Gail wrote this almost four weeks ago when oil was still $80 per barrel. Today it is $66 per barrel. The unintended consequences of this crash have yet to be realized. Enjoy the lower gasoline prices, because the other consequences may not be so pleasant.

Guest Post by Gail Tverberg

The world is in a dangerous place now. A large share of oil sellers need the revenue from oil sales. They have to continue producing, regardless of how low oil prices go unless they are stopped by bankruptcy, revolution, or something else that gives them a very clear signal to stop. Producers of oil from US shale are in this category, as are most oil exporters, including many of the OPEC countries and Russia.

Some large oil companies, such as Shell and ExxonMobil, decided even before the recent drop in prices that they couldn’t make money by developing available producible resources at then-available prices, likely around $100 barrel. See my post, Beginning of the End? Oil Companies Cut Back on Spending. These large companies are in the process of trying to sell off acreage, if they can find someone to buy it. Their actions will eventually lead to a drop in oil production, but not very quickly–maybe in a couple of years.

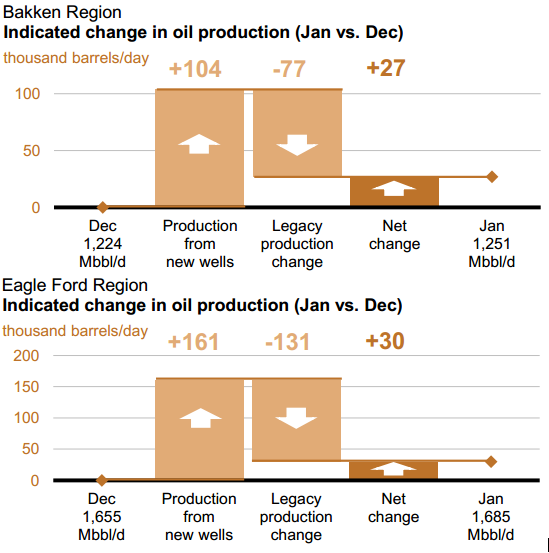

So there is a definite time lag in slowing production–even with very low prices. In fact, if US shale production keeps rising, and Libya and Iraq keep work at getting oil production on line, we may even see an increase in world oil production, at a time when world oil production needs to decline.

A Decrease in Oil Prices May Not Fix Oil Demand

At the same time, demand doesn’t pick up quickly as prices drop. We are dealing with a world that has a huge amount of debt. China in particular has been on a debt binge that cannot continue at the same pace. A reduction in China’s debt, or even slower growth in its debt, reduces growth in the demand for oil, and thus its price. The same situation holds for other countries that are now saturated with debt, and trying to come closer to balancing their budgets.

Furthermore, the Federal Reserve’s discontinuation of quantitative easing has cut off a major flow of funds to emerging markets. Because of this change, emerging market demand for oil has dropped. This has happened partly because of the lower investment funds available, and partly because the value of emerging market currencies relative to the dollar has fallen. Again, a decrease in oil price is not likely to fix this problem to a significant extent.

Europe and Japan are having difficulty being competitive in today’s world. A drop in oil prices will help a bit, but their problems will mostly remain because to a significant extent they relate to high wages, taxes, and electricity prices compared to other producers. The reduction in oil prices will not fix these issues, unless it leads to lower wages (ouch). The reduction in oil prices is instead likely to lead to a different problem–deflation–that is hard to deal with. Deflation may indirectly lead to debt defaults and a further drop in oil demand and oil prices.

Thus, oil prices are likely to continue their slide for some time, until real damage is done, perhaps to several economies simultaneously.

