The next Fourth Turning is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II. – The Fourth Turning – Strauss & Howe -1997

Harpers Ferry – 1859 Tucson – 2011

The mass murder in Tucson is another brick in the wall of this Fourth Turning Crisis. The importance of this tragic event is not what happened in that Safeway parking lot, but the reaction in the aftermath of the shooting. Turnings are not about specific events, but how generations react to the events based on their stages of life. A turning is an era with a characteristic social mood, a new twist on how people feel about themselves and their nation. It results from the aging of the generational constellation. A society enters a turning once every twenty years or so, when all living generations begin to enter their next phases of life. We entered this Fourth Turning between 2005 and 2008, with the collapse of the housing market and subsequent financial system implosion.

We have crossed the threshold into a decisive era of secular upheaval, when the values regime will propel the replacement of the old civic order with a new one. The Silent Generation (1925-1942) is dying off, Baby Boomers (1943-1960) are entering elder hood, Generation X is entering midlife, Millenials are entering young adulthood—and a new generation of child Artists are being born. Strauss & Howe have documented that a long human life of 80 to 100 years makes up a social cycle of growth, maturation, entropy, and death (and rebirth) known as a Saeculum. Within each cycle, four generations proceed through their four stages of life. Every 15 to 25 years a new Turning surprises those who only think of history in a linear way. Strauss & Howe are historians who have been able to document this generational cycle going back to the 1400s.

The Anglo-American saeculum dates back to the waning of the Middle Ages in the middle of the fifteenth century. In this lineage, there have been seven saecula:

- Late Medieval (1435-1487)

- Reformation (1487-1594)

- New World (1594-1704)

- Revolutionary (1704-1794)

- Civil War (1794-1865)

- Great Power (1866-1946)

- Millennial (1946-2026?)

The Turnings of history are like the seasons of nature. Seasons cannot be rearranged, seasons cannot be avoided, but humans and nations can prepare for the challenges presented by each season. Winter has descended upon our nation.

We are still in the early stages of this Fourth Turning and the mood of the country continues to darken like the sky before an approaching blizzard. Generational theory does not predict the specific events that will happen during a Turning. The events, personalities, and policies that become the chapters in history books are not what drive a Turning, it is how each generation reacts to the events, personalities and policies. Someone who is 60 years old will react differently to an event than they would have reacted at 20 years old. The issues that are driving this Fourth Turning (un-payable entitlement obligations, Wall Street greed & power, globalization gutting the middle class, increasing government control, wealth distribution) were all known and understood in 1997. It took the spark of a housing market collapse and the generations being in proper alignment to catalyze the mood of the country.

Chapter one of this Fourth Turning is approaching its end. Chapter two guarantees to be more intense, with more violence, and periods of great danger. Strauss & Howe envisioned this chapter based upon their analysis of the issues looming back in 1997:

The risk of catastrophe will be very high. The nation could erupt into insurrection or civil violence, crack up geographically, or succumb to authoritarian rule. If there is a war, it is likely to be one of maximum risk and effort – in other words, a total war. Every Fourth Turning has registered an upward ratchet in the technology of destruction, and in mankind’s willingness to use it. Thus, might the next Fourth Turning end in apocalypse – or glory. The nation could be ruined, its democracy destroyed, and millions of people scattered or killed. Or America could enter a new golden age, triumphantly applying shared values to improve the human condition. The rhythms of history do not reveal the outcome of the coming Crisis; all they suggest is the timing and dimension. – The Fourth Turning – Strauss & Howe -1997

American Revolutions

“A Fourth Turning is a solstice era of maximum darkness, in which the supply of social order is still falling but the demand for order is now rising. As the community instinct regenerates, people resolve to do more than just relieve the symptoms of pending traumas. Intent on addressing root causes, they rediscover the value of unity, teamwork, and social discipline. Far more than before, people comply with authority, accept the need for public sacrifice, and shed anything extraneous to the survival needs of their community. This is a critical threshold: People either coalesce as a nation and culture – or rip hopelessly and permanently apart.” – The Fourth Turning – Strauss & Howe -1997

“Photo credit: ComfortBetrays.com”

There have been three prior Fourth Turnings in U.S. history: the American Revolution, Civil War and Great Depression/World War II. The American Revolution preceded the Civil War by 87 years. The Great Depression followed the Civil War by 69 years and this Millenial Crisis arrived 76 years after the Great Stock Market Crash of 1929. Essentially, each prior Fourth Turning has represented a Revolution in American history.

