By Gerold

My forty-year old Godson was belly-aching about the lack of jobs. He whined it’s all the Boomers’ fault.

I tore a few strips off him. I asked him WTF am I wasting my time researching and writing these articles if he doesn’t read them. Since I had him cornered, I told him a few things he obviously didn’t want to hear.

We are in an economic depression. It was predicted in Strauss and Howe’s 1997 book “The Fourth Turning” [Link] that occurs every four generations as a time of great turmoil. Their Generational Theory is a framework which explains where we are, how we got here and where we’re going. For more details see ‘Notes” at end.

This is a ‘Stealth Depression.’ The government is doing its utmost to hide it with fake statistics. Their ass media handmaidens are carrying their water telling us everything is wonderful. And, if my Godson believes the ass media, he deserves his fate.

At the bottom of this deception are fake inflation (CPI) statistics. They distort everything else because most economic data is ‘inflation adjusted.’ Consequently, when other economic data such as GDP growth is adjusted with fake inflation statistics, then those numbers are also distorted.

Note: there’s a difference between inflation (increased money supply) and Consumer Price Index (CPI), but I used the terms interchangeably to make it easier for my Godson to understand.

Anyone who buys stuff or reads John Williams ShadowStats [Link] knows that the actual inflation rate in 2017 is roughly 5% and NOT the bullshit 2% (or less) that the government claims. I say “roughly” because I rounded the numbers to make it easier for him to understand.

I wish I could have shown him the ShadowStats graph below.

Consequently, every so-called 2017 statistic that’s “inflation-adjusted” is off by 3%. (Hint: 2 – 5 = -3)

The government claims that (inflation adjusted) 2017 GDP growth is roughly 2%. Since it’s understated by 3%, it means the economy is “growing” at negative 1%. In other words, the economy is SHRINKING by 1%. And, that’s only this year.

Looking at the chart again, you’ll see that since 2001, the real inflation rate (the blue line based on non-manipulated methodology) bounced between 2% and 9%. This means the government’s bullshit inflation rate was understated between 0% and 7%. The ‘mean’ (roughly average) overstatement is roughly 3% to 5% since 2001.

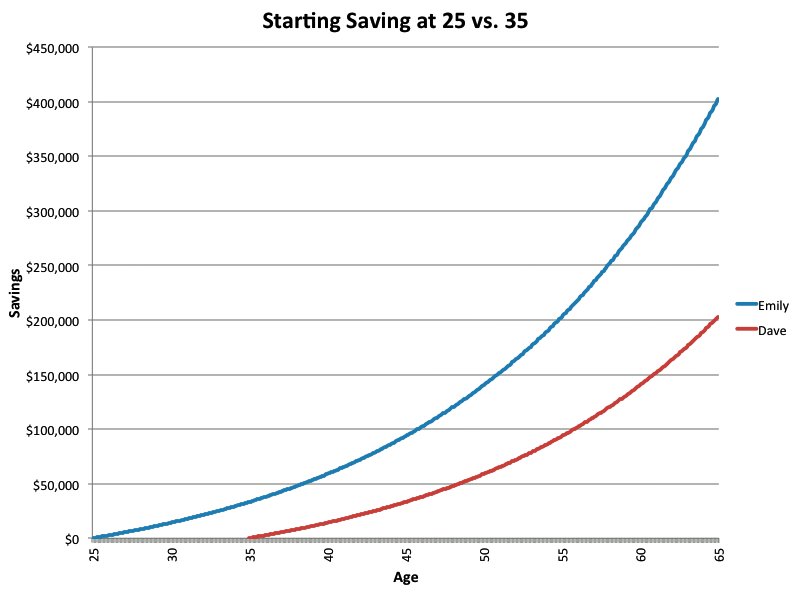

The “magic of compounding interest” is often called the eighth wonder of the world. If you earn a small percentage every year and keep reinvesting your earnings, the growth rate eventually goes exponential. And the sooner you start, the more you make. I wish I could have shown him the chart below that shows the difference ten years can make.

Emily (the blue line) started investing ten years before David. Emily makes a shitload more than David. That’s the magic of compounding interest.

The trouble is; it works in reverse, too. If the economy shrinks ‘only’ a couple of percent every year before too long the economic decline also goes exponential. The economy has been shrinking roughly 3% to 5% for the last sixteen years. Because of the magic of compounding interest, the economy is less than HALF what it once was when you factor in the REAL rate of inflation. More people, less than half the pie.

Now, do you see why everything’s gone for shit? Now, do you see why so many people are out of work, or if they do have jobs, why they cannot make ends meet? Even good jobs pay half what they once did. Lousy jobs pay even less. Bullshit inflation statistics hide the real decline.