The United States’ Role in the Oil Over-Production / Under-Demand Clash

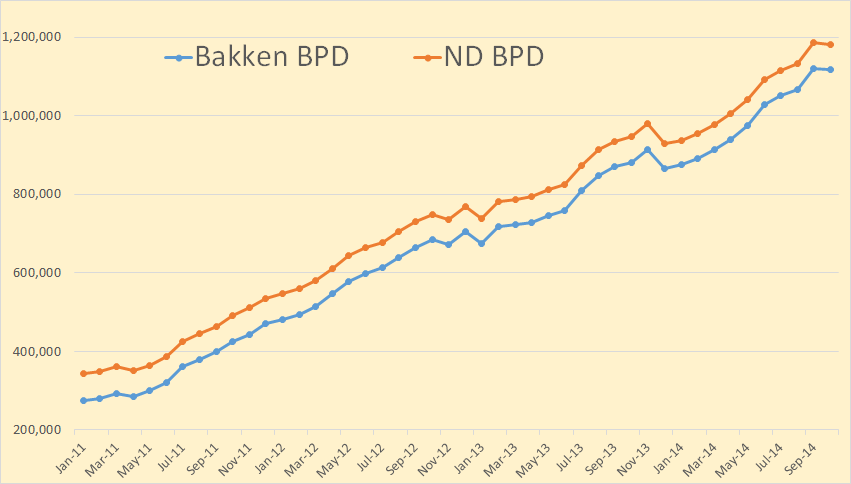

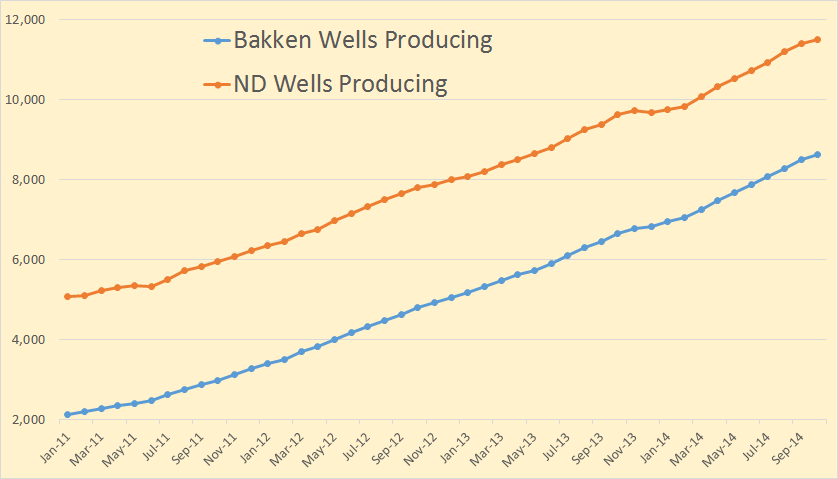

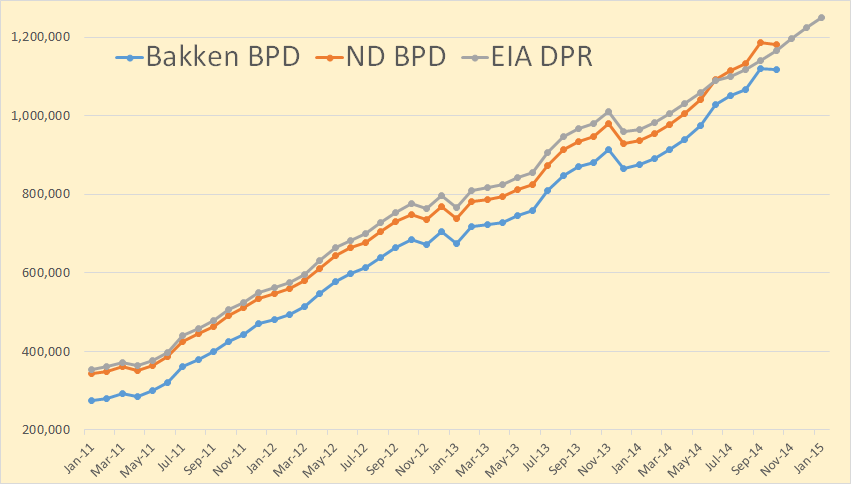

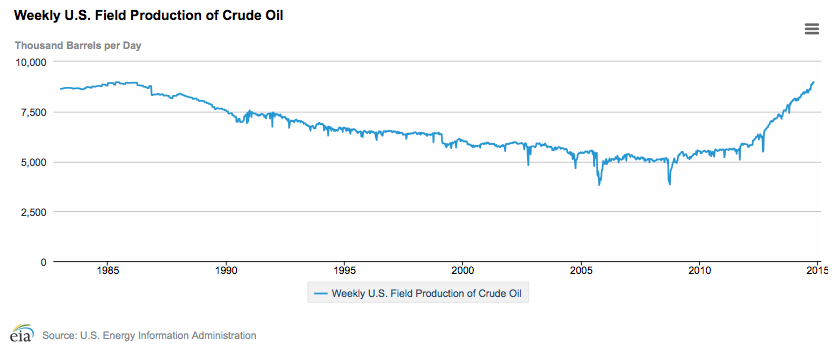

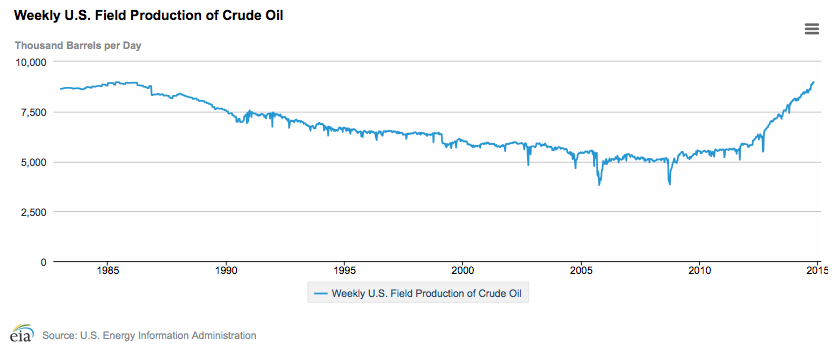

The United States is the country with the single largest increase in oil production in the past year. This growth in oil production seems not to have stopped, in recent weeks.

