“At this juncture, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.” – Fed chairman, Ben Bernanke, Congressional testimony, March, 2007

“Capitalism without financial failure is not capitalism at all, but a kind of socialism for the rich.” – James Grant, Grant’s Interest Rate Observer

The Federal Reserve issued their fourth quarter Report on Household Debt and Credit last week to the sounds of silence in the mainstream media. There were minor press releases issued by the “professional” financial journalists regurgitating the Federal Reserve’s storyline. Actual analysis, connecting the dots, describing how the massive issuance of student loan and auto loan debt has produced a fake economic recovery, and how the accelerating default rates in auto loans and student loans will produce the next subprime debt implosion, were nowhere to be seen on CNBC, Bloomberg, the WSJ, or any other status quo propaganda media outlet. Their job is not to analyze or seek truth. Their job is to keep their government patrons and Wall Street advertisers happy, while keeping the masses sedated, misinformed, and pliable.

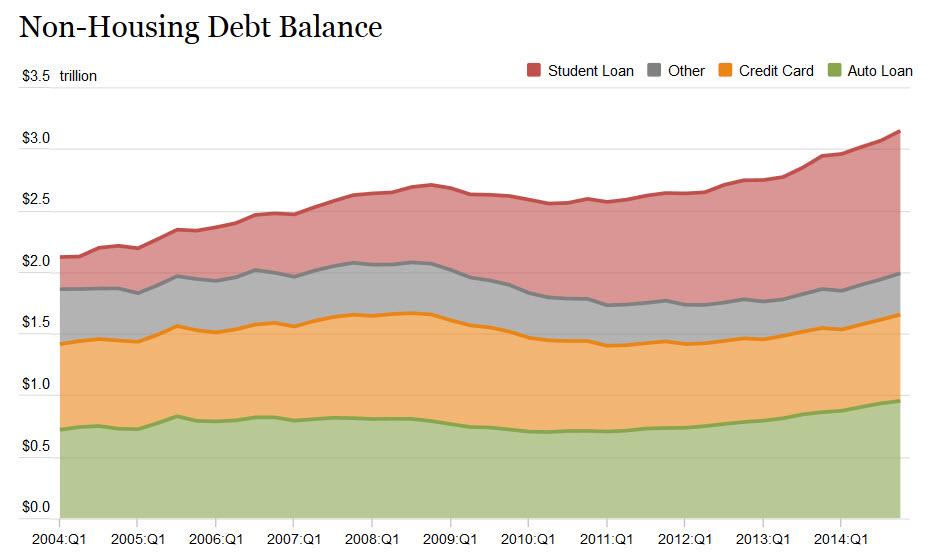

Luckily, the government hasn’t gained complete control over the internet yet, so dozens of truth telling blogs have done a phenomenal job zeroing in on the surge in defaults. The data in the report tells a multitude of tales conflicting with the “official story” sold to the public. The austerity storyline, economic recovery storyline, housing recovery storyline, and strong auto market storyline are all revealed to be fraudulent by the data in the report. Total household debt grew by $117 billion in the fourth quarter and $306 billion for the all of 2014. Non-housing debt in the 4th quarter of 2008, just as the last subprime debt created financial implosion began, was $2.71 trillion. After six years of supposed consumer austerity, total non-housing debt stands at a record $3.15 trillion. This is after hundreds of billions of the $2.71 trillion were written off and foisted upon the backs of taxpayers, by the Wall Street banks and their puppets at the Federal Reserve.

The corporate media talking heads cheer every increase in consumer debt as proof of economic recovery. In reality every increase in consumer debt is just another step towards another far worse economic breakdown. And the reason is simple. Real median household income is still below 1989 levels. The average American family hasn’t seen their income go up in 25 years. What they did see was their chains of debt get unbearably heavy. Non-housing consumer debt (credit card, auto, student loan, other) was $800 billion in 1989.

The 300% increase in consumer debt, while incomes stagnated, has created a zombie nation of debt slaves. And this doesn’t even take into account the quadrupling of mortgage debt from $2.2 trillion in 1989 to $8.7 trillion today. This isn’t Twelve Years a Slave; it’s Debt Slaves for Eternity. And who benefits? The Wall Street bankers, .1% oligarchs, and corporate fascists pulling the levers of government and society benefit. An economic and jobs recovery for working Americans is nowhere to be seen in the chart below.