Anyone waiting for “The Collapse” can stop waiting; it began years ago and will continue for a long time. There’ll be shocks and lurches along the way. The U.S. dollar will strengthen as the Euro declines and capital flees into the dollar. Cash will be banned starting with large denomination bills; it already has been in India. Years ago, Satyajit Das admitted they can’t stop the collapse; all they can do is try to engineer a soft landing.

And, never mind the ‘nominal’ pay (dollar amount) of wages. Purchasing power is declining and the Middle Class is slowly dying. Dollars are worth less every year. Zimbabwe was a perfect, if extreme, example. They were printing trillion dollar bills that couldn’t buy a loaf of bread. Everyone was a trillionaire, yet everyone was starving.

Too Much Debt

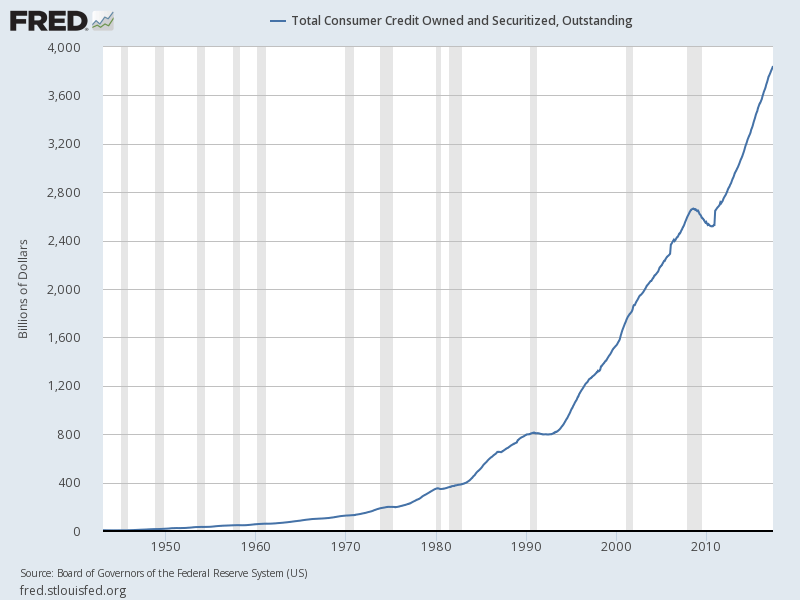

Never in history has there been so much debt worldwide; household debt, corporate debt and government debt. The graph below is consumer (household) debt.

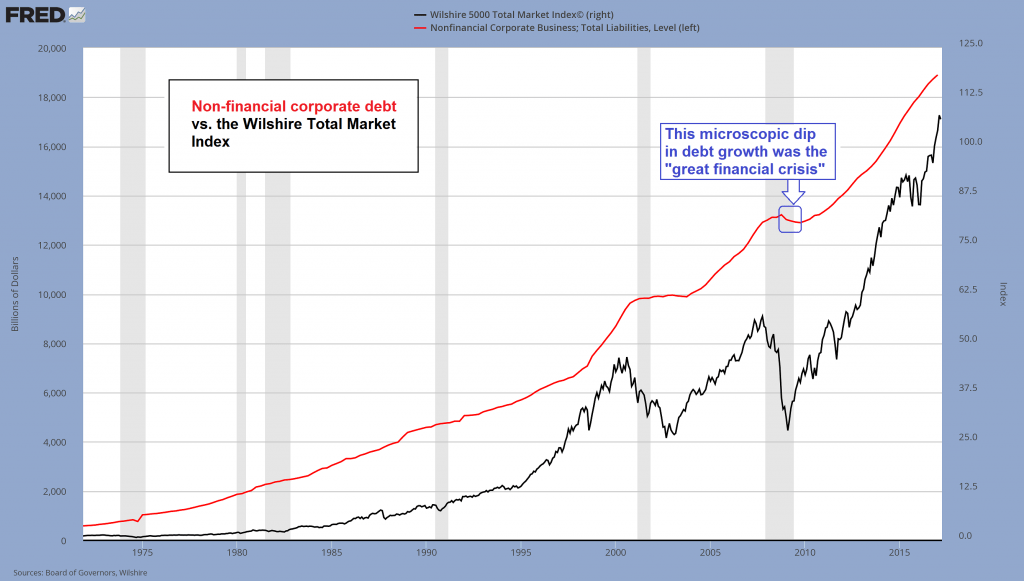

And, the graph below is corporate debt. Notice the small box showing how little corporate debt declined during the ‘Great Financial Crisis” of ’08. Now imagine what happens when the idiots at the Fed and other central banks increase interest rates and all this debt becomes more expensive to service? More on that later.

Credit: Bonner & Partners

Nowadays, money is based on nothing tangible. Money is now created with debt, and they need more debt to pay the interest on the bonds that created this debt/credit/money in the first place. We’ve reached a point where there isn’t even enough money in existence to pay the interest let alone touch the principle. Consequently, everything is slowly turning to shit.

