Why China thinks gold is the buy of the century

by Michael J. KosaresLet’s start with some big, but digestible numbers:$3,950,000,000,000 = China’s total foreign exchange reserves$1,250,000,000,000 = Value of the world’s 31,866 metric tonnes gold reserve at $1220/troy ounce_________________________________________________________________________________________________________$1,280,000,000,000. = China’s holdings of U.S. Treasuries in its foreign exchange reserves$ 319,000,000,000. = Value of U.S. 8133 metric tonnes gold reserve at $1220/troy ounce_________________________________________________________________________________________________________Now let’s delve into what those numbers might mean to the average gold owner…When it comes to the gold market, China is the dragon in the room. With its nearly $4 trillion in foreign exchange reserves and potential purchasing power, that presence is formidable.How formidable? Consider this:– China could purchase the total United States gold reserve (8133 metric tonnes) with 8% of its foreign exchange reserves.– It could purchase the total global gold reserve (31,866 metric tonnes) with 32% of its foreign exchange reserves.– It could purchase all the gold stored by Exchange Traded Funds (+/- 1750 metric tonnes) with less than 2% of its foreign exchange reserves.– At $4900 per troy ounce, the value of U.S. gold reserves would match China’s U.S. Treasury holdings of roughly $1.28 trillion.– At $4700 per troy ounce, the value of the world’s gold reserves would match China’s total foreign exchange reserves of roughly $4 trillion.– To put it another way, China could pay double the current price for the world’s total gold reserve and still have nearly $1.5 trillion in foreign exchange reserves.– China sits atop the list of the world’s foreign exchange holdings.The United States ranks thirteenth at $133 billion. For the United States to ascend to the top of the rankings, it would need to revalue its $319 billion gold reserve to almost $4 trillion – or raise the value to just under $15,300 per troy ounce…There is quite a bit more. You may read the entirety of Michael’s very interesting analysis here.

Month: September 2014

THEY CAN’T KILL US ALL

This Fourth Turning will not be led by old people. This Crisis is developing into a generational war. The corrupt social order is run by older generations for the benefit of themselves. Young people across the globe are the ones being screwed. Over 70% of young people voted for Scottish Independence. The ongoing protests in Hong Kong are solely young people who don’t want the corrupt Chinese oligarchs to be running Hong Kong. Millions of young Americans have been lured into over a trillion dollars of student loan debt, with only crappy service economy jobs available, and kept from buying houses by Wall Street bankers looking out for their own selfish interests. The tension and anger is growing by the minute. The youth across Europe, Asia and the U.S. are pissed off and will be the ones doing the dying in the forthcoming storms. They are young and have nothing to lose. The oligarchs around the world are worried. They are outnumbered. They can’t kill us all. Or can they?

![]()

![]()

![]()

![]()

![]()

![]()

.jpg)

Australian Scientists Caught Rigging Climate Number to Fake Global Warming

In Australia, the scientists have been caught red-handed adjusting the number to pretend the climate has been getting warmer. Let’s get real here. There are natural cycles within climate. How did the Ice Ages end before without cars? Guess it must have been a lot of cows farting as Europe has declare cows posed the second greatest threat to the environment next to cars. Keep one thing in mind. Creating a climate crisis means they get funding. The money flows to them for investigating what does not exist.

I’M THE TAXMAN

They keep turning the screw tighter and tighter.

Photographers face fines for taking pictures in National Forests

The government attempts to turn a right into a paid privilege.

Free speech is under attack as the federal government is attempting to institute a permitting system for photography taken on so-called “public land” controlled by the U.S. Forest Service. Under the directive, professional photographers will be obligated to purchase a “special-use permit” for the privilege of shooting pictures inside tax-funded national forests.

In usual form, the restrictions are being manifested gradually — first targeting photographers who make their living off of shooting pictures. Under the proposed directive, commercial photographers will face fees of $30 to $800 per day to professionally document the beauty of the parks.

“We take your First Amendment rights very seriously,” paradoxically stated U.S. Forest Service Chief Tom Tidwell. “The directive pertains to commercial photography and filming only.”

What the forest bureaucrat fails to acknowledge is that “commercial photography and filming” is inextricably tied to the First Amendment. The right to free speech does not end when the product holds value to another party. No distinction between casual and professional speech is made in the constitution.

By definition, commercial photography includes any image or movie that can potentially be sold to anyone else. That might include individuals shooting stock nature photography, magazine photographers, documentary filmmakers, or even theatrical productions. It could include professional landscape photographers like Ansel Adams or the tourist who takes a unique shot that gets the attention of a publisher.

Commercial photography is so broad in nature that restrictions on it have the potential to affect anyone with a camera. But the government dubiously assures us that commercial photography is the “only” field being restricted.

