“Facts do not cease to exist because they are ignored.” – Aldous Huxley

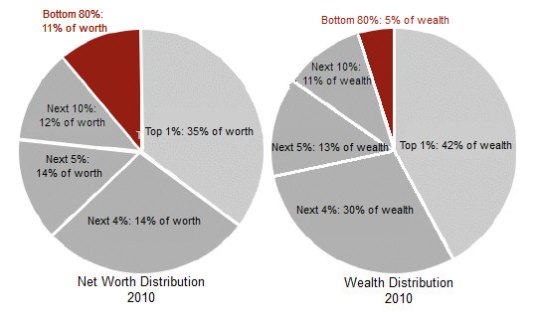

Six months ago I wrote an article called Are You Seeing What I’m Seeing?, describing my observations while traveling along Ridge Pike in Montgomery County, PA and motoring to my local Lowes store on a Saturday. My observations were in conflict with the storyline portrayed by the mainstream media pundits, Ivy League PhD economists, Washington politicians, and Wall Street shills. It is clear now that I must have been wrong. No more proof is needed than the fact the Dow has gone up 1,500 points, or 11%, since I wrote the article. Everyone knows the stock market reflects the true health of the nation – multi-millionaire Jim Cramer and his millionaire CNBC talking head cohorts tell me so. Ignore the fact that the bottom 80% only own 5% of the financial assets in this country and are not benefitted by the stock market in any way.

The mainstream corporate media that is dominated by six mega-corporations (Time Warner, Disney, Murdoch’s News Corporation, Comcast, Viacom, and Bertelsmann), has one purpose as described by the master of propaganda – Edward Bernays:

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. …We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. …In almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons…who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind.

These media corporations’ task is to use propaganda and misinformation to protect the interests of the status quo. The ruling class has the power to manipulate public opinion, obscure the truth, alter government data, and outright lie, but they can’t control the facts and reality smacking the average person in the face every day. Based on the performance of the stock market and the storyline of economic recovery being peddled by the corporate media, the facts must surely support their contention. Here are a few facts about what has really happened in the last six months since I wrote my article:

- The working age population has grown by 1.1 million, the number of employed Americans is up 500k, while the number of people who have left the labor force has gone up by 600k. The BLS reports the unemployment rate has fallen without blinking an eye or turning red with embarrassment.

- The number of Americans entering the Food Stamp Program in the last six months totaled 1 million, bringing the total to 47.8 million, or 20% of all households (up 15 million since the Obama economic recovery began in December 2009).

- Existing home sales have increased by a scintillating 2.9% on a seasonally adjusted annual basis and average prices have fallen by 6% in the last six months. It is surely a great sign that 32% of all home sales are to Wall Street investors and 25% are either foreclosure sales or short sales. A large percentage of the remaining sales are funded by 3% down FHA government backed loans.

- There were 31,000 new homes sales in January versus 34,000 new home sales six months prior. Through the magic of seasonal adjustment, this translates into a 15% increase.

- Single family housing starts were 41,600 in February versus 51,400 six months prior. Even using seasonal adjustments, the government drones can only report a pathetic 4.7% annualized increase and flat starts over the last three months, with mortgage rates at all-time lows.

- The National Debt has gone up by $750 billion in the last six months, while Real GDP has gone up by less than $150 billion.

- Real hourly earnings have not increased in the last six months.

- Consumer debt has risen by $65 billion as the Federal Government has doled out student loans like candy and auto loans (through the 80% government owned Ally Financial – aka GMAC, aka Ditech, aka ResCap) like crack dealer in West Philly.

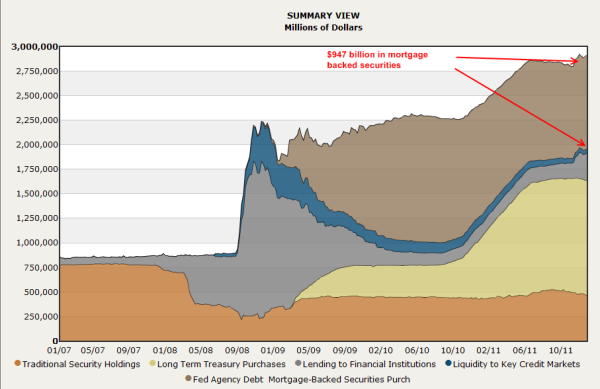

- The Federal Reserve has increased their balance sheet by $385 billion in the last six months by buying toxic mortgages from Wall Street banks and the majority of Treasuries issued by the government to fund the $1 trillion annual deficits being produced by the Obama administration. It now totals $3.2 trillion, up from $900 billion in September 2008, and headed to $4 trillion before this year is out.

- Retail sales have increased by less than 2% over the last six months and are barely 1% above last February. On an inflation adjusted basis, retail sales are falling. Other than internet sales and government financed auto sales, every other retail category is negative year over year. This is reflected in the poor sales and earnings reports from JC Penney, Sears, Best Buy, Wal-Mart, Target, Lowes, Kohl’s, Darden, McDonalds, and Yum Brands. I’m sure next quarter will be gangbusters, with the Obama payroll tax increase, Obamacare premium increases, 15% surge in gasoline prices, and continued inflation in food and energy.

Considering that 71% of GDP is dependent upon consumer spending (versus 62% in 1979 before the financialization of America), the dreadful results of retailers and restaurants even before the Obama tax increases confirms the country has been in recession since the second half of 2012. In 1979 the economy was still driven by domestic investment that accounted for 19% of GDP. Today, it wallows at all-time lows of 13%. In addition, our trade deficits, driven by debt fueled consumption, subtract 3.5% from GDP. These facts are reflected in the depressed outlook of small business owners who are the backbone of growth, hiring and entrepreneurship in this country. Small businesses of 500 employees or less employ half of all the private industry workers in the country and account for 65% of all new jobs created. There are approximately 27 million small businesses versus 18,000 large businesses. The chart below does not paint an improving picture. The small business optimism has dropped from an already low 92.8 in September 2012 to 90.8 in March 2013.

The head of the NFIB couldn’t make the situation any clearer:

“While the Fortune 500 is enjoying record high earnings, Main Street earnings remain depressed. Far more firms report sales down quarter over quarter than up. Washington is manufacturing one crisis after another—the debt ceiling, the fiscal cliff and the Sequester. Spreading fear and instability are certainly not a strategy to encourage investment and entrepreneurship. Three-quarters of small-business owners think that business conditions will be the same or worse in six months. Until owners’ forecast for the economy improves substantially, there will be little boost to hiring and spending from the small business half of the economy.” — NFIB chief economist Bill Dunkelberg

If consumers, who account for 71% of the economy, aren’t spending, and small business owners, who do 65% of all the hiring in the country, are petrified with insecurity, why is the stock market hitting all-time highs and the corporate media proclaiming happy days are here again? It can be explained by the distribution of wealth and income in this country. Every media pundit, politician, Wall Street shill, Ivy League PhD economist, and corporate titan you see on CNBC, Fox or any corporate media outlet is a 1%er or better. The chart below shows the bottom 99% saw their real incomes decline between 2009 and 2011, while the top 1% reaped the stock market gains and corporate bonuses for using “creative” accounting to generate record corporate profits. The trend in 2012 through today has only widened this gap, as real worker wages have continued to decline and the stock market has advanced another 20%.

