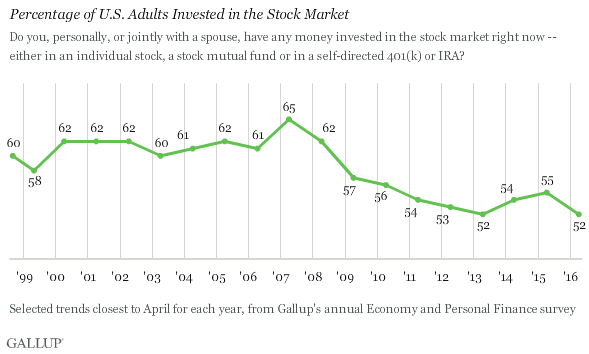

The chart below would appear to be in conflict with the results of a recent Gallup poll regarding stock ownership by Americans. The ratio of household equities to money market fund assets is near a record high, 60% above the 2007 high and 30% above the 1999 internet bubble high. The chart would appear to prove irrational exuberance among the general populace.

In reality, the lowest percentage of Americans currently own stock over the last two decades. With the stock market within spitting distance of all-time highs, only 52% of Americans own stock, down from 65% in 2007. As the stock market has gone up, average Americans have left the market. They realize it is a rigged game and they are nothing but muppets to the Wall Street shysters.

The reason the ratio of household equities to money market funds is so high is due to the Federal Reserve’s “Save a Wall Street Banker” policies implemented over the last seven years. When you purposely destroy the lives of senior citizens by reducing interest rates to “emergency” levels of 0% and keep them there six years after the great recession is over, it tends to reduce the amount of savings in money market funds. The divergence created by the Fed’s insane policies is borne out by the data.

The average middle class American has experienced two Fed induced financial collapses since 2000, with another coming down the tracks in the very near future. They have been impoverished by the Fed’s ZIRP and QE policies, sold to the masses as saving Main Street, but really designed to save and further enrich Wall Street. The entire engineered stock market rally has been designed by the Fed, Wall Street bankers, and the CEO’s of corporate America who have bought back hundreds of billions of their stock, in order to enrich the .1% and their lackeys.

The average middle class American has rationally exited the rigged stock market and refuse to be lured back in. Back in 2007, nearly three in four middle-class Americans, with annual household incomes ranging from $30,000 to $74,999, said they invested money in the stock market according to Gallup polling.

Today, only 50% report having stock investments. This 22% drop is more than double the changes seen in stock investing among higher and lower income groups. Millions of middle class families have had to liquidate stock holdings just to survive in this ongoing Main Street recession.

| April 2007% | April 2016% | Change(pct. pts.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| National adults | 65 | 52 | -13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than $30,000 | 28 | 23 | -5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $30,000 to $74,999 | 72 | 50 | -22 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $75,000 or more | 90 | 79 | -11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 to 34 | 52 | 38 | -14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 35 to 54 | 73 | 62 | -11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 55+ | 65 | 56 | -9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup Poll Social Series | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The data indicates an extremely dangerous coming scenario. The middle class is already angry, disillusioned, suspicious of the establishment, and impoverished by Fed induced inflation, Fed induced lack of interest income and Obama induced Obamacare disaster. Those making less than $75,000 are invested in the stock market at an all-time low level, and what they do have invested is a pittance compared to what the ultra-rich have in the market.

The millennial generation also has a record low level of stock ownership, as they carry massive levels of student loan debt, have less job opportunities as Boomers can’t afford to leave the job market, pay skyrocketing rents, and deal with a Fed induced over-priced housing market. They don’t trust the establishment, government, or Wall Street. The angry older middle class are venting their anger by supporting Trump for president. The pissed off younger generations are throwing a monkey wrench into the coronation of Queen Hillary by supporting Sanders in droves.

The dangerous divergence begins to come into focus. Every credible stock market valuation used over the last 100 years is now at extreme levels only seen in 1929, 2000, and 2007. The Shiller P/E ratio now stands at 26.4, putting valuations in the highest decile throughout history, indicating likely real returns of 0.5% over the next 10 years. As stock prices push towards all time highs, corporate profits continue to plunge. A 40% to 60% decline in stocks is essentially baked into the cake.

Millions of upper middle class professionals have bought into the establishment propaganda. They actually believe the Federal Reserve is infallible and can keep stock prices elevated for eternity. Despite conclusive evidence the Fed failed in 2000/2001 and again in 2008/2009, the willfully ignorant stock market participants are putting their faith in highly educated academics whose insane monetary machinations have led to a global recession and global debt levels imperiling the worldwide global economy.

The last remaining threads keeping the country from imploding have been the rising stock market and the home price recovery. Both recoveries have been engineered through Fed easy money, Wall Street fraud, and mainstream media propaganda. Neither is based on a solid foundation of free market true demand. When the bottom gives out, it will drastically impact the upper middle class and people who pass for rich in this day and age. When the tide goes out for the third time in the last sixteen years, millions will be revealed to be swimming naked and in debt up to their eyeballs.

