Who could have predicted this? Oh Yeah – Me.

I wrote Subprime Auto Nation in September of 2012. GM and the rest of the slimeball auto industry utilized the free money being pumped out by the Federal Reserve to hawk their vehicles to every LeBron, Lakeisha, and Jamal in West Philly and the rest of Obama Welfare Nation with subprime auto loans out the yazoo. What could possibly go wrong providing seven year financing on $40,000 Cadillacs to people without jobs, without prospects, with sub 100 IQs, and long histories of defaulting on loans?

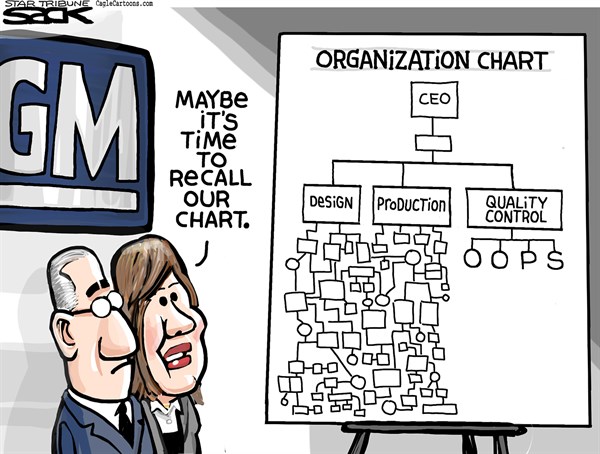

Considering Ally Financial, the number one dispenser of this subprime slime, was owned by Obama and the Feds until a few months ago, you have your answer. They used your tax money to get their voters in the latest models from that QUALITY IS OPTIONAL Government Motors union loving car company that has recalled more cars in the last few months than it sold in the previous two years.

Do you find it interesting that Obama and his minions, along with their co-conspirators on Wall Street decided to IPO Ally Financial back to the public just as the bad debt was beginning to roll in on this subprime slime? The underwriters for this joke of a company were Citigroup, Goldman Sachs, Morgan Stanley and Barclays Capital.

Wall Street has packaged these worthless pieces of paper into derivative sacks of shit and sold them to their clients, little old ladies, and pension funds. Does this ring a bell? They’ve done exactly what they did with subprime mortgages. EXACTLY. It worked so well the first time.

Now the shit is being fed into the fan. Guess who will be sprayed with the shit.

Submitted by Pater Tenebrarum of Acting-Man blog,

Sub-Prime Car Loans See a ‘Sudden Jump in Late Payments’

We have commented a few times on the slightly diffuse character of the echo bubble, which has infected a great many nooks and crannies of the economy. One of the areas which has experienced an enormous boom was the sub-prime auto loan sector. It seems however that the party in this sub-sector of the bubble economy is in the process of ending.

According to Bloomberg:

“A three-year lending boom to car buyers with spotty credit that helped push auto sales to a six-year high is starting to show signs of overheating.

The percentage of loans packaged into securities that are more than 30 days late rose 1.43 percentage points to 7.59 percent in the 12 months ended September 30, according to Standard & Poor’s. That’s the highest in at least three years, the data released last week by the New York-based ratings company show.

“We’re at this inflection point,” Amy Martin, an analyst at S&P, said by telephone. “Now that they are opening the lending spigot, it’s only natural that losses are starting to rise.”

Underwriting standards began to decline amid five years of Federal Reserve stimulus that set off a race for higher-yielding assets, spurring a surge in issuance of bonds tied to subprime auto loans. That breathed life into a car-finance business that had contracted in the wake of the credit crisis, attracting new lenders and private-equity firms such as Blackstone Group LP with cheap funding and high margins.

Delinquencies on subprime auto loans are likely to have increased more during the fourth quarter, the holiday period when consumers typically stretch their budgets, according to S&P. That’s poised to increase losses that bondholders will take from defaults on the debt, which stood at 6.92 percent at the end of September after falling to as low as 4.15 percent in 2011, S&P data show.

“Many lenders have told us that their performance in recent years exceeded their expectations,” Martin wrote in a report last month. “We are now hearing that they expect losses to trend upward to more normal levels this year and next.”

[…]

Subprime lenders have found cheap funding in the bond market, with $17.6 billion of asset-backed securities tied to subprime auto loans issued last year, more than double the $8 billion sold in 2010, according to Barclays Plc. About $3.6 billion of the securities have been offered this year, according to data compiled by Bloomberg.

(emphasis added)

We wonder of there is any pie Blackstone doesn’t have a finger in these days… Anyway, it seems investors in these loans – after enjoying above average returns for a good while – must now brace for growing losses. That ‘underwriting standards have declined’ is really no surprise – that is what happens when the Federal Reserve prints wagon-loads of money and pressures short term interest rates to zero. In fact, this decline in lending standards was arguably one of the main goals of the policy.

It Always Starts Somewhere …

However, what interests us about this development is mainly this: it shows that the credit bubble is beginning to fray at the edges. Every downturn starts with a seemingly innocuous report about things ‘suddenly’ and ‘unexpectedly’ going wrong in a relatively obscure corner of the market. We find ourselves reminded of how sub-prime real estate credit troubles began to show up for the first time in February of 2007, leading to the often repeated mantra that this particular disturbance in the force was ‘well contained’.

That is however never how it works – in the end, it is all one big interconnected market. When troubles begin to show up at one end of it, they soon tend to begin to spread.

A car repo notice – at least the repo sector can expect a boom now.

Good-bye overpriced SUV piece of junk – it was nice to know ye while it lasted …

Conclusion:

One should certainly keep both eyes open henceforth; more anecdotal evidence of this type is likely to emerge in coming months, especially if the Fed continues with its ‘QE tapering’ course. Once problems become visible in one obscure corner of the low grade credit markets, it is often a warning sign for the entire market and economy.