Once you understand this, many things fall into place:

Factory orders fell to where they were a decade ago [Link] Inventories (especially autos) are rising. Credit spreads can’t get much lower. The U.S. dollar is on the decline, yet commodity prices are unchanged which means they’re deflating when adjusted for the REAL inflation rate. The U.S. corporate tax rate is among the highest of industrialized nations. Some production is returning to the U.S., but it’s performed by robots.

Stock markets give the illusion of recovery, but there are fewer retail investors. In addition to the Federal Reserve-Treasury Ponzi scheme, the corporate sector has been the primary buyer of their own stocks (“buy-backs”) since the Crash of ’08 as companies take advantage of ultra-low interest rates.

Demographics is Destiny

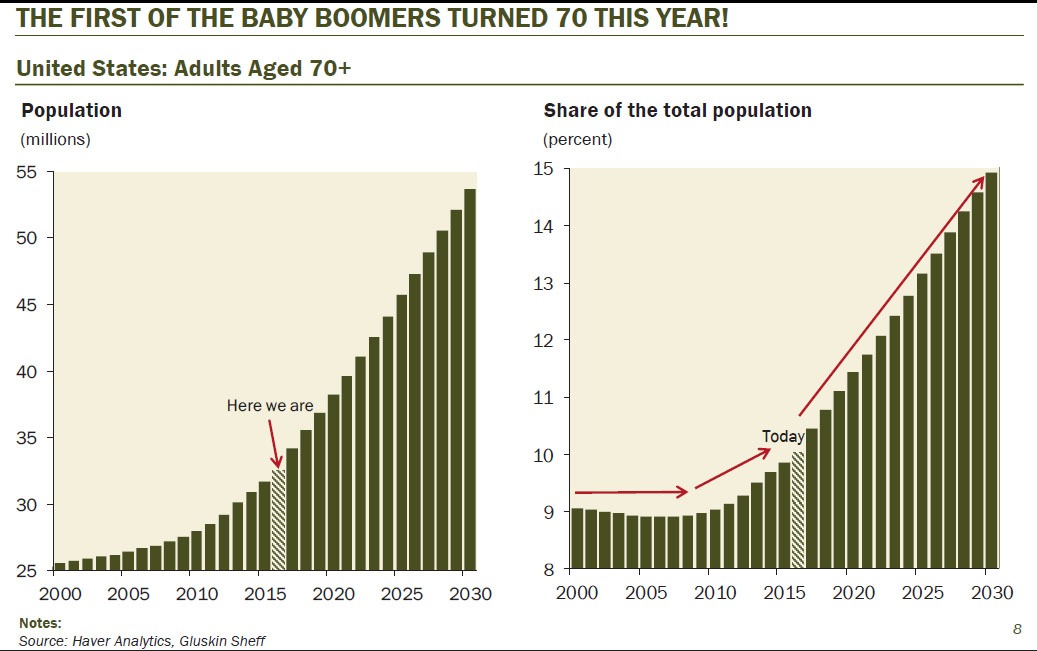

Few people appreciate the power of demographics which is the study and analysis of population dynamics over time or space. North America has a cohort of 80 million boomers, the first of who are turning 70 this year. Millions of boomers will do so every year for the next 15 years. Many will live to age 85 or longer.

The power of this demographic is seen in the two charts below. The first one shows the U.S. population aged 70+. The second shows their share of the overall population.

The graphs above show where we are today and, most important, where we are going.

Other than government employees, few people have a defined benefit pension plan. Most boomers have less than $100,000 in retirement savings. Given today’s low interest rates, bonds don’t pay much and even Blue Chip stock dividends are only slightly higher. Consequently, aggregate growth in incomes will decelerate and pose additional deflationary pressure on the economy.

Those who can retire will have a lot of time on their hands. They’ll spend money on experiences such as travel, tourism and restaurants, but a lot less on clothing, durables and housing. Demographics is indeed destiny. [Link]

Boomers are spending less, but younger generations are not picking up the slack. Malls are empty or closing. Stores are going bankrupt at an unprecedented rate. It’s not all because of online shopping because online shopping has not increased as much as the decrease in bricks & mortar. [Link] Few people have money except the 0.1%. As George Carlin used to say “It’s a big club and you ain’t in it.”

Oil prices are plunging not because of the over-supply governments and the ass media want us to believe, but because of lack of demand. We’re in a Stealth Depression. Fewer people have money to buy gas or jobs to drive to.