The feudal financial industry lords are feasting on caviar and champagne in their mountaintop manors while the serfs and peasants scrounge in the gutters for scraps and morsels. This path has been chosen by the king (Obama) and enabled by his court jester (Bernanke). Money printing and inflation are their weapons of choice. We are living in a 21st Century version of the Dark Ages.

On the Road Again

I’ve been baffled by a visible disconnect between deteriorating data and the storyline being sold to the ignorant masses by the financial elitists that run the show. The websites and truthful analysts that I respect and trust (Zero Hedge, Mish, Jesse, Karl Denninger, John Hussman, David Stockman, Financial Sense and a few others) provide analytical evidence on a daily basis that confirm my view that our economic situation is worsening. We are all looking at the same data, but the pliable faux journalists that toil for their corporate masters spin the data in a manner designed to mislead and manipulate in order to mold public opinion, as Edward Bernays taught the invisible ruling class. As you can see, numbers and statistical data can be spun, adjusted, and manipulated to tell whatever story you want to depict. I prefer to confirm or deny my assessment with my observations out in the real world. I spend 12 hours per week cruising the highways and byways of Montgomery County and Philadelphia as I commute to and from work and shuttle my kids to guitar lessons, friends’ houses, and local malls. I can’t help but have my antenna attuned to what I’m seeing with my own eyes.

As I detailed in my previous article, Montgomery County is relatively affluent area with the dangerous urban enclaves of Norristown and Pottstown as the only blighted low income, high crime areas in the 500 square mile county of 800,000 people. The median household income and median home prices are 50% above the national averages. Major industries include healthcare, pharmaceuticals, insurance and information technology. It is one of only 30 counties in the country with a AAA rating from Standard & Poors (as if that means anything). On paper, my county appears to be thriving and healthy, with white collar professionals living an idyllic suburban existence. One small problem – the visual evidence as you travel along Welsh Road towards Montgomeryville or Germantown Pike towards Plymouth Meeting reveals a decaying infrastructure, dying retail meccas, and miles of empty office complexes.

I don’t think my general observations as I drive around Montgomery County are colored by any predisposition towards negativity. I see a gray winter like pallor has settled upon the land. I see termite pocked wooden fences with broken and missing slats. I see sagging porches. I see leaky roofs with missing tiles. I see vacant dilapidated hovels. I see mold tainted deteriorating siding on occupied houses. I see weed infested overgrown yards. I see collapsing barns and crumbling farm silos. I see houses and office buildings that haven’t been painted in 20 years. I see clock towers in strip malls with the wrong time. I see shuttered gas stations. I see retail stores with lights out in their signs. I see trees which fell during Hurricane Sandy five months ago still sitting in yards untouched. I see potholes not being filled. I see disintegrating highway overpasses and bridges. I constantly see emergency repairs on burst water mains. I see malfunctioning stoplights. I see fading traffic signage. I see regional malls with rust stained walls beneath their massive unlit Macys, JC Penney and Sears logos. I see hundreds of Space Available, For Lease, For Rent, Vacancy, For Sale and Store Closing signs dotting the suburban landscape. These sights are in a relatively affluent suburban county. When I reach West Philly, it looks more like Dresden in 1945.

Dresden – 1945 Philadelphia – 2013

I moved to my community in 1995 when the economy was plodding along at a 2.5% growth rate. The housing market was still depressed from the early 90s recession. The retail strip centers and larger malls in my area were 100% occupied. Office parks were bustling with activity. Office vacancy rates were the lowest in twenty years during the late 1990s. National GDP has grown by 112% (only 50% after adjusting for inflation) since 1995, with personal consumption rising 122%. Domestic investment has only grown by 80%, but imports skyrocketed by 204%. If the economy has more than doubled in the last 18 years, how could retail strip centers in my affluent community have 40% to 70% vacancy rates and office parks sit vacant for years? The answer is that Real GDP has not even advanced by 50%. Using a true rate of inflation, not the bastardized, manipulated, tortured BLS version, shows the country has essentially been in contraction since the year 2000.

The official government sanctioned data does not match what I see on the ground, but the Shadowstats version of the data explains it perfectly.

My observations also don’t match up with the data reported by the likes of Reis, Trepp, Moody’s and the Federal Reserve. Reis reports a national vacancy rate of 17.1% for offices, barely below its peak of 17.6% in late 2010. Vacancy rates are 35% above 2007 levels and more than double the rates in the late 1990s. But what I realized after digging into the methodology of these reported figures is the true rates are significantly higher. First you must understand that Reis and Trepp are real estate companies who are in business to make money from commercial real estate transactions. It is in their self -interest to report data in the most positive manner possible – they’ve learned the lessons of Bernays. These mouthpieces for their industry slice and dice the numbers according to major markets, minor markets, suburban versus major cities, and most importantly they only measure Class A office space.

I didn’t realize the distinctions between classes when it comes to office space. The Building Owners and Managers Association describes the classes:

Class A office buildings have the “most prestigious buildings competing for premier office users with rents above average for the area.” Class A facilities have “high quality standard finishes, state of the art systems, exceptional accessibility and a definite market presence.” Class B office buildings as those that compete “for a wide range of users with rents in the average range for the area.” Class B buildings have “adequate systems” and finishes that “are fair to good for the area,” but that the buildings do not compete with Class A buildings for the same prices. Class C buildings are aimed towards “tenants requiring functional space at rents below the average for the area.”

So we have landlords self-reporting Class A vacancy rates in big markets to a real estate company that reports them without verification. Is it in a landlord’s best interest to under-report their vacancy rate? You bet it is. If potential tenants knew the true vacancy rates, they would be able to negotiate much lower rents. There is a beautiful Class A 77,000 square foot building near my house that was built in 2004. Nine years later there is still a huge Space Available sign in front of the building and it appears at least 50% vacant.

I pass another Class A property on Welsh Road called the Gwynedd Corporate Center that consists of three 40,000 square foot buildings in a 13 acre office park. It was built in 1998 and is completely dark. The vacancy rate is 100%. As I traveled down Germantown Pike last week I noted dozens of Class A office complexes with Space Available signs in front. I’m absolutely certain that vacancy rates in Class A offices in Montgomery County exceed 25%. When you expand your horizon to Class B and Class C office space, vacancy rates exceed 50%. The only booming business in my suburban paradise is Space Available sign manufacturing. We probably import those from China too. Despite the spin put on the data by the real estate industry, Moody’s reported data supports my estimates:

- The values of suburban offices in non-major markets are 43% below 2007 levels.

- Industrial property values in non-major markets are 28% below 2007 levels.

- Retail property values in non-major markets are 35% below 2007 levels.

The data being reported by Reis regarding vacancies in strip malls and regional malls is also highly questionable, based on my real world observations. The reported vacancy rates of 8.6% for regional malls and 10.7% for strip malls, barely below their 2011 peaks, are laughable. Again, there is no benefit for a landlord to report their true vacancy rate. The truth will depress rents further. This data is gathered by surveying developers and landlords. We all know how reputable and above board real estate professionals are – aka David Lereah, Larry Yun. A large strip mall near my house has a 70% vacancy rate, with another, one mile away, with a 50% vacancy rate. Anyone with two eyes and functioning brain that has visited a mall or driven past a strip mall knows that vacancy rates are at least 15%, the highest in U.S. history. These statistics don’t even capture the small pizza joints, craft shops, antique outlets, candy stores, book stores, gas stations and myriad of other family run small businesses that have been forced to close up shop in the last five years.

