“Facts are to the mind what food is to the body.” – Edmund Burke

No wonder one third of Americans are obese. The crap we are shoveling into our bodies is on par with the misinformation, propaganda and lies that are being programmed into our minds by government bureaucrats, corrupt politicians, corporate media gurus, and central banker puppets. Chief Clinton propaganda mouthpiece, James Carville, famously remarked during the 1992 presidential campaign that, “It’s the economy, stupid”. Clinton was able to successfully convince the American voters that George Bush’s handling of the economy caused the 1991 recession. In retrospect, it was revealed the economy had been recovering for months prior to the election. No one could ever accuse the American people of being perceptive, realistic or critical thinking when it comes to economics, math, history or distinguishing between truth or lies. Our government controlled public school system has successfully dumbed down the populace to a level where they enjoy their slavery and prefer conscious ignorance to critical thought.

The next six months leading up to the November elections will surely provide a shining example of the degraded society we’ve become. Both parties and their propaganda machines, SuperPacs, and corporate media sponsors will treat the igadget distracted masses to hundreds of hours of lies, spin, and vitriol, designed to divert the public from the fact that both parties act on behalf of the same masters and have no intention of changing course of the U.S. Titanic to avert the iceberg dead ahead. We will be treated to storylines about race, gun control, the war on women, energy independence, global warming, the war on terror, the imminent threat of Iran and North Korea, Obamacare, Romneycare, and of course the economy, stupid.

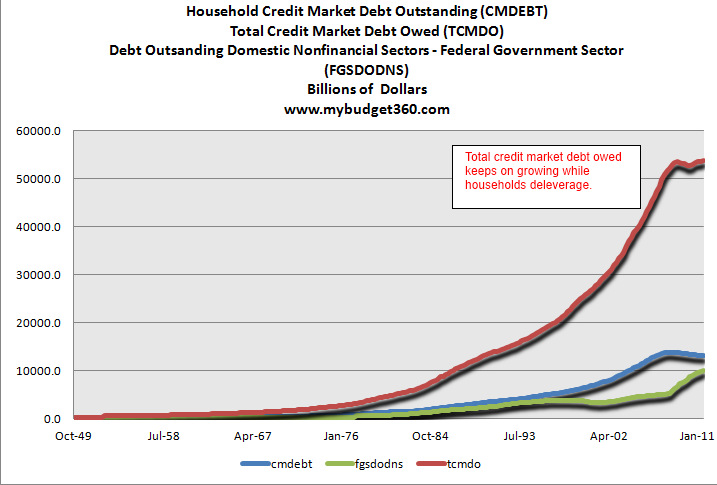

There are 240 million voting age Americans. About 130 million will likely vote in the 2012 election based upon recent voter participation results. This means that 110 million Americans don’t give a crap about who runs this country or they’ve come to their senses and realize our votes don’t matter. Between 1840 and 1900 voter participation ranged between 70% and 82% as Americans took their civic duty seriously and believed their vote counted. Since 1913, when the politicians relinquished control of our currency to a private bank controlled by a small group of powerful men, voter participation for President has ranged between 49% and 62%. It hasn’t surpassed 57% since 1968. Now that corporations are people and our candidates are selected by a few rich men, the transformation from a republic to a corporate fascist state is almost complete. During the coming interminable political campaign you will hear about jobs until your ears bleed. I can guarantee that 98% of the rhetoric will be false. Neither party wants the American people to understand the truth about what happened to our economy and jobs over the last 100 years. It has been a bipartisan screw job and ignoring the facts doesn’t change them.

The first fact that can’t be ignored is how many Americans are actually unemployed today. Here is some truth you won’t get from a politician or media talking head:

- There are 243 million working age Americans.

- There are 142 million employed Americans.

- Only 101 million of the employed Americans are working more than 35 hours per week. This means that only 41.6% of all working age Americans have a full-time job.

- According to the government drones at the BLS, 88 million Americans have “chosen” to not be in the labor force – the highest level in U.S. history.

