Driving home from work on Friday night I found it terribly amusing listening to the “business journalists” on the local news station trying to explain the 531 point plunge in the Dow and the 1,105 point plummet from the Tuesday high. The job of these faux journalist mouthpieces for the status quo is not to report the facts, analyze the true factors underlying the market, or seek the truth. Their job is to calm the masses, keep them sedated, and paint the rosiest picture possible.

The brainless twit who reported the stock market bloodbath immediately went into the mode of counteracting the impact of what was happening. She said the market is overreacting, as the country has strong job growth, low inflation, a strongly recovering housing market, and an improving economy. The fact that everything she said was a complete and utter falsehood was exacerbated by her willful ignorance of the Fed created bubble leading to the most overvalued stock market in history. How can these people pretend to be business journalists when they haven’t got a clue about stock market valuations and just say what they are told to say?

Anyone who listens to a mainstream media pundit, talking head, or spokes bimbo deserves the reaming they are going to receive. They are paid to lie, obfuscate, spin, and propagandize on behalf of their corporate media executives, who are beholden to Wall Street bankers, mega-corporations, and the government for their advertising dollars. The mainstream media is nothing but entertainment for the masses, part of the bread and circuses designed to distract the dumbed down, iGadget addicted, ignorant masses.

The entire stock market bubble has been created and sustained by the Federal Reserve and their QE and ZIRP schemes to prop up insolvent Wall Street banks, enrich corporate executives, and produce the appearance of a recovering economy. The wealth was supposed to trickle down to the masses, but the trickle has been yellow in appearance and substance. The average American is far worse off today than they were in 2007, with the Greater Depression Part 2 underway.

The Fed balance sheet currently stands at $4.5 trillion. Seven years ago this week it stood at $931 billion. Seven years before that it stood at $641 billion. From August 2001 through August 2008 the Fed grew their balance sheet by 45%. This period encompassed a recession, dot.com implosion, and a housing crash. Since 2008 the Fed felt it necessary to increase their balance sheet by 383% even though we have supposedly been in an economic recovery for over six years, with unemployment back to 2007 levels, corporate profits at record highs, and everything back to normal if you listen to the mainstream media.

Someone needs to explain the correlation between the Fed balance sheet and the S&P 500 to the bubble headed spokes models on CNBC, Fox, CNN, and MSNBC. The economic recovery is nothing but a debt saturated fraud, propped up by subprime auto loans, 7 year 0% auto financing schemes, enslaving young people in student loan debt that will never be repaid, pretending unemployed people aren’t unemployed, under-reporting inflation to suppress wages and inflate GDP, and artificially inflating stock, real estate, and bond markets with negative real interest rates.

Anyone who doubts the sole purpose of QE1, QE2, and QE3 was to boost the stock market and create the glorious “wealth affect”, is either blind, dumb or a direct beneficiary of the scheme. When the S&P 500 bottomed at 666 in March 2009, the Fed balance sheet stood at $1.9 trillion. In June of that year, the official end of the recession, the Fed balance sheet stood at $2.1 trillion. If the recession was over in June 2009, why would the Fed possibly need to more than double their balance sheet over the next five years? If the crisis had passed, as we’ve been told by the mainstream media, politicians, and central bank academics, what possible reason would the Fed have for pumping heroine into the veins of the criminal Wall Street cabal?

The reason is quite simple. The Fed is owned and controlled by Wall Street. Do you need any more proof than knowing Helicopter Ben makes more ($300,000) from a sixty minute lunchtime speech at a Bank of America banker bacchanal than he made per year as Federal Reserve Chairman. The chart below provides the remaining proof. From the March low of 666, the S&P 500 went up by 200%, to over 2,000 when the Fed reluctantly ended QE3 on October 29, 2014. Do you think it was just a coincidence the Fed balance sheet also expanded by 200% since QE started in late 2008?

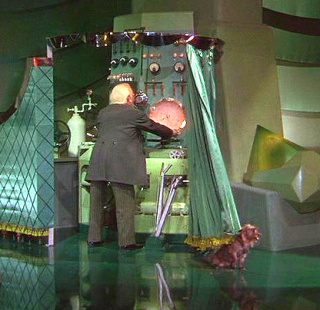

The mouthpieces for the oligarchy have contended this was all just a coincidence. They have been told to spread propaganda about fundamentals, economic recovery, job growth, and rising earnings per share. Is it also a coincidence the S&P 500 is exactly where it was on September 30, 2014 as the Fed stopped pumping heroine into the arms of Wall Street traders? The market went up 200% in five years, in virtual lockstep with the Fed balance sheet. The Fed balance sheet has been virtually flat for the last year and the S&P 500 is virtually flat in the last year. No correlation there. The mainstream media needs to distract you from seeing the truth. Look over there at Caitlyn Jenner. How about that Trump. Black Lives Matter. Time for fantasy football. Whatever you do, don’t look behind the curtain and realize the people running the Federal Reserve are corrupt, captured, and clueless on what to do next.

