“Things always become obvious after the fact” – Nassim Nicholas Taleb

“Facts do not cease to exist because they are ignored.” – Aldous Huxley

The S&P 500 currently stands at 2,126, fractionally below its all-time high. It is now 300% above the 2009 low and 34% above the 2008 and 2001 previous highs. Most people believe this is the new normal. They are comfortably numb in their ignorance of facts, reality, the truth, and the inevitability of a bleak future. When the herd is convinced progress and never ending gains are the norm, the apparent stability and normality always degenerates into instability and extreme anxiety. As many honest analysts have proven, with unequivocal facts and proven valuation measurements, the stock market is as overvalued as it was in 1929, 2000, and 2007.

Facts haven’t mattered, as belief in the infallibility and omniscience of Federal Reserve bankers, has convinced “professionals” to program their high frequency trading supercomputers to buy the all-time high. If central bankers were really omniscient and low interest rates guaranteed endless stock market gains, then why did the stock market crash in 2000 and 2008? The Federal Reserve’s monetary policies created the bubbles in 2000, 2007 and today. There was no particular event which caused the crashes in 2000 and 2008. Extreme overvaluation, created by warped Federal Reserve monetary policies and corrupt Washington D.C. fiscal policies, is what made the previous bubbles burst and will lead the current bubble to rupture.

Benjamin Graham and John Maynard Keynes understood how irrational markets could be over the short term, but eventually they would reach fair value:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Graham

“The market can stay irrational longer than you can stay solvent.” – Keynes

Graham’s quote reflects the difference between hope and reality. This explains the ridiculous overvaluation of Amazon, Shake Shack, Twitter, Linkedin, Tesla, Google, and the other high flying new paradigm stocks. Story stocks soar because the herd believes the stories peddled by Wall Street and company executives. Five of these six stocks don’t have a PE ratio because you need earnings to calculate a PE ratio. In the long run the market will weigh the value these companies based upon profits and cashflow. It is the same story for the market as a whole. There is no question who is to blame for what now amounts to a three headed hydra of bubbles poised to burst.

The Federal Reserve has simultaneously blown bubbles in the stock, bond, and real estate markets by keeping interest rates at 0% for the last six years, three rounds of QE money printing that created $3.6 trillion out of thin air to prop up the insolvent Wall Street banks, and unending jawboning about inflation being too low as real middle class wages stagnate at 1989 levels. There isn’t a question about whether the bubbles exist, only about how much bigger they will become before bursting again. As John Hussman points out, the financial stability of the world will be endangered when the bubbles burst this time.

“Unfortunately, the Federal Reserve has now created the third financial bubble in 15 years. Focusing on two variables – inflation and unemployment – the Fed has missed the most important consideration: the risk to financial stability. It is the same mistake the Fed made during the housing bubble. This mistake will ultimately end just as tragically. The only question is how much worse the Fed makes the situation in the interim.”

The mouthpieces for the vested interests on Wall Street and slithering around the halls of Congress, roll out their tired storylines about low interest rates supporting ridiculous valuations and corporate profits remaining permanently high because we’ve entered a new paradigm. We’ve heard it all before. Taking extreme risks based upon false economic beliefs, the infallibility of Ivy League educated academic bankers, and delusions of never ending gains produced by Wall Street HFT computers will end in tears for the third time in fifteen years.

The Federal Reserve began lowering interest rates in late 2007 from 5.25% to 2% by September 2008, and then .25% by January 2009. Did that prevent a 50% collapse in stock prices? Did it prevent national housing prices from plummeting by 35% between 2006 and 2010? The main reason stocks bottomed in March 2009 was the FASB bowing down to their masters and revoking mark to market accounting, allowing the insolvent Wall Street banks to pretend they were solvent. The combination of fraudulent accounting, zero interest rates and round after round of QE money printing has propelled this mal-investment mania to epic proportions. Total stock market valuation of $36 trillion now exceeds 200% of GDP. Prior to the Fed bubble blowing era, the total stock market valuation averaged about 50% of GDP.

Mark Hulbert, whose job at Marketwatch appears to be writing alternating bullish and bearish articles to keep the public confused, disoriented, and dependent upon hope and central banker heroine injections, produced the chart below showing corporate profits as a percentage of GDP. Corporate profits always revert to their mean. The capture of our economic system by Wall Street and mega-corporations is glaringly obvious in the increasingly higher peaks in corporate profits since the late 1990’s, as the Federal Reserve has provided the Greenspan/Bernanke/Yellen Put for the reckless Wall Street gambling casino and dangerously low interest rates encouraging corporations to issue record levels of debt in order to buy back their stock, fire workers, and ship jobs to low wage slave factories in the Far East.