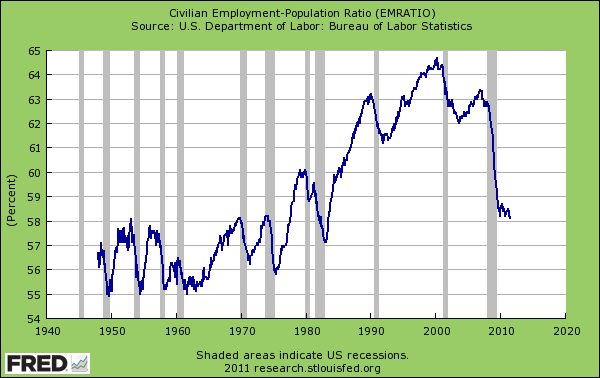

- The percentage of Americans in the workforce at 63.8% is the lowest since 1980 and down from a peak of 67.1% in 2000. The difference between these two percentages is 8 million Americans.

- The BLS reports there are only 12.7 million unemployed Americans in the country, down from 15.3 million in 2009.

- The BLS reports the unemployment rate has dropped from 10% in late 2009 to 8.3% today. Over this time frame the working age population grew by 5.7 million, while the number of employed Americans grew by 3.6 million. Only a government drone could interpret this data and report a dramatic decline in the unemployment rate.

Any critical thinking human being would examine the data being reported as fact by our government and regurgitated without question by the corporate mainstream media and conclude it is false, misleading and manipulated. The economy was booming in 2000 and 67.1% of the working age population were in the labor force. Today the economy is in much worse shape. More people NEED to work in order to just make ends meet, but according to the government, 8 million Americans have chosen to not work. Only an Ivy League economist or CNBC bimbo pundit would believe such a blatant distortion of reality. A comparison to prior decades provides all the evidence you need:

- In 1980 the working age population was 168 million and the labor force totaled 107 million.

- By 1990 the working age population grew by 21 million and the labor force grew by 19 million.

- By 2000 the working age population grew by another 23 million and the labor force advanced by 17 million.

- Since 2000 the working age population has grown by 30 million, but shockingly the labor force has supposedly grown by only 12 million.

This data is so twisted that there is absolutely no doubt the Federal Government is purposely manipulating the numbers to make the economic situation appear better than the reality. During the Great Depression propaganda and spin had not been perfected. There weren’t multiple definitions of unemployment designed to confuse and mislead the public. The peak level of unemployment in the 1930s was 25%. The current reported level is 8.3%. On a comparable basis to the 1930s, including short-term discouraged workers, those forced to work part-time, and the long-term discouraged workers which were defined out of existence in 1994 by the BLS, the real unemployment rate is 22% today. It feels like a depression for millions of Americans because it is a depression.

The rhetoric from the Obama administration about a jobs recovery is laughable. Full time employment peaked in July 2007 at 122.4 million. Today there are 113.9 million people classified as full-time, with only 101.3 million working more than 35 hours. There are 8.5 million fewer people with full time jobs today than there were in 2007. That fact is even more disheartening considering the working age population has grown by 10.5 million over the same time span. Taking an even longer term view provides the perspective needed to assess our true economic state. Total nonfarm employment hasn’t grown in twelve years, while the working age population has grown by 30 million people.