Total debt on the balance sheet of American consumers (formerly known as citizens) now tops $11.8 trillion, up from the $11.1 trillion trough in 2013. The peak was “achieved” in a frenzy of $0 down McMansion buying, Lexus leasing, and Home Equity ATM extraction in 2008, when the total reached $12.7 trillion. The $1.6 trillion decline from peak insanity had nothing to do with austerity or Americans reigning in their debt financed lifestyles.

The Wall Street banks took the $700 billion of taxpayer funded TARP, sold their worthless mortgage paper to the Fed, suckled on the Fed’s QE and ZIRP, and wrote off the $1.6 trillion. Wall Street didn’t miss a beat, while Main Street got treated like skeet during a shooting competition. Every solution proposed and implemented since September 2008 had the sole purpose of benefitting the criminals on Wall Street who perpetrated the largest financial heist in world history. The slogan should have been Bankers Saving Bankers Since 1913.

The average American benefited in no way from the government/banker bailout. Their wages have deteriorated, their daily living expenses have risen, Obamacare has resulted in higher healthcare premiums, higher co-pays, more part-time jobs, less full-time jobs, and less healthcare choices for the working class, while Wall Street generates billions in risk free profits, bankers and corporate executives reap massive million dollar bonuses, and the .1% parties like its 1999. Rising wealth inequality has been systematically programmed into our economic system by bankers and their bought off puppet politicians in Washington D.C. – Corporate fascism at its finest.

The lack of real economic recovery for the average American has been purposely masked through the issuance of $500 billion of subprime student loan debt and $200 billion of auto loan debt (much of it subprime) since 2010 by the Federal government and their co-conspirators on Wall Street.

The issuance of debt by the government to people not financially able to repay that debt, in order to generate economic activity and boost GDP is nothing more than fraudulent inducement using taxpayer funds. Debt financed purchases is not wealth. Debt financed consumption does not boost the wealth of the nation. If adding debt produced economic advancement, why has the number of Americans on food stamps escalated from 33 million in 2009 to 46 million today during a five year economic recovery? Why have 10 million Americans left the labor force since 2009, pushing the labor participation rate to 30 year lows, during a jobs recovery?

Why have social benefits distributed by the Federal government surged by $2.5 trillion since 2012, reaching a record high of 20.8% of real disposable income? It resides 33% above 2007 levels and still above levels during the depths of the recession in 2009. But at least the stock market hits record highs on a daily basis, creating joy in NYC penthouse suites and Hamptons ocean front estates. American dream for the .1% achieved.

Does this look like Recovery?

When you actually dig into the 31 page Federal Reserve produced report, anyone with a few functioning brain cells (this eliminates all CNBC bimbos, shills, and cheerleaders), can see our current economic paradigm is far from normal and an economic recovery has not materialized. Record stock market prices and corporate profits have not trickled down to Main Street. Janet, don’t piss down my back and tell me it’s raining (credit to Fletcher in Outlaw Josey Wales). The mainstream media spin fails to mention that $706 billion of consumer debt is currently delinquent. That is 6% of all consumer debt.

Could the Wall Street banks withstand that level of losses with their highly leveraged insolvent balance sheets? The number of foreclosures and consumer bankruptcies rose in the fourth quarter versus the third quarter. Does this happen during an economic recovery? Donghoon Lee, research officer at the Federal Reserve Bank of New York, may be looking for a new job soon. When a Federal Reserve lackey actually admits to being worried, you know things are about to get very bad very fast.

“Although we’ve seen an overall improvement in delinquency rates since the Great Recession, the increasing trend in student loan balances and delinquencies is concerning. Student loan delinquencies and repayment problems appear to be reducing borrowers’ ability to form their own households.”

And he didn’t even mention the increase in auto loan delinquencies which will eventually morph into a landslide of bad debt write-offs, repossessions, and Wall Street bankers demanding another bailout. The pure data in the Fed report doesn’t tell the true story. The $306 billion increase in outstanding debt only represents a 2.7% annual increase. And even though mortgage debt increased by $121 billion, it was on a base of $8.17 trillion. That is a miniscule 1.5% increase. A critical thinking individual might wonder how national home prices could rise by 25% since the beginning of 2012, while mortgage debt outstanding has fallen by $220 billion over this same time frame, and mortgage originations are hovering at 1997 levels.