Aging Work Force

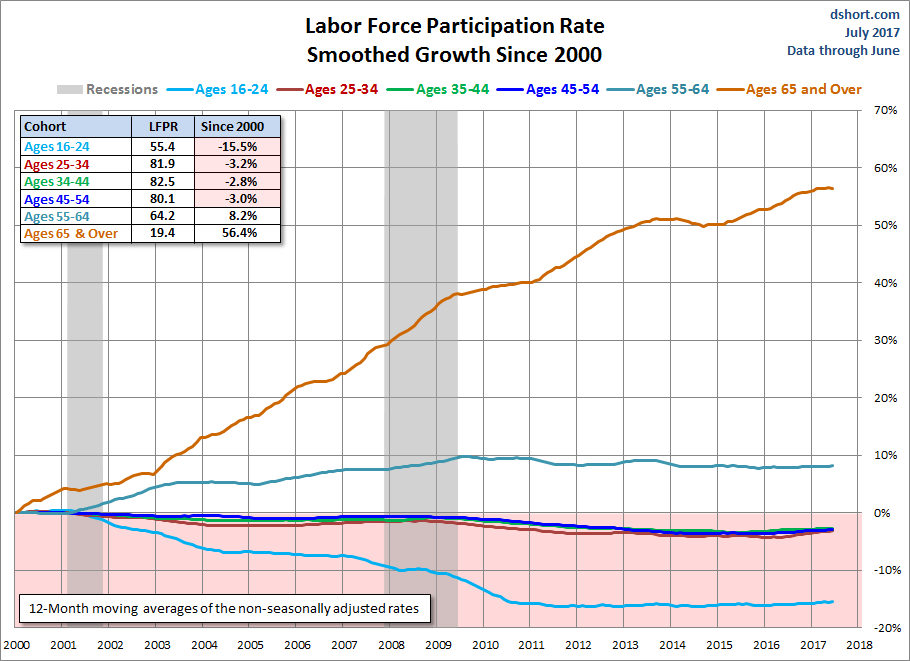

Another indicator of this Stealth Depression is the aging Amerikan work force. Look at the Labor Force Participation Rate in the chart below. The greatest increase in jobs is aged 65 and older (brown line.) The biggest decline is in the youngest cohort (blue line.)

Credit: Advisor Perspectives

Many Boomers can no longer afford to retire. The last two recessions (shaded gray) and the stock market crash in ’08 devastated their retirement plans. And, many who did retire have returned to work to make ends meet. I understand my Godson’s complaint; his cohort’s employment is down since 2000. However, every age group is screwed. The oldsters want to retire, but can’t and the youngsters can’t find decent jobs. Welcome to the Stealth Depression.

Fake Jobs

The U.S. Bureau of Labor Statistics (BLS) employment numbers are as fake as the so-called inflation rate. Mish reported “that 67 percent of non-employed younger men lived with a parent or close relative in 2015, compared to 46 percent in 2000.” He says what the statistics miss are “masses of people on welfare via fraudulent disabilities, people in school wasting money in dead-end retraining exercises, people who have simply given up looking for a job…” The unemployed who have abandoned job searching are classified as “discouraged workers” and excluded from the unemployment statistics. Fake everything masks the Stealth Depression.

Adding insult to injury, the idiots at the Fed believe the government’s fake labor statistics and are using them to justify interest rate hikes discussed below. More below.

Central Bank Idiocy

“Never underestimate the power of stupid people in large groups.” ― George Carlin

The Fed and other central banks worldwide are neo-Keynesian idiots worshiping at the altar of neoclassical economics. They completely ignore the impact of debt. Their track record for explaining, predicting and controlling economies is a series of utter failures, yet they continue singing from the same song sheet. The Overton Window [Link] explains this herd mentality. Nassim Taleb uses the term “intellectuals-yet-idiots.” The collapse of Argentina, Greece, Venezuela, and Zimbabwe are their most recent catastrophes, and they won’t be their last.

The most powerful of the central banks is the U.S. Federal Reserve (the “Fed”) which manages monetary policy through interest rate manipulation that ultimately affects the global economy. They operate on the principle that the U.S. economy booms when they lower interest rates and increase the money supply. Conversely, the economy shrinks when they raise rates and reduce the money supply.

Being idiots, they either do the wrong thing or, if they do the right thing, they do it at the wrong time or too late or too long. The length, depth, and global consequences of the Great Depression of the 1930s were primarily caused by the Fed’s ineptitude. Trying to minimize stock market speculation, they raised interest rates in 1928 and 1929. The stock market crashed, and the slowing U.S. economy triggered recessions worldwide. Oops!

Being idiots, they repeated their mistake reacting to the international financial crisis in 1931. More oops! And, then they failed to act as a “lender of last resort” during the subsequent banking panics. Still more oops!

President Richard Nixon “closed the gold window” in 1971. This cancellation of convertibility of the U.S. dollar into gold increased inflation prompting the Fed to raise interest rates to combat the falling dollar. The result was a major recession inducing the Fed to lower rates. More see-sawing of rates caused a series of recessions from 1980 to the Great Recession of 2008. Lots more oops!

