‘If you’re committed enough, you can make any story work. I once told a woman I was Kevin Costner, and it worked because I believed it’ – Saul Goodman – Breaking Bad

“As calamitous as the sub-prime blowup seems, it is only the beginning. The credit bubble spawned abuses throughout the system. Sub-prime lending just happened to be the most egregious of the lot, and thus the first to have the cockroaches scurrying out in plain view. The housing market will collapse. New-home construction will collapse. Consumer pocketbooks will be pinched. The consumer spending binge will be over. The U.S. economy will enter a recession.” – Eric Sprott – 2007

In Part One of this article I provided the background of how our current debt saturated economy got to this point of ludicrousness. The “crazy” bloggers, prophets of doom, and analysts who could do basic math were warning of an impending financial crisis in 2006 and 2007, which would be caused by the issuance of hundreds of billions in subprime slime by the Too Big To Trust Wall Street shysters. Subprime mortgages, auto loans, and credit card lines provided the kindling for the 2008 conflagration.

Under normal circumstances we wouldn’t have seen such irrational, reckless, greedy behavior from Wall Street for another generation. But, Wall Street didn’t have to accept the consequences of their actions. They were bailed out and further enriched by their puppets at the Federal Reserve, the lackey politicians they installed in Washington D.C., and on the backs of honest, hard-working, tax paying Americans. The lesson they learned was they could continue to take excessive, reckless, unregulated risks without concern for losses, downside, or consequences.

In reality, the Fed and government have worked in tandem with Wall Street to create the subprime economic recovery. The scheme has been to revive the bailed out auto industry by artificially boosting sales through dodgy, low interest, extended term debt. With the Feds taking over the entire student loan market, they have doled out hundreds of billions to kids who don’t have the educational skills to succeed in college, in order to keep them out of the unemployment calculation.

That’s why you have a 5.7% unemployment rate when 41% of the working age population (102 million people) is not working. The appearance of economic recovery has been much more important to the ruling class than an actual economic recovery for average Americans, because the .1% have made out like bandits anyway. Who has benefited from the $650 billion of student loan and auto debt disseminated by the oligarchs in the last four years, the borrowers or lenders?

The Fed chart that reveals how warped the economy has become in the last few years is the one showing number of loan accounts by type over the last twelve years. For the first decade, the number of mortgage loans was greater than auto loans by a significant margin. Since the beginning of 2013 the number of auto loans has soared past the number of mortgage loans. And this happened during a supposed housing recovery. Have people decided living in a car is a better deal than living in a home? Why the surge in auto loan accounts?

The avalanche of auto loans was initiated by the Obama administration and their fully controlled bankrupt finance company Ally Financial (formerly known as the upstanding subprime lenders GMAC, Ditech, ResCorp) after the American taxpayer handed them $12 billion of TARP. The Feds took control of Ally in early 2009 and decided to maintain control of this entity longer than any other TARP recipient, until 2014. I wonder why?

As the biggest lender in the auto space and main lender for bailed out automakers GM and Chrysler, doling out high risk loans to boost auto sales would make Obama look like a genius for saving GM and keeping their union workforce voting Democrat. The Wall Street banks couldn’t let Ally Financial capture all the easy profits. The Fed’s ZIRP gave the green light for auto lenders to borrow billions at 0% and lend it out to anyone who could fog a mirror. And they have. When you borrow at 0% and lend to deadbeats at 10%, you can deal with substantial losses knowing you always have the Yellen Put when things blow sky high.