It couldn’t have been the Wall Street/Fed/Treasury Dept. withhold foreclosures from the market, sell to hedge funds and convert to rental units, and screw the first time home buyer scheme to super charge Wall Street profits and artificially boost home prices. Could it? New home sales prices and new home sales were tightly correlated from 1990 through 2006. Then the bottom fell out in 2006 and new homes sales crashed. Nine years later new home sales still linger at 1991 recession levels. New home sales are 65% lower than they were in 2005, but median prices are 20% higher. This is utterly ridiculous.

If prices had fallen to the $100,000 to $150,000 level, based on the historical correlation, first time home buyers would be buying hand over foot. But the Federal Reserve, their Wall Street owners, connected hedge funds, and the Federal government has created an artificial price bubble with 0% interest rates and trillions of QE heroin. The 1% can still afford to buy overpriced McMansions, but the young are left saddled with student loan debt, low paying service jobs, and no chance at ever owning a home.

The chart that puts this economic recovery in perspective is their 90+ days delinquent by loan type. If you haven’t made a payment in 90 days or more, the odds are you aren’t going to pay. The Fed and the ever positive corporate media, who rely on advertising revenue from Wall Street, the auto industry, and the government, go to any lengths to spin awful data into gold. Their current storyline is to compare delinquency levels to the levels in 2009 at the height of the worst recession since the 1930s. Mortgage delinquencies have fallen from 8.9% in 2010 to 3.2% today (amazing what writing off $1 trillion of bad mortgages can achieve), but they are three times higher than the 1% average before the financial meltdown. Is that a return to normalcy? Home equity lines of credit had delinquency rates of 0.2% prior to the 2008 meltdown. Today they sit at 3.2%, only sixteen times higher than before the crisis. Is that a return to normalcy? Do these facts scream “housing recovery”?

The outlier on the chart is credit card delinquencies. The normal, pre-crisis level hovered between 9% and 10%. Banks can handle that level when they are charging 18% interest while borrowing at .25% interest. During the Wall Street created recession, delinquencies spiked to 13.7%, but after writing off about $150 billion of bad debt and closing 100 million credit card accounts, delinquencies miraculously began to plunge. Delinquencies have plunged to 7.3% as credit card debt still sits $170 billion below the 2008 peak. This is a reflection of Americans depending on their credit cards to survive their everyday existence.

With stagnant real wages and household income 7% below 2008 levels, the average family is using their credit cards to pay for food, energy, clothing, utilities, taxes, and medical expenses. They are making the minimum payments and staying current on their payment obligations because their credit cards are the only thing keeping them from having to live in a cardboard box. A Bankrate.com survey this week revealed 37% of Americans have credit card debt that equals or is greater than their emergency savings, leaving them “teetering on the edge of financial disaster.” Greg McBride, Bankrate.com’s chief financial analyst sums up the situation:

“Not only do most of them not have enough savings, they’ve all used up some portion of their available credit — they are running out of options. People don’t have enough money for unplanned expenses, and if they have more credit card debt than emergency savings, it’s a double whammy. In the event of unplanned expenses, their options are limited.”

Who doesn’t have an unplanned expense multiple times in a year? A major car repair, appliance repair, hot water heater failure, or a medical issue is utterly predictable and most people are unprepared to financially deal with them. As many people found in 2009, credit card lines can be reduced in the blink of an eye by the Wall Street banks. This potential for financial disaster is why Americans are doing everything they can to stay current on their credit card payments. That brings us to the Federal Reserve/Federal Government created mal-investment subprime boom 2.0, which is in the early stages of going bust.

I’ll address the Subprime bust 2.0 in Part Two of this article.

It looks to me like the youngsters are taking themselves out with student loan debt, creating an entire generation of debt slaves.

[img [/img]

[/img]

Looks like Admin hits another one out of the park. And no one can deny your facts. Looking forward to part two!

I remember right before the beginning of the Greater Depression, there was a bill passed that increased the minimum payments on credit cards to some minimum percentage of the balance. I was in the Army at the time living paycheck to paycheck, and that little change combined with a simultaneous increase in gas prices to well over $4.00 a gallon in upstate NY where I had the misfortune to be stationed, pushed me to the brink of insolvency… The only thing that saved my ass was impending deployment with all the various additional pays plus tax free status; I got my fiscal house in order ASAP!!!