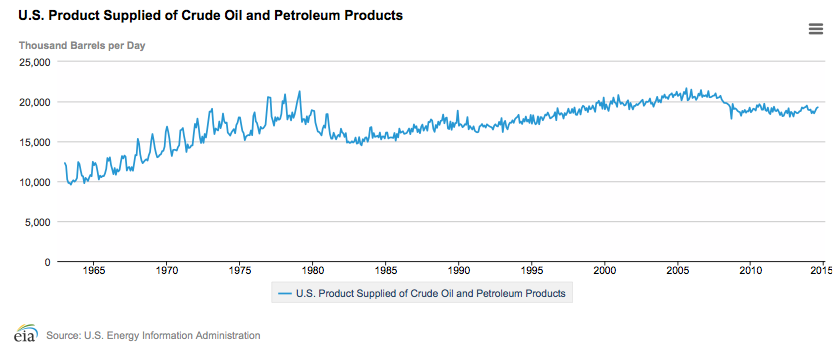

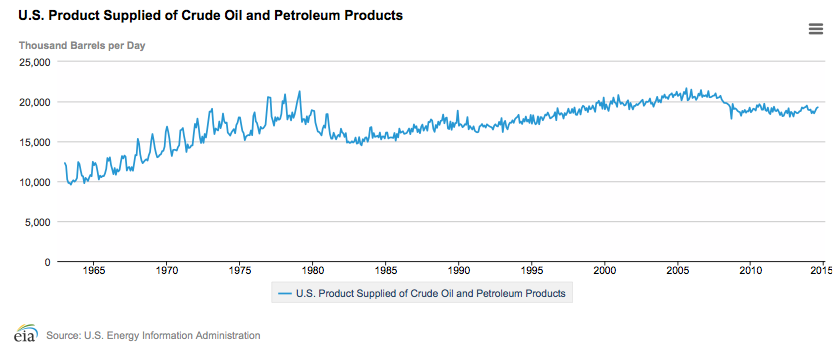

At the same time, the US’ own consumption of oil has not increased (Figure 2).

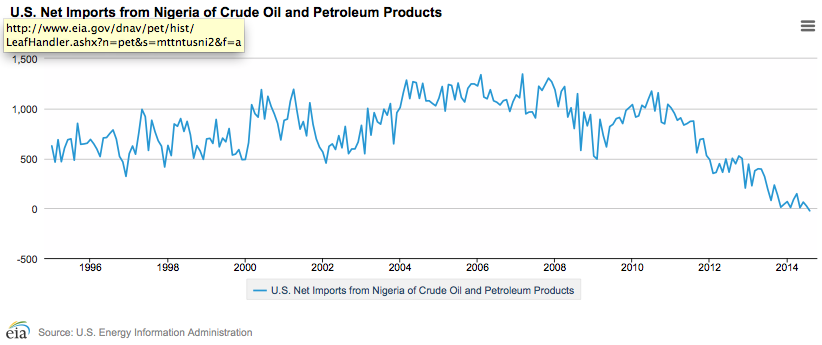

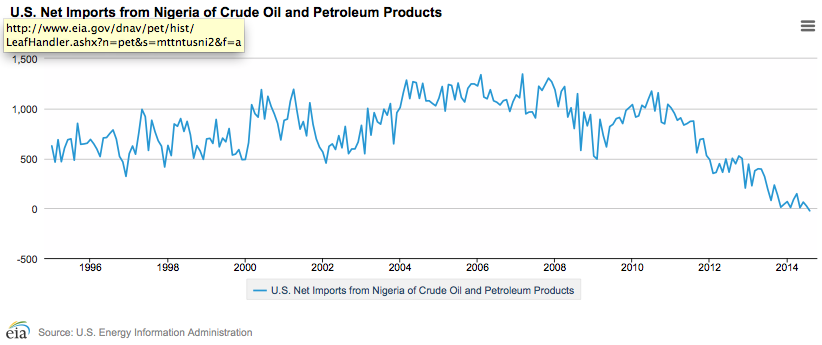

The result is a drop in needed imports. A number of oil exporters have been hit by the US drop in imports. Nigeria extracts a very light oil that competes for refinery space with oil from shale formations. Our imports of Nigerian oil have been reduced to zero (Figure 3). (The amounts I am showing on this and several other charts are “net imports.” These reflect transactions in both directions. Often the US imports crude oil and exports oil products, sometimes to the same country. In such a case, we are selling refinery services.)