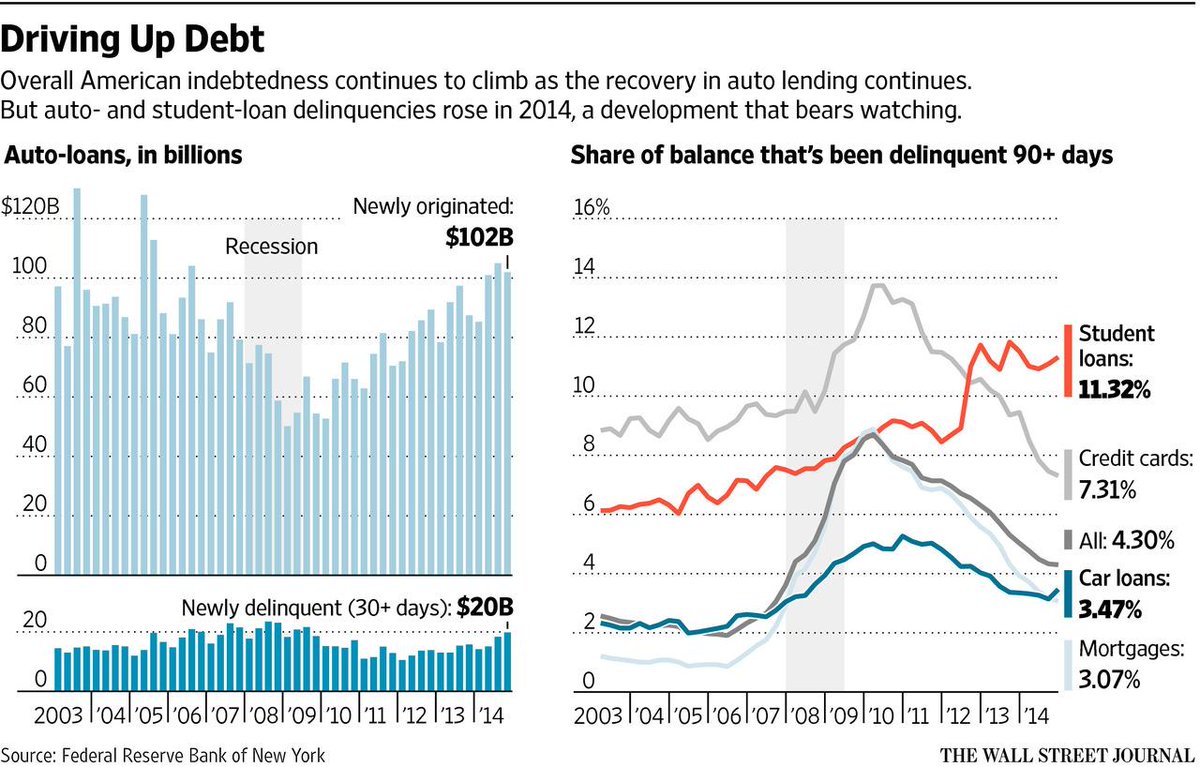

The Fed report downplayed the 13% surge in seriously delinquent auto loans in one quarter, from 3.1% to 3.5%. This is just the seriously delinquent loans and amounts to $33 billion. The chart below paints a dire picture of the future. The financial industry originated $102 billion of new auto loans in the fourth quarter, but $20 billion entered delinquency status. That is almost 20%. During 2012 this percentage was closer to 12%, as only $10 billion entered delinquency status. I wonder if the tripling in issuance of subprime auto loans since 2009 has anything to do with the delinquencies. Subprime auto loan issuance has swelled from 20% of all loans in 2009 to north of 30% and are approaching the pre-disaster era of 2006. Auto loans to consumers rated below prime comprised 38.7% of all outstanding loans as of the third quarter 2014. We all know how the last subprime boom worked out. The NYT sums up the current situation:

More than 2.6% of car-loan borrowers who took out loans in the first quarter of last year had missed at least one monthly payment by November, the highest level of early loan trouble since 2008 [and] more than 8.4% of borrowers with weak credit scores who took out loans in the first quarter of 2014 had missed payments by November [also] the highest level since 2008, when early delinquencies for subprime borrowers rose above 9%.

Think about that for a second. One out of twelve subprime auto loan borrowers was delinquent on their payments in the first nine months of their loan. I guess they thought they could use their SNAP card for car payments. Let them eat Cadillac Escalades.

The auto loan delinquency rates reported by the Fed, captured credit reporting agencies (Experian, Equifax), and the corporate mainstream media dramatically underestimates the true picture. In a scathing recent report, The Center for Responsible Lending dismantles the positive storyline being spun by the purveyors of propaganda at the Fed and their Wall Street owner peddlers of debt. Some pertinent facts in the report are as follows:

- The dollar value of originations to people with credit scores below 660 has roughly doubled since 2009, while originations for the other credit score groups increased by only about half. Likewise subprime auto loan securitization issuances stood at $13.7 billion in 2013, more than 12 times the issuance since 2009.