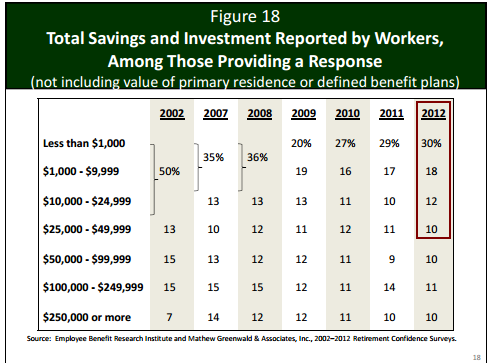

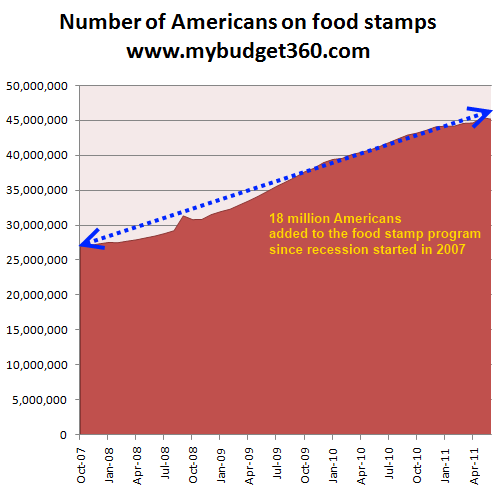

Obama will tout the fact that we’ve added 3.6 million jobs since the bottom of this recession. What he won’t tout is that hiring of temporary workers surged by 37% and accounted for 25% of all the jobs added since 2009. I’m sure these temporary workers, with no health or retirement benefits, are confident about their future. The facts about jobs and employment are consistent with the 47 million Americans on food stamps (up from 35 million when the recession supposedly ended). It’s a sure sign of recovery when spending on food stamps doubles in the last two years. No depression here, just move along.

Record numbers of Americans being added to the SSDI rolls for depression and other illusory disabilities is surely a positive development pointing to a strong economic recovery. In just the first four months of this year, 539,000 joined the disability rolls and more than 725,000 put in applications. “We see a lot of people applying for disability once their unemployment insurance expires,” said Matthew Rutledge, a research economist at Boston College’s Center for Retirement Research. The number of applications last year was up 24% compared with 2008, Social Security Administration data show. Why participate in the labor market when you can collect a government check for life because you are obese or depressed. These are the people no longer in the labor force. Once they go on SSDI, they rarely go back to work again.

The government reported figure of 12.7 million unemployed Americans is an utter falsehood. There are in excess of 30 million Americans that are either unemployed or working part-time that want full-time jobs. Government propaganda doesn’t change the facts.

“Facts don’t cease to exist because they are ignored.” – Aldous Huxley

Would You Like a Side Order of Facts with That Propaganda?

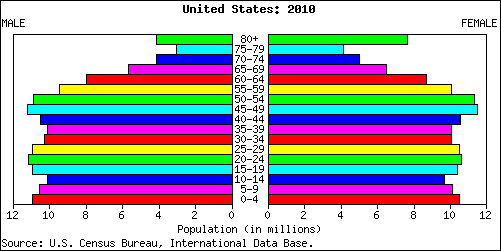

When you watch the Wall Street scam artists paraded on CNBC declaring the number of people not in the labor force is going up due to Baby Boomers retiring, you should understand they are propagating a falsehood. They are either intellectually dishonest or too lazy to do the most basic of research. They are paid millions to impart false storylines to anyone dumb enough to watch CNBC expecting facts or a smattering of truth. If you want some truth, turn to John Mauldin and John Hussman. CNBC doesn’t invite these outstanding honest analysts on their station when they can roll out a shill like Abbey Joseph Cohen or James Paulson. They wouldn’t want some factual analysis when they can have Becky Quick do one of her frequent handjob interviews with that doddering old status quo fool Warren Buffet.