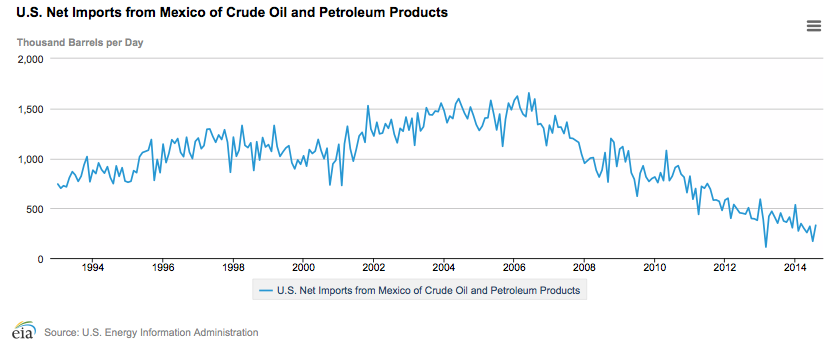

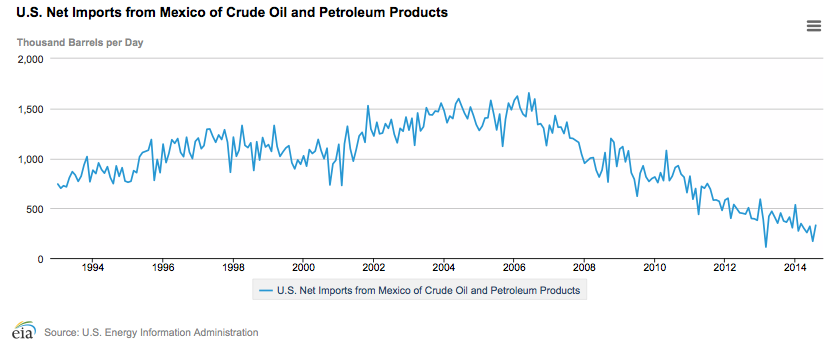

Our imports of oil from Mexico are way down as well (Figure 4), in part because their oil production has been falling.

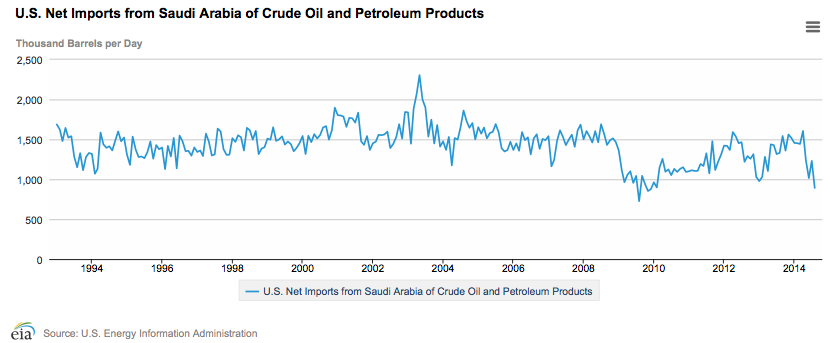

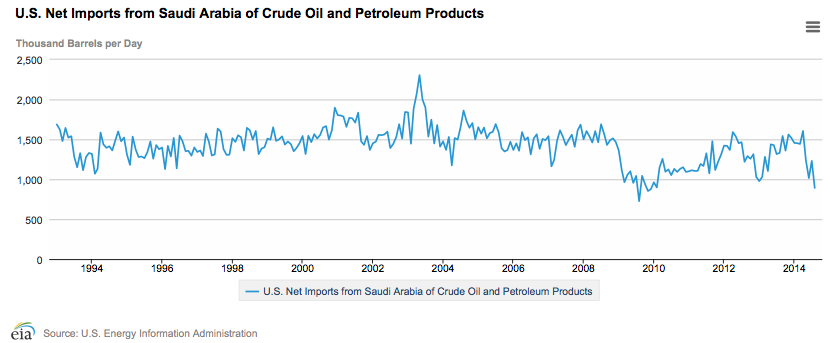

It is only in the past few months that US imports from Saudi Arabia have started to be significantly affected (Figure 5).

Saudi Arabia, like other oil exporters, depends on the sale of oil revenue to provide tax revenue for its budget. While it has a reserve fund for rainy days, over the long term it, too, depends on revenue from oil exports. If Saudi Arabia’s exports to the United States decrease, Saudi Arabia needs to find someone else to sell these would-be exports to, or revenues to fund its budget will drop.

Alternatively, it can reduce the price it charges to US refineries, to influence purchasing decisions–something it has just done. Lowering its price to US refineries tends to push the world price for oil down.

Of course, the US also talks about allowing an increasing amount of crude oil exports, as its oil from shale formations rises. This increase would make the surplus of oil on the market worse, and world prices lower, if oil demand does not pick up.

Depending on Saudi Arabia and OPEC

In the West, we have been led to believe that OPEC in general and Saudi Arabia in particular exert great control over oil prices. We have been told that several OPEC countries have spare capacity. Several of the Middle Eastern countries claim that they have very high reserves, and we have been led to believe that they can ramp up their production if they invest more money to do so. We have also been told that these countries will reduce oil production, if needed, to hold up oil prices.