Public commenting on the policy has been extended to December 3, 2014. Readers are encouraged to submit a formal comment demanding that no aspects of photography be restricted and turned into a paid privilege.

Let me tell you how it will be

There’s one for you, nineteen for me

Cos I’m the taxman, yeah, I’m the taxman

Should five per cent appear too small

Be thankful I don’t take it all

Cos I’m the taxman, yeah I’m the taxman

If you drive a car, I’ll tax the street

If you try to sit, I’ll tax your seat

If you get too cold I’ll tax the heat

If you take a walk, I’ll tax your feet

Taxman!

Cos I’m the taxman, yeah I’m the taxman

Don’t ask me what I want it for (Aahh Mr. Wilson)

If you don’t want to pay some more (Aahh Mr. Heath)

Cos I’m the taxman, yeah, I’m the taxman

Now my advice for those who die

Declare the pennies on your eyes

Cos I’m the taxman, yeah, I’m the taxman

And you’re working for no one but me

Taxman!

GETTING CATS OUT OF TREES

Everything You Need to Know About the S&P Until Christmas

Everything You Need to Know About the S&P Until Christmas

By Andrey Dashkov

When I need to clear my mind, I put on my beat-up Saucony sneakers and drive to nearby Deer Lake Park in Burnaby, British Columbia. After a couple of miles, though, as my body gets into a rhythm, my mind wanders back to the thought that occupy it for hours each day: where will this market go next?

And I’ve thought a lot about what went on this summer. Since June 1:

•S&P 500 is up 2.7%, having set a new record high in September;

•MSCI World index is down 0.5%;

•10-year Treasury yield is down from 2.54% to 2.50%;

•Brent Crude 0il is down 12.8%; and •Gold is down 2.2%.

The Bureau of Economic Analysis reported that the US economy expanded by 4.6% year on year in the second quarter, up sharply from the first quarter’s disappointing 2.1% annual decline. Consensus estimates for annual GDP growth in the third and fourth quarters of this year are about 3%.

The stage seems to be set for the fifth straight year of positive economic growth in the US; however, we’re always cautious about government-supplied information, especially during an election cycle.

At the moment, macro developments seem closely intertwined with stock market performance. Instead of slumping, the market was rather vibrant this summer. The S&P 500 showed resilience, reaching higher highs after a dip in late July and early August that coincided with increased uncertainty surrounding the Ukrainian crisis.

Geopolitics aside, the market was supported by GDP growth, which in turn was underpinned by strong corporate profits and margins. In fact, in the second quarter, the S&P 500 set a new record for profit margins: 9.1%. So much for “sell in May and go away.”

Expanding earnings and margins are great news on the fundamental front. Of the trends we observed this summer, at least two will benefit S&P 500 companies’ profitability. Cheaper oil may keep energy costs down, while consumers are more than willing to swipe their debit and credit cards. In August, consumer confidence jumped to its highest level since October 2007, having increased for four months in a row.

Loose Money Helping Stocks in the Short Term

The Fed has done its part, too. Long-term effects of its prolonged loose monetary policy aside, it’s hard to argue that it hasn’t helped stocks in the short term. With Treasury rates still low, debt options abound, and companies can obtain cheap funding for things like capital expenditures and buying back shares.

In the first quarter, 290 companies from the S&P 500 bought back shares at a cost of $159.3 billion, 59% more than a year ago. Dividends are up as well: in the first quarter, S&P 500 companies spent a record $241.2 billion on dividends and repurchases together, according to Standard & Poor’s.

Second-quarter share repurchases were estimated at $106 billion, according to Financial Post. That’s much lower than first-quarter repurchases (though the official numbers aren’t out yet) and down 10% year on year.

Buyback Frenzy Is a Net Positive for Share Prices

However, the most important takeaway is that the cumulative effect of the recent buyback frenzy was positive for share prices and dividends. With fewer shares, it’s easier for companies to maintain dividend payments. Higher share prices may drive down dividend yields, but companies tend to increase dividends over time, which makes up for that in part. And despite the S&P 500’s significant growth over the past five years, dividend yields have not decreased as much as one would expect.

The chart below tracks the S&P 500’s median dividend yield since the first quarter of 2009.

The median dividend yield decreased just slightly over this period: from 1.9% in 1Q09 to 1.7% in 2Q14, and it’s held relatively steady over the past three years.

The good news is that S&P companies aren’t stretching their balance sheets too thin to cover these dividend payments—these payments are backed by earnings. The median dividend payout ratio (the ratio of dividends paid to net income), although up from five years ago, still looks solid.

S&P companies can successfully cover their dividends with earnings, so there’s no reason to fear that they’ll have to borrow to keep paying them. However, a lot of investors worry about leverage. On one hand, financial leverage boosts return on equity (ROE), and prudent borrowing can be a positive for investors. On the other hand, large amounts of leverage leads to volatility in earnings, a less stable balance sheet, and risk that affects valuations.

