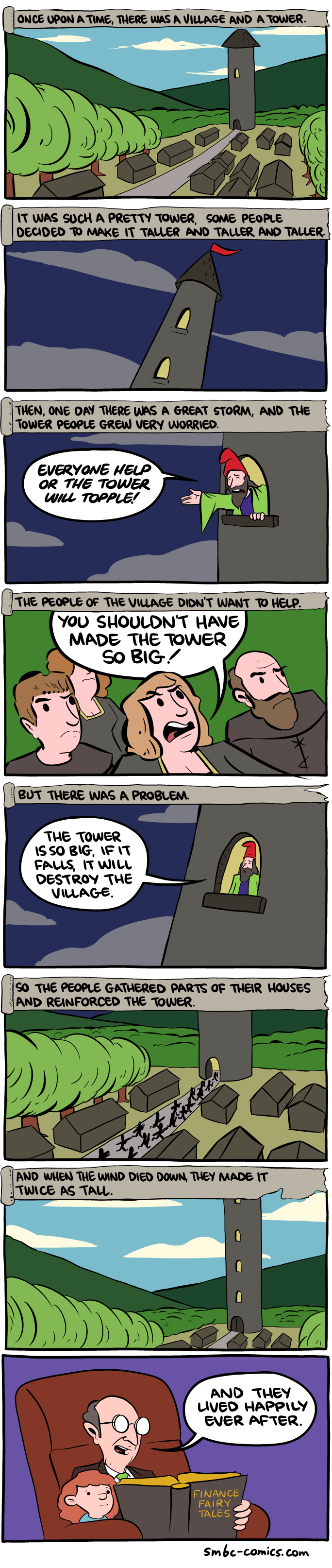

The so-called “trustees” of the social security system issued their annual report last week and the stenographers of the financial press dutifully reported that the day of reckoning when the trust funds run dry has been put off another year—-until 2034.

So take a breath and kick the can. That’s five Presidential elections away!

Except that is not what the report really says. On a cash basis, the OASDI (retirement and disability) funds spent $859 billion during 2014 but took in only $786 billion in taxes, thereby generating $73 billion in red ink. And by the trustees’ own reckoning, the OASDI funds will spew a cumulative cash deficit of $1.6 trillion during the 12-years covering 2015-2026.

So measured by the only thing that matters—-hard cash income and outgo—-the social security system has already gone bust. What’s more, even under the White House’s rosy scenario budget forecasts, general fund outlays will exceed general revenues ex-payroll taxes by $8 trillion over the next twelve years.

Needless to say, this means there will be no general fund surplus to pay the OASDI shortfall. Uncle Sam will finance the entire $1.6 trillion cash deficit by adding to the public debt. That is, Washington plans to make social security ends meet by burying unborn taxpayers even deeper in national debt in order to fund unaffordable entitlements for the current generation of retirees.

The question thus recurs. How did the untrustworthies led by Treasury Secretary Jacob Lew, who signed the 2015 report, manage to turn today’s river of red ink into another 20 years of respite for our cowardly beltway politicians?

They did it, in a word, by redeeming phony assets; booking phony interest income on those non-existent assets; and projecting implausible GDP growth and phantom payroll tax revenues.

And that’s only the half of it!

Continue reading “The 2015 Untrustworthies Report——Why Social Security Could Be Bankrupt In 12 Years”

The stereotype of “lazy Greeks”

The stereotype of “lazy Greeks” More stereotyping …

More stereotyping …