The dangerous divergence will then take a nasty turn. The bottom half of the 1% will now be as angry as the 99%. Any attempt by the establishment to further screw the nation by bailing themselves out will be met with violent disapproval. The country is a powder keg. The upcoming election is guaranteed to inflame opposing factions. A stock market crash in the next six months would sow the seeds of financial, political, and social upheaval not seen in this country since the 1960s. The established social order will be swept away in a swirl of chaos and retribution. The dangerous divergence will be resolved.

Regardless if you abide by the Christian faith like myself or not, in these volatile and uncertain times my recommendation is to follow the advice of the Apostle Paul, given to the Greek people of Thessaloniki some 2,000 years ago, but just as relevant today:

“Make it your ambition to lead a quiet life: You should mind your own business and work with your hands, just as we told you, so that your daily life may win the respect of outsiders and so that you will not be dependent on anybody.” 1 Thessalonians 4:11-12

I agree but what if that dirty , rotten scoundrel called Stucky is right. What if God just tied the world in a knot and left it to random chance ?What then John ?

Im pretty much out myself. I sold most of my “real” stocks around the time QE ended. I still have some gold miner stocks, fuck me, right? I haven’t left anything in the casino that Im not prepared to lose, and I haven’t really ‘lost’ any money on them since i haven’t sold them and don’t intend to.

I did pretty well with UPS, which I considered a kind of short on all brick and mortar retail establishments. And, of course, its up like 10/share since i sold it. I also did pretty good with advanced auto parts. The average age of vehicles on the road keeps going up, since new cars have gotten so expensive, I considered that one a short of the auto industry. Not sure how its going lately, don’t really care.

I was actually thinking about it the other day, the whole “stock tips from a shoeshine boy” line when I heard a few of my co workers talking about investing in the stock market. Apparently they had never done it before, and I kept my mouth shut about it being a bad idea, since Ive been thinking this sucker was gonna tank as soon as the fed stopped printing, and Ive been wrong. But they will probably get roasted in the next year or two.

Admin, this will actually go on to prove your point, though. When these guys inevitably get burned on the next downturn, they will probably walk away in disgust, and never put money into it again. As Hussman has pointed out, they have pulled all the future gains forward to today, and anyone buying stocks right now, or even holding them, will probably be looking at negative real returns for the next 5-10 years. Good luck getting people like that to put money into it again.

@bb I have no intention to turn this thread into a discussion on the merits of God’s promises in the New Testament.

However, since you asked, God was relatively silent if you will for 400 years during the Israelites slavery in Egypt and for another 400 years from Malachi (last book of the Old Testament) until John the Baptist was the voice crying in the wilderness in Matthew (first book of the New Testament).

It’s also been nearly 2,000 years since John the Apostle recorded the words of the vision he had of Jesus saying “Behold, I am coming soon” in Revelation 22:12, the last book of the Bible. Nevertheless, I hold to the following:

“The Lord is not slack concerning His promise, as some count slackness, but is longsuffering toward us, not willing that any should perish but that all should come to repentance.” 2 Peter 3:9

I’d be willing to bet 90% of those ‘self directed’ 401(k)’s and IRA’s don’t have a clue about what is really going on with their accounts

bb,

God has a will for man that will be done, he gives us the choice to do it his way or the hard way (our way).

That’s what “Thy will be done on Earth as in Heaven” stresses to us every time we say the Lord’s prayer.

None of the hardships and strife in man’s life are placed on us by God, they stem from doing things our way instead of God’s way but to the same end either way.

The market is a casino run by thieves. The only way to seek justice is for everyone to pull their money out of the system and shut it down. No 401k, IRA,or any other “qualified” phony retirement account. Why would people believe that the goobermint created qualified money accounts for us peons to prosper when all they do is steal and denigrate us?

Understand that when you purchase a stock, the stock is not registered in your name. It is called street name registration(Wall Street Firm) and you only get a ledger entry and the firm owns the stock. This is so the firm can use the stock in any manner it chooses such as re-hypothication.

This whole retirement account scam was to destroy the private pensions and get that money into the banksters hands. Anyone that plays the game is aiding and abetting. If you are going to buy stocks or bonds make sure they are registered in your name and take physical possession of them.

I started moving my money out of these accounts in March 2006 when the FED announced it will no longer publish M3 money supply. They stated the cost did not justify the return. Of course, one cannot determine true inflation without it so that was a huge red flag. It only took 2 years to witness the great crash which is not yet complete.

Occult money magik is a powerful show of rule bending . Until you understand that this is actually money magik you will not be able to grasp what has/continues to happen.

And yes, the critical thinkers left the casino in 2008- 2009 mainly and have not returned.

This article is also posted in Market Oracle. Admin is swimming with the big fish prognosticators. While I agree with Admin and have pulled out of the market, Walayat has been a very outspoken bull for at least 7 years. He seems to think the central banks will take the markets to new highs. He has been successful so far.

Common sense and gut feel tells me that can only end in disaster but a new high might be made before the big one. This is the 4th Turning crisis, I think. For good or ill here it comes.

