Ticking away the moments that make up a dull day

You fritter and waste the hours in an offhand way.

Kicking around on a piece of ground in your home town

Waiting for someone or something to show you the way.

Tired of lying in the sunshine staying home to watch the rain.

You are young and life is long and there is time to kill today.

And then one day you find ten years have got behind you.

No one told you when to run, you missed the starting gun.

I stumbled across two mind blowing charts yesterday that had me pondering how generations of Americans had frittered their lives away, spending money they didn’t have on things they didn’t need, utilizing easy to acquire debt, and saving virtually nothing for their futures or a rainy day. We are a nation of Peter Pans who never grew up. While I was driving home from work, one of my favorite Pink Floyd tunes came on the radio and the lyrics to Time seemed to fit perfectly with the charts I had just discovered.

We were all young once. Old age and retirement don’t even enter your thought process when you are young. Most people aren’t sure what they want to do for the rest of their lives when they are in their early twenties. Slaving away at your entry level low paying job, chasing the opposite sex, getting drunk, and having fun on the weekends is the standard for most young people. But you eventually have to grow up. Because one day you find ten years have got behind you. No one tells you when to grow up. And based on the charts below, tens of millions missed the starting gun.

I graduated college in 1986 and started my entry level CPA firm job, making $18,000 per year. I did live at home for a year and a half before getting an apartment with a friend. I was able to buy a car, pay off my modest student loan debt, go out on the weekends, and still save some money. I was in my early 20’s and had opened a mutual fund account at Vanguard. Anyone who entered the job market from the mid 1970s through the mid 1980’s, which would be the late Baby Boomers and early Generation Xers, had job opportunities and the benefit of low stock market valuations.

P/E ratios of the market were single digits in the late 70s and early 80s, versus 20 today. Dividend yields on stocks averaged 5% for the S&P 500, versus 1.9% today. The Dow bottomed out at 759 in 1980, while the S&P 500 bottomed at 98. A 20 year secular bull market was about to get under way. Baby Boomers and Generation Xers had the opportunity of a lifetime. Even after six years of the bull, when I graduated from college the Dow stood at 1,786 and the S&P 500 stood at 521. I had just begun to invest when the 1987 crash wiped out 20% in one day. It meant nothing to me. I didn’t have much to lose, so I just kept investing.

The 20 year bull market took the Dow from 759 to 11,722 by January 2000. The S&P 500 rose from 98 to 1,552 by March 2000. You also averaged about a 3% dividend yield per year over the entire 20 years. Your average annual return, including reinvested dividends, exceeded 17%. Anyone who even saved a minimal amount of money on a monthly basis, would have built a substantial nest egg for retirement. If you had invested in 10 Year Treasuries, your annual return would have exceeded 11% over the 20 years. Even an ultra-conservative investor who only put their money into 5 year CDs would have averaged better than 7% per year over the 20 years.

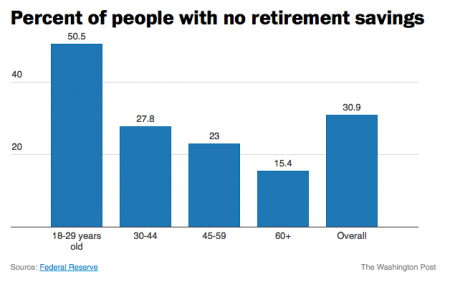

Even with the two stock market collapses since 2000, your average annual return in the stock market since 1980 still exceeds 11%. That’s 34 years with an average annual total return of better than 11%. Every person who had a job over this time frame should have accumulated a decent level of retirement savings. That is why the chart below is so shocking. Over 15% of all people 60 and older and 23% of people 45 to 59 years old have NO retirement savings. None. Nada. Zilch. This means 25 million Boomers and Xers are stuck living off a Social Security pittance and choosing between keeping the heat on or eating a feast of Ramen noodles and Friskies. It seems they let 30 years get behind them. They missed the starting gun.

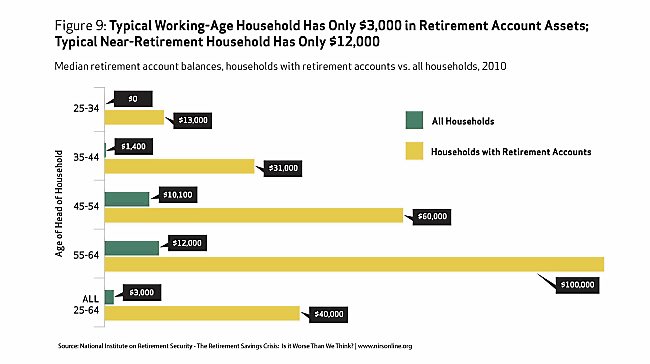

I’m not shocked that over 50% of 18 to 29 year olds have no retirement savings. With the terrible job market, declining real wages, massive levels of student loan debt, two stock market crashes in the space of eight years, and 4% annual returns since 2000, young people today have neither the means nor trust in the system to save for retirement. Their elders had no such excuse. Just a minimal amount per paycheck saved over the last 30 years would have compounded to well over $100,000, even at modest salary levels. It is disgraceful that 25 million people over the age of 45 have saved nothing for their retirement. Far more disgraceful is the median household retirement balance of $3,000 for all working age households. There are 122 million households in this country and 61 million of them have $3,000 or less in retirement savings.