A very significant part of what we have been led to believe is exaggerated. Saudi Arabia’s oil exports were much higher back in the late 1970s than they are now (Figure 6). When they cut oil production and exports in the 1980s, they likely did have spare capacity.

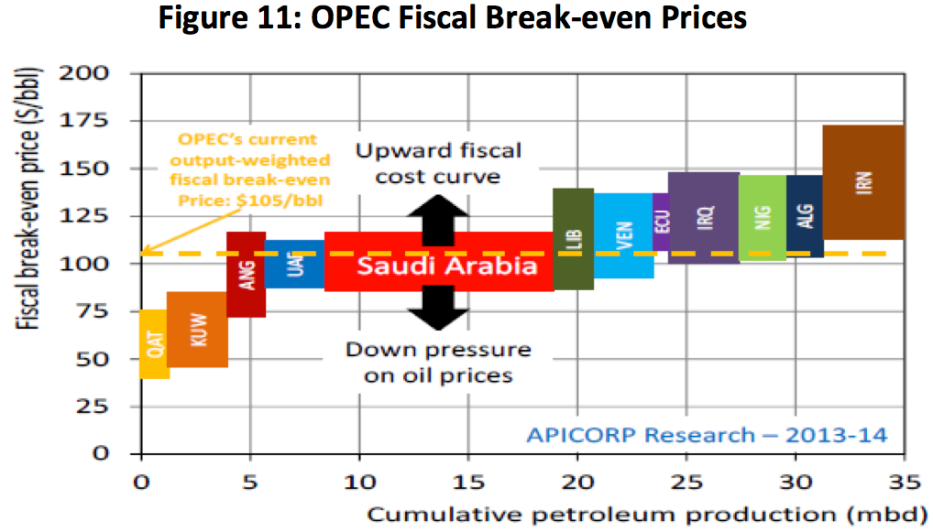

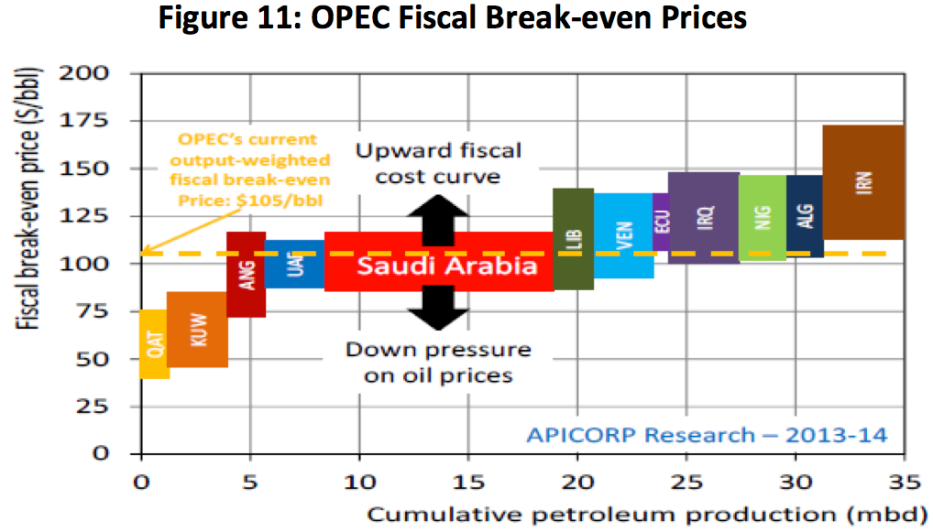

But where we are now, the situation has changed greatly. The population of the Middle Eastern oil producers has risen. So has their own use of the oil they extract. Their budgets have risen, and the countries need increasing revenue from oil taxes to meet their budgets. Some countries, including Venezuela, Nigeria, and Iran, require oil prices well over $100 per barrel to support their budgets (Figure 7).

If oil prices are too low, subsidies for food and oil will need to be cut, as will spending on programs to provide jobs and new infrastructure such as desalination plants. If the cuts are too great, there is the possibility of revolution and rapid decline of oil production. Virtually none of the OPEC countries can get along with oil prices in the $80 per barrel range (Figure 7).

