2012 to be a record-setting year for commercial real estate defaults. Last week delinquencies for office and retail loans hit their highest-ever levels, according to Fitch Ratings. The value of all delinquent commercial loans is now $57.7 billion, according to Trepp, LLC. If you think the criminal Wall Street banks limited their robo-signing fraud to just poor homeowners, you would be mistaken. The fraud uncovered in the commercial lending orbit will dwarf the residential swindle. Research by Harbinger Analytics Group shows the widespread use of inaccurate, fraudulent documents for land title underwriting of commercial real estate financing. According to the report:

This fraud is accomplished through inaccurate and incomplete filings of statutorily required records (commercial land title surveys detailing physical boundaries, encumbrances, encroachments, etc.) on commercial properties in California, many other western states and possibly throughout most of the United States. In the cases studied by Harbinger, the problems are because banks accepted the work of land surveyors who “have committed actual and/or constructive fraud by knowingly failing to conduct accurate boundary surveys and/or failing to file the statutorily required documentation in public records.”

The Wall Street geniuses bundled commercial real estate mortgages and re-sold them as securities around the world. The suckers holding those securities, already staggering from the overabundance of empty office space, will be devastated if it turns out they have no claim to the properties. They will rightly sue the lenders for falsely representing the properties. Mortgage holders in these cases may also turn to their title insurance to cover any losses. It is unknown if the title insurance companies have the wherewithal to withstand enormous claims on costly commercial properties. It looks like that light at the end of the tunnel is bullet train headed our way.

One of the fingers in the dyke of the “extend and pretend” dam has been removed by the FASB. The new leak threatens to turn into a gusher.

Andy Miller, cofounder of Miller Frishman Group, and one of the few analysts who saw the real estate crash coming two years before it surprised Bernanke and the CNBC cheerleaders sees a flood of defaults on the horizon. In a recent interview with The Casey Report Miller details a dramatic turn for the worse in the commercial real estate market he has witnessed in the last few months. His company deals with distressed commercial real estate. This segment of his business was booming in 2009 and into the middle of 2010. Then magically, there was no more distress as the “extend and pretend” plan was implemented by the governing powers. The distressed market dried up completely until November 2011. Miller describes what happened next:

“All of a sudden, right after Thanksgiving in 2011, the floodgates opened again. In the last six weeks we probably picked up seven or eight receiverships – and we’re now seeing some really big-ticket properties with major loans on them that have gone into distress, and they’re all sharing some characteristics in common. In 2008 and 2009, these borrowers were put on a workout or had a forbearance agreement put into place with their lenders. In 2009, their lenders were thinking, “Let’s do a two- or three-year workout with these guys. I’m sure by 2012 this market is going to get a lot better.” Well, 2012 is here now, and guess what? It’s not any better. In fact I would argue that it’s still deteriorating.”

Why the sudden surge in distressed properties coming to market in late 2011? It seems the FASB finally decided to grow a pair of balls after being neutered by Bernanke and Geithner in 2009 regarding mark to market accounting. They issued an Accounting Standards Update (ASU) that went into effect for all periods after June 15, 2011called Clarifications to Accounting for Troubled Debt Restructurings by Creditors. Essentially, if a lender is involved in a troubled debt restructuring with a debtor, including a forbearance agreement or a workout, the property MUST be marked to market. Andy Miller understands this is the beginning of the end for “extend and pretend”:

“I believe it’s a huge deal because it means you don’t have carte blanche anymore to kick the can down the road. After all, kicking the can down the road was a way to avoid taking a big hit to your capital. Well, you can’t do that anymore. It forces you to cut through the optical illusions by writing this asset to its fair market value.”