However, it was not long after the change in minimum payments plus the fuel price hike that the economy hit the skids. In retrospect it seemed obvious. Makes one wonder what will be the catalyst that finally brings down the house of cards, and how much time we have remaining. I don’t think we will get off so lightly this time…

With all the doom please don’t forget to enjoy the day you are standing in, you only live once. Enjoy listening to my friend and fellow Arkansan J Edwards, he’s awesome!

http://youtu.be/mEWFs5ODmAE

And if all that isn’t crazy enough, recently every time I drive my car I hear the same commercial. It’s some type of program to teach you how to make you fortune flipping houses; No money- doesn’t matter, bad credit- doesn’t matter. Make an easy $75,000 on the average flip.

WTF?

Admin – thanks once again. Great article. It ties in with my recent running battle re manufacturing, that the core issue is debt driven consumption.

I read where a lot of student loan money is being funnelled into living expenses – ie the loans are being used as income to pay rent, buy food, keep the mortgage going.

The increasing auto debt is astonishing. Anyone buying a car that does not have the ability to pay cash for it is screwing up in a big way. Note I did not say it should not be financed – at zero per cent financing may be a good option. Nonetheless if you do not have the ability to pay cash, you should not buy a car on credit. It is a recipe for a vicious circle of debt.

Re homes, there is no way prices will fall precipitously so long as the cost to build is high. The current cost of building is absurdly high. Add all the govt charges onto the build price, and costs are absurd. And that is not considering the cost of land. If the young are prepared to live in a prefab, the may be able to get something built for a reasonable price. But a true house is expensive to build, and will prop up home prices.

Admin – I wrote you a note with the drachmas I sent. I think it is nearly time for me to describe my doomstead and get out of Dodge plans in some detail to folks around these parts. I will post an article.

I have decided to opt out of the rat race, and am going somewhere I can ignore the world,and live a simpler life around people that are salt of the earth. I am setting up my affairs so as to be free of tax, save for property tax. In fact, I am going to be able to recover some of what I have put in over the years. That is not impossible for me due to things I put in place decades ago, but for most others what I am doing is impossible.

I no longer am willing to be a milch cow. Someone else can keep the FSA funded. It will not be me. I will work some land, travel, and be free of the yoke of tax slave.

I can hardly wait.

Thanks again.

Sensetti,

I don’t blame the youngsters; after all when you are young you do stupid things and it is up to those of us who are older and wiser to try and keep those with less common sense from totally fucking up their lives before they begin…

No, the blame on this goes to the Oreo and his cocksucking bankster pals who deliberately created this debt servitude. How hard was it before to get a student loan when you actually had to go to a bank and get them to sign off on your borrowing along with a cosigner? How much more valuable was your degree before every Tom, Dick, and Harry with a pulse and no other qualification could borrow 10k+ a year and compete for scarce college slots, raising the cost exponentially, simultaneously increasing, and dumbing down the pool of available graduates?

If the objective of the head (half)negro-in-chief was to make it easier for the lower classes to go to college then I guess he succeeded. Now every moron who can find their way to a student aid office can go to college… Maybe his goal all along was to trap a generation of young people in the chains of debt servitude; after all, when martial law is imposed and the draft is reactivated, this will be a surefire way of guaranteeing compliance. Waive the debt in return for service? Maybe that will be used for all of us with debt; go along with the regime and follow orders in return for easing the burden of debt… The only true power any government has is the power to punish criminals, and when there are not enough criminals the government must make more of them…

You’ve proven yourself to be a real winner with your racial slurs. Why dont you grow up and leave that bullshit out. For some reason any credibility seems to escape your sway when I hear Nigger

Sensetti and The Burning Platform –> ” I started thinking bout leavin the first time I pulled in, looking away everyday I made my way back again, it hurts me so wondering if I go, I”ll be gone for good” J Edwards

One more

http://youtu.be/5RmFubx5j9A

In unrelated news, the city of Chicago has had their credit rating downgraded to Triple-Rahm.

https://ca.news.yahoo.com/exclusive-chicago-rating-downgrade-could-end-swaps-deals-174532024–finance.html

Re: Llpoh

Atlas is shrugging an omen of things to come.