The disconnect between reality, the data reported by the mouthpieces of the status quo, and financial markets is as wide as the Grand Canyon. Even the purveyors of false data can’t get their stories straight. Trepp has been reporting steadily declining commercial delinquency rates since July 2012, when they had reached 10.34%, the highest level since the early 1990s. The decline is being driven solely by apartment complexes and hotels. Industrial and retail delinquencies continue to rise and office delinquencies are flat over the last three months. Again, the definition of delinquent is in the eye of the beholder.

The quarterly delinquency rates on commercial loans reported by the Federal Reserve is less than half the rate being reported by Trepp, at 4.13%. Bennie and his band of Ivy League MBA economists have reported 10 consecutive quarters of declining commercial loan delinquency rates. This is in direct contrast to the data reported by Trepp that showed delinquencies rising during 2012.

|

Real estate loans |

||||

|

All |

Booked in domestic offices |

|||

|

Residential 1 |

Commercial 2 |

Farmland |

||

| 2012:4 |

7.57 |

10.07 |

4.13 |

2.67 |

| 2011:4 |

8.48 |

10.34 |

6.11 |

3.26 |

| 2010:4 |

9.12 |

10.23 |

7.96 |

3.59 |

| 2009:4 |

9.59 |

10.54 |

8.73 |

3.42 |

| 2008:4 |

6.04 |

6.67 |

5.49 |

2.28 |

| 2007:4 |

2.91 |

3.08 |

2.75 |

1.51 |

| 2006:4 |

1.70 |

1.95 |

1.32 |

1.41 |

The data being reported doesn’t pass the smell test. Commercial vacancy rates are at or above the levels seen during the last Wall Street created real estate crisis in the early 1990’s. During 1991/1992 commercial loan delinquency rates ranged between 10% and 12%. Today, with the same or higher levels of vacancy, the Federal Reserve reports 4% delinquency rates. When the latest Wall Street created financial collapse struck in 2008 and commercial property values crashed while vacancy rates soared, there were dire predictions of huge loan losses between 2010 and 2012. Commercial real estate loans generally rollover every 5 to 7 years. The massive issuance of dodgy subprime commercial loans between 2005 and 2007 would come due between 2010 and 2012. But miraculously delinquency rates have supposedly plunged from 8.78% in mid-2010 to 4.13% today. The Federal Reserve decided in 2009 to look the other way when assessing whether a real estate loan would ever be repaid. A loan isn’t considered delinquent if the lender decides it isn’t delinquent. The can’t miss strategy of extend, pretend and pray was implemented across the country as mandated by the Federal Reserve. This pushed out the surge in loan maturities to 2014 – 2016.

In an economic system that rewarded good choices and punished those who took ridiculous undue risks and lost, real estate developers, mall owners, and office landlords would be going bankrupt in large numbers and loan losses for Wall Street Too Stupid to Succeed banks would be in the billions. Developers took out loans in the mid-2000’s which were due to be refinanced in 2012. The property is worth 35% less and the rental income with a 20% vacancy rate isn’t enough to cover the interest payments on the loan. The borrower would have no option but to come up with 35% more cash and accept a higher interest rate because the risk of default had risen, or default. Instead, the lenders have pretended the value of the property hasn’t declined and they’ve extended the term of the loan at a lower interest rate. This was done on the instructions of the Federal Reserve, their regulator. The plan is dependent on an improvement in the office and retail markets. It seems the best laid plans of corrupt sycophant central bankers are going to fail.

Eyes Wide Open

There are 1,300 regional malls in this country, with most anchored by a JC Penney, Sears, Barnes & Noble, or Best Buy. The combination of declining real household income, aging population, lackluster employment growth, rising energy, food and healthcare costs, mounting tax burdens, and escalating on-line purchasing will result in the creation of 200 or more ghost malls over the next five years. The closure of thousands of big box stores is baked in the cake. The American people have run out of money. They have no equity left in their houses to tap. The average worker has only $25,000 of retirement savings and they are taking loans against it to make the mortgage payment and put food on the table. They can’t afford to perform normal maintenance on their property and are one emergency away from bankruptcy. In a true cycle of doom, most of the jobs “created” since 2009 are low skill retail jobs with little or no benefits. As storefronts go dark and more “Available” signs are erected in front of these weed infested eyesores, more Americans will lose their jobs and be unable to do their 71% part in our economic Ponzi scheme.

The reason office buildings across the land sit vacant, with mold and mildew silently working its magic behind the walls and under the carpets, is because small businesses are closing up shop and only a crazy person would attempt to start a new business in this warped economic environment of debt dependent diminishing returns. The 27 million small businesses in the country are fighting a losing battle against overbearing government regulations, increasingly heavy tax burdens, operating cost inflation, Obamacare mandates, a low skill poorly educated workforce, and customers with diminishing resources and declining disposable income. Small business owners are not optimistic about the future because they don’t have a sugar daddy like Bernanke to provide them with free money and a promise to bail them out if their high risk investments go bad. With small businesses accounting for 65% of all new hiring in this country and looming healthcare taxes, mandates, regulations and penalties approaching like a freight train, there is absolutely zero probability that office buildings will be filling up with new employees in the next few years. With hundreds of billions in commercial real estate loans coming due over the next three years, over 60% of the loans in the office and retail category, vacancy rates at record levels, and property values still 30% to 40% below the original loan values, a rendezvous with reality awaits. How long can bankers pretend to be paid on loans by developers who pretend they are collecting rent from non-existent tenants who are selling goods to non-existent customers? The implosion in the commercial real estate market will also blow a gaping hole in the Federal Reserve balance sheet, which is leveraged 55 to 1.

I regularly drive along Schoolhouse Road in Souderton. It is a winding country road with dozens of small manufacturing, warehousing, IT, aerospace, auto repair, bus transportation, retail and landscaping businesses operating and trying to scratch out a small profit. Most of these businesses have been operating for decades. I would estimate that most have annual revenue of less than $2 million and less than 100 employees. It is visibly evident they have not been thriving, as their facilities are looking increasingly worn down and in disrepair. Their access to credit has been reduced since the 2008 crisis, as only the Wall Street banks and mega-corporations with Washington lobbyists received Bennie Bucks and Obama stimulus pork. These small businesses have been operating on razor thin margins and unable to invest in their existing facilities or expand their businesses. The tax increases just foisted upon small business owners and their employees, along with Obamacare mandates which will drive healthcare costs dramatically higher, and waning demand due to lack of income, will surely push some of these businesses over the edge. There will be some harsh lessons learned on Schoolhouse Road over the next few years. I expect to see more of these signs along Schoolhouse Road and thousands of other roads in the next few years.