Ben Bernanke and the Wall Street banks are running out tricks in their bag of deception. Wall Street banks created billions in profits by using accounting entries to reduce their loan loss reserves. They’ve delayed mortgage foreclosures for two years to avoid taking the losses on their loan portfolios. They’ve pretended their commercial loan portfolios aren’t worth 50% less than their current carrying value. Bernanke has stuffed his Federal Reserve balance sheet with billions in worthless commercial mortgage backed securities. The Illusion of Recovery is being revealed as nothing more than a two bit magician’s trick. In the end it always comes back to cash flow. The debt cannot be serviced and must be written off. Thinking the American consumer will ride to the rescue is a delusional flight of the imagination.

Apocalypse Now – The Future of Retailers & Mall Owners

When I moved to my suburban community in 1995 there were two thriving shopping centers within three miles of my home and a dozen within a ten mile radius. Seventeen years later the population has increased dramatically in this area, and these two shopping centers are in their final death throes. The shopping center closest to my house has a vacant Genuardi grocery store(local chain bought out and destroyed by Safeway), vacant Blockbuster, vacant Sears Hardware, vacant Donatos restaurant, vacant book store, and soon to be vacant Pizza Pub. It’s now anchored by a near bankrupt Rite Aid and a Dollar store. This ghost-like strip mall is in the midst of a fairly thriving community. Anyone with their eyes open as they drive around today would think Space Available is the hot new retailer. According to the ICSC there are 105,000 shopping centers in the U.S., occupying 7.3 billion square feet of space. Total retail square feet in the U.S. tops 14.2 billion, or 46 square feet for every man, woman and child in the country. There are more than 1.1 million retail establishments competing for every discretionary dollar from consumers.

Any retailer, banker, politician, or consumer who thinks we will be heading back to the retail glory days of 2007 is delusional. Retail sales reached a peak of $375 billion per month in mid 2008. Today, retail sales have reached a new “nominal” peak of $400 billion per month. Even using the highly questionable BLS inflation figures, real retail sales are still below the 2008 peak. Using the inflation rate provided by John Williams at Shadowstats, as measured the way it was in 1980, real retail sales are 15% below the 2008 peak. The unvarnished truth is revealed in the declining profitability of major retailers and the bankruptcies and store closings plaguing the industry. National retail statistics and recent retailer earnings reports paint a bleak picture, and it’s about to get bleaker.

