“I told my dad he was dumb, turned out he was dumb like a fox!” That comment came from a friend in the bond department of a large brokerage firm. We were discussing buying bonds, CDs and interest rates. He was fresh out of college when Paul Volcker started raising interest rates to double digits.

“I told my dad he was dumb, turned out he was dumb like a fox!” That comment came from a friend in the bond department of a large brokerage firm. We were discussing buying bonds, CDs and interest rates. He was fresh out of college when Paul Volcker started raising interest rates to double digits.

With extraordinarily high-interest rates, his dad took everything he had and bought non-callable CDs and quality bonds, all yielding double digits. He told his dad that was dumb – you don’t want all your eggs in one basket – and what if interest rates go higher? His dad didn’t listen and enjoyed a very comfortable retirement with plenty of safe, guaranteed income.

He said his dad recognized a once-in-a-lifetime opportunity, locked in some terrific, safe returns on his life savings and enjoyed his retirement.

Will history repeat itself?

I contacted friend Chuck Butler, editor of the Daily Pfennig. Interest rates are rising, when is it time to lock in some safe, long-term yields?

DENNIS: Chuck, thank you for your time in helping to educate our readers.

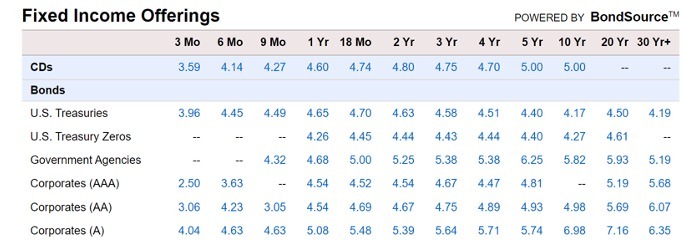

While Fed Chairman Powell is raising rates, they are not anywhere close to those of the Volcker years – yet. I’ve attached a screenshot of today’s offerings.

While rates change by the minute, this is a good place to start. Readers tell me they are in a good cash position, the market is tanking, and they expect it to continue to go down. Inflation is eating away at their cash, and they want to earn some return. Ten-year bonds and CDs are still not close to beating inflation.

While rates change by the minute, this is a good place to start. Readers tell me they are in a good cash position, the market is tanking, and they expect it to continue to go down. Inflation is eating away at their cash, and they want to earn some return. Ten-year bonds and CDs are still not close to beating inflation.

Chuck, rates are inching back to what we used to call normal. Cash is good, but is it safe? What are you telling your readers?

CHUCK: Dennis… Thanks again for the opportunity to share my thoughts with your readers.

A tricky situation for sure! Every time the Fed Heads raise rates, bond yields go higher, and look very enticing to investors.

But I feel we need to be patient here. I believe that the Fed Heads are going to hike rates to combat inflation until things get very ugly in stocks and the economy. That means we would wait until the Fed Head’s rate hikes are coming to an end. You’ll be very lucky to time it exactly, but… being near the top is still good.

Right now, I’m suggesting limiting any fixed income investments to short term. You will earn some yield but maintain flexibility down the road.

DENNIS: We read about people getting clobbered in the bond market. I continually remind readers that we are NOT bond traders.

Any bond you buy should be held until maturity. While interest rates fluctuate, when they mature, you will get your money back. The real threat is inflation, you can lose a lot of buying power along the way.

What is happening to those who bought trillions in bonds yielding 1-2%? I know you’ve mentioned that certain pensions, etc., were required to hold a certain amount in bonds.

CHUCK: Well, this is a two-pronged answer. First, let me explain that there are institutions that must buy Treasuries, no matter what the current yield is.

Pensions, Insurance Companies, State and City Gov’ts. They have investment mandates that require them to own only Treasuries… So, these folks are now holding some underwater bonds, meaning they could not currently resell them without taking a big loss. They are the “Big Boys” and can deal with losses much better than you and I.

Speculators who thought the Fed was going to pivot and begin to cut rates are looking at red ink in their bond holdings right now. That red ink will continue as long as they hold the bond.

If they sell before maturity, they will take a loss. If they hold on to maturity they will get their principal back, but the interest they receive will be well below the current market rates. They hope the Fed will panic and cut rates radically so they can resell the bonds for a profit, but that is a real gamble. It’s not a situation that I would want to be in.

DENNIS: I was taught that longer term bonds should pay more interest because there is more risk – risk of default or inflation eroding the buying power of your money.