- In every quarter since 3Q 2013, repossession rates have been significantly higher than the same quarter in the previous year. Most alarming, the 2Q 2014 repossession rate was 70% higher than 2Q 2013.

- The speed of repossession also creates an environment where a spike in the repossession rate can occur without a parallel spike in seriously delinquent accounts. Lenders can initiate repossession if they believe the collateral is under threat. As such, it is very likely that as signs of a deteriorating market become clear, lenders accelerate repossession at an earlier point in delinquency. In many markets, a rise in delinquencies serves as a harbinger of potential defaults. In this market, delinquency rates can remain artificially low due to the quick repossession process.

- Lenders routinely allow dealers to make loans that exceed the value of the car. LTV ratios above 100% allow a dealer to finance additional insurance products, such as extended warranties and credit insurance policies. Higher LTV ratios also allow dealers to finance “negative equity”, which is the amount that is still owed when a trade – in vehicle is worth less than the outstanding balance of the loan on the trade – in.

- To make monthly payments seem affordable on larger auto loans, lenders are extending loan terms to as long as 96 months. Longer loan terms result in the borrower owing more than the car is worth for the bulk of the loan term. The Office of the Comptroller of the Currency (OCC), which regulates national banks, recently warned that, “The average loss per vehicle has risen substantially in the past two years, an indication of how longer terms and higher LTVs can increase exposure.”

The Federal Reserve used to report on a monthly basis regarding the average LTV, maturity, and average amount financed for all car loans. They abruptly stopped reporting this info as of 2012, just as the subprime auto boom launched. They have provided no rational for stopping this reporting. The data is readily available and the Center for Responsible Lending details the data in their report. It’s clear why the Fed doesn’t want to provide the data – because it proves how outrageously reckless the banks have become under the Fed’s regulatory reign of nonchalance. The last time the Fed reported this data in 2011, here was the data:

Average Loan to Value Ratio – 80%

Average Maturity – 62.3 months

Average Amount Financed – $26,673

That was then. This is now:

Average Loan to Value Ratio – 110.4%

Average Maturity – 65 months

Average Amount Financed – $27,430

It is mind bogglingly ludicrous for financial institutions to loan 110% of the value of a vehicle over a seven year term when the vehicle depreciates by 10% the moment you drive it off the lot and 50% in the first three years. It is even more preposterous for these financial institutions to loan 126% of the value of a vehicle for 71 months at 10% interest to someone without the means, income, or willingness to repay the loan. But, these are the current terms offered to subprime borrowers. Would a rational lender who followed basic risk management methods ever make such a high risk loan, without trusting the Federal Reserve will rescue them when these loans blow up in their face? Could this massive mal-investment occur if the Fed’s QE and ZIRP monetary policies were not propping up Wall Street? Not a chance. So, we know who wins. But who loses?

Subprime loans are used by sophisticated Ivy League educated MBA bankers to lure over-indebted, lower income, lower educated, easily manipulated Americans with bad credit (they’ve defaulted before), into high interest auto loan debt with promises of easy payments on their very own luxury SUV. It’s like Christmas has arrived and Ally Financial is Santa Claus. The longer the term, higher the loan amount, and the higher the interest rate, the better for the lender – because the lender isn’t bearing the risk. Sound familiar? It’s back.

The subprime loan securitization market is booming again. Who cares if Ally, GM Financial, and a slew of other subprime lenders are under investigation by the DOJ for the underwriting criteria they used on securitized subprime auto loans as well as the representations and warranties related to these securitizations. Private equity firms are filling the yield gap with good old fashioned slicing and dicing of subprime auto loan tranches – and get this – many rated AAA by the upstanding rating agencies S&P and Moodys. How could this possibly go wrong?

It seems Blackstone isn’t only the lead player in the buy to rent housing price scheme, but they are a major player in the subprime auto loan scheme. Wolf Richter explains:

Subprime auto lender Exeter Finance, which PE firm Blackstone Group bought in 2011, exploded its portfolio from $150 million to $2.8 billion in three years. It has now become America’s third-largest issuer of subprime auto-loan structured securities. It too received subpoenas from the DOJ and other agencies. And it has been losing money for three years. American Banker took a look at a $500-million securitization the company sold last August and found a doozy:

The average APR on those loans was 18.59%. The original term length was 70 months. 75% of these loans had a loan-to-value ratio of over 105%. Eighty-one percent of the borrowers had a FICO score of below 600. And yet some of the securities that these loans are turned into are rated AAA.