The truth of the matter is that far too many are far too dependent on a system that is far too broken. The weight of that is enormous, far more than all of the facts and data ever published. There will be a wailing and a gnashing of teeth.

Llpoh, you should seriously consider coming out for a visit before you go full Galt.

“But at least the stock market hits record highs on a daily basis, creating joy in NYC penthouse suites and Hamptons ocean front estates. American dream for the .1% achieved.”

And, American soldiers still busy protecting our freedoms in 150 different countries ! USA! USA! USA!

+10000….another great view from the abyss , admin…careful not to stare too long.

***** BREAKING NEWZZ *****

Admin just passed Barry Bonds as the all time home run leader. Nice job!

[img [/img]

[/img]

Admin has said before that he doesn’t write in order to get an “Attaboy!”, like I did above. But, I don’t know what else to add when Admin covers EVERYTHING so damn thoroughly.

Maybe one thing. I understand PERSONAL debt and the dangerous horrors thereof.

I don’t understand national/government debt. They’re just numbers. When the government “lends” Ukraine $50 billion dollars, does money actually change hands? I don’t think so. It’s just bit&bytes entered in a computer. It’s unreal … literally, as in not real money, ever. And it seems that this shit can go on forever.

I apologize in advance for my ignorance. I just can’t wrap my mind around the meaning of these ginormous amounts of (debt) money.

Car sales efforts by dealers are beyond ridiculous. Saw an ad yesterday for an Orlando KIA dealer that advertised: No down, no interest and no payments for one year.

Pick one up, drive it for a year and give it back..

Makes sense to me!

MA

I’ll tell you what the meaning of all that debt, stuck. It means the banking cartel gets to skim the earnings of people who had nothing to do with that debt for the rest of their lives. Already in a town near you, you just don’t realize it, yet. Why do you think obongo is always calling spending on infrastructure? What he really wants is borrowing for infrastructure. So later, the banks can say you owe us, for the party you’ve been having. How about you give us your airport, and we’ll call it even? See greece

Once again another fucking racial slur if you think a “nigger ” came in and orchestrated a meltdown of our entire system I am surprised you even know how to log into your computer. Please it is tremendously more helpful to set your racial hatred aside long enough to complete a thought.

Thank you in advance.

RE the cost of housing. I work in commercial construction and the cost of building is sky high. My dad was a contractor in the 50’s-70’s. This ain’t my dads economy!!! My direct labor cost for a union carpenter in a large metro area approaches $70 per hour. $ 39 wages/ $15 benefit package and another $16 in BS…. The cost of materials has hit bottom and has equalized. It cost a certain amount of $$$ to mill a 2×4.or create a sheet of plywood or OSB and still make a few dollars. Every contractor I know has been and still is in survival mode. We make enough to pay our bills, pay our people and go to the next job. None of us can afford new equipment. As you drive by job-sites just look. No new trucks, no new material handlers etc…. Yet the cost of a house or a new building is too high. Not only are housing prices going to come crashing down so are all cost including wages…. It is not going to be fun. Everything is going to come to a screeching halt. In one day there will be no jobs at all, overnight it will happen. Everything and everyone is stretched too the limit.

I love building. It is in my blood. Wood has been in my family for generations, but this is not my dad’s or grandpa’s economy and things are not going to end well.

“Wood has been in my family for generations, …” —– Constman54

Mine too. Sometimes all I got left is good wood.

Your short post is very informative …. and very very scary.

Republicans are too stupid to be allowed to oversee a portable toilet , much less the world’s largest economy…asshats one and all.

Senate Republicans Bungle Their Interrogation of Janet Yellen

http://mises.org/library/senate-republicans-bungle-their-interrogation-janet-yellen

Jim has an amazing way of intaking massive amounts of information, sorting the wheat from the chaff, organizing it, and presenting it in a concise, organized way that most reasonably well educated people might begin to understand. We used to call guys like jim, fundemental economists. The problem is that their are entire industries (MSM, politics, economists) devoted to muddying that message.

Good job Jim , thanks for all you do.I really mean that. bb

Sensetti says–“It looks to me like the youngsters are taking themselves out with student loan debt, creating an entire generation of debt slaves.”