The far worse data points are the $12,000 median retirement balance of aged 55 to 64 households and the $10,100 median retirement balance of aged 45 to 54 households. These people are on the edge of retirement and have less than one year’s expenses saved. There is no legitimate excuse for this pitiful display of planning. These people had decades to save, strong financial market returns, and if they worked for a decent size organization – matching contributions to their retirement accounts. They didn’t need a huge salary. They didn’t need to save 20% of their salary. They didn’t have to be an investing genius. A savings allocation of just 3% to 5% would have grown into a decent sized nest egg after a few decades of compounding.

We know from the data in the chart, it didn’t happen. The concept of delayed gratification is unknown to the millions of nearly broke Boomers and Xers, shuffling towards an old age of poverty, misery and regret. A 64 year old has a life expectancy of about 20 years. They’ll have to budget “very” frugally to make that $12,000 last. The question is how did it happen. I don’t buy the load of crap that you can’t judge people as groups. I judge people by their actions, not their words. I know you can’t lump every Boomer and Xer into one box. Individuals in every generation have bucked the trend, lived within their means, saved for the future, and accumulated significant nest eggs for their retirement. But the aggregate numbers don’t lie. The majority of those over the age of 45 have squandered their chance at a relatively comfortable retirement. These are the people who most vociferously insist the government do something about their self created plight. It’s their right to free healthcare, free food, subsidized housing, free utilities, higher minimum wages, and a comfortable government subsidized retirement. They are wrong. They had a right to life, liberty and the pursuit of happiness. It was up to them to educate themselves, get a job, work hard, and accumulate savings.

The generations of live for today, don’t worry about tomorrow Americans over the age of 45 have no one to blame but themselves. They bought those 4,500 sq foot McMansions with negative amortization 0% down mortgages. They had to keep up with the Jones-es by putting in granite counter-tops, stainless steel appliances, home theaters, Olympic sized swimming pools, and enormous decks. They have HDTVs in every room in their house and must have every premium cable channel, along with the NFL package. They upgrade their phones every time Apple rolls out a new and improved version. They pay landscapers to manicure their properties. They lease new BMWs every three years. They have taken exotic vacations on an annual basis. They haven’t packed a lunch for themselves since they were 16 years old. Eating out for lunch and dinner has been a staple of their existence for decades. That morning Starbucks coffee is a given. A new wardrobe of name brand stylish clothes for every season is a requirement because your neighbors and co-workers are constantly judging you. Nothing proves you’re a success like a Rolex watch, Canali suit, Versace boots, or Gucci handbag. The have it now generations got it then and have virtually nothing now because they acquired all of these things with debt.

Real cumulative household income is up 10% since 1980. Consumer debt outstanding has risen from $350 billion in 1980 to $3.267 trillion today. That is a 933% increase. We’ve had decades of faux prosperity aided and abetted by Wall Street shysters, corrupt politicians, mega-corporation mass merchandisers, and Madison Avenue maggots trained in the methods of Edward Bernays to convince willfully ignorant consumers to consume. And consume we did. Saving, not so much. You can blame the oligarchs, bankers, retailers, and politicians for the fact you didn’t save, but it rings hollow. No matter how much propaganda is spewed by the ruling class, we are still individuals with free will. The older generations had choices. Saving money requires only one thing – spending less than you make. Most Boomers and Xers chose to spend more than they made and financed the difference. When the average credit card balance is five times greater than the median retirement account balance, you’ve got a problem. The facts about our consumer empire of debt are unequivocal as can be seen in these statistics:

- Average credit card debt: $15,593

- Average mortgage debt: $153,184

- Average student loan debt: $32,511

- $11.62 trillion in total debt

- $880.3 billion in credit card debt

- $8.05 trillion in mortgages

- $1.12 trillion in student loans

I don’t blame those in their 20’s and 30’s for not having retirement savings. Anyone who entered the workforce around the year 2000 has good reason to not trust the system or their elders. There have been two stock market collapses and every asset class is now extremely overvalued due to the criminal machinations of the Federal Reserve. There are far less good paying jobs. Real wages keep declining. They were convinced by their elders to load up on student loan debt, leaving them as debt serfs. The Wall Street/Federal Reserve scheme to boost home prices and repair their insolvent balance sheets has successfully kept young people from ever being able to afford a home. So you have young people unable to save, invest or spend. You have middle aged and older Americans with little or no savings, mountains of debt, low paying service jobs, and an inability to spend. The only people left with resources are the .1% who have captured the system, peddle the debt, and reap the rewards of consumption versus saving. They may be able to engineer a stock market rally to further enrich themselves, but they can not propel the real economy of 318 million people. Our consumer society is dying – asphyxiated by debt – shorter of breath and one day closer to death.