The Great and Powerful Fed has had the curtain pulled back to reveal a doddering old lady and a gaggle of flying monkey academics attempting to bluster their way out of the box they have created for themselves at the behest of their Wall Street owners. The global economy is in free fall and the Fed talking heads are still speechifying about a lousy .25% increase in the Fed Funds rate, as if it means anything to anyone in the real world of paying bills, going to work, buying groceries, and living life. Do these pompous pricks actually think a minuscule increase in an obscure interest rate will impact the average household whose real income is lower than it was in 1989? The gall of these academic pinheads is breathtaking to behold.

The only thing propping up our stock market over the last year has been the insane lemming like behavior of corporate CEOs across the land, borrowing at record low rates thanks to the Fed, and using the proceeds to buy back $2.3 trillion of their own stock in order to “enhance shareholder value” and of course enrich themselves through their stock incentive compensation plans. Our market had also been seen as a safe haven by Chinese billionaires and rich Europeans seeking shelter from the storms sweeping across their continents. Last week’s stock market implosion will scare the CEO lemmings into halting their buybacks as they calculate the amount of value destruction they inflicted on shareholders, while the interest on the debt keeps rising.

You can be sure the discussions among the elite members of the Deep State – Fed central bankers, foreign central bankers, the heads of the biggest Wall Street banks, Treasury Department apparatchiks, Washington politicians, heads of the corporate media outlets, influential corporate CEOs, and powerful billionaires – are happening this weekend in an effort to keep their debt based ponzi scheme going. They know only one solution – print more money (QE4), increase government debt levels, fake the economic data, and utilize their propaganda outlets to calm the masses with more lies.

Can these desperate measures work again? Maybe temporarily, but their impact lessens each time they roll them out. They will never voluntarily abandon the addiction to credit expansion because it is the only thing sustaining the wealth of the Deep State. These sociopath arrogant egotists would rather destroy the world financial system than admit they were wrong. Ludwig von Mises explained what will happen many decades ago.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

So I m sitting in the auto repair shop this morning having the tires rotated and balanced. The guy who is the store manager is telling one of the mechanics that he can’t believe he got a loan on a 50k Camero three years after his house was foreclosed on…..yep we’re screwed.

Hey Jim Krugman said in his editorial today that we shouldn’t worry about the National debt….In that case why don’t we expand it by 10 trillion this year to fix EVERYTHING.? Maybe because Krugman is an idiot and debt does matter.

“The mainstream media is nothing but entertainment for the masses, part of the bread and circuses designed to distract the dumbed down, iGadget addicted, ignorant masses.”

We must bear in mind that the “alternative media” – on the Web – is also in the business of selling eyeballs to advertisers, and therefore must provide entertainment for the masses.

[img [/img]

[/img]

Maybe total destruction of the current financial system is what they really want .A financial Armageddon would be a good reason to get rid of all the worthless paper money. Maybe that’s the real goal.It’s been said here many times and ways the elites of the world would be willing to destroy the system in order to replace the old with a new system with the same elites still in control.

“These sociopath arrogant egotists would rather destroy the world financial system than admit they were wrong.”

Destruction of the US financial system is one of their goals. The need to usher in the new global currency for the multipolar NWO cannot be achieved without it.

bb.

Systems usually aren’t destroyed, they’re smoothly merged into a new system and form a basis for it that keeps people from noticing the process -the result- till after it has happened.

An example: Our money went from gold and silver coins to gold and silver treasury notes to silver and silver treasury notes to Federal Reserve Notes without anyone actually noticing the changeover from gold and silver backed money to issued fiat money backed only by itself. Most people still don’t really understand this happened.

Next changeover will be like the changeover from national currencies in Europe to the Euro but will be aimed at a world wide uniform currency for all nations under the control of no single nation or group of nations. I imagine it will be a two step process (three step would be better for them but, IMO, would take too long).