Corporate profits as a percentage of GDP have averaged 6.3% over the last six decades. They deviate wildly above and below this mean, with peaks attained near stock market highs and valleys at stock market lows. The current level of 8.7% is two standard deviations above the 6.3% long-term average, meaning it is above 95% of all instances in history. Based on history, what are the odds of corporate profits rising to three standard deviations above the mean (99.7% above all instances)? Not good. They have already fallen from the 10.1% high in 2012.

Corporate profits have been juiced by Wall Street using mark to fantasy accounting, loan loss reserve manipulation, risk free Wall Street casino gambling with free money provided by the Federal Reserve, corporations refinancing debt, suppression of wages through global arbitrage by mega-corporations, government entitlement deficit spending, never ending wars in foreign lands enriching arms dealers, and expansion of the surveillance police state throughout every city, town, and hamlet in the good ole USA.

Over the last six decades, when corporate profits edged above 6.3% of GDP, competition from new companies taking advantage of the high profits would result in price drops and eventually lower profits. It was called capitalism. The Great Deformation created by the Federal Reserve Politburo dictates and monetary machinations have disconnected corporate profits and stock market gains from the real world of everyday Americans. The propping up of insolvent banks and allowing poorly run corporations (Sears, Rite Aid, GM) to survive by refinancing debts at insanely non-risk adjusted interest rates, has delayed the creative destruction that is part an parcel of a capitalist system.

Crony capitalism rewards connected corporations and damages the small businesses which are the true jobs creators. Large corporations don’t create jobs, they ship them overseas. More small businesses are closing than opening for the first time in modern U.S. history. Thank the Fed, the feckless politicians in Washington DC who are about to put a final nail in the small business/American jobs coffin with passage of TPP, mega-corporation CEOs, and the billionaire oligarchs pulling the strings behind the curtain, for destroying a once healthy, job creating economic system.

The game is up. The accounting games are over. There are no loan loss reserves left to relieve. Americans with no wage growth are running out of money they don’t have. Corporate revenues are flat or falling. The Fed liquidity machine has been shutdown. Interest rates are likely to rise sometime this year. A global recession is in progress. It’s only a matter of time before Greece officially defaults. Inflation in healthcare costs, food, rent, and other daily living expenses have sapped the vitality from a deteriorating US economy.

Young people are enslaved in student loan debt, priced out of the housing market, and left with burger flipping jobs as Boomers cling to their jobs like grim death. An economy built upon consumer spending and an ever increasing level of debt has run out of consumers capable of spending and has reached the saturation point of debt expansion. The corporate titans of industry, in a last gasp to keep the party going, are buying back their own stocks at all-time highs to the tune of over $300 billion in order to boost their EPS and goose their own bonuses. The best part is they are borrowing to do so, boosting corporate debt to all-time highs. They would not and could not do this if the Federal Reserve wasn’t incentivizing them to do so with phenomenally low interest rates. These financial shenanigans can’t hide the fact that corporate profits are now falling and will continue to fall.

Mark Hulbert does the usual mainstream media faux analysis and concludes it will take five years for corporate profits to fall to their long term average, resulting in a 20% decline in the S&P 500 by 2020. His assumptions are laughable in their cluelessness about how the world really operates. If he analyzed his own chart he would see corporate profits plunge in a one to two year time frame and never stop at the long-term average. Averages are created by data points above and below the mean. As a corporate media pawn dependent on a paycheck from an employer that depends upon Wall Street advertising revenue, Hulbert couldn’t possibly tell the truth.

Not only are corporate profits as a percentage of GDP near record highs, P/E ratios are also at record highs (excluding the internet bubble when there was no E). The Shiller P/E (S&P 500 divided by the 10-year average of inflation-adjusted earnings) is now 27, versus a long-term historical norm of 15 prior to the late-1990’s bubble. Importantly, the profit margin embedded into the Shiller P/E is currently 6.7% versus a historical norm of just 5.4%. Hulbert’s assumption that P/E ratios would remain constant as earnings fell, is asinine in its concept. That has never happened in history.

