Direct from BOOM Finance and Economics at the links below

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn. BOOM is also published weekly at WordPress: https://boomfinanceandeconomics.wordpress.com where all previous BOOM Editorials are available — the entire Archive.

THIS WEEK’S EDITORIAL

GERMANY VERSUS FRANCE – ECONOMIES IN STAGFLATION: The German and French economies are poorly led by politicians who appear totally unable to understand what is happening. Their economic data look eerily similar, stuck in the mud of low to negative GDP growth, high CPI inflation rates and chronic unemployment levels. Let’s look at Germany first.

GERMANY: Economic growth is stagnant and may be on the cusp of contraction. Its GDP growth Quarter on Quarter (QoQ) has been close to zero for two and a half years. Its annual GDP growth rate is now negative 0.1%. Its Year on Year CPI Inflation rate is 7.4% and has been above 7% for most of the last 12 months. The unemployment rate is stagnant at 5.6%. For the last 9 months it has been stuck at 5.5% – 5.6%.

However, in the recently released data, there are some signs of hope. The good news is that the Year on Year CPI inflation rate has now dropped from 8.7% in February to 7.2%. The Month on Month CPI inflation rate has dropped to 0.4 % from 0.8 % in February. However the all-important energy inflation figure has risen again after falling dramatically from 19.1% to 3.5% in February. In the latest data release, energy inflation rose again from 3.5% to 6.8%. And the food prices inflation rate is still above 20% with the services inflation at 4.8%.

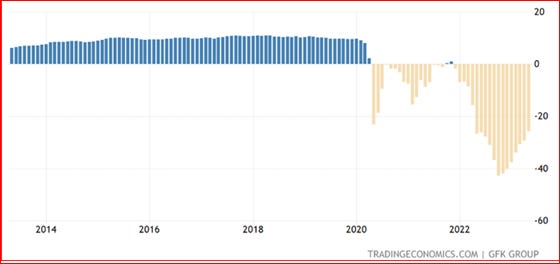

Some optimism can be found in business confidence which is steadily rising again over the last 6 months after having fallen for the previous 12 months. Consumer confidence is also rising but is still negative as measured by Germany’s GfK Consumer Climate Indicator. It fell off a cliff in early 2020 at the start of the Covid Panic-demic. German consumers were rock solid in their confidence levels for many years until the Covid fiasco began. Since then their confidence has markedly declined and is still a long way from pre-2020 levels.

10 Years of Consumer Confidence in Germany — Germany’s GfK Consumer Climate Indica

Overall, the German economy, once called the “powerhouse, the engine of growth” of Europe, is a shadow of its previous strength. The German people are clearly very worried. Food and energy prices are high and rising, unemployment is stubbornly refusing to improve and confidence is poor. Businesses are attempting to see a better future through the fog but BOOM expects their confidence to be short lived as the reality of their situation sinks in.

The war in Ukraine has been a terrible and decisive economic event with Western European nations surrendering their judgement to the United States. The German political class has cemented their nation’s future as a vassal state of the US Dollar Empire. As a result, their economic future is bleak, the US military occupation has been enhanced and the German people are effectively powerless to change anything with key decisions being made a long way away – in Washington DC.

FRANCE: What about France? French GDP Growth Quarter on Quarter (QoQ) has also been markedly flat for two and a half years. Annual GDP growth YoY is currently at 0.8%. Business confidence is falling while consumer confidence is stagnant. The annual inflation rate rose to 5.9% in April from 5.7% in March. The Core Inflation Rate continues to slowly rise month by month. Energy inflation is rising again to 7% in April from 4.9% in March. Food inflation remains around 15% per annum and the unemployment rate is stuck at 7.2%.

The stats reveal almost the same overall picture as Germany. The people are discouraged, disenchanted with their leadership, protesting in the streets. Again, the war in Ukraine has been decisive. The French political class have surrendered to Washington and their future is now clearly defined as another vassal state of the US Dollar empire. The economic outlook is bleak and the people know it. They are seeking political change as soon as possible. Street protests are occurring all over France, not just in Paris.

POLAND: Poland was once a haven of economic hope in Europe. However, again, the war in Ukraine and the Covid Super Panic-Demic has been double blows to the nation with the US/NATO again taking charge of their destiny. So, how is their economy reacting? The official stats are revealing.