This Wasn’t Supposed To Happen: Crashing Inflation Expectations Suggest Imminent Launch Of QE4

Submitted by Tyler Durden on 08/23/2015 14:34 -0400

The wind up for the most telegraphed rate hike in history was supposed to achieve one thing: generate benign inflation in the form of a rising short end and a broadly steeper yield curve, or in short: boost inflation expectations without crashing the market (recall after 7 years of ZIRP and QE all the media is blasting is that “rate hikes are good for stocks”) – after all why else would the Fed be hiking rates if not to offset the market’s inflationary expectations and to have “dry policy powder” ahead of the next recession, even if said powder was a meager 25 basis points.

It was most certainly not supposed to achieve this:

This is how Nomura summarizes the chart above:

“with deflation fears in the air and oil getting floored, inflation products have already become an unloved asset class. If the Fed surprises the market with a September hike, we expect all BEIs to fall under pressure but likely led by the <5yr sector as risk markets also crater. Just like currently, BEIs are held hostage to commodities and credit markets even as the Fed probabilities are being revised down."

Here is a better way of summarizing it: the last three times inflation expectations tumbled this low, the Fed was about to launch QE1, QE2, Operation Twist and QE3.

And the Fed is now expected to hike rates in less than a month even as inflation expectations are the lowest since Lehman?

Good luck. The Fed - which is damned if it hikes rates (and crushes financial conditions by tightening, sending deflationary signals surging even higher and undoing 7 years of stock market levitation), and damned if it launches QE4 (as it loses all verbal jawboning credibility it worked so hard to establish in the past year ) - is now truly boxed in.

Here is my own little window on where we’re at. My personal account with a super regional bank. A few years back you had only to keep an average minimum balance of $8000 or more to be entitled to free checking. I noticed last month in my monthly statement a $100 annual fee from my bank for the privilege of keeping an average minimum balance of more than $200,000 with them! That the interest paid on this rather large stable deposit amounted to just $108 last year just shows how today’s banks view deposits. An inconvenience they’d just as soon be rid of! Were it not for the convenience of being able to pay my bills electronically and the inconvenience of keeping over $200,000 in cash in my home, I’d agree with them.

The modern TBTF bank is not a financial intermediary where depositors funds are loaned to borrowers with the bank making a profit on the ‘spread’ and the loans are held on the banks balance sheet as assets. They don’t really want deposits anymore because A. they are too small ( The FDIC only insures them up to $250,00) and B. they are required to pay into the Federal Deposit Insurance Fund an amount based upon their insured deposits.

The problem is that no one, including the Federal Reserve really understands the modern mega banking model. Not even their CEO’s if we are to listen to the sworn testimony. Its a black box in which hundreds of billions of dollars in overnight loans, repos and derivative bets spin at high frequency trading velocities backed by phantom assets that every three months spew out imaginary numbers they call quarterly ‘earnings’.

This lack of understanding lies behind the deer in the headlights look of our Central Bankers. They are like a pilot whose experience and training was on a single engine Cessna flying under Visual Flight Rules being put in the cockpit of a 747 flying over the Pacific at night. They are afraid to disengage the autopilot less they have to fly the aircraft and they don’t know how!

We know from seeing the results of the 2008 and ’09 audits of the Fed, that, over that two year period, the Fed created, out of thin air, $23.5 trillion for the big international banks, to use in any way they chose. Among other uses, our six giant banks used that nearly interest free money to pay back those pesky 6% TARP loans. According the Bloomberg, the Fed also loaned (gifted?), that money, created out of thin are, to the big European banks to the tune of hundreds of billions of dollars. For instance:

(Bloomberg) “Almost half of the Fed’s top 30 borrowers, measured by peak balances, were European firms. They included Edinburgh-based Royal Bank of Scotland Plc, which took $84.5 billion, the most of any non-U.S. lender, and Zurich-based UBS AG, which got $77.2 billion. Germany’s Hypo Real Estate Holding AG borrowed $28.7 billion, an average of $21 million for each of its 1,366 employees.”

Since there have been no subsequent audits of the Fed, one can only imagine how much money the Fed has created, out of thin air, over the last six years. What I’m getting at is; what’s a $4.8 trillion balance sheet, when the Fed has created trillions upon trillions of dollars more? We have no idea how much, if any, of that Fed-created money all these banks have paid back to the Fed. How do we know that these “loans” are not just part of a giant game of liar’s poker?