And, now the Fed, deluded by the government’s fake economic statistics is raising interest rates so they can lower them when the next Fed-induced recession hits. Once again, the government is the problem disguised as a solution. Economic growth is fake. Bill Bonner says, “Fake money produces fake prosperity. Take away the fake money… and the fake prosperity goes ‘poof,’ too.”

We’re in a Depression. Technically we did, but fundamentally we never recovered from the Great Recession of ’08, so raising rates will kill the zombie economy and induce another recession that will make the last one look like a walk in the park. The only question is “when?”

Increased Risks Create Black Swans

Confidence is the glue holding our financial world together. Uncertainty undermines confidence and increases risk. Many Black Swans are circling overhead ready to trigger a shit-storm.

– The recent failure of Republicans repealing Obamacare.

– Trump’s promised tax reforms unsupported by the Republicans.

– The Deep State’s war Trump.

– Further Fed rate hikes.

– Political theater raising the U.S. debt ceiling before the October deadline.

– Risk of a credit default cycle. We’re in the terminal phase of debt creation.

– The Tech bubble was $15 trillion. U.S. housing bubble was $30 trillion. Current bond bubble $100 trillion. Current derivative bubble $550 to $1,500 trillion. Bubbles burst. The numbers are going exponential.

– The VIX (“fear index”) at historic lows means unprecedented stock market complacency.

– The ass media’s never-ending Trump Derangement Syndrome.

– Record number of Amerikans disapprove of both parties. [Link]

– North Korea is playing a dangerous ICBM game.

– Increased pressure on China to rein-in North Korea.

– Chinese presence on artificial islands in the South China Sea and a container ship mysteriously ramming the Amerikan destroyer USS Fitzgerald.

– The Neocons continue pushing for a war with Russia.

– Globally, we’re in the biggest financial bubble the world has ever seen.

– Interest rates will rise uncontrollably and increase borrowing costs when bond vigilantes overwhelm government monetizers.

– Rapefugees over-running and destabilizing Europe.

– Resource-rich trading partners like Canada & Australia won’t be spared from the next down-turn by Chinese demand like they were during the ’08 – ’09 recession. Their banks are being down-graded, yield-curves flattening, defaults increasing and real-estate in unprecedented bubbles.

– The Anglo-Amerikan empire’s destabilizing wars in the Middle East including Syria are now in the sixteenth year.

– Most of Amerika’s public pension systems are insolvent with Illinois at the epicenter.

– The Jewish calendar Jubilee year 5777 promises fireworks into 2018.

We cannot rely on history to forecast the outcome of all these risks. Right now, many of us are blinded by Normalcy Bias [Link] and see this as just Chicken Little “doom & gloom”. However, the shit will continue to hit the fan.

Gold & Silver; a Double-Edged Sword

One solution to protecting some of your wealth is buying precious metals (PMs) like gold & silver. Remember; never put all your eggs in one basket.

Gold-bugs for years have been hoping PM prices sky-rocket. They should be careful what they wish for.

When confidence is shattered, the matrix of rackets and criminalized financial sector loses control. That’s when it hits the fan, and the price of gold & silver will skyrocket. We will have a short window of opportunity to capitalize on PMs and convert them into assets before asset prices skyrocket as well. In a worst-case situation (let’s hope it doesn’t go that far) a loaf of bread will be more valuable than an ounce of gold. You can’t eat gold.

Buy physical PMs, not paper. Remember, PMs are insurance, not necessarily an investment. Hide them; don’t store them in a safety deposit box. If you don’t have them, you don’t have them.

What Can You Do?

– Spend less than you make. Start by cutting non-essentials.

– stop spending money you don’t have to buy shit you don’t need to impress people you don’t like.

– Get out of debt.

– Stay out of debt.

– If you plan to sell your house in the future, do it NOW before the bubble bursts. It’s better to be a year too early than a month too late.

– Rent (I do.) Over-priced real estate is a bottomless money pit, a time-waster and a tax cow (property taxes only go up, never down.)You’ll have a deteriorating pressboard shack when the mortgage is finally paid. Wait for the bubble to burst if you insist on buying into the house hoax to satisfy your Missus’ misguided sense of security.

– Keep only enough money in the bank for bill payments to avoid Bail-ins.

– Keep several months’ cash on hand for expenses, but be prepared to abandon this strategy when they ban cash.

– Cryptocurrencies are a risky and volatile strategy. Again, don’t put all your eggs in one basket. They can be hacked, or banned by the government.

– By 1 oz. gold coins (not bars) from reputable dealers if you’re rich, silver if you’re not.

– Stockpile durable essentials like toilet paper, garbage bags, soap, etc., etc.

– Learn to shoot and safe gun-handling.

– Guns & ammo.

– Stop eating junk food and exercise more because you need to stay healthy.