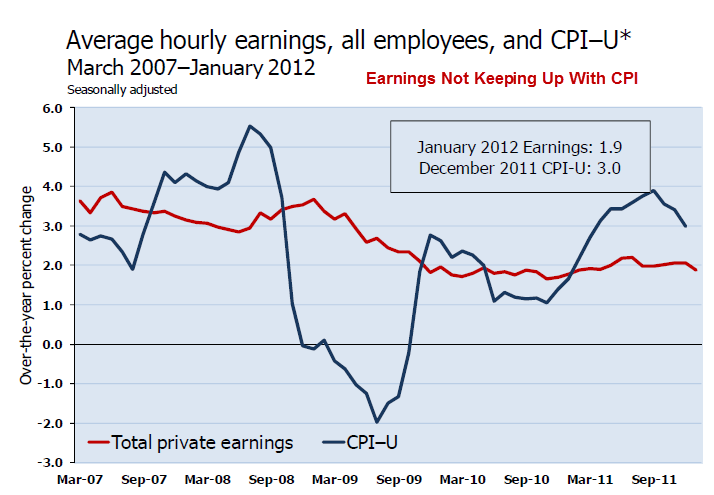

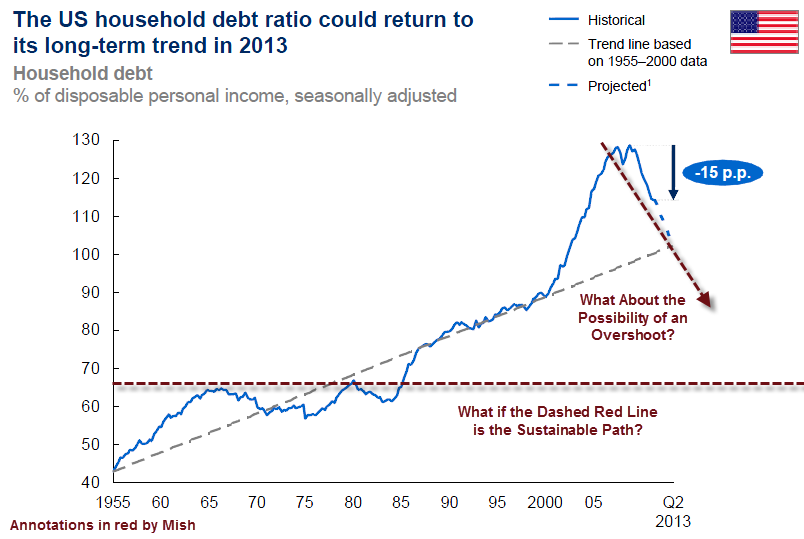

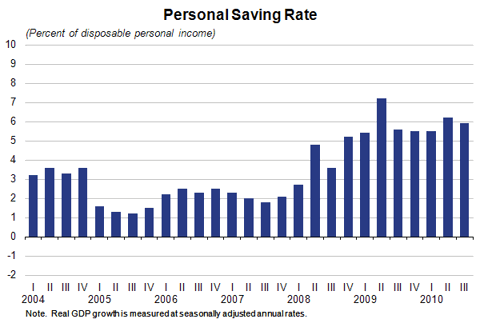

A critical thinker might wonder how could real disposable income be dropping over the last three months and only have risen by 0.3% in the last year if we’ve had the strong job growth touted by Obama. Could it be the jobs being created are extraordinarily low-paying? There are signs of desperation everywhere you look. The two charts below, from one of John Mauldin’s recent articles, reveal the truth about the Baby Boomers retiring storyline. The first chart shows the employment level for those over the age of 55 since 2007. There were 25.3 million people over the age of 55 working in 2007 and there are 30.1 million working today. People over 55 have seen their total employment level rise by 4.8 million jobs since the beginning of the recession, and over 3 million jobs since the 3rd quarter of 2009. Total employment is down by 4 million since 2007, while employment among those over 55 is up 19%. John Hussman described the reality about employment in his recent weekly article:

“If you dig into the payroll data, the picture that emerges is breathtaking. Since the recession “ended” in June 2009, total non-farm payrolls in the U.S. have grown by 2.32 million jobs. However, if we look at workers 55 years of age and over, we find that employment in that group has increased by 3.04 million jobs. In contrast, employment among workers under age 55 has actually contracted by nearly one million jobs, regardless of which survey you use. Even over the past year, the vast majority of job creation has been in the 55-and-over group, while employment has been sluggish for all other workers, and has already turned down.”

I wonder how Larry Kudlow will spin this.