The First American Revolution began in 1773 when Parliament’s response to the Boston Tea Party ignited a colonial tinderbox—leading directly to the first Continental Congress, the battle of Concord, and the Declaration of Independence. History always seems easy to predict in retrospect. This is another of the many faults in human thinking. There was very little talk or thought of the colonies breaking away from the mother country during the 1760s. Up until the Boston Tea Party catalyst event, no one could have predicted the events which would occur in a chain reaction over the next 21 years. There were dark cold bitter days during this Crisis winter. In the end, George Washington’s honor, courage and fortitude symbolized the character of a new nation.

Historians Charles and Mary Beard described the Civil War as the Second American Revolution. The Civil War Crisis began with a presidential election that southerners interpreted as an invitation to secede. The attack on Fort Sumter triggered the most violent conflict ever fought on New World soil. The war reached its climax with the Emancipation Proclamation and Battle of Gettysburg (in 1863). The epic conflagration redefined America. The slavery issue was settled for good, signed in the blood of 600,000 men. The industrial might of the North was rechanneled toward progress as a world industrial powerhouse. In retrospect many will say the Civil War was entirely predictable, but that is completely untrue.

The great compromise generation (Henry Clay, John C. Calhoun, Daniel Webster) of the 1850s passed from the scene, leaving the country in the hands of firebrands on both sides. John Brown’s raid on Harper’s Ferry and subsequent execution served to increase the brooding mood of the country. The bloodiest war in the history of mankind was not predictable even one year before it began. The aristocracy of Washington DC actually took carriages in their Sunday best to watch the First Battle of Bull Run. Shortly thereafter Lincoln mobilized 500,000 men and unleashed a catastrophic spiral of butchery over the next four years that exhausted itself with the assassination of Lincoln and the surrender at Appomattox in the same week. The resolution of this Crisis felt more like defeat than victory.

Renowned American historian Carl Degler called FDR’s New Deal the “Third American Revolution”. The Crisis began suddenly with the Black Tuesday stock-market crash in 1929. After a three-year economic free fall, the Great Depression triggered the New Deal Revolution, a vast expansion of government, and hopes for a renewal of national community. After Pearl Harbor, America planned, mobilized, and produced for world war on a scale never seen in the history of mankind, making possible complete victory over the Nazis and Fascists. In 1928 did anyone foresee an 89% stock market crash, worldwide depression, vast expansion of government power, a world war more devastating than the prior war, and the usage of an atomic weapon of mass destruction? Not a chance. Only in retrospect do people convince themselves that it was predictable.

Black Tuesday, October 29, 1929 marked the abrupt unforeseen end of the Roaring Twenties. The bewilderingly rapid collapse of the worldwide financial system in the space of three years left the American people shaken and desperate. With their wealth destroyed and unemployment exceeding 20%, the American public turned to Franklin Delano Roosevelt and his New Deal promises of government social and work programs. He declared “nationwide thinking, nationwide planning, and nationwide action, the three essentials of public life”. This was truly a Third American Revolution. FDR’s policies changed the course of American history. The renewed spirit of American youth during the 1930s was essential in preparing them for the trials that awaited from 1941 through 1945. It is somewhat ironic that FDR’s revolutionary social programs, begun during the last Crisis, will be a major factor in the current Crisis – the Fourth American Revolution.

Fourth American Revolution

“The US government is on a “burning platform” of unsustainable policies and practices with fiscal deficits, chronic healthcare underfunding, immigration and overseas military commitments threatening a crisis if action is not taken soon.” – David M. Walker