I’d love to offer some sage advice on how to fix this problem, but it’s too late. Too many people missed the starting gun. More than ten years got behind them. No one is going to come to the rescue of people who never saved for their future. The Federal government has already made $200 trillion of entitlement promises it can’t keep. State governments have made tens of trillions in pension promises they can’t keep. They can’t tax young people who don’t have jobs. Older generations who think the government is going to rescue them from their foolish shortsighted choices are badly mistaken. Their benefits are likely to be reduced because the unsustainable will not be sustained. The 45 to 64 year old cohort who chose not to save can run and run to try and catch up with the sun, but it’s too late. It’s sinking. Their plans have come to naught. They are destined for lives of quiet desperation. There is nothing more to say.

So you run and you run to catch up with the sun but it’s sinking

Racing around to come up behind you again.

The sun is the same in a relative way but you’re older,

Shorter of breath and one day closer to death.

Every year is getting shorter; never seem to find the time.

Plans that either come to naught or half a page of scribbled lines

Hanging on in quiet desperation is the English way

The time is gone, the song is over,

Thought I’d something more to say.

Iank35 says:

“If the boomers hadn’t gone out and spent their money in the economy and saved/invested it instead, would the returns have been the same?”

Absolutely the returns would have been better! If they had lived below their means and simply put the extra money in savings at a bank they would still have been better off than they are today. As llpoh said here or in another thread recently, they would have controlled TRILLIONS of dollars in capital. Instead, the boomers went into massive fucking debt and transferred all of that capital to the banks and bankers.

IS – congrats on how you are going.

Re being frugal, staying home with family, tossing a burger on the bbq instead of eating out, etc. Was not exactly a punishment. We were not suffering at all. We were well fed and warm and safe. But we did not spend money on what we did not need. Wanting is not needing.

And they payoff is we now get to have anything we want – forevermore.

It is not that hard. Just say no, and have a supportive partner.

Reverse Engineer says:

“Obviously I won’t post an Ideological article like this one on the Diner, anymore than I would post any of the trash you write in your 30 Blocks of Squalor or People of Walmart articles. Its all Libertarian Propaganda. I post your articles that do good economic analysis, and this one does not qualify. It is complete trash.”

I wonder if admin judges your articles here with the same standards and critical eye? I don’t know, but I do suspect, he is more generous than that. One of the points of blogging is to challenge your readers beliefs. Admin seems to be better at that AND economics.

FWIW, the PoWM posts are not articles written by admin. Do you not know that? PoWM is Libertarian propaganda?

I may not pass and lose access to TBP forever but I think admin SHOULD require an IQ test before people can post comments. Jeebuz!

IS – a small business from home can spin some cash and some nice deductions too.

For several years we ran a small Admin business doing typing, monthly statements etc for small biz, and made about a grand a month.

LLPOH, like I said on the FED thread, I may have an incredible opportunity coming here in the next five years or so. It won’t be owning my own business but more in having knowledge and skills that less than five people in the world will have and I’d be one of only two still actively using those skills in a growing market. It basically comes down to my employers failing to plan and that will give me a big position of strength. My current boss and former Co. owner agrees that I likely have a huge opportunity ahead of me. Should this event come to pass, I’d love to pick your brain. I still have a lot to learn and the next crash may not be kind to my employers but I’m not too worried about that.

I meant to say above:

“LLPOH apparently has reached the success level he was aiming for and is NOW beginning to relax and enjoy…”

@Harsh Reality

I posted a joke. It went over your head. Evidently, it is you who have never been married. Or worse still, you married a woman who has never bothered to concern herself with your family budget.

Second point would be that you are either a young whippersnapper or a very old, non-repentant brain-dead 60’s hippy.

Third point is how disgusting and misleading your ‘Harsh Reality’ misnomer is, as you probably have no experience with harsh reality. I hope and pray you never will, despite the fact that it would do you a whole lot of good to actually face and overcome harsh reality. Unfortunately for you, your day is coming, and soon.

Research what Stucky has posted here on TBP, regarding his mother’s ‘harsh reality,’ then get back to us.

After reading Stucky’s account of his mother’s abuse, I was unable to post here. Recalling my own mother and father-in-law’s account of “harsh reality” was so painful to recall that I quite literally shut down.

So, Harsh Reality, I will continue to hope and pray that you don’t live long enough to witness your entire family butchered, and live to be the only survivor. Unless or until that happens, how dare you claim to know anything about harsh reality.

Wow! I just finished reading all the comments on this thread and RE really “slipped in the shit” to put it mildly. Way to shit the bed RE! Congrats!

FWIW, I wrote him off as a loser and danger to those around him when he admitted to paying off his education debt with a credit card and then intentionally going bankrupt on the credit card. Never went back to his site after that.

Integrity………..you either has some………..or you don’t.

“It is not that hard (to achieve financial well being).. Just say no, and have a supportive partner.”