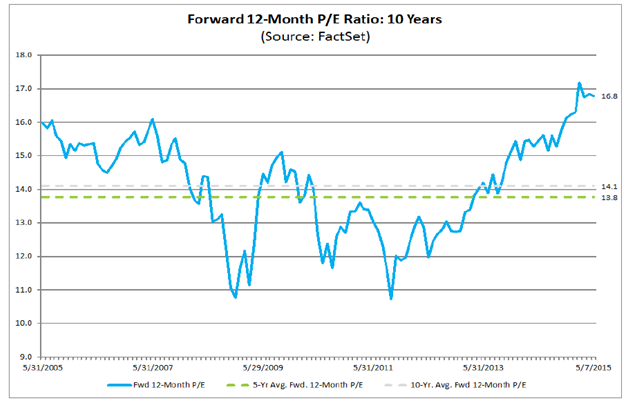

The forward 12 month P/E Ratio, which is always lower because stock analyst “experts” always overestimate earnings, is well above the previous bubble high in 2007. This P/E Ratio will also revert to its mean over the long-term. In the short-term, P/E ratios will also plunge well below the ten year average of 14.1, just as it did in 2008 and 2011 before the Fed re-inflated them with liberal doses on QE. With the QE spigot turned off, interest rates not going lower, and earnings already falling, all that is left is for prices to adjust to reality. Everything done by our leaders in government, banking and the corporate world since 2008 has been wrong. They’ve done the exact opposite of what needed to be done to purge the system of corruption, mismanagement, reckless use of debt, and the men responsible for destroying our financial and economic system. The public has come to believe these people have saved us, when they have really condemned us to a future of chaos, turmoil, pain, default, debasement, and war. Time will prove those who used reason to be right.

“A long habit of not thinking a thing wrong, gives it a superficial appearance of being right, and raises at first a formidable outcry in defense of custom. But the tumult soon subsides. Time makes more converts than reason.” ― Thomas Paine, Common Sense

When the tumult subsides and the herd is forcefully converted to reason through an onslaught of reality and the revelation that the Federal Reserve bankers behind the curtain are nothing but academic puppet hacks for the vested interests, the S&P 500 will be back in the triple digit realm. That may seem like crazy talk, but it is simply basic math and reversion to the mean. When corporate profits as a percentage of GDP fall from the extreme 8.7% level of today to a slightly under average level of 5%, and P/E ratios fall from the extreme level of 16.8 today to previous recent lows of 11 reached in 2009 and 2011, basic math shows the S&P 500 will be trading in the 900 range. That would be a 58% decline. For some perspective, it would still be 35% HIGHER than the March 2009 low. So this certainly isn’t the worst case scenario.

Anyone using logic, reason, historical precedent, facts, and utilizing basic mathematics is declared a doomer in today’s world. The sheep would rather follow assertive idiots than an introspective wise person. We are awash in assertive idiots in control of Congress, government agencies, Wall Street, mainstream media, and the corporate world. The psychopathic lemmings will meet their demise in due time. It will be obvious after the fact.

“It has been more profitable for us to bind together in the wrong direction than to be alone in the right one. Those who have followed the assertive idiot rather than the introspective wise person have passed us some of their genes. This is apparent from a social pathology: psychopaths rally followers.” – Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable

Not more fucking charts!

Proportional, inversely proportional, logarithmic, distribution, variance, against the mean, histograms, pie charts, divergence, convergence, Year-over-Year, cumulative, % change, frequency, ratios, venn-diagrams, scatter charts.

Then there are P/E ratios, margin accounts, short sales, derivatives, new housing starts, bonds, T-Bills, Greek Bonds, Euros, RMB’s, specie (gold / silver), retail sales, Baltic Dry Index.

WTF – how many ways can you dice it / slice it? Do we really need another fucking chart to convince us that things have gone to shit – and we’re just going on momentum, thin air?

Shake Shack is an apropo metaphor for this market. A poor mans 5 guys. In fact when I went there, the fries were just Cisco. A total media promoted scam. I really cannot think of any reason to invest in this company. And more to the point, what about Facebook, Uber, etc.? I mean really, can an economy that is supposed to be the worlds biggest, be based on the likes of a company which has at most a few thousand employees in cubicle farms? Clearly this is not unlike 2000 with pets.com and the other fake companies that advertised on the Super Bowl shortly before the crash. Outside of 50/50 stock bond mutual funds in 401K which are held for the extremely long term I wouldn’t touch anything in this market at this point.