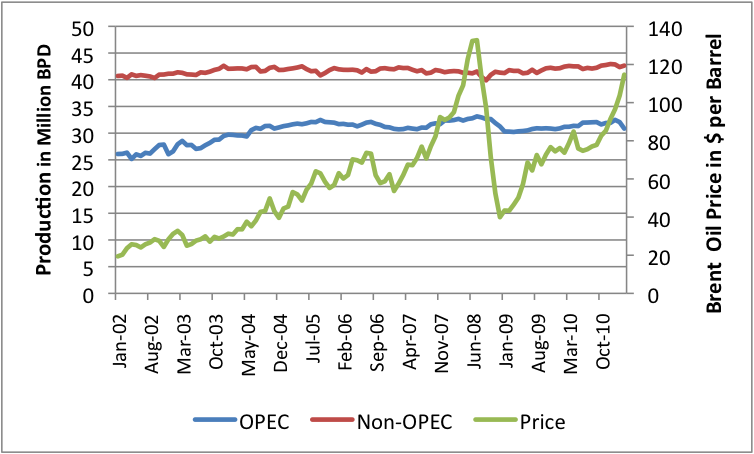

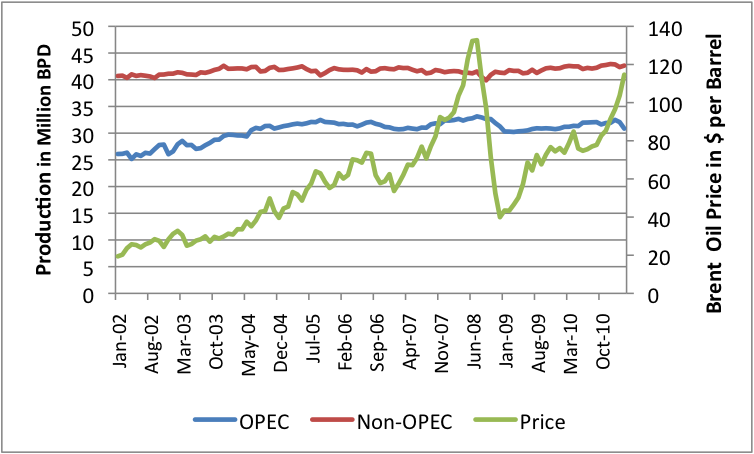

Most of OPEC’s actions in recent years have looked like actions a person would expect if OPEC countries were not all that different from other oil producers–their oil supplies were subject to limits and they tended to act in their own self interest. When oil prices were rising rapidly in the 2007-2008 period, they ramped up production, but not by very much and not very quickly (Figure 8). When oil prices dropped, they dropped their production back to where it had been, before the big ramp up in prices.

Another situation occurred when Libya’s production declined in 2011. Saudi Arabia said it would increase its own supply to offset, but it could only produce extra very heavy crude when light oil was what was needed. In fact, even the increase in heavy oil is somewhat in doubt.

Furthermore, the dynamics of OPEC have been changed considerably in the last few years. Part of the problem relates to fact that both oil prices and the quantity of oil exports have been approximately flat in the period between 2011 and mid-2014. In such a situation, revenue from oil exports tends to be flat. OPEC members have found this to be a problem because their populations continued to grow and their need for water and imported food has continued to rise. These countries need ever-more tax revenue, but oil revenue is not providing it. At a minimum, OPEC countries have a strong “need” to maintain their current level of oil exports.

The other part of changing OPEC dynamics relates to increased oil production volatility. The bombing of Libya and sanctions against Iran have both produced unstable situations. Oil exports from both of these countries are lower than in the past, but can suddenly rise as their problems are “fixed,” adding to downward price pressures.

Another issue is the significant attempt to raise Iraq’s oil production in recent years. If Iraq’s oil production (plus US shale production) is too much to satisfy world demand for oil, should the rest of OPEC be the ones to try to “fix” the problem?

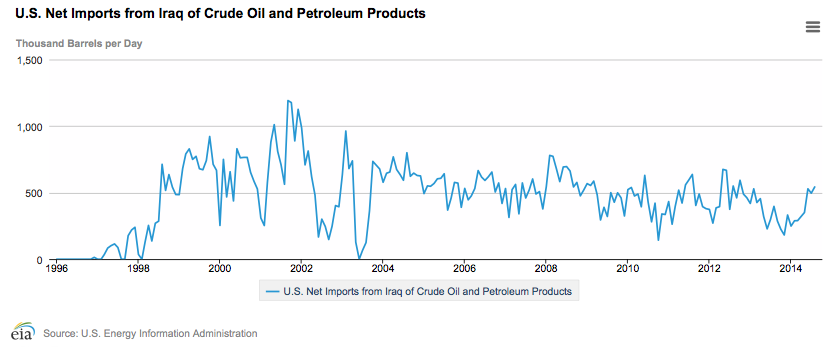

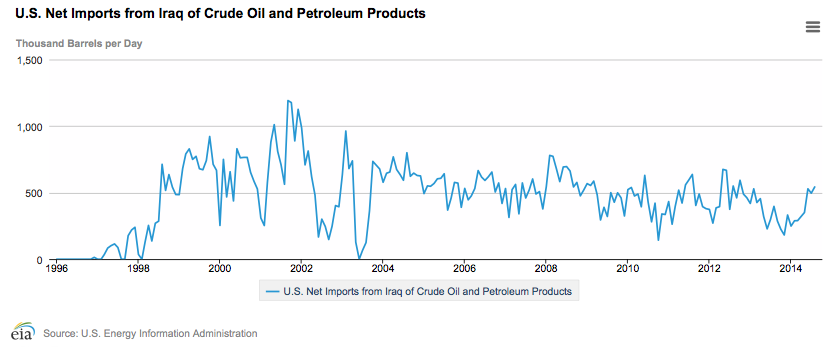

Figure 9 seems to indicate that US imports from Iraq have increased in recent months. Of course, if we import more from Iraq, we will likely need to cut back on imports elsewhere. This doesn’t create good feelings among OPEC exporters.