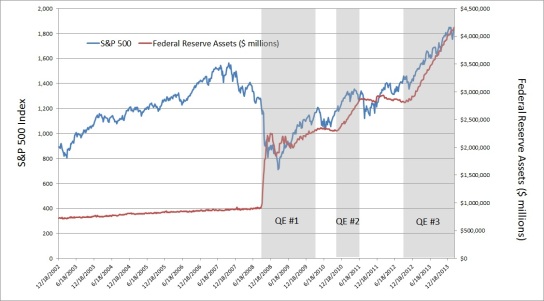

No one knows exactly what events will transpire over the next 15 to 20 years as this Fourth Turning morphs from regeneracy to climax and finally to resolution. The mainstream media, most politicians, and self proclaimed progressives are blind to the cyclicality of history. They believe history proceeds in a linear upwards path. These are the people you see on TV talking about toning down the rhetoric, false gestures of bipartisanship, and soothing words about the financial crisis being a thing of the past. They fail to understand that once the mood of the country is catalyzed by a trigger event or events, there is no turning back the clock. Winter must be dealt with head on. Very few, if any, “financial experts” anticipated a housing collapse, followed by a deep recession, a 50% stock market crash, and a financial system which came within hours of total implosion on September 18, 2008 (as detailed in the documentary Generation Zero). Absolutely no one anticipated the extreme measures taken by the U.S. government and Federal Reserve to “Save” the country from a 2nd Great Depression. These measures have added $5 trillion to the National Debt in the last 40 months. It took 205 years to accumulate the 1st $5 trillion of debt.

While it is impossible to predict the exact trials and tribulations that will confront America over the next decade, the issues that will drive this Fourth Turning were clearly visible to anyone with their eyes open, many years in advance of the Crisis. Strauss & Howe clearly detailed the easily observable issues that led to the current Crisis back in 1997. Their book is not prophecy, but historically provable interactions between generations based upon the circumstances confronting society at the time.

“Sometime around the year 2005, perhaps a few years before or after, America will enter the Fourth Turning. A spark will ignite a new mood. It will catalyze a Crisis. In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. It could be a rapid succession of small events in which the ominous, the ordinary, and the trivial are commingled.” – The Fourth Turning – Strauss & Howe -1997

The authors use their common sense, based upon known trends, to posit potential catalyst scenarios such as:

- A global terrorist group blows up an aircraft and announces it possesses nuclear weapons.

- Beset by a fiscal crisis, states begin to balk at Federal mandates leading to secession actions, militia violence, cyber attacks on the IRS, and demands for a new Constitutional Convention.

- An impasse over the federal budget reaches a stalemate. The government shuts down. The President declares emergency powers. Congress rescinds his authority. Financial markets spiral out of control. Default looms.

These “theoretical” scenarios were put forth in 1997. The authors concluded that these were unlikely, but that no matter what the catalyst, the response by the generations would be predictable. It seems this Fourth Turning is being driven by a succession of smaller triggers, rather than one large trigger. The housing collapse, which began in 2005, ultimately led to the world financial system collapse in 2008. The overreach by government in attempting to repair the damage done by Wall Street and K Street led to the Rick Santelli Tea Party Rant heard round the world in February 2009. The Tea Party movement has since taken the country by storm, surprising the linear thinkers and stunning the ruling elite. Last week a congresswoman and a dozen bystanders were gunned down, further darkening the mood of the country and inflaming passions among competing political ideologies. So what happens next?

Strauss & Howe postulated on the possible path of this Crisis and I see nothing to doubt their analysis:

“An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. It is unlikely that the catalyst will worsen into a full fledged catastrophe, since the nation will probably find a way to avert the initial danger and stabilize the situation for a while.” – The Fourth Turning – Strauss & Howe -1997

The CNBC talking heads, mainstream media pundits, clueless Washington politicians, corrupt Wall Street shysters, and non-thinking robotic masses have been convinced that the actions taken by Ben Bernanke, Barack Obama, Tim Geithner and Congress have averted a financial disaster and saved the world. One hundred years from now when Chinese historians look back on the period from 2000 until 2025 they will ask themselves, “what the hell were they thinking?” The causes of this Crisis are as clear as day to anyone willing to see. A small group of Wall Street bankers and corporate interests through their proxy, the Federal Reserve, created the largest housing bubble in the history of the world generating hundreds of billions in obscene undeserved profits, while destroying the wealth and futures of millions of middle class Americans. Once the fraudulent nature of the bankers’ pillaging of the nation’s wealth came to light, the entire ponzi scheme collapsed, as they always do. On a parallel track, the Federal government, knowing full well that its un-payable social welfare commitments could never be fulfilled, decided to engage in two wars of choice, made additional un-payable social welfare commitments, and created new bloated bureaucratic agencies in the name of security and safety.