So, taking it a step further, if the Fed can create all this money (debt) out of thin air, then why couldn’t the Fed also retire (destroy) it? After all, it wouldn’t be unprecedented. Remember the $29 billion in junk paper from Bear Stearns (aka Maiden Lane 1)? Check and see how the Fed retired that debt. Then came Maiden Lane II and Maiden Lane III, the AIG trash paper. What do you think happened to all that worthless shit?

What I’m saying is, if the Fed has the power to create, then it should have the power to destroy. And that destruction could include all the US Treasuries and toxic waste GSE’s it’s been holding since QE 1. However, the Fed’s power to create and destroy could disappear, if the USD was no longer the world’s reserve currency.

Here’s how that could happen. King Salman bin Abdulaziz al-Saud, the new guy in charge, is not all that happy with what the US frackers have done to the price of Saudi oil, and he has been communicating with the Russians and the Chinese. Couldn’t it be possible that a push to have the yuan included in the SDRs might just be the second step in replacing the USD as the petrodollar and, therefore, the world’s reserve currency? China has already taken the first step to make this happen by instituting bilateral trades with Russia, Gatar, Brazil and, most recently, Canada.

Those EM held US dollars would surely be coming home to the good old US of A, and, with lower oil prices, there will be fewer countries with enough money to buy any kind of expansion of the ever expanding US debt, if, in fact, those countries were so inclined.

Unit472, I sure wouldn’t want to have 200k in a bank right about now. I get the impression that the banks are serious about trying out bail-ins during the next catastrophe. What better way to deal with all those pesky deposit accounts than to take them away from you?

Not that I think they’d be any safer but why not join a credit union and avoid those minimum balance fees? I’ve had free checking for decades with balances far lower than you mention.

I’d certainly be moving significant chunks of cash out of the banks control if I were you. Actually, I already did and it’s not easy. Still, I sleep better knowing the crooked bastards won’t be taking my savings.

Anecdotal observation. Todays Cleveland Plain Dealer has nary a mention of the stock market debacle of last week, while the NY Times has a minor article on it. The major headline in the Cleveland paper was ghetto focused on the poor while the NY Times was focused on Abortion. Go figure. When are they going to report what is really going on? I mean I get the bread and circus aspect but as a person who somewhat wants to be in the know about what’s going on, I really find this interesting. In fact, a conspirasist would opine that the news sources are doing this on purpose.

@IndenturedServant, it’s not so easy to change banks once you’ve tied your brokerage, pension, social security, IRA disbursements etc. as well as all your utility, cable, HOA, etc. payments to a bank account. Its a lot of work notifying everyone to send the bills and payments to a new account number and the odds are good it will get screwed up by someone somewhere. Also , if you use turbotax you don’t like to change things too much because they know all your account # and you just plug those numbers in and the complete your tax forms for you. To be honest I don’t write checks anymore. I pay all my bills on line or use a debit or credit card so my bank does a lot of work for me and until this year I paid nothing for the service. Charging me $100 per year to maintain an account under the circumstance is not unreasonable except, as I said I keep over $200k with them and they can earn over $500/year on that by depositing it at the Federal Reserve and they only paid my $108 in interest. If I could I would deposit my funds at the Fed and earn the lousy 0.25% they GIVE to banks as Interest on Excess Reserves that banks get. In Europe the ECB charges banks 0.2% to park money there…. and banks pay it because they can’t store $10 billion euros in a goddamned vault and they have a forex risk if they deposit it somewhere else.

That’s the absurdity of where ZIRP has led. Banks don’t want deposits because they can borrow on the wholesale money markets for next to nothing or even for nothing where negative rates are in play. Taking deposits are a nuisance they have to provide as part of their charter as ‘depository’ institutions and unless you are willing to take the risk of keeping large amounts of cash at home ( I do keep more than I should) what the hell can you do? The Central Banks have created a nightmare where stocks are so overvalued and, along with bond funds, so lacking in liquidity bank deposits and cash are the only places one can be sure you can access your money when there casino breaks.

Unit472, I’m not sure where you are but in larger metropolitan areas you can rent private vault space. I do that in two big cities that I frequent. I with you about keeping too much cash at home. Just be sure it’s protected from fire in addition to theft and potential rodent damage.

I can see why you’re hesitant to change accounts. Banks just rub me the wrong way. I’ve used credit unions all my life and rarely ever have a complaint about them.

“That’s the absurdity of where ZIRP has led. Banks don’t want deposits because they can borrow on the wholesale money markets for next to nothing or even for nothing where negative rates are in play.”

