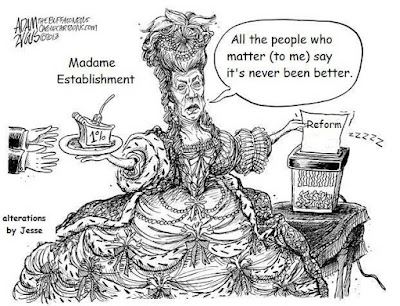

Guest Post by Jesse

“What is good? All that enhances the feeling of power, the will to power, and the power itself in man. What is bad? All that proceeds from weakness. What is happiness? The feeling that power is increasing— that resistance has been overcome.

Not contentment, but more power; not peace at any price, but war; not virtue, but competence. The first principle of our humanism is that the weak and the failures shall perish. And they ought to be helped to perish.”

Friedrich Nietzsche

There is a range in human behaviours. There may be a baseline, but not all are the same.

And this is why theories that assume that everyone has a basic world outlook that is the same like you, that all people have a natural desire to be friendly, helpful, and sharing falter out of either a good nature or from a good maximizing, selflessly reasoning behaviour, falter so badly when applied to the real world.

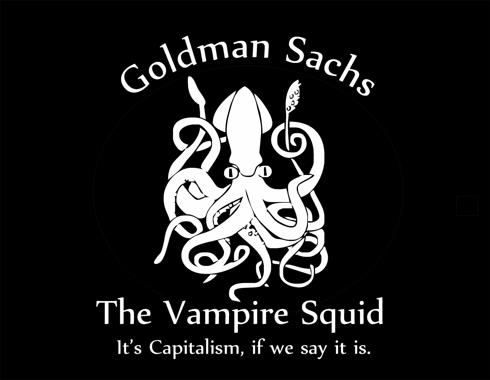

When a society fails to restrain some of the worst behaviours of those who prey on others in term of power or money, their example serves to bring out the worst in a much larger subset of the population that is marginally sociopathic, weak in their human values.

Bad behaviour breeds bad behaviour, and those who profit by it find ways to justify this through self-serving social and political theories, to themselves and to others.