– If you’re wealthy, apply the Jim Sinclair GOTS checklist. [Link]

– Invest in yourself and your skills.

– Start now if you haven’t already because time is getting short.

Afterward:

My Godson found another job. It’s a step down from his last one which was a step down from the previous one, but at least it’s a job. The ingrate should be thankful he has a job. Any job! More than 20% of eligible workers don’t.

Welcome to the Stealth Depression of the Fourth Turning. When it ends, no one knows, but when it does I guarantee it’ll be unlike anything we’ve ever seen.

The mantra:

We cannot borrow our way out of debt.

We cannot spend our way to prosperity.

We cannot pretend our way out of trouble.

They keep trying, but ultimately, they’ll fail.

Notes: for more details on The Fourth Turning, scroll way down past the ads on the right side of this blog to the “Fourth Turning Library” for numerous articles expanding the insightful Fourth Turning analysis and predictions.

I finally got a halfway decent job, and BOY am I thankful! Been there for two weeks and the boss is still getting resumes from as far away as New York (I’m near the Colorado/ Utah border). Well, I got another problem. The problem is once the guy hired me and the other person, he announced he was hiring us as ‘contractors’ and that we would have to take the taxes out of our checks and we’d have lots of deductions. Problem is, that’s not how it works. Whether you are a contractor or employee depends on the work you do and what rules you follow. For instance, if you have a set time your boss wants you to come in, if you boss trained you for the job, you are an employee. If you are a contractor, your boss can tell you WHAT they want but not HOW to do it. We are clearly employees NOT contractors according to the IRS rules. Right now I need this job really badly so I plan on keeping my mouth shut. The only penalty to me is paying more in taxes. I figure if I say anything I am just going to lose the job. HE stands to lose alot more when the IRS catches him at this fraud, which hopefully won’t happen for a while.

Funny thing is, he told me if he had realized I was NOT a millennial (I don’t look my age) he would have hired me right off the top. He said he HATES dealing with them and their shitty/ entitlement/ bad attitude. His last two employees were fat/ obese millennial women who both STOLE from him by putting hours on their paychecks they didn’t work.

One prime determinate of whether you are a legitimate contractor is whether or not your services are also offered to the general public.

If the one you are working for expects you to do that work exclusively for him and not for his competitors as well, you are an employee.

Whether or not you carry the insurance liability for yourself and your work is another determinant.

Basically, if you are a contractor you are expected to be a legitimate business yourself and either have or be seeking other customers as well.

Your Boss’s largest liability will probably come when he lets someone go and they file an unemployment claim against him. He will find himself facing a good deal of penalties and back UI taxes for all his “contractors” when they do.

So funny that we tell be do all this stuff with there money to protect themselves. WHAT MONEY? These articles are written for people that make more than the median income obviously. I am in the 6 figure range and have done a few thing this guy has said and think why am I being so honest and integrity filled. I would encourage people to run up credit cards and default on them for some extra cash. If we ever actually do have a crash again Blackstone and investment real estate companies will then start being even more than they already own. We are not renting because we can we a renting because they own everything. Most people do have dime to there name and these articles tell them where to put there pennies?

“WHAT MONEY?”

That money that people piss away on starbucks, massive cell phone bills that resemble car payments, junk food and all manner of crap they don’t NEED! You NEED, food, water, shelter, transportation and, if essential to staying employed, a phone. A $35/mo land line will suffice in most cases. Everything else is a want or desire and not essential to life or employment.

If you simply stop accumulating debt, make severe cutbacks to your budget (Yeah right, like people actually do a budget. That should be a clue!) to eliminate all “wants” and put the difference towards paying off debt, you can get yourself out of the debt slave cycle. Have a few yard sales to sell off all that useless shit you’ve accumulated by spending money you didn’t have on shit you didn’t need and you’ll speed things up significantly.

Get a second job delivering pizzas or something and use every penny of that income to pay down debt. Add in any raises or bonuses you might get and debt goes away pretty fucking quick. Sell your $30k-$50k car and get yourself a $1500 beater. Even a few repairs to a beater will be far cheaper than $300-$600/mo car payments for the next seven years.

The steps themselves are excruciatingly simple so that leaves desire and will power. Most people are living paycheck to paycheck already. These steps won’t change that in the short term but in one to three years when you are debt free, savings will accumulate the same way debt currently accumulates. So, you can make a few short term changes and become your own master or continue on as is, pissing your paycheck away and remain a debt slave.

Being a debt slave is a choice. So is making a better choice.

And people who keep having children they cannot afford to pay for themselves and people who needlessly collect one pet after another.

Read Dave Champion’s awesome book, Income Tax, Shattering the Myths. Eye opening and fantastic.

At this point I do not know what will happen because we are so far down the road to perdition.

However,most of the world is worse off than us so we might make it thru if we can avoid devastating wars, natural disasters,famines or pandemics.