New numbers are due on 17th May, but the latest available data for Poland shows that the economy contracted QoQ by 2.4% in the last quarter of 2022. Poland’s gross domestic product (GDP) advanced by 2% year-on-year in that quarter. This sounds solid. However, the Polish annual GDP growth number was at 12.2% in June 2021 and has been falling steadily ever since.

The stock market as measured by the WIG Index is still around 2007 levels. Poland’s current annual CPI inflation rate is 14.7% as measured in April 2023 from 16.1% in March. Unemployment is stuck around 5.5%. Business confidence has been negative since the Covid Panic struck in early 2020 and consumer confidence has been badly damaged since then and is still strongly negative. Retail sales are stagnant. Poland’s economic future is now under a cloud after having shown great promise just 3 short years ago.

THE EURO AREA: When the entire Euro Area is considered, the economic situation is no better than in Germany, France or Poland. The Euro area is also called the Eurozone. It is a currency union of 20 member states of the European Union that have adopted the Euro as their currency and sole legal tender. Non-EU members include the city states of Andorra, Monaco, San Marino, and Vatican City.

Let’s look at the stats. The Eurozone economy grew slightly by just 0.1% in the first quarter of 2023. Its GDP Growth has been stagnant for almost two and a half years. Its Annual GDP growth rate is 1.3%. The annual CPI inflation rate is 6.9% in March 2023. The recent peak of inflation was at 10.6 % in October last year. However, Food inflation is alarmingly stuck around 17.5% per annum.

Thankfully, energy inflation has fallen strongly over the last 6 months. But inflation expectations overall are stuck at historically high levels. The unemployment rate is 6.6% and has been static at that reading or 6.7% for the last 12 months. Business confidence has recovered strongly since the Covid Panic-Demic. However, consumer confidence is stuck in negative territory. Retail Sales are stagnant in a non-growth scenario.

So, the entire Euro Area is suffering from economic growth stagnation, teetering on the brink of recession and with high levels of CPI inflation. That is Stagflation – a terrible consequence of poor leadership.

WHO HAS ATTACKED WESTERN EUROPE?: The inescapable truth here is that Western Europe was not attacked by a deadly, once in a century, pandemic virus. Neither was it attacked by Russia.

Those nations have actually been attacked by the purveyors of fear and control, promoting a virus that is clearly no more dangerous than a bad bout of Influenza and a war in Ukraine that is none of their business and which was orchestrated (and caused) by the events that occurred in Kiev way back in 2014 when Victoria Nuland famously said in a captured conversation, “Fuck the EU”.

That conversation, between the then Assistant Secretary of State Victoria Nuland and the then US Ambassador to Ukraine, Geoffrey Pyatt, reveals a great deal about what has subsequently happened to Europe. The entire conversation is available in a transcript produced in a BBC article headlined “Ukraine crisis: Transcript of leaked Nuland-Pyatt call” and dated February 7th, 2014.

Some excerpts are worthy of deep consideration when looking at what has happened to Western Europe’s economy over the last 3 years.

The Americans clearly regarded the United Nations, based in New York, as a key political operative in reaching a settlement suitable to the USA in the Ukraine government crisis that erupted in 2014. Nuland says to Pyatt — “that would be great, I think, to help glue this thing and to have the UN help glue it and, you know, Fuck the EU. “

There can be no doubt about the intent of what Nuland said here. She wants the European Union to have absolutely no say in the future of Ukraine. She thinks the US is the chief protagonist and she wants to enlist the UN to do the work on the ground to effect change. She also said: “we want to try to get somebody with an international personality to come out here and help to midwife this thing.”

All this is telling in regard to the events concerning Ukraine and the economies of Western Europe. The people of Europe are now effectively enslaved in a failing economy with persistent stagflation reducing their standard of living day by day. High energy prices have become the norm and are likely to persist for the long term unless there can be some suitable settlement with Russia.

The farmers of Belgium and the Netherlands, the protesters of Germany, France and Italy know what is at stake here. They have realised that they are no longer in control of their nations’ destiny. Their votes count for nothing it seems.

BOOM expects more social unrest, more economic stagnation, more CPI inflation, more unemployment and more fear to continue in all the nations of Europe while not so Great Britain also slowly sinks beneath the economic waves.