Yes, reversion to the mean seems an unlikely stopping point. The energy it took to get asset price inflation to drive prices this high (into ORBIT) will in all likelihood be mirrored to the downside.

Imagine if prices for assets overshoot the mean to the DOWNSIDE to the same extent? This is what I fully expect, but I’ve expected it for 20 straight years so what do I know?

What most market watchers don’t confront is the feedback loop problem.

The reason AAPL is $130 a share today instead of $1 a share twelve years ago (split-adjusted) is because of a feedback loop of perceived wealth. If people’s PERCEPTION of their wealth was much lower, could iPhones be given to 9-year-olds? Would fund managers bit $130/share for Apple?

This was one of the largest feedback loops in Asset Price History. It rests on a volatile gas called “TRUST.” An army of Wimpy’s has promised an army of Popeye’s two burgers next week so the Wimpy’s can eat a burger today. Prices got bid upward in a spiral, a mania, because of blind, Pollyanna-ish trust in all those future burgers (IOU’s), but the Wimpy’s will never make good on that ocean. In fact, Ph.D. economists arose to tell us those IOU’s need NEVER be made good, just roll over the debts in perpetuity.

When trust finally rolls over, the rush for the exits will be EPIC.

Only a tiny fraction of people will get their wealth out of the Happy Land (Dance Club) Stock Exchange before it burns to the ground. The Fed has spread all sorts of gasoline around the exchange and most of the exits are actually blocked from the outside.

Stocks and bonds will turn down in earnest when, instead of dreaming of riches, people begin having nightmares about blocked exits. The stampede will begin and there will be no stopping it.

There were only two charts. Difficult to write a FINANCIAL article without including charts, imho.

We’re thinking about investing in Lotto tickets rather than stocks. Both are a fucking pure gamble. But, I like scratching off things.

When stocks fall hard, it will likely coincide with rising interest rates.

This will be the double-whammy; a few people will panic into bank balances (selling their stocks and bonds), but what happens when banks keep following through to push effectively negative interest rates?

Attempts will be made to prevent bank runs, but I still think they are inevitable. If the authorities attempt to block cash withdrawals, people will simply buy any asset class that promises anything remotely like cash’s portability. It is possible the metals will have an early day in the sun.

But no one knows for sure.

“The game is up. The accounting games are over.” ———— article

But, not yet. Right? Cuz we’ve been hearing that for quite some time now.

Of course, no one knows when the shit will actually hit the fan.

Admin (and anyone else), lemme aks yew just one question; in your opinion, what is the LONGEST this shit can continue? Another 5 year? 10 years?

For Dutchman:

[img]http://bigcharts.marketwatch.com/kaavio.Webhost/charts/big.chart?nosettings=1&symb=AAPL&uf=0&type=2&size=2&sid=609&style=320&freq=2&entitlementtoken=0c33378313484ba9b46b8e24ded87dd6&time=20&rand=1871893322&compidx=aaaaa%3a0&ma=5&maval=13&lf=4&lf2=1&lf3=0&height=444&width=579&mocktick=1[/img]

[img]http://bigcharts.marketwatch.com/kaavio.Webhost/charts/big.chart?nosettings=1&symb=spx&uf=0&type=2&size=2&sid=3377&style=320&freq=3&entitlementtoken=0c33378313484ba9b46b8e24ded87dd6&time=20&rand=1475342230&compidx=aaaaa%3a0&ma=5&maval=13&lf=4&lf2=0&lf3=0&height=335&width=579&mocktick=1[/img]

Notice the little blip at the far left (below), which was the “crash” of 1987. Note that, for all the hoopla of the last 6 years, the meat of the bull market (DJIA) was 1987-2000. That’s a long time ago, and look at the MACD today. Not a great time to be plowing money long, in all likelihood.

[img]http://bigcharts.marketwatch.com/kaavio.Webhost/charts/big.chart?nosettings=1&symb=djia&uf=0&type=128&size=2&sid=1643&style=320&freq=3&entitlementtoken=0c33378313484ba9b46b8e24ded87dd6&time=20&rand=1721201490&compidx=aaaaa%3a0&ma=5&maval=13&lf=4&lf2=0&lf3=0&height=335&width=579&mocktick=1[/img]

Dow Transports, anyone? Can we imagine if stocks took back all the gains dating from the early ’80’s? Do you think this is impossible, when this has been a time of unprecedented credit inflation that flowed, not into food and clothing, but into stocks and the total bond market?