Debt and Cash Both Up

These are legitimate concerns, but our next chart shows that in the past five years, S&P companies have increased debt while also accumulating a lot of cash on their balance sheets.

Debt and cash grew at about the same pace during the last couple of years. There were many reasons for this trend, but two interrelated ones stand out: the abundance of cheap debt that S&P companies took advantage of (why spend your own cash when you can finance on such great terms and pay it back over a long period?); and the desire to keep interest on that debt as low as possible by making credit rating agencies happy and holding a lot of cash in the bank.

If a correction is in the cards for the near term, this cash, increased earnings, and the support coming from share buybacks will provide some cushion for these companies’ valuations.

Why We’re Not “Permabears”

So what’s ahead? I wish I knew. There are a lot of market bears out there who say this rally will come to a halt sooner rather than later, and the S&P will fall off a cliff. I stay away from calling tops and bottoms and wonder how many pundits actually have any skin in the game. Going short the market requires timing; so any “permabear” who puts money where his mouth is may lose a lot if his timing is wrong.

I’m not saying the rising market is somehow “wrong.” There are solid company-level fundamentals and positive macro-level data points here and there that support a significant part of its growth.

Your Plan to Profit

We’re pragmatists at Miller’s Money. Quantitative easing and basement-level interest rates have flooded the market with dollars and eroded yields, but you should use these circumstances to capture some of the benefits they’ve created. No, you can’t earn much on CDs. No, dividend yields might not beat inflation (at least not all of them, and certainly not every estimate of inflation). And yes, the current rally will eventually end, one way or another. We just don’t know when or how. No one does.

What matters is that even in this situation you can protect your financial wellbeing by sticking to our core strategy: diversify geographically and across sectors; and invest in assets that provide robust yield relative to risk and have the potential to rise in price. You can learn more about the Miller’s Money Forever core strategy here—a time-tested plan designed for seniors, savers and like-minded conservative investors.

MSM TOUTS RISING HOME PRICES WHEN THEY ARE FALLING

This was the headline on Marketwatch this morning:

U.S. home prices rise 0.6% in July

This was the truthful headline on Zero Hedge:

Case-Shiller Home Prices Tumble Most Since Nov 2011, 3rd Drop In A Row

Does this chart reflect rising or falling home prices?

The MSM propaganda peddlers pick and choose the data they present. They present seasonally adjusted employment, orders, homes sales, etc. But they decide not to present the seasonally adjusted figures for home prices when they show a large decline. The Case Shiller Index is a three month moving average, so the decline is even greater than the numbers presented. Home prices peaked months ago and are now headed down. That’s a fact Jack.

I THOUGHT THE AUTO INDUSTRY WAS BOOMING

The MSM keeps telling me that auto sales are skyrocketing. They tout this as proof the consumer is back. Then why is Ford slashing their profit forecast by $1.5 billion? Why are their North American profit margins crashing? Why hasn’t their stock price moved at all in the last year? Why is their stock price 25% lower than it was in 2011? Why is GM’s stock price down 25% in 2014 YTD? Why is GM’s stock price still 20% lower than it was in 2011? Why are dealer lots overflowing with inventory?

The reason none of this computes is because the auto recovery is a farce. The “fantastic” sales are nothing but a debt financed bonanza created by the Fed’s easy money. Subprime financed auto”sales” are just pre-repossession gifts to deadbeats. Leases are nothing but short-term rentals to math challenged dumbasses which will be flooding dealer lots over the next few years. Even the legitimate sales are being financed at 0% for 7 years. This auto recovery is nothing but smoke and mirrors.

Ford sharply cuts full-year profit outlook

By Mike Ramsey

Published: Sept 30, 2014 8:21 a.m. ET

Just three months into the top job at Ford Motor Co., Mark Fields slashed the auto maker’s full-year profit outlook on rising troubles in emerging auto markets and costs from quality troubles and U.S. recalls.

Mr. Fields told investors on Monday the nation’s No. 2 auto maker by sales expects to report pretax profit this year of between $6 billion and $7 billion, approximately $1.5 billion less than it had forecast in July.

The largest factors: a roughly $1 billion larger tab for warranty and recall costs, a $300 million hit from declines in Russia, and a loss in South America that is $900 million larger than forecast. Better than expected unit volumes and pricing helped offset some of the shortfalls, it said.

Ford shares closed down 7.5% at $15.11 in 4 p.m. trading, the lowest close since March, and continued falling after-hours.

“The big shock today was the margin forecast given for North America,” said Brian Johnson, Barclays auto analyst. Despite high expectations for the 2015 F-150 pickup truck, Ford’s outlook for the rest of the year implies North American operating margins of between 8% and 9%, down from 11% last quarter.