Nothing good has come from the campaign of fear unleashed around the super-hyped threat of “Covid” or the “thing” that the US and the UN “glued” together to change the governance of Ukraine in 2014.

Sadly, Victoria Nuland is still an American diplomat currently serving as US Under Secretary of State for political affairs.

US BONDS, STOCKS, BANKS AND PROPERTY PRICES STRONG: The prices of US bonds and stocks continue to show strength in the US markets, as per BOOM’s expectations. Financial sector stocks rose strongly towards the end of last week in unison with the strong, general market sentiment.

The US property sector is starting to show price strength, especially in the housing sector, again as per BOOM’s expectations expressed a few weeks ago. The Philadelphia Stock Exchange PHLX Housing Sector Index (Code: HGX or $HGX) tracks housing development companies working directly in the US home construction market.

Multiple companies in the building and prefabrication of residential homes, mortgage insurers, and suppliers of building materials make up the index. It has risen 41% since October and rose by 2.84% last week. Philadelphia Housing Index: Weekly Chart over 2.5 years (from Stockcharts.com).

In the bond markets, all sectors rose to consolidate their uptrend since October. In the stock markets, all of the major stock indices finished the week with strong gains. Many property ETF’s were well supported but with some weakness still evident in the office sector. The major financial sector ETF, stock code XLF, confirmed its 6 month uptrend during the week. Wells Fargo, a major home lender, did not join the party. Its shares ended the week down 3.61%. BOOM will watch that stock closely next week for signs of buyer strength or reluctance.

INFLUENZA VACCINES ARE “INADEQUATE” Who wrote this? How could Influenza vaccines be “inadequate”?

“As of 2022, after more than 60 years of experience with influenza vaccines, very little improvement in vaccine prevention of infection has been noted. As pointed out decades ago, and still true today, the rates of effectiveness of our best approved influenza vaccines would be inadequate for licensure for most other vaccine-preventable diseases. Even decades-long efforts to develop better, so-called ‘‘universal’’ influenza vaccines—vaccines that would create more broadly protective immunity, preferably lasting over longer time periods—have not yet resulted in next-generation, broadly protective vaccines….“

Those words come from three authors, one of whom is none other than the famous (or infamous) Dr Anthony Fauci.

Perspective: Re-thinking next-generation vaccines for coronaviruses, influenza viruses, and other respiratory viruses David M. Morens, Jeffery K. Taubenberger, and Anthony S. Fauci, Office of the Director, National Institute of Allergy and Infectious Diseases, National Institutes of Health, Bethesda, MD 20892, USA 2Viral Pathogenesis and Evolution Section, Laboratory of Infectious Diseases, National Institute of Allergy and Infectious Diseases, National Institutes of Health, Bethesda, MD 20892, USA Correspondence: [email protected] https://doi.org/10.1016/j.chom.2022.11.016

QB Explained: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND

BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Until next week. Make your own conclusions, do your own research. BOOM does not offer investment advice. CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy Watch this short 15 minutes video and learn as Professor Richard Werner brilliantly explains how global banking systems really work.

AND Watch for 4 minutes, this Bank of England explanation: Money is essential to the workings of a modern economy, but its nature has varied substantially over time. This video describes what money is today.

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

On 25th April 2017, the central bank of Germany, the Bundesbank, released a statement on this matter — “In terms of volume, the majority of the money supply is made up of book money, which is created through transactions between banks and domestic customers. Sight deposits are an example of book money: sight deposits are created when a bank settles transactions with a customer, ie it grants a credit, say, or purchases an asset and credits the corresponding amount to the customer’s bank account in return. This means that banks can create book money just by making an accounting entry: according to the Bundesbank’s economists, “this refutes a popular misconception that banks act simply as intermediaries at the time of lending – i.e. that banks can only grant credit using funds placed with them previously as deposits by other customers”. By the same token, excess central bank reserves are not a necessary precondition for a bank to grant credit (and thus create money).” Reference: https://www.bundesbank.de/en/tasks/topics/how-money-is-created-667392

The Reserve Bank of Australia (Australia’s central bank) has also contributed to the issue in a speech by Christopher Kent, the Assistant Governor on September 19th 2018…“the vast bulk of broad money consists of bank deposits” “Money can be created…when financial intermediaries make loans“ – “In the first instance, the process of money creation requires a willing borrower.” “It’s also worth emphasizing that the process of money creation is not the result of the actions of any single bank – rather, the banking system as a whole acts to create money.”

