Donald Trump tells me our best days are ahead. Once his tax cut plan is passed, the future will be so bright I’ll have to wear shades.

Donald Trump tells me our best days are ahead. Once his tax cut plan is passed, the future will be so bright I’ll have to wear shades.

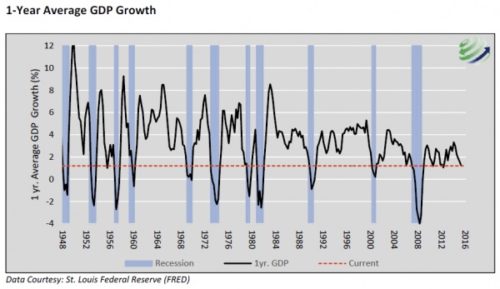

Sometimes a single chart reveals the truth being obscured by the Deep State propaganda machine, working overtime selling their economic recovery narrative. The economy most certainly is booming for Wall Streeters and D.C. parasites sucking on the teet of Federal government largess. But for the average working deplorable, this supposed recovery has passed them by.

The cognitive dissonance is strong, as average Americans want to believe what their “leaders” are telling them to believe, but their personal financial situation contradicts the narrative. Even using the highly manipulated data peddled by the BLS, any critical thinking individual can see through the lies, misinformation and bullshit.

REUTERS/Adrees Latif

REUTERS/Adrees Latif