The desperate reach for yield in a zero interest rate environment created by the Federal Reserve has generated this latest subprime disaster in the making. The Federal Reserve’s only tool is to create new bubbles when their old bubbles cause hundreds of billions in damage to the real economy and real people. These toxic subprime auto loan securities are being bought by pension funds, life insurance companies, and mutual funds in a frantic effort to reach their yield goals when 10 Year Treasuries yield 2%. When it all goes to hell, little old ladies, pensioners, and conservative investors will be screwed again. It’s so clear, even the Fed can see it coming.

At lower-rated and unrated nonfinancial businesses, however, leverage has continued to increase with the rapid growth in high-yield bond issuance and leveraged loans in recent years… new deals continue to show signs of weak underwriting terms and heightened leverage that are close to levels preceding the financial crisis. – Federal Reserve Quarterly Report

If you think the subprime borrowers in the auto market are high risk, you haven’t seen anything yet. In Part Three of this article I’ll address the student loan debacle and the coming worldwide debt implosion which will change the world forever.

Jim, stop it. Didn’t you watch the state of the union? Obama says the crisis has passed. Who am I going to listen to, some little doom and gloom blogger, or the presdent of the united states. Gotta go, housewives is on.

@Admin: You’re laying out your case very well. I can’t disagree with any of it so far and look forward to part 3!

So . . . it’s even worse than I thought? Fantastic.

Fun fact: Sector rotation was invented by locust.

The world has gone full retard. 96 month auto loans? Most cars a scrap material by then. Do they really expect some guy flipping burgers is going to pay off the loan on his Escalade?

But the insanity is not limited to sub-prime losers. We’ve had ZIRP for more than six years here. $3.8 trillion has been added to the Fed’s balance sheet since Lehman. That cannot and will not be unwound.

Meanwhile, not to be outdone, the European banks are now instituting NIRP. Savers are being charged a fee for depositing their money while borrowers are actually being paid to take on debt. Yeah, that’ll end well.

And then there’s the basket case called Japan and China’s enormous property bubble looming on the horizon.

Would someone please hit the f’ing reset button already?

If the recovery is so strong, why are banks still exempted from mark to marking balance sheets (FASB 157)? The exemption was allowed for banks at about the time the market bottomed in 09 as I recall and it has yet to be revoked.

I’m not sure what to say .Steve , how would you like to go get drunk?Celebrate the doom.

Excellent article. Thanks for doing the work researching and writing. It sure is effing scary, though. It is collusion, pure and simple.

Chum w , why do you keep coming back? Just to criticize ?Maybe you should spend your free time elsewhere. Just saying.

Admin

Swallow your principles for a moment ….. DELETE chumbawamba’s post ….. we’ll all give you a standing ovation.

BTW …. I voted the fucker down … it went from 2 to 3 ….. AND ALSO increased the up vote from 0 to 1 !! WTF?? That has happened several times on other votes as well.

The Debt Clock thingy on the right side of the screen is at about … $18,158,825,000,000

This is what the number looks like in bits (BInary digiTS) —- 1010110100101101000100011010

Doesn’t look so bad now, does it?

“Subprime loans are used by sophisticated Ivy League educated MBA bankers to lure over-indebted, lower income, lower educated, easily manipulated Americans with bad credit (they’ve defaulted before), into high interest auto loan debt with promises of easy payments on their very own luxury SUV. It’s like Christmas has arrived and Ally Financial is Santa Claus. The longer the term, higher the loan amount, and the higher the interest rate, the better for the lender – because the lender isn’t bearing the risk. Sound familiar? It’s back.”

And worse yet, these morons get a voice in selecting the next leadership of this nation.

God help US.

How do you keep auto manufacturers in business while you blow up the economy? You allow the unthinkable, loan money to the tards with no strings on a car they have no business buying that they could never afford and you now have millions of units (cars) sold. That is what it is all about, when channel stuffing started having major blow back from dealerships, subprime auto loans on a massive scale was the next step to complete doom. They know the morons won’t pay the payments but it still counts as units sold.