The mainstream media pawns, posing as journalists, have not only gotten the facts wrong regarding the current situation, but their myopia extends into the near future. The perpetual optimists that always see a pot of gold at the end of the rainbow are either willfully ignorant or a product of our government run public education system and can’t perform basic mathematical computations. As pointed out previously, consumer spending drives 71% of our economy. As would be expected, the highest level of annual spending occurs between the ages of 35 to 54 years old when people are in their peak earnings years. Young people are already burdened with $1 trillion of government peddled student loan debt and are defaulting at a 20% rate because there are no decent jobs available. Millions of Boomers are saddled with underwater mortgages, prodigious levels of credit card and auto loan debt, with retirement savings of $25,000 or less. Anyone expecting the young or old to ramp up spending over the next decade must be a CNBC pundit, University of Phoenix MBA graduate or Ivy League trained economist.

There will be 10,000 Boomers per day turning 65 years old for the next 18 years. Consumers in the 65-74 age segment spend 28% less on average than during their peak years. It is estimated that between 2010 and 2020 there will be approximately 14.5 million more consumers aged 65 or older. The number of Americans in their peak spending years will crash over the next decade. This surely bodes well for our suburban sprawl, mall based, cheap energy dependent, debt fueled society. Do you think this will lead to a revival in retail and office commercial real estate?

We’ve got $1 trillion annual deficits locked in for the next decade. We’ve got total credit market debt at 350% of GDP. We’ve got true unemployment exceeding 20%. We’ve had declining real wages for thirty years and no change in that trend. We’ve got an aging, savings poor, debt rich, obese, materialistic, iGadget distracted, proudly ignorant, delusional populace that prefer lies to truth and fantasy to reality. We’ve got 20% of households on food stamps. We’ve got food pantries, thrift stores and payday loan companies doing a booming business. We’ve got millions of people occupying underwater McMansions in picturesque suburban paradises that can’t make their mortgage payments or pay their utility bills, awaiting their imminent eviction notice from one of the Wall Street banks that created this societal catastrophe.

We’ve got a government further enslaving the middle class in student loan debt with the false hope of new jobs that aren’t being created. We’ve got a shadowy unaccountable organization, owned and controlled by the biggest banks in the world, that has run a Ponzi scheme called a fractional reserve lending system for 100 years, and inflated away 96% of the purchasing power of the U.S. dollar. We’ve got a self-proclaimed Ivy League academic expert on the Great Depression (created by the Federal Reserve) who has tripled the Federal Reserve balance sheet on his way to quadrupling it by year end, who has promised QE to eternity with the sole purpose of enriching his benefactors while impoverishing senior citizens and the middle class. He will ultimately be credited in history books as the creator of the Greater Depression that destroyed the worldwide financial system and resulted in death, destruction, chaos, starvation, mayhem and ultimately war on a grand scale. But in the meantime, he serves the purposes of the financial ruling class as a useful idiot and will continue to spew gibberish and propaganda to obscure their true agenda.

It is time to open your eyes and arise from your stupor. Observe what is happening around you. Look closely. Does the storyline match what you see in your ever day reality? It is them versus us. Whether you call them the invisible government, ruling class, financial overlords, oligarchs, the powers that be, ruling elite, or owners; there are powerful wealthy men who call the shots in this global criminal enterprise. Their names are Dimon, Corzine, Blankfein, Murdoch, Buffett, Soros, Bernanke, Obama, Romney, Bloomberg, Fink, among others. They are using every means at their disposal to retain their control and power over the worldwide economic system and gorge themselves like hyenas upon the carcasses of a crippled and dying middle class. They have nothing but contempt and scorn for the peasants. They’re your owners and consider you as their slaves. They don’t care about you. They think the commoners are unworthy to be in their presence. Time is growing short for these psychopathic criminals. No amount of propaganda can cover up the physical, economic, social, and psychological descent afflicting our world. There’s a bad moon rising and trouble is on the way. The time for hard choices is coming. The words of Edward Bernays represent the view of the ruling class, while the words of George Carlin represent the view of the working class.

“There’s a reason that education sucks, and it’s the same reason it will never ever be fixed. It’s never going to get any better, don’t look for it. Be happy with what you’ve got. Because the owners of this country don’t want that. I’m talking about the real owners now, the big, wealthy, business interests that control all things and make the big decisions. Forget the politicians, they’re irrelevant.

Politicians are put there to give you that idea that you have freedom of choice. You don’t. You have no choice. You have owners. They own you. They own everything. They own all the important land, they own and control the corporations, and they’ve long since bought and paid for the Senate, the Congress, the State Houses, and the City Halls. They’ve got the judges in their back pockets. And they own all the big media companies so they control just about all the news and information you get to hear. They’ve got you by the balls.

They spend billions of dollars every year lobbying to get what they want. Well, we know what they want; they want more for themselves and less for everybody else. But I’ll tell you what they don’t want—they don’t want a population of citizens capable of critical thinking. They don’t want well informed, well educated people capable of critical thinking. They’re not interested in that. That doesn’t help them. That’s against their interest. You know something, they don’t want people that are smart enough to sit around their kitchen table and figure out how badly they’re getting fucked by a system that threw them overboard 30 fucking years ago.” – George Carlin

Another fine analysis. In other news, Jerry Sandusky tells his biographer, “‘Maybe I tested boundaries'”.

So, we went off the gold standard in 1913 and 1971, had a depression, a world war, the boomer generations and stagflation, then the Reagan Administration figured out how cntl-P works and here we are a few bumps in the road later.

If one looks at the short history of our nation, that which our forebearers feared has come upon us.

“For the thing that I fear comes upon me, and what I dread befalls me.” (Job 3:25, ESV)

Job’s mistake was fear. That mistake will not be repeated.

The Lord is my rock and my fortress and my deliverer,

my God, my rock, in whom I take refuge,

my shield, and the horn of my salvation, my stronghold. (Psalm 18:2, ESV)

Please note Psalms says nothing about the MSM, which we know from WWII, as evidenced in Vietnam has misrepresented fact continuously, so much so they wouldn’t know how to report the news if their lives depended on it.

The printing press brought about the Protestant Revolution, it remains to be seen what sea change will result from the Internet and real freedom of the press.

We moved here to the Puget Sound in 2008 after years of living in non western countries overseas. I remember my first impressions of it here as a run down backwater of urban blah. I felt like I had gone back in time 30 years.

The cities we lived in abroad were crazy with modernizing, construction, money, retail, entertainment, activity, people, transit, buzz. Here it was….dull and lifeless. Empty street level retail everywhere you went. Now in 2013 that same retail is STILL vacant! All over in every neighborhood, downtown, vacant empty commercial space is anywhere you look. I went to my local depressing shopping area today and saw more storefronts than ever were empty. And the Puget Sound is supposed to be one of the ‘better’ economies in America. Dear god.

But we were in Ecuador in November and the place was rocking! I haven’t seem boom like that in years. Guyaquil, Ecuador, their biggest city was an absolutely boomtown. Buildings, roads, utilities, harbor, sidewalks, hotels, apartments–the place was kicking out the jams. Everybody working, jobs galore.

Whatever money is floating around in this world looking for opportunity–it isn’t going to the over regulated tax sucking western world. Money is doing plenty of things in plenty of places, but the USofA sure as hell ain’t one of them.

If you really want a good idea of what a depressing laggard our country is, just get out of it for a while to see what’s happening elsewhere. You won’t want to come back.