What will truly amaze future historians is the “solutions” that our leaders chose to save the country. Despite already being the largest debtor the planet has ever seen, with a National Debt of $8 trillion in 2005, the President and Congress have added an additional $6 trillion of debt, with plans to increase that debt at a rate of $1.5 trillion per year for the foreseeable future. Despite the fact that the housing boom was created by loose monetary policy and non-enforcement of existing laws and regulations by the Federal Reserve, our leaders have allowed this bank owned entity to reduce interest rates to 0%, buy $1.5 trillion of toxic mortgages from the Wall Street banks that caused the crisis, suspend requirements for banks to report their assets at their FMV, monetize the debt spending by the Federal Government, and create inflation through the printing of money out of this air. The Federal government’s response to the crisis was to create a mandated healthcare benefit for 35 million more Americans with no means to pay the untold trillions in future costs. Our leaders’ solution to a crisis caused by excessive debt has been to create twice as much debt. A passage from the Book of Matthew which Abraham Lincoln utilized during a prior Fourth Turning Crisis is a fitting description of where we stand today:

“Every kingdom divided against itself is brought to desolation; and every city or house divided against itself shall not stand.” – Matthew 12:25

The country is deeply divided. There is a vast swath of America that has chosen ignorance over knowledge. With 50% of Americans paying no income taxes, they will vote for anyone who promises them more. The rest of America is split between those who believe the answer lies in increased Federal government coordination and control and those who want a return to liberty, individual responsibility and a vastly reduced Federal government footprint. As I have tried to figure out the most likely path of this Fourth Turning I was focused on an external conflict in the Middle East or an incident on the Korean Peninsula providing the next spark. After the shooting in Tucson, this Fourth Turning is beginning to crystallize.

What I realized was that the three previous American Revolutions all occurred on U.S. soil. The First American Revolution was fought on American soil by a loose confederation of autonomous states against the overbearing control of a great European empire. The Second American Revolution was fought by Americans against Americans and resulted in a vast expansion of Federal government power and diminishment of state power. The Third American Revolution took place under the auspices of saving America from the depths of Depression with government social programs and the birth of the Nanny State. Each Revolution has further expanded the power and control of the Federal government. I believe the Fourth American Revolution will ultimately come down to a battle between the Liberty movement and the ruling oligarchy of Wall Street, Mega-corporations and supporters of the Military Nanny State.

I trust that Strauss & Howe correctly assessed the main factor that will drive the next phase of this Crisis – the Great Devaluation:

“It could be a series of downward ratchets linked to political events that sequentially knock the supports out from under the residual popular trust in the system. As assets devalue, trust will further disintegrate, which will cause assets to devalue further, and so on. Every slide in asset prices, employment, and production will give every generation cause to grow more alarmed. With savings worth less, the new elders will become more dependent on government, just as government becomes less able to pay benefits to them. Before long, America’s old civic order will seem ruined beyond repair.” – The Fourth Turning – Strauss & Howe -1997

There is no doubt in my mind that the next downward ratchet in this Crisis will be caused by Ben Bernanke and his attempt to generate just enough inflation to make our un-payable debt load less burdensome. His track record regarding economic forecasting, assessment of housing prices and anticipation of economic distress is flawless. He hasn’t been right once. With the top 1% richest Americans controlling 42% of the financial wealth in the country, an all-time high, the next leg down will boil over into class warfare. The middle class has been devastated thus far. Another stock market collapse and more job losses would push them over the edge. The evident failure of government solutions will invigorate the Liberty Movement to become even more strident in their anti-government message. The subsequent battle between the Haves and Have Nots is likely to flair into protests, riots and increasing violence. There will be no compromises. The 2012 Presidential election could incite reactions on par with the election of Lincoln in 1860. While the country convulsively flails about, foreign adversaries will take advantage of our weakness. Peak oil will throw a further wrench into the downward spiral. Out of this tempest, the country will either turn to a strong leader and more government control or move back toward a smaller Federal government footprint and a return to rule by the people and for the people. The outcome is unknown, but the path is foreseeable. Let’s hope that Ben Franklin was right.

All of us who were engaged in the struggle must have observed frequent instances of superintending providence in our favor. To that kind providence we owe this happy opportunity of consulting in peace on the means of establishing our future national felicity. And have we now forgotten that powerful friend? Or do we imagine that we no longer need his assistance? I have lived, Sir, a long time, and the longer I live, the more convincing proofs I see of this truth-that God governs in the affairs of men. And if a sparrow cannot fall to the Ground without his Notice, is it probable that an Empire can rise without his Aid?” – Benjamin Franklin, To Colleagues at the Constitutional Convention

“History offers no guarantees. If America plunges into an era of depression or violence which by then has not lifted, we will likely look back on the 1990s as the decade when we valued all the wrong things and made all the wrong choices.” – The Fourth Turning – Strauss & Howe -1997

Reuters

Reuters