Did The Fed just swing from omnipotence to impotence?

The Fed cut rates and the market dropped.

Time for the Fed to go full Costanza and raise rates. pic.twitter.com/2tYfXbUWIY

— Vamp Capital ??♂️? (@RampCapitalLLC) March 3, 2020

It seems an emergency rate-cut of 50bps has done more to damage confidence that rebuild it… “what do they know?”

The Fed rate cut was unnecessary and panicky. It can’t fix the virus and won’t fix the market or economy.

— Brian Wesbury (@wesbury) March 3, 2020

The Dow is down 1000 points from the post-Powell rate-cut spike high…

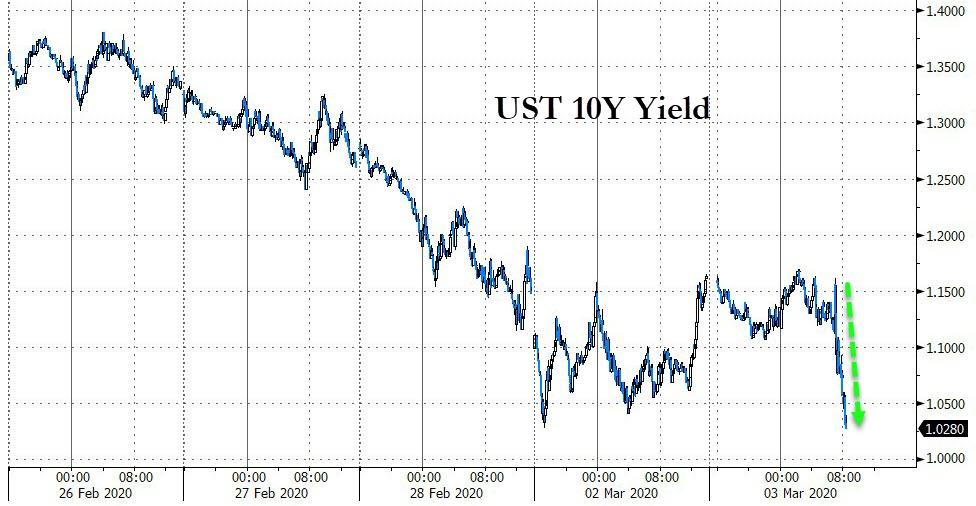

And bond yields are crashing…

Gold is soaring back towards recent highs…

Dan Ivascyn, group chief investment officer of Pacific Investment Management Co., said in an email Tuesday:

“Rate cuts don’t stop virus spread. May help support risk assets short term but highly imperfect solution to what is ultimately a health concern.”

We wonder what Powell and Trump are thinking?

* * *

Fed Chair Powell just attempted to explain how his 50bps rate-cut will ‘ease’ any fears (health, social, financial, economic).

“My colleagues and I took this action to help the U.S. economy keep strong in the face of new risks to the economic outlook.”

Powell started by saying that the fundamentals of the economy are strong, which is seriously unfortunate given it exposes his actions as purely market-driven. Remember, that’s also what John McCain said on the day after the Lehman bankruptcy.

Powell says fundamentals “remain strong” but the spread of the coronavirus “has brought new challenges and risks.”

“We’ve come to the view now that it is time for us to act in support of the economy, and once you reach that decision, we decided to go ahead.”

Powell noted that the outbreak and measures to contain it will weigh on activity “for some time.”

“I don’t think anybody knows how long it will be.”

Powell on fiscal policy: Not our role, we have a full plate with monetary policy.

“We’re in active discussions with central banks around the world on an ongoing basis.”

Powell says G-7 statement was “a statement of general support” at a high level.

Powell, asked about possibility of more rate cuts, says:

“As I said in my statement, we’re prepared to use our tools and act appropriately depending on the flow of events.”

As Rabo noted earlier, in order to decide what to do after The Fed cut, answer this first, key question:

what level of interest rates is required to incentivize you to risk the death of yourself and your family?

I am sure that there are policy wonks out there who believe they can correctly capture that precise equilibrium level on monetary policy. The point is that lower rates don’t help in this situation at all. If demand is destroyed by people bunkering down at home for weeks, and supply chains being disrupted, all lower borrowing costs can do is help tide businesses over if banks agree to extend loans and credit cards, etc. (as China is already now doing) – and all that does paint us further into the corner we are already in, because those rates won’t be able to rise again.

Of course, if we don’t see any major fiscal stimulus then it’s hard to imagine how one can remain too optimistic either.

President Trump is demanding more though…

“The Federal Reserve is cutting but must further ease and, most importantly, come into line with other countries/competitors. We are not playing on a level field. Not fair to USA. It is finally time for the Federal Reserve to LEAD. More easing and cutting!“

Watch Live at 11amET:

* * *

Trump wins? … but what is The Fed so afraid of?

Shortly after the G-7 meeting promised to do whatever it takes, and the biggest demand for Fed repo liquidity since the program began…

A desperate Fed has once again met market expectations, The Fed has just announced an emergency 50bps rate-cut.

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity.

In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent.

The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.

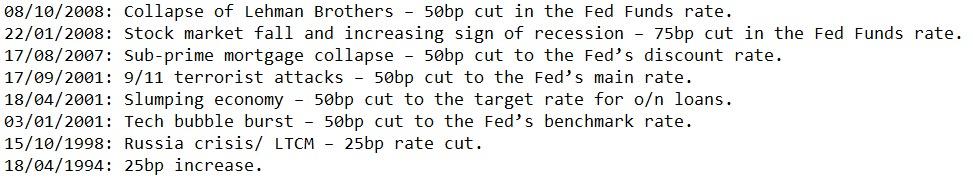

This is the largest rate-cut since the fall of 2008, and just the ninth emergency rate cut in history…

So you have to wonder, just how huge a deal is the virus’ impact on the global economy – despite consensus that this dip in economic activity will almost immediately v-shaped recover back to the new normal?