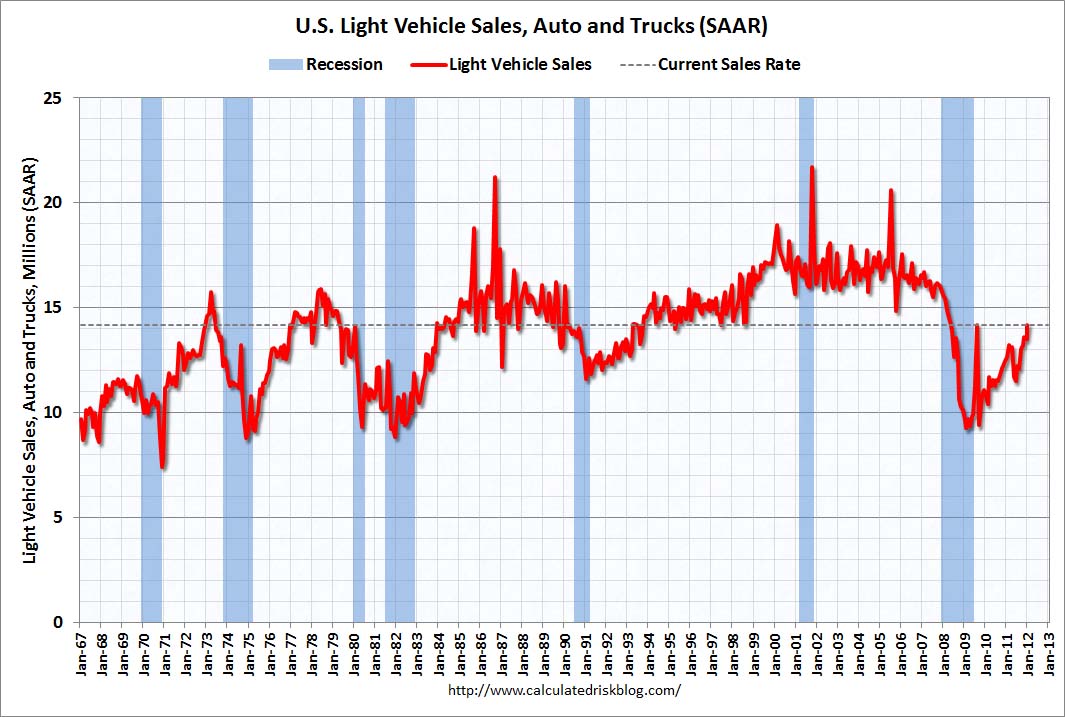

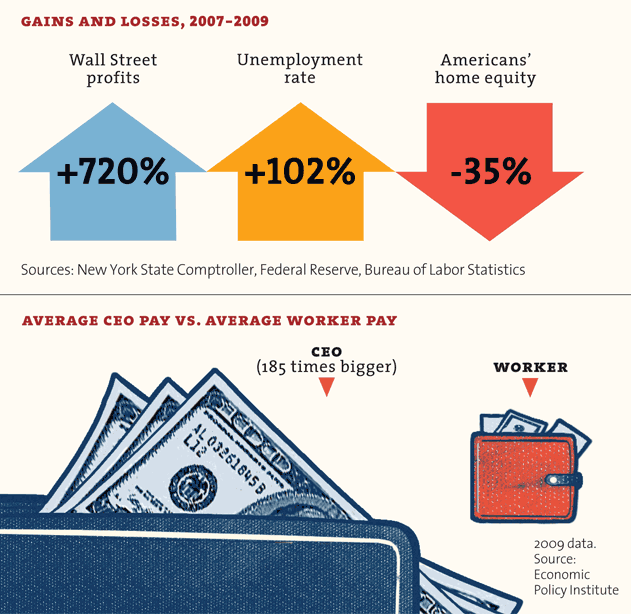

Now for the really eye opening facts. While the labor participation rate has been plunging, the Boomer participation rate has been skyrocketing. The participation rate for the over 65 age group is now at an all-time high. Do you think this has anything to do with home values dropping 36% since 2005, gasoline prices doubling since early 2009, food prices surging by 25%, the 1.4% annual return of stocks since 1999, or the .15% senior citizens can earn on their money today versus the 5% they could earn in 2007?

Intellectually dishonest ultra-liberal Ivy League defender of the Federal Reserve – Paul Krugman had this to say about Ben Bernanke’s zero interest rate policy on senior citizens:

“Finally, how is expansionary monetary policy supposed to hurt the 99 percent? Think of all the people living on fixed incomes, we’re told. But who are these people? I know the picture: retirees living on the interest on their bank account and their fixed pension check — and there are no doubt some people fitting that description. But there aren’t many of them.”

It must be comforting living in an ivory tower or penthouse suite and looking down upon the ignorant masses while caressing your Nobel Prize. The millions of senior citizens with $100,000 of savings could earn $5,000 of interest income in 2007 to supplement their $18,000 of Social Security income. Today, they can earn $150 while the Wall Street banks receive the benefits of ZIRP by borrowing for free from the Federal Reserve and earning billions risk free. Paulie doesn’t think the $4,850 reduction in income and the 15% increase in inflation since 2007 had a negative impact on senior citizens. They must be pouring into the work force because they are just bored, after working for the last 45 years. John Hussman has a slightly different viewpoint, based upon facts rather than a false disproven ideology:

“Beginning first with Alan Greenspan, and then with Ben Bernanke, the Fed has increasingly pursued policies of suppressing interest rates, even driving real interest rates to negative levels after inflation. Combine this with the bursting of two Fed-enabled (if not Fed-induced) bubbles – one in stocks and one in housing, and the over-55 cohort has suffered an assault on its financial security: a difficult trifecta that includes the loss of interest income, the loss of portfolio value, and the loss of home equity. All of these have combined to provoke a delay in retirement plans and a need for these individuals to re-enter the labor force.