[img]http://bigcharts.marketwatch.com/kaavio.Webhost/charts/big.chart?nosettings=1&symb=djt&uf=0&type=128&size=2&sid=1644&style=320&freq=3&entitlementtoken=0c33378313484ba9b46b8e24ded87dd6&time=20&rand=2028316717&compidx=aaaaa%3a0&ma=5&maval=13&lf=4&lf2=0&lf3=0&height=335&width=579&mocktick=1[/img]

1 year maximum. 6 months is most likely.

ONE year MAX??? Wow.

Ho Lee Fuk, Jimbo. Holy fuck!!!!

Stuck

When I refer to accounting games, I’m referring to 2008/2009 when the Wall Street banks recorded billions in losses, knowing the Federal Reserve would provide anything they needed to keep them alive. They built up reserves on their books for losses taken by the taxpayers. They then spent the next four years pumping up their profits by reversing these reserves. The reserves are depleted, so they can’t use these accounting tricks to boost profits.

They’ve tried every trick in the book, and the economy is still in recession. Interest rates are still at .25%, so the Fed has no bullets to fire when the next crisis hits. Hope is not a strategy.

History shows that banknote inflation sticks…but credit inflation reverses.

30 years of declining interest rates generated a Narrative that debt doesn’t matter *even as people counted debt (IOU’s) as their own wealth.*

Thus we have had a long period of insane levels of debt issuance, flooding IOU’s into producing a vast ocean of wealth resting on zero interest rates….which reflect phenomenal, historic, unprecedented complacency and trust. This is, in the broadest sense, the money (wealth) supply, and when interest rates rise, it evaporates at astonishing speed.

For 30-40 years credit inflation did two things: It pumped stock prices into orbit, but above all it allowed the filling of an ocean of IOU’s. Stocks went “high,” bonds went “wide” (and deep, if you count declining interest rates.)

A reversal of this generational mania will see stocks fall out of orbit and burn on re-entry.

The same reversal will see bonds evaporate, AND get “shallower,’ until half the economy is beached. Hospitals, makers of fighter planes and the vast bureaucracy of pandering to the Have-Nots will be like dead whales rotting in the sun as the means to pay for it all disappears.

Since LBJ doubled-down on FDR, and Nixon cut the dollar loose from any mooring, the Fed Gov grew to become THE dominant economic player. Uncle Sam is about to experience a catastrophic cut to his ability to tax & borrow and spend like an 18-year-old sailor on shore leave visiting a whorehouse with a no-limit credit card.

Are you dependent on his spending?

Never doubt the Wizard Of Oz’s ability to fool everyone in front of the curtain. There is still a lot of wealth to be siphoned from the middle class. My guess is that the collapse will be in stages the first two will be jolts…the last one a tidal wave .The first jolt in October 2015,the next jolt Nov 2016 after the election…..the last Sept. 2017…but I’m just guessing ….like most economists .

Jim…Janet Y says she’s going to raise interest rates soon…..Is never considered soon now ?

Buckhed

The reason she has to raise rates is to give herself some ammunition for the next market collapse. When rates are already at .25%, she has no bullets in the gun. She wants to get rates up to .75% or 1.00% by the end of the year. I don’t think the markets will cooperate. The crash will come before she can refill her chamber.

Thanks DC for those additional charts.

Is there a chart that extrapolates to the date where we ‘bend over, hold our ankles, and kiss our ass good-bye?

Jim…I don’t see it happening . Some form of QE 4 will happen soon…unless they can figure out a way to really massage the 2nd quarter GDP numbers…which I can’t see happening either .

Dutch…a dart board will be as accurate as any chart .

Have to agree on the 6- months to a year. For the past three years, I have been thinking that the stock market could collapse at any moment, dragging the rest of the system with it…but I have always believe that fall of 2015 was the most likely time.

The question I have is more on the mechanics of a breakdown. How does one know if a dip will become a crash? How long between a stock market meltdown and a banking system failure (I assume that is inevitable)? If the banks do fail, how long before shops start to close, gas gets hard to find and expensive and finally the grocery stores are empty?

To me, these are the real practical questions we all need to consider. I have a few partial answer that are purely speculative. I would like to hear what everybody else thinks…

Market down 225.

I’m a goddamn guru.

I’m going to start charging you shit throwing monkeys $200 per month for my words of wisdom.