The company now expects Europe to lose $1.2 billion on a pretax basis in 2014 and projects the red ink there would flow into 2015, although at a lower rate. Ford no longer expects European auto demand to return to prerecession sales levels even by 2020.

Ford also is suffering quality problems and has recalled 3.9 million U.S. vehicles so far this year, according to National Highway Traffic Safety Administration data.

Mr. Fields took over from former CEO Alan Mulally in July, and on Monday led a team of executives in laying out a road map for the business through 2020. While the company pointed out bright spots in Asia, North America and its Lincoln luxury brand,

Mr. Fields said the weak short-term outlook isn’t casting a shadow over his early days as CEO. He said the company is “looking at reality and dealing with it in a proactive way.”

Ron Paul Explains Why The “Scottish Referendum Gives Reasons To Be Hopeful”

Submitted by Ron Paul via The Ron Paul Institute for Peace and Prosperity,

Even though it ultimately failed at the ballot box, the recent campaign for Scottish independence should cheer supporters of the numerous secession movements springing up around the globe.

In the weeks leading up to the referendum, it appeared that the people of Scotland were poised to vote to secede from the United Kingdom. Defeating the referendum required British political elites to co-opt secession forces by promising greater self-rule for Scotland, as well as launching a massive campaign to convince the Scots that secession would plunge them into economic depression.

The people of Scotland were even warned that secession would damage the international market for one of Scotland’s main exports, whiskey. Considering the lengths to which opponents went to discredit secession, it is amazing that almost 45 percent of the Scottish people still voted in favor of it.

The Scottish referendum result has done little to discourage other secessionist movements spreading across Europe, in countries ranging from Norway to Italy. Just days after the Scottish referendum, the people of Catalonia voted to hold their own referendum measuring popular support for secession from Spain.

Support for secession is also growing in America. According to a recent poll, one in four Americans would support their state seceding from the federal government. Movements and organizations advocating that state governments secede from the federal government, that local governments secede from state governments, or that local governments secede from both the federal and state governments, are springing up around the country. This year, over one million Californians signed a ballot access petition in support of splitting California into six states. While the proposal did not meet the requirements necessary to appear on the ballot, the effort to split California continues to gain support.

Americans who embrace secession are acting in a grand American tradition. The Declaration of Independence was written to justify secession from Britain. Supporters of liberty should cheer the growth in support for secession, as it is the ultimate rejection of centralized government and the ideologies of Keynesianism, welfarism, and militarism.

Widespread acceptance of the principle of peaceful secession and self-determination could resolve many ongoing conflicts. For instance, allowing the people of eastern Ukraine and western Ukraine to decide for themselves whether to split into two separate nations may be the only way to resolve their differences.

The possibility that people will break away from an oppressive government is one of the most effective checks on the growth of government. It is no coincidence that the transformation of America from a limited republic to a monolithic welfare-warfare state coincided with the discrediting of secession as an appropriate response to excessive government.

Devolving government into smaller units promotes economic growth. The smaller the size of government, the less power it has to hobble free enterprise with taxes and regulations.

Just because people do not wish to live under the same government does not mean they are unwilling or unable to engage in mutually beneficial trade. By eliminating political conflicts, secession could actually make people more interested in trading with each other. Decentralizing government power would thus promote true free trade as opposed to “managed trade” controlled by bureaucrats, politicians, and special interests.

Devolution of power to smaller levels of government should also make it easier for individuals to use a currency of their choice, instead of a currency favored by central bankers and politicians.

The growth of support for secession should cheer all supporters of freedom, as devolving power to smaller units of government is one of the best ways to guarantee peace, property, liberty — and even cheap whiskey!

Three Reasons Why The Stock Market Top Is In

The pool of greater fools willing and able to buy assets at higher prices with leveraged free money has been drained by six years of credit/risk expansion.

This is a syndicated repost courtesy of oftwominds-Charles Hugh Smith. To view original, click here.

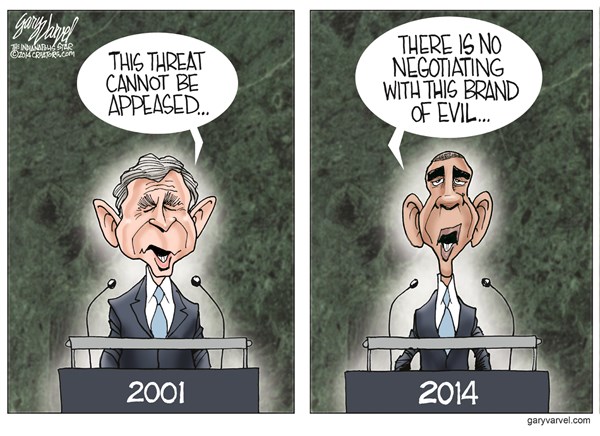

SAME SHIT, DIFFERENT MOUTHPIECE

(Deceiver) “Yes, Virginia, spaghetti grows on trees.”