In short, what we’ve observed in the employment figures is not recovery, but desperation. Having starved savers of interest income, and having repeatedly subjected investors to Fed-induced financial bubbles that create volatility without durable returns, the Fed has successfully provoked job growth of the obligatory, low-wage variety. Over the past year, the majority of this growth has been in the 55-and-over cohort, while growth has turned down among other workers. Meanwhile, broad labor force participation continues to fall as discouraged workers leave the labor force entirely, which is the primary reason the unemployment rate has declined. All of this reflects not health, but despair, and helps to explain why real disposable income has grown by only 0.3% over the past year.”

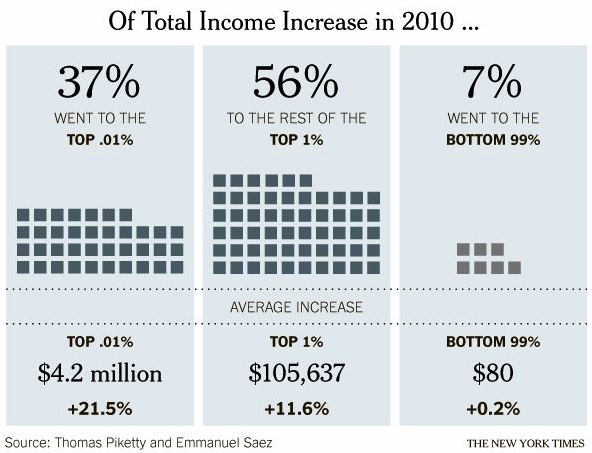

Do you believe Krugman or Hussman? The key takeaway from the data is the desperation exhibited by average Americans, while the political governing elite and Wall Street pigs continue to gorge themselves at the trough of free money provided by the Federal Reserve, while paying themselves obscene bonuses for a job well done buying the corrupt Washington politicians.

Over the next six months we will hear unceasing rhetoric from Obama and Romney about how they are going to create jobs. Neither of these government apparatchiks have a clue about jobs or desire to change the course that was set one hundred years ago with the creation of the Federal Reserve. Obama never worked at a real job in his entire life, while Romney has spent his life firing people and spinning off heavily indebted companies to unsuspecting investors. The current deteriorating jobs picture has been decades in the making and a truly bipartisan effort. The rhetoric about America being an engine of growth and the world leader in innovation and entrepreneurship is laughable when examined with a critical eye. We are an aging empire living in the past as the facts portray an entirely different reality. Our fastest growing industries include:

- Solar panel manufacturing (subsidized by your tax dollars)

- For-profit universities (diploma mills subsidized by your tax dollars)

- Pilates and yoga studios

- Self-tanning product manufacturing

- Social network game development

- Hot sauce production

The “surge” in jobs in the last three months is being driven by these industries:

- Food services and drinking places

- Administrative and support services

- Ambulatory health care services

- Credit intermediation

- Hospitals

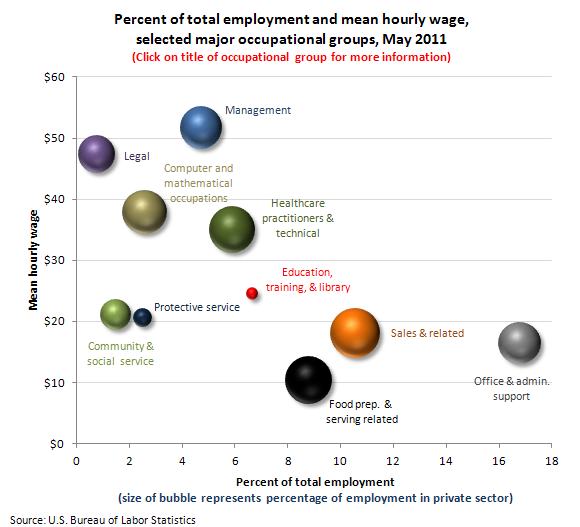

Is this the picture of a world leading jobs machine or a delusional, paper pushing, self-involved, obese, sickly, overly indebted crumbling empire? The job openings in industries that actually produce something are barely identifiable on the chart below. Maybe the University of Phoenix can successfully retrain construction and manufacturing workers to be waiters, waitresses, and Wal-Mart greeters if the Federal government can funnel more of our tax dollars into student loans.