—-Llpoh

100% true. The big part of that equation is a supportive partner. My wife and I are in a comfortable situation because of ………

My wife and I.

SSS – dead right.

I cringe whenever I hear couples are not on the same page financially. When one wants to go on an expensive vacation, and the other wants to save for a rainy day, it leads to many many problems.

My wife is a godsend. She never wanted things. Family first, and save for our future. I am very fortunate.

That is truly despicable. And the thumbs up to that crap? Show yourselves, assholes.

A few weeks back I made mention of a meal I had made that was sourced entirely from the bounty of our land and work. Someone who read it divided the cost by the purchase price of our property and concluded that that single meal cost several thousand dollars to eat as opposed to his 80 cent can of chili. He had made a sound financial decision, I was a fool. If that meal had been the only thing we ever got from our decision to buy this place and become farmers it would have been a foolish purchase indeed. Of course that was a ridiculous analysis of our cost benefit, but he had a point. Had I ever really looked at the value of what we had decided to do in purely economic terms and was it worth it. As I commented above not everything we do in life can be boiled down to a monetary equation, that there are some investments we make that aren’t denominated in federal reserve notes yet which still bring value to our lives. Not one person responded to that comment and I decided I had been mistaken to leave out the accounting aspect.

Yesterday we took a break from splitting food to go look at a small stand of pine and mixed hardwood hat we had filed an intent to cut on. The piece is oddly shaped with some wet, marshy areas but it makes up the eastern boundary to the property and because of the age and size of the pines on it- over sixty years and close to one hundred feet- it has cast a shadow on a much larger piece of grazing land as well as affect the ph of the soil. We had tagged all the oaks we were leaving as well as the sugar maples and tried to get a count on the board feet the stand contained. It was nice walk since the ground had frozen and it gave us an opportunity to really get a feeling for how the cut would expand the adjoining pasture. We’d install new fence afterwards, of course, and maybe rebuild a section of rock wall along the neighbors land, but that was work for another time after the timbering was done. The land was on a grade and fell several hundred feet from the northern end to the southern most point. The total acreage was only two and half or three acres at most, but the age of the trees added dimension and gave us enough board feet to equal a stand twice that size.

I mention these things because there is a valuation to them. I have come to a point in my life where I think far less in terms of dollars and cents and more in terms of future yields and fertility. However, after a couple of days of reflection based on some comments I read I thought it might be a worthwhile exercise to try and figure out the dollar amounts connected to this sliver of land and it’s future outputs. The cost of the land was tied up in the original purchase which included the house and buildings. Dividing from the total purchase price by acre would skew the numbers, that and the fact that this particular piece was not prime land, but marginal at best. We had made a purchase of an adjoining parcel a couple of years ago that was similar, so I will rely on that figure for my cost basis. Let’s say that the approximate value at current rates would be around $2,000. I estimate that we will harvest approximately 25,000 board feet of pine at a current price of $1,800 per one thousand board foot. Our cost for cutting, clearing and trucking are approximately 75 cents a board foot. The town must be paid a tax based on stumpage- in other words for every tree cut whether it is top quality or rotten- leaving us with a total income on the pine of $20,000. From that I subtract 10% for wear and tear on our tools and equipment, gas and oil for the chainsaws, etc. and we are left with $18,000. We’ll harvest approximately 20 cords of firewood @ $300 per cord for an additional $5,400 (minus 10% for expenses noted above). When completed the number of remaining sugar maples with give us an additional 125- 150 taps with a production rate of one gallon per tap, annually. Syrup currently retails for $60 per gallon, $40 in bulk sales so we’ll use an average of $50 per gallon. There are an additional 100-150 taps potentially on that line based on the number of seedling and saplings. This figure will not generate an income for 15 years, but it is part of the calculation. The remaining oaks each produce enough mast to feed the pigs in the Fall. Calculating the feed rate of mast is next to impossible, but let us assume that out of our total herd size annually, one pig is produced from the nourishment provided in that stand. A single harvested hog will net us $250. This figure is an annuity. When completely harvested and seeded and returned to pasture the total free land will produce approximately 300 bales of hay with one cut, 450 if we get two for an annual average production of 375 bales. The price per bale is currently $4-$5. Less costs in baling (50%) we have a total annual income of just over$2,000. Since we do not sell our hay but use it to feed our livestock based on annual consumption of hay per animal, the hay produced is enough to feed a steer to harvest. Live, on the hoof prices are currently $2.25 per pound. Hanging weight if slaughtered goes for $4.50 per pound and yields 65% of live weight.We harvest at 2 years an under for an average live weight of half a ton. Our average beef income on that single piece of newly cleared land will average $2,500 per year.