“The reason she has to raise rates is to give herself some ammunition for the next market collapse. When rates are already at .25%, she has no bullets in the gun. She wants to get rates up to .75% or 1.00% by the end of the year. I don’t think the markets will cooperate. The crash will come before she can refill her chamber.” – Admin

Exactly…QE4 cannot work without being able to lower interest rates. I suspect the curent “war on cash” is also a big part of this…if cash were eliminated entirely, and the sheep went along quietly, the not only could they eliminate bank runs, but they could also go negative on interest rates…

I think this is the plan, but I also think it will be a spectacular failure. Even ‘murikans are won’t fall for the “lend me money and i will pay you back less later” routine, are they???

sorr “will they”?

My typing skills leave much to be desired.

Jim, I thought we were already paying that much! (sarc) John

If charts (or my blind interpretation of them) could forecast the ebb and flow, I’d not be on my 14th year of writing off capital loss carry-overs, I’d be typing this from my summer home in the Caribbean, facing west from a beach or hilltop.

No one knows “when.” Or if they do, they ain’t talking.

Until prices get below the 13 and 26 period exponential moving averages, the 13 crosses below the 26 and both are (obviously at that point) turned down (all on a weekly basis), the trend is up.

The trend is still up.

The problem is, as I’ve stated before, thinking of the market anthropomorphically seems perfectly sensible to me. “Mr. Market” is the biggest asshole you could ever meet. He is the guy you hated the most, the most devious, backstabbing manager you ever endured, times 1000!

Mr. Market sets people up and then he takes them down. Mr. Market ruins kings as easily as he ruins courtiers, cads or cabbies. Mr. Market has engaged in the greatest set up, for the greatest crushing economic cataclysm, in several centuries.

How did Mr. Market do this?

1. He is patient; the last smash of this kind was the South Sea Bubble in 1720. People need to be lulled into thinking that sort of thing is “ancient history” and thus irrelevant.

2. He knows people are lazy and filled with envy and avarice. Like any casino or lottery official, he highlights the Big Winners and promotes how EASY it was for them to get the loot.

3. He knows people have recency bias, so he knows that the higher he lets prices rise, the more chumps he pulls into the trap.

4. He knows that “gold fever” blinds people to risk. He gives people plenty of early gains to soothe any latent fears about risk, and the higher their balances go, the more fervently they believe in him.

5. He knows that when people buy into one illusion, they become susceptible to believing a whole spectrum of them. Once debt was deemed money (when the US dollar was divorced from anything physical like silver-1964– and gold -1971– it became an IOU-nothing) then there was no way for people to relate to money at all. It became a floating abstraction, which is perfect for Mr. Market’s diabolical plan.

6. Mr. Market knew that bottoms of importance arise from capitulation, so he had to show people (twice!) in recent memory that it was unnecessary to ever capitulate; the kind people “in charge” would bring in the defibrillator and shock the market back into Bull Mode, and all their wealth would return and fly even higher. Only chumps sell out.

So here we are, stock prices in orbit, an ocean of bonds outstanding, people awash in their minds in vast stores of wealth and a level of never-capitulate complacency that is visible from Mars.

Each of these points are necessary, and in combination, sufficient precursors for a collapse in wealth that comes around quite rarely. If the Nasdaq’s 80% fall in 2000-2002 isn’t going to set records, imagine what kind of percentage losses (in DOLLAR TERMS, folks) will.

The stock and bond markets, and even the banks, are all the largest Roach Motel in history. As long as only a tiny few of the roaches who go in wish to leave, all appears safe. But if that outflow rises even a little tiny bit, exit will become impossible.

Admin: “Hope is not a strategy.”

Hope in one hand, shit in the other. Which one fills up first? End of line…..

Maybe we’re barking up the wrong tree. We focus on the inevitable economic collapse. When the real life changing catastrophe may come from somewhere entirely different.

The reality of the situation is that most every nation on the planet is up to their eye balls in debt. They seem to have a infinite number of ways to play the game of “extend and pretend”. Japan has done this for over 20 years.

Dutchman

This isn’t a catastrophe. It has already happened twice in the last fifteen years. It’s just math and reality colliding. It won’t be the end of the world when stocks, bonds and real estate fall in price dramatically. It will be unpleasant for the noobs who don’t think it can happen.

Never fear our female savior is on the horizon, right after the black savior moves out. Think of all the wonderful things he brought to us and multiply it by ten. We will go to heights never envisioned by the writers of the constitution. Go buy a shovel my friends and start digging as time is short for all of us.