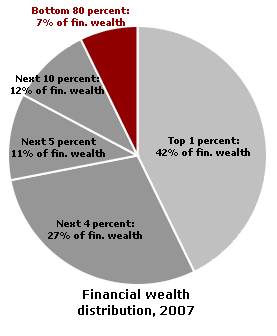

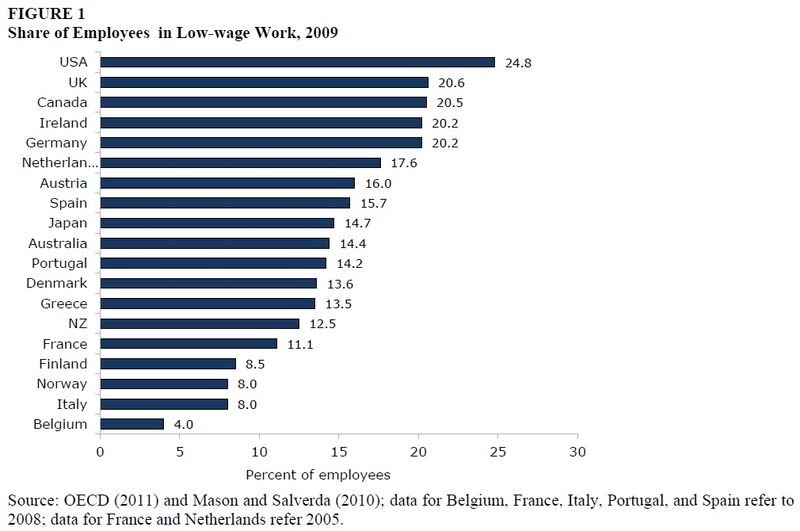

If you thought low wage work was only for Chinese, Indians, and Vietnamese, you haven’t been paying attention. The United States is a world leader. We are by far the world leader among developed countries in percentage of low wage workers at 24.8%. I find it hysterical that the dysfunctional insolvent countries of Greece, Spain, Portugal, and Italy have a much smaller percentage of low wage workers than the great American empire. We have 142 million employed Americans and 35 million are slaving away in low paying thankless jobs. This explains why the half the workers in the country make less than $25,000 per year.

The top three employment occupations in the country are:

- Office and administrative support work

- Sales & Related

- Food preparation and serving related

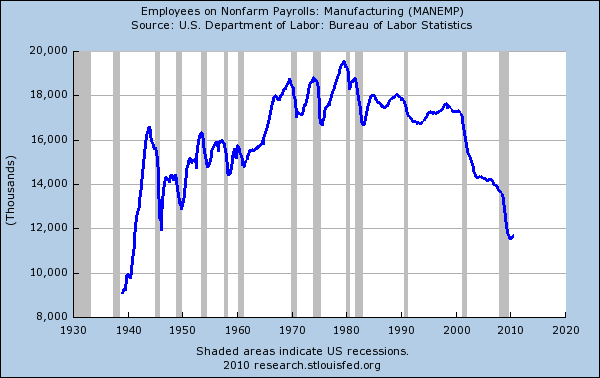

There are high paying good jobs in America, but there aren’t many and on-line college graduates from the University of Phoenix aren’t going to get them. The highest paying jobs today require a high level of specialization and education, especially in the healthcare and technology industries. This disqualifies the vast majority of government run public school graduates. High paying manufacturing jobs which were the backbone of the country during the 1950s and 1960s are gone forever. The reasons for this transformation are multifaceted and will be addressed in Part Two of this article. It didn’t happen by accident and there are culprits to blame. The conversion of our country from making high quality things other countries needed to a debt driven service economy of paper pushers, hash slingers, and retail “specialists” has slowly but surely destroyed the middle class. The masses are distracted by the latest technological marvel that allows them to waste another two hours per day posting how they feel about the latest episode of America’s Got Something or America’s Top Whatever. We have become a country that glories in our materialism and shallow culture while acting like a thug around the world with our unparalleled military machine.