You may have noticed that the one figure I do not include is my labor. I do this for several reasons, first because we do not hire labor on our farm, we do it ourselves because we want to and because we love it. If I were living my old life I would have paid someone to let me do what I do now. I no longer belong to a gym and pay dues because I get all the fitness training I need doing what I do and am in better shape than I was when I did belong to a gym. I get all my meals right here and they are both nutritive and delicious. I have a quality of life that exceeds my wildest expectations and that I couldn’t imagine putting a price on, but if I did it would exceed a $20 an hour pay rate. With the exception of two injuries in the past 6 years (broken wrist, distal bicep rupture) I have not been to see a doctor nor have I taken any medication. I don’t know what the savings in health insurance/health care has been, but based on my last plan it is a minimum of 20-30K. So labor, as far as I’m concerned, is a wash.

The cost of the land- the ‘investment” for economic folks- was $2,000. The net return on the one year harvest- will be over $20,000. The annualized returns of the product of that effort- the maple syrup, the beef and pork production sustained by the organic matter of that clearing effort- will be $9,000, in perpetuity.

There are plenty of factors that could affect the annual returns in either direction- if we get a cow calf as opposed to a bull calf she will produce between 10-20 calves during her life greatly expanding our returns on beef. Same for the pigs. If we have a sow who throws two litters per year of 10 piglets we quadruple the return on pork. Of course things could also go the other way if there is a drought (we live on the side of a mountain with numerous springs, streams, wells and cisterns) or if we have severe fluctuations in commodities prices.

If we had taken our lifetime savings and placed them into a 401K rather than our homestead we would still have to live with the risks of the market. We’d still be paying for energy. We still be buying food, paying our mortgage, health insurance and deductibles, water bills, vacations and distractions, health club, etc. I can’t even begin to figure in the benefits this lifestyle has brought my children and our marriage. I spend the majority of my life in the company of the people I love and care for the most, I get to share with them not only the skills and experiences of self reliance, but the health benefits and intellectual stimulation of living in tune with nature and the seasons. By carefully balancing our income with our improvements we can keep our tax burden at a manageable level where as successful consumers it was onerous. We also enjoy some of the finest meals on a daily basis and deep sleep unencumbered by anxiety and the restlessness that attends a sedentary lifestyle.

There is a hidden economy in our world that is ours for the taking. It requires hard work, physically demanding labor and long term planning based on timelines much further apart than paydays. There are fewer opportunities for consumer goods and vacations, we do not clothe ourselves in the latest fashions ( I spent the better part of our Friday date night sewing patches on my overalls while my wife and I talked and enjoyed a glass of wine by candlelight) and we haven’t got any of the I-gadgetry that has been at the center of everyone’s lives these days. What we do have is a life based on the pillars of family, industry and an accord with Nature.

To me there is no more sound investment than that.

FWIW, I wrote him off as a loser and danger to those around him when he admitted to paying off his education debt with a credit card and then intentionally going bankrupt on the credit card. Never went back to his site after that.

Integrity………..you either has some………..or you don’t.

Hard to believe IS, but he considers it a mark of his superior intelligence. An amazing example of sell love and delusions of grandeur.

“You Gotta Game The System” is a lesson he teaches his flock with pride and much self admiration.

I save silver/gold, lead, food, cash, and I work toward being as self sufficient as possible. No dividends but no debt; it’s all Millennials can trust these days.

Great article and a great song to inspire it!

Makes sense Justin, No one can predict the future but at least you are trying to cope in a sane and responsible manner.

Not many places you can put your trust in these days, and it’s a problem that more groups than the millennials have. Being self sufficient as much as possible certainly alleviates some of the problem.

Excellent article and comments especially from Llpoh.

An uncle on my mother’s side of the family is the only one (so far) to reach millionaire status. After returning from the Korean War, Uncle Herman worked for someone else for a few years, then decided to start a welding, metal-working business out of his garage. I remember this because my father loaned him $1,000 to get started in the middle or late 50’s, a significant amount of money back then.

After 10 years of working 70-hour weeks, he was a CEO of a non-public company that manufactured truck-bed tool boxes. Herman was very good with “numbers” and was very strict with his employees as I recall. I don’t think he even had any formal education in business either. Quite remarkable in many ways.

Most people do not want to pay the price to get ahead or become wealthy: it’s too harsh and difficult. It’s really that simple.

GO, does anyone call him out on that bullshit or do they just fulfill the role of sycophants?

The thing I’ve noticed about most hoomans is that they constantly give clues as to their true personalities. The amazing part is how few people seem to pick up on it.

My best friend is a guy I’ve known for 20 years. He has a neighbor who has a small, hobby machine shop in his back yard and I occasionally employ him to make things I dream up. He usually asks me to hang around when he’s just doing a small job that won’t take long. Thing is, this guy gossips more than ten women. What I noticed was that if anyone else was around he acted like their best friend but the minute they left he talked a non-stop stream of bullshit about them. One day he brought up his neighbor, my best friend, and started to run him into the ground like he was the biggest piece of shit on Earth. I cut him off midway through his diatribe and asked what he told others about me when I wasn’t around? He looked genuinely shocked before saying he would never do that to me. I told him it was my observation that he talked shit about everyone……behind their back and reasoned that since this was the case that there was no way he did not talk shit about me in my absence. At that point he suggested I find someone else to have my things made. I’d bet $100 that RE is the same kind of guy or worse.