Imagine a television program depicting beautiful rural scene where trees are in full blossom near an Alpine lake. Soft mandolin music is playing in the background. A British narrator with great gravitas makes an announcement;

“It is not only in Britain that spring, this year, has taken everyone by surprise. Here, in the Ticino, on the borders of Switzerland and Italy, the slopes overlooking Lake Lugano have already burst into flower at least a fortnight earlier than usual.”

So far, so good. It sounds like the beginning prose of our own poetic writer here, Hardscrabble Farmer. The narrator continues.

“Most important of all, it’s resulted in an exceptionally heavy spaghetti crop.”

The scene switches to trees heavily laden with spaghetti handing down from the branches.

Young women dressed in traditional Swiss garb are picking ripe pasta from the trees, and very gingerly laying it in their baskets. The narrator explains that the Swiss treat the spaghetti harvest as a “family affair” as compared to Italy where it is like an industrial assembly line supplied by Italy’s “vast spaghetti plantations in the Po valley.” He speaks softly but carries the big stick of measured authority, reminding folks of what they should have known all along.

Then, the narrators tone drops a pitch and says somewhat ominously; —

“The last two weeks of March are an anxious time for the spaghetti farmer. There is always the chance of a late frost which, while not entirely ruining the crop, generally impairs the flavor and makes it difficult for him to obtain top prices in the world markets.”

But, wait, there’s good news, after all; — “But now these dangers are over and the spaghetti harvest goes forward!” The viewers should be relieved, he informs them, that the “spaghetti weevil” is no longer a threat.

The narrator then gives a brief description of how the spaghetti crop is harvested and laid out to dry. He addresses the unasked question; “How is it that all spaghetti is so amazingly uniform in length?” The narrator responds in a conspiratorial voice — as if letting you in on a great secret — that it’s the result of, “many years of patient endeavor by plant breeders who succeeded in producing the perfect spaghetti.”

The commercial, which was filmed in black and white and made to appear in the style of a Movietone newsreel, ends with images of a happy family celebrating the fruits of their labor. The “ceremonial dish” of spaghetti was picker earlier in the day, dried in the sun, and “brought fresh from the garden to the table at the very peak of condition”. The folks even make a toast from their special drinking receptacles called “boccalinos”.

Here it is.

OBSERVATIONS

1) The idea for the broadcast came from Charles de Jaeger, an Austrian by birth, who fled to Britain in the 1930’s when the Nazi’s invaded Austria. When he was a schoolboy in Vienna one of his teachers taunted the class by saying, “Boys, you are so stupid, you’d believe me if I told you spaghetti grew on trees!”.

2) That this was aired on APRIL FOOLS DAY (1957) seemingly went over the heads’ of quite a few folks. This hoax is listed as #1 in 100 best April Fools’ Day hoaxes of all time on http://hoaxes.org/aprilfool/

3) There were only two TV channels in the UK in 1957 – the BBC and the independent ITV — so, this broadcast was seen by millions.

4) The broadcast ended and within minutes callers besieged the BBC switchboard … some with complaints, many with questions. It was so bad that the BBC was obligated to issue a statement before the end of the day;

“The BBC has received a mixed reaction to a spoof documentary broadcast this evening about spaghetti crops in Switzerland. The hoax Panorama program, narrated by distinguished broadcaster, Richard Dimbleby, featured a family from Ticino in Switzerland carrying out their annual spaghetti harvest. It showed women carefully plucking strands of spaghetti from a tree and laying them in the sun to dry. But some viewers failed to see the funny side of the broadcast and criticized the BBC for airing the item on what is supposed to be a serious factual program. Others, however, were so intrigued they wanted to find out where they could purchase their very own spaghetti bush.”

5) DESPITE the retraction, callers CONTINUED to flood the BBC for advice on growing their own spaghetti trees. Exasperated switchboard operators eventually had to resort to that special brand of English humor by advising callers … “place a sprig of spaghetti in a tin of tomato sauce and hope for the best”. And then some did just that!

The point of this little article is to offer some proof that a significant percentage of a population, and in any time-period, and regardless of country of origin are GULLIBLE AND WILL BELIEVE ANYTHING … no matter how moronic the proposition.