TPTB feel they have been really successful keeping the illusion going for John Q Public, ask any of them and they will tell you it’s all good, we’re in a strong recovery. I weep for our nation.

Hey!!!!! Where’s chumbawamba’s post??????

It just …. just …. just ….. disappeared into da air !! How’d it do dat?

[img [/img]

[/img]

“…worse yet, these morons get a voice in selecting the next leadership of this nation.”

_A_ voice? These morons are practically _the_ voice.

Stucky says:

“The Debt Clock thingy on the right side of the screen is at about … $18,158,825,000,000

This is what the number looks like in bits (BInary digiTS) —- 1010110100101101000100011010

Doesn’t look so bad now, does it?”

Well, when you put in the commas and a dollar sign in front, it sure looks bad!

$1,010,110,100,101,101,000,100,011,010

So the Banksters’ plan is moving ahead just like we knew it would at ludicrous speed.

The average loan to values today on bad car loans is just the tip of the iceberg. I’ve been watching this for a while, and even talked to some other attorneys about some of the deceptive lending practices and fraudulent ‘truth in lending’ statements used by many car dealerships and the lenders who turn a blind eye.

There’s a growing group of attorneys around the country helping people negotiate, litigate, or find other solutions in court. Here’s a website looks like it’s becoming a good resource for finding legal help: http://www.BadAutoDebt.com

Hey Denny …. how much does the attorney keep …. 75% ?

@Stucky: “I don’t understand national/government debt. They’re just numbers. When the government “lends” Ukraine $50 billion dollars, does money actually change hands? I don’t think so. It’s just bit&bytes entered in a computer. It’s unreal … literally, as in not real money, ever. And it seems that this shit can go on forever.

I apologize in advance for my ignorance. I just can’t wrap my mind around the meaning of these ginormous amounts of (debt) money.”

Stucky, this video explains some gov spending in a per household basis, so it’s a little easier to grasp. What he doesn’t explain is the relationship of how the gov keeps the ship afloat. As I understand it, the only way they can keep borrowing is because other countries continue to buy our bonds. What that ends, they’re up the creek with out a paddle.

The second short video explains mandatory vs. “discretionary” spending, and spells out how bad the future will be due to promised benefits such as Social Security and Medicare.

Admin can probably sum all this up in 2 sentences better than me or these videos.

Just for fun:

[img [/img]

[/img]

Maybe it will end up in a textbook in 20 years, who knows?

It is so ironic that a Democrat president has presided over the largest transfer of wealth from the middle class to the top 1%… and this guy is called by Fox talking heads a socialist…. Ben and Barack were the best thing that happened to the top 1%, Wall Street, public companies exec’s and the Silicon Valley VC’s , EVER !! ha… I forgot he increased the minimum wage by dollar over three years or so… wow… maybe their income will actually reach 80% of the increase in cost of living

Check out a report by McKinsey from about a week ago:

The total global debt since 2007 grew by 40% or $57 trillion.

The debt of governments of developed nations grew by $19 trillion.The debt of China has quadrupled from $7 trillion to $28.

Housing Bubble Redux: Subprime Auto Market Begins To Crack

Submitted by Tyler Durden on 03/02/2015 10:36 -0500

As noted last week, the aggregate amount of loans for new and used cars will in short order eclipse the $1 trillion mark, joining total student debt in full-on bubble mode. Better still, early delinquencies on auto loans are now sitting back at their 2008 highs (both for all borrowers and for subprime borrowers, with 9% of the latter now missing a payment within the first 8 months of origination). Despite this, and despite the fact that nearly a third of all auto loans in 2013 were made to subprime borrowers (the same amount we saw in 2006 at the very height of reckless underwriting standards), Experian says everything is fine.

Meanwhile, Wells Fargo recently noted that although lending standards had indeed gotten back to “normal” (and as a reminder, “normal” now means how things were in 2006) it’s beginning to look like some households “might be overleveraged.” Simultaneously, lenders are again showing a propensity towards origination for the purpose of selling loans rather than holding them; that is, originating loans and then happily passing them on to the Wall Street securitization machine, which explains why despite a collapse in the issuance of ABS backed by home equity loans since the crisis, total ABS issuance in the U.S. hit its highest level since 2008 last year.

