It seems hard to believe, but your government is purposely recreating the mortgage debacle of 2007 and putting you on the hook for the billions in losses coming down the road. In their frantic effort to generate the appearance of economic recovery they are willing to gamble with taxpayer’s money while luring unsuspecting blue collar folks into buying houses they can’t afford. During the previous housing bubble, greedy Wall Street bankers, deceitful mortgage brokers, and corrupt rating agencies colluded to commit the greatest control fraud in the history of mankind. This time it is your government, aided and abetted by the Federal Reserve, that is actively promoting the lending of money to people incapable of paying it back. And again, you the taxpayer will be on the hook when it predictably blows up.

The FHA, created during the first Great Depression, is supposed to be self-sustaining through mortgage insurance premiums charged to homeowners, just like Fannie, Freddie, Medicare, Social Security, and student loan lending were supposed to be self- sustaining through taxes, fees, and interest. This agency was supposed to promote homeownership for lower income Americans, but has been used by politicians as a tool to capture votes, payoff crony capitalist benefactors, and as a Keynesian stimulus tool designed to kindle a fake housing recovery. They entered the fray at the tail end of the last Fed/Wall Street created housing bubble, insuring a huge number of subprime mortgage loans from 2007 through 2009. The taxpayer has already had to bail out this incompetent, politically motivated, joke of an agency to the tune of $1.7 billion in 2014.

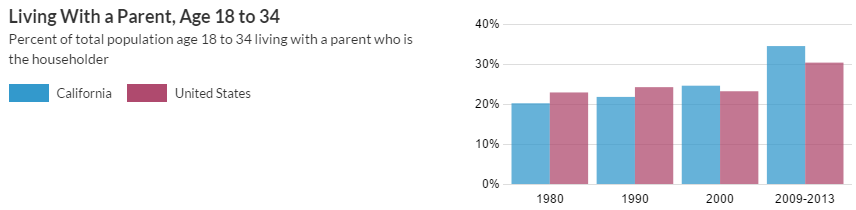

Edward J. Pinto, a former Fannie Mae official, estimates that under standard accounting practices the agency is already insolvent to the tune of $25 billion. Mark to fantasy accounting hasn’t just benefitted the criminal Wall Street cabal, but also the bloated pig government housing agencies – Fannie, Freddie and the FHA. The FHA’s share of new loans with mortgage insurance stood at 16.4% in 2005 and currently stands at 44.3%. This is a ridiculously high level considering the percentage of first time home buyers is near all-time lows and low income buyers have lower real median household income than they had in 2005. Distinguished congresswoman Maxine Waters, who once declared: “We do not have a crisis at Freddie Mac, and particularly Fannie Mae, under the outstanding leadership of Frank Raines.”, prior to them imploding and costing taxpayers $187 billion in losses, thinks the FHA is doing a bang up job. Her financial acumen is unquestioned, so you can expect another bailout in the near future.

Continue reading “GOVERNMENT USING SUBPRIME MORTGAGES TO PUMP HOUSING RECOVERY – TAXPAYERS WILL PAY AGAIN”