I happen to believe that though our debt and warmongering are the most serious problems we have,they are ultimately caused by our social problems.Kind of like an alcoholic-his getting drunk is the immediate problem but the ultimate problem is the emotional problems that caused him to become an alcoholic.

Along with reining in the Fed,we have to disband the FSA.If all these people receiving govt $ had to work for even $20/day it would help make them productive citizens and boost the economy.

Even though the multiplier is low for low wage jobs,it would still lead to a substantial amount of economic activity,which would lead to even more economic activity.

America was founded as a Christian nation and we need to get back to that.Religious people are more stable and tend to be the backbone of successful nations.

I waver back and forth on the subject of drug legalization-I hate the thought of locking people away for something that only directly hurts them but drugs today are so much more potent then when most of us were younger-even pot is very potent now.

Crime-we must get hold of the crime rate(violence,fraud,theft) in this country.If the average citizen knew how much they were paying for the various types of crime it would no longer be tolerated.

A substantial amount of insurance premiums are due to crime.Costs of crime are added into every product and service we purchase.How many people stay home and do not spend $ because of crime?

How many people do not take that 2nd job that entails working at night or leaving their family alone at night because of crime?More crime equals more cops,equaling more salaries,benes, and pensions.

If our military members can sleep in a tent,on the ground,or in the back of a truck for months on end,why is it cruel and unusual punishment to find rural pastureland and build tent prisons?

“Along with reining in the Fed,we have to disband the FSA.If all these people receiving govt $ had to work for even $20/day it would help make them productive citizens and boost the economy.”

——–

Some of those FSA critters are getting up to $50,000 in total government handouts, which is over $26/HOUR. They will fight to the death to keep those bennes.

Ill tell you what is going to happen. A major awakening. It is amazing when people realize that they are not able to do what they have been accustomed to for so long, no matter how stupid or uneconomic it is. That is when they wake up from their sheeple fog and realize they have a problem. Then denial, anger etc. ensues. I suspect that will be directed towards whatever DC and local crook happens to be sitting in the big chair at the time.

That will also be when the smart people (like here) will have their day. We will know exactly what happened, whom caused it, and what to do about it.

End the Fed.

Eliminate the Federal Reserve and the warmongering would stop and FSA would have to get a job.

What would you replace it with?

Think about it, it would have to fill all the same requirements the Fed is now filling to keep the economy alive and not end up looking like, or worse than, the Great Depression.

FWIW, we had plenty of “warmongering” before the Fed was established, that’s a function of people and governments in general and has been throughout history.

“What would you replace it with?” – Well, let me take a stab at this….Oh, I don’t know, a REAL capitalist economy? You know, we had that in this country for about 100 years before the creature from Jeckyll Island was created…..

I know that your modern programming is causing you to go in to shutdown at the thought of honest money that has to be earned and not conjured out of thin air from someone else’s debt obligation, but it is possible.

Discussing about what to replace it with, is like a Cocaine addict debating about what drug to replace Cocaine with. The idea is that you DON’T replace it, because IT is toxic and is killing the body. Same with the fed, or “healthcare”, you don’t replace anything that is toxic. You just remove it.

It is ILLUSION and BULLSHIT that is keeping us from acknowledging a great depression, nothing more. Maybe you like to live in fantasy unicorn land, but some of us would like to get to work building something real for a change.

While I am a believer in The Fourth Turning book, I also believe the govt found a way to keep boomers working so they can keep taxing them at their highest income earning years by crashing the mats. Making them keep working and not retire. Now I’m focused on the govts next move. There are 73m boomers. First ones turning age 70 this year at the rate of over 10,000 per day. There are 24m gen x and 77m eco boomers. Eco are college educated in massive student loan debt with McDonald’s jobs. They will play right into the hands of NWO by renting rides that are driverless not owning cars, renting homes not becoming landowners, and complacent with no privacy and reduced freedoms. 1984 will become full reality for eco boomers and millenials. They won’t remember what a representative republic is. Thx Obama…..

Well if the idea behind the war on drugs is that it enslaves users, who will lead a war on debt? It is addictive and definitely not a victimless crime.

Both drugs and debt are self inflicted.

Greetings,

When the Black Swan does finally land, it will f^ck us up in ways we couldn’t predict. The best advice I ever got was from hanging out with some Mormons in Utah for 6 weeks. Start with a simple get-away bag. If you had to run out of your home and into the night, what, exactly, would you like to have with you? This might have nothing to do with an economic collapse but could be weather related or some other disaster.

Once you’ve got that all worked out then put away enough stuff to sustain yourself and whoever happens to be with you for two weeks. This is not impossible to do and the supplies you would need would easily fit into two large plastic tubs. You could even take those things with you so as to not be a burden on whomever takes you in if you must leave home.