I will try to shine a light on the commercial real estate debacle. I was an estimator/project manager for a general contractor in the Upper Darby area in 2004-2006, just before the bubble burst. We were building like crazy. Office buildings, strip malls, town houses, etc. In many cases, the projects were built on leased land, and it is a mufti-year process.

First, a lease on the land. Then design and cost estimating. Those may take a year and the investment may be near a million at this point. Then actual construction, which, depending on the size of the project may take several years … and bingo! You now have multimillions invested that are mostly borrowed relevant to the market conditions at the time of the loan. Some of my projects went into the eight figures and were five years in the process.

Many of these projects were in process when the bottom fell out in 2007- 2008. Then there was no choice but to finish them and hope for a recovery and profit, or lose the millions invested with zero payback. Most were finished. Now they set empty. Ditto for hundreds of housing developments in process at the time. Millions of unrecoverable investment dollars if the project was halted. A gamble if they were finished. Now they sit empty and the millions will be lost eventually anyway when the banks collapse.

BTW: The typical WAWA or Sheetz cost about $5 million to $8 million in 2006. I would guess they are up around $8 million to $10 million plus now. Not counting land costs.

Thank you for another illuminating piece that helps me understand more than I did before I read it.

I don’t know which is more breathtaking, the stupidity or the corruption. The small (70,000 pop.) and prosperous city I inhabit is full of empty commercial space, much of it built after 2005. Most of the empty space has never been rented. I ponder what will eventually happen to these buildings and office parks. Section 8 housing perhaps?

The mental gymnastics required to maintain a positive attitude in this dreadful circus are becoming rather difficult to perform.

Gayle

Rafael Sabatini’s potboiler “Scaramouche” introduces the title character this way: “He was born with the gift of laughter and the sense that the world was mad.”

Mark Twain wrote this: “Power, money, persuasion, supplication, persecution — these can lift at a colossal humbug — push it a little — weaken it a little over the course of a century; but only laughter can blow it to rags and atoms at a blast. Against the assault of laughter nothing can stand.”

Keep laughing at the fools who think they’re the masters of the universe.

“Don’t bother me with facts, son. I’ve already made up my mind.”

Foghorn Leghorn

[img [/img]

[/img]

[img [/img]

[/img]

[img [/img]

[/img]

Thank god I don’t live in the U.S.

Michael, if you live in Europe, you are only a step ahead of the US. The contagion from the South will move north. Wait and see. I live in the Philippines and they are still growing.

Admin: another excellent, thought provoking post. Thank you! Marissa: I agree with your Latin American observations X100. Money is pouring into Latin America. I train airline pilots from most of the countries down there and they are intelligent, hard working, respectful individuals. They are what Americans used to be.

Town of +70K here.

You can drive past strip mall after strip mall, all of which either empty, or nearly empty.

In one case the only thing thats open is the DMV, all of the real stores have closed over the last 4 years.

Great article.

That’s what happens when you wipe out the middle class. Corporations got greedy, so they made more profits by making stuff in China. 55,000 manufacturing facilities have been closed and offshored. Corporations cashed in, workers got screwed. Corrupt Unions got greedy, and resulted in more jobs shipped to China. They sold it to the public as a “service” economy. Well, service economies don’t need much commercial property.

Once the middle class is gone, what is there? The very rich and 100 million on welfare. The owners and the debt serfs. The owners aren’t is as good a shape as they think. Once Bernanke quits blowing up the biggest debt bubble in the history of the world, there’s no place for them to hide.

Marissa and Ragman,

So the globalist agenda is working, the dichotomy is that the $T’s spent to save the world’s financiers, went straight to 1/10 of 1% who are using it to buy the rest of the world.

They only have to outbid the Chinese.

Neo-feudalism is a good word to describe it, which results in economic slavery.

The chief Fed supporter and CNBC cheerleader is Steve “fat ass” Liesman The shills on CNBC even conduct their own “surveys” which, of course, report that everything is great, Bernanke is a genius, buy the dip, buy stocks (they’re still a great value),

Case in point. Did you know the American dream is back?

American Dream Is Back, So Are Stocks: CNBC Survey

CNBCBy Steve Liesman | CNBC

http://finance.yahoo.com/news/american-dream-back-stocks-cnbc-121228555.html

The American dream is back bitchez! Time to take on some more debt.

Admin,

Great read and I have not even finished my second cup of coffee.I stole the Bernay’s and Carlin quotes and sent them to my 17 year old daughter as it related to a discussion we were having last night about rights, the Constitution, what is real and what the government wants us to think is real. Surprisingly intense conversation for a 17 year old. Fortunately she has not been indoctrinated, so I still hold out hope. I am half way through Ken Follete’s “Fall of the Giants” and the parallels of the obscene abuse of power to manipulate the masses and force war onto the ignorant peasants is palpable. It is interesting, people that could read, read newspapers and many went to public houses to discuss the events of the day, I am not sure they were ignorant or willfully ignorant as much as manipulated. Many were stuck in a fuedal like survival existence. Grinding poverty was commonplace. Today there seems to be much more willful ignorance. Listening to a discussion this morning the commentator lamented how it has become distasteful, or unPC to discuss these themes in public. My wife will often point out that I make people uncomfortable when I bring these things up. It is a sad state of affairs when people are so scared to face the truth that they cannot even bare to discuss it in public. On the rare occasion that I can coax someone into discussing any of these things, I find most are woefully lacking on the true facts. When you point this out to them they only get belligerent at the fact that you are challenging their reality. So sad. I am afraid this will not end well.

Thank you,

Bob.

Picture of an improving economy?

[img [/img]

[/img]

Another great read, thank you.

I find the disconnect absolutely crazy-making but I am getting better at accepting what I can’t change.

I’m hosting a family event this weekend with college educated sibs, cousins, friends , a few so’s and I can guarantee I will be the only one who thinks in this way AND I will be accused of being a tortured sole obsessed with the “alternative” news and by-in-large just WRONG, WRONG, WRONG.

For the event to go well I will be required to listen to inane talk about whatever amuses these people.

Notes: the first meaning of amuse was ‘to divert the attention of in order to mislead,’ ‘delude, deceive’ and now means ‘entertain, make smile or laugh’; bemuse means ‘confuse, bewilder, puzzle’

Another blog I follow suggested that 2013 would be the year of the disconnect – where people who are awake and aware purposefully disconnect from those still listening to MSM and drinking the kool-aid – I imagine after the cook-out I might choses not to see or hear from a lot of these people again and they’ll probably not even notice – or be pleasantly relieved not to have their reality purposefully questioned by a whack-job doomer.

Your not alone BostonBob. My family thinks I’m a lunatic. My co-workers leave the room if I even mention anything that conflicts with what they want to believe. *sigh* I keep trying though.

Saq

Unlike you, I have stopped trying. Brian Williams is smarter, better looking, and more trustworthy in his interpretation of current realities than I could ever possibly be. And who’s this Jim Quinn fellow anyhow?

Every cent of equity is being sucked out of this country to help finance the booms abroad. It won’t be coming back either.

Yoji, “If you want to survive in this economy, you must become like an Castle or Private Fiefdom – as independent as possible, with your wealth kept within your walls, having weapons to defend it, with enough education to be aware of the treacherous political currents swirling around you so you can avoid being harmed by them.”