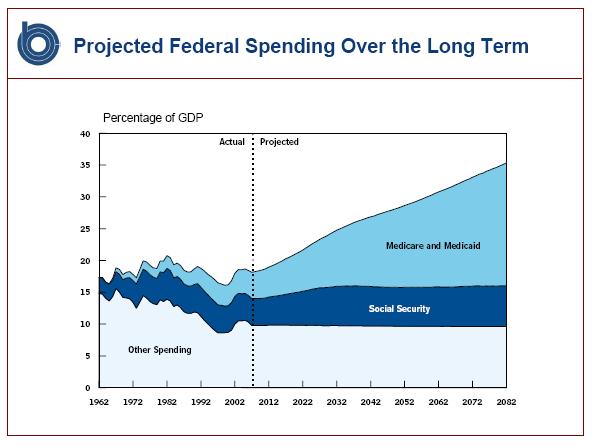

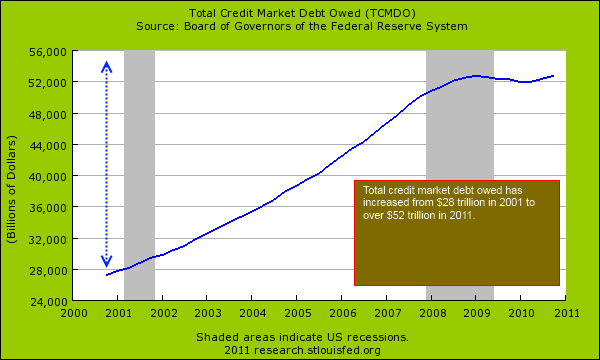

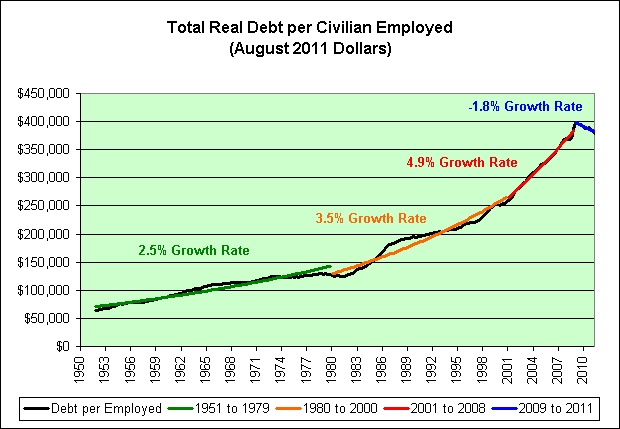

This result is not an accident. It was set in motion by the actions of a handful of rapacious, wealthy powerful men that have been calling the shots in this country for the last hundred years. It wasn’t a planned conspiracy but the logical result of man-made inflation, a fiat currency not backed by gold, the craving of rich men to become richer, a willfully ignorant populace, and a slow devolution of our society into a corporate fascist state. We praise and honor psychopathic criminals while scorning and ridiculing the middle class workers that built this country. The American dream has become a nightmare for the millions of unemployed and underemployed. The acceleration of debt accumulation and money printing guarantees this rotting carcass of a country will go belly up in the foreseeable future.

“Thus did a handful of rapacious citizens come to control all that was worth controlling in America. Thus was the savage and stupid and entirely inappropriate and unnecessary and humorless American class system created. Honest, industrious, peaceful citizens were classed as bloodsuckers, if they asked to be paid a living wage. And they saw that praise was reserved henceforth for those who devised means of getting paid enormously for committing crimes against which no laws had been passed. Thus the American dream turned belly up, turned green, bobbed to the scummy surface of cupidity unlimited, filled with gas, went bang in the noonday sun.” – Kurt Vonnegut

In Part Two of this article I will examine how we got to this point and what is likely to happen next.

![[SNLCreditSuisse.jpg]](https://3.bp.blogspot.com/_pMscxxELHEg/S41iYJmDurI/AAAAAAAAHpo/DfLns3uE_J8/s1600/SNLCreditSuisse.jpg)