These are things that Wells should know something about as they made some $30 billion in auto loans last year and indeed it now appears the bank may be getting concerned about the market it’s helped to build. As the NY Times reports:

Wells Fargo, one of the largest subprime car lenders, is pulling back from [subprime auto lending], a move that is being felt throughout the broader auto industry…

Wells Fargo has imposed a cap for the first time on the amount of loans it will extend to subprime borrowers.

The bank is limiting the dollar volume of its subprime auto originations to 10 percent of its overall auto loan originations, which last year totaled $29.9 billion, bank executives said.

The decision, detailed in interviews with top Wells Fargo executives, along with other large auto lenders, is a sobering moment for the booming market. Other lenders may decide to take their cue from Wells Fargo, one of the nation’s largest lenders.

The Times’ description of industry dynamics could easily be mistaken for a recap of the buildup to the housing bust, as investors chase returns, Wall Street chases fees, banks ease lending standards to increase volumes, and borrowers who are jobless (which must mean they aren’t experienced waiters) throw every semblance of prudence out the window:

Large banks, weathering a slowdown in other types of lending like mortgages, have increased their auto lending. And much as in the housing boom, investors in search of higher returns, like insurance companies and hedge funds, are buying billions of dollars of investments backed by subprime auto loans.

Such growth, though, has given rise to concerns, like those at Wells Fargo, that growing competition is fostering lax lending practices, including longer repayment periods and increased loan balances.

Federal and state authorities, meanwhile, are examining whether dealerships have been inflating borrowers’ income or falsifying employment information on loan applications to ensure that any borrower, even some who are unemployed and have virtually no source of income, can buy a car.

Just how bad has it gotten? This bad:

Last week at the annual conference of the Global Association of Risk Professionals in New York, Darrin Benhart, a senior regulatory official at the Office of the Comptroller of the Currency, which regulates Wells Fargo, noted that lenders had extended repayment periods to 84 months — 40 percent longer than the typical period — and were making loans that were far greater than the value of the car.

This is perhaps the clearest sign yet that we have learned literally nothing from the crisis years. That is, this is precisely the same dynamic and it will end precisely the same way: defaults will rise, investors in assets backed by these loans will suffer outsized losses, and the assets themselves will become completely illiquid. Indeed, the dominoes have already started to fall. Here’s Fitch with the last word:

Weaker seasonal trends led to annualized net losses (ANL) on U.S. subprime auto ABS reaching their highest level since 2009, according to the latest monthly index results from Fitch Ratings.

Subprime auto loan ABS ANL rose 4.5% month-over-month (MOM) to 8.19% last month, the highest level since February 2009 (9.07%). Prime ANL also crept higher in January.

In the subprime sector, 60+ day delinquencies rose to 4.75% in January, a 7.7% move higher and were 24% above the same period in 2014. This is the highest level recorded since October 2009 (4.76%). Meanwhile, ANL rose 4.5% MOM in January hitting a five-year high when 9.07% was recorded in early 2009. Asset performance has slowed over the past two years driven mainly by softer underwriting and collateral credit quality in securitized pools.

“In the past five years, global registrations of the seven largest ultra-premium car brands–a group that also includes Aston Martin and Lamborghini–have surged by 154 percent, far outpacing the 36 percent gain in overall car sales worldwide.”

“Rolls-Royce registrations have risen almost five-fold. Almost 10,000 new Bentleys cruised onto the streets last year, a 122 percent increase over 2009, while Lamborghini rode a 50 percent increase to pass the 2,000 vehicle mark.”

.

http://www.zerohedge.com/news/2015-03-02/nyc-residents-pay-2-3000-month-%E2%80%9Cmicro-apartments%E2%80%9D-luxury-car-sales-outpace-regular-c

Stucky, I know of a few of the attorneys who are getting settlements for their clients in the range of $4000 – $10000 for the bad practices by dealer and lenders, and in some cases having the car loans forgiven. I think the attorneys are mostly working on a contingency and splitting the fees with the client. Other cases are ending up in Chapter 13 cases where the loan balance and interest rates can often be crammed down.

how much does the attorney keep …. 75% ? yap