For example, there are people, even here, who believe that the Sandy Hook shootings were a hoax. The FACT that this would have required at least hundreds of fallible human beings to pull it off is brushed off as irrelevant to them. “Fallible” in the sense that it is a FACT that a secret no longer remains a secret when more than one person knows the secret. People spill-the-beans the first chance they get as it is human nature, and that, too, is a fact. And, yet, we are to believe that hundreds (or, at a minimum, dozens) of human beings have kept this secret now for years … and will continue to do so forever. I’m guessing that such people are, at this very moment, planting spaghetti sprigs in their Ragu sauce.

SOURCES:

http://intimesgoneby.wordpress.com/2014/04/01/april-fools-day-1957-the-spaghetti-tree-hoax/

http://hoaxes.org/archive/permalink/the_swiss_spaghetti_harvest

http://en.wikipedia.org/wiki/Spaghetti-tree_hoax

=============================================== =

=============================================== =

BONUS SECTION —- HOMEMADE TOMATO SAUCE (fast and easy)

Saturday we went to the farmers market. There was a basket of tomatoes for sale which were bruised, somewhat ugly, and very ripe … about 12 pounds, for a mere $3. I bought them.

Sunday we celebrated my dad’s 90th-something birthday. Spaghetti happens to be in his Top 3 favorite foods.

I’ve made spaghetti (tomato) sauce from scratch just once before in my life, about 15+ years ago. It was a TEDIOUS and LOOOONG process. Picture the typical Italian mama cooking ALL DAY in the kitchen; starting with blanching the tomatoes (to remove the skin), taking out the seeds, cooking and stirring, adding this, adding that, cooking and stirring, and oh, yeah, more stirring.

I just found out much of the flavor from a tomato comes from the skin, the seeds and the gelatinous material around the seeds. So, removing those items seems crazy at this point. Removing seeds is done to remove the “bitterness” that sometimes results in cooking tomatoes. However, there is a much better remedy for taking care of that.

Anyway, I SWORE to myself I would never do that again, and haven’t, until Saturday. I found a recipe online a few months ago which claimed to simply the process tremendously while producing superior results. He was correct. Everyone in my family absolutely loved it …… a LOT, and we are a critical bunch when it comes to food. It took about two hours, and most of that time was in the roasting and subsequent heating.

Why bother making your own tomato sauce? Because if the label shows “Imported by”, or “Prepared for” but no country of manufacture then it is highly probable that the tomato sauce was manufactured in China.

The original recipe link is at the end. I modified it and it’s listed below.

RECIPE

1)- Buy enough tomatoes, which when cut in half, will completely cover a baking sheet. Preheat oven to 375 degrees. (It should go without saying that the quality of your sauce can’t exceed the quality of your tomatoes. So, if you buy that bland cardboard tasting crap from a supermarket, then don’t expect good sauce regardless of how much you doctor it up. If the tomato tastes yucky when eaten raw, it will taste just as yucky when cooked. Garbage in, garbage out.)

2)- Light grease a baking sheet with a good oil. I used grape seed oil.

3)- Cut tomatoes in half, remove stem, remove the stiff core, place face down on cookie sheet.

4)- Make a slit in each tomato. Stuff some minced garlic in it according to your taste. I used ½ teaspoon.

5)- Get a big yellow onion, peel it, cut it to make rings. Place a ring on each tomato.

6)- Drizzle good oil over the tomatoes.

7)- Spread seasonings over tomatoes according to your liking. I used Himalayan rock salt (gotta have salt!), and copious amounts of oregano, basil, and thyme. At this point I also added a cup of freshly grated Parmesan. (Don’t add to much spice, because roasting intensifies the taste. It’s much easier to add more spice in the final step.)

So, that shouldn’t have taken you more than 15 minutes.

8)- Roast for about 45 minutes. There’s your big secret, roasting. Roasted tomatoes creates an incredible richness in taste not found in even fresh tomatoes. That’s why roasted peanuts taster richer and better than plain peanuts. So, roast for about 50 minutes or until the tomatoes are soft and the skin begins to break or brown.

9) Remove from oven. Put the tomatoes ONLY in a food processor … not the liquid. However, reserve the liquid because you might need in later. Pulse until you get the consistency you like.

10) Taste the sauce. The end.

————————————-

Or, is it? You have a decision to make. Unless you’re really brilliant and lucky, you will probably have to adjust the spices. A little more of this, add some that … whatever …. hey, you’re not building a rocket engine, you’re just making sauce. There is no “right” or “wrong” way. It’s all up to your taste buds, and your creativity.

In my case the sauce was too thin. As I mentioned, the tomatoes were very ripe and juicy. To thicken it up I “fried” some tomato paste. Just heat it for a minute or two on a skillet, no oil, as this will bring out the full flavor of the paste. Then I added just some of the reserved liquid from the roasting. Add the tomato paste concoction to the tomato sauce. I cooked it down for another 40 minutes, until it was the thick consistency I like.