“You Gotta Game The System” is a lesson he teaches his flock with pride and much self admiration.

There are a lot of persons making a business out of that idea, from SS planners to money lending or borrowing. How did that work out for Lehman o Bear Sterns? Yet every rube coming down the pike thinks he’s got a sure-fire scheme, ask Bernie Madoff.

“GO, does anyone call him out on that bullshit or do they just fulfill the role of sycophants?”

Very few do IS, and they are immediately ostracized, ridiculed, censored, until they leave or are forced out by the treatment they receive from him or his gophers. They are a hand picked group of his bummy lickers that he gives power over to censor, remove postings, throw in a dungeon he created, etc, all kinds of silly childish shit, anyone he decries as a CONTRARIAN to his idiotic rantings

He speaks of liberty, free speech, fairness, but it is all a crock of lying shit.

His sycophants are a sorry group, they stand in line eagerly to kiss his ass and praise his every silly utterance. He constantly proclaims to the nit wits that they have the POWER OF GOD as Admins on his site, power that he bestowed on them. An amazingly dim group of gophers.

it would be nice to think he is being taught a lesson, but he is banned from so many reputable sites like this, that it is hard to keep count. The Automatic Earth, Karl Denningers, just recently Zero Hedge, now TBP, to name a few, that he is no doubt used to it.

He is a strange one, complete hypocrite, grand blowhard of all blowhards, who demands on his site that he be taken seriously in all matters and treated with respect. A sick puppy indeed, who will do anything for recognition and Alexa ratings, his only goals in life. He wants to be the “Super Star of Doom”

It’s not fair to not mention some good things about someone you are speaking about in unflattering terms.

The Diner was a great place at one time early on. Free speech was sacred and we attracted some wonderful posters of great merit. It was a pleasure to meet them and learn something from them. We formed friendships, we fought, argued, we were free and the place had the wonderful smell of fresh air and honest conversation, even though tempers got out of control at times.

Those were the Glory Days of the Diner, that credit has to be given to it’s founder. Such is Life, Power seems to always corrupt.

Golden – We here at TBP have know the asshole RE for a very long time. Everything you say is true. He is the most hypocritical beast ever encountered.

Many are the times he has screamed and abused the Admin for “censorship” while openly admitting he sensors at will on his site. When he posts (thank God that is over with) something on TBP, he includes about 8 links (no shit – around 8!) to his own site in the very first paragraph or 2. I have never known anyone, anywhere to do such a ridiculous thing.

He openly admits to shit that would make others too ashamed to show their faces in public. He is proud of having zero integrity. He used to decry that when he could no longer be self-sufficient, he would put himself on an iceflow or some such, as it is good for the world. What happened in reality? Off to the local apartment complex to live with those he has spent years ridiculing and abusing.

He is a slimy piece of shit. Make no mistake.

Admin – thanks for removing that one comment. It was an absolute disgrace.

“Many are the times he has screamed and abused the Admin for “censorship” while openly admitting he sensors at will on his site. When he posts (thank God that is over with) something on TBP, he includes about 8 links (no shit – around 8!) to his own site in the very first paragraph or 2. I have never known anyone, anywhere to do such a ridiculous thing.”

IIPOH, Yes, he is known for that link shit.

Ilargi at TAE got pissed of about it and told him to quit WHORING on his site. The wise ass replied back to him with some nonsense and links to the diner in the posting. Ilargi declared him a smelly whore and banned him.

Shame is not present anywhere in his makeup, or that of Lefty’s in general. Also the line he uses of hiding someones postings where no one can ever find them as not being censorship is a testament to what a phony he is.

He recently declared the Diner was no longer free, that it was a dictatorship and he was PAPA DOC. That’s what a fraud he is. I started calling him Baby Doc after that. No shame, NONE WHATSOEVER.

He is preparing the world for doom nowadays by giving lessons on how to cook Jack Daniels and egg omelets. And you are supposed to take him seriously, He’s as Mad as Hatter!

Wow GO, people with those traits generally, deep down inside, know that they are scum but they still struggle to put on righteous airs. Pride is a terrible thing sometimes.

I actually ran across The Diner twice before finding TBP several years ago. They were brief encounters and I likely did not find anything there of value. After finding TBP I went back a few times thinking I’d given up too early. I read a few things there from time to time but TBP had already captured my attention. When I got into a discussion here on TBP one night and he took pride in intentionally defaulting on his debt my scumbag meter pegged and that was it.

You’ll like TBP. Things are on a pretty even keel here but it does turn into the wild west sometimes. The funny thing is that you can never tell what will set off a pissing contest around here. From what you describe about The Diner, you’re gonna love TBP. Just don’t be a pussy and never apologize!

“today (age 37), done way better than most of my peers, and all I have is NOTHING (just no debt) to show for it. I have 2 little kids, and here the crisis is. WTF.”

—-SAH

You have something to show for it. No debt.