Eighteen-month treasuries yield more than 10- and 20-year treasuries. That looks wacky.

What is Mr. Market telling us?

CHUCK: Dennis, this is called an “inverted yield curve”. Yes it looks strange, with short term bonds yielding more than long term bonds. But…. You have to look under the hood here.

Historically speaking, whenever the Treasury yield curve inverted, it spelled that a recession was on the way for the U.S .economy. A lot of technical investors who use charts and historical data are sending up a red flag!

The yield curve inverted months ago – and has only gotten worse since it originally inverted. The U.S. economy is already in recession (2 consecutive quarters with negative growth). I believe that the bond market is telling us that things are going to get worse. As I mentioned, stay short term with your bond buys. I would say buying bonds 3 years and in, would meet that short term description.

DENNIS: I look at the rates and feel very uncomfortable with the idea of owning any bond funds. I know the brokerage houses push them because they earn big fees.

With the market in a recession, which could move into stagflation, the chances of default would concern me.

How do you feel about buying into funds?

CHUCK: Well, I’m not a believer in funds. I would rather own the bond, currency, stock etc. outright, and not part of a fund with management fees, liquidity issues, and so forth.

DENNIS: Brokers tout their funds because of safety from diversification. When I look at the rates, for a fund to beat CD rates, there must be some risk involved.

Wouldn’t readers who want to invest some of their cash just be better off with CDs?

CHUCK: This plays well with what I just talked about… If you are someone that needs to be short term with your investments, and need to earn interest, then bank CDs are a very good instrument to use. If you keep your investment amount below the FDIC limit ($250,000) then the default risk is removed.

If you look at the chart you provided, 3-year CDs are paying 4.75%, and 18-month are paying 4.74%. Is the additional .01% worth going out another 18 months? If you bought a $10,000 CD your additional yield would be $1/year. Unless you feel the Fed will pivot and drop rates, there really is no incentive…. particularly when it is not coming close to beating inflation.

DENNIS: I began the discussion about my friend’s dad who saw a once-in-a-lifetime chance to lock in safe, solid rates for the long term.

While it is foolish to try to time the market, what should we look for to spot another opportunity like this – if it should arise?

CHUCK: While I like the story about your friend’s dad, I cringed when there was no diversification of his holdings. It worked for him, but not everyone is that lucky. Bonds, stocks, currencies, metals, are a good diversification…

I think the thing to look for here is, when the Fed Heads begin to waffle about where interest rates are going. As you know, the Fed Heads are always out on the speaking circuit, and they love to tell their audiences how smart they are, and in doing so, they will spill some sign that they are not all-in on raising rates further. That’s when you should look to buy a bond, in my humble opinion.

You can do well without having to put all your eggs in one basket.

DENNIS: One final question. I’m telling readers to make sure they are short term with their fixed income investments. Investors want cash to jump in before the Fed and inflation has turned the corner.

Does that make sense?

CHUCK: Yes, it makes sense… You know, as I was writing the answer to the previous question down, I thought… “investors don’t follow the Fed Heads’ speeches”, so that’s where you and I come in; we do follow the Fed Heads’ speeches, and will be ready, willing and able to get the word out we’re giving the wink and nod to investors to buy bonds and/or longer-term CDs again…

So, the lesson here is that investors need to keep reading our letters! Why not, they are FREE!

Dennis here. I really appreciate Chuck’s reminder about putting all your eggs in one basket. When I was seeking advice from the bond rep I was still young and trying to hit a five-run investment home run…. As a retiree, I’m concerned about protecting my investment capital. We can hit some nice singles and doubles investment returns and maintain our safety.

In the meantime, we all must fight the emotions as we see the turmoil in the stock and bond markets….

Chuck writes the Daily Pfennig four days a week. I highly recommend it. It’s a must-read if you want to stay on top of things.

I hope someday my children and grandchildren will say, “grandpa (or grandma) was dumb like a fox….”

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

Past Performance Is Not Indicative Of Future Results

Back in 1981 was talking w/ an older man who ran investments for a private equity fund. Told me to buy AAA Bonds that were discounted and trading in the mid-60s. With one child & another on the way, plus mortgage, no $$$ for that. But did follow an Exxon 8% (I think) that was $65-66.

A year later it traded near par. That’s a decent ROI 😉

that market rally in the last 3 weeks . . just a fig newton of the imagination

Beware.

With rates inverted ladder short term cd’s. That way you will keep your powder dry.