I like my sauce smooth and creamy … but also with chunks of tomato. A paradox for sure, and impossible to buy from a store. At this point the sauce is creamy smooth from being in the food processor. So, I took a couple of fresh tomatoes and finely diced them and threw them in the pot. Perfect.

ADD MORE STUFF you like! In my case, the sauce did have a slight bitter taste. Two things cure that; butter or wine. I added ¾ stick of butter, let that melt, and 15 minutes later the bitter taste was gone, not to mention the sauce had a creamy texture. You like mushrooms in your sauce? Now is the time to add it. Some people like a sweeter tasting sauce. So, go ahead and add some honey …no one will shoot you. What you end up with is a sauce that is amazingly delicious and EXACTLY to your liking …. and you won’t poison your family with Chinese garbage.

SOURCES

Here is the original recipe with pictures;

http://geroldblog.com/2013/07/13/roasted-tomato-sauce/

Here are comments on a blog where folks share their secrets to great tomato sauce. Some very interesting info is presented there. http://chowhound.chow.com/topics/847753

HOW BANKERS DESTROY LIVES

Keynesianism at its finest. Abenomics was pushed into high gear in 2013. Abe and his banker cronies were going to create inflation at all costs. They have succeeded. Everything is soaring in price in Japan. One small problem. Real wages are collapsing and the lives of average Japanese are being destroyed.

The Japanese are a tiny people. Maybe they’ll like sleeping in drawers.

Don’t forget to thank a banker today for their man made inflation. Thank God our central bankers wouldn’t do such a thing.

A CENTURY OF TOTAL WAR

Ron Paul’s statement proven by words of co-sponsor of the Federal Reserve Act of 1913:

“It is no coincidence that the century of total war coincided with the century of central banking.” ― Ron Paul, End the Fed

25 Rules of Disinformation

Via Cryptome

These rules are generally used more directly by those at the leadership, key players, or planning level of the criminal conspiracy or conspiracy to cover up.

1. Hear no evil, see no evil, speak no evil. Regardless of what you know, don’t discuss it — especially if you are a public figure, news anchor, etc. If it’s not reported, it didn’t happen, and you never have to deal with the issues.

2. Become incredulous and indignant. Avoid discussing key issues and instead focus on side issues which can be used show the topic as being critical of some otherwise sacrosanct group or theme. This is also known as the ‘How dare you!’ gambit.

3. Create rumor mongers. Avoid discussing issues by describing all charges, regardless of venue or evidence, as mere rumors and wild accusations. Other derogatory terms mutually exclusive of truth may work as well. This method which works especially well with a silent press, because the only way the public can learn of the facts are through such ‘arguable rumors’. If you can associate the material with the Internet, use this fact to certify it a ‘wild rumor’ from a ‘bunch of kids on the Internet’ which can have no basis in fact.

4. Use a straw man. Find or create a seeming element of your opponent’s argument which you can easily knock down to make yourself look good and the opponent to look bad. Either make up an issue you may safely imply exists based on your interpretation of the opponent/opponent arguments/situation, or select the weakest aspect of the weakest charges. Amplify their significance and destroy them in a way which appears to debunk all the charges, real and fabricated alike, while actually avoiding discussion of the real issues.

5. Sidetrack opponents with name calling and ridicule. This is also known as the primary ‘attack the messenger’ ploy, though other methods qualify as variants of that approach. Associate opponents with unpopular titles such as ‘kooks’, ‘right-wing’, ‘liberal’, ‘left-wing’, ‘terrorists’, ‘conspiracy buffs’, ‘radicals’, ‘militia’, ‘racists’, ‘religious fanatics’, ‘sexual deviates’, and so forth. This makes others shrink from support out of fear of gaining the same label, and you avoid dealing with issues.

6. Hit and Run. In any public forum, make a brief attack of your opponent or the opponent position and then scamper off before an answer can be fielded, or simply ignore any answer. This works extremely well in Internet and letters-to-the-editor environments where a steady stream of new identities can be called upon without having to explain criticism, reasoning — simply make an accusation or other attack, never discussing issues, and never answering any subsequent response, for that would dignify the opponent’s viewpoint.

7. Question motives. Twist or amplify any fact which could be taken to imply that the opponent operates out of a hidden personal agenda or other bias. This avoids discussing issues and forces the accuser on the defensive.

8. Invoke authority. Claim for yourself or associate yourself with authority and present your argument with enough ‘jargon’ and ‘minutia’ to illustrate you are ‘one who knows’, and simply say it isn’t so without discussing issues or demonstrating concretely why or citing sources.

9. Play Dumb. No matter what evidence or logical argument is offered, avoid discussing issues except with denials they have any credibility, make any sense, provide any proof, contain or make a point, have logic, or support a conclusion. Mix well for maximum effect.