At age 42, I was in the same situation. Two kids, no debt. 20 years later. Much different story. In a takeoff to a title of a Bob Dylan song, “Save, Lady, Save.”

“You’ll like TBP. Things are on a pretty even keel here but it does turn into the wild west sometimes.”

Thanks IS, I’m already sure of it.

You have something to show for it. No debt.

Agreed SSS, A valuable asset that few possess these days.

The ability to earn a dollar and keep it to yourself, not having to hand over half of it immediately to some friendly bankster who has you in bondage with his credit card usury.

“He is a strange one …. grand blowhard of all blowhards, who demands ….. that he be taken seriously in all matters and treated with respect.”

—-GO’s description of RE

Sounds like me!!!! You should see the respect I get when I start in on illegal drugs. The love everyone shows me is suffocating.

I don’t think Admin banned RE from the site. He merely told RE that he wasn’t going to post any more of RE’s articles on TBP. And he did it with classic Admin prose …… “You’re fucking done on TBP. I will never post your drivel again.” Heh, that brought a big smile to my face. And Admin can do that by sending RE’s guest post submissions to the trash bin.

Take my word for it, Admin has been very tolerant of RE over the years. Very. If this were my blog, I’d have snapped long ago, even though I totally share Admin’s passionate belief in free speech. Enough is enough.

SSS

He is banned from commenting too. His comments always contain a link to his site.

He will never get help from me again.

I hate his fucking guts. I always have, but I tried to be the better man.

He pushed me too far this time.

I’m actually saddened to see RE banned from TBP. Although I never read any of his articles, since the old days back at RD, I will miss the subtle and not so subtle ass reaming snark born of some of his quirky verbose meanderings, (e.g, 700 million died, negroes don’t assault retards traversing black neighborhoods, pot latch was the best system of currency, evah…and on and on about gubermint and the Illuminati….every tool has it’s purpose and RE’s was the entertaining ass kickings he seemed to inspire others to deliver to his online persona….maybe be the retard for self-preservation was no act?

You hate his fucking guts ?Woe to RE .Not sure what happened between you guys through the years but I’m glad you still love me and little bb.

Admin – Too bad Smokey isn’t around to rejoice over this. He hated RE’s guts with a deep and abiding passion.

Admin

Got it. Thanks for clarifying. As I said, “If this were my blog, I’d have snapped long ago.” Your level of tolerance is much higher than mine. Kudos to you, sir.

@ Anonymous, who said, “You hate his fucking guts? Woe to RE. Not sure what happened between you guys through the years”

Years ago, RE launched an unrelenting and unapologetic attack on Admin’s FAMILY, not him, but his family. He never backed off. Never. Do the math. It sat there like a ticking time bomb.

SSS ,I just repeated what admin said in the above comment. I don’t know what happened.

Mr. Quinn, my thanks to you for your long and arduous efforts to keep this site afloat; it has made a difference to me personally. As a first year (1946) BB I would like to chip in my take, and situation on “retirement” readiness, etc. Belief in college, the corporate ladder, and a pension was ingrained at an early age. Our “father knows best” lives (which never existed outside tv land or ann landers columns) ran into the draft when us white trash couldn’t afford college; what a great red pill that experience was. It left many of us with a hatred and distrust of authority in all shapes we will carry to the grave. Made it tough to be a corporate ladder climber, sucking the asses of all those smartass young MBAs telling me to keep paying into the retirement fund. All they could see was the big bucks for being a dominatrix for the company. Then the PC world came in and the old shoes were tossed out for vibrants and feminazis. oops- there went the pension. at least I cashed out ahead of my overpriced suburban mcmansion and used what I had paid in to buy a farm in flyover country. At least I had started reading people like yourself before the SHTF starting in earnest in 2008.

I feel for those who cannot see ahead, and urge them get out of their current situation to find freedom. No debt, No credit, No Income, No taxes. Freedom is indeed, nothin left to lose.

My pittance of Social ain’t much- with a garden, a greenhouse, chickens, etc we will maintain until we can’t. We are happy to be poor and not owe nobody nothing, and give what we can of our knowledge and charity to our friends and neighbors. I feel that those who think they will have a retirement, or count on savings will be very disappointed when the PTB steal it from them. The only real savings are your strength and courage to become free from this endless treadmill of consumerism, debt, pointless involvement in politics, and all the trappings of the empire “matrix”. Thanks again, Jim.

llpoh – “There is a lot of ranting around the MSM re “inequality”. It annoys the shit out of me in general.” I too have worked really hard, saved hard, done without, blah, blah. And, as Admin says, a lot did the opposite, choosing to live for the day and not for the future. These people tick me off too because now they expect to be bailed out, their debts forgiven (as if these debts magically appeared and had nothing to do with their lifestyle), etc. So they’re No. 1 Something for Nothings.