Right on, my thoughts exactly.

JQ, this article is spot on. We’ve had our differences in the past, but we’re thinking more and more alike all the time. Great work!

Let your eyes and ears do the “walking”..

Take a hike to your closest major “Mall” and count the unoccupied stores versus the occupied. Drive down your major highway, stop at every strip mall and count the empty store fronts versus the active ones.

Go shopping in Walmart (or your pit of choice) and save the receipt. In six months, go back and buy the same list and compare the two.

Then compare all that data to what you’re being told (holding a small trash can to throw up in) and you shall know the truth.

It’s a damn pity that people like Stockman can’t tell the truth when they are working for the upper powers that be and then find their souls and see the light and start preaching the truth as soon as they leave (or are booted out) of the bounds of the beltway. Mr. Stockman now broadcasts the truth but he does not, nor will he ever have my approval or admiration because for so many years he was just as big a wuss as now occupies his ex-office in the Office of Management and Budget.

Fuck you David..

Another great article, Jim..

MA

Admin,

Another one outta the park!!!

Monday’s doom was just a prelude to your finale.

Olga,

I’ve been “purposefully disconnected” for several years now.

My sympathies. You may not like where you’re headed.

David,

Yes, and I’d say that’s exactly according to plan.

Bostonbob,

People NEED to be uncomfortable. Keep it up!!! Sometimes just planting the seed is enough. A seed planted in 2007 set me off on what is, thus far, a 6-yr. journey. At about 4 years in, I discovered TBP.

What a fricking liar you are. Those aren’t pictures of PA, Montgomery Co. and Philly. Those are pictures of right around here (Southeast MI, Detroit, Toledo, etc.)

Unless your area is as blighted as mine, in which case we’re all in trouble.

Hello Muck!!!

[img][IMG [/IMG][/img]

[/IMG][/img]

Even as a Christian, with all of God’s promises of a new Heaven and Earth, and justice for every person’s actions, I can’t help despairing for this world. It is just so sad that mankind will ruin the world, all for some sense of control and 70 or 80 years of pride and ‘the good life’. As the Bible says, every one of them will eventually die (over which they have no control) and their wealth will be given to others.

Revelation is a prophetic book about the end of the world system. In it the ‘world leader’ is outlined in detail; outstanding speaker, liar, highly intelligent, and will bring ‘all the world’ together in a temporary ‘peace’. He in fact brings ALL the world together. Never in the history of this world have we literally seen ALL the world linked together so well, especially in commerce and finance, but as well governmentally (i.e. United Nations, WMF, etc.).

In 1981, long before computers and global economy were dreamed of, Calvary Chapel and Chuck Smith were discussing the Anti-Christ in Revelation, and I was only 23. I clearly recall the estimations that there must be a ‘global economic failure’ in order to trigger a ‘one-world’ leader’s emergence. Yes, we’ve heard of 1984 and many theories, true without doubt. But no one was more accurate than Chuck Smith in my opinion, and of course his opinion was based on the Bible.

Get ready for the 666 decision (to accept or refuse). Cashless society, a simple mark on the hand for identity, legislation requires it to buy or sell. All fantasy just 20 years ago. Now a reality.

I am mostly fearful of living in this generation, and yet with the hope that the Rapture will take place before it gets really bad (again, I refer you to read Revelation).

If you have not investigated Jesus for yourself, now is the time to do so. God created the heaven and the earth, and man, and all within it. Seek Him while there is time, because time is not infinite. It will run out.

@Believer – Can I have your stuff when you get “raptured” (beware of apple sauce!)

@everyone else – My local mall has taken to putting up “temporary” walls through units so they can at least rent out half.

The stores look like little more than alleyways, but it seems like its the only way they can draw in business.

Hi Maddie’s Mom!

[img [/img]

[/img]

MA

Whatever the media or government put out as information.I figure the opposite is most likely true.

Student Loan Defaults Soar By 36% Compared To Year Ago

Submitted by Tyler Durden on 03/26/2013 16:46 -0400

The growing debacle that is the US student loan bubble – nearly the same size and severity as the Subprime crisis at its peak- has been painfully dissected on these pages in the past, so at this point the only thing remaining is to keep track of the bubble growing exponentially in real time as it hits all time records, and eventually pops. Helping us to track the realtime growth is the latest data from Equifax, via Reuters, which confirms what everyone knows: things in student bubble land are getting worse by the minute. Much worse, because in just the first two months of 2013, banks wrote off $3 billion of student loan debt, up more than 36 percent from the year-ago period, as many graduates remain jobless, underemployed or cash-strapped in a slow U.S. economic recover.

From Reuters:

The credit reporting agency also said Monday that student lending has grown from last year because more people are going back to school and the cost of higher education has risen.

“Continued weakness in labor markets is limiting work options once people graduate or quit their programs, leading to a steady rise in delinquencies and loan write-offs,” Equifax Chief Economist Amy Crews Cutts said in a statement.

The cost of earning a 4-year undergraduate degree has gone up by 5.2 percent per year in the last decade, according to the CFPB, forcing more students to take out loans. While other forms of debt went down, student loan debt continued to rise through the economic crisis.

Delinquencies have spiked in the last eight years, with about 17 percent of the nearly 40 million student loan borrowers at least 90 days past due on their repayments, a February report from the New York Federal Reserve Bank showed.

Er…. BTFD in the S&P (if there is a D of course – the way Kevin Henry is buying everything these days who knows)?

What else did you expect us to conclude here? It is painfully obvious by now that the farce will not end until the second coming of the stock, tech, housing, bond and, new entrant, student bubbles all pop spectacularly and at the same time, in the most epic Ben Bernanke organized New Normal credit supernova ever to be seen.

Great article,I agree with 100%. One thing to think about that wasn’t discussed, is how many small mom and pop businesses that are still in those retail space have been basically broke since 2008, bringing in just enough to keep the lights on but not bringing in much else.After investing your life for decades, they have to keep going hoping against hope that it will turn around. What else can they do, who’s going to hire a late middle age self made man or woman ? Expect a great falling out this year or next. My advise, stock up on shit that will help you survive.

In SoCal, the apt market is going crazy strong. The govt supports C&I via SBA financing for owner-user deals. You take the SBA financing away and require 40% down payment versus 10% and it is a whole different ballgame. IF you look at the spread between leased fee and fee simple values you have another illustration of the gov’t distorting asset values.

Admin – good stuff. I agree with almost all of it, and, as always, my areas of disagreement are more quibbles than disagreements. (But some of those minor quibbles have lead to some doozies of flamefests. Hopefully not this time!)

The biggest small quibble I have is in the the way you mention the 1%. Indeed, I agree that the 1% have largely sucked up any gains in real income. But I think the measurement should be far finer than the 1%. Say the .01%. That would tell me more.

Because the fact is, the top 1% ( around 1.5 million people) are largely small businessmen, small business owners, doctors, lawyers, senior managers, accountants, etc. I do not consider these folks elite – I consider them to be aspirational sorts by and large, and worthy of any success they may have attained. They include, most likely, folks like AWD, Hope, etc.