Stay the fuck away from ANYTHING controlled by bankers and joos……….you’ll be glad you did.

And in other news…………………………China is creating a new billionaire EVERY WEEK. Keep buying that Chinese crap at Nigmart , your dollars go straight to the communist Chinese billionaire class. Boy, when did communism include a billionaire class?

‘New normal?’ So next we can presumably expect – in order – ‘Denial,’ ‘Return to Normal,’ ‘Fear,’ ‘Capitulation,’ and ‘Despair?’

‘Return to Mean’ looks iffy this time.

Why “Average Joe” Will Never Do Well In The Stock Market

Submitted by Tyler Durden on 05/26/2015 15:50 -0400

Because “normal people” just do not think like this…

And bad news is good news…

h/t @RudyHavenstein

Dutchman, yes, everywhere and everyone is eyebrows deep in debt.

The funny part is, if you distill most of the Uber-wealthy’s paper assets (wealth), what you have left is debt…. IOU’s.

We are simultaneously awash in debt, and debt as wealth.

Can we thus see that the denouement of this is that the debt is repudiated, and the wealth simply disappears?

The real issue is title, and taxation. Who owns title to actual land and productive capitals (not just to a pile of IOU-land and IOU-productive capital). And who will still own it once the political parasites attempt to tax it as a means of redistributing things in their direction, even though they don’t hold title.

These are the questions that must be answered.

@Bea Lever (“And in other news…China is creating a new billionaire EVERY WEEK. Keep buying that Chinese crap , your dollars go straight to the communist Chinese billionaire class. Boy, when did communism include a billionaire class?”)- that was pretty funny, but in my lifetime, they have gone from peasants forced to smelt pig iron in their backyards (thanks Mao for the carbon dioxide) to a mighty economy where the man on the street looks every bit as prosperous as the average Yank (and a sight better than the Walmart crowd. It looks like bogus Communism trumps Crony-Capitalism

BTFD!!!!

Saw a video recently….said when the ATM’s stop working you have 72 hours before TSHTF…. I’d say they were off by 60 hours.

@BUCKHED

A small % will go Money Island. Most of those will throw their Chimp-out in their own neighborhoods, i.e., they’ll sh** where they eat, like all clueless wonders. Look at Baltimore: Cops pull back, give the locals the “space” they want and murders skyrocket. http://redstatements.co/be-careful-what-you-ask-forbloody-weekend-in-baltimore/

The poorer sections of cities are going to go full Escape From New York.

I think a much larger % will simply sit down. Some will drink. Many will consume a month’s Rx in a few minutes, chase it with a tumbler of vodka and be done. Bottom line: Plenty of people have zero reserves, but the majority of those lack even the wherewithal to riot.

The ones I worry about aren’t the usual Chimp-out suspects. If your majority neighbors are leftist, expect them to show up on your doorstep first with big puppy-dog eyes, and when you don’t give them what you have, they’ll come back with Molotov’s famous cocktail.

Shake Shack dropped 8% today. See, I can move markets.

@Robert

That was no joke that China creates a billionaire every week, it is posted on Drudge Report today.

That really chaps my ass that all of a sudden Chi-Coms are mastering extreme capitalism yet they are still reds. Whut up wit dat?? We are knee deep in niggas and they are knee deep in cash………..I feel like I live in the Twilight Zone.

DC, leftist neighbors better be able to throw those cocktails further than .223.

I’ve given up on trying to make logical sense of the markets. I am betting on the last day of the shmita year for the downfall like the rest of the fanatical side of the internet. At least their arguments make more sense that any FED report.

overthecliff, I read you loud and clear.

I just wish the barbarians weren’t already inside the gates.

“Sometimes people hold a core belief that is very strong. When they are presented with evidence that works against that belief, the new evidence cannot be accepted. It would create a feeling that is extremely uncomfortable, called cognitive dissonance. And because it is so important to protect the core belief, they will rationalize, ignore and even deny anything that doesn’t fit in with the core belief.”

Frantz Fanon

“Certainly there were many others as reprehensible and irresponsible as those who played the leading roles. The German people were the victims. The battle, as one who survived it explained, left them dazed and inflation-shocked. They did not understand how it had happened to them, and who the foe was who had defeated them.”