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

I’m genuinely curious if Europe even knows they are being played…

I think they know but half of Americans are Incorrigible Useful Idiots led by certified Idiots.

How about someone start a 3rd Party and recruit folks like: Tucker Carlson, DeSantis, MTG, Scott Ritter, Gen Flynn, Col Douglass MacGregor, Seymour Hersh, Snowden, Assuage, Mike Maloney, Tom Emmer, Craig Hunter, Rick Wiles, Mike Adams, Tulsi Gabbard, Lauren Boebert, Kari Lake, Blake Masters, Kristi Noem, Judge “cutie”(?), Roger Stone, Bannon, Ron Paul, the 2000 Mules guy, Judge Bartholomew (?), etc.

see, now here’s a difference between america and europe. in america, you have some of the most rigged, tampered-with, and outright fraudulent election procedures imaginable. deliberately leaving the door open to fuckery. In europe, we have paper ballots, id checks, public observers in polling places and ballot countings, etc. The difference, though , is that in europe, any party that doesnt follow the programme is simply banned. the result is like soviet elections: the only candidates are the approved ones. it doesnt matter who you vote for, so it doesnt matter if the votes are honestly counted.

Tell US, do Europeans think Americans really voted in FJB? Do Europeans think Americans support FJB blowing up the Nord Stream Pipeline? Do Europeans think Americans support Sanctions that are destroying Europe? Do Europeans think Americans want our government to export moral and social perversions to other countries? Do Europeans think Americans want our Military or any Corporations to abuse and rip off citizens of any country? There exist an Evil Cabal running the West doing these things that we must overthrow .

Bravo rhs jr – all of the above but most Europeans couldn’t give a f**k so they deserve what they’ll get.

Got it in one my friend. Same in UK – whoever you vote for you get the same set of muppets. It is now proven that there is only one MP who has the remnants of truth and integrity because when he tried to instigate a debate on vaccine damage he addressed an empty house – 3 times! Then got sacked for his trouble! ALL the MPs were instructed to stay away – ALL parties!

UK is a joke of a democracy but it’s worse than US, where at least any voter with a brain cell can see the corruption upfront. In UK they are sneaky secret sods – they have been at it for 1,000 years – thus by now they are good at it.

His Tweet even got suspended – so much for Musk – he’s controlled opposition too.

BUT this site is OK and worth following – you will get most of the truth from these guys (I know of no other in UK – even GB News is controlled opposition and very clever too): https://www.ukcolumn.org/video/standing-up-to-be-counted-andrew-bridgen-mp-speaks-to-uk-column-about-covid-19-policy-and check out my Letter at “Disgraceful MPs AWOL” : https://austrianpeter.substack.com/p/the-blob-hmg-censors-failed-alarm?utm_source=post-email-title&publication_id=762792&post_id=118080669&isFreemail=false&utm_medium=email

The target must be the Republican Party.

There will always be highly-promoted interests in establishing the Maximum State, distributing Maximum Free Shit; hence there will always be Democrats.

The Republicans supply, now and then, only the gentlest of taps to the brakes of this runaway train. If the Rep Party cannot be replaced, their policies must be altered so that they become virtually unrecognizable to the current Republican ‘leadership’.

As many here have suggested, TINVOWOOT – at least not without a smidgen of blood in the streets. And maybe a lot more than a smidgen.

The Republican Party is a top down PTB machine immune to reform similar to the public school system; the GOP has no Grass Roots so their policies cannot be altered by We The People; right Mr August, There Is No Way To Vote Our Way Out Of This. The GOP must be replaced. If not replaced, then Civil War or Secession are most likely.

Many of those listed could possibly be killed first and those like Ron Paul are too old , Stone, Bannon, not, and Lauren Boebert, I’d ask her what she means by building a better relationship with Israel.

I wonder why they haven’t yet done it rhs jr? Perhaps they are not really committed to such a world-changing strategy? But then who are they committed to other than their bank accounts and the trough that never stops giving? Just like UK, they are all in the Big Club and answer to their handlers.

Yet it does not get any better than in London.