Usually these well-written articles by Admin get a lot more comments. Dozens more in fact. I wonder if people are experiencing a lull in the doom, given the markets have recovered to near previous highs each time they’ve dropped in the past several months. Possibly this behavior is a harbinger in itself: the watchmen on the wall no longer chatter; they simply lie and wait for the arrows to fall.

Excellent article, Admin, especially the soothsaying in the final paragraphs. A powder keg indeed.

BTW, over 51,000 reads and 112 comments on ZH…Congrats!!!

While I made a nice profit on stawks in the 80’s and early 90’s, I was one of those who were clobbered by the Fed’s actions post 2008. Who could have known the lengths they would go to in order to save the asses of the .1%? It sure as hell killed those of us positioned on the “bear” side.

WTF?

This gets 65,000 reads on Zero Hedge with 136 comments and on my own blog it’s as if I didn’t write shit.

A post about taking your phone into the shitter gets four times as many comments.

Admin – I read it, and I agree wth it. Did not have much else to say. Good job!

Good article, I posted it on SLL.

Jim, I read it, but I’m not good at commenting on economic articles dealing with the stock market. Anything I’d have to say would just be retarded because I never traded stocks and never invested in them.

Your articles about the markets posted on LRC brought me here, though. You explain market activity in a way that a nosepicker like me can read your stuff and feel like I know a little more about that kinda thing.

The article is right on.

After the 2008 crash our 401k’s weren’t worth a penny more than the wages we had contributed over the years. Maybe even less.

By 2012 they had recovered most of the loss and we cashed them in. That money is now sitting in a savings account in a credit union because I don’t know what else to do with it.

Now within a year or so of retirement we have no investments, no CD’s, no interest income of any kind, no nothing.

It is not possible to buy stocks when one’s net worth is low. Middle class Americans tend to have little net worth, and a lot of debt. Even if they wanted to, which as Admin pointed out they do not, they simply do not have the money/liquidity to buy stock.

And will not have, as far into the future as my chrystal ball lets me see.

Llpoh, not only that, but most don’t even have a thousand dollars for an emergency. Most are also carrying around high interest debt of some kind. Investing in the stock market makes no sense when you are paying 12-15% interest on a credit card debt. Before even thinking about throwing any money into the casino, you should be debt free, at least aside from maybe a mortgage, at least a couple months worth of savings.

My personal opinion, as just some guy on the Internet who no one should ever listen to, is that anyone buying stocks right now after a 7 year run that’s only gone up when the fed was printing money is retarded, but, again, I’m not a tenured economist so what do I know.

BTW – where is Stuck? Is he and his parents ok?

Gator – nice comment.

Where are the rest of you monkeys? Let us get this thread moving.

After posting this, Admin needs to make a full disclosure statement that he has NO investments in the market. Heh.

As for me, I’m a high-roller and let it all hang out with really risky stuff like utilities and Procter & Gamble. I know, I know. It’s a crap-shoot, but with a twist. I make money. Not a lot, but every year. No exceptions. And I personally manage all details of my accounts. That means I can save on legal fees if I ever decide to sue myself.

Admin, not many comments because there is little to add to a post that that is so dead-on correct. Everyone knows all this.

But I could add that our upper-middle-class of salaried shills for the establishment, and government bureaucrats, is the major obstacle to any restoration of free-market principles, fiscal rectitude in government, or sound monetary policy.

Don’t blame the dumb welfare classes for the massive expansion of our welfare and warfare state, or the degradation of our money and the destruction of small businesses. Our salaried class of

Didn’t mean to post that before completing it… pressed the wrong button (it’s early AM after all).

It’s our upper middle classes who dominate the PC universities, and the educational bureaucracies, and have destroyed free speech and free thought.

These are the people who never fail to support yet another boondoggle local project that will suck up taxpayer money while conveying your money to crony developers, and who support the creation of local laws and rules that make it impossible to build new housing, especially for entry level buyers. They are not troubled by massive property tax hikes because their salaries rise as prices inflate, and their attitude to those of us who live outside their circle of protection is superciliously pitying at best, and downright contemptuous for the most part. They assuage their guilt by supporting welfare programs whose costs, both in money and in lost opportunity, ruined schools and neighborhoods, and shrinking wealth, will be borne by the lower middle classes that are the bulk of the “middle class”, the people for whom they have the most contempt.

Peggy Noonan remarked that we now have two classes of people in this country: the protected and the unprotected. These people are the Protected Classes- our crony capitalist rich and their salaried shills, who benefit from policies that cause the destruction of our money and the funneling of wealth to a small, connected elite, while destroying the wealth and closing off opportunities to the rest of us, the unprotected.

These are the people who stand to lose the most when the current order unravels.

I agree with most of what is said but seriously wonder if people will ever rise up in these days. If these kind of things happened at the start of our country they would have been in the streets long ago. I just don’t think people have the guts to stand up anymore. I hope I’m wrong but this is how the Jews were led to slaughter by lowering their head and marching forward. I pray for this country but this country will not pray for itself.

Jim, I think Chicago is right on this one. We come here primarily to read your stuff. My usual reaction to reading one of your articles is. ‘Yup’. There is nothing to add. There is nothing to dispute. And you know I love to pick morons apart. That ain’t you.