Unit472, you are exactly right, especially when it comes to big banks. They don’t like their checking account practices being put under a microscope, which they are subject to because of the tougher consumer protection laws. Banks with under $1 billion in assets, however, are exempt.

The big banks are also subject to Basil 3 reporting requirements for large client deposits that exceed day to day banking operations. Consequently, if a big money client suddenly pulls a large amount of money out of his account, the bank has to go into a detailed, documented explanation as to why. It is all part of the big banks’ Liquidity coverage ratio (LCR) reporting requirement., as spelled out in Basil 3. Record keeping can be expensive.

unit472 says: @IndenturedServant, it’s not so easy to change banks once you’ve tied your brokerage, pension, social security, IRA disbursements etc. as well as all your utility, cable, HOA, etc. payments to a bank account. Its a lot of work notifying everyone to send the bills and payments to a new account number and the odds are good it will get screwed up by someone somewhere. Also , if you use turbotax you don’t like to change things too much because they know all your account # and you just plug those numbers in and the complete your tax forms for you.

————————–

If you do it incrementally, it would not be difficult. I’d be most concerned about the Social Security messing up, but I’d still change to a credit union. Just sayin’…

A bunch of angry Chinese investors raided the Fanya Metals Exchange, grabbed the guy running the place and turned him over to the police. The police later released him, no charges.

Interesting times, coming soon.

“THEY’RE GONNA NEED A BIGGER BALANCE SHEET”

No they’re not.

The U.S. government doesn’t need to ‘balance’ ANYTHING, as long as they can continue to bribe, blackmail and/or coerce any potential outside controlling agencies (and even sovereign states) that might otherwise require accountability into subserviently -and unquestioningly- accepting its rigged stats, doctored figures & phony numbers.

On the upside for savers, rational people and justice-lovers in general, that moment of loss of control seems to be rapidly approaching as we speak.

I predict a major economic collapse in the U.S. within the next year. Two years tops. Thank God!

We might see a financial collapse in Canada before we see one in the US. Maybe now, Ted Cruz will stop pushing so hard for the Keystone XL pipeline.

“While WTI is selling for around $40 per barrel, Canada’s oil sands are selling for about half of that. Some producers are losing money even on mature projects that only have operational costs. In other words, they are losing money on each barrel sold. Suncor Energy Inc. (NYSE: SU), Cenovus Energy (TSE: CVE), and Canadian Natural Resources (NYSE: CNQ), are just a few of the companies that are seeing their share prices crater. Much of the oil industry is facing major financial pressure from low oil prices, but Canada is probably suffering worse than others.”

Today may be another “look out below!” day for stocks. I have 50% allocated in my meager 401k to a cash/money market fund and my strategy was to move the remainder there on Sept. 7 and ride out the rest of the year there. Looks like I’ll be a few weeks too late unless we get a big bounce. Yikes.

sir, please change 2.1 billion in stock buybacks to 2.1 TRILLION. love this article, but this mistake needs to be changed. thank you for this great article.

sorry 2.3 billion to 2.3 trillion in stock buybacks.

will

Good catch. I changed it. Thanks.

Well, it looks like markets around the world are tumbling downwards.

There should be a joke about autumn leaves and stockmarket shares falling together.

I’m just not clever enough to make it.

Deutsche Bank Sums It Up “The Fragility Of This Artificially Manipulated Financial System Was Finally Exposed”

Submitted by Tyler Durden on 08/24/2015 09:05 -0400

Today’s dose of vile tinfoil hattery magick comes straight from the bank with the cool $55 trillion or so in derivatives, Deutsche Bank:

The fragility of this artificially manipulated financial system was exposed over the last couple of days of last week. It all ended with the S&P 500 falling -3.19% on Friday – its worst day since November 9th 2011.

* * *

We’ve long felt that the only thing preventing another financial crisis has been extraordinary central bank liquidity and general interventions from the global authorities which we still expect to continue for a long while yet. So when policy changes, risks arise. The genesis of this recent sell-off has been the threat of the Fed raising rates next month, but China’s confrontational move two weeks ago and the subsequent knock-on through EM have accelerated us towards something more serious. We always thought something would get in the way of the Fed raising rates in September and we’re perhaps seeing this now. With 24 days to go until we find out, the probability of a hike has gone down to 34% from a 54% recent peak on August 9th. Having said we always thought something would come along to derail a Fed rate hike we probably should have gone underweight credit. However with trading liquidity poor and with a reasonably high desire to be long amongst investors there has to be a big move to justify the change in stance. Also with a strong possibility that the Fed will relent and that China could add more stimulus soon, there may be a small window to be short European credit. So at the moment this could be a dangerous time to sell. However if it wasn’t for expected intervention and extraordinary central bank policy we would be very bearish as the global financial system remains an artificial construct reliant on the largesse of the authorities.