Stocks are spiking…

But, we note, that stocks are losing their initial gains…

Gold is jumping…

And the dollar is dumping…

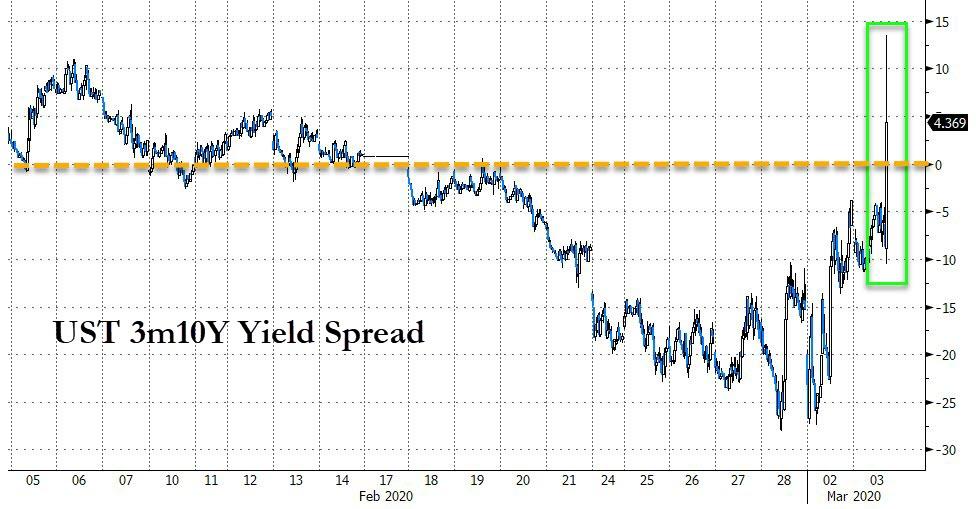

But hey, The Fed managed to un-invert the yield curve…

It seems the current Fed is ignoring the risks that former Dallas Fed head warned of last week…

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, anbd even 2007-2009.. and have only seen a one-way street… of course they’re nervous.”

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?”

the market is dependent on Fed largesse… and we made it that way…

…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

The market is now pricing in no more rate-cuts in March but a high probability of at least one rate-cut in April.

At 11amET, Powell will hold a press conference.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Not enough MOAR – we needed more better MOAR. Why, the only thing that will keep this fraud within a Ponzi scheme within a criminal enterprise continuing on its merry way (for the 0.1%) is MOAR MOAR! And, a WAR! Make that 2 WARS! MOAR WARS!! MOAR MOAR!!

PS – dear taxpayers, here’s the bill. Sorry, we had to start issuing you bills using scientific notation. Too many zeros for standard issue liabilities. Sorry you didn’t learn scientific notation in school but hey, that’s how it goes when you learned about Harvey Milk and that black peanut scientist dude and Margaret Sanger instead. Now you understand why we don’t teach math in public school and – oh wait, you don’t understand, never mind.

Can we get backing to talking about how hot AOC is? The Fed is so yesterday.

She’s ok until she opens her mouth. Which means she’s never ok for more than 10 seconds.

True, but ain’t they all more or less? She has excellent woman’s wiles. Very underrated. With protective police guns she is effective and dangerous. Post-feminism is so much fun.

She’s good at the shaming and emasculation game which for what reason I can’t understand is what the Millennial men put up with. But then again, when 50% of the chicks available from your generation are blue haired fat lesbians I guess you better tow the line nowadays to get some once in a while.

I grew up in SoCal back in 1970s/80s and hot chicks were dime a dozen. If girls wanted attention they had to behave themselves to some degree. We also wouldn’t date the Latinas not because we were racist, but because these girls were flat out crazy.

My life has not been pleasant, and women are central to that. Liberated mothers destroy men as boys, which is why Millennial men put up with it. It’s a continuation of mother dearest on Team Woman. This is the Red Pill truth. Most will turn away. I will agree with Vox Day Beale when he’s right. His blog site footer is correct:

SUCCESS COMES MOST SWIFTLY AND COMPLETELY NOT TO THE GREATEST OR PERHAPS EVEN TO THE ABLEST MEN, BUT TO THOSE WHOSE GIFTS ARE MOST COMPLETELY IN HARMONY WITH THE TASTE OF THEIR TIMES.

White men are their own worst enemy, of themselves and to each other, even here. White guilt is OB and AOC and libtardfa and what started it all as the environmental reward and persists with its terminal righteousness.

Nothing a sock and some Duct Tape couldn’t solve. So many uses.

Next step for Fed: buy hundreds of billions of US S&P shares on the sly–or maybe they did that yesterday. If this already beyond the ability of the PPP to address, the Exchange Stabilization Fund can chip in a few trillion. Or the BIS. Someone has to do something or the oligarchs will lose big time, and that can’t be permitted!

Watch for Belgium to mysteriously buy another USD $360 bln of US Treasuries in one fail swoop. Has happened before in a pinch.

Why should you be worried, Bob, you’re not an oligarch. Otherwise, I’d have divorced your ass like MacKenzie. Hand over the billions, Daddy Warbucks, ch-ching!

An early Merry Christmas to you bank F..ks. NOW JUMP!!!

50 bhp doesn’t fill me with confidence.