Adam Fergusson, When Money Dies: The Nightmare of the Weimar Collapse

While I share the pessimism here on this thread, I’ve learned a lot of patience and a little humility while waiting for “The Crash”. One thing I haven’t seen mentioned here which will soon play a large part in keeping the debt ponzi going a LOT longer than “…6 mos. to a year…” is the upcoming seizure of America’s retirement accounts. Trillions and trillions of dollars are there for the taking by our political and banking masters and they will take them.

Sadly, this completely legal confiscation (hey – they write the laws!) will buy even more time and hold off the day of reckoning a while longer. When this Potemkin economy (worldwide, too) finally consumes all the oxygen and collapses it will be one for the history books. Worldwide.

Administrator says: I’m going to start charging you shit throwing monkeys $200 per month for my words of wisdom.

I called a bottom for 2015, still waiting. Also called a Dow 55,000 for 2025. Oftentimes, the writing is on the wall but people act like it’s in braille.

Dammit, I should have said..act like it’s in cursive. Folks don’t read cursive anymore, do they?

Occasionally I feel justified in having no money

Seizure of retirement accounts would really awake me upset. I would want to vote those politicians out of office and other stuff.

“Amazon, Shake Shack, Twitter, Linkedin, Tesla, Google… Five of these six stocks don’t have a PE ratio because you need earnings to calculate a PE ratio.”

Both my Grandfathers rolled in their graves when you wrote this, we have arrived in A Brave New World.

Mike makes a good point with the Retirement Account comment, but that could come after a shocking event. It could degenerate into a virtual, globalist, banker, government, free for all if Trust is fractured and the shock is significant. Panic can be exponential. Maybe all of the spoils are already divided, per d.c.’s comments, title and possession, now for the intermission…have a great summer!

In reply to Jim @26th May 2015 at 11:53 am

Shake Shack , A poor man’s 5Guy burger !

Have you seen the prices at Shake Shack ???

“Market down 225. I’m a goddamn guru. I’m going to start charging you shit throwing monkeys $200 per month for my words of wisdom.”

—-Admin

No, I’m the guru. I’ve talked about bulletproof energy preferred common stocks until I’m blue in the face. You’ve never said I’m wrong, Jim, mainly because I’m not. Duh.

I’ve already made money on every one of my utility energy stocks. To the point I can’t LOSE money even if the company recalls the stock at $25 per share par value. No exceptions. A market crash will make me more money. Power companies, along with water and railroad companies, won’t disappear. They can’t. Period.

P.S. I have played the Monopoly board game since I was a little kid. Whoever designed that game was a fucking genius.

SSS…how long can Railroads and Power companies operate when the employes don’t show up for work?

Monopoly … destroying friendships since 1904

[img [/img]

[/img]

[img [/img]

[/img]

Equities are high for two reasons: One, debt instruments have no yield, thus making equities more attractive. Two, the cost of debt is near zero, thus exaggerating corporate profits, since business has effectively has no cost of debt service, thus grossly exaggerating profits.

A two-percent rise in prime would bring about the greatest stock market crash in modern history.

Stephanie Shepard says:

I’ve given up on trying to make logical sense of the markets. I am betting on the last day of the shmita year for the downfall like the rest of the fanatical side of the internet. At least their arguments make more sense that any FED report.

————————

Steph, I’m with you on the Shemitah thing–it lines up with the once every 7-year blowouts:

ECONOMIC INCIDENTS IN THE PAST 40 YEARS

1973 Recession

1980 2nd Recession

1987 Stock Market Crash

2000 Dot-Com Bubble Crash

2007 “Great Recession”

ALL incidents happened in Shemitah years, seven years apart.

(Note that 1994 is missing above–why?)

“The majority of economic crashes can be linked to Shemitah years to the ending date of that year, Elul 29, specifically the Great Depression, the Great Recession and the second Great Depression (1937-1938). 70% of all historic to-the-day crashes are linked to the Shemitah, 60% of all of the greatest percentile crashes happened within 18 days of the Shemitah’s conclusion, and 100% of the greatest stock crashes since World War Two happened in a Shemitah year. 100% of all point crashes happened in the wake immediately following a Shemitah year.”

https://sites.google.com/site/cathoderaytubeland/thanksgiving-from-hell/the-mystery-of-the-shemita

September 13 marks the end of this Shemitah. I’m moving my meager 401k funds to all cash on September 1 as a precaution–already have 50% in a money market fund and all of my matching funds go there.