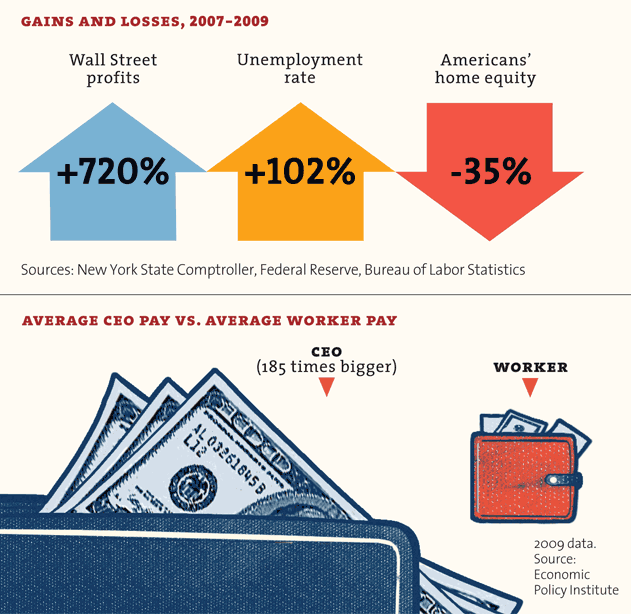

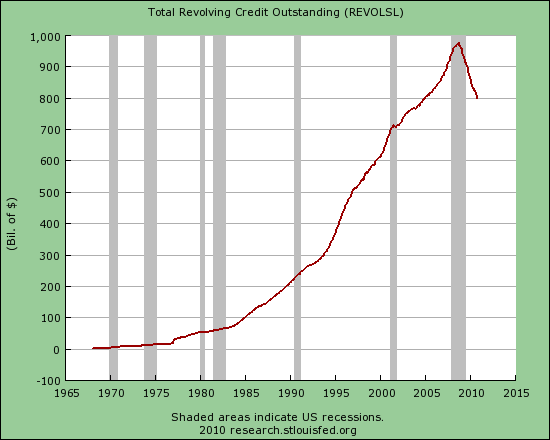

Retail sales in 1992 totaled $2.0 trillion. By 2011 they had grown to $4.7 trillion, a 135% increase in nineteen years. A full 64% of this rise is solely due to inflation, as measured by the BLS. In reality, using the true inflation figures, the entire increase can be attributed to inflation. Over this time span the U.S. population has grown from 255 million to 313 million, a 23% increase. Median household income has grown by a mere 8% over this same time frame. The increase in retail sales was completely reliant upon the American consumers willing to become a debt slaves to the Wall Street bank slave masters. It is obvious we have learned to love our slavery. Credit card debt grew from $265 billion in 1992 to a peak of $972 billion in September of 2008, when the financial system collapsed. The 267% increase in debt allowed Americans to live far above their means and enriched the Wall Street banking cabal. The decline to the current level of $800 billion was exclusively due to write-offs by the banks, fully funded by the American taxpayer.

Credit cards are currently being used far less as a way to live beyond your means, and more to survive another day. This can be seen in the details underlying the monthly retail sales figures. On a real basis, with inflation on the things we need to live like energy, food and clothing rising at a 10% clip, retail sales are declining. Gasoline, food and medicine are the drivers of retail today. The surge in automobile sales is just another part of the “extend and pretend” plan, as Bernanke provides free money to banks and finance companies so they can make seven year 0% interest loans to subprime borrowers. Easy credit extended to deadbeats will not create the cash flow needed to repay the debt. The continued penetration of on-line retailers does not bode well for the dying bricks and mortar zombie retailers like Sears, JC Penny, Macys and hundreds of other dead retailers walking. With gas prices soaring, the economy headed back into recession and the Federal Reserve out of ammunition, Andy Miller sums up the situation nicely:

“Well, I think we’re headed into an economy right now where there’s just not a lot of upside. Do we think, for example, in the shopping center business, that retail and consumer spending is going to go way up? Certainly not. I think that as times get tougher and unemployment remains high, it’s going to have a negative impact on consumer spending. In almost in any city in America right now, it doesn’t take a genius to see how much retail space has been constructed and is sitting there empty. Vacancy rates are as high as I’ve seen them in almost every venue that I visit. I’m very concerned about the retail business, and I think it’s extremely dangerous right now.”

The major big box retailers have been reporting their annual results in the last week. The results have been weak and even those whose results are being spun as positive by the mainstream media are performing dreadfully compared to 2007. A few examples are in order:

- Home Depot was praised for their fantastic 2011 result of $70 billion in sales and $6.7 billion of income. The MSM failed to mention that sales are $7 billion lower than 2007, despite having 18 more stores and profit exceeded $7.2 billion in 2007. Sales per square foot have declined from $335 to $296, a 12% decline in four years.

- Target made $2.9 billion on revenue of $67 billion in 2011. $953 million of this profit was generated from their credit card this year versus $744 million last year because they reduced their loan loss reserve by $260 million. Target is supposedly a retailer, but 33% of their bottom line comes from a credit card they desperately tried to sell in 2009. They have increased their store count from 1,600 to 1,800 since 2007 and their profit is flat. Sales per square foot have declined from $307 to $280 since 2007.

- J.C. Penney is a bug in search of a windshield. Their sales have declined from $20 billion in 2007 to $17 billion in 2011 despite increasing their store count from 1,067 to 1,114. Their profits have plunged from $1.1 billion to a loss of $152 million. Their sales per square foot have plunged by 14% since 2007. Turning to a former Apple marketing guru as their new CEO will fail. Everyday low pricing is not going to work on Americans trained like monkeys to salivate at the word SALE.