Shouldn’t the United States Take Some Responsibility for Fixing the Problem?

One might ask whether the United States should be cutting back in its oil production, in response to low prices. Of course, as indicated above, US oil majors (like Shell, Chevron, and Exxon) are cutting back on investment in new fields, and this is eventually likely to lead to lower production. The question is whether this will be a sufficient change, quickly enough.

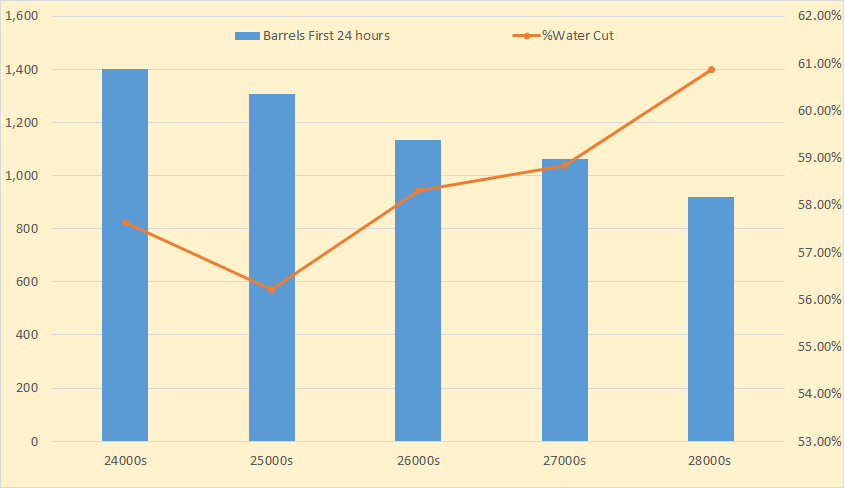

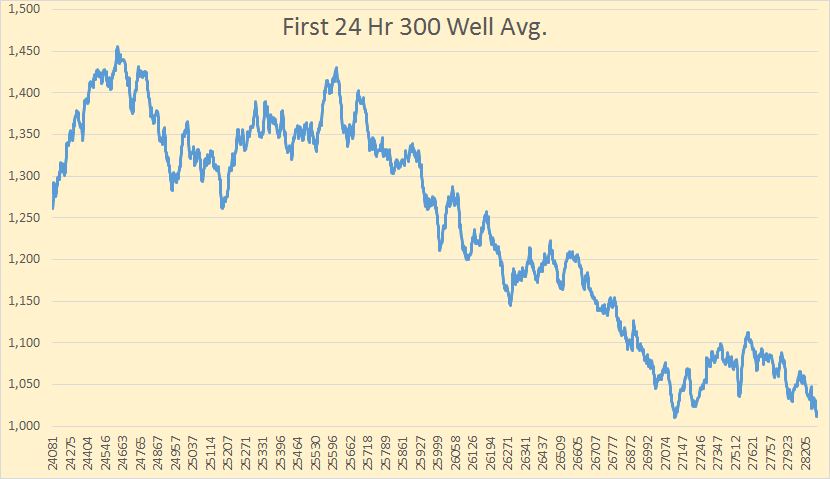

It is less likely that shale drillers will intentionally cut back quickly. The shale drillers have taken on leases on huge acreage and are reluctant to step back now. For one thing, part of their costs has already been paid, reducing their costs going forward on acreage already under development. They also have debt that needs to be repaid and many contractual arrangements with respect to drilling rigs, pipelines, and other services. Some may have futures contracts in place that will soften the impact of the oil price drop, at least for a while. Because of all of these factors, there is a tendency to continue business as usual, for as long as possible.

Whether or not shale drillers intentionally plan to cut back on oil production, some of them may be forced to, whether or not they believe that the production is likely to be profitable over the long run. The problem is likely to be falling cash flow because of lower oil prices, if the price drop is not mitigated by futures contracts. Because of this, some companies may be forced to cut back on drilling quite soon. Another alternative might be to ramp up borrowing, but lenders may not be very happy with such an arrangement.