The true oligarchs are very small in number, and when you combine them with the investment bankers making absurd salaries, the handfull of folks at each megacorp making ridiculous salaries, etc., I doubt the truly elite/absurdly compensated, etc. would number more than thousands or tens of thousands versus the remaining say 1.4 million of the top 1% who have earned every cent they make.

An additional point I would like to make is that I am truly of the belief that a modern economy will make it very difficult for the lower half of the population – by lower half I mean those in the bottom half of skills and intelligence. It is going to be extremely difficult for those folks to be able to generate enough value in a world economy to earn a reasonable standard of living.

Then there will be those in the upper half that make bad decisions. They will receive poor training, they will go ito debt, they will marry poorly, they will take art history instead of engineering or accounting at college, they will have no work ethic and a huge sense of entitlement. These folks too will struggle to produce enough to achieve a reasonable standard of living in a global economy. I estimate that this number could be perhaps half of the upper half.

So, that means in my calculations, that perhaps only 1/4 of the population will be able or willing or smart enough to produce enough in a global market so as to earn a reasonable standard of living.

THEN you add in the issues you so ably discussed above – for instance, the absurd difficulty involved in running/starting/maintaining a small business. The absurd tax system and government expenditures. The unbelievable stupidity of the people with respect to borrowing and spending. Etc.

There is a major crisis coming. Global competition, a stupid and irresponsible population, an out of control and damaging political/government system, elites and bankers running amok, unsustainable demographics and the associated costs, etc. will eventually collapse the entire economy. And the forecast I made above that 25% of the population may be able to earn a reasonable standard of living looks increasingly difficult to attain. At least until an equilibrium is reached.

The fact is, in the long run, the majority of people are going to have to adjust their expectations. The majority of folks will have to work long, hard hours for relatively low pay, and will have to live frugal lives. People in the end will be paid only for what they can produce, and their global competition will be fierce. Only the brightest, most skilled, best educated, most hard-working and most productive will be able to live affluent lifestyles.

The expectation and belief that low skilled, low abilty, slothful folks will lead a comfortable lifestyle is a pipe dream that is failing throughout the world.

[img [/img]

[/img]

I live in Delaware County, a place less affluent that Montgomery County. Currently, I am at Penn State attempting to earn a degree in Engineering; however, I’m beginning to doubt whether saddling myself with debt obtaining the degree will be worth it in when interest rates rise, jobs are scarce, and the loans need to be repaid.

People are lied to on a daily basis and most don’t realize it, but it’s not the ignorance that scares me; it’s the joy of ignorance that frightens me. I cannot have a conversation with anyone my age that involves anything remotely important. Every conversation reverts back to beer, women, and iGadgets. It’s difficult to try to relate to people whose heads are so far up theirs own asses that they say things like, “I wouldn’t care if the government put chips in everyone to track people. The ‘freedom people’ might not like it though.” This comment was made by a college-educated man. It scares me because these are the same people who will eventually control much of the decision making in this country.

I believe Goethe said “None are more hopelessly enslaved than those who falsely believe they are free.” I do not believe in this falsity. I will not be enslaved.

Income Growth For Bottom 90% In America Since 1966 Is… $59!

Submitted by Michael Krieger of Liberty Blitzkrieg blog,

We’ve all seen these statistics before in one form or another, but David Cay Johnston does an excellent job going into more detail for us in an article he published late last month. As he correctly notes, when things get extreme like this you ultimately end up with extreme social unrest. Furthermore, as I have pointed out for years and years, this kind of disparity does not happen under free markets with rules and regulations applied equally to all. It happens under totalitarian societies, whether fascism, communism or crony capitalist corporatism (which is the model in the USA). It only happens when a very small oligarch class takes over the political process of a nation and then uses it to game the system.

However, I would take exception to Mr. Johnston’s conclusion that the root problem is the tax system. While I do not for one moment deny that the oligarchs game the tax system to provide loopholes for themselves, this is not why the 1% of 1% has taken all the wealth of the nation. This is much more related to the Federal Reserve and its policies of printing trillions of money out of thin air and distributing it to the oligarchs, either directly or through low interest loans. If you tax the rich more, they will still make more because they will still have the access to the cheap money. The Federal Reserve is the core cancer of the entire thing and they must be stopped. Some excerpts below:

The average increase in real income reported by the bottom 90 percent of earners in 2011, compared with 1966, if measured at one inch, would extend almost five miles for the top 1 percent of the top 1 percent.

Remember, we got off the gold standard in 1971, after which the Federal Reserve could print as much as they wanted and distribute it wherever they wanted…and they have.

Incomes and tax revenues have grown from 2009 to 2011 as the economy recovered, but an astonishing 149 percent of the increased income went to the top 10 percent of earners.

If you wonder how that can happen, the answer is simple: Incomes fell for the bottom 90 percent.

Ponder that last fact for a moment — the top 1 percent of the top 1 percent, those making at least $7.97 million in 2011, enjoyed 39 percent of all the income gains in America. In a nation of 158.4 million households, just 15,837 of them received 39 cents out of every dollar of increased income.

In 2011 the average AGI of the vast majority fell to $30,437 per taxpayer, its lowest level since 1966 when measured in 2011 dollars. The vast majority averaged a mere $59 more in 2011 than in 1966. For the top 10 percent, by the same measures, average income rose by $116,071 to $254,864, an increase of 84 percent over 1966.

Between 1980 and 2005, more than 80 percent of the total increase in income went to the top 1 percent of American households.

The median wage has been stuck since 1999 at a bit more than $500 per week in real terms and job growth has lagged far beyond population growth. But capital gains and dividends have soared, a new Congressional Research Service study shows. And, of course, the rich get most of that income. Thomas Hungerford concluded:

That is a lot of stress being placed on people between the bottom rung and the top. I think it is more stress than the social ladder can bear, although when and how it will break no one will know until it happens.

Tax policy is driving these trends.

llpoh

I agree with you. The 1% does include mostly self made entreprenuers and small business owners. The truly evil scumbags are in the .01% as you correctly point out. I tried to differentiate between the hard working business people that are being screwed and the Wall Street scumbags pillaging the working class.

“But actually, he thought as he re-adjusted the Ministry of Plenty’s figures, it was not even forgery. It was merely the substitution of one piece of nonsense for another. Most of the material that you were dealing with had no connexion with anything in the real world, not even the kind of connexion that is contained in a direct lie. Statistics were just as much a fantasy in their original version as in their rectified version. A great deal of the time you were expected to make them up out of your head.”

Orwell’s 1984

MechEngine

You and your generation are our only hope. I hope there are many more like you who have their eyes open. Your generation will have to do the heavy lifting in the coming conflict.

And don’t forget, FOX Business says people are just out of work because they’re lazy…

…well, they say it when there’s an Occupy protest, at least. Gotta maintain that stance of opposing the liberals, even if the liberals have a point

Llpoh and Admin,

Entrepreneurs and small business owners are a rung below the 1%, which are the C level execs of multinationals who justify the indefensible by claiming they’re beholden to the stockholders in pursuit of almighty profit, the stockholders being the 1/10th of 1%. Their lap dogs are the executives and politicians who do their bidding. I’ll lump career politicians in with the 1%.

Entrepreneurs and small business owners as you describe them belong in the 2%. I’ve never heard anyone complain about them. Llpoh has a persecution complex and don’t get me started on profit. Morally, profit belongs to each input of production equitably, the only measure being the cost of the input, capital dollars being no more equal than wages. It’s a scientific fact, as much as economics is a science. Oops, I got started.