One is only a debt slave if one agrees to the terms of his or her enslavement. Things that can’t be repaid, won’t be repaid. The Millennial s is wedded to the belief that the system is fair and should be supported for the good of all. All? (Think the greedy generation, AKA Boomers, and the 1%. When the Millennial s realize the reality of their one sided exploitation, they will renege on the debt en mass, as they should, laws not withstanding. A law that is not a moral law, is no law. No man is born a slave, except that he accepts the yoke of another.

The purpose of MSM propaganda, net neutrality, and lies from our elected professional politicians is to keep reality from rearing its ugly head. Goebbels and Bernays, not withstanding, propaganda is never decisive in running rough shod over truth. Lies have their day, truth is for eternity.

Re: Muck: Car sales efforts by dealers are beyond ridiculous.

The financial arm of the mfgs. are bundling the (mostly subprime) cars loans as CDOs, and selling them off – probably to corrupt pension fund managers, because nobody would buy this stuff with their own money. I’d be expecting lower car sales going forward, too, because those 7+ year loans have cannibalized their future car sales. The implosion should be entertaining to watch, when it comes.

See also: rental property backed bonds.

Llpoh the Essene—You’re going to bail? Taking it on the lam, are you? There is a satisfaction, a fulfillment, in “being very much your own man “, in control of your own destiny. I guess you are seeing an unflattering future as present conditions foretell. Noah was in the same boat. (pun intended).

I believe, as does James Howard Kunstler, that community is the future. A place where real democracy can flourish. Not the kind of Democracy spouted by BO and the Neo Cons as they are dropping bombs on innocents, making the world ‘safe for Democracy’. A world where you have an illusion that your vote counts or that voting counts. No! A community where friends and neighbors work out a future, where your say has meaning. A decentralized democracy.

I know what you’re thinking, “that ain’t never going to happen”. It will. I believe what the angels told Howard Storm…God is going to “change the consciousness of man and return man to his true relationship with Him”.

So, Llpoh, remember that for one to survive, one need family and community. It’s always been like that.

And if llpoh high tails it to the reservation, wont he have family and community?

Constman54–As one who has done every job in the construction trade, I know from where you speak. I, too, liked the creativity of working with my hands, looking at the finished product with a sense of satisfaction. That was a good feeling. What happened???

Alan Greenspan, the FED head, created a bubble in housing, which popped in 2006-2007. The era of liar loans. Houses, condos could be bought and turned for a fast profit. The era of the ‘greater fool theory’ (I don’t care what it cost, some fool will come along and pay me more for it).

Build, build, build…one could do no wrong. Soon, there was a glut of houses and condos and soon, the idea of unlimited demand evaporated as fast as the price of Beanie Babies. Kinda like the ‘tulip craze’.

Make no mistake, Alan Greenspan as well as his co conspirators in congress were wholly responsible for the ensuing collaspe. (Think Chris Dodd and Barney Frank, et al). Those are two names that deserve to be relegated to the dustbin of history.

Today, we have gov regulations impeding the building industry. It is regulated to death, literally. New regs are increasing every year from our central planners, increasing cost. You can buy a house cheaper

than you can build one.

Also, the Boomers are retiring at a rate of 10,000 per day. The people have raised their kids and no longer need as large a house. This increases the housing glut. Real Estate can expect a 40% decline in prices. (Harry Dent) Even then, no jobs, no demand for houses.

It is a bleak future for builders, I’m afraid and I’m not seeing a return to the way it was in the late 40’s, 50’s and 60’s anytime in the far future. Most of my friends are doing remodels to keep the wolf away from the door. Bad news!

words of wisdom

[img [/img]

[/img]

LISTEN CLOSELY GUYS,I had a visit from my dear friend THE LORD,…HE had the TWO witnesses with him and they TOLD ME, WAR IS UPOND US,this nation will be destroyed unless everyone GETS READY and I mean FAST,were out of time.WAR will be upond the nation soon,and TO FEW are ready for it……………..

OH,heck,I forgot,they told me TO START BOXING UP EVERY THING I WOULD BE NEEDING AT OUR BUG OUT LOCATION,and GET READY TO GO…………..