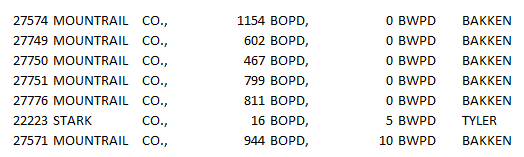

We notice that some companies are already in very cash flow negative situations–in other words, in situations where they need to keep adding more debt. For example, Capital Resources, the largest operator in the Bakken, shows rapidly growing outstanding debt through 6/30/2014, without seeming to take on significant new acreage (Figure 10).

When companies are already in such cash flow negative situation, there may be more problems than otherwise.

If Lower Oil Prices “Hang Around” for Months to Years, What Could this Mean?

We are in uncharted territory, in such a situation.

One of the big issues is potential deflation. The issue seems to be not only lower oil prices, but lower prices for many other commodities, as well. The concern is that wages will drop, as will government receipts. Lower wages already seem to be happening in Spain. Unless governments figure out a way to “fix” the situation, this situation will make debt repayment very difficult. Lower debt will tend to reinforce the low prices of oil and other commodities.

If low prices become the norm for many kinds of commodities, we can expect major cutbacks in production of these commodities. This would be the situation of the 1930s all over again. Ben Bernanke has said he would send helicopters of money to prevent such a situation. The question is whether this can really be arranged, given that the United States (and several other countries) have already been “printing money” since 2008. At some point, it would seem like the arsenals of central banks will get used up.

If there is a cut back in debt and cutback in production of commodities, many goods we have come to expect in the market place will disappear, as will many jobs. There are likely to be breaks in supply chains, leading to more cutbacks in production.

With all of the debt problems, there is a question of how well international trade will hold up. Will would-be explorers trust buyers who have recently defaulted on their debt, and don’t look likely to be able to earn enough to pay for the goods that they currently are ordering?

The discussion has been mostly with respect to oil, but liquefied natural gas (LNG) is likely to be affected by low prices as well. Reuters is reporting that likelihood of US exports of LNG to Asia is down, for a number of reasons, including the discovery that costs would be higher than originally expected and the regulatory process less smooth. Another reason LNG exports are likely to be low is the fact that Asian prices dropped from a high of $20.50/mmBtu in February to a low of $10.60/mmBtu in August. Without sustained high LNG prices, it is hard to support the huge infrastructure investment needed for LNG exports.

Can Oil Prices Bounce Back?

If we could somehow fix the world’s debt problems, a rise in the price of oil would seem to be much more likely than it looks right now. As long as the drop in demand is related to declining debt, and the potential feedbacks seem to be in the direction of deflation and the possibility of making defaults ever more likely, we have a problem. The only direction for oil prices to go would seem to be downward.

I know that we have very creative central banks. But the issue at hand is really diminishing returns. Prior to diminishing returns becoming a problem, it was possible to extract and refine oil cheaply. With cheap oil, it was possible to create an economy with low-priced oil, inexpensive infrastructure built with that low-priced oil, and factories built with low-priced oil. Workers seemed to be very productive in such a setting, in part because low-priced oil allowed increased mechanization of production and allowed cheap transport of goods.

Once diminishing returns set in, oil became increasingly expensive to extract, because we needed to use more resources to obtain oil that was very deep, or in shale formations, or that required desalination plants to support the population. Once we needed to allocate resources for these endeavors, fewer resources were available for more general uses. With fewer resources for general activities, economic growth has become inhibited. This has tended to lead to fewer jobs, especially good-paying jobs. It also makes debt harder to repay. History shows that many economies have collapsed because of diminishing returns.

Most people assume that of course, oil prices will rise. That is what they learned from supply and demand discussions in Economics 101. I think that what we learned in Econ 101 is wrong because the supply and demand model most economists use ignores important feedback loops. (See my post Why Standard Economic Models Don’t Work–Our Economy is a Network.)

We often hear that if there is not enough oil at a given price, the situation will lead to substitution or to demand destruction. Because of the networked nature of the economy, this demand destruction comes about in a different way than most economists expect–it comes from fewer people having jobs with good wages. With lower wages, it also comes from less debt being available. We end up with a disparity between what consumers can afford to pay for oil, and the amount that it costs to extract the oil. This is the problem we are facing today, and it is a very difficult issue.

We have been hearing for so long that the problem of “peak oil” will be inadequate supply and high prices that we cannot adjust our thinking to the real situation. In fact, the two major problems of oil limits are likely to be shrinking debt and shrinking wages. The reason that oil supply will drop is likely to be because customers cannot afford to pay for it; they don’t have jobs that pay well and they can’t get loans.

In some ways, the oil prices situation reminds me of driving down a road where we have been warned to look carefully toward the left for potential problems. In fact, the potential problem is in precisely in the opposite direction–to the right. The problem gets overlooked for a very long time, because most of us have been looking out the wrong window.

For more on this subject, read my last two posts:

WSJ Gets it Wrong on “Why Peak Oil Predictions Haven’t Come True”

Eight Pieces of Our Oil Price Predicament