Oh, and everyone has a right to be wrong, even you, LL.

Admin – thanks. We do need a good flamefest around here, though. I am trying to antagonize Stuck, but he seems to smart to bite. Maybe SAH and Z will show up.

Nonanonymous says “it is a scientific fact”. Hahahahahahahahaha! what a load of crapola! Seriously, that is too funny. Non talks about morality, then says it is a scientific fact. Which is it? Morality, or scientific fact? They are mutually exclusive positions. Plus, there is no allowance for the cost of capital. In order to get someone to risk their capital, the potential return must exceed the 95% chance that the investment will be lost. Now that is an economic fact. Do you reallly believe that I wil invest 100 dollars knowing my expected total return is $5? Hell no. So that means that in order to be in balance, at a minimum I require a potential return of $2000 for my $100 investment. And that will only make the bet a break even proposition. In reality, I need perhaps the potential for a $4000 return in order to compensate me for the overall risk. So, if I am starting a business, I need to judge that if I invest $1 million, that I have a 1/20th chance of making $40 million. Otherwise the bet sucks ass. So I probably need a potential return on investment of several times my investment per year.

THAT is the economic science. And that is why the capital suppliers get the lion’s share of profits – because they carry the total risk of all loss.

Profit belongs to the owners of capital – those that risk the capital to be specific. A worker does not risk anything. He or she offers their labor in return for compensation – money. They get a fixed, known return for their labor, each and every week. They are not responsible for the quality of their work. They are not responsible for paying for their fuck-ups. They can leave at anytime owing nothing. The worst, generally, that can happen to them is that they lose their jobs.

Compare this to the risk takers: The risk takers put up their capital – very often the savings they have made from being employees. They have no guaranteed return. They have a risk of losing all of their savings/investments/worldly goods. They are responsible for the fuck-ups of their employees. They have any number of legal risks. In exchange for taking horrendous risk – 95% of small business start-ups fail within what, five years – they get the 1 in 20 chance of turning a profit. By taking the risk, the risk takers provide society with jobs, taxes, output, etc., for so long as the business stays afloat. 19 times out of 20 the business dies and takes the risk takers capital, and perhaps all of their worldly goods, with it.

Seriously, Nonanonymous, where do you get this shit? Your professed “scientific economic fact” is total horseshit.

The required profits relate directly to risk and required capital investment and potential return. Large, sharemarket-held companies offer a general return of around 5 percent. The risk is much more stable than for start ups, generally. If people want lower risk, they can put their money in the bank for little or no interest. It is a bet, a wager, a calculated risk. The potential reward has to balance the risk.

Anyone starting a business must see a potentially huge reward, or they will simply not start a business given the significant, almost certain chance of failure. Most businesses fail, some make a little money, some make a lot, and some become Microsoft.

And re having a persecution complex – damn right I do. As does every small business person I know. The world is out to get us. We are not paranoid. The red tape, problems with employees, foreign competition, changes to laws and regs that happen almost daily, etc., are facts of our life. The world IS out to get us. Make no mistake there.

Admin said that he cannot believe anyone would start up a business given the circumstances which prevail, or something near to that. No truer words were ever written.

Sorry, I lost you at morality and science are mutually exclusive.

Just so we’re clear, you didn’t recently start up a business, you started one up under the false prosperity that has existed since the end of WWI provided by deficit spending.

Yet, you accept no responsibility nor assume any obligation for the situation in which we find ourselves.

No wonder you’re paranoid.

Please don’t get me wrong, I respect you. I’m just not going to listen to your self delusion.

Still want to discus profit? Someone who cheats other people might feel paranoid, too, I suppose. Wouldn’t know, I’m not a clinical psychologist and I don’t care.

Morality and science mutually exclusive? Well, at least you know what mutually exclusive means.

Seriously, Non, you really need to understand what you are talking about before you post. I will help you with a couple of definitions:

Morality:

Noun

Principles concerning the distinction between right and wrong or good and bad behavior.

Science:

The intellectual and practical activity encompassing the systematic study of the structure and behavior of the physical and natural..

Morality thus involves qualitative judgment of right and wrong. Science is the quantitative study of what is. They are in no way the same things at all. Morality can in no way be quantified – it has to do with what is right and what is wrong, and it involves human judgement and perception. Science is the study of what is, and it does not in any way include distinction between right and wrong – only what is, or what is not. Thus they are mutually excusive. Morality can be part of deciding how to use science. You talked about profit and its rightful distribution as a scientific fact – which is hokem and which I already thoroughly debunked, as it would result in a total collapse of capital going into business. You can make some case that perhaps morally profit should be distributed differently – effectively you are suggesting communism – and we all know how that worked out.

With regard to cheating other people, are you suggesting, or outright saying, I cheat people in business? To cheat means to act dishonestly. That I do not do. At all. I may not meet your definition of “moral”, but I do not cheat ANYONE.

LL, I respect your right to be wrong. I also think we’re arguing the same point from different sides. I never said science and morality are the same. You said they’re mutually exclusive. Not the same and mutually exclusive are not the same. But here we go arguing around in circles.

So, on the topic of honesty, do we agree legality and morality are not the same? You get my point.

And to take it a step further, next you’ll tell me you don’t lie, but God says “all men are liars”, I paraphrase.

So, you don’t CHEAT anyone? Really? Did you say that with a straight face? You’re either a liar, a cheat or both. Which one are you.

Even all of that is beside the point, again arguing the same point from differing sides, BUT, what is your definition of truth, for that will determine whether we ever agree on anything.

I’ll go first, “Sanctify them in the truth; your (God’s) word is truth.” (John 17:17, ESV). So, my definition of the truth is what God says in his word. You may have a different definition, and you would be wrong.

In fact, to go a step further, I define words the way God defines them in his word. So, faggots are sodomites, etc.

Must people reject the truth, so I won’t be offended if you do, but I am curious. What is your definition of truth? Do you believe God, or do you lean unto your own understanding?

Non – you are seriously insulting to say that I am either a liar or a cheat. I lie – everyone does in at least some small way – ie. hell no your butt does not look big in that, etc.. But I do not cheat. And I do not lie to take financial advantage.

I have no motive to cheat. I do not need the money, so I have no financial incentive. Further, I have built my business based on acting honestly. I am, and have long been, honest with my employees, my suppliers, and my customers. It has paid off for me very well, so again, I have no motive to cheat – it would be harmful to me. Most of my competition has disappeared, and I have thrived, owing in large part to my history and pattern of behaving honestly in business.

I believe that my personal integrity has grown mightily over the decades, and I am a better man than I might have been long ago, and as a result I do not cheat. My word is my bond. Strange but true.

You are obviously damaged goods, if you think it impossible for a businessman – a successful businessman – cannot operate and do business honestly. That is bitter and twisted. There are those that behave poorly for sure, but it is not my way, and it is not the way I advocate to other business people. My experience is that honesty and character lead to success, and dishonesty and cheating lead to failure. But perhaps that is just old fashioned of me.

Tread lightly calling me a cheat and a liar. That is truly un-Christain of you, especially as you have no clue to the truth.