Once you have that all worked out then it becomes rather easy. You know what you need for two weeks so if you double that then you know you can sustain yourself for one month etc.

I guess after all of that you can work out for yourself what the best hedge is for your neck of the woods. Perhaps it is ammo, water, booze or precious metals. In my neck of the woods, water will become non-existent almost immediately especially if we lose power. I must have at least 100 2 liter bottles filled up with water just for trading purposes.

It isn’t an underground bunker like the wealthy have but I sleep better at night knowing that I have something as well as the means to protect it.

Do NOT rent. You never get that money back. But a house outside of town or in a cheap area….renting stupid… this guy is silly and sounds fat… duh exercise…. are you talking to yourself?

I agree with most everything here except ‘inflation’. Acknowledging the distinction between CPI and monetary inflation still doesn’t explain what has happened. Were official inflation as measured by the CPI being rigged by government the GDP deflator would have to match at some point. You can’t have 5% CPI inflation for a decade while nominal GDP only shows a 3% growth rate.

>My forty-year old Godson was belly-aching about the lack of jobs. He whined it’s all the Boomers’ fault…I tore a few strips off him. I asked him WTF am I wasting my time researching and writing these articles if he doesn’t read them. Since I had him cornered,…if my Godson believes the ass media, he deserves his fate.

It sounds like you hate your godson. How many years out of his 40-year life have you tried to educate him? Did you spend 40 years trying to teach him and failing? If so, maybe he’s just too stupid or you just can’t teach.

It also sounds like you were angry that your godson insulted the Boomers. Let’s assume that the Boomers are praiseworthy and blameless and wise. That’s great. Then we can disregard Gen X and the younger people and let the Boomers save the world. After all, they are virtuous, vigorous, insightful, blameless, and wise.

– Get out of debt.

– Stay out of debt.

Words of wisdom except that for every dollar you don’t borrow the government will borrow two. In our debt based monetary system, either total debt must grow or the entire system collapses. ZIRP and NIRP are certifiably insane monetary policy, but they are necessary to stave off collapse. Housing bubble, student loan bubble, auto loan bubble, all necessary to stave off collapse. If everyone swore off debt, the jig is up.

DurangoD: Why would you want to stave off the collapse of this artificial and increasingly-totalitarian system that has inflicted so much harm on the world? Do you imagine that we are going to vote ourselves back to a Republic and to a better America? I certainly don’t. The unfortunate option left to us is collapse and, hopefully, a rebuilding without the artificiality under which we now labor. Like the author of this piece, I think it’s coming whether we endorse it or not.

Herr Hauptman, I upvoted you. But I fear a peaceful reset is not in the cards. I hope that the central bankers having already lost their minds will soon be losing their heads.

You can’t eat gold…..good one…hadn’t heard that one in a while.

I guess Zimbabwe is a good example;folks there pan for a few flakes of gold in order to buy food,most notably a loaf of bread .

Zimbabwe used to produce enough food to feed most of Africa when it was known as Rhodesia.

Get out of debt. I hear this mantra all of the time and used to believe it. Now not so sure any longer and I think it depends on the kind of debt we’re talking about. If we’re talking credit cards, car leases, other forms of secured or unsecured consumer debt – yep, get rid of it as quickly as practical. No good reason to have it because it’s pure consumption. If we’re talking mortgage debt, I might say keep it as long as you can comfortably service it. Why? (1) Because it’s tied to an asset. Even if the value of the home goes down, it’s still an asset and can be liquidated for something. (2) Renting is, again, pure consumption where you own nothing and are subject to removal by the owner at the end of your rental agreement. (3) No tax advantage to renting. (4) If you think you own your home free and clear of a mortgage you don’t because you owe always owe property tax. (5) If you truly believe in inflation, you would be better to keep the mortgage at a low fixed rate and pay it back with cheaper and cheaper dollars. (6) If you believe in deflation, forget everything I just said and pay off the mortgage because the value of the home is decreasing and dollars are more difficult to come by. I tend to think inflation is the way it will go for a lot of reasons but primarily the Feds need to service their debt with cheaper dollars. (7) If you really think the end of the world as we know it is here and it’s about to go all Mad-Max, which I don’t, then what difference will paying debt down make??? All I can say is that we’ve done pretty good with real property over the years and I’m glad that I haven’t listened to some of the prognosticators predicting the end of the world as we know it starting next month…

Good post, anyone has author’s email? Like to chat with him.

Sounds a lot like what I said months ago.

What I think I need to do, and keep putting it off, is to buy a generator that is big enough to run my home and hook it up via a transfer switch so it will be easy to switch over to generator power. I probably should get a propane powered one because then I can just stockpile those propane tanks, and gasoline goes bad after a while. Along with getting the house generator powered I need to buy more food, water, toilet paper, trash bags. If I had power and a few years of food and water I think I might be able to rest easier.