Via Birch Gold Group

“All right, everybody, smile like inflation is totally under control…” IMF Photo by Cory Hancock

From Peter Reagan at Birch Gold Group

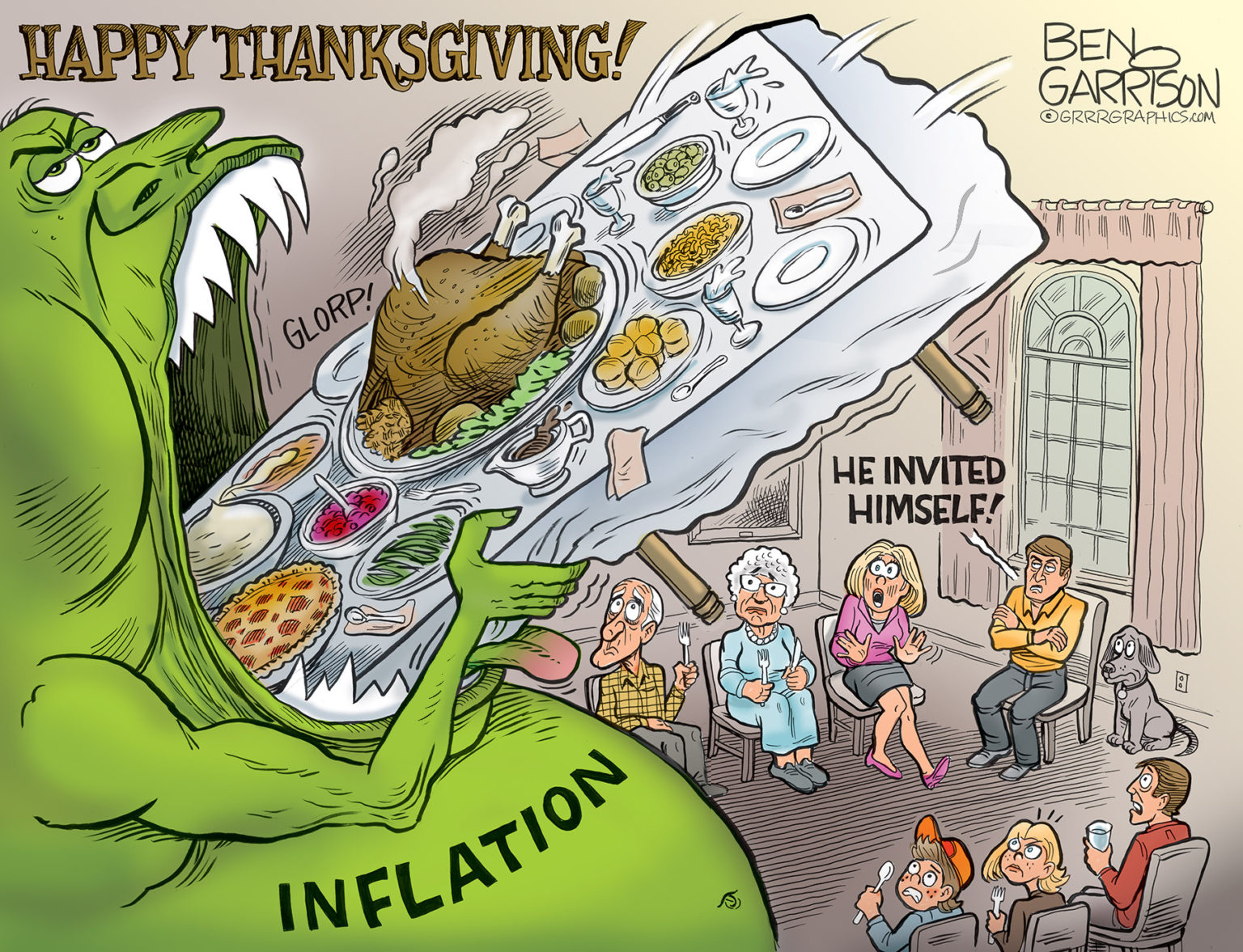

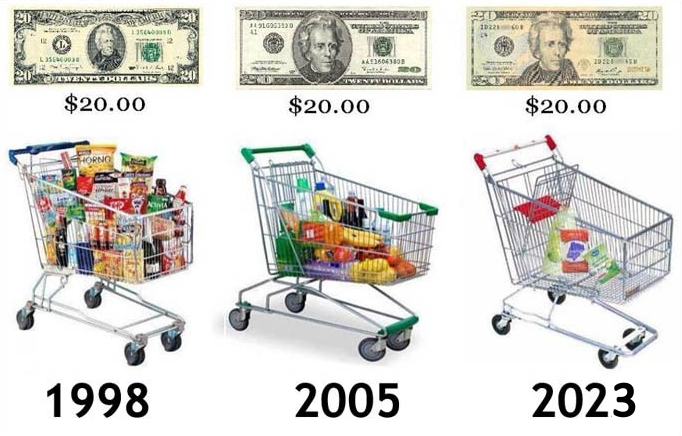

If you can see beyond the mainstream media’s attempted glossing over of President Biden’s failures, then one topic stands out: Historic inflation since June 2021.

Of course, Biden doesn’t deserve all of the blame for inflation heating up. After all, the previous administration spent trillions, and Powell’s Fed practically ignored it until the “inflation train” had already left the station.

Now, it looks as though the price inflation that’s been siphoning our savings could be sticking around for quite a while longer. It could even become “business as usual.”

To illustrate this, we’ll start with some of Powell’s recent remarks on the future of rates for the next 6 months:

Federal Reserve Chairman Jerome Powell on Wednesday affirmed that more interest rate increases are likely ahead as inflation is “well above” where it should be. “Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,” he said. Powell said the labor market is still tight though there are signs that conditions are loosening.

He noted that the number of open jobs still far exceeds the available labor pool.

Powell even included a deadline with his remarks: “Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.”

Continue reading “Fed Stealthily Admits That Inflation Won – So What’s Next?”