10. Associate opponent charges with old news. A derivative of the straw man — usually, in any large-scale matter of high visibility, someone will make charges early on which can be or were already easily dealt with – a kind of investment for the future should the matter not be so easily contained.) Where it can be foreseen, have your own side raise a straw man issue and have it dealt with early on as part of the initial contingency plans. Subsequent charges, regardless of validity or new ground uncovered, can usually then be associated with the original charge and dismissed as simply being a rehash without need to address current issues — so much the better where the opponent is or was involved with the original source.

11. Establish and rely upon fall-back positions. Using a minor matter or element of the facts, take the ‘high road’ and ‘confess’ with candor that some innocent mistake, in hindsight, was made — but that opponents have seized on the opportunity to blow it all out of proportion and imply greater criminalities which, ‘just isn’t so.’ Others can reinforce this on your behalf, later, and even publicly ‘call for an end to the nonsense’ because you have already ‘done the right thing.’ Done properly, this can garner sympathy and respect for ‘coming clean’ and ‘owning up’ to your mistakes without addressing more serious issues.

12. Enigmas have no solution. Drawing upon the overall umbrella of events surrounding the crime and the multitude of players and events, paint the entire affair as too complex to solve. This causes those otherwise following the matter to begin to lose interest more quickly without having to address the actual issues.

13. Alice in Wonderland Logic. Avoid discussion of the issues by reasoning backwards or with an apparent deductive logic which forbears any actual material fact.

14. Demand complete solutions. Avoid the issues by requiring opponents to solve the crime at hand completely, a ploy which works best with issues qualifying for rule 10.

15. Fit the facts to alternate conclusions. This requires creative thinking unless the crime was planned with contingency conclusions in place.

16. Vanish evidence and witnesses. If it does not exist, it is not fact, and you won’t have to address the issue.

17. Change the subject. Usually in connection with one of the other ploys listed here, find a way to side-track the discussion with abrasive or controversial comments in hopes of turning attention to a new, more manageable topic. This works especially well with companions who can ‘argue’ with you over the new topic and polarize the discussion arena in order to avoid discussing more key issues.

18. Emotionalize, Antagonize, and Goad Opponents. If you can’t do anything else, chide and taunt your opponents and draw them into emotional responses which will tend to make them look foolish and overly motivated, and generally render their material somewhat less coherent. Not only will you avoid discussing the issues in the first instance, but even if their emotional response addresses the issue, you can further avoid the issues by then focusing on how ‘sensitive they are to criticism.’

19. Ignore proof presented, demand impossible proofs. This is perhaps a variant of the ‘play dumb’ rule. Regardless of what material may be presented by an opponent in public forums, claim the material irrelevant and demand proof that is impossible for the opponent to come by (it may exist, but not be at his disposal, or it may be something which is known to be safely destroyed or withheld, such as a murder weapon.) In order to completely avoid discussing issues, it may be required that you to categorically deny and be critical of media or books as valid sources, deny that witnesses are acceptable, or even deny that statements made by government or other authorities have any meaning or relevance.

20. False evidence. Whenever possible, introduce new facts or clues designed and manufactured to conflict with opponent presentations — as useful tools to neutralize sensitive issues or impede resolution. This works best when the crime was designed with contingencies for the purpose, and the facts cannot be easily separated from the fabrications.

21. Call a Grand Jury, Special Prosecutor, or other empowered investigative body. Subvert the (process) to your benefit and effectively neutralize all sensitive issues without open discussion. Once convened, the evidence and testimony are required to be secret when properly handled. For instance, if you own the prosecuting attorney, it can insure a Grand Jury hears no useful evidence and that the evidence is sealed and unavailable to subsequent investigators. Once a favorable verdict is achieved, the matter can be considered officially closed. Usually, this technique is applied to find the guilty innocent, but it can also be used to obtain charges when seeking to frame a victim.

22. Manufacture a new truth. Create your own expert(s), group(s), author(s), leader(s) or influence existing ones willing to forge new ground via scientific, investigative, or social research or testimony which concludes favorably. In this way, if you must actually address issues, you can do so authoritatively.

23. Create bigger distractions. If the above does not seem to be working to distract from sensitive issues, or to prevent unwanted media coverage of unstoppable events such as trials, create bigger news stories (or treat them as such) to distract the multitudes.

24. Silence critics. If the above methods do not prevail, consider removing opponents from circulation by some definitive solution so that the need to address issues is removed entirely. This can be by their death, arrest and detention, blackmail or destruction of their character by release of blackmail information, or merely by destroying them financially, emotionally, or severely damaging their health.

25. Vanish. If you are a key holder of secrets or otherwise overly illuminated and you think the heat is getting too hot, to avoid the issues, vacate the kitchen.

QUOTES OF THE DAY

Jeffrey Kluger