One more we are all feeding at the government trough (majority of contractors). 60-70%,of our work is tied to the government in some way. New library, private owner with government financing, private owner with gov’t tax breaks, school remodels and new……. All the private work is done by contractors who pay cash. It’s an underground economy… They pay little to no workers comp, little to no payroll tax and there work is crap for the most part, but their price is 40% lower…. Because the economy is so squed with corporate welfare and poor guy welfare it is next to impossible to run an honest operation and be profitable. Not impossible, but you find yourself depending on the f-ing government for work one way or another.

What I see is we have all become so dependent and entitled that when the SHTF no one will no what to do. No one can even fix there own toilet anymore!! My son is a freshman in college and I made him work on a site all last summer. But dad it’s my “last” summer with my friends…… You entitllied little shit get out there and work!! I told him a young man MUST learn to work with his hands!! And not that Stucky!! A time will come when he will know things no one knows anymore. He actually worked great. He knew I would kick his ass if he came off as the entitled bosses son. And he admitted he enjoyed the work.

All that to say we all feed way too much at the gov’t trough!! And the only way to get off of it is for it to come crashing down!! It’s gunna hurt though and I don’t look forward to it.

FYI: that chart showing total new sales vs median price scares the shit out of me. It show massive deflation is on the way and our quality of life is going to take a huge hit.

Everyone around Tallahassee seems to be talking about how much house prices have fallen. Greece did a swan dive off one of their Olympic towers expecting somebody to refill their pool but they might do a bloody belly flop this week (three big loans are due in March) and the banksters & PIIGS will follow; and oil stocks & loans, many bonds, student loans, and probably sub-prime cars. I don’t think your teleprompter’s speeches are going to turn all the economic charts pointing down now back up Mr Hopey-changey…

Jim, I rarely agree with everything you write, and I don’t this time. But instead of discussing our differences, I must commend you on your use of the Federal Reserve notes, charts and graphs and deciphering them in your own style. You are tops there.

One area of debt service which you did not cover in this recent post of your was what the current price of oil will be doing to balance sheets everywhere in the oil plays. I wrote about it this morning after reading a great warning shot from Bloomberg earlier.

Last quarter, the “paper price” of oil was $95 a barrel for accounting purposes in the oil sector accounting offices. This current quarter (Q1), and important date has just passed: the first trading day of March.

I explain in detail why the closing price of oil on March 2nd (this past Monday) is so important and what that third monthly opening date for this quarter (Q1) portends for balance sheets in next month’s Earnings Reports in the Oil game.

Keep up the great work you do. All I ask is you dial back on the conspiracy theory assumptions.

– Rock

http://360horizon.blogspot.com/2015/03/oil-sector-stocks-are-cruising-for-more.html

The US are a corporatocracy, a form of oligarchy where a tiny minority of big corporations, lobbies, banks and corrupt officials&media are leagued together to control the country.

Everyone knows that elections are won by the party who receive more donations from lobbies and corporations.

In fact, the presidency is bought at its base. We also know that most congress members are linked to big corps and often millionaires and represent only the happy few and not American people.

The most bizarre thing is that American have become so manipulated by media and think thanks, that they continue to vote for the same two parties without wondering why their country is going down a bit more every year.

Americans, time to wake up before it’s too late

Barack Hussein Obama, a muslim by birth has now succeeded in being worse than his predecessor, GW Bush.

Obama answers only to the interests of big corps:

Allowing Shell to drill in the Arctic

Helping Monsanto destroy the planet

Pushing hard ofr the TTIP which is an attempt from big corporations to crush democracies

Subsiding, helping promoting fracking and destroying the planet and entire communities

He also answers to totalitarian religious fascist regimes like saudi arabia

By destroying the only last stable states in the middle east (Syria, Libya), helping islamist terrorist groups to rise and thus creating the so called “islamic state”.

Therefore helping to create terrorists states in the region and fueling the current illegal immigrant crisis in Europe, in reality a muslim invasion disguised as a refugee crisis.

Waging an unnecessary and stupid war against Russia, toppling stable regime and destroying countries like Ukraine.

Helping Iran get an atomic bomb.

With what happens in Ferguson and other places, destroying the social fabric of the USA.

etc…

If this guy would destroy the planet, the USA, the western world and an entire civilization, he wouldn’t proceed otherwise.