But then there’s the No. 2 Something for Nothings – the 1% – who have and continue to gain their wealth through absolutely no work, through so-called “financial innovation”, fraud, corruption, monopolies. This is where the blatant, in-your-face inequality is coming from. To deny this is just stupidity. Yes, sure, the top 20% pay most of the taxes, but let’s get real where a lot of them get their money from – through a financial system where they are set up to win.

So, yeah, there IS inequality.

P.S. I never begrudge someone more money if they choose to work harder than me or are more talented, but I do get angry when they make it from nothing.

Backwards – I object re the characterization of the 1%. A little research will reveal that what you say about the 1% is incorrect. The one percent is made up of doctors (lazy fucks who inherited their degrees, no doubt), lawyers, small businessmen and women, etc. – lazy fucks each and everyone, according to you.

Re the top 20% – I do not begrudge them whatever affluence they have managed to scrape together. And the vast majority are not doing anything more than going about their business trying to secure their futures.

The top 1% mantra is a lie. Wish people would stop using it.

Now, if you substitute the top .05% or thereabouts (probably even less than that, as that is still 150,000 people) for top 1%, I can generally agree with your comments.

But to chuck doctors, lawyers, small business folks into the same pot as the oligarchs is crap.

“Although I never read any of his articles, since the old days back at RD”

You didn’t miss anything Flash. Rantings of a Looney Tune with illustrations that reflect a sick, twisted demented mind.

His financial stuff is plagiarism, stuff he reads at zero hedge mostly, twisted and contorted into his lunatic style and presented as if original. He never had an original thought in his entire life.

llpoh – …lazy fucks each and everyone, according to you.” You apparently can’t read either. I said, “P.S. I never begrudge someone more money if they choose to work harder than me or are more talented, but I do get angry when they make it from nothing.”

I was speaking above about the people “who have and continue to gain their wealth through absolutely no work, through so-called “financial innovation”, fraud, corruption, monopolies.” Do you think doctors fit that description? I did say “absolutely no work,” didn’t I?

I’ll use the same words you used on Star: “What, you too stupid to read?”

BE – I objected to your use of 1%. The one percent is not made up of lazy fucks – quite the contrary

As I said, I largely agree with you save you are overstating the percentages. It is the. 05 percent, not the 1 percent.

llpoh – fine, but I never called anyone “lazy fucks”. It takes work to make “something from nothing”, or at least a lot of campaign contributions and lobbyist fees. 1% (3 million people) haven’t made a good chunk of their money from capital gains?

Not one of you seems to realize that if it weren’t for all those folks spending their last dime (and far more),all those wonderful investment products and opportunities for the savvy Wall street crowd would not have materialized. Such hubris! We should at least admit that a great portion of our wealth was gained on the backs of the workers who worked hard to produce the product then giving back all their wages and future wages until the day they die……,

Dan, isn’t that cannabilism?

We traded production for Wall St hubris.

They PRODUCE nothing. They exist to suck off the truly productive.

In case you haven’t noticed, our country has been hallowed out while our GDP grows.

Believe reality before your very eyes, or believe the shills.

Either way doesn’t matter, tis a house of cards and those that worked, or those that sucked, will – by and large – end up in the same boat.

The 0.1% will be gone, and so will everything we thought we owned and knew.

I don’t know why I bother, by and large those that believe Wall Street and the politicians “produce” and create things of value refuse to see the world for what it has become.

Good luck to you, thanks for stopping by.

dan and TE – I’ve said that for years. IF workers had have saved for their own retirement (not getting involved with Wall Street, 401K’s, etc.), in which case they wouldn’t have consumed like they did (and they did consume, a lot of them, because they were relying on what their government told them, that Social Security would have their backs, then these corporations/Wall Street would have nowhere near the money they have now, not even close.

We traded our souls for Wall Street, believed that globalization was going to benefit us (ha!). Under the guise of helping us through different entitlements (which were brought in in order to lull us into consuming like idiots), we became dependent. That is never a good place to be.

What a bull shit article.

Yes, if you were smart, had the connections, were a savvy investor, you could be doing well.

But aren’t you conveniently forgetting that roughly 1 our of 4 people can’t balance their check book???

Or that the average IQ is 100, and the implementation of 401K programs prevented companies from helping their employees navigate the various retirement avenues?

You assert that these guys are deserving for what they are going to get, and you, being so smart deserve you rich retirement.

Take your ego and shove it.

Sincerely,

Tom Johnson

Tom Johnson

Blow me.

Cordially Admin

You sound like one of the assholes who chose not to save. You must be another dumbass Boomer. I love when assholes like yourself open with bullshit article when you have no facts to support your bullshit. You idiots are so predictable and never accept responsibility for your own ineptitude. Blame it on someone else, right asshole?

You simpletons can’t get it through your thick fucking skulls that saving requires spending less than you make. Because ignorant Americans like yourself choose not to balance their checkbooks is your excuse.

What a douchebag. I really should require an IQ test for allowing idiots to comment.

Tom J,

Is my generation and those after mine, whose chances at a life outside of a third world existence you’ve helped squander, deserving of the pain of your generation’s greed and ineptitude?