So 6 years after we first said what at the time was seen as heretical “tinfoil” conspiracy theory, now everyone admits it. Almost time to take a vacation maybe…

Crashes on Wall Street tend to give rise to spending famines in spending on Main Street. For instance, the 800,000 people invested in NJ’s public pension have got to be thinking about holding onto whatever money they still have.

“The Division of Investment and the State Investment Council have pursued a policy of diversification ininvesting the fund’s assets. The fund is now invested in large and small capitalization U.S. stocks,

international stocks in both developed economies and emerging markets ”

This has got to be a scary time for pension holders everywhere.

Panic!! All Major US Equity Indices Halted

Submitted by Tyler Durden on 08/24/2015 09:24 -0400

Nasdaq was the first to be halted at 0758ET.

The Dow is now down 850 points from Friday’s close and halted…

The S&P 500 Futures is halted for the first time in history.

Even the morning news had a “special report” break through, to say the stock market was down (not crashing)… the key message from the news anchor:

“The fastest way to lose money in a market like this is to panic sell. In fact, those that held their positions in 2007-2008 actually recovered their losses and even grew some.”

The whole time, I couldn’t help thinking that TPTB had these messages waiting for just such an event… they knew this was coming and have a plan to try to reassure the masses / investors. Likely because they don’t want a riot on their hands.

Looks like some major crimes are being committed on US stock markets this morning. Pulling out all the stops to interfere with the smooth operation of the exchanges.

http://www.zerohedge.com/news/2015-08-24/meanwhile-beneath-surface-market-liquidity-worse-during-flash-crash

Administrator–A lone voice crying in the ‘wilderness’. Who’s to listen? Only the faithful commenting on this site, I guess. The ‘unwashed many’ listening to the ‘siren song’ of another.

Nice bedtime story! Sounds like a fairy tale. Fairy tales are never really believed especially when the MSM is telling you that the reality is low unemployment, stable economy, normal market correction, etc. Go about your business, nothing to see here. Besides I don’t really want to be upset.

Unit472–If ya can’t take it out of one bank, open accounts in many banks and S&Ls as possible and wire (spread) the money everywhere. When the bail-in comes and you can’t draw money out and can only get $10 a week from you ATM, you can get more cash, cumulatively, to settle you needs.

Let’s see! 2008 big botta boom! Ah, 7 years later, 2015 a bigger botta boom?

HEY!!! Maybe there is something to this Shemita thing. Hmmmmm!

I can’t wait till they start jumping out the windows

maybe they(PTB) want a complete collapse. so bad distribution systems get messed up etc. keep

that mess for a year or two and the resulting fallout would surely put a dent into population and do they not want that? prepare accordingly, as this collapse may be . designed

Admin / Jim – not sure if this will get lost or not LOL – something you might want to consider, as you are the only real Fourth Turning guy on the net …

The Regeneracy is here.

And Trump, GamerGate, the Hugo Awards kerfluffle, men’s rights / PUA movements, the Meninist on Twitter, Chateau Heartiste (and many others) are ALL part of this phenomenon.

I call it the Great Pushback.

I’d like to take credit for noticing but that goes to david-93 who pointed it out to me and others on Vox Day’s blog.

If you can see the connections, might make a good article for you to write / post ?

There are two sides to every trade. The teevee will tell you loads of money has disappeared since Thursday. But it hasn’t disappeared, it’s just changed hands. From the many muppets to the several slimeballs. The important ones that either were tipped off to this crash or, more likely, caused it. The retail investor, pensioner, trusting baby boomer, naive millennial all just coughed it up again. Sheep need to be sheared from time to time.

the tumbleweed–No it disappeared. If you had a car worth $100, that is the nominal value, but you were only able to sell it for $50, that is the real value, could you say that $50 disappeared? Yes, but that lost $50 dollars didn’t transfer to someone else, truthfully it never really existed except in the mind of the owner. There isn’t always a buyer for every stock until it reaches equilibrium, somewhere between ‘bid and ask’ and an exchange takes place. The real value is when you get the money in your hand.

Jim, solid post!

Just for your reference, a “heroine” is a female hero, and “heroin” is apparently a dangerously addictive drug.

I hate spell chequer as well…