- The death spiral of Sears/Kmart is a sight to see. As the anchor in hundreds of dying malls across the land, this retail artifact will be joining Montgomery Ward on the scrap heap of retail history in the next few years. Its eventual bankruptcy and liquidation will leave over 4,000 rotting carcasses to spoil our landscape. The one-time genius and heir to the Warren Buffett mantle – Eddie Lampert – has proven to be as talented at retailing as his buddy Jim Cramer is at picking stocks. He has managed to decrease sales by $10 billion, from $53 billion to $43 billion in the space of four years despite opening 247 new stores. That is not an easy feat to accomplish. At least he was able to reduce profits from $1.5 billion to $133 million and drive the sales per square foot in his stores down by 15%.

- Widely admired Best Buy has screwed the pooch along with the other foolish retailers that have massively over expanded in the last decade. They have increased their domestic sales from $31 billion to $37 billion, a 19% increase in four years. This increase only required a 444 store expansion, from 873 stores to 1,317 stores. A 51% increase in store count for a 19% increase in sales seems to be a bad trade-off. Their chief competitor – Circuit City – went belly-up during this time frame, making the relative sales increase even more pathetic. The $6 billion increase in sales resulted in a $100 million decline in profits and a 13% decrease in sales per square foot since 2007. It might behoove the geniuses running this company to stop building new stores.

- The retailer that committed the greatest act of suicide in the last decade is Lowes. Their act of hubris, as Home Depot struggled in the mid 2000’s, is coming home to roost today. They increased their store count from 1,385 to 1,749 over four years. This 26% increase in store count resulted in an increase in sales from $47 billion to $49 billion, a 4% boost. Profitability has plunged from over $3 billion to under $2 billion over this same time frame. They’ve won the efficiency competition by seeing their sales per square feet fall by an astounding 21% over the last four years. I’ve witnessed their ineptitude as they opened four stores within 10 miles of each other in Montgomery County, PA and cannibalized themselves to death. The newest store, three miles from my house, is a pleasure to shop as there is generally more staff than customers even on a Saturday afternoon. This beautiful new store will be vacant rotting hulk within three years.

Do the results of these retail giants jive with the retail recovery stories being spun by the corporate mainstream media? When you see some stock shill on CNBC touting one of these retailers, realize he is blowing smoke up your ass. These six struggling retailers account for over 1.1 billion square feet of retail space in the U.S. One or more of them anchor every mall in America. Wal-Mart (600 million square feet in the U.S.) and Kohl’s (82 million square feet) continue to struggle as their lower middle class customers can barely make ends meet. The perfect storm is developing and very few people see it coming. Extend and pretend has failed. Americans are tapped out. Home prices continue to fall. Energy and food prices continue to rise. Wages are stagnant. Job growth is weak. Middle and lower class Americans are using credit cards just to pay their basic living expenses. The 99% are not about to go on a spending binge.

As consumers reduce consumption, retailers lose profits and will be forced to close stores. It is likely that at least 150,000 retail stores will need to close in the next five years. Less stores means less rent for mall developers. Less rent means the inability to service their debt as the value of their property declines with the outcome of Ghost Malls haunting your community. Maybe good old American ingenuity will come to the rescue as we convert ghost malls into FEMA prison camps for uncharged Ron Paul supporters, Obamacare death panel implementation centers, TSA groping educational facilities, housing for the millions kicked out of their homes by the Wall Street .01%ers, and bomb shelters for the imminent Iranian invasion.

Debt default means huge losses for the Wall Street criminal banks. Of course the banksters will just demand another taxpayer bailout from the puppet politicians. This repeat scenario gives new meaning to the term shop until you drop. Extending and pretending can work for awhile as accounting obfuscation, rolling over bad debts, and praying for a revival of the glory days can put off the day of reckoning for a couple years. Ultimately it comes down to cash flow, whether you’re a household, retailer, developer, bank or government. America